Does the market always seem to move lower after you hit the buy button?

Do you wish your trade will be over soon because you HATE to watch your P&L swing up and down?

Are you frustrated to see the market ALMOST reached your target profit, but only to do a 180-degree reversal and hit your stop loss?

If you replied YES to any of the above, then I’ve got the answer for you.

Swing trading.

Now you might be wondering:

“What is swing trading and how does it work?

Don’t worry.

Because in this post, you’ll learn everything you need to know about swing trading — including 3 swing trading strategies that work.

Sounds good?

Then let’s begin…

Swing Trading Basics: What is swing trading and how does it work

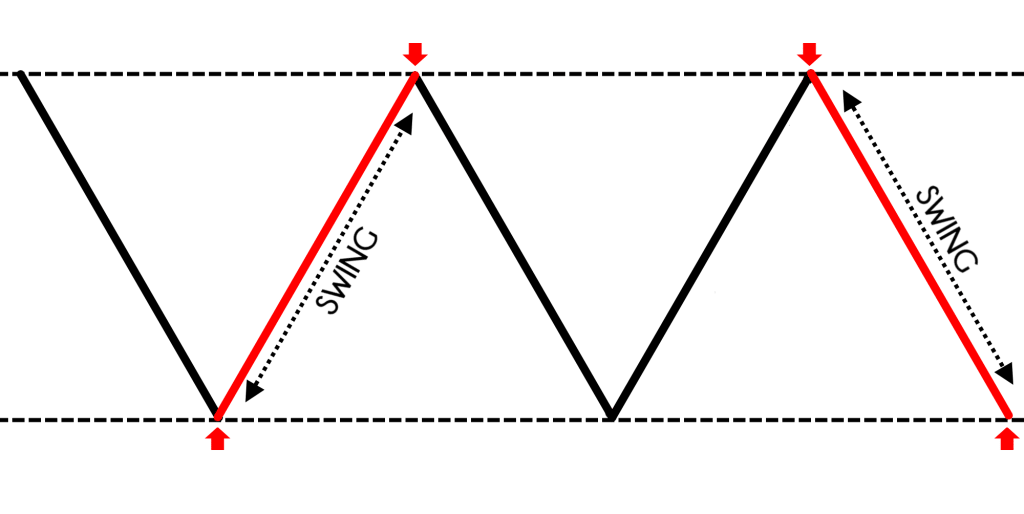

Swing trading is a trading methodology that seeks to capture a swing (or “one move”).

The idea is to endure as “little pain” as possible by exiting your trades before the opposing pressure comes in.

This means you’ll book your profits before the market reverse and wipe out your gains.

Here’s an example of a swing trade:

Next, here are the pros & cons of swing trading…

Pros:

- You need not spend hours in front of your monitor because your trades last for days or even weeks

- It’s suitable for those with a full-time job

- Less stress compared to day trading

Cons:

- You won’t be able to ride trends

- You have overnight risk

So far so good?

Then let’s move on…

Swing trading strategies #1: Stuck in a box

And one thing…

The swing trading strategies I’m about to share with you have “interesting” names attached to it.

This helps you understand the trading setup better so you know how to apply it to your trading.

Now, let me introduce to you the first swing trading strategy for today…

Stuck in a box.

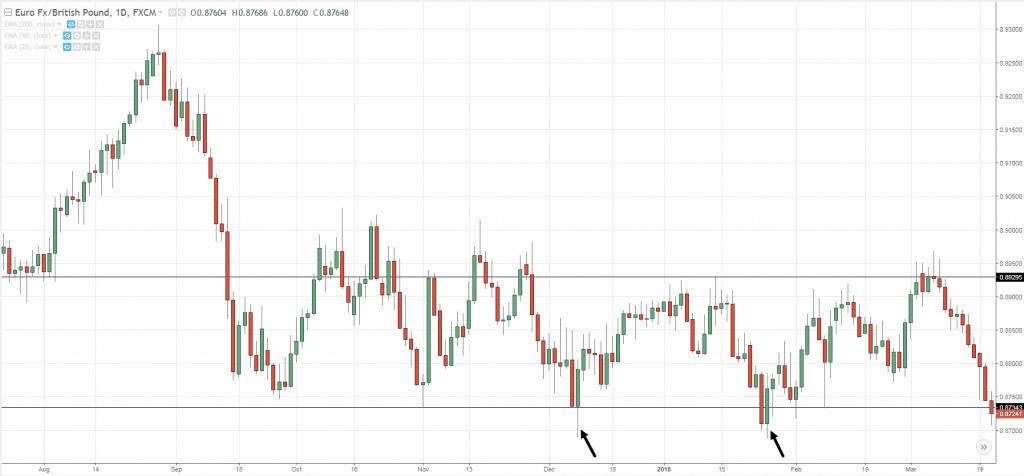

It’s swing trading in a range market because the market is “stuck” between Support and Resistance (somewhat like a box).

