Here’s the thing:

No matter how many entry techniques you learn, there are only 2 ways to enter a trade.

On a pullback. On a breakout. And that’s it.

But many of you struggle with this concept.

You probably have thoughts like…

How do I know where a pullback will end?

Breakout tends to fail, I hate trading breakouts.

Should I wait for confirmation, or not?

Don’t worry.

Because in this post, I’ll teach you the essentials of trading pullbacks and breakouts.

You’ll learn stuff like:

- How to identify a pullback

- The 6 levels the market will likely retrace to (so you can “predict” market turning points)

- How to develop a system to trade pullbacks

- How to find high probability pullback trades

- How to identify a breakout

- How to spot explosive breakout trades before it occurs

- How to develop a system to trade breakouts

- The secret to finding explosive breakout trades

Are you ready?

Then let’s begin…

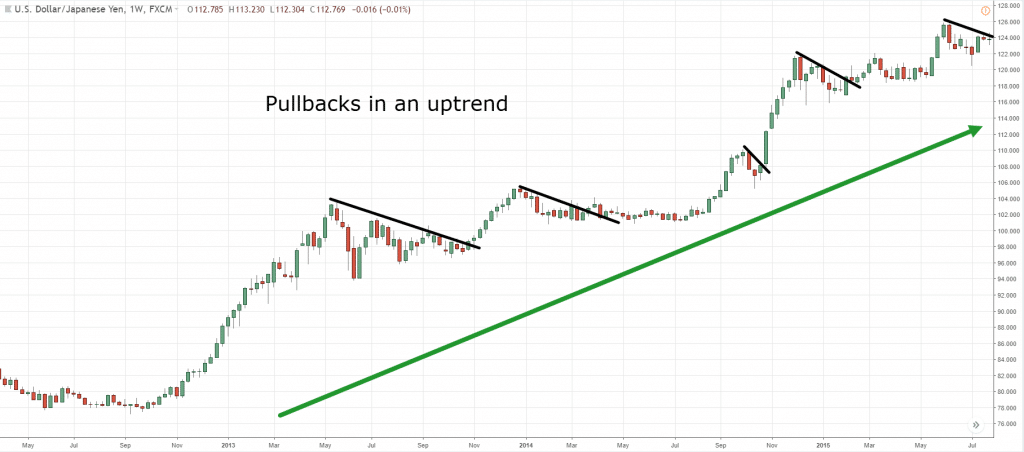

What is a pullback?

A pullback is when price temporarily moves against the underlying trend.

In an uptrend, a pullback would be a move a lower.

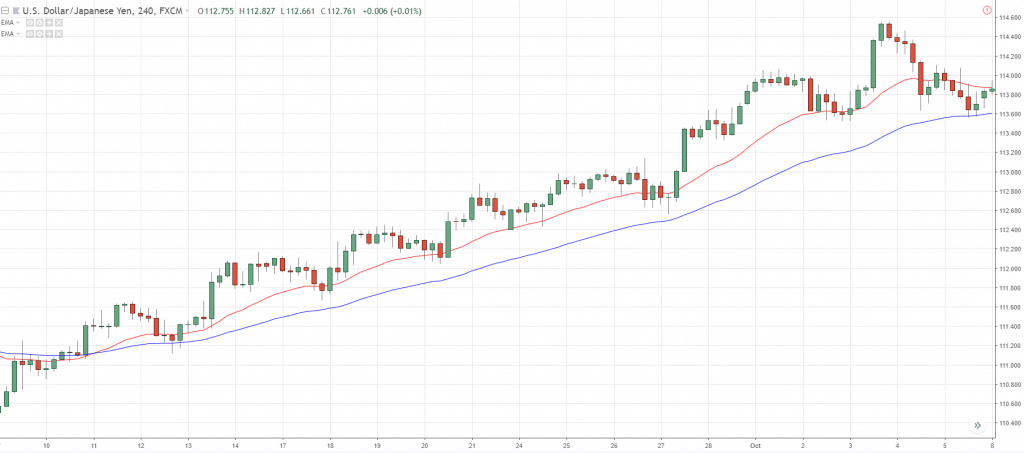

Here’s an example:

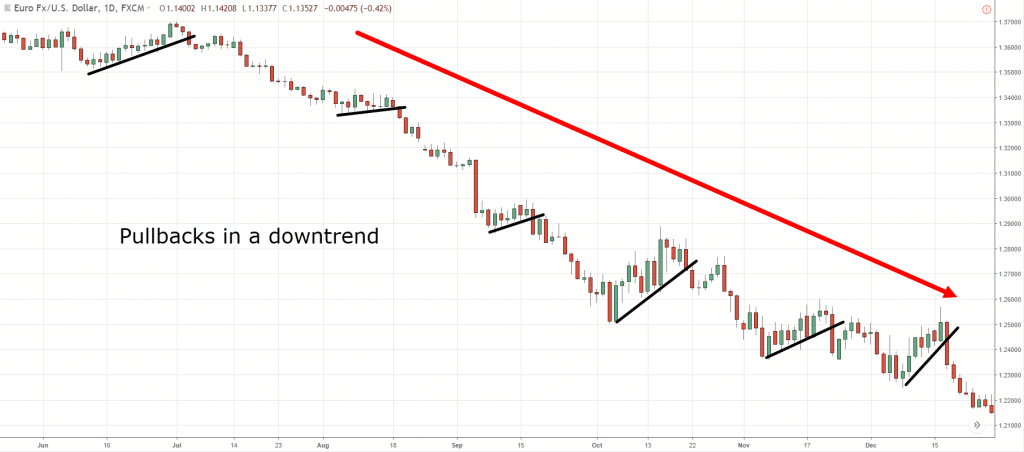

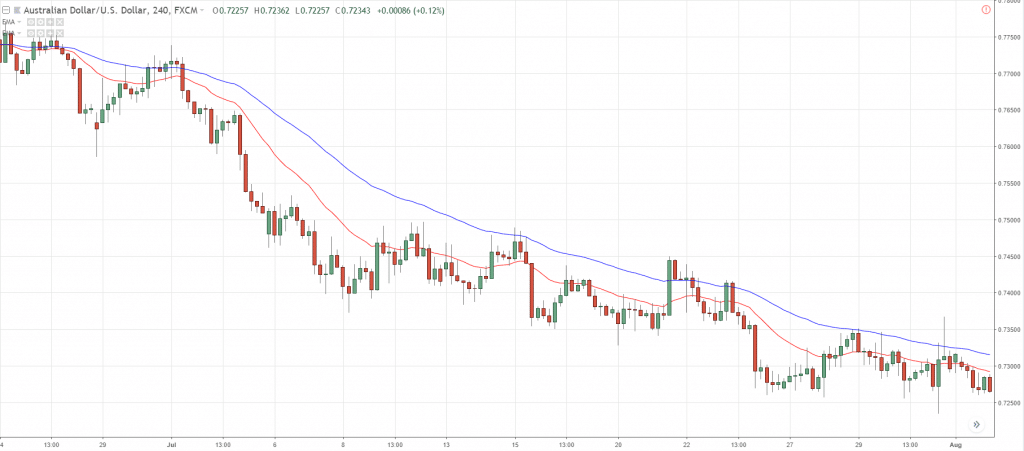

In a downtrend, a pullback would be a move higher.

