Do you feel lost trying to figure which Forex trading strategies to use?

For example:

Should you be a day trader, swing trader, position trader, news trader, scalper, or a combination of different forex trading strategies?

It can be frustrating, right?

What’s the best forex strategy out there?

Because you’ve seen traders make money with different forex trading strategies.

But…

When you attempt it, it fails you. @^*@^#@*#!!

Now, don’t worry.

Because in today’s post, I’ll share with you 5 types of Forex trading strategies that work and how to find the best one that suits you.

Sounds good?

Then let’s begin…

Forex trading strategies that work #1 — Position trading

Position trading is a longer-term forex trading strategy approach where you can hold trades for weeks or even months.

The timeframes you’ll trade on are usually the Daily or Weekly.

As a position trader, you mainly rely on fundamental analysis in your trading (like NFP, GDP, Retail sales, and etc.) to give a bias.

Also, you might use technical analysis to better time your entries.

Let’s say:

You analyze the fundamentals of EUR/USD and determine it’s bullish. But, you don’t want to go long at any price.

So, you wait for EUR/USD to come to Support before taking your position.

Now if your analysis is correct, you could enter at the start of a new trend before anyone else.

An example:

Now, let’s discuss the pros and cons of position trading…

The pros:

- Don’t need to spend much time trading because your trades are longer-term

- Less stress in your trading as you’re not concerned with the short-term price fluctuations

- A favorable risk to reward on your trades (possibly 1 to 5 or more)

The cons:

- Require a firm understanding of fundamentals driving the market

- Need a larger capital base because your stop loss is wide

- May not make a profit every year because of the low number of trades

And lastly…

There’s a trading strategy called Trend Following (which is similar to position trading).

The only difference is Trend Following is purely a technical approach that doesn’t use any fundamentals.

Nonetheless, using a trend-following approach can be the best forex strategy for trending pairs.

Forex trading strategies that work #2 — Swing trading

Swing trading is a medium-term trading strategy where you can hold trades for days or even weeks.

The timeframes you’ll trade on are usually the 1-hour or 4-hour.

As a swing trader, your concern is to capture “a single move” in the market (otherwise called a swing).

So you’ll likely:

- Buy Support

- Sell Resistance

- Trade breakouts

- Trade pullbacks

- Trade the bounce of the moving average

Thus, it’s important to learn technical concepts like Support & Resistance, candlestick patterns, and moving average.

Here’s an example of swing trading on USD/JPY:

Now, let’s discuss the pros and cons of swing trading…

The Pros:

- Don’t have to quit your full-time job to be a swing trader

- It’s possible to be profitable every year because you have more trading opportunities

The Cons:

- Won’t be able to ride big trends

- Have overnight risk

Now, if you want to learn more about swing trading, then The Complete Guide to Finding High Probability Trading Strategy will help immensely.

But overall, using a swing trading approach can be the best forex strategy when the pair is ranging.

Let’s move on…

Forex trading strategies that work #3 — Day trading

Day trading a short-term trading strategy where you’ll hold your trades for minutes or even hours (it’s similar to swing trading but at a “faster” pace).

The timeframes you’ll trade on are usually the 5mins or 15mins.

As a day trader, your concern is to capture the intraday volatility.

This means you must trade the most volatile session of your instrument because that’s where the money is made.

So, you’ll likely:

- Buy Support

- Sell Resistance

- Trade breakouts

- Trade pullbacks

- Trade the bounce of the moving average

Now…

If you adopt a forex trading strategy like day trading, you won’t be concerned with the fundamentals of the economy or the long-term trend because it’s irrelevant.

Instead, you’ll identify your bias for the day (whether to be long or short) and trade that direction for the session.

An example:

Below is the chart of USDCAD (4-hour timeframe) at 1.34945 Resistance.

If the price can’t break above it, chances are, today will be a “down” day.

Next…

On the 15-minute timeframe, you noticed a Shooting Star has formed which signals selling pressure.

You can take a short trade with possible target profit at Support (blue box).

Here’s what I mean:

Now, let’s discuss the pros and cons of day trading…

The pros:

- If you’re good, you can make money on most months

- No overnight risk because you close your positions by the end of the day

The cons:

- It’s stressful as you’re constantly watching the markets

- Can lose a lot more than intended if you suffer massive slippage (from Black Swan events)

- Huge opportunity cost as you could be earning a full-time salary elsewhere

Day trading is something a lot of traders are attracted to, but most aren’t suited to.

But if you have the necessary skills and capital to be a successful day trader, then this could be the best forex strategy for you.

Now if day trading is still too “slow” for you, then the next forex trading strategy might suit you…

Forex trading strategies that work #4 — Scalping

Warning:

I don’t recommend scalping for the retail traders because the transaction cost will eat up most of your profits.

And you’re slower than the machines which put you at a major disadvantage.

Still, if you want to learn more, then read on…

Scalping is a very short-term strategy where you’ll hold trades for minutes or even seconds.

This is the fastest one among all forex strategies.

As a scalper, your concern is with what the market is doing now and how you can take advantage of it.

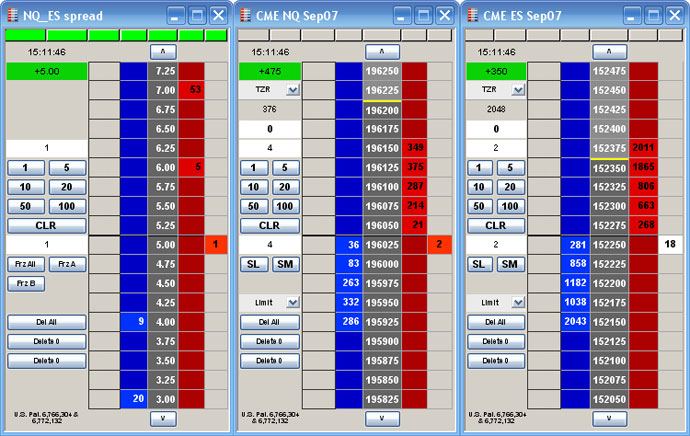

The main tool you’ll use to trade is order flow (which shows you the buy and sell orders in the market).

An example:

Now, let’s discuss the pros and cons of scalping…

The pros

- Have lots of trading opportunities each day

- Can make a healthy income from trading

The cons

- High financial cost (paying your software, newsfeed, connection, and etc.)

- Glued to the screen for many hours a day

- It’s a highly stressful endeavor

Lastly…

If you want to be a scalper, I recommend you join a proprietary trading firm because they will provide the tools and the forex strategies to help you with it.

Forex trading strategies that work #5 — Transition trading

You’ve probably never heard of this forex trading strategy before because I came up with it.

Here’s how…

Back while I was in proprietary trading, one of the “interesting” things I learned was transition trading.

You’re probably wondering:

“What is transition trading?”

Well, the idea is to enter a trade on the lower timeframe, and if the market moves in your favor, you can increase your target profit or trail your stop loss on the higher timeframe.