Here’s how it works:

- Identify a range market

- Wait for the price to break below Support

- If the price breaks below Support, then wait for a strong price rejection (a close above Support)

- If there’s a strong price rejection, then go long on the next candle open

- Set your stop loss 1 ATR below the candle low and take profits before Resistance

Here’s an example of swing trading in forex:

Now you might be wondering:

“Why should I take profits before Resistance?”

Recall…

As a swing trader, you’re only looking for “one move” in the market.

So to ensure a high probability of success, you want to exit your trades before the selling pressure steps in (which is at Resistance).

Make sense?

Good because we’ll be applying this concept to the remaining swing trading strategies.

Next…

Swing trading strategies #2: Catch the wave

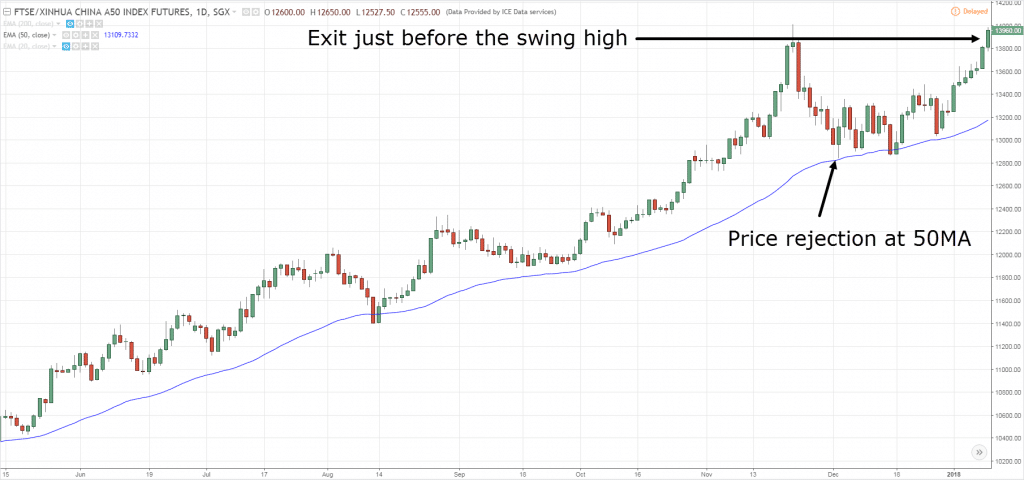

This swing trading strategy focuses on catching “one move” in a trending market (like a surfer trying to catch the wave).

The idea here is to enter after the pullback has ended when the trend is likely to continue.

However…

This doesn’t work for all types of trends.

Instead, you want to swing trade trends that have a deeper pullback because there’s more “meat” towards the upside.

As a guideline, you want to see a pullback at least towards the 50-period moving average (MA) or deeper.

Now, let’s learn how to catch the wave with this swing trading strategy…

- Identify a trend that respects the 50MA

- If the market approaches the moving average, then wait for a bullish price rejection

- If there’s a bullish price rejection, then go long on next candle

- Set your stop loss 1 ATR below the low and take profits just before the swing high

Here’s an example:

Do you want more examples?

Then go watch this training video where I’ll show you how to identify more swing trading setups step by step…

Now you might be wondering:

“But why the 50-period moving average?”

I go with the 50MA because it’s watched by traders around the world so that could lead to a self-fulfilling prophecy.

And usually, the 50MA coincides with previous Resistance turned Support which makes it more significant.

Now, it doesn’t mean you can’t use 55, 67, 89, or whatever moving average you choose because the concept is what matters.

Swing trading strategies #3: Fade the move

Now you’re probably thinking:

“What’s the meaning of fade?”

