Attention: To All Stock Traders

What do you want to learn

Candlestick Patterns

Price Action Trading

Systems Trading

Trading is hard…

When I was in university…

A forex broker came to my school and organised a trading competition.

It was a paper trading competition, but still, there were prizes to be won.

So, I took part in the trading competition thinking…

“How hard can this be?”

After 2 days…

I blew up my account.

I wasn’t upset but excited.

Because I realised trading offers an unlimited earnings potential. You are the boss. And you can trade from anywhere in the world.

I told myself…

“Damn it, I’m going to be a trader!”

And that was the start of my trading career.

At this point, I scour the internet and learn whatever I can get my hands on.

Now…

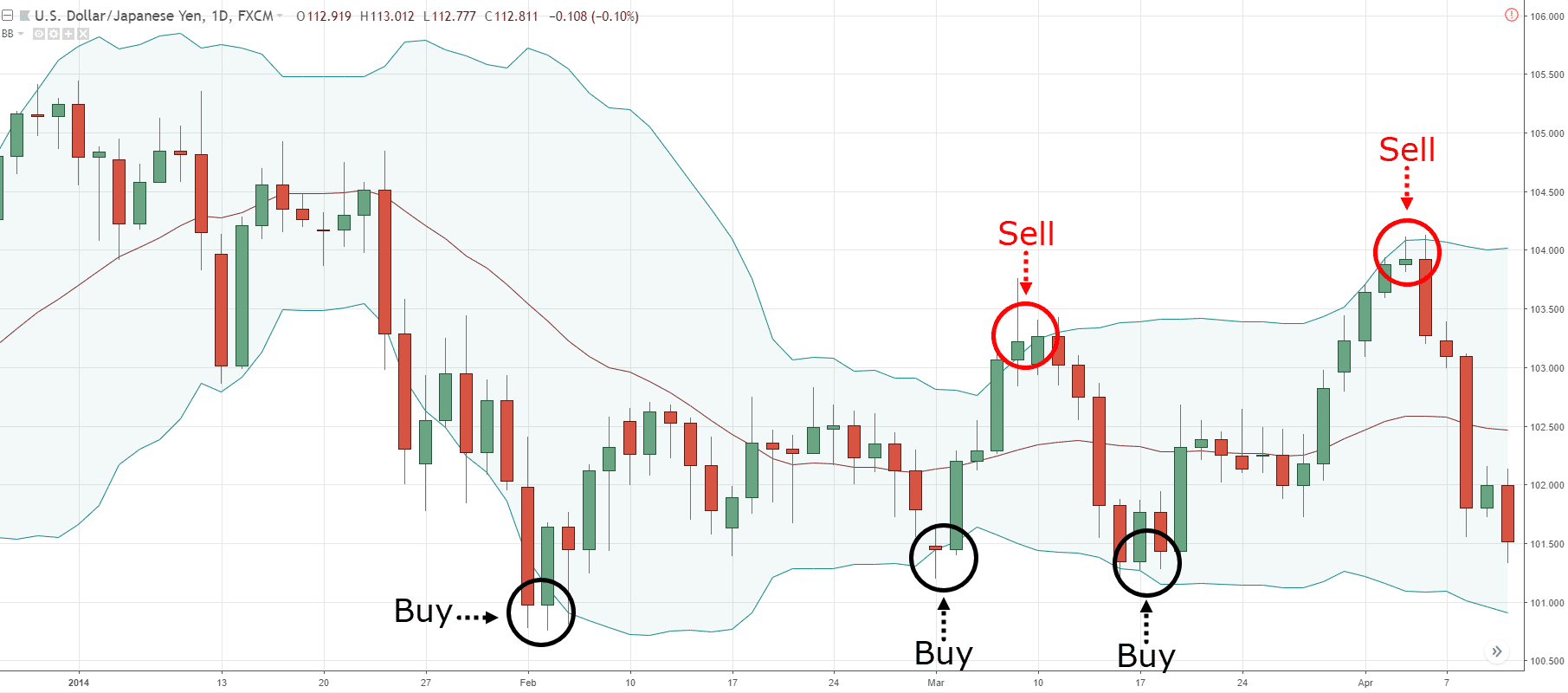

The first trading strategy I came across was Bollinger bands.

The idea is simple—buy low and sell high.

You want to buy at the lower band and sell at the upper band.

Here’s an example:

When I first saw this chart, I thought…

- “This is the holy grail!”

- “I’m going to keep this trading strategy to myself”

- “I’ll be a full-time trader after I graduate from university. Or maybe I should quit my studies now?”

The next logical thing to do is, trade with a live account.

So I did just that.

But somehow, I didn’t make money with this trading strategy.

And guess what I did?

