What is a trailing stop loss

Have you ever wondered how professional traders ride big trends?

You know the type of trend that keeps going higher and your profit keeps snowballing — while you do nothing.

Well, the secret is this…

They use a trailing stop loss.

You’re thinking:

“It doesn’t work.”

“I’ve used it before but the market always hit my stop loss before it trends.”

That’s because:

- You have the wrong expectations about riding a trend

- You’re using the wrong trailing stop loss technique

- Your trailing stop loss is too tight

But don’t worry.

I’ll teach you how to fix all these and more in today’s post.

PLUS, you’ll learn 5 powerful techniques to trail your stop loss so you can reduce risk and ride MASSIVE trends.

Now if you prefer, you can watch this training video below…

What is a trailing stop loss and how does it work

A trailing stop loss is an order that “locks in” profits as the price moves in your favor.

And you’ll only exit the trade if the market reverses by X amount.

This is how a trailing stop loss looks like:

Here’s a trailing stop example:

You bought ABC stock for $100 and your trailing stop loss is $10.

This means if the price goes higher to $120, your trailing stop loss is at $110 (120–10).

And you’ll exit the trade if the price drops to $110.

See how it works?

Now you might be wondering…

Why use a trailing stop loss?

Let’s be honest.

You and I both can’t predict how long a trend will last.

But what you can do is, use a trailing stop loss and take what the market offers you.

Disadvantages of Trailing Stop Loss

Now here’s the truth:

Most of the time (even if you use a trailing stop loss), you’ll not ride a trend.

Also, it’s common to watch your winners turn into losers — as the price moves in your favor and then hit your trailing stop loss.

This causes many traders to give up and they’ll claim “it doesn’t work”.

But here’s thing…

If you can endure the emotional swings, you’ll eventually catch a huge trend — possibly achieving a 1 to 20 risk to reward or more.

And this is something most traders never get to experience because “it doesn’t work” for them.

Next…

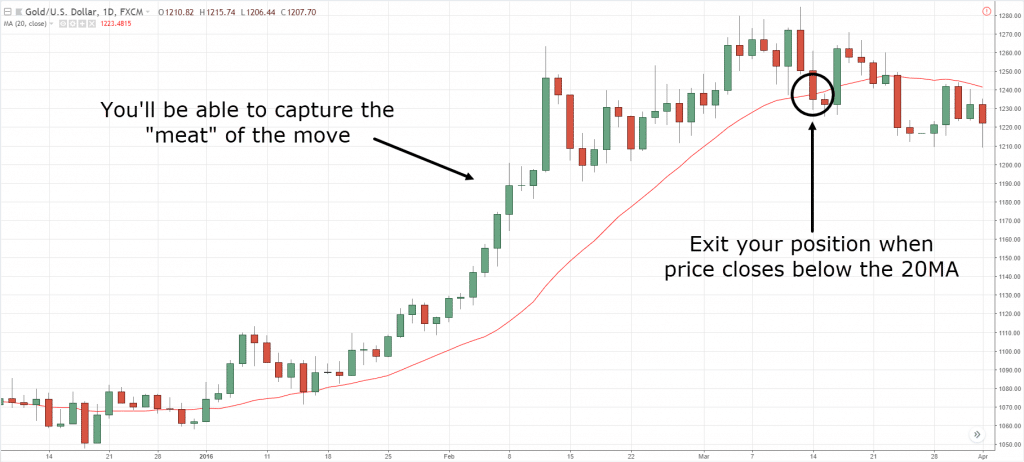

How to trail your stop loss with Moving Average

The Moving Average is an indicator that averages out the past prices and shows it as a line on your chart.

You can use it to identify the trend, filter out the “noise”, etc.

If you want to learn more, go check out The Moving Average Indicator Strategy Guide.

But for now, let’s learn how to use it to trail your stop loss.

Here’s how:

- Decide on the type of trend you want to ride

- Use the appropriate Moving Average

- Exit when the price closes beyond it

This means if you want to ride a short-term trend, you can trail your stop loss with a 20-period Moving Average (MA) — and exit your trade if the price closes beyond it.

An example:

Pro Tip:

You can use the 50-period MA to ride the medium-term trend and the 200-period MA to ride the long-term trend.

