I’ve seen some of your comments saying:

“Hey Rayner, the markets are rigged because my stop loss always gets hunted!

“If I hadn’t placed any stop loss, I could have stayed in the trade until the market reverses in my favour!”

Now, I know stop loss order isn’t the sexiest topic to talk about.

But here’s the thing…

Stop loss orders are crucial if you don’t want your trading account to be destroyed by one bad trade.

So, stop looking for a quick dopamine fix from the latest trading fad.

Instead…

Focus on today’s post where you’ll discover:

- How a stop loss order works

- Common myths about stop loss orders (debunked)

- How to set a stop loss like a PRO

- This “trick” to find the best trading opportunities

- A huge bonus tip on how to maximise your profits using stop loss orders

Sounds good?

Then let’s get started…

What is a stop loss order and how does it work

What is stop loss?

A stop loss in trading is an order that protects your trading capital when the price moves against you.

An example:

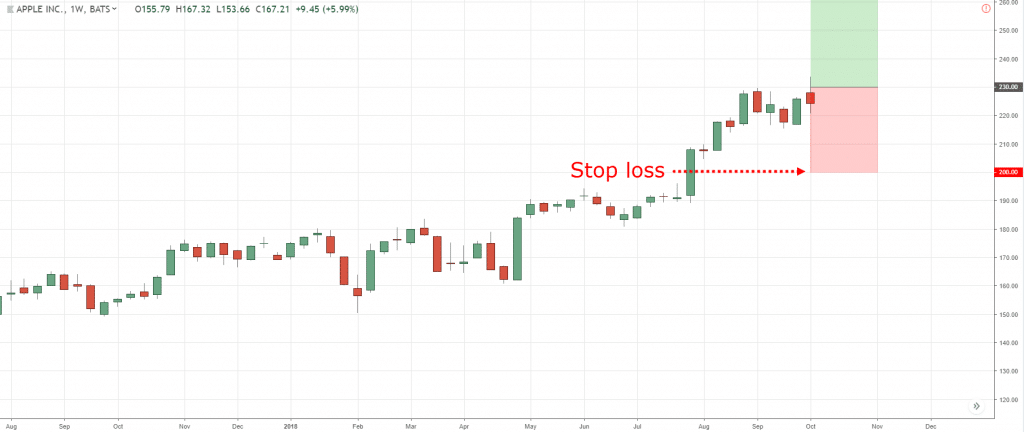

You buy Apple shares at $230 and have a stop loss order at $200.

This means if the price of Apple drops to $80, you will exit the trade and restrict your loss to $30 per share (assuming no slippage).

Stop loss on AAPL Weekly:

And if used correctly, a stop loss:

- Prevents you from blowing up a trading account

- Allows you to live and “fight” another day

- Limits your losses to feel like an “ant bite”

Now you might be thinking…

“But my broker always hunts my stop loss.”

“A stop loss doesn’t work for me.”

“A stop loss reduces my profit.”

But, that’s not true.

Read on and you’ll discover why…

(Or if you prefer, you can watch this training below…)

The truth about stop loss nobody told you

Now:

Let’s debunk some of the biggest myths about stop loss in trading (that has fooled many traders).

Myth #1: My broker always hunt my stop loss

Most regulated brokers don’t hunt your stop loss because it’s not worth the risk.

Why?

Think about this:

If the word gets out that ABC broker hunts their client stops loss, it’s only a matter of time before existing clients pull out of their account and join a new broker.

If you are a broker, would you want to risk doing that over a few measly pips?

I guess not.

Most brokers don’t hunt your stops as the risk far outweighs the reward.

Now, you are probably thinking…

“But my broker widens the spread and stops me out of my trade.”

There is a reason for this.

Let me explain…

A broker widens their spreads during major news release because the futures market (which they hedge their positions in) has low liquidity during this period.