I started looking for a new trading strategy…

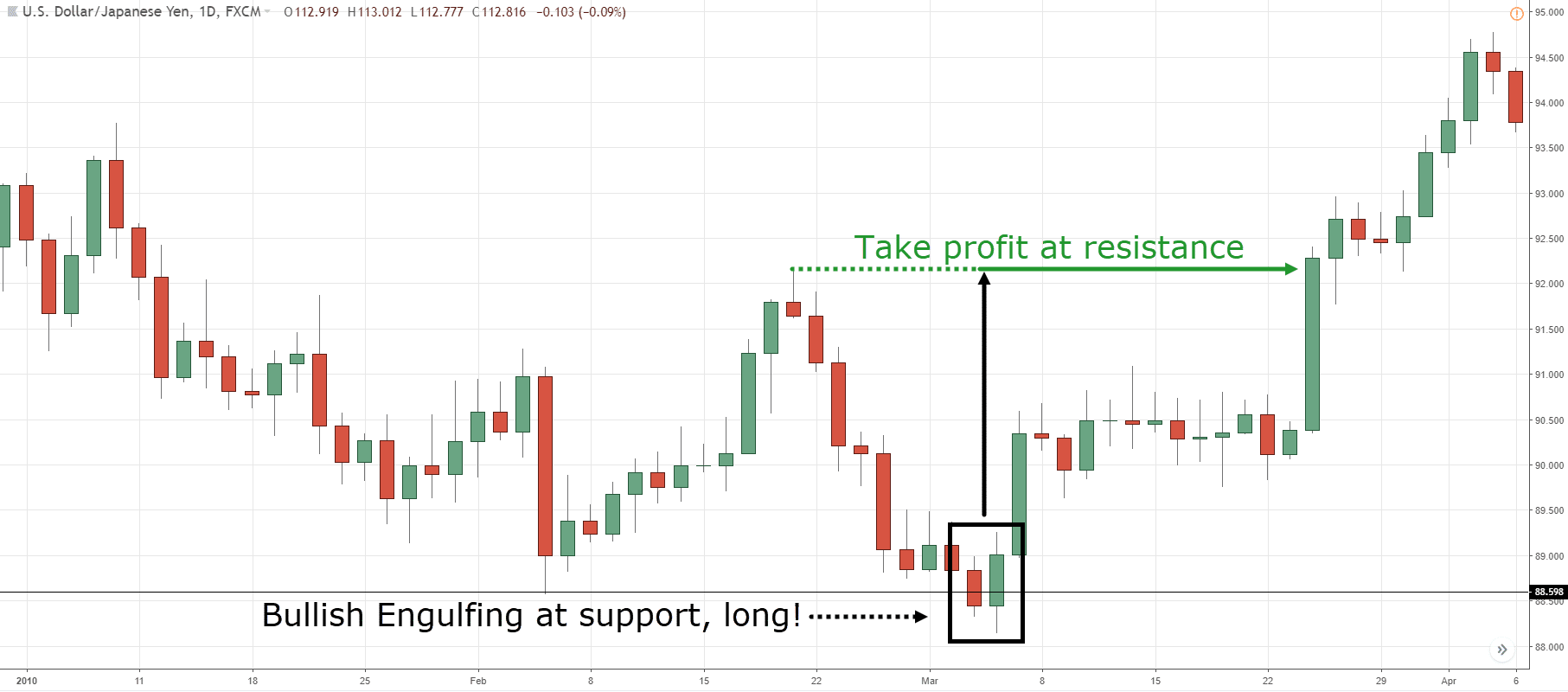

Price action trading

This led me to trade the raw price itself, the price action world.

In fact, if you Google price action trading, you will see many websites regurgitating similar content

You’d probably see something like:

- Identify support and let the price come to it.

- Wait for a Hammer to form.

- Go long.

- Take profit at resistance.

- Buy a Lambo (they don't explicitly say this, but it's implied).

Here’s what I mean…

Now…

I was an ambitious trader who wanted to make millions of dollars.

I couldn’t settle for one trading strategy.