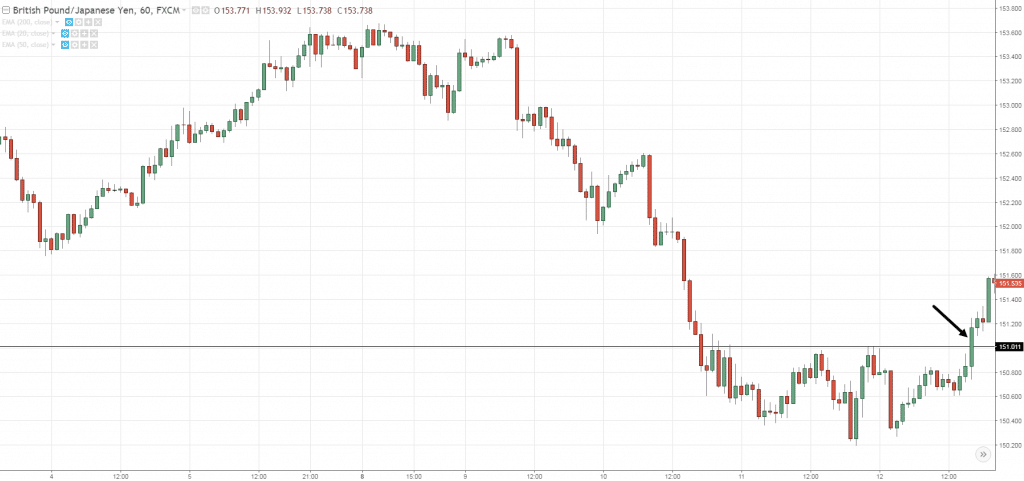

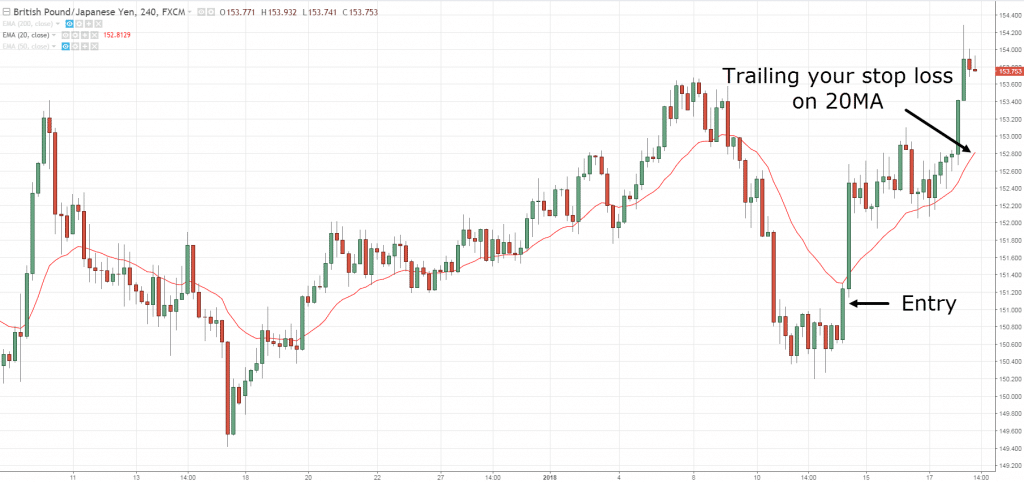

Here’s an example:

Let’s say you traded the breakout on GBP/JPY 1-hour timeframe and the price quickly went in your favor.

Now…

You noticed the 4-hour timeframe respecting the 20MA.

So instead of taking profits, you trail your stop loss using the 20MA hoping to ride a bigger move.

And if you’re wrong, you’ll exit your trade when the price closes below the 20MA.

Now, there are variations of forex strategies for transition trading.

But the main idea is this:

- Find an entry on the lower timeframe

- If the price moves in your favor, consider planning your exits on the higher timeframe

Now, let’s discuss the pros and cons of transition trading…

The pros:

- Can get an insane risk to reward (possibly 1 to 10 or more)

- Can lower your risk as your entry is on the lower timeframe

The cons:

- Only a handful of your trades will lead to monster winners

- Must understand multiple timeframes really well

Now that you have an idea of the different forex trading strategies out there.

The next question is…

Which Forex trading strategies suit you best?

Here’s the thing:

I’ve seen traders wasting many years on forex strategies that don’t suit them (right from the start).

If ONLY they considered these 3 things I’m about to share with you…

…they could have saved years of frustrations, money, time, and effort.

And, I don’t want you to be one of them.

So before you attempt to trade any forex trading strategies, you MUST consider these 3 questions…

1. Do you want to grow your wealth or make an income from trading?

First, let’s define what’s income and wealth.

Income = Make X dollars a month

Wealth = Grow X % a year

For income:

If you make an income from trading by using one or more forex strategies, you must find more trading opportunities within a shorter time period (for the law of large numbers to play out).

This means you must trade the lower timeframes and spend more hours in front of the screen.

The Forex trading strategies you can use are scalping, day trading, or short-term swing trading.

For wealth:

If you want to grow your wealth from trading, you can afford to have fewer trading opportunities.

This means you can trade the higher timeframes and spend fewer hours in front of the screen.

The forex strategies you can use are swing trading or position trading.

2. How much time can you devote to trading?

This is a no-brainer.

But I’ve included it because I’ve seen traders who can’t think logically (not you of course).

So here’s the deal:

If you have a full-time job, or you can’t afford to spend 12 hours a day in front of your monitor, then don’t try scalping or day trading (it’s silly).

Instead, go with a swing or position trading forex trading strategy.

But, if you have all the time in the world and enjoy short-term trading, by all means, go ahead.

3. Does this Forex trading strategy suit you?

Here’s the breakdown:

Most trading strategies will fall into 1 of 2 categories:

- A high win rate with low reward to risk

- A low win rate with high reward to risk

So, which approach is better?

Well, in terms of profitability both approaches can work because it depends on your win rate and risk to reward ratio.

So a better question would be…

“Which approach are you more comfortable with?”

If you prefer a higher winning rate but smaller gains, then go for swing trading.

If you prefer a lower winning rate but larger gains, then go for position trading.

Forex trading strategies for beginners, how to get started…

Now if you’re new to Forex trading, you can get overwhelmed with the sheer number of trading strategies out there.

You’ve got stuff like trading indicators, chart patterns, Elliot Waves, etc.

Where do you start?

My suggestion is to master Support and Resistance and here’s why…

Because if you think about this, the price can only do one of two things:

- It reverses at Support and Resistance

- It breaks Support and Resistance

This means if you understand Support and Resistance, you have the ability to be a trend trader, breakout trader, or even a reversal trader.

The best part?

It works on different timeframes whether you use a forex strategy such as day trading, swing trading, or even position trading.

So here’s how to get started…

1. Learn how to draw Support and Resistance

I show you how to do it step by step in this training below…

2. Learn how the price reacts at Support and Resistance (SR)

When the price breaks SR, ask yourself:

What’s the pattern that occurred before the breakout?

When the price reverses at SR, ask yourself:

What’s the pattern that occurred before the reversal?

After studying thousands of charts, you’ll have a 6th sense of whether the price is likely to break or reverse at SR

3. Define your trading timeframe

Next, commit to a timeframe you can trade comfortably.

For example:

If you have a full-time job, it doesn’t make sense to trade the 5mins timeframe because you don’t have the time for it.

Instead, you’re better off trading the higher timeframes (like 4-hour and above) as it requires less screen time.

So, be honest with yourself and decide on a timeframe that suits you best.

4. Develop a trading plan

Once you know your trading strategy and timeframe, you can develop a trading plan and a forex strategy for it.

If you want to learn how to do it, go study this post below…

How to be a profitable trader within the next 180 days

Conclusion

Here’s a recap of the different forex trading strategies that work:

Position trading: A wealth-building approach for those who can’t spend the whole day in front of the screen

Swing trading: A wealth or income building approach for those who can spend a few hours each day trading

Day trading and scalping: An income-generating approach for those who can spend the whole day in front of the screen

And finally…

Before you learn any forex trading strategies, you must consider…

- Your trading goals

- Your time available

- Whether the strategy fits your personality

Now here’s what I’d like to know…

Which forex trading strategies do you use?

Let me know your thoughts in the comments below.

You are just great…!

Thanks Wai!

I do swing trading as I still have a full time job. I’m still learning but look to make this my income stream in the very near future.

Hey Tony,

I’m glad to hear that!

Hello Tony. Somebody actually said its impossible to learn trading online and be profitable…do you agree with that?