An example:

According to the works of Adam Grimes, trading pullbacks have a statistical edge in the markets as proven here.

You may wonder:

What are the pros and cons of trading pullbacks?

Advantages of trading pullbacks:

- You get a good trade location as you’re buying into an area of value. This gives you a better risk to reward profile.

Disadvantages of trading pullbacks:

- You may potentially miss a move if the price doesn’t come into your identified area.

- You’ll be trading against the underlying momentum.

Now, this brings you to the next question.

Where does the pullback end?

You can’t predict with 100% accuracy where pullbacks will end.

But here are some guidelines:

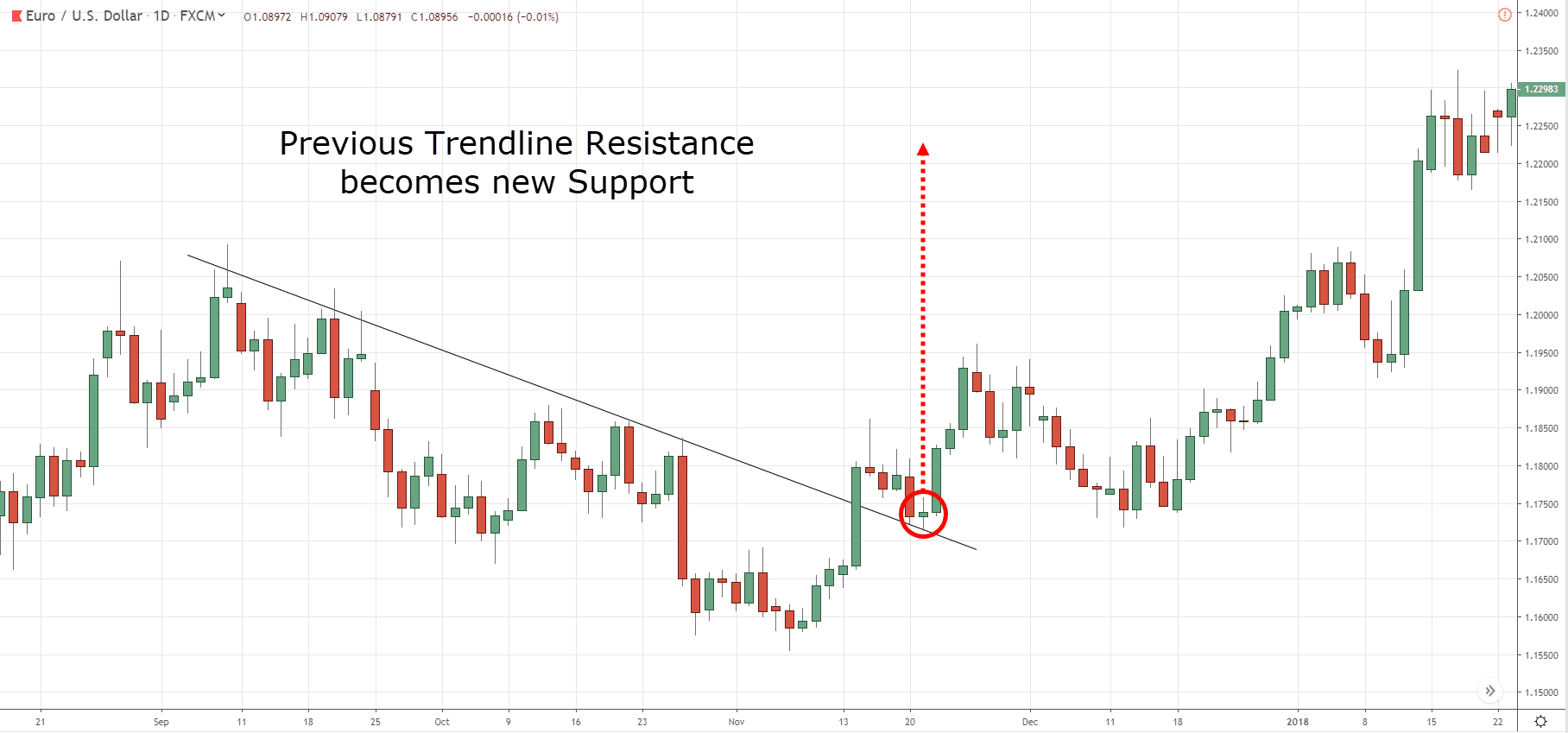

1. Towards previous resistance turned support

2. Towards previous support turned resistance

3. Towards a dynamic support

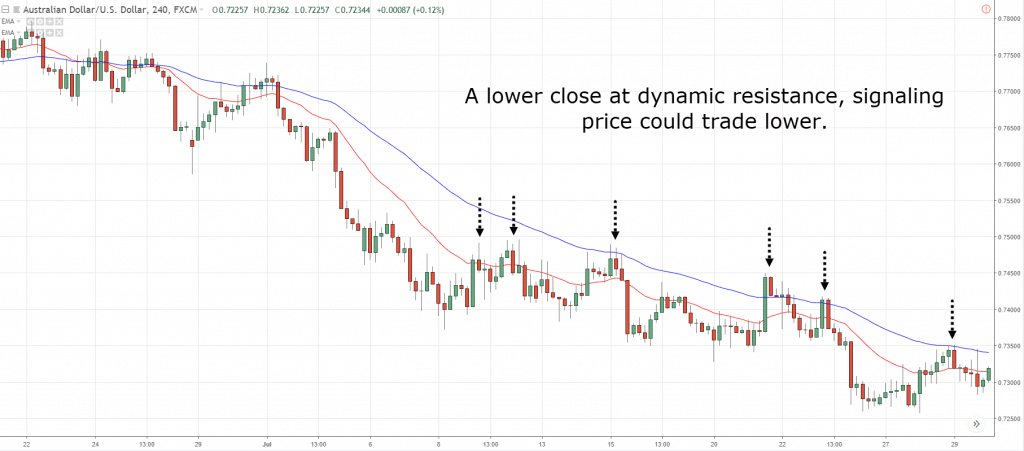

4. Towards a dynamic resistance

5. Towards a Fibonacci retracement

6. Towards a trendline

Now:

You have an idea where price could potentially retrace to.