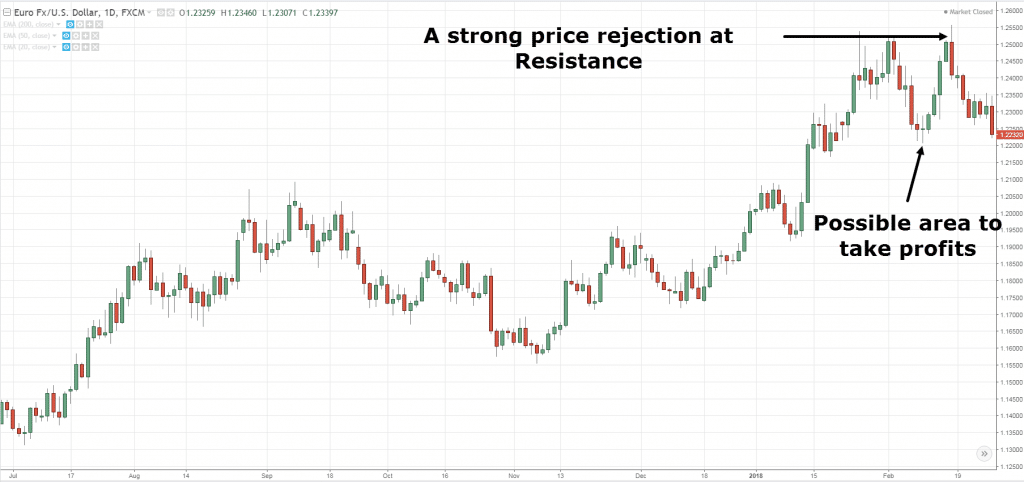

It means… to go against.

Basically, you’re trading against the momentum (also known as counter-trend).

So, if you’re the trader that likes to “go against the crowd”, then this trading strategy is for you.

Here’s how it works…

- Identify a strong momentum move into Resistance that takes out the previous high

- Look for a strong price rejection as the candle forms a strong bearish close

- Go short on the next candle and set your stop loss 1 ATR above the highs

- Take profits before the nearest swing low

Here’s an example:

Do you want more examples?

Then go check out this training video below for more detailed examples…

Now…

You’ve learned 3 types of swing trading strategies that work.

But there’s one important thing that’s not covered…

Your trade management.

For example:

What if you enter a trade and the market didn’t hit your stop loss?

But neither has it reach your target profit.

So what should you do?

Do you hold the trade?

Do you exit the trade?

Or do you pray?

Well, I’ll cover all these and more in the next section…

How to manage your trades so you can trade with confidence and conviction

Now, with trade management, there are 2 ways you can go about it…

- Passive trade management

- Active management

I’ll explain…

1. Passive trade management

For this method, you’ll either let the market either hit your stop loss or target profit — anything between, you’ll do nothing.

Ideally, you want to set your stop loss away from the “noise” of the markets and have a target profit within a reasonable reach (before key market structure).

Here are the pros & cons of it…

Pros:

- Trading is more relaxed as your decisions become more “automated”

Cons:

- You can’t exit your trade ahead of time even though the market is showing signs of reversal

- Possible to see a winning trade become a full 1R loss

2. Active management

For this, you’ll watch how the market reacts and then decide whether you want to hold or exit the trade.

Now, this is important…

For an active approach to work, you must manage your trades on your entry timeframe (or higher).

Don’t make the mistake of managing it on a lower timeframe because you’ll scare yourself out of a trade on every pullback that occurs.

Here are the pros & cons of it…

Pros:

- You can minimize your losses instead of getting a full 1R loss

Cons:

- More stressful

- You may exit your trade too soon without giving it enough room to run

If active trade management is for you, then here are two techniques you can consider:

- Moving average

- Previous bar high/low

Let me explain…

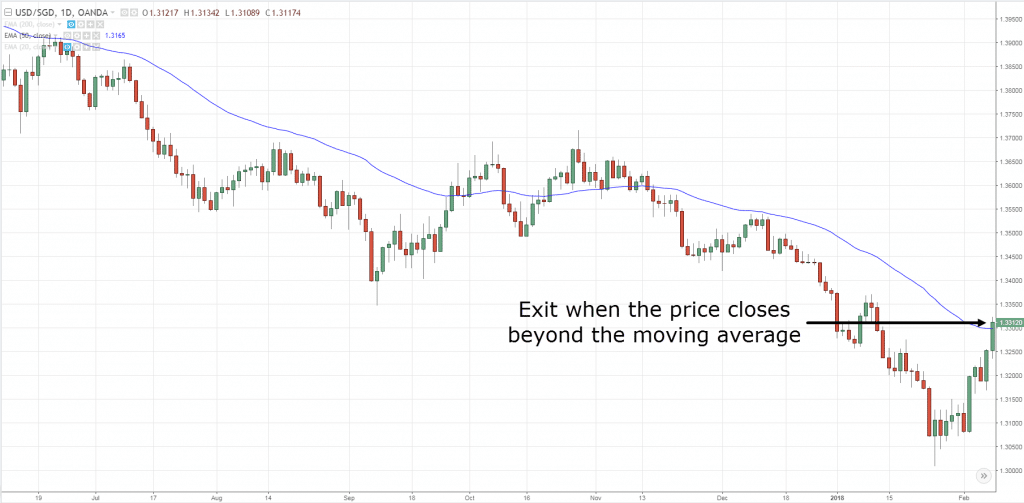

Moving Average

This technique involves using a moving average indicator to trail your stops.

You’ll hold on to the trade if the price doesn’t break beyond the moving average.

If it does, then you’ll exit the trade.

An example:

This technique is useful for swing trading strategies like Catch the Wave because the moving average tends to act as a dynamic Support & Resistance in trending markets.

Next…

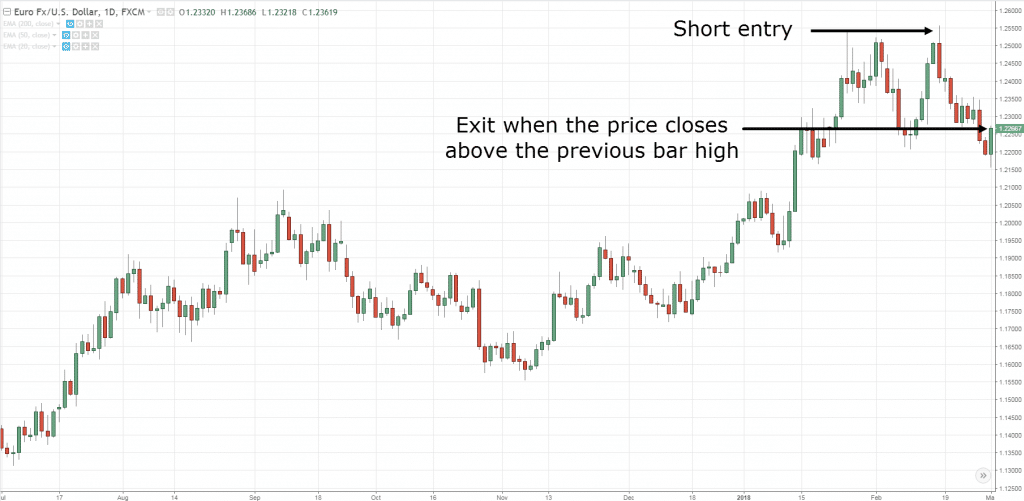

Previous bar high/low

This technique relies on the previous bar high/low to trail your stop loss.

This means if you’re short, then you’ll trail your stop loss using the previous bar high.

If the market breaks and closes above it, then you’ll exit the trade (and vice versa).

Here’s what I mean:

This technique is useful for swing trading strategies like Fade the Move because the market can quickly reverse against you.

So, you don’t want to give your trade too much room to breathe and quickly cut your losses when the market show signs of reversal.

Frequently asked questions

#1: Which of the 3 trading strategies above is the best?

There’s no best swing trading strategy out there and it all depends on your trading style to see which approach resonates with you.

For example, if you’re a trend trader, then you’ll probably look for trend continuation setups using Strategy #2. If you’re more of a contrarian trader, then Strategy #3 might be more suitable for you to fade the move.

#2: How will I know if there’s a bullish or price rejection on the next candle?

You’ll have to wait for the candle to close first before placing a trade. If the candle closes strongly near the high of the range, then it’s a bullish price rejection. If the candle closes strongly near the low of the range, then it’s a bearish price rejection.

Conclusion

So here’s what you’ve learned:

- Swing trading is about capturing “one move” in the market by exiting your trades before the opposing pressure comes in

- Stuck in a Box is a swing trading strategy suited for range markets

- Catch the Wave is a swing trading strategy suited for trending markets

- Fade the Move is a counter-trend swing trading strategy

- Passive trade management is less stressful but you must be comfortable watching winners turning into a full 1R loss

- Active trade management is more stressful but you get to minimize your losses

Now here’s my question for you…

Do you have any swing trading strategies to share?