Hi Luke,

Check out the trading academy.

https://www.tradingwithrayner.com/academy/

Thank you very much Rayner…though am still a newbie to trading but I love you and I love your materials and the way you present on YouTube.

Can you mentor me?

Hi Luke,

Check out the trading academy.

https://www.tradingwithrayner.com/academy/

Very Very nice detail guide towards the beginner.

Thanks

hey there!

Jarin here from TradingwithRayner Support Team.

You’re most welcome! If you are a beginner in trading, I highly recommend you to take a look at our Academy. It is a free course for beginners that will help you out big time!

Here is the link:

https://www.tradingwithrayner.com/academy/

Cheers!

I prefer the Swing Trading approach as I normally look at the 4 hourly and daily chart. Beside, I would prefer to monitor my trades once is live for that couple of hours.Once I’m in the money,I would prefer to trial my stops.

Thank you for sharing, Simon!

thank you so much God bless

cheers bud

Hi Bro Rayner,

Great information bro.. I think I m day trading… your transition trading really works..

I’m glad to hear that, Ali.

hi rayner you got good stuff i’ve never seen bebore thanks alot big guy i salute you

Thank you. Michael!

Hi,

Well done Rayner in helping us traders !!

I prefer swing trading, Uk trading times 8am to 16:30), using a 4 hr graph, I use the Alert on MT4.

Always wait for the candles to show their direction, only when this happens do I strike. !

when this happens I then use the 5 min graph for my entry and exit using a stop loss of 1%.

Im careful with RED news as the spreads go crazy.

I dont trade FOMC and NON FARM PAYROLLS 2 hours prior their time .

Personally I do NOT hold persitions over night.

Happy trading

Thank you for sharing, Martin!

Hi Rayner.

I’m a swing/day trader but I have tried all methods. My problem is I have difficulty trading one method. Patience is my problem. Great article Rayner.

Michael

Thank you, Michael.

cheers

Your write ups are always very interesting and resourceful too. I am a swing position trader only interested in trading Price Action at Support and Resistance. For me that involves naked trading with only the MA lines on my candle chart. Still on the elementary stage for now but working steadily on it. Thank you

You’re welcome, Emeka.

Why did you not include trend following trading Rayner ?

Hi Brendan

I did. It’s stated at the top along with position trading.

Hey Rayner,

Very concise peace of work with one critical note:

You say in daytrading:

The cons:

…………

Can lose a lot more than intended if you suffer massive slippage (from Black Swan events)

…………

I don’t think that Black Swan events should ever be considered in trading as they are too rare to get nervous about. Besides, if your maximum Risk is 2% of your capital and have stops in place no Black Swan is going to kill you financially.

Best Regards,

Peter van der Meulen

Hi Peter

For day trading you’re typically trading with larger size since your stops are tighter.

And during such events, you might suffer massive slippage as it’s no guarantee of getting filled (e.g. the EURCHF saga where traders had slippage of thousand pips).

With large size and huge slippage, careers are over in an instant.

I prefer to do swing trading using 1 to 4 hr time frame. Hopefully there will be more trading opportunities this way. I would also very much like to use the trend following method as seen from your videos. I think my problem is emotions.

Thank you for sharing, Sum Mun.

Thank you Rayner “Our Buddy Trader” Teo, as you always keep us educating about successful trading.

Just wanted to know that, What inspires you truly for this amazing work ?.

Hey Chandan

I do get a “KICK” whenever traders tell me how much they have benefited from sharing.

As always…no one beats your passion in sharing your knowledge for free. Big thanks Rayner!

You’re welcome, Junil!

Transition trading is so wonderful. This information is an eye opening indeed. Rayner I really don’t have enough words to thank you..!!!!

The pleasure is mine, Dave!

Thank you Rather. Great write up.

You’re welcome, Roy.

Awesome article Rayner. Learned a lot from this. Am a day trader. Like to time entries from Support and Resistance levels in the market, analyze my trades with daily and 4hr. Pick trades mostly with 4hr chart. Once again, thumbs up Rayner. Keep up the good work.

Thank you for sharing, Okere!

Thanks Rayner. Do you have any actual data as support for the claim that these can work (audited track records for example)?

Hey AC

You can look up firms like Dunn, Mulvaney, Winton as they are hedge funds which employ a Trend Following approach (which falls under position trading).

For short-term trading, you can look up proprietary trading firms and ask them what’s the trading methodology they adopt (which are usually day trading and scalping).

hi rayner! have not receive any notifications on your weekly videos of late. for e.g. the analysis from 5-9? Did I missed it or have you stop doing the analysis?

Thank you for all the great guidance!

Hey Brian

I haven’t sent any recently.

But don’t worry, it’s back this week!

Great information (as always)!! I would love to hear more about the transition trading. Is there another article with more information?

Thanks for all that you do for us!!

Robin

Hey Robin

I don’t have any more on it, but I’ll see how I can add more information in future.

cheers

Awesome post Rayner.

I am also wishing to know more about transition trading…

I’ll write more about it in a future post, cheers.

You’re awesome Rayner…..really informative article

I prefer swing trading….I can spend few hours a day for trading. Prefer low winrate + Big wins.

However I want to both make income as well as build wealth in parallel via trading.

You’re welcome, Rahul.

Thanks for sharing!

Thanks Rayner for this educational blog. It reinforces what I think I know!

Hopefully get me to be profitable with real accounts.

Saeed

Cheers

Hey rayner! Can a daily timeframe be used for swing trading or is it better to use the 4 hour timeframe in entering trends?

Best regards 🙂

Yes, that’s possible. Both are fine.

How about you Rayner, what kind of trader are you?

Swing and position trader

How to determine Support and Resistance level ??

I don’t have any materials covered on it here.

But I pay attention to the most obvious levels and ignore the minor ones.

Hi rayner I like your website I would like to say that I would be a hybrid of swing trading as well as trend trading. I fail alot and well I dont like ofcourse no one does realy. I am asking for your almighty nolage on what would be a good trading stratagy for me.

1. I dont like spending all day on a screen.

2 I Love family time

3 i can do at least 2 hours a day

4 I am stuburn. (Half the reson for my past faliars witch i realised through your web site).

5 i am starting at a very younge age and i can learn alot through experience and others telling me what a good stratagy might be.

I also need help knowing what turms there are because wile i trade i realy HAVE NO IDEA WHAT I AM DOING. but i try to go in with a plan think of where i believe the market will go( mostly rong on my judgment ) and get somwhere with it i do use a stop loss and i am trying to find how to get a trailing stop loss for mql5

Also thanks for your website it had some helpful facts and has helped alot thanks. So i hope you could help me become a better tradsman

Thank you for sharing, Daniel.

I’m glad to be of help!

Hello dani,,,, its painfull to here that even me i had a such problem of lossing money because I failed to abind my self into a good trading strategy for most of my past trading days,, but honestly iam telling without more effort nothing sweat can be got, so i struggled alot and it came by chance on my side a beautiful way that has low risk, good profit, and it saves time you might trade just in a week and all of your time you might do other things. For sure now iam free i can not stay much on my screen but i get time to deal with my medical school. Dani if ur ready honestly and kindly i can help you to know the strategy free just as my brother. And you shall be happier with it, i shall also help you some more other trading challenges that i have faced and the way to solve them.

Hi Abcom

Can you be a helpe to me

I’m new in the market

I want to have a good strategy? Someone help me

Thanks for the tips, information. Keep up the good work RT. I give you huge credit bro when it comes to trading.

I appreciate it, bud.

Thanks for a plausible explanation.Your write up encourages alot of people to make a firm decision to master a specific trading parttern.

You’re welcome, Musa.

I found the active management more stressful than other strategies, may I ask what strategy do you prefer?

Swing and position trading.