Average True Range indicator: How to use it to enormous big trends

Have you seen traders use a fixed 20 pip trailing stop loss?

It’s a joke.

Because it doesn’t consider the volatility of the markets.

Imagine having a 20 pip stop loss when the market swings an average of 200 pips a day.

It’s like flushing money down the toilet bowl.

So, what’s the solution?

You can use the Average True Range (ATR) indicator to set a volatility based trailing stop.

Here’s how it works…

- Decide on the ATR multiple you’ll use (whether it’s 3, 4, 5 etc.)

- If you’re long, then minus X ATR from the highs and that’s your trailing stop loss

- If you’re short, then add X ATR from the lows and that’s your trailing stop loss

To make your life easier, there’s a useful indicator called “Chandelier stops” (from TradingView) which performs this function.

Pro Tip:

You can use 2 ATR to ride the short-term trend, 4 ATR for medium-term trend, and 6 ATR for a long-term trend.

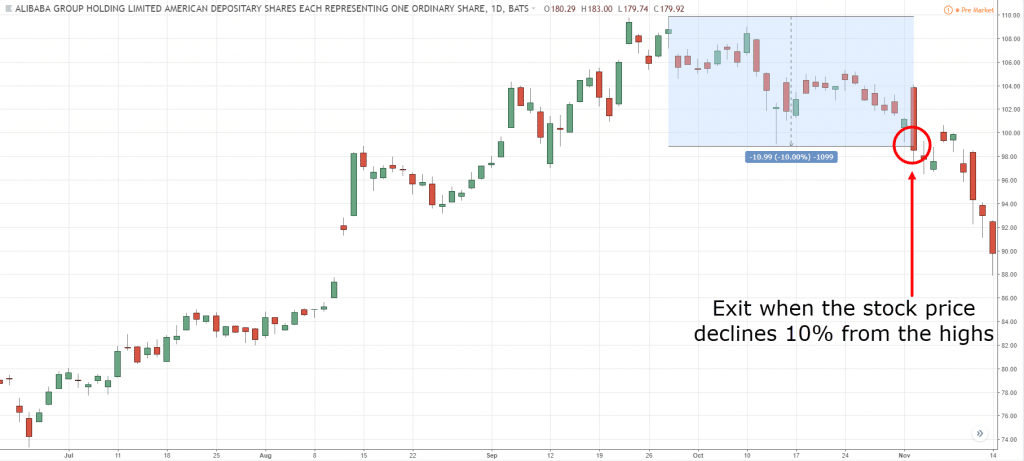

You don’t need a chart to trail your stop loss, here’s how…

Decide on the trailing stop loss percentage where you’ll exit the trade.

It can be 10%, 20%, or whatever you decide.

For example:

If you buy ABC stock at $100 and have a trailing stop of 10%.

This means if ABC stock drops 10% (from its high), you’ll exit the trade.

An example:

Pro Tip:

This technique is useful when trading a portfolio of stocks with equal weight for each position.

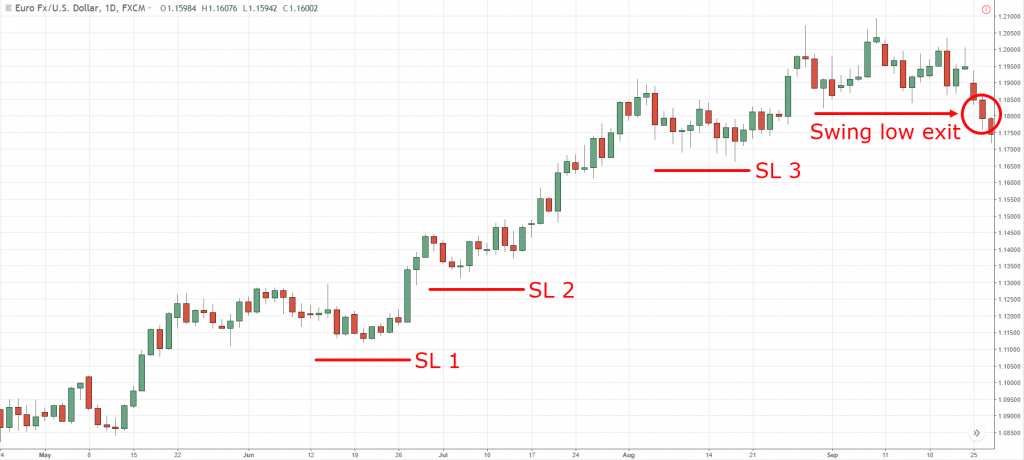

The zero indicator method to trail your stop loss

You know an uptrend consists of higher highs and lows.