If you look at the depth of market (aka the order flow), you’ll notice the bids and offers are thin just before major news release (like NFP) because the “players” in the market are pulling out their orders ahead of the news release.

Thus, you get thin liquidity during such period which results in a wider spread.

And because of this, the spreads in spot forex is widened (because if it isn’t, there will be arbitraging opportunities).

So, it’s not that your broker is widening their spread for fun, but they are doing it to protect themselves.

The bottom line is this…

Most brokers don’t hunt your stop loss because it’s bad for business in the long run.

And they widen the spreads during major news release because the futures market is thin during this period.

Myth #2: A stop loss reduces your profit

You might think having a stop loss in trading is stupid.

Because the market always seems to hit your stop loss, and then BOOM, it reverses back to your intended direction.

And if you didn’t have a stop loss in place, you’d be sitting in profits instead of having a loss, right?

But here’s the thing…

All you need is ONE time when the market doesn’t reverse— and you’ll lose everything, and more.

Here’s an example…

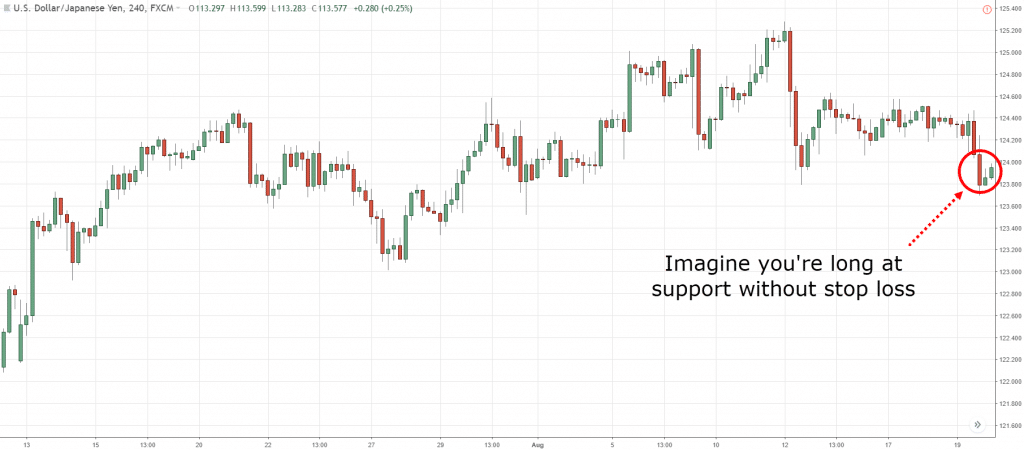

You buy at the area of Support with no stop loss because the market will “surely” reverse back in your favor:

And here’s what happens next…

Do you see what I mean?

I know it stinks when your stops get triggered unnecessarily.

But you’d be glad you have it when sh*t hits the fan.

Myth #3: You should use a fixed stop loss on every trade

Now, this is a big mistake.

Why?

Because not all markets are created equal.

Here’s an example:

Right now, GBP/JPY has an average true range of 180 pips…

This means on average each day, it moves about 180 pips from the open to close.

Now, look at the USD/CAD…

It moves an average of 80 pips a day (open to close).

So, what’s the issue?

This means you shouldn’t use a fixed stop loss as they move different “amount” each day.

A 100 pips stop loss on USD/CAD might be enough, but on GBP/JPY, it’s asking for trouble (as it easily moves 180 pips a day).

Do you see my point?