This brings you to the next question…

Do you wait for confirmation?

A confirmation is when a candle closes in your direction, confirming your initial trading bias.

This increases the probability of your trades.

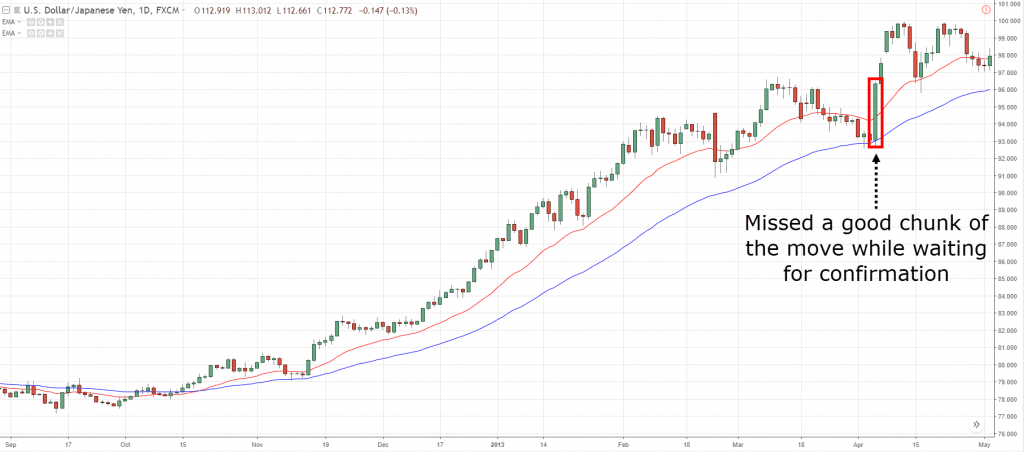

An example…

While waiting for confirmation, you get a poorer risk to reward. Because you’re entering your trades after the price has moved in your favor.

And sometimes…

It could cause you to miss a big move like this:

Do you wait for confirmation?

There’s no right or wrong answer here, but rather what suits you best.

Whichever choice you make, you must know the possibility and consequence that comes with it.

Now, let’s put this knowledge to use and discover a simple pullback trading strategy…

How do you develop a pullback trading system to trade pullbacks?

Before you can develop a system, you need three things:

- The condition for your setup

- Your entry

- Your exit

Disclaimer: Below is a random trading plan I’ve created to illustrate my point.

If 200 EMA is pointing higher and the price is above it, then the trend is bullish (Condition).

If the trend is bullish, then wait for the price to pullback to an area of support (Condition).

If price pullback towards your area of support, then wait for a higher close (Condition).

If price closes higher, then enter long at next candle open (Entry).

If you are long, then place your stop loss below the low of the candle, and take profit at swing high (Exit).

Vice versa for a short setup.

By using the IF-THEN syntax, it keeps your trading more objective with lesser room for discretion.

Now, that's not all in your pullback trading strategy:

Here comes the exciting part…

How do you find high probability pullback trades?

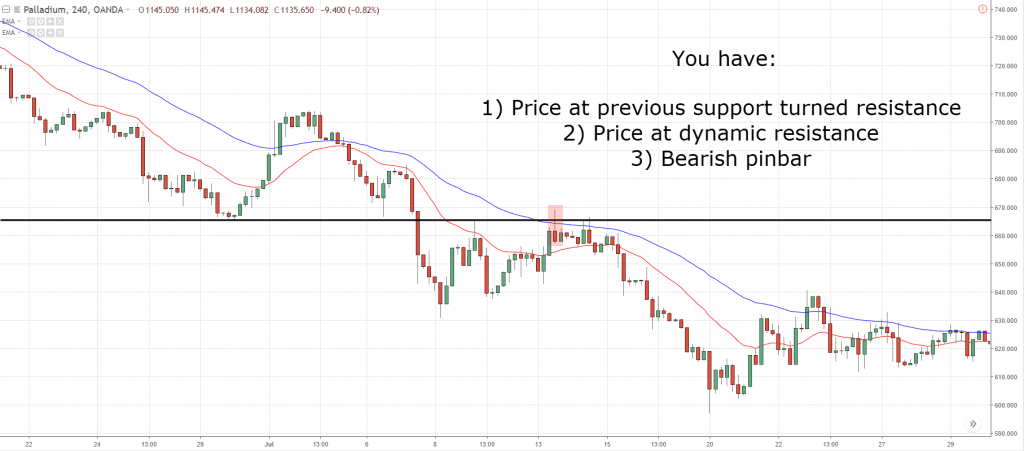

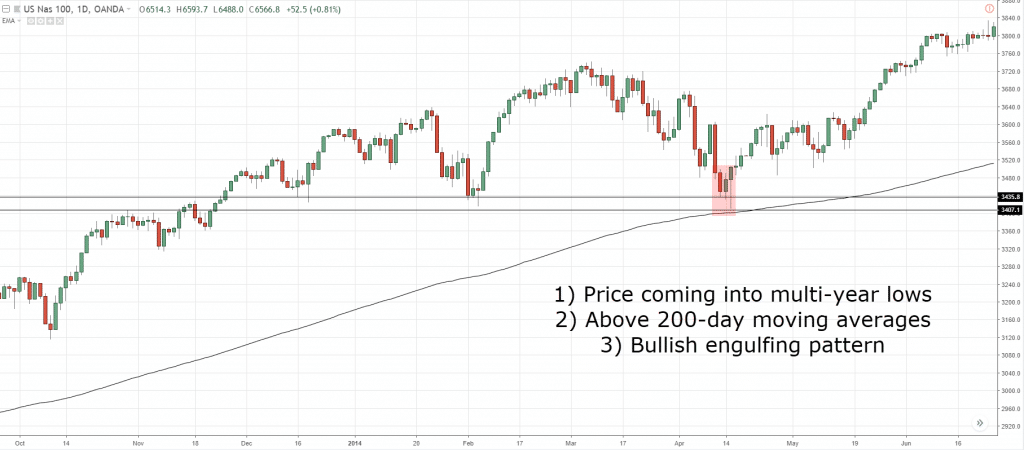

If you want to find high probability trades, you need to look at something called confluence.

What’s that?

A confluence is when 2 or more trading tools come together to give the same trading signal.

Example 1:

Alternatively, go read Moving Average 101, by Steve Burns, to learn how to incorporate moving average into your trading system.

Now here’s the thing:

More confluence:

- Higher probability trades

- Lower frequency of trades

Less confluence:

- Lower probability trades

- Higher frequency of trades

It does not make sense to only wait for high probability setups because you may end up with very little trades.

Likewise, you don’t want to be taking trades all the time just because a single indicator gave a buy/sell signal. If you want more explanation, read How To Trade Like A Pro: Take Mediocre Setups by Tradeciety.

