In today’s post, you’ll learn a simple 100 day moving average strategy to profit in bull and bear markets.

The best part?

You can apply this trading strategy to different markets like forex, stocks, futures, etc.

So let’s get started…

What is the 100 day moving average and how does it work?

The moving average indicator calculates the average price over a given period.

So for a 100 day moving average, it calculates the average price over the last 100 candles.

This means it will add the closing price over the last 100 days, and divide by 100.

So, you’ll get the average price over the last 100 days.

Here’s how the 100 day moving average looks like…

If you want to know why the moving average line goes up and down, then check out this moving average article here.

How to use the 100 day moving average to trade with the trend

Here’s the thing:

The moving average is a trend following indicator because it “follows” the price.

This means if the price moves higher, the moving average will move higher too (and vice versa).

So, how can you use the EMA 100 strategy to trade with the trend?

Simple.

When the price is above the 100 day moving average, then the medium-term trend is up and you’ll look for buying opportunities.

If the price is below the 100 day moving average, then the medium-term trend is down and you’ll look for selling opportunities.

Here’s what I mean…

Now…

Just because the price is above the 100 day moving average doesn’t mean you should immediately hit the buy button.

Why?

Because the market could be over-extended and about to make a pullback or complete reversal.

That’s why you want to wait for the price to come towards an area of value, which is what I’ll cover next…

Area of value: How to buy low and sell high

You’re wondering:

“What is an area of value?”

This refers to an area on the chart where buying/selling pressure could step in.

For example:

Support is an area of value where buying pressure could step in and push the price higher.

Resistance is an area of value where selling pressure could step in and push the price lower.

Now when you combine this with the 100 moving average, you can find areas on your chart to buy low and sell high.

Here’s how it works…

When the price is above the moving average 100, then look to buy near support. And when the price is below it, then look to sell near resistance.

An example…

Now, you don’t want to blindly buy at support because the price could break through it.

Instead, you want to wait for a signal to tell you that buy pressure is stepping before you pull the trigger.

Also read: Support and Resistance Trading Strategy — The Advanced Guide

And that’s what I’ll cover next…

Entry trigger: How to time your entry with precision so you can avoid entering trades too early

An entry trigger is a specific price pattern that tells you when to enter a trade.

It can help you objectively time your entries on a 100 moving average period.

You can use tools like candlestick patterns, moving average crossover, etc. But for this article, we’ll use candlestick patterns.

In particular:

Let me explain…

Bullish reversal candlestick patterns

A hammer is a bullish reversal candlestick pattern that shows rejection of lower prices.

Here’s how to recognize it:

- Little to no upper shadow

- The price closes at the top ¼ of the range

- The lower shadow is about 2 or 3 times the length of the body

An example:

Later, you’ll learn how to use this candlestick pattern to time your entry with the moving average 100.

But for now, let’s move on…

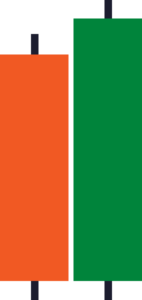

Bullish engulfing pattern

The bullish engulfing pattern is another candlestick pattern that shows rejection of lower prices.

Here’s how to recognize it:

- The first candle has a bearish close

- The body of the second candle completely “covers” the body of the first candle (without taking into consideration the shadow)

- The second candle closes bullish

Here’s what I mean…

Now, let’s move onto bearish reversal candlestick patterns…

Shooting star

A shooting star is a bearish reversal candlestick pattern that shows rejection of higher prices.

Here’s how to recognize it:

- Little to no lower shadow

- The price closes at the bottom ¼ of the range

- The upper shadow is about 2 or 3 times the length of the body

An example:

And finally…

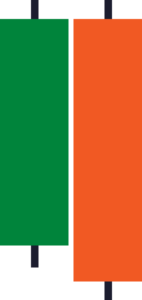

Bearish engulfing pattern

The bearish engulfing pattern is another candlestick pattern that shows rejection of higher prices.

Here’s how to recognize it:

- The first candle has a bullish close

- The body of the second candle completely “covers” the body of the first candle (without taking into consideration the shadow)

- The second candle closes bearish

Here’s what I mean…

Now you’re probably wondering:

“How do I apply all these to trading?”

Well, don’t worry.

Because in the next section, you’ll learn an ema 100 strategy based on the concepts you’ve just learned.

Let’s go…

A 100 EMA strategy that works

Here’s how it works…

#1: The price is above the 100 day moving average

This tells you the market is in an uptrend and you want to look for buying opportunities.

#2: The price retraces toward support

Now you don’t want to blindly buy at any level on the chart. So, you’ll wait for the market to retrace towards an area of value (like support, respected moving average, etc.).

#3: A valid entry trigger

If conditions #1 and #2 are met, then look at a bullish reversal candlestick pattern so you know the buyers are momentarily in control—and you can enter on the next candle’s open.

Here’s an example…

Here’s another example…

As for stop loss and exits, I cover more in these articles below…

Conclusion

So here’s what you’ve learned:

- The 100 day moving average is a trend following indicator which calculates the average price over the last 100 days.

- If you want to trade with the trend, then look for buying opportunities when the price is above the 100 day moving average and selling opportunities when the price is below it.

- Don’t blindly buy just because the price is above the 100 day moving average. Instead, wait for the price to come towards an area of value, and then look for a bullish entry trigger to time your entry for this 100 EMA strategy.

Now here’s what I’d like to know…

How do you use the 100 moving average?

Leave a comment below and share your thoughts with me.

You may also be interested in reading:

Excellent!!!

I am a beginner and this explanation has clarified me a lot.

Hey there, Rosalina!

I am glad to know you learned something from Rayner’s blog!

Cheers!

Hey! I’ve been using 200ma as my trend indicator. I trade on a 1hr timeframe. So will using 100ma be more accurate as compared to 200ma?

Thanks.

You can use 20 ema or 50 ema.

Here’s a quick guide on how to use Moving Average Indicator:

https://www.tradingwithrayner.com/moving-average-indicator-strategy/

Hope this helps!