Thanks a lot Rayner, this is very informative, I’ll also like to learn more about Transition trading, if it’s convenient for you,may you please make a video on it with few examples, will be very appreciated

I’ll look into it, cheers.

Thank you so much Rayner, you have just helped me

I’m happy to hear that!

Great Article – Thank you!

You’re welcome, Jordan!

Very detail and precise article.

Thanks for sharing.

I now understand why I don’t make money. I will make necessary adjustments and I hope things change.

Glad to hear that!

Keep me updated on your progress, cheers!

For me i see, both trade might sense the same interm of finance because, the long term trade have a great deal of pips in profit as compared to the short term trades, so the one with short term trade will trade more to compesate the profit of the one with long term trade. But sometimes what matters is what you can see on the screen at time t, if it happens the short time has favour so you can take it and if its a long term trade you can also trade. But the major deal is about your time to trade as stated in this article.

Thank you for sharing, Abcom!

Thank you very much for this article. Where does counter trading fit then?

It can fall under day or swing trading, cheers.

Hey Rayner, whats up my Friend?

Awesome stuff!

Please what MA or Donchian (DC) setting would be appropriate for the different types of trading strategies, if one wants to know what trend to follow and setups to look for?

For example, would the following suggestions work:

position trader – using the daily and weekly time frame – 200MA or 200 DC

swing trader – using the 4 hour and 1 hour time frame – 100MA or 100 DC

day trader – using the 15 mins and 5 mins time frame – 20MA or 20 DC

scalper – probably the 1 min – 20MA or 20 DC

I ask this because its not too clear how effective using, for instance, the 200MA (long term trend), on the 5 mins time frame can be, since the 5 mins time frame seems more suited for traders looking for shorter and quicker opportunities.

Cheers.

Hey Rex

There’s no best indicator or settings for any timeframe.

They all have a different purpose for it.

For example:

200MA on the 5mins can be used as a long-term trend filter on the 5mins timeframe.

And the 20MA can be used to trade strong trends on the 5mins timeframe.

There really isn’t a one size fit all here.

Nice.

Thanks Rayner, you’re a blessing!

Day trading

Nice

Hi Rayner reading through, I come to realize without any doubt I am a swing trader, due to my full time a very demanding job which I would like to be knowledgeable and profitable with trading to catch a break. My question here is since I know what kind of trader I am and I like the trend following strategy, how can I create a trading plan that as I follow to the T, will give me an edge as u always say, in the market.

Thank you in advance.

This might help… https://www.youtube.com/watch?v=l0PQpCQO3ZM&t=55s

I have been totally blown away by all of the information you have been providing us! I have been getting my trading education over the past 11 months and it always seems that people will only give you part of the information and always leave out the most important parts. And I am talking about information that I am paying for! You my friend give us the full meal deal and we are so grateful for that. You Rock!!

Thank you, Greg!

I really appreciate it.

Thanks rayner…

You’re welcome, Akbar!

Hi Rayner, thanks a lot for your effort. I have a question… is valuta trading different then crypto trading? Can I use the same strategies? Thanks in advance!

I’ve no idea what’s valuta trading.

Hi Rayner, your article is really informative and helpful for a new and aggressive trader like myself. If it’s possible can you please make an article about the Pro’s and Con’s about being an aggressive day trader.

Your work is brilliant by the way

I’ll look into it, cheers.

I’ve never heard the term transition trading but last week I shorted the eurusd at h1 and managed the trade looking at d1. It turned out to be a 9R trade. It was my best week in months!

Nice stuff!

Reyno simply you are superb. Thank you dear.

Cheers Muneer!

i am a beginner and yet to find a strategy. But i’m keen to becoming a scalper

I don’t cover much on scalping as I’m not a scalper.

Best!

dear rayner, i am government servant, now a days we have very long vacations due to corona virus situation, so i can spend a lot time to screen until our vacations end, but after my job, i can spent 3 to 4 hours for trading, my plan is to earn minimum 5 to 6 dollars a day, so please tell me what timeframe and trading strategy is best for me in both, vacations and after my job starts, in these days i am using swing trading and scalping, please reply, what should i do,

thanks

Hi Sajid,

Swing trading should be good for you using multiple timeframe analysis.

Check this post out…

https://www.tradingwithrayner.com/trading-multiple-timeframes/

I have a different question. Do you have a trading platform that is proprietary. If so how much?

I don’t have such a thing.

Thanks bro for your enlightment,am a position trader I prefer using a daily chart pin bar combined with trend and areas of value.

Thanks for sharing, John!

I already try the swing strategy using FXLeaders and it works well, and while reading these strategies I think I want to try another strategy too. Thank you for sharing.

Thanks for sharing!

I rarely compliment someone on these kind of sites, but you are not only a successful trader, you are an appropriate teacher for this subject. I have tested a few German suppliers, running and offering roughly the same business-model as you do, but successful traders, even being eloquent, are often poor teachers.

So, here are my regards – and let us know, when you finally move in your penthouse and buy a supercar, because, what else should you do with your money?

Frank

To help more people grow their wealth from the financial markets without losing their pants.

cheers

Thank you so much for sharing this information….it really helps

Awesome to hear that!

Hey rayner, please I need to know more on choosing best currency pairs

I learned much more from you than i did from my teacher.. I can’t thank you enough!

I’m glad to be of help, cheers.

Am a scalper very new to trade but might change to a day trader and then swing.

I am 24/7 in front of charts and books and learning from you tube all of my times from when i lost 5k a fews week ago.Let me take more learn from you Rayner.I can spend all the times in trading.Thanks to your book.andthen if possible,show me the way to improve more than now.Thank you Ray.

You’re welcome, David!

Rayner, I like the way you teach. It is very simple and comprehensible.Can you please guide me in Trading?.

I trade mostly Support and Resistance then TRENDLINE .. I guess I’m more of a swing trader

Thanks for sharing, Awkamfon!

Started trading a few month back,I was trading like a mad man and was going mad so I dicided to take a break three week back and have since start studying Rayner web site and learning about trading and it’s like a pin dropping in my mind

It been powerful information.thanks bud

Nice!

Thank you boss I have learnt a lot from this, I want to be a day trader, and scalping small. I’m a beginner

Thank you

cheers

hi Rayner, i am using trend following, my entries are pull backs.

Thanks for sharing!

hi there,

i am a newbie trader and im follwing you, sir Rayner Teo., and im learning everytime.

i chose day trading and scalping coz i have all my time in a day, and a have a daily goal to achieve..

thank you for all the materials available here, it realy helps me a lot..

Glad to be of help!

I’VE NEVER seen a site like this I’m so glad I stumbled across it been using these methods and boy oh boy The Best I salute Rayner thanks a lot

I will prefer swing trading because that’s what suit me. Thank you Rayner.

You’re welcome!

I use support and resistance combined with an 8 EMA and 20 SMA for entry

Thanks for sharing!

hey buddy, right now im swing trader and as you said it has higher win rates and barely 1 to 1 risk to reward, i think position trading is fine for me in the way that i just give 20% of my portfolio to it cause im in stock market, in the other hand your transition trading got my attention and im gonna check that out, with higher win rate and that insane risk to reward it will be something 🙂

Awesome, let me know how it works for you. cheers

Swing trading

I cannot afford to be looking at the chart 24/7 and i am still on the demo

Is it good for trading if i use ECN account?…my strategy is..day trading, scalping

i have few hours available every day,i would try position trading,thank you for your high spirit to teach the begginers.

You’re welcome!

Thanks for the information.. I am a medical student with limited time and I just started learning about forex trading..please can I still make an income trading

Hi Rayner , can you describe one rout to be trader for example :

1-Define what trader you are

2-Make Trading Plane

3-Find strategies and master them for differente conditions of market

….

….