My suggestion is to have a confluence between 2 to 4 factors.

Some confluence factors you can consider to tweak your pullback trading strategy:

- Trend

- Support & resistance

- Moving Averages

- Multi-year highs/lows

- Oscillators overbought/oversold

- Candlestick patterns

Right now:

You’d probably realize there’s an endless combination you can come up with. To find out whether it can be consistently profitable, you’d have to test it yourself.

If you want to learn more high probability trading strategies on pullbacks, then check out this video below:

Moving on, let’s talk about breakout…

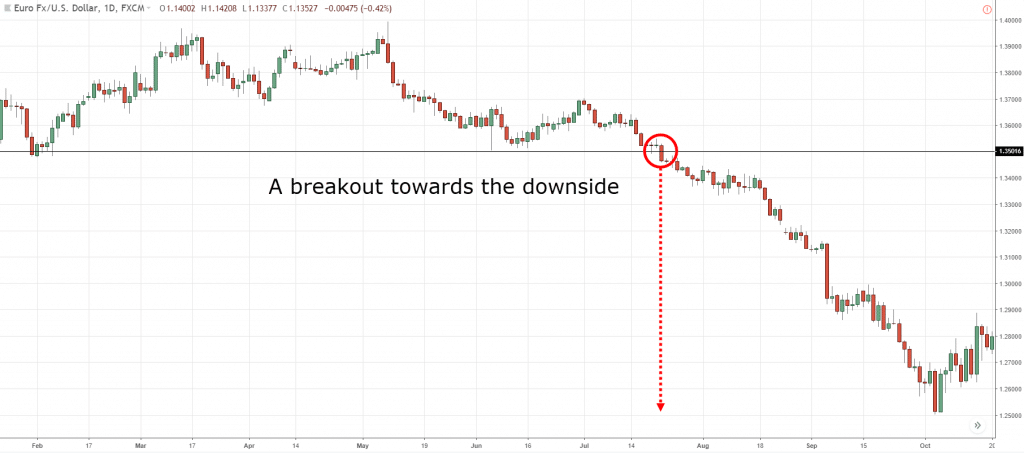

What is a breakout?

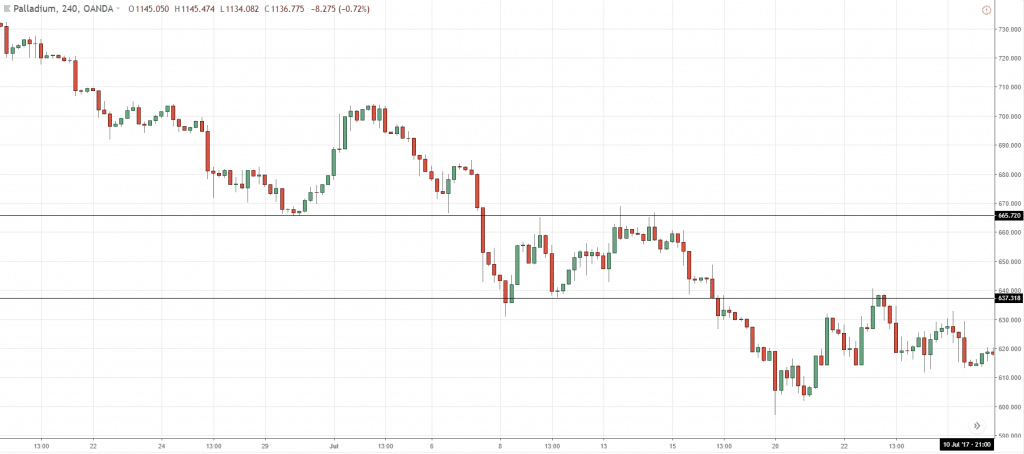

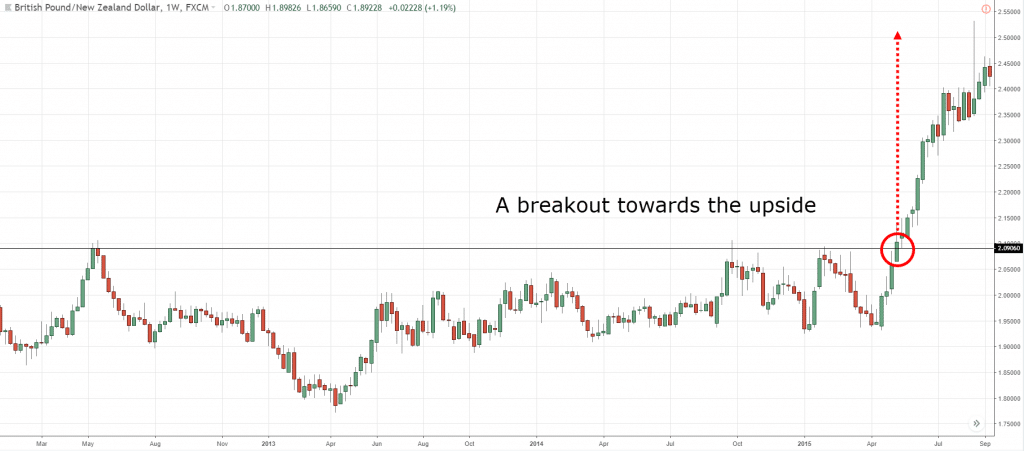

A breakout is when price moves outside of a defined boundary.

The boundary can be defined using classical support & resistance.

Breakout to the upside:

What are the pros and cons of trading breakouts?

Advantages of trading breakouts:

- You will always capture the move.

- You are trading with the underlying momentum.

Disadvantages of trading breakouts:

- You get a poor trade location as you’re paying a premium.

- You may encounter a lot of false breakouts.

Despite the possibility of false breakouts, it should not deter you from trading it.

Why?

Because the best traders in the world love trading breakouts.

I turn bullish at the instant my buy stop is hit, and stay bullish until my sell stop is hit. Being bullish and not being long is illogical. – Ed Seykota

When I’m bearish and I sell a stock, each sale must be at a lower level than the previous sale. When I am buying, the reverse is true. I must buy on a rising scale. I don’t buy long stocks on a scale down, I buy on a scale up. – Jesse Livermore

Now, this brings to the next question…

How do you identify a potential breakout before it happens?

