Have you tried a trend trading strategy that goes like this?

You identify an uptrend.

You go long.

The trend reverses — and you get stopped out.

Then you start wondering…

“Is the trend really my friend? If so, why do I keep getting stopped out when I trade with the trend?”

Here’s why:

A new trader looks for a trend and enters a trade. But…

A seasoned trend trader looks for a specific type of trend, stalks the best entry, let the market comes to him — and then enters a trade.

Now if you want to trade trends like a pro, then this trend trading strategy guide is for you.

Because you’ll learn:

- The benefits of trend trading (that you’ll rarely find elsewhere)

- How to define trends like a pro

- 3 types of trends every serious trader must know

- When is the best time to enter a trend

- How to set a proper stop loss in a trending market

- A trend trading strategy that lets you profit in bull & bear markets

Are you ready?

Then let’s begin.

The benefits of trend trading strategy

You’ll love to trade with the trend because it:

- Improves your win rate

- Offers a better risk to reward

- Can be applied across any markets

Let me explain…

Trend trading improves your win rate

There are 5 points in this chart: A, B, C, D, and E.

Do you want to buy at C, D or E?

Or go short at A or B?

Chances are, you’ll prefer C, D or E because the move last longer and you have a higher probability of winning.

Offers a better risk to reward

Besides increasing your win rate, trend trading also improves your risk to reward.

Here’s what I mean:

This means for every $1 you risk, you could make a multiple of that amount (like $2, $3, or even $10).

Trend trading can be applied across any markets

Here’s the thing:

Trends exist due to greed and fear in the markets.

When there’s greed, you’ll get more buying pressure, which results in higher prices (an uptrend).

When there’s fear, you’ll get more selling pressure, which results in lower prices (a downtrend).

You’re probably wondering:

“Will trend trading stop working?”

Only if humans have no emotion (which is unlikely).

Thus, you can expect trends to occur in any markets like forex, futures, stocks, bonds, agriculture, etc.

30-Year Treasury Bond:

USD/JPY:

Fun facts:

Jesse Livermore, the most famous trader of all time, made $100 million in 1929.

Richard Dennis, the founder of the turtle traders, made $400 million trading the futures market.

Ed Seykota, possibly the best trader of our time, achieved a return of 250,000%, over a 16 year period.

Do you know what they have in common?

They adopt a trend trading strategy.

How to define trends like a pro

You probably know…

An uptrend consists of higher highs and lows. And downtrend consists of lower highs and lows, right?

But… what if you get a chart that looks like this?

Is this an uptrend, range, or downtrend?

Uh oh.

And this is the problem when you define trends using higher highs and lows — there is subjectivity involved.

So, what can you do?

You can use the 200-period moving average (MA) to help you with it.

Here’s how…

If the price is above 200MA and 200MA is pointing higher, then it’s a long-term uptrend.

If the price is below 200MA and 200MA is pointing lower, then it’s a long-term downtrend.

An example:

If you want to learn more, go watch this training video below:

Now, the next thing you must know is…

Trends can exist on different timeframes

Here’s the thing:

Depending on the timeframe you’re on, a market can have different trends on different timeframes.

Here’s what I mean…

Downtrend on weekly:

Uptrend on 4-hour:

Now…

A mistake traders make is trading trends on every timeframe. This is a big NO.

Instead, you should trade trends on your selected timeframe.

This means:

If you’re trading the Daily, then your job is to trade trends on the daily timeframe.

If you’re trading the hourly, then your job is to trade trends on the hourly timeframe.

If you’re trading the 5 minutes, then your job is to trade trends on the 5 minutes timeframe.

Get it?

Now to take things a step further…

You can combine trend trading and multiple timeframe analysis to improve your trading results.

Go watch this training video below to learn more on how to trade with the trend on multiple timeframes:

3 types of trends every serious trader must know

Most traders assume a trend simply consists of higher highs and lows. But it’s not enough because trends are not created equal. Some are better to trade breakouts, and some to trade pullbacks.

So in this section, you will learn the 3 types of trends (that most traders are unaware of), and the best way to trade each of them.