Very good best of luck for you

Cheers

hi Rayner, whats up my friend!

im following you for couple of months now. and your advice is the best so far, and i thank you for that. im new in trading i started about year ago just to see what is forex all about. lost Little money gave up and now im back for couple of months in forex.

im trading with my demo account testing myself all that ive learned so far and mostly from you.

but so far my winning rate over 100 trades is about 80%

so best trading strategy for me is swing trading.

Awesome! Let me know how it works out for you, cheers.

Everything here have just been wonderful and awesome thanks RAYNER,am a beginner but i know your the right person to take me through

Cheers

I want to know the three strategies so that i can choose my own time…..Position trading, Day trading and scalping then the swing trading….

Thank you so much for the learning sir….I hope someday I can be a successful trader…..God willing

Thank you so much for your sharing. I happened to explore your website a few days ago. Your teaching is concise and easy to understand. Learning has never been so clear from books and other websites. I’m looking forward to an improved and profitable trading journey.

Glad to help out, Amanda!

This was quite encouraging and educative

Glad to hear that!

books for fx trading

Teach me…..Please

Day trading is the one I’m very interested in right now. I just opened up a TD Ameritrade account, what’s your thoughts on this particular institution? What else would you recommend?

Break out trading

Looks like I,m a Break Out /Swing trader .

Your Posts have focused my trading more than ever before Rayner , Thank you so much .

My win / loss ratio has improved immensely with now a better trading plan and has shown me the weak points of my previous trading style .

I now spend only 30min a day in front of the screen instead of 2 hours ( end of day data ) with this now very much streamlined trading system .

Forever grateful for you help , thankyou Rayner .

Awesome to hear that, Peter!

Hello Teo,

I like scalping and daytrading

Hi Rayner, thanks for sharing your knowledge. I am currently spending most of my time day trading and scalping, but I am still a raw novice learning all the time.

No worries, take all the time you need. Baby steps!

First of all find your teachings very useful to me thank you for your dedication , i haven’t started trading yet m still learning but the strategy that are attracted is SWING TRADING STRATEGY i love it , it will fit my personality also i have a full time job

Awesome to hear that!

And trend following?

Why wouldn’t you be able to use a 5Min timeframe if you for a full time job? lets assume you get home at 5:30, and you can trade from 7pm-12am, is that not enough time?

Yes, you could if you’re willing to sacrifice everything else.

Im think im doing the position and swing strats

Go for it!

I’m a newbie, I find day trading and calping fascinating. I have all the time in the world to sit in front of my screen. Which time frames should I focus on Ray

I generally use Price action trading based on technical analysis. But some time win and some time loose. Prefer daily closing basis US time frame. But I am Indian and some time I miss the exact closing. But I think Swing trading strategy is the best of all .

Hi Rayney, this is Bryan from Sydney Australia. I am currently trying to set up a trading plan by studying your numerous YouTube uploads in conjunction with my cycle analysis.

I believe there are trading cycle (1 month or 20 day), primary cycle (20 week or 100 day), seasonal cycle (50 week or 200 day) and long term cycle (4 year or 200 week) in a market.

My trading plan is looking for a position trade of primary cycle in a direction of seasonal cycle. And I use a price action in a 4 hour chart to enter a trade to maximise R/R ratio in the trade.

All of this can be done in the daily time frame! (Thanks for your TAE method, finding a trend using MAs, support and resistance and price action trading methology…)

I set up a daily chart with four MAs. The four MAs are 20 EMA, 50 EMA, 100 EMA and 200 SMA.

The 200 SMA defines the long term trend of market. If price is above the 200 SMA, the long term trend is up and vice verse.

The 50 and 20 EMA act as an area of value so when price is on or in the 50 and 20 EMA zone, I look to enter a trade in the direction of the long term trend.

Finally when I enter the trade, I look at 4 hout chart for a market structure and support/ resistance and candle stick patterns to execute my trade in maximising R/R ratio.

Now here is my thought on how to improve our winning rate using the cycle analysis.

Let’s consider two market cycles, 20 week primary cycle representing 100 EMA and 30 day trading cycle representing 20 EMA on the daily chart. In the cycle analysis, there is also a half span cycle which used to identify a cycle low when a prevailing trend is strong. So the half span of primary cycle is 50 EMA.

Now, we can state as follow in terms of the cycle analysis. The 30 day trading cycle lows occur when price is on or below the 20 EMA on the daily chart. Similarly, the 20 week primary cycle lows occur when price is on or below the range of 50 and 100 EMA (called primary cycle zone).

Therefore, if we can enter the long trade at the cycle lows in up trend or cycle highs in down trend, we could maximise our profit potential and at the same time minimise our loss potential!!!

I am trying to return to trade again after 5 years of rest and currently studying the market to set up my trading plan. Thanks for Rayner to sharing a valuable knowledge and experience of profitable trading.

Currently, I am a one trick pony, looking at the ASX 200 index but I like to expand to various Forex, world indices and commodities, If you could help me how to trade in those markets I would be greatly appreciated.

I will prefer day trading.

Thanks for sharing!

Hi Teo, I need your recomendation for a good brokerage firm. Thanks

Hi Teo, Am just new on trading but started with cryptocurrency. i need your support on forex trading.

I want to be swing tradee

Thanks for sharing

My pleasure!

Swing trading

Hey Rayner,

It’s very enlightening. I would love to know more about swing trading and scalping strategies please. Looking to derive income at the moment.

Traders can you get so emotional with irrespective of the strategy adopted. Discipline is key.

Well said!

Wow This Article really cuts down the frustration thanks…..

My pleasure!

Thanks a lot for such awnsome witten. You made my day! Finally I know where can I start!

At the present, I can look at screen full time and get exited to see dolars come to my account so I chose day and swing trading.

In the fulture when Covi-9 has gone I will back to work so the postion trading would be my choise.

Cheers!

Cheers Pham!

I like day trading and scalping

Hi Rayner,I’ve recently discovered (by a pure chance) your Youtube sessions and can’t tell you how much difference they have made…I’ve been reading books on Trading (contradicting each other) for the last 10+ years and got so confused that at some point I had completely lost interest in the matter.It’s really amazing how logical and straightforward your “lessons” are…admirations man.

You’re most welcome, Zlatko! Glad to hear that!

I will like to know more about scalping and day trading and strategy to use.

Thanks Mr Rayner

great work out there!!!!

Thank you, Dan!

Thanks Rayner as I speak I love reading more about trading so that I understand the concept si nce you came close to me the rainbow colour arranged them self… What I am saying I was mixing a lot of things now I understand better… Keep on being with I really appreciate your wonderful work… One of the good days we will mit that will my biggest thanks I ever give anyone.. God bless you

You’re most welcome, Reuben!

I’ve learnt a lot from this short read. I’m new to forex trading and I’m so happy to be watching your videos and reading your post. Thank you very much.

You’re most welcome!

Hi Rayner

What’s up ?

I enjoy your videos – many thanks.

I’m into scalping and a bit of ‘transition’ when the opportunity presents.

You must understand I am 72 so time is of the essence 😉

Do you know of any scalping programmes which make a profit?

Great advise. I thoroughly enjoy your publications.

I’m a dangerous scalper because i haven’t mastered most of those strategies but i think they seem to be with minimal risks, right?

Brother thanks for sharing.

Great discussion Rayner.

Personally, I work a trending method that works top down. I go from Daily, then 4H, then 1H and 15m. The Daily and 4H are for direction setting and the 1H and 15m are for entry and exit. I use short, medium and long term trendlines and look for trendline breaks. For confirmation I use 2 EMAs and the RSI (optional really).

Thank you for sharing, Ken!

Thanks sir I dont what to say, you’re genius.

Cheers bud

I think day trading is suitable for beginners because you can quickly and easily experience more signals within short time.