Leave a comment below and let me know your thoughts on different swing trading strategies

Dear sir.

How are you and family.

Before I finally stumbled into you, I have searched and searched for a good forex teacher like you but I have seen none.

I tell you my friend, you are my final bus stop. There is no where to go again.

I like you because you receive joy to help every one need. You are out to see people success. Brother man you are great. God will bless you you because you are good. Brother man , you are a good man. And I tell you, if 30% of people populating this earth planet that we are in, I think there will be no problem. The earth will be a paradise.

Brother man, please continue the good work and keep the light shining.

You have brought forex to my door step. You made it simple. Man you are great.

I appreciate the kind words, cheers.

Hey..hey, I would just like to thank you. I wanted to get into trading stocks, but had no idea what I was doing or what to look for (still don’t but learning, mostly thanks to you). I found you on YouTube and many others, but I liked your videos the best. Anyway, with just watching your videos and some paper trading on your lessons I started an account with 1k and in two weeks I have already over doubled my account! Keep doing what you are doing! And know it is very much appreciated!

Hi Kevin,

You are welcome!

I’m so glad to hear that!

You are gud bru, you let difficult things looks so easy. Admire what you do buddy

you are best.

Excellent presentation and lucid explanation. Thanks Bro. one small doubt . if the swing high is less than near stop loss assuming 1 ATR, is it worth looking at the strategy. what should one do, for further confirmation on the reversal of the swing to improve the probability. Thanks again.

I’m not sure what your question is… could you elaborate?

Hi Ray, thanks for the article. its really educative, i’m the knowledge I have gathered today will help me alot in my trading..

awesome!

Hi Rayner, I wish to know when are you launching your book worldwide?

I believe it can be found on Amazon.

Hi Rayner

Hope you are doing ok , I have been following you for a while now & find you quiet honest & humble person I have a question in my mind which is not related to this post but just wonder if you as a profitable trader can answer it , there are hundreds of guys around who are claiming that they are profitable in the forex market on long run & active in education field most of them has a educational program and fees in place so my qouastion is that , is that won’t be more attractive and in favor of both parties if the profetible person like you (only example) to offer an automated trade copying with let’s say $1000 account (by accepting all risk & legal matters ) with their educational program and the person who is learning could make money while is learning and the person who is teaching has more ground to stand on , and at the end of day both parties are happy , let’s say if I’m a profitable trader of course I would tell about it to my family & close ralitives and as they trust me they would invest with me & earn money with my trading decision why I don’t do it to my student if I’m in educational field of it ??!!

Because no trader can follow a signal for long if they don’t understand how it works.

When a few losing trades come in, they bail out.

If you’re a profitable trader, the last thing you want is to take your family money. It messes up your own trading psychology and you’re probably trading with money you can’t afford to lose.

Good read very educational!! Thank you for your time and work.

You’re welcome, Anthony!

Hi Rayner…do you have any trade manager EA that you can recommend.

I have full time job but low income = low trading capital, so I can only trade on 4H ( 4% risk for my stop to be according to my plan), NO time to manage trade during work on during night …more often trade do move in my favior but reverse back before TP…which is why I need EA to Breakeven at 1:1 and be able calculate lot size and place orders, but I can only afford up to $50 for such EA.

Hey Andile

I don’t use such EAs.

Hi Rayner I been listening to your trading strategies. The way you are explain it is very help full and easy to understand it . I will continue to follow with your strategies. I had lost $25,000 in the market, and I thought I knew what to do under I look at my account and had losses so much. Now I need to Study hard with the market and learn much it I could before I get back to the market again. Thank your

You’re welcome, Amy. cheers

With that strategies what strategy do you think that will work better? Or what strategy do you prefer?

I trade all 3 of them actually.

Hi bro,

Thanks for sharing this informaton. I follow yours trading rules and make some adjustment break event stop and trailing stop. It work very good to me and see my account blooming makes me confident to use this strategy for all my trade.. Of couse i cant win all trade, but when i loss i loss only 1R and when im in profit i can take as much as 3R max..

Im so happy to find this article on internet and also enjoy watching your youtube video.

Thanks bro

Awesome to hear that, Sandy!

Very helpfull..as a newbie at forex trading,how use swing trading if we use priceaction cause i am learning priceaction&i trade no use indicator

Real help sir.. thanks a lot sir

You’re welcome!