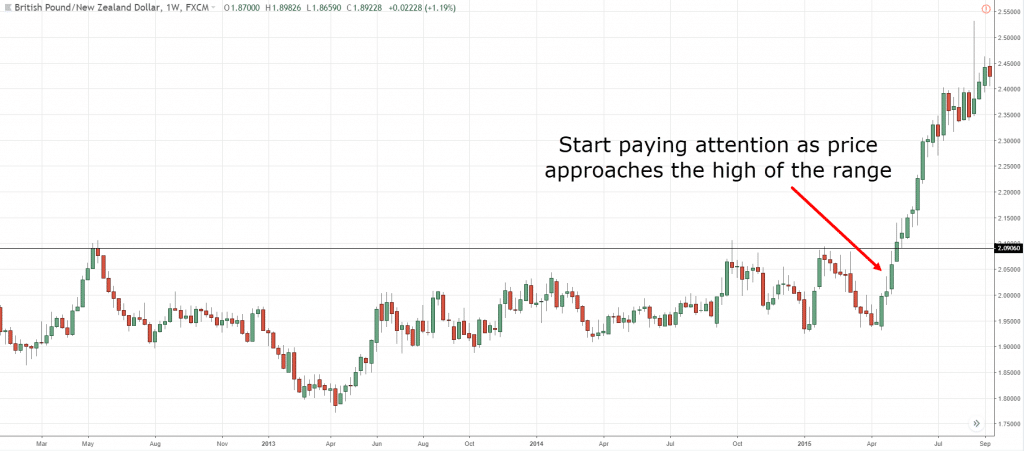

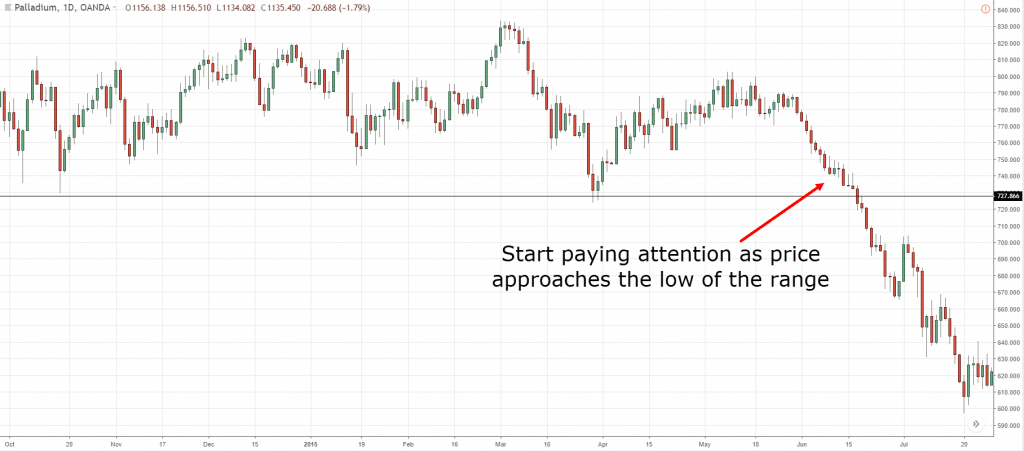

In a range market…

1. Mark the highs and lows of the range

2. Pay attention if price trades beyond the highs/lows of the range

Here’s an example:

Now, let’s move on to trending markets…

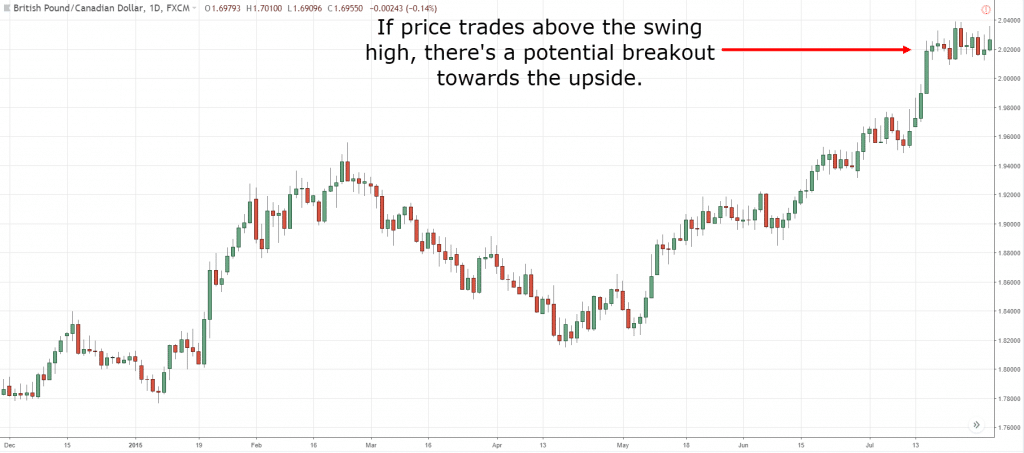

In an uptrend…

1. Identify a swing high

2. Pay attention if price trades above the swing high

An example:

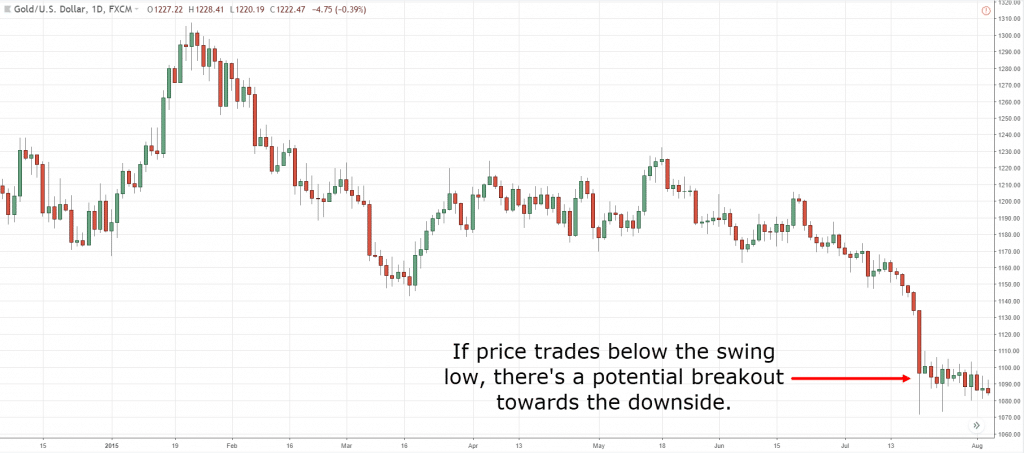

1. Identify a swing low

2. Pay attention if price trades below the swing low

Here’s an example:

Now you know how to anticipate a potential breakout, and this leads you to the next question…