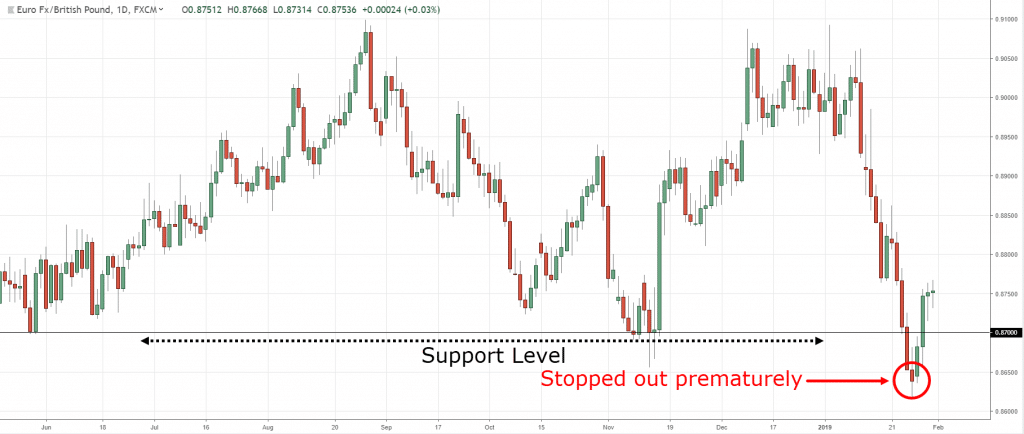

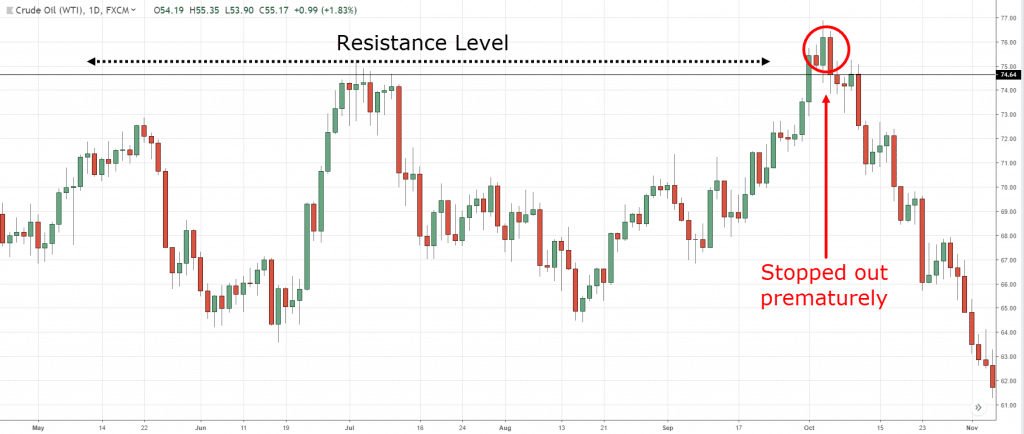

Myth #4: You should set your stop loss below Support and above Resistance

This is a BAD idea.

Why?

Because you’ll get stop hunted, easily.

Don’t believe me?

Then look through your charts (or past trades)…

Notice how often the price magically trades below Support and then reverse higher?

And it’s the same for Resistance.

The price would trade just above it, and then, BOOM, collapse lower.

Here’s what I mean…

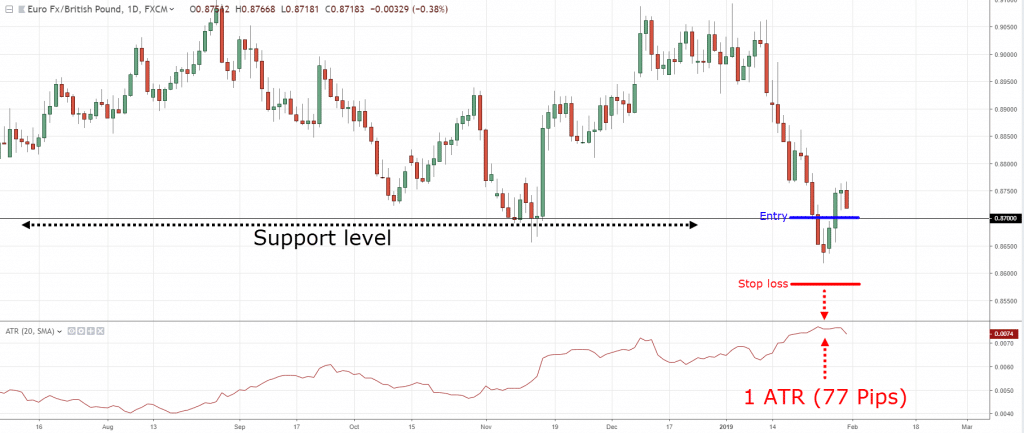

Support level at EUR/GBP Daily:

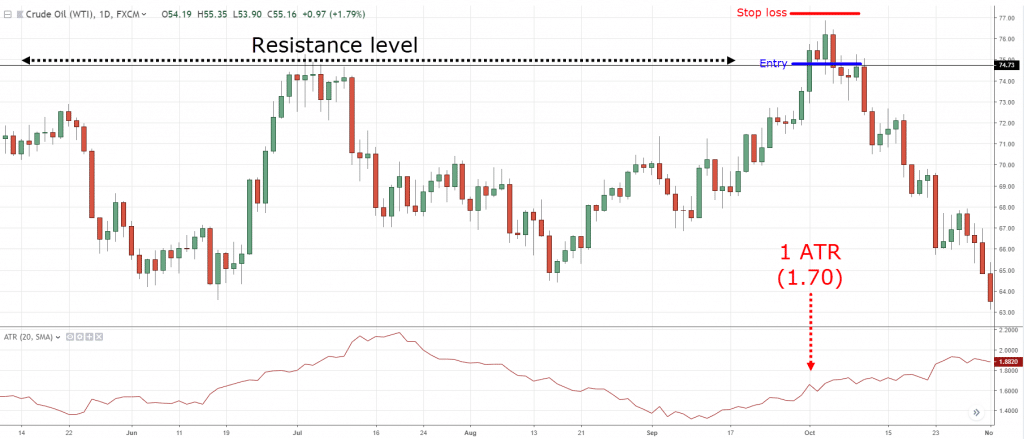

Resistance level at UKOIL Daily:

Why does it happen?

Because that’s how the “smart money” moves the market.

If you want the full details, go watch this video below…

Now you’re probably wondering…

“So how should I set my stop loss?”

That’s what you’ll discover next.

Let’s go…

How to set stop loss like a professional trader

Here’s my 2-step technique that works…

- Identify the market structure

- Set your stop loss away from the market structure

The best part?

You can use this to any market or timeframe.

Here’s how…

1. Identify the market structure

Market structure refers to things like Support & Resistance, trendline, etc.

It acts as a “barrier” to make it difficult for the price to go through.

For example:

You can think of Support like a “barrier” that prevents the price from dropping lower.

If you want to learn how to identify market structure, then go watch this training below…

Anyway…

The key thing is to identify market structure on your chart because you want the price to have difficulty reaching your stop loss.

2. Set your stop loss away from the market structure

Recall:

You don’t want to set your stop loss at the market structure (like just below Support) because you’ll get stop hunted easily.

Instead, give your stop loss some “buffer” away from the market structure.

Here’s how…

- Find out the current ATR value

- Add the ATR value above market structure (for short)

- Subtract the ATR value below market structure (for long)

Here are a few examples on where to place stop loss…

Entry at Support in EUR/GBP Daily:

Entry at Resistance in EUR/GBP Daily:

If you want more details, then go check out this training below…

How to use ATR indicator to set stop loss

Stop loss secrets: How to find amazing trading opportunities most traders miss out

Before I dive deeper, you must understand the essence of risk management.

It consists of 3 things:

- The distance of your stop loss

- Risk per trade

- Position size

If you’re a serious trader, you’ll always risk a fraction of your capital (like 1% on each trade).

So the question is:

How do you maintain the 1% risk on every trade?

You manipulate the other 2 variables, the distance of your stop loss and position size.

So…

If your stop loss is wide, your position size decreases (to keep your risk constant).