This means you can use the swing low to trail your stop loss because if the trend holds, it shouldn’t close below it.

Here’s how to do it:

- Identify the previous swing low

- Set your trailing stop loss below the swing low

- If the price closes below it, exit the trade

An example…

Pro Tip:

The market tends to “hunt” stop losses below Support or swing low.

To avoid it, set your stop loss 1 ATR below the market structure.

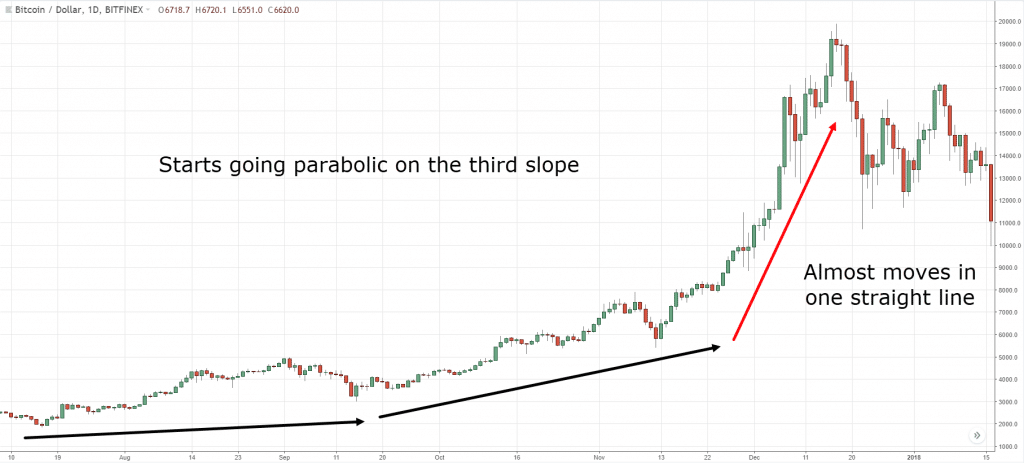

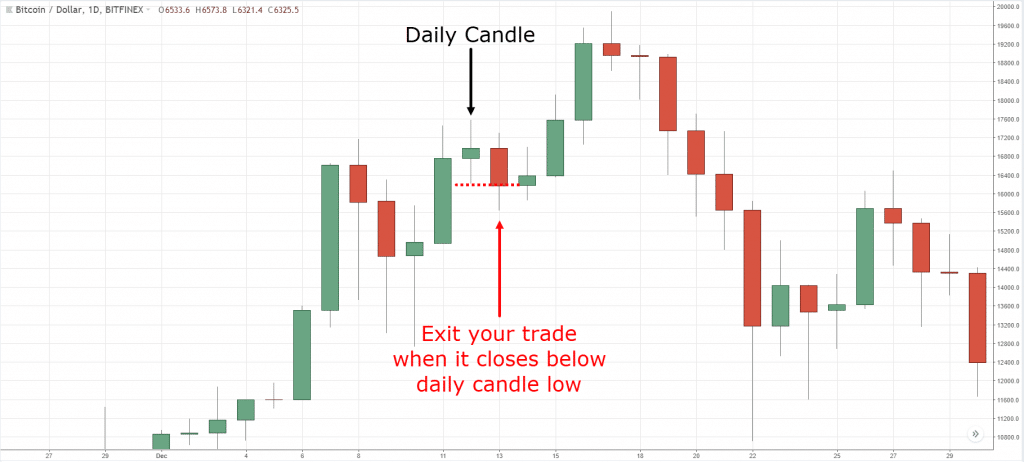

How to trail your stop loss when the market goes “crazy”

What do I mean by “crazy?”

It’s when the market goes parabolic in one straight line (like a rocket taking off).

For example:

But here’s the thing:

Parabolic moves are not sustainable.

It’s a matter of time before the market reverse and COLLAPSE.

So, in market conditions like these, you want to trail your stop loss tightly.