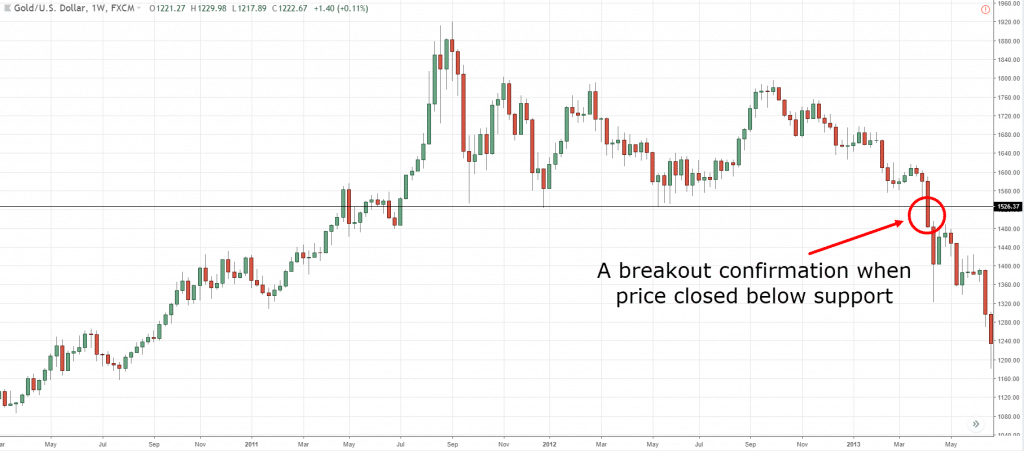

Do you wait for confirmation?

For breakout trades, a confirmation would be a candle close beyond the highs/lows you’ve identified.

An example:

You may potentially end up missing a huge chunk of the move.

Here’s an example:

Do you wait for confirmation?

This depends entirely on your trading personality. There’s no hard and fixed rule about it.

If you’re someone who prefers a candle close, then wait for a confirmation.

If you’re someone who prefers a better risk to reward, then trade without confirmation.

But bear in mind both have their pros and cons, and it’s something you have to accept.

Confirmation

- Easier to execute the trade psychologically

- Poorer risk to reward

No confirmation

- Harder to execute the trade psychologically

- Better risk to reward

Now, let’s put this knowledge to use…

How to develop a system to trade breakouts?

Likewise, before you can develop a system, you need three things:

- The condition for your setup

- Your entry

- Your exit

Disclaimer: Below is a random trading plan I’ve created to illustrate my point.

If the price has been in a range for the last six months, then place a buy stop order at the high of the range (Condition).

If a trade is triggered, then place a stop loss at the low of the previous candle (Entry and exit).

If the price goes in your favor, then look to trail your profits at the low of the previous candle (Exit).

Vice versa for short setup.

Now here comes the best part…

The secret to finding explosive breakout trades

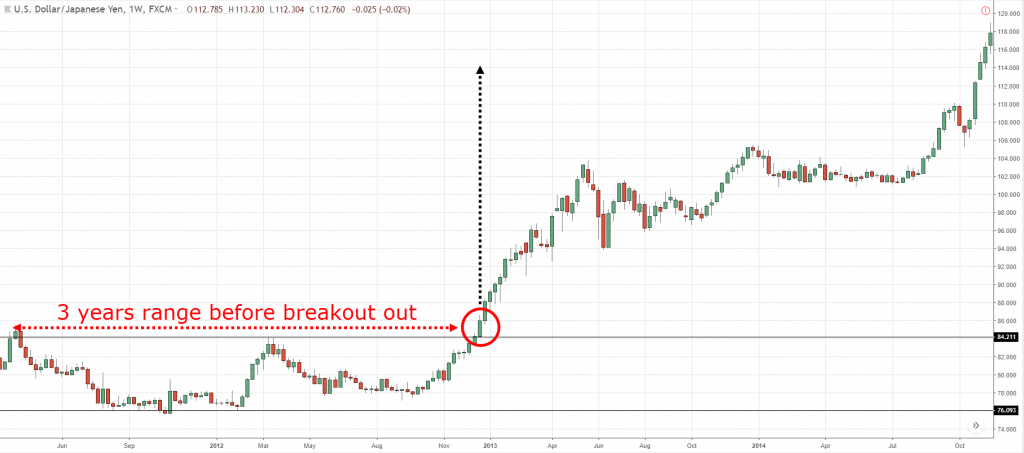

The market tends to move in a cycle.

From a ranging period to a trending period, and vice versa.

The longer it’s in a range, the bigger it’ll trend later on.

An example:

If you notice the price has been ranging for a long time, you’re not alone.

Traders all around the world will be seeing the same charts as you.

Some will be queuing to short the resistance, and some will be trading the breakout.

If the price does trade above the resistance, shorts will get squeezed, and breakout traders will hop on the bandwagon.

This is why the price is sustained for a period of time, due to the imbalance of buying/selling pressure.

If you want to learn more high probability trading strategies on breakouts, then check out this video below:

Frequently asked questions

#1: Where can I place my stop loss during breakout trade?

There a few ways to do it:

- You can set your stop loss below the lows of the buildup (if you’re trading a breakout with a buildup).

- You can also set your stop loss 3 to 5 ATR away from your entry price.

#2: How can I trail my stop loss for a breakout trade?

You can use the Chandelier Stops to trail your stop loss, a moving average, or even market structures, etc.

If you want to discover more powerful techniques to trail your stop loss, then check this out.

#3: Is there a way to anticipate that a breakout is more likely to occur?

If the higher timeframe is in an uptrend and the price is now consolidating or forming higher lows at resistance, then the market is likely to breakout higher (which is in line with the higher timeframe trend).

This concept can be similarly applied for a downtrend.

Conclusion

You’ve just learned how to successfully trade pullbacks and breakouts.

Now it’s time to put these techniques and high probability trading strategies into practice.

Now here's what I'd like to know...

How do you trade pullbacks and breakouts?

Leave a comment below and share your thoughts with me.

Hi Rayner

Wow, this article was very well written! I am a trend follower, and like you, I also only trade pullbacks and also breakouts. I really appreciate the time and effort you took to put all these info into an article like this. Thanks!

Hope you don’t mind me adding a little of what I picked up from other traders. A famous trader, Raghee Horner(can easily google her) wrote a book called “The million Dollar setup” in which basically she uses the 34ema plotted separately at high, low and close to check the strength of the trend. If an uptrend has the 34ema lines pointed sharply at an angle between 12 to 2 o’ clock like on the face of a clock, then the trend is strong. If in a downtrend the 34ema lines are pointed at an angle between 4 to 6 o’ clock, then the trend is strong. I personally use a variant of this system, not the 34ema, but the 20sma to point out to me if the trend is strong and worth trading. Anyway, my point is that for traders trading a pullback, the slope/angle of moving average lines can be a good indicator of the strength of the trend.

As for how I trade breakouts, it would be largely similar to what you mentioned above, with the addition of adding bollinger bands to let me know if price might be breaking out. When the bollinger bands squeeze together and become very narrow, then price closes strongly above or below with the upper and lower bands pointed in opposite directions and expanding, then it would be a good time to enter in the direction of the breakout.