Be blessed always

Cheers

Excellent way to put forward…points for me

Pause for confirmation before taking action…second candle watch..

Defined market structure

Range or trending…and decide strategy.

Price action trading…not indicators trading…may add value but not soul of trading…price is God…

Thank you for sharing, Jay!

Hi Rayner, what type of 50MA do you use for strategy #2 ?

I believe it’s exponential in the examples. But it’s not going to matter much as the concept is what matters.

How Can I Cope With High Impact News Event That Will Go against My Analysis

Risk management and position sizing.

You never know if the news will work for or against you.

And it helps if you’re trading in line with the higher timeframe trend.

Hi Rayner, do these strategy’s work as well on the shorter time frames, like 5m, 15 &1hr’s?

I’d say focus on the concept is more important than the exact strategy.

Hi Rayner!

I’ve been a follower for about 3 yrs now & your ideas and insights on trading are so helpful. Thank you.

Now, may I ask your opinion about the trading idea that I’m developing, specifically on Trailing Stop Loss technique. I rely on the idea that stop loss would depend on the volatility of the price movement. So I use Bollinger Band with 10MA period but at 1.65 outer band settings. I disregard the mid & upper band and use the Lower Band as my Trailing Stop Loss. for Long position. The 1.65 setting for std deviation is roughly equivalent to 85% of data point distribution.

Can you comment or give some opinion on this? Is 10MA (mid band) too short?

thanks.

I can’t comment much since it’s all relative.

10MA might be short but if you’re looking to ride a short trend, it might be appropriate.

Good stuff Rayner, you have improved my forex knowledge and my bottom line at the same time in a very short period of time I have been following you.

Much blessings to you.

Awesome to hear that!

Hi Rayner! Do you know if it’s strategies apply to options? I’m looking for strategies and a mentor to trade swing/options.

Thanks a lot!

I don’t trade options so I can’t comment on it.

Good morning

Pls advice us how i confirm this is low and this is high? In equity markets

Thank you Rayner for your uncountable number of very educational posts. You’ve let me seen the light in trading. I use it in stock trading.

Thank you once again and keep up the good work. May the profits be with you!

You’re welcome, Davy!

Hi Rayner

I was wondering can I have your Email address?

You can reach me via the contact page.

Hi Ray, good tips.

When you say enter on the next candle after a bullish reversal, you mean the next trading day? How will you know the next candle is going to be bullish or bearish?

You’ll wait for the candle to close first before placing a trade.

Noted. Thanks

Hey Ray, what if the market does not go down anywhere near the MA line? How long do we wait?

Move onto another better-looking chart, don’t force trades.

Hi Rayner, I have been doing stock swing trading for quite a while. I’m using similar strategies like those you have mentioned and I only take good quality trades. But the problem is I find it difficult to find good trade setups. Usually, I could only find 1 to 3 in a week. I would like to be able to trade more often. Could you advise on this? Another thing is may I know which broker do you use for forex trading? Thanks.

You can increase the number of markets you trade or look at different timeframes.

Hi Rayner,

I want to work for you. I am also passionate about trading and keep learning new things. I can translate all your stuff into Hindi language, i am from India. Please do let me know if i can work with you

Thank you. My email id is : kumargajender85@yahoo.com

Hi Reyner,

I really love the way you explained the swing trading strategy it’s very clear and direct to the point. I hope you make another topics regarding this. It’s very helpful specially to a person like me who has a full time job.

-Cheers Brother

I’ve got another one here… https://www.tradingwithrayner.com/swing-trading/

Hello! Are you doing pair trading? Do you mind to discuss it a little and may be give some advises?

you are a good man & great human being among traders

bcoz you hold humanity but where as western world trying to make money from every thing by selling what they know.

Hi bro,1st wanna say dat u r really gr8 specialy wen u say..hay hay watsup…i luv ur way to saying dis..now i wanna knw dat somewgere u mention abt SL dta is 1 ATR or 6ATR ..so wanna knw in detail abt these ATR…nd how to calculate it.God Bless U my dear

You can pull out the ATR indicator from tradingivew. It calculates the value for you.

Sir yr teaching method is very silmplicity understand easily, and we learn more and more yr best techniques coming days..,.. Thanks

You’re most welcome!

SIR I WANT TO KNOW ONE MONTH OPTION BUYING STRATEGIES

This is explosive , thanks ray

Your good trader

Hi king,

I’m so glad to hear that!