If your stop loss is tight, your position size increases (to keep your risk constant).

So the takeaway is this…

You want to have a tight stop loss so you can increase your position size and still keep your risk constant.

This means…

The market needs to move lesser for you to earn 1R on your trade (compared to someone with a wider stop loss).

In other words…

You make more profits in a shorter amount of time.

Now you’re probably wondering:

“What has this got to do with finding amazing trading opportunities?”

The secret is this…

If you want to find amazing trading opportunities, you must enter your trades close to the market structure.

Here’s what I mean…

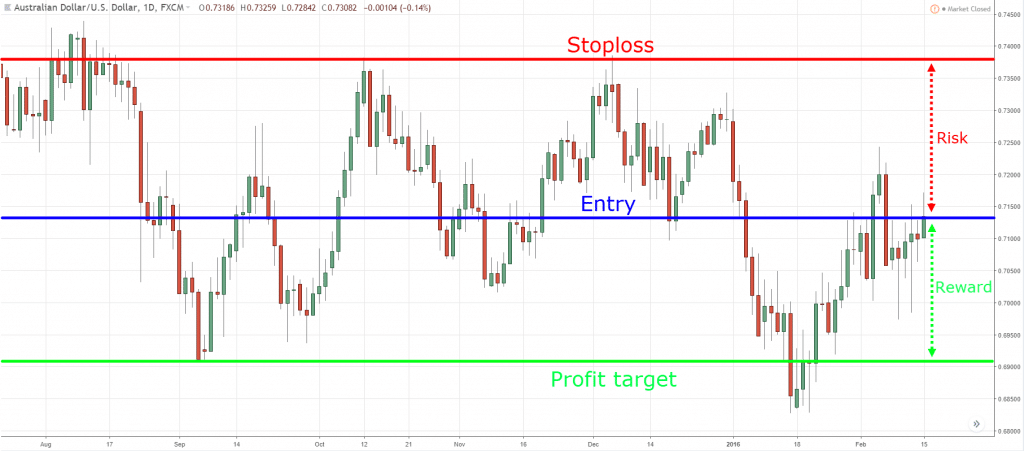

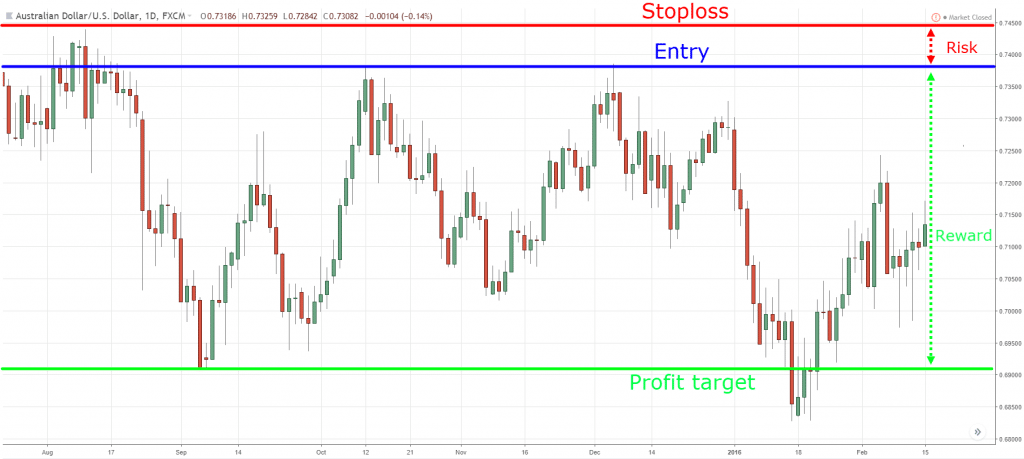

Wide stop loss at AUD/USD Daily:

Tight stop loss at AUD/USD Daily:

Tight stop loss (let the market come to your level with valid setup, show how much market needs to move to earn 1R)

As you can see…

Both examples have their stop loss at the same level.