You’re great. I now have more to do with candle sticks than human being.

I’m fairly new to the market actually and what’s been working for me is a combination of swing trading,day trading and news trading. Is it a bad approach to take a bit of the three and combine it? Not making much but still in the green and it’s all thanks to your videos about technical analysis and candle patterns + how to combine both. Thanks for the free content you provide you really give people like me a place to start from and slowly dive into the big world of trading and investing.

My pleasure!

Having tried positions trading before I realised that swing trading suits me best, so far in two trades I am seeing 40% growth.

Thanks for your tutorials as I didn’t know what a swing trader was.

Happy to help, Mike!

I like a swing trading and transition trading

thank you so much Rayer,

im beginner trader , ive full time job and you just gave me an answer of all my questions, id like to learn more from you , thank you brother

Hey Aziz,

You are most welcome!

I like transition trading and scalping

Hi! Rayner, i am so exited of what your giving back to the community, stay blessed my friend b’couz this is part of giving back to the community,…I am still learning everyday, haven’t open the real acc. I am in Demo acc. for two weeks now….

My question is, 1% = 0.01 LS & that is to say your risking 1% of your acc.? sorry for disturbunces.

Hey Salim.

You are most welcome!

Check out this video…

https://youtu.be/1ohBdvp8CoU

You are a resourceful person Rayner. I have been trying swing trading but without much understanding and in the process making loses. Going through yr articles equips me with knowledge. Thank you

Hey Thebe,

I’m glad to hear that!

I preferred swing trading and I want to know how to use it , because I have limited time to work on the screen..

Hey Alao,

Check out this post…

https://www.tradingwithrayner.com/swing-trading-strategies/

Hey Alao,

Check out this post…

https://www.tradingwithrayner.com/swing-trading-strategies/

I was a scalper when I started. Now doing day trade and trying to be a swing trader. Thanks for sharing all your knowledge and experiences.

Hey WIn,

I’m glad to hear that!

Thanks for this wonderful piece of information. Well presented and easy to comprehend. Pieroo from Uganda

Hey Pieroo,

You are most welcome!

My brother that I am very clear I want to become a day trader

(While reading the transaction trading I am completely shocked great strategy what you find after completing my day trading course please teach me transaction trading thank you so much my dear bro

Hey Anwar,

You are most welcome!

I think that i have found my man with you Reynar,i have been trying to learn Forex trading but with all the material i have been using i was getting confused,since i have been watching your videos and reading your ebooks im really progress,so i dnt want to confuse myself anymore,all i want is your resources im now confident that im going be good at this, so im in South Africa anf would really appreciate it,if u could email me relevant material for beginners,i have never traded before,you are amazing men.

Hey Jonathan,

I’m glad to hear that!

Check out the trading academy…

https://www.tradingwithrayner.com/academy/

Thank you Ryner…. I’m a beginning and have been struggling to know a strategy which will work best for me…. Thank you for the insight

Hey Joses,

I’m so glad to hear that!

Hello Rayner

Though I am new in forex I have devoured two of your of your books the one on reading candle stick pattern and the ultimate guide to price action trading, I found them really helpful, but the transition trading strategy on this article really caught my attention, I would like it if you could expound more on it in subsequent articles.

Thank you.

i use the swing trading strategy. thanks for this post brother! you are blessed sir. you are the best.

Hi Victor,

I’m glad to hear that!

I prefer swing trading cause I am working at the moment and interested in creating wealth rather than just income

Hi Mbongiseni,

I’m glad to hear that!

I prefer day trading because I have more free time to my self and also wish to create income. You are a blessing to manytraders.

I have been learning using the swing and goes for the 4 hour time frame. Thanks for sharing your knowledge with me, it has been so helpful

Hi Vincent,

You are most welcome

Currently unemployed,hoping to make this an income stream.Already have an account but it is very small $250.please help.

I am more of a swing/ day trader because I use the H1 and H4 tf. Sometimes I close my trades daily and sometimes I hold till next day or days. But I find it hard picking the right currency. Which currency strength meter can I use?

Can you help with that?

I am a day trady.

But am still looking for more strategies that will work for me best.

waw thats great

Hi Vikas,

Thank you!

I did not start Forex Trading yet i am still following your teachings are very interesting.

Hi Alex,

Check out the trading academy…

https://www.tradingwithrayner.com/academy/

Hi Rayner, i prefer to be a swing trader. Please send me more information about swing trading. Thank you.

Hi John,

Check this post out…

https://www.tradingwithrayner.com/swing-trading/

Thank you for such good advice, I prefer and learn swing trading in the past year.

Hi Ivica,

I’m glad to hear that!

Cheers.

I’m quite new with live account and I’ve been tilting between scalping and day trading. It consumes my time yet I make losses at the end of the day. I Don’t know what strategy and best trading timeframe that works for me. I really need help on this

i do day trading and scalping. thanks for the insights!!!

Hi Adrian,

You are most welcome!

Wow…. This is a trading life changing skills bro.

Rayner…. You are blessed and a blessing to many traders who chose to learn from you.

I have been a day trader but now I want to learn from you how to be a good Transaction trader.

Please if it pleases you prepare for us the guidance on how to be a successful Transaction trader. Be blessed abundantly.

Much love from Tanzania, East Africa.

Hi Henry,

Thank you!

Cheers…

Hi Rayner,

Thank you for all your help and videos. I am very new to Forex and was wondering what you think of the various approaches that some traders use like Bounceback, GoldCup, Delorean, Harmonics, Pivots etc. Great to seee that you give so much advice for free and that you don’t force premium products onto evrybody.

Kind regards,

Johnny.

Hi John,

Check out the trading academy…

https://www.tradingwithrayner.com/academy/

Good common sense info for those considering trading. I’m getting to like your posts and your books are also full of good tips and advice. Keep ’em coming!

Hi Rusty,

Thank you!

Cheers…

Am a scalper trader I love your work 100%. Hope you can teach us on indices too.

Hi Dube,

You are most welcome!

Cheers…

I am currently using the day trading/scalping strategies. just start to become a bit more consistent with my trades and profiting slightly

Hi Francis,

I’m glad to hear that!

I have been position and swing trading. Since covid i was trying intraday trading as well.

Thank you for all the valuables information on trading.

* Can this technique apply on cryptocurrency trading, since i don’t have interest trading forex but crypto.

* Secondly, interested in transition trading technique, with multiple timeframe. I’m thinking of 15minutes — (entry)

1hours &

4hours. (Higher timeframe)

Please what do you think about it, could it be possible.

I only have interest in crypto currency market trading.

Thanks.

BIG Great

Hi Md,

Thank you!

Thanks Rayner ! your articles have been very helpful.

my best trading strategy is the position trading

Hi Hanson,

Thank you!

Cheers…

Thank you very much.

This really helps.

Hi Loveday,

You are most welcome!

Hello Rayner

Thanks for your continued support for all kinds of traders. Your selfless nature is incredible. Cheers

Hi Phineas,

You are most welcome!

my name is Thabea I am very happy for this email, what I need to do now is to practice practice and practice thank you so much Rayner for everything

Hi Thabea,

You are most welcome!

i enjoy your write up, am a day trader.

Hi Ezekiel,

Thank you!

hey my friend Teo

Many thanks for your hard work and your style of teaching..

I have started trading recently and learnt a lot from your lectures..

I am wondering , you with this knowledge and spend lots of time on trading , why you are not a Million-er by now? is that because you do not want it or the nature of this business does not allow you to become one ?

thanks again for your honesty

Hi Parviz,

Thank you!

It’s not about the money but the passion to see others succeed .

Cheers…

Great article Rayner, thank you very much. My preferences are both wealth building and swing trading. Your articles have been very useful on improving my understanding of swing trading and I look forward to each new installment. Best wishes and good health to you. YNWA

Hi Greg,

Thank you!