Don’t give it too much room to breathe because you want to “run” at the first sign of cracks.

So, how do you do it?

- Identify the timeframe of the parabolic move

- Trail your stop loss on the previous candle low

- Exit if the price breaks and close below it

Here’s an example:

As you can see, this technique got you out of Bitcoin at $17,000 — and avoided the collapse.

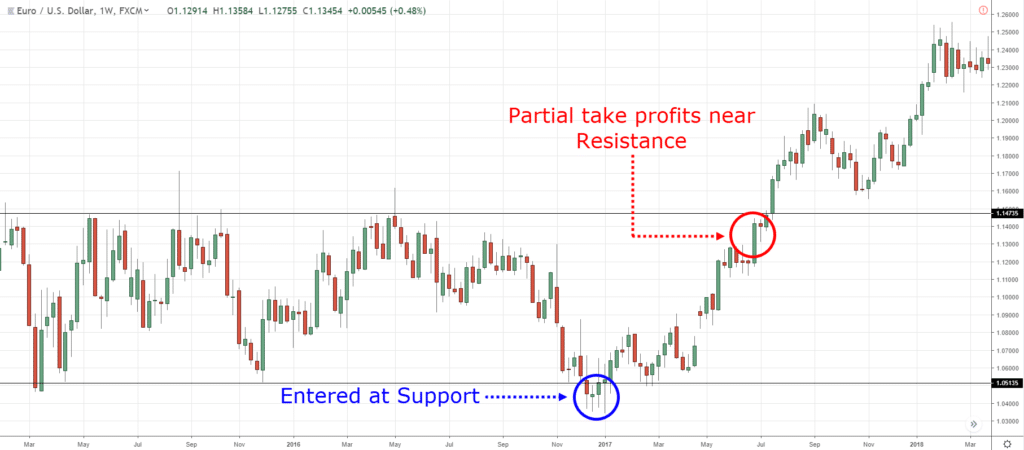

Bonus Trading Tip: How to capture a swing and ride massive trends (at the same time)

Here’s the thing:

There’s no rule to say you must either capture a swing or ride a trend.

Instead, you can do both!

This means you have the consistency of a swing trader plus, the ability to ride big trends (like a Trend Follower).

So, how does it work?

Simple.

You exit a portion of your trade at a fixed target and let the remaining ride the trend.

Here’s an example:

Partial take profits on EUR/USD Weekly:

Now, there are two things to consider…

- How many units do you sell at your fixed target?

- How will you manage the remaining units?

Let me explain…

1. How many units do you sell at your fixed target?

Here’s the thing:

If you sell too little units, it becomes a Trend Following trade.

And if you sell too much, it becomes a swing trade.

For starters, you can sell 50% of your position at the first target and keep the remaining to ride a trend.

Once you’re proficient with this technique, you can “play around” with the percentage to suit your goals.

2. How will you manage the remaining units?

You’ve hit your first target profit, yay!

What now?

Will you attempt to ride a trend or have a second target profit?

If you have a second target profit, where will it be?

If you want to ride a trend, how will you trail your stop loss?

Clearly, those are questions only you can answer (and it depends on your goals and personality).

So think about it.

Now you might be wondering…

Which is the best strategy to trail your stop loss?

I’ll be honest.

There’s no best trailing stop strategy, nor is there a best stop loss strategy.

Because it depends on what YOU want from your trading.

For example:

To ride a short-term trend, you can trail with 20-period MA, 2 ATR, etc.

To ride a medium-term trend, you can trail with 50-period MA, 4 ATR, etc.

To ride a long-term trend, you can trail with a 200-period MA, 6 ATR, etc.

Do you see my point?

The most important question to ask is…

What’s the type of trend you want to capture?

Then use the right technique to achieve your goal.

Conclusion

- A trailing stop loss is an order that “locks in” profits as the price moves in your favor

- You can trail your stop loss using: Moving Average, Average True Range, percentage change, market structure, and weekly high/low

- There’s no best stop loss strategy or method to trail your stop loss. Instead, ask yourself what’s the type of trend you want to capture and then use the right technique for it

Now here’s my question to you…

How do you trail your stop loss and ride the trend?

Leave a comment below and share your thoughts with me on trailing stop loss.

Hey R

Just received your email on trailing stops.