The only thing is the distance of the stop loss — and that makes all the difference.

Bonus Tip: How to adjust your stop loss and ride massive trends

Generally:

Stop loss is used to protect your trading capital when the market moves against you.

But it can also be used to help you ride massive trends — otherwise known as trailing stop loss.

This means as the market moves in your favor, you adjust your stop loss higher (in the hopes of riding a trend).

An example:

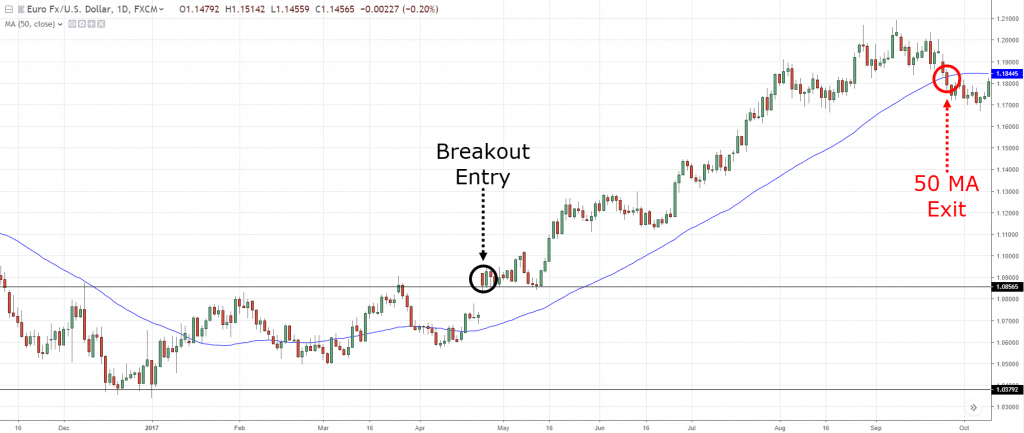

In the chart below, you can see, EUR/USD broke out of Resistance (on Daily timeframe).

If you want to ride the trend, you can use a 50-period Moving Average (MA) to trail your stop loss — and exit when the price closes below it.

Now…

Moving Average is not the only way to trail your stop loss.

If you want to learn more, go read… 5 Powerful Techniques to Trail Your Stop Loss.

Frequently asked questions

#1: What if I place a buy limit order to enter at the market structure with a tighter stop loss, but the price doesn’t retest that structure and I miss the trading opportunity altogether?

If you miss that trading opportunity, then so be it because that’s part and parcel of trading and you won’t always catch every piece of the move.

Alternatively, the price could create a new market structure that you can lean against to set your stop loss.

The last thing you want to be doing is to chase the market as you’ll likely need a wider stop loss. That’s when the market is prone to a pullback or reversal, which would not be favourable for you.

#2: If I want to trade stocks and I cannot decrease my position size any further, should I increase my % risk per trade just to have a stop loss in place?

That’s a choice you have to make. Because if you’re someone with a smaller account, it could be difficult to risk 1% on each trade. You might have to deal with a 2% to 4% risk on each trade.

At the same time, when you’re risking a larger percentage of your account, you should expect the drawdown to be deeper as well.

Conclusion

So here’s what you’ve learned today:

- A stop loss protects your capital when the market moves against you

- You want to set your stop loss away from the market structure so you don’t get stopped out easily

- If you have a tighter stop loss, you can increase your position size and still keep your risk constant

- The best trading opportunities are near the market structure because you can have a tighter stop loss

- A trailing stop loss allows you to ride massive trends and protects your open profits

Now over to you…

How do you use a stop loss when trading?

Leave a comment below and share your thoughts with me.

I try to use my stops exactly like you have instructed, plus I like to zoom in with intra-day charts to get a better position before a breakout, just to have some cushion to work with in case it’s a false breakout.

Thanks for sharing, Troy!