The truth is I dont always follow traders alot because getting different information related to the market behaviour can be destructive . I have known about you for 1year 2 months and I just followed you 2 weeks ago and learnt alot

My trading is now epic•••

Hi King,

This is good news…

Thank you!

Rayner, you are just the best!

Hi Ariku,

Thank you!

Cheers…

I am a Newbie and would like to be a consistently profitable Day trader, do you think placing trades based on 30mins chart time frame will help me achieve this easily?

I have read and watched a couple of videos by you where you recommended 5mins and 15mins charts for Day trading, but I am of the opinion that the higher the time frame is, the higher its accuracy. Please advise me.

Thank you.

Hi Ariku,

Check out this post…

https://www.tradingwithrayner.com/trading-multiple-timeframes/

Thanks a million. I really appreciate!

Hi Ariku,

You are most welcome!

I can’t thank you enough I choose swing trading and to trade trending mkt . God bless

Hi Fortune,

I’m glad to hear that!

Thank you so much reyner for help I bought you book And I want to finish read this book that I bought another one thank you rayner

Hi Manuel,

You are most welcome!

your assistance and help highly appreciated

wish you all the best

You are welcome, MMM!

Hey Brother, your tutorial are very elaborate

However I need price action compilation as shipping is not allow to Nigeria thanks in anticipation

Hi Asifat,

You can get the book from Amazon store.

https://amzn.to/3tETAsm

Cheers.

hello sir..i have a question..how i set my stoploss if i use trendline or moving average as my area of value??

Hey Upin,

Check out this post.

https://www.tradingwithrayner.com/set-stoploss/

Cheers.

You look for a swing and take profit

[…] Swing Points refer to swing highs and lows — obvious “points” on the chart where the price reverses from. […]

Good inspiring and you are number one transiparent forex teacher i ever see ….. You are doing great Job as once i read your books my imegination come like we having face to face conversation or like physical talk. You are using clean and understandable Language..

Thanks a lot…..!!!

Thanks again….!!!

Isaack from Tanzania.

Thank you for your appreciation, Isaack.

We just want to give the best to you guys.

Cheers!

Amazing, Full of knowledge, practice-based scenarios. Learn a lot, love it Man.

Glad to help, Mubasser!

Thanks Rayner you have really helped me alot

You’re most welcome, Emmanuel!

Thanks rayner I actually but your book and this have change my life style of trading having consistent profit…I trade stock in a box swing trading

We are so glad to hear that, Collins!

Rayner you are really the best teacher, I have been learning from you for over 2 years now and I keep on growing.

Thank you for your kind words, Joshua!

Glad Rayner could help!

Cheers!

Dear rayner, thanks for ur kindness for sharing ur trading plan. I think it will be very helpful for newbie like me.

But i want to ask you one thing i still do not understand yet.

1. Can u elaborate specifically what the trigger for entry for the strategy?

2. What do u mean with strong rejection and what the signal that newbie like me can obviously recognize?

Silver

Members ship

Google payment errors

For international payment

Hitesh korhari

India

Hi, Hitesh! Are you trying to purchase Rayner’s product?

As of now we only accept Debit/Credit Card Visa, Mastercard, JCB, American Express, and Discovery

Otherwise, you are always free to use Paypal to transact by choosing a different payment method.

Hi @rayner, Greetings,

I have gone through your youtube videos there are very good videos out there , There is a small request can you make a video on how to trade “indices” where the market has a very fast movement throughout the day also can you make video for the one who is new in trading I mean a video from Beginners to Advanced level because your videos are scattered everywhere and I am not able identify which to pick first

If you are a beginner in trading, I highly recommend you to go through Rayner’s Academy. It is really made for beginners for you to learn the basic in trading.

This will help you out big time!

Here is the link: https://www.tradingwithrayner.com/academy/

Hi rayno..I’m from India,I have only 100dollar account,how can I earn descent profit…

Hi, Meghakorosiya!

You might find the article below helpful:

https://www.tradingwithrayner.com/whats-the-easiest-way-to-grow-a-small-account/

Hope this helps!

Good explanation,,

Thanks, Keith!

Hay hay

Hi, words can’t just describe how much I will thank you.But may God bless you

Just one doubting.Sir I trade crypto spot trading and It will be very helpful if you have an article for the swing crypto and it will really help and benefit us.

Thanks

Hi, Abdulrahman!

This strategy may also be applied in crypto with proper risk management and following your trading plan properly.

Hope this helps!