I’m using you strategies and mixing it with Heikin Ashi candles and killing it. I trail my stop by bring my stop above/below the provisions days HA.

Do you ever use heikin ashi? M

I’ve not used it before.

I usually use 20/30 pips

Thanks for sharing, Ope.

Newbie here. I will follow your stop loss strategy. I will let know the result.

Sure thing!

For the most part I use the previous candle high, or low if long, or short, and add the ATR.

Thank you for sharing, William.

That’s nice and clear but I get a little confusion on how movie g average helps me coz they show the past movement.

Everything is a derivative of past prices, even the chart you use.

Moving Average can act as a “barrier” in trending markets so your stops can go beyond it to ride a trend.

Wow, this is awesome information!! I’m a newbie and with my paper trades I’ve just been setting up regular stop losses. I can start incorporating the trailing stop loss, so I can practice some swing trading. I’ve heard of trailing stop losses, but wasn’t exactly sure how to implement it. I will definitely try it.

Awesome, let me know how it works for you.

Rayner this is an awesome lesson thankyou much may the law of the more you give the more you recieve apply to you

Thank you, Patrick!

Example if i purcahse 100 rupees share.in the trailing stop loss order, i would like to give 10 rupees , what i have to enter in trailing stop loss 10 or 90?.

If i buy a 100 rupees share.if i would like to give 10 rupees as trailing stop.in stop loss order,what should i enter 10 or 90 in trailing stop loss?

Every 15 minutes, I run the last 10 days of minute candles through the routine that determines how to trail for a number of different values for the parameters that determine how to manage the trailing stop loss orders.

The optimum values are written to the database and are used by the same routine that runs live.

Thanks for sharing!

Can you adjust your trailing stop loss a few days after placing the trade?

Hi Rayner,

How do you position size with a trailing stop loss strategy (trail by

1 ATR from most recent high’s close price). I do not think your previously introduced position sizing formula 1% of trading capital / take profit – stop loss works for the particular trailing stop loss strategy (by 1 ATR). Thanks!

Hey hey hi my friend reyner,

I want to share something here, i strongly follow your Technics and it improves my trading, thanks for your guidance n share your thoughts to us, while taking trade sell on high n buy at lows according to Trend i set my stoploss 5-10 points below/above on previous highs /lows and after the trend give me 15-20 points on my way i set it to cost to cost and accordingly trailing my stoploss!!!!

I liked your techniques on trading. I look forward to learn more from you

Thank you, glad to help out!

Excellent info and well presented, Rayner. Thanks! One thing I might note is that sometimes you will get gigantic candles in your trade’s direction. In that case, the trailing stop you’re using may be tighter than setting a stop at the previous candle’s close.

Makes sense, thank you for sharing!

Thanks sir I am Indian market playing with index watch so give best idias.

Hi rayner

Can u explain 5 mints digital and binary trading

Is it good or bad for beginers

Hi Bro ,I Begginer for Trading every time am trading loss only am booking ,pls guide me i want expert in trading,and i seen your videos too it’s helpful for me

I use Swing high/low and book profit in in every swing because i don’t want to confuse myself in many things.. i am from india

Thanks for sharing, Pavan!

Simple is good.

Hello Rayner,

Thanks for article which I enjoyed because it was – among other things – easy to read and simple to understand and provided a good choice of methods with directions on how to use. Quality work.

Thank you, Stephen!

Very useful article.

Hey Deepak,

You are most welcome!

Look forward to reading it

Hey A,

Cheers!

Hi,

I haven’t received the book yet. When can I expect it?

Thanks,

Arif

Hey Arif,

Check your email.

Cheers.

Going to start soon, will use your technique. Tq..

Hey Ade,

I’m glad to hear that. Make sure you backtest…

Cheers!

Please send me this pdf

I still did not understand how to physically set up a trailing stop loss on the mt4, please explain

Hey R!!!

I like to ride the trend and book my profit at 1/2 % of trade with using trailing stop loss some how beyond the 20 MA

Hi Muhammad,

I’m glad to hear that!

hallo

i have been looking for this trailing stop months now, every one tells you how to use it, but i did’t find a person telling me where to find it

so please tell me where can i find the trailing stop ?