Please How do you set a stop loss when you place a buy/sell limit order ?

Hey there, Michael!

Here is a link that may help you set a stop loss when you place a buy/sell order…

https://www.tradingwithrayner.com/how-to-set-a-stop-loss/

Hope that helps!

Thanks Rayner, may i ask you do a Scalper could make a profit consistenly..? are you a Scalper or swing trader..

Swing and position trader.

Thank you for another great lesson about stop loss but still no idea about the other two tips…anyway ill review it again, thank you sir Rayner…God bless you & your family

My pleasure, Jesse!

Using market structure

Thanks for sharing!

Great blog Rayner! Your articles are based on sound logic and real experience, and are well organized. I really enjoy reading them.

Awesome to hear that, Jack!

I Never use the word Stop Loss. I much prefer the Term “Protective Stop”.It is set initially to protect my trading account and is adjusted to protect open equity.Change the thinking help change the results.

Thanks for sharing, Jim!

Cheers

Hi sir i am not into Forex i Trase in NSE and BSE ,, will your strategy work in NSE and BSE market

HI RAYNER, I HAVE WATCHED MANY OF YOUR VIDEOS-YOU ARE VERY SMART!!CONGRATS!!CAN YOU TELL ME PLEASE -WHAT PLATFORM OF TRADING DO YOU USE?

Hey Asuna,

Thank you!

Rayner uses tradingview for his charting analysis.

I usually put my stop loss a little bit above the candle that broke the market structure

why you don’t subtract the entry price from your Stop loss on the denominator?

Rayner, thanks for the tips. Quick (and possibly stupid) question: I can’t seem to put in BOTH a Stop Loss and a Take Profit orders into my online trading. How can this situation be handled? Thanks.

Hi Patrick,

Every question is important.

Kindly contact your broker.

Cheers.

Hi Tochukwu,

Thanks for the reply. I guess it’s not a broker issue, but the fact that for every long position one can’t have 2 sell orders simultaneously, unless you’re selling short on one of the sell orders.

The obvious solution that I can think of is keep the Stop Loss order and manually execute a “Take Profit” order if/when the price reaches the Target Profit levels.

Thanks.

Hi Patrick,

Thanks for the update.

Cheers.

You are my GURU…You are my MENTOR….I am always learning great things from u…..You are the best…..

You are most welcome. Rajesh!

Thanks Mr Rayner, I have learnt not to put my stop loss at the area of value to avoid being hunted.

The lessons here are superb

Awesome, Daniel!

Rayner do you accept bitcoin or usdt as means of payment for the price action trading secrets?

Hi!

As of now we only accept Debit/Credit Card Visa, Mastercard, JCB, American Express, Paypal, and Discovery.

Please email us at support@tradingwithrayner.com for other concerns.

Cheers!

Hi Rayner, love your work and ideas and enthusiasm. I am new to trading and do not understand the terminology as much, can you explain the stop loss using stocks like TSLA or AAPL etc.

Can you please tell me and other newbies in step by step, on how to use ATR to set stop loss.

I understood the 1st example but not others, especially Currency ones

->Add the ATR value above market structure (for short)

What does market structure mean ?

does it mean if I bought a stock at $100, and if it trading at $95, and ATR is 2, set stop loss to $97 ??

or if support is $80 and resistance is $120

stop loss should be $82, or $78.

Can you please give example in this format. Would highly appreciate if you could do that.

Hey there, Rohit!

Jarin here from TradingwithRayner Support Team.

Here is the link on how to use ATR to set a stop loss: https://www.tradingwithrayner.com/use-atr-indicator-set-stoploss/

For Market structure, check this out: https://www.tradingwithrayner.com/course/16-market-structure/

And I highly recommend you go through Rayner’s Academy. It is a free course made by Rayner to learn the basics of Trading.

Here is the link: https://www.tradingwithrayner.com/academy/

That free course will help you a lot!

Hope that helps!