So, another trading strategy I chanced upon was…

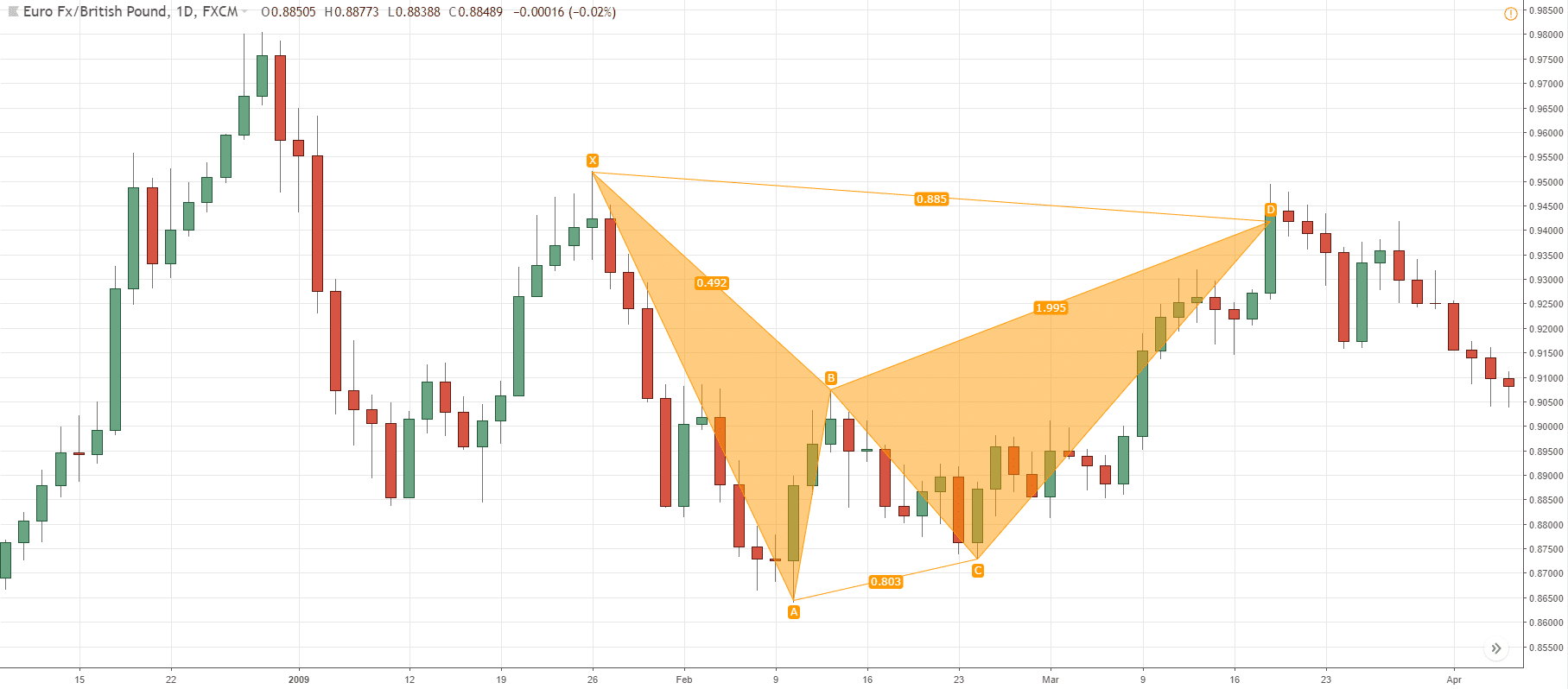

Harmonic patterns

Harmonic patterns are drawn by using the confluence of Fibonacci ratios and extensions.

They have a few variations like Gartley, Bat, Crab, etc. I was drawing so many animals on my charts, my computer screen looked like a kindergartener's art project.

An example of a Bat pattern…

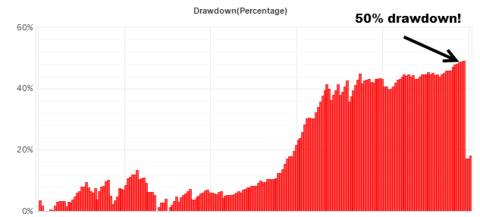

Now, despite learning so many trading strategies.

Do you know how much money I was making?

Nothing. Zero. Zilch.

In fact, I was a losing trader.

And my account was down 50%...

The voice in my head said things like…

- “I’ve put in so much time and effort, but nothing to show for it.”

- “Should I continue this path?

“What if it doesn’t work out and I waste even more time and money?

You can call me stubborn, silly, or stupid (and I’m probably all three).

But…

I refuse to give up.

During this period, there’s one quote which kept ringing in my head…

There is no such thing as failure, only feedback.

One day…

I chanced upon a book called Market Wizards by Jack Schwager.

In the book, Jack said something that hit me hard.

I’m paraphrasing here…

“Every successful trader I’ve interviewed has one thing in common. They have an edge in the markets. Without an edge, even the best risk management or psychology won’t save you.”

But how do I find an edge?

That’s when I came across the book Trend Following, by Michael Covel.

In the book, Michael shared how hedge funds make millions in up and down markets.

Next, a thought came to my mind…

“There are hedge funds that manage billions of dollars using a trend following strategy. Surely, they must know something, right?”

Now, the idea behind trend following is simple:

- Trade across different markets so you increase the odds of capturing a trend.