Lastly I do look forward to reading articles like these that you take the time and effort to write, because sometimes they remind me of what I already know, and also many times you point out something that I would never have thought of and which gives another perspective of how to trade a trend. Hope you keep them coming!

Hi Larry,

Thank you for reaching out. I’m really glad to know you found this article useful.

I’ve heard the works of Raghee but I’ve never look at it myself. It’s about time I read her teachings.

Yes looking at the slop of the moving average is a good way to define the strength of a trend. Because a mistake many traders make is to treat all trends the same when that’s clearly not the way. Some trends are stronger and some are weaker.

I hope to hear more from you soon Larry 🙂

Rayner

Great article as always Rayner, succinct and to the point and explained in a really easy to understand format. I’ve been trading over 20 years and still picked up some very useful information in your article

Thanks

Keep up the great work

Pete

Hey Pete,

Thanks for stopping by.

I’m really glad to know a veteran trader like yourself still find something useful here.

Hope to hear more from you in the near future 🙂

Rayner

Nice one !!

Keep it one, thanks for this effort to write this article.

Reminds me 5 years back things that I already known, but already forgotten now.

Hi tjenarvi,

You’re most welcome.

Sometimes traders focus on the complex stuff when all you need is to, ‘KISS’.

Cheers!

Rayner

one issue with your examples, you show bo’s as trading with a larger time frame, and pb’s trading a smaller time frame fyi

Hi Bob,

The principles are the same for all time frames.

I randomly selected the charts that could illustrate my point.

Hope it helps!

Rayner

Hi Rayner,

Great lesson – Thank you, I am busy putting my trading plan / rules together, stictly trading Pull Backs, Break Outs and Swings when the market is trending and the range when the market is in a Trading Range, exclusively with the trend – Your articles and videos have been a grear help in getting me to this point, I am really grateful for your time and effort!

Thank you

Hello Neill,

I’m so happy to hear that.

Yes developing your trading plan is key. And once you’ve nailed that down, execute your trades consistently for the law of large number to play out.

Keep me updated on your progress. I hope to hear much more from you.

Rayner

Hi Dear Rayner,

I don’t have what to say.. this article should be at the “Hall of Fame” of your blog, it’s really an amazing, amazing post, amazing work, many thanks for your time!

I need a little clarification where to place SL in breakout trade, and when and how to trail it.

(it’s in the paragraph before the last one)

BTW:

The link (cheat-sheet) in the end of the post is broken, it’s take me again to this post.

Thank you!!

Shlomi

Hello Shlomi,

Thank you for your comments, that really made my day!

You can use 2ATR for your breakout trades, and trail using a moving average, or take profits at the nearest SR. That’s up to you.

The link should be fine now. You need to go to your email and download the cheat sheet. Let me know if it’s working for you 🙂

Rayner

OK. But you wrote to put the SL in low of the candle before the breakeout, and then how trail it.. and I don’t understand this way.. if you could explain me it again please..

About the broken link.. it’s still lead me to this page 🙂

Thank for your time!!

Shlomi

LOL. It was my fault 🙂

I just had to click on it, not to open it in a new tab 🙂

Sorry for bother you Rayner.

Shlomi

Not at all Shlomi, cheers!

Hi Shlomi,

There are few ways to place your initial stoploss.

1) You can place at candle low

2) A certain number of ATR away from entry

Trailing stoploss is a different thing here. You typically want to trail so you can ride the trend, should it continues in your direction.

Using moving average is one approach. You can consider using the 20 or 50 MA to trail your stoploss.

Rayner

Hi Rayner,

So.. there isn’t any golden rule for SL, it’s more dependent on the situation for every trade separately.

Which kind of MA is recommended, MA or EMA, and which one for 100 and 200?

Again, full thanks for your help!

Shlomi

I use 20 & 50 ema for my trading.

You’re most welcome!

Rayner

hi Rayner,

My account is not that big, so losing almost half of it give me stress. so I decided to pause for a while and analyze whats wrong… A friend of mine told me to read your blog… As I’ve start reading your story, I become interested on it.. So I continue reading the rest of the blog (nearly half of it) . Then I analyze and understand what is happening….

Now, that I have a knowledge (not that much) on what it is all about my trading is getting better. Because it is easy to understand and everything is based on your experience and observation. It is a big help for me….

Thank you so much for sharing and helping us…

Waiting for more post, even though Im not finish yet with the rest of your blogs…

God bless and more blessing to come…

Cristina

Hi Cristina,

Thank you for sharing your experience. I’m glad you found this website useful.

Don’t hesitate to let me know if you’ve got any questions, I’ll be glad to help.

Rayner

Rayner,

thank you so much… as of now i’m gaining.. still I little bit scared but i trust what i’ve from you and most of all I trust my self that I can do this. thanks again for your advice and knowledge.

again, thank you.

cristina

You’re welcome, Cristina.

Cheers!

Rayner

Nice article and information is presented in a clear way. I love to see few more articles on the below topics in your blog:

1) Importance of money management

2) How to retain or maintain positive mindset after having few loosing trades

3) Importance of sticking to one trading method and getting mastery in it, instead of switching trading methods

4) Methods to withdraw some amount every month if you are a full time trader

Hi Indra,

Thank you for sharing your feedback.

I’ll look into your suggestions and see what I can do.

Rayner

Good PM Rayner:-

Thanks for explaining the concepts with the examples. Your clear explanation help me shorten my learning curve. Although English is not my first language, I find your explanation easy for me to understand .

Thanks a lot.

Albert Tay

Hey Albert,

You’re most welcome. Glad you found it useful 🙂

Rayner

Thanks a lot rayner, this article is so useful, i

i cannot thank you enough.

You’re welcome, Gonzalo.

Great to hear that!

Rayner

thank you very much… god bless to you

Don’t mention it, Kusuma 🙂

Thx so much Rayner , by efforth and share knowledge clear explenation …….greeting . God blest to you and family ……….!

You’re welcome, Casio.

cheers

Rayner I thank you for your great tutorial. I started to study forex for about 1 month before bumping into your tutorials; which have made things very clear to me. I have an idea on trading breakout. Please correct me if I am wrong: once I get convinced that breakout is in the offing, I will personally do 1 of the following 2 things:

– Wait for confirmation before entering a trade

– Enter the trade before confirmation, but with a wide stop loss (probably at previous swing high/low). Please tell me what you think. Again thanks a lot Rayner.

The best breakouts are those that form buildup at SR areas.

This post will help…https://www.tradingwithrayner.com/how-to-trade-breakouts/

Rayner, you are a blessing to people like me,you have brought a great deal of trading improvement to my trading,your simplicity to you explanations is overwhelming.

God Almighty bless you with long life.