I have a full time job…I’m a trend trader!!

Hi Tj,

I’m glad to hear that!

GREATINSIGHTS!!

Hi Ronald,

Thank you!

I will like to a day trader

Hi Ade,

The journey starts now.

Check out this post…

https://www.tradingwithrayner.com/intraday-trading/

Cheers…

Hi Rayner i’m a beginner and i am reading all your available tutorials in the web i know it’s not easy but i hope i can there slowly. Thank you for all your free tutorials

Hi Bernardo,

You are most welcome. Nothing is difficult, just condition your mind at it…

Check out the trading academy it’s FREE!

https://www.tradingwithrayner.com/academy/

Thanks for short and simple explanation.

Hi Bull,

It’s my pleasure!

hi i like your work and i wil like to sign in to yr wepsite and more more about tranding. here is my email mthimkulu.luzeka@gmail.com plz send me the link to join

Hi Luzeka,

Visit the website to get started…

https://www.tradingwithrayner.com/

Thanks a lot Rayner…It’s really a nice nice one, I’m better of with short-term tradings

Hi Charles,

I’m glad to hear that!

To build up my income stream in order to support my family. Note : I am still waiting for the “Pullback Stock Trading system” delivery.

Thanks for your Great sharing

Best Regards!

CP

Hi Chiun,

Thank you.

Your tracking details for the book have been sent to you.

I feel like you are teaching me in class Sir thank you for your help

Hi Eric,

You are most welcome!

Hey Hey, wat’s up my friend!!!

Me I use Scalping and Day Trading Strategies.

Hi Simbarashe,

Thanks for contributing!

Cheers.

I think I’d likely be a daytrader and a swing trader

Hi Thomas,

I’m glad to hear that!

Swing is good

Hi A,

I’m glad to hear that!

Hey Rayner, I have been scalping for about a year now, but I make small profits, large losses, I have blown my account twice so far, I think I will try swing trading instead, cheers

Hi Hassan,

I’m glad you want to try the swings.

Position

please sir teach me more I don’t know anything about forex trading

Hi Lambart,

Check out the trading academy…

https://www.tradingwithrayner.com/academy/

Thanks a lot for being my guru. Iam beginner. The long way to go.

Hi Gopu,

It’s my pleasure!

Cheers.

Thank you. I’m new to this arena and don’t even know what I am yet; day, swing, scalper etc. I like your teaching style as most of it makes sense to me.

Hi John,

You are most welcome!

I do more of swing trading and also day trading and I am a full-time employee.

Hi Kenneth,

I’m glad to hear that!

Hi,

I really love you bisect forever. I love swing and scalping but seems not to be getting it. Sometimes the whole charts just get messed up without direction. Your help will be most appreciated

Hi Ope,

Check this post out.

https://www.tradingwithrayner.com/swing-trading/

Thanks rayner you are doing a great job. I am a position trader

Hi Henry,

You are most welcome!

Thanks for your informative articles

Hi Kish ,

You are most welcome!

Cheers.

hope method3 will apt for me. You really excellent. Thanks a lot. From your videos only I learned how to trade and everything.

But still having doubts with candlestick patterns. If I get a clear idea about bullish and bearish candles it will be really helpful.

Thanks for your support

I must says Big thanks to Sir Reyner who open my eyes so deeply to understand candlestick patterns and other strategies to trade forex when to enter trade how to enter and where to exit as now person into the business. thank you Sir , but please Sir I need more guide because am a scalper trader thanks. Onyema Isaiah

Hi Onyema,

You are most welcome!

Check out this video.

https://youtu.be/w8kJXCy_Rrs

Thanks for the help Rayner. You’re really one of the most helpful forex gurus I’ve come across so far. Plan to be a swing and day trader since I have a full time job. Keep up with the good content!

Hi Nazirul,

You are welcome!

Your explanation is thorough and further examples with charts given to explain your theories. After reading and watching most of your forex education, I’m understanding the charts much better when im trading price actions. Thanks Rayner! I really do appreciate all the time and effort you’ve put in to educate retail traders like me.

Hi Hadi,

I’m glad to hear it!

Cheers.

Been about 2 months or now Rayner, reading & watching your work. I love your work & how you educate so easily & again how you’ve worked up your way. No pressure..”it looks like the one you’re seeing on screen right now”that got me cracking up. Thank you for such simplicity!!

Hey Yanga,

Thank you!

Cheers.

I am a day trader

Hi David,

I’m glad to hear that!

Day trading is the best for me

Hey Aregbe,

You are most welcome!

Cheers.

I’m more of a swing trader , but I’m glad i got to know the types . I definitely know what I’m doing now .

Mothihaloga,

I’m glad to hear that!

Cheers.

I want to be a swing trader

Hi Benji,

Check out this post.

https://www.tradingwithrayner.com/swing-trading/

I’m a day trader

Hi Benard,

Check this out.

https://www.tradingwithrayner.com/intraday-trading/

Hello my friend!

Enjoying you content……

Swing trading is best suited for me!

Hi Khemchand,

I’m glad to hear that!

Cheers.

I am indeed grateful to your quick response clarifying all my doubts and showing me the forward path. I am planning for swing trading strategy in equity and commodity. I shall decide about forex after sometime.

Thank you once again. God bless you.

Hi Ravinder,

You are most welcome!

Sir you simply the best and I still want to learn more than what Ive learned from you already.

Hi Njabulo,

You are most welcome!

Swing trading

The trading strategy that suit me is Day trading because i have enough time and energy to spend in front of the screen.

I’m glad to hear that, Nelkon!

Hello Brother can i ask u a question

I consider swing trade.

You are such a genius !!!

Please sir am a novice in trading , I don’t know anything in trading but I want to start trading and making ends meet.please I don’t understand this words buy and sell ( long and short). My question now is assuming i go long (buy) ETH/BTC , is it the same ETH/BTC i go long i will sell (short) in other to make profit? . or how do you make make profit when you go long and when you go short. Please am confused can you kindly make a video of that how To go long and make profit or how to go short and make a profit.

Please sir am a novice in trading , I don’t know anything in trading but I want to start trading and making ends meet.please I don’t understand this words buy and sell ( long and short). My question now is assuming i go long (buy) ETH/BTC , is it the same ETH/BTC i go long i will sell (short) in other to make profit? . or how do you make make profit when you go long and when you go short. Please am confused can you kindly make a video of that how To go long and make profit or how to go short and make a profit.

Hello Rayner, My Cards Doesn’t Support International Transactions… I am Very Sorry I can’t buy this Valuable Book That Can Change my Life.. ❤️

Sir I have read and have fully understood every detail written here by you, and at the end of the day I will like to be a day trader and make income from it sir, thank you so much for this great opportunity I await your response sir and God bless you more and more every day sir.

You are welcome, Edward!

swing, Trend and Position trading strategies

Thank you rayner for your support to beginners like me. It is very useful stuff to start a journey in trading. Thank you very much.

I’m a noob in the world of trading and I’ve started reading stuff all over the web. Information overload drove me nuts until I came across your video when i was searching for Support and Resistance. Viola! Your way of teaching is easy to understand and I can relate to the mistakes you point out in every topic you share. I’m binge reading/watching stuff from you now. Thank you and you’re keeping me motivated. I slacked off for several days after I hopped on without any knowledge and lost some. I’m going to start again and not too scared now. Thanks to you. I’m going to do the Law of large numbers and evaluate myself with it.

Thanks for the infor, I don’t enough time sitting before the screens but once I do find some time(let’s say 3hours) am comfortable and confident trading smaller timeframes. I love swing trading eventhough I have never tried it, my fear or doubt being what really makes swingers so comfortable holding trades for hours even months? Is it fundermental analysis or their technical analysis their drive? If its their fundermental analysis what news do they tradethat drives the markets that long? If it’s technical how is it done?