- Follow the price. (If it goes up, buy. If it goes down, short.)

- Trail your stop loss so you can ride the trend.

- Risk a fraction of your capital on each trade.

And that’s it!

So with those principles in mind, I developed my own trend following strategy.

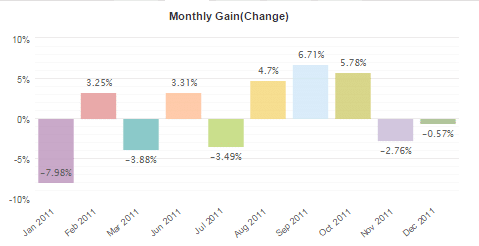

And here’s what happened to my account…

After being a losing trader for 4 years, it took me 6 months to make back everything, and more.

I was ecstatic when I saw my account finally in the green after being in the red for years!

Today…

I have multiple trading strategies so I can profit in different market conditions (and yes, including Trend Following).

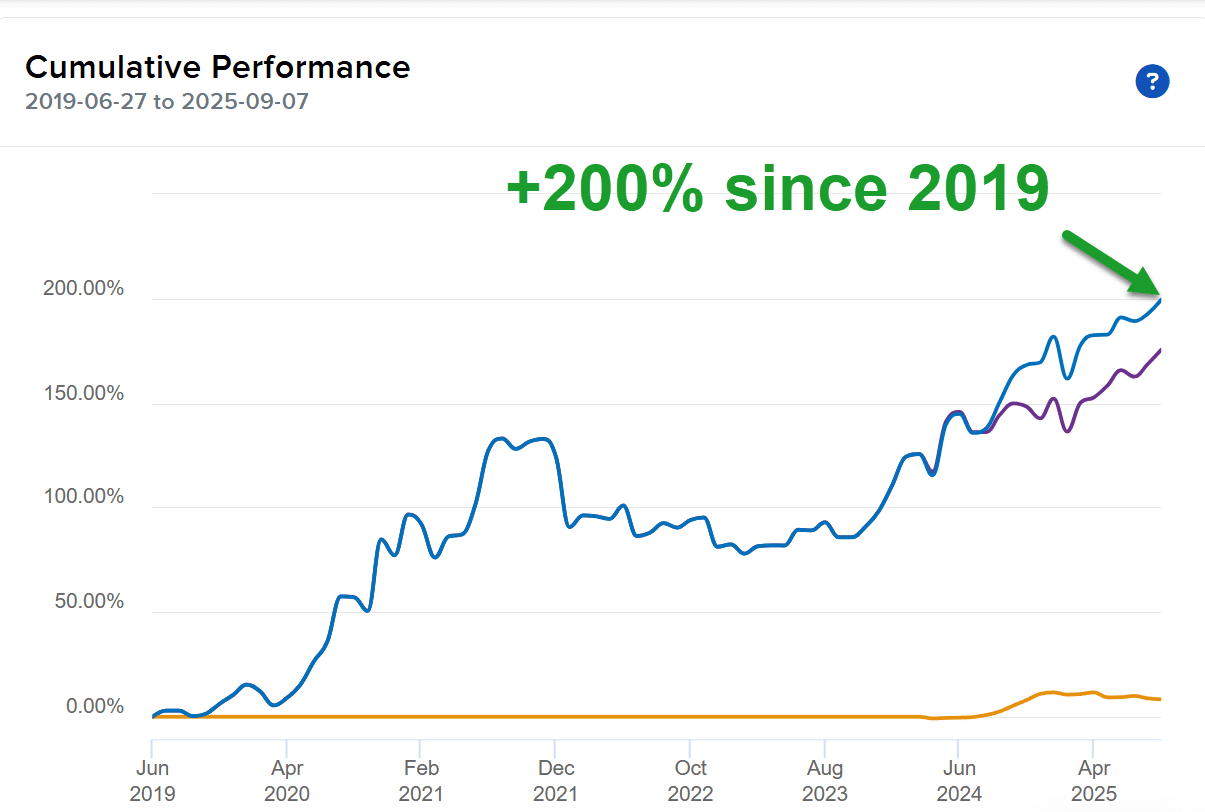

Here’s my trading results over the last few years…

Now, the reason I’m sharing this with you is because…

Trading is a marathon, not a sprint.

You’ll make mistakes, lose money, and get humbled by the market.

The only way to see this through is to commit and do whatever it takes!

Lastly…

I’ve got one goal here at TradingwithRayner, to help you profit from the financial markets in 15 minutes a day.

To kick things off, I’d like to send you a 54-minute training that teaches you 3 rule-based trading strategies (backed by 25 years of data).

You’ll get the exact trading rules and walk through of each strategy. There’s no fluff or theory, just real strategies you can use.

So click the orange button below to get started now.