Excellent tips which every person should fallow so that maximize the profit. Good luck . thanks

Hi Prasad,

Thank you!

Cheers…

Am blessed to have you as my mentor after so many years of trading blindly and losing always am glad to say my trading it’s 70% win. Thank you so much my friend.

Hi Jessica,

I’m so glad to hear of your improvement.

Cheers.

Another convert to ‘the’ Rayner way….just reading a few of your articles has changed loss after loss into win after win….love the presentation style too!!

I was getting fed up with the ‘stop loss hunters’ …..

Hi Wml,

I’m so glad to hear that.

Keep winning…

Cheers.

Good summer onTSL, just was curious on how risk reward scenario would be with high longer term trail stop loss

Hello am ask do trail stop be active and accurate in trade of boom and crash 1000 on those spike candlestick

Well simplified. I like your methods of teaching

Hi Tolu,

Thank you!

Cheers.

I am just loving the way you put your teachings making me want to start trading like a pro even when I am just starting. Keep it up man

Haha, Thank you, Abraham.

MA cross is not a trailing strategy but an exit strategy…

Thank you Rayner for your awesome guidance! I am new to options trading and love the trailing loss concept. Where I’m not sure to do is placing the trailing stop loss as a market or a limit order. Which one is best and why?

Hello again. As a 2nd question related to options trading with a trailing stop loss, how do we manage a trend with the options’ expiration date approaching?

What I am looking for is a system that will work with weekly options.

I would like to trail my stop loss. By looking market structure. Because I love to trade without indicator.

Thanks rayner.

Best wishes from INDIA.

Glad to hear that. Aman!

Thanks a lot for this extensive info. For short term trades (day trading on 5 min chart) I usually try to stick to the 21EMA as support (long position) and use a 2ATR for trailing the stop. I have some issues regaring the change in volatility during the price evolution. Would you recommend to let the trailing stop distance fixed (initial 2ATR) or adjust it according to the change in ATR during a trade?

how do you set your trailing stop?

Hey Rose,

This post should be of great help.

https://www.tradingwithrayner.com/trailing-stop-loss/

Cheers.

I trail according to market structure + broker spread. Majulah Singapura! ✊

Useful techniques thank you

You are most welcome, Ashok!

When using the close below the 10 Day MA, is this done manually by setting alerts on your charting software and then executing on your brokerage or is there a way to automatically link it?

You have to close it manually, Jay.

Hello my friend, I wanted to thank you for your very accurate and professional training

You’re most welcome, Tohid!

i would like a better example on how to trail parabolic moves properly can you go into a steb by step method

Hey there, Rudolf!

Jarin here from TradingwithRayner Support Team.

I highly recommend not to chase a parabolic move. Parabolic moves are not sustainable.

It’s a matter of time before the market reverse and COLLAPSE.

So, in market conditions like these, you want to trail your stoploss tightly.

Don’t give it too much room to breathe because you want to “run” at the first sign of cracks.

So, how do you do it?

First, Identify the timeframe of the parabolic move

Second, Trail your stop loss on the previous candle low

Lastly, Exit if the price breaks and close below it

There’s no best method to trail your stop loss. Instead, ask yourself what type of trend you want to capture and then use the right technique for it.

Hope that helps!

Hello

Which Broker supports trailing Stop loss Alerts ? I can’t find brokers in USA & India who supports it. Can you guide me.

-Regards,

Hi Rayner,

A (day-trading-)newbie question: What about simultaneously opening two positions for the same asset (e.g. EUR/USD):

1. BUY at current price P with SL = P-X and TP = P + r * X

2. SELL at the same price P with SL = P + X and TP = P – r * X

If it makes sense (if impossible to the same broker, using two distinct brokers), recommendations on how to choose:

(i) X,

(ii) r (what about a conservative value x = 1.5?) AND

(iii) entry position are most welcome!

Regards, God bless you!

Onul

Hi, Onul!

If you are a beginner, I highly recommend to only risk 1-2% of your account per day. You might find the articles below helpful:

https://www.tradingwithrayner.com/forex-risk-management/

https://www.tradingwithrayner.com/forex-day-trading-techniques-that-work/

https://www.tradingwithrayner.com/intraday-trading/

Hope this helps!

Thanks but I expected an answer to my specific question.

Great to learn

Thanks, Sanjay!