Awesome to hear that, Albert!

hi i am from India and new to trading and i want to make this as my profession,i love the candle charts , and you-tube is my guru for learning intraday strategies,But i always hesitate to start with real money,confidence lags because of my earlier bad experiences had with most of the research companies who have cheated me ,is there any possibilities to come out of this mind set and become a successful trader,i will be glad if you could help me in this matter

And what do you expect me to do?

Hi Rayner,

Thank you for sharing your knowledge for free. It is very helpful for people like me whose knowledge with stock trading is so limited. I’m glad and thankful I found your post in investagrams. I am hoping that I can apply the new learnings correctly to improve my trading decisions 😀

I have tried to download the cheatsheet but the confirmation email is redirecting me to a link of an image, probably the link is incorrect?

Hey Mylene

No worries about it. Just drop me an email and I’ll send it over.

Great stuff thanks

Welcome!

Thanks Rayner. Great sharing!

You’re welcome!

Excellent article so precise and crystal clear . . . . Thanks a lot

You’re welcome!

Hi Rayner!

Thank you so much for your free material.

I foundn in it very very important lessons. I will study it .

God bless you

You’re welcome, Zenebe!

Thank you so much for your good lesson Rayner

You’re welcome!

Thank you for your precious reference.

I will study it hard this week.

God bless you!!

Cheers

hello rayner,

thanks for the help thus far. i am a certified student of yours.

do u give out signals?

I don’t, cheers.

Vbest knowledge by you sir thanks

Cheers Sandeep!

Hey Rayner Please Make a Video Advance Trade using 50 & 200 EMA Candle Breakout & How Do use Both EMA’s Chart Pattern Like a Pro.

Mr. KHAN From IND ♥️

I’ll look into it…

Hi Rayner

Best among the articles/practices used in trading circles. I have noticed much improvement in my trading after reading your many writings. God bless you.

Awesome to hear that!

Hi Raynor ,very practical articles and helping me in improving as a trader .god bless you

Cheers Sandeep

Hi Rayner, I want to have all your books on trading. Can you send them to me. David.07221991@gmail.com

amazing content, thanks alot

Cheers Amit

Hi Rayner,

Thanks a lot for all your knowledge that you share, that is really great from you.

Could you please make a video or artical with your advices for day trader, TF, best patterns, indicators, etc…someone who is satisfied with 30-50£ a day, 5-10 pips per a trade …thank you so much again☺️. All the best☺️

Hi Rayner,

Thanks for your sharing. I found a lot of useful experience in this. Keep walking!

Cheer!

Cheers!

In trading Education feeding step by step it’s important and your feeding us .

Thank you sir.

My pleasure, glad to help!

Hello Rayner

Your article is very clear and I got many information there. Thank you for share so useful knowledge with us. Be blessed!

Rayner, your lecture is very precise and to the point. your are a great educator. Keep it up and remain blessed.

Cheers Sunny

You’re most welcome!

Hey Rayner

Thank you very much for everything you are doing for us, I’ve learned a lot from YOU, am a different person now, thanks again. May the Lord bless you.

Hey Relebohile,

It’s my pleasure!

Rayner, good morning. This is simply amazing. Your understanding of market is simplified I like it. It has given me a clear view in trading. Either pullback or breakout that’s it. Ha ha ..thank you for your sharing this for new traders like me.

..Ravi Bhadane

Hi Ravi,

It’s my pleasure!

Hi Rayner,

I would like to know whether your PULLBACK STOCK TRADING SYSTEM work for Indian markets? I am a newbie into markets. Found one of your video useful in Youtube. Browsed through your website and found good information. But no where it mentioned about Indian or foreign stock markets.

Personal request: If you provide a pdf copy of the PULLBACK STOCK TRADING SYSTEM, it will be useful at this moment as no international shipping allowed now as Corona cases rise worldwide. Hope you understand.

Keep rocking.

Hi Sarvesh,

It’s expected to always backtest strategies being tested and given out for FREE.

The reason behind not having a soft copy for the PSTS is to leave something physical behind in this world with the name Rayner Teo.

Cheers…

Man you are just SOOOO helpful with your trading knowledge, thank you very much. Njabulo from South Africa

Hi Njabulo,

It’s my pleasure!

Cheers.

Hi Rayner,

Just received copy of booklet trading today. Thank you very much. Simple technique, easy to implement. Will try backtest on our local stock first to look at suitability.

By the way, i got piece of paper on this booklet mentioned latest version on pullback trading system. My question, how to get the ‘souvenir’ that you provide at update.pullbackstocktradingsysystem.com since i cannot find any access to that page.

Hi Shairazi,

I’m so glad for your feedback about the PSTS.

Check your email as the update has been sent to you.

Cheers…

I also only trade pullbacks and also breakouts. I really appreciate the time and effort you took to put all these info into an article like this. Thanks!

Hi Sriinivas,

Thanks for sharing.

Cheers.

Hai , good morning , I learn a lot from your articles, it cleares my doubts while I am suffering during trading.

Hi Nagurvali,

I’m glad to hear that!

Please Rayner, I pray thee, see this comment and reply. LOL.

Am a bit confused about this breakout thing. This is my understanding of how it is.

Let’s say price is in an uptrend, we wait for it to come to an area of value.

Finally, It gets there, the normal thing for me to do is buy.

Now the breakout I understand is if the price breaks below the area of value and keeps going downward.

Since I am anticipating that move, I will put a pending sell stop order to capture it.

The same for downtrend.

Is that not what breakouts is about??

Thank you

Godspower

Well said Reyner thanks you are a blessing to us

You are welcome, Vuminkosi!

[…] This means you can look to buy breakouts or pullbacks. […]

Hey Rayner your article have be helping my trading journey .I must confess that ..

You have won my heart and given me hope to keep going..

Glad to hear that, Ifenna!

Very good for concepts & application. Requires strong scanner / screener to scan these breakouts on daily, weekly & monthly charts. Kindly advice on screener / scanner.

What timeframe is better to trade pullback

Thank you Rayner! I did have very high rate of success on breakouts since learning from your blogs. My two latest breakouts were 180% move by a under $10 stock that was a headliner last thursday. The other one was a 172% move up by another less $10 stock 2 weeks prior. These stocks were ranked winners to laggers in 30 days and more stocks are queuing up. I use atr, rsi, and candles as confluences and boy they ever make wonders. Keep the blog going thank you.

We’re so happy to hear that, Ed! You did a good job!

Bro u just changed my trading for the better

Hi, Bella!

So glad to hear that!

Cheers!

I try to be more conservative with trading even though I tend to be a bit of a risk-taker, I can say that your teaching has made me feel more confident trading pullbacks and breakouts. It made clear to me the areas I had doubts. Thanks for the good work.

You are most welcome, Felix!