Am trading VIX 75 and other indices but all in all I am seeing vix75 profitable of the all.

I wanna trade nas100 and I need help

Thank you

I have recently started trading and its so difficult to find what type of trading should i do. I have been loosing my funds. Recently I have started following your channel on YouTube and I hope to learn from it. There were trades where I went long and the moment everything reversed, I felt I am so unlucky. But now I am looking forward to learn from you guys.

Thanks for your Books and YouTube Videos, it helps beginners like us.

You are welcome, Amar!

Thanks so much Rainer for the help so far. Am very grateful. I used MBEE on oil uptrend and no losses yet but I think I did not apply the system at the right time because the uptrend is slower.

Btw I started trading in January 13 without knowing all that I have leant from you today. At the beginning I think it was luck I happened to make 4000 euro in 2 weeks. But as am writing this comment if care is not taking I might end up blowing my account.

Thanks to the Book price Action Trading Secrets) my eyes are now open on trade. I wish to learn more from you and hope some updates from you. Thanks a lot Reyner

Hi I am learning a lot by reading the information. I have a lot of time and I can stand in front of the screen for 12 hours. I knew I needed to learn Scalping strategy

Gaining lots of knowledge sir and its free…thank you God bless u sir

You are most welcome, Jitu!

I like day trading on the 15 minute chart becuz my personality is impatient, i like to see results within a few mins or hours rather then days…im only just starting trading but already built a lot of confidence and learnt alot from u…thx mate

Glad to hear that, Chris!

I am a swing trader, and after watching all your YouTube videos and numerous write ups, I’ve made more profits in the recent month compared to the last six months of my readings.

Awesome, Habib!

I prefer day trading Rayner and i really need your help

Hi Francis,

Check out this post.

https://www.tradingwithrayner.com/intraday-trading/

Cheers.

Hi Rayner!

Quick question: I want to get your Price Action Trading Secrets Book, but you mentioned a price of approximately $13 only for the US.

I live in South Africa and would like a copy. Is it not possible for me to get a PDF e-book version or is it only available in hardcopy?

Hi Nicholas,

Please contact support.

support@tradingwithrayner.com

Cheers.

First; thank you. I am new to trading and lost my opened gains few weeks ago. A lot of cash. After reading your ‘The ultimate guide to price action trading’ last week, I found that that lose would have been avoided if I knew about Structure. The future is what is now important. Once more thank you.

I am a Day trader on my off days. I do position trading too; but after reading this page I have to improve it by defining exits.

‘Price Action Trading Secrets’ is in my plan

Hi Hans,

I’m glad to hear that!

Keep it going.

Cheers.

Thanks so much for the trading strategies, so educative, I thought i was only a scalper, but now i have understood that I’m a full day trader. Thanks once more and remain blessed for blessing others.

Awesome, Austine!

Swing trading is the forex trading strategy I use, though I am a crypto trader

Hey Skylord,

That’s good to know!

Cheers.

Day trading

Your videos are very helpful for me as beginner.

Awesome, Xoli!

Your materials are very insightful. I look forward to reading more. I use Swing trading

Thank you, Ahmed!

I just started really trading real money a couple months ago. I think I’m a position trader as I have a full time job.

Awesome, Chris!

I will go with #3 Day Trading, especially breakouts…….that is the only thing that works for me…….

Good to know, Ram!

Give me your email adress please

Hi Daniel,

You can make the request through

support@tradingwithrayner.com

Cheers.

I prefer day trading

Good to know, Khwezi!

Thank You Rayner

You are welcome, Gift!

Swing trader

Thanks for your contribution, Aide!

I’m still trying to figure out which kind of trader i am. I feel like I am more of a day trader.

Am still trying to figure out who I am,because I feel like am more of a day trader too…

Because am still an apprentice for now

Glad to hear that, Faruk!

Can you do a video on how to set up a trading strategy

Hi there

How can i identify entry point in a certain script in future what is most convenient way to set a target price.

Is there any other concept beside support and resistance to set entry and exit points

First and foremost, I want to say thank you very much for the article and everything.

I’m a newbie in fx trading and I prefer day trading. Please I’d like to know if I can use EFC indicator for 15 mins timeframe and if it is reliable. Thanks!

Educative

Thank you, Cubanks!

I am still a beginner in Forex trading. But I already like news trading because I believe it a huge impact on what happes in the market.i have a quick question though, can I combine trading news, S and R, MACD and candle stick pattern profitably. Thank you for all your videos on YouTube and the free books. They have been helpful

Im interested in learning the day trading and scalping

* I like Swing trading because the 1-hour or 4-hour timeframes and the importance of learning technical concepts like Support & Resistance, candlestick patterns, and moving average.

Help, I find it difficult catching the initial move. I hesitate looking for the entry waiting on break of structure and pullbacks.

*Also, I show interest in Transition trading working with multiple timeframes, MA’s and the risk to reward. As I continued to read, I came across Has Your Trading Strategy Stopped Working. Here’s How You Can Fix it. What I learned is having an edge is key. Understanding the law of large number and going back studying the market conditions I won in and much more.

Love the content!

Glad to hear that, Ernest!

I choose swing trading thanks you so much for this wonderful post

Awesome, Happyboi!

I choose swing trading cause I still have a full time job.. thank you so much for this wonderful post

Glad to know this, Happyboi!

Hello Rayner, I use the day trading strategy and sometimes the transition trading works too.. thank you

Good to know that, Richmond!

Thank you Rayner. Swing trading will suit me better as I don’t like sitting in front of the computer for too long.

I love that, Bongekile!

For now im a beginner in trading. I prefer positional trading. But still lacking for TA and other fundamentals.

Awesome to hear that,, Mark!

Check this post out.

https://www.tradingwithrayner.com/position-trading/

Cheers.

your videos and books are very educative. Do you have an video on supply and demand ? I also would appreciate something on mutilple confluence and entry trigger. Thanks

For supply and demand ( support and resistance), you can check this link:

http://www.youtube.com/watch?v=PuboYnBc0t8&t=4s

And for you to instantly improve your trading entries, you can check this link:

http://www.youtube.com/watch?v=7vE7qslz0LQ

SWING TRADING. THANK YOU SO MUCH FOR THIS INFORMATION. I’VE REALLY LEARNT A LOT FROM YOU. GOD WILL CONTINUE TO BLESS AND KEEP YOU. LOVE FROM NIGERIA .

Hi, Genesis!

It’s our pleasure to help and give purposeful trading education.

Cheers!

Thanks RT for this great and eye opening info for newbies like me. Keep up the good work ….

It’s our pleasure, Jimmy!

I’m a beginner and have lots of time to spend on the screen, therefore i want to use the scalping strategy as my source of income.

Thank you for sharing, Daniel!

Sir you are talking about the market that we can only trade in three or five markets.If you are talking about asset or other markets such as forex or indices or futures

I like the swing and position trading strategy

Thank you for sharing your thoughts, Rafael!

I am a day trader, trading in 15mins timeframe

Thank you for sharing, Godwin!

Good work, I like it

Thanks, Dominic!

I follow the trend on 5M or trend reversal using the 200 and 50 EMA cross over coupled with price action both from today with what I have learnt here I will do it with daily bias on a higher time frame

Thank you for sharing, Joseph!

I just want to suggest that there is a way to balance a full-time job with day trading. If we find a job that allows us to work more than 8 hours a day, including weekends, our workweek would start on Saturday and end on Tuesday. Then, from Wednesday to Friday, we could dedicate ourselves to day trading. In this setup, we maintain full-time employment while still having three full days each week for trading.”

Thanks for sharing that approach, Piotr!