They are:

- Strong trend

- Healthy trend

- Weak trend

Let me explain…

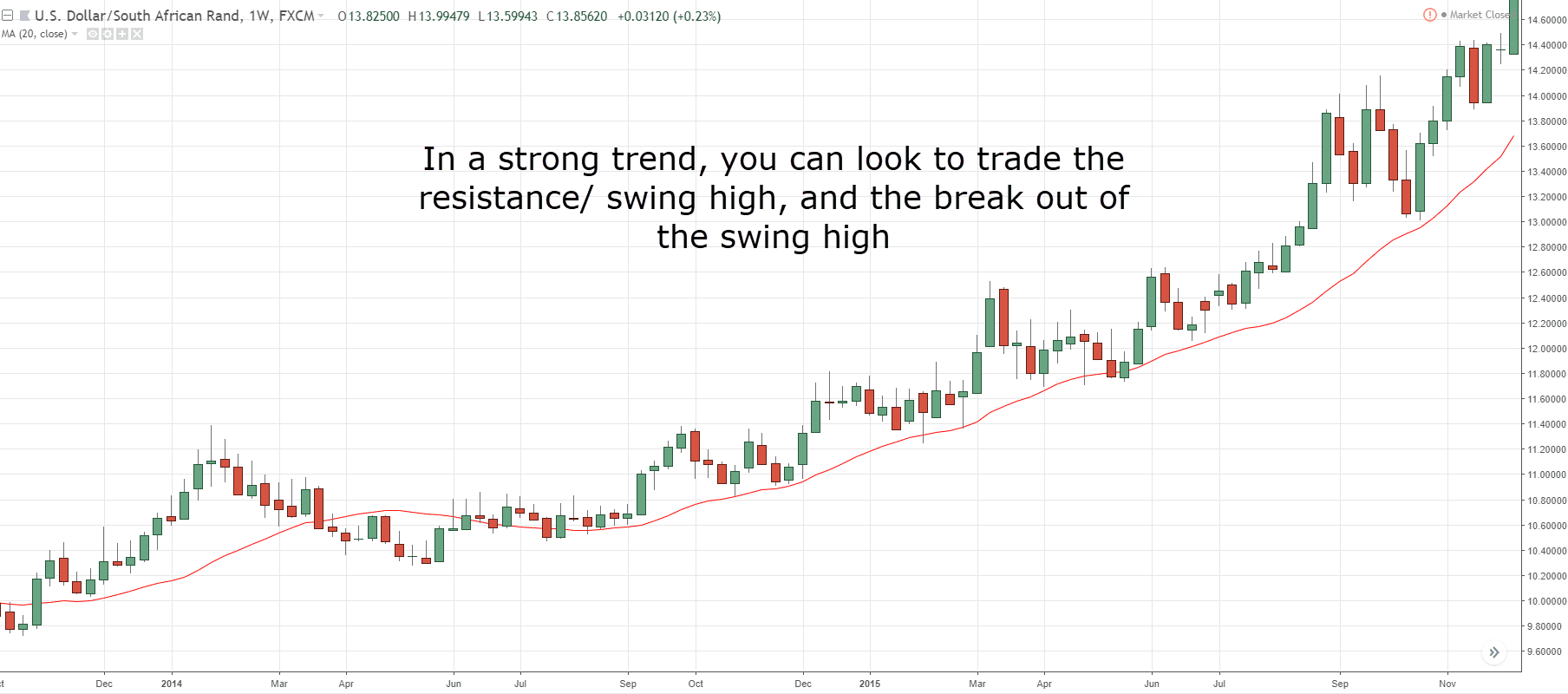

Strong trend – In this type of trend, the buyers are in control with little selling pressure. You can expect this type of trend to have shallow pullbacks —barely retracing beyond the 20MA. In some cases, you will get no selling pressure as the trend goes parabolic.

Healthy trend – In this type of trend, the buyers are still in control with the presence of selling pressure (possibly due to traders taking profits, or traders looking to take counter-trend setups). You can expect this type of trend to have a decent retracement usually towards the 50MA, which provides an opportunity to hop on board the trend.

Weak trend – In this type of trend, both buyers and sellers are vying for control, with the buyers having a slight advantage. You can expect the market to have steep pullbacks and tends to trade beyond the 50MA.

When is the best time to enter a trend

Here’s a fact:

There are two ways to enter a trend, on a breakout or pullback. And the entry method you’re going to use depends on the type of trend the market is in.

Let me explain…

Strong trend

In a strong trend, the market has shallow retracement (not exceeding 20MA) which make it difficult to enter on a pullback because the market hardly retraces and then continues pushing higher.

Thus the best way to trade with the trend here is on a breakout or, to find an entry on the lower timeframe.

An example:

Healthy trend

In a healthy trend, the market has a decent retracement which makes it ideal to enter on a pullback.

However, you can also enter on a breakout. But you’ll have to “endure” the retracement back towards 50MA (which drains your mental capital).

Thus, a better entry is to enter on a pullback.

Here’s what I mean:

Weak trend

In a weak trend, the market has steep retracement (usually exceeding 50MA) and it’s difficult to “predict” where the retracement will end using MA.

Also:

In a weak uptrend, the market tends to break the highs only to retrace back much lower (which makes trading breakout difficult).

Thus, the best way to enter this type of trend is at Support and Resistance.

An example:

How to set your stop loss in a trending market

Whenever I put on a stop loss, I would think of this quote…

Place your stops at a point that, if reached, will reasonably indicate that the trade is wrong. Not at a point determined primarily by the maximum dollar amount you are willing to lose – Bruce Kovner

So, here are 3 ways you can do it:

- Moving average

- Structure

- Trendline

Let me explain…

Moving average

The key here is to use the MA that is respected by the markets.

For example:

In a strong trending market, price tends to respect the 20MA. Thus, you should place your stop loss below the 20MA. And if it breaks, you know your trading idea is wrong.

If price tends to respect the 50MA, then place your stop loss beyond 50MA.

Structure

Here’s the thing…

An uptrend consists of higher highs (and lows), and a downtrend consists of lower highs (and lows).

So, here’s what you can do:

Uptrend — you can place your stop loss below the previous low

Downtrend — you can place your stop loss above the previous high

An example:

Trendline

Here’s a two-step process in using trendline:

- Draw trendlines by connecting the lows of an uptrend (and highs of a downtrend).

- Once you’ve identified the “barrier”, you can set your stop loss below the trendline (for uptrends), and above the trendline (for downtrends).

Here’s what I mean:

Now you’re probably wondering:

“Where exactly do I set my stop loss?”

Now…

You don’t want to set your stops at the edge of the trendline (or structure) because you could get stopped out prematurely. Likewise, you don’t want to place it too far away, which hurts your risk to reward.

Thus, you can set your stop loss 1 or 2 ATR away from the structure which gives your trade enough “room to breathe”.

This video explains more:

Also read: How to Read and Interpret The Moving Average

How to develop a trend trading strategy

Let’s be clear:

A trend trading strategy is only 1/3 of the equation. Without proper risk management and discipline, even the best trading strategy isn’t going to make you money in the long run.

Now, go watch this video to learn more:

Now…

Whenever I develop a trend trading strategy, it needs to answer these 7 questions:

- Which markets you trading

- What’s the timeframe you’re trading

- What are the conditions of your trading setup

- What is your entry trigger

- Where is your stop loss

- How will you exit your winners

- How will you manage your trade

Markets Traded

- Agriculture commodities

- Currencies

- Equities

- Rates

- Non-Agriculture Commodities

Trend trading strategy template

If the market (on the Daily timeframe) is a healthy trend, then wait for it to pullback towards 50MA.

If the market pullback towards 50MA, then wait for a candle to close in your favor

If the candle closes in your favor, then look to enter on next candle

If you enter on next candle, then set your stop loss 2 ATR from entry

If stop loss is set, then look to take profit at the nearest swing high/low

**Disclaimer: I will not be responsible for any profit or loss resulting from using these trend trading strategies. Past performance is not an indication of future performance. Please do your own due diligence before risking your hard earned money.

Losing trade at (JP225USD):

Winning trade at (EUR/NZD):

Winning trade at (NZD/CAD):

Frequently asked questions

#1: I’m confused when you say trend trading increases your win-rate. Wouldn’t trend trading decrease your win-rate because most markets tend not to trend most of the time?

There’s a difference between trend trading and trend following.

Trend trading simply means trading with the trend. You can be a swing trader in a trending market. Whereas for trend following, you’re attempting to capture the full trend by trailing your stop loss.

So yes, trend trading increases your win-rate as you’re trading along the path of least resistance, compared to someone trading against the trend. However, don’t confuse that with trend following, which is an attempt to ride the entire trend.

#2: If the price is below the 200 MA in the lower timeframe but above the 200 MA in the higher timeframe, should we treat this market as an uptrend or a downtrend?

You should always pay attention to the trend of the timeframe you’re trading on:

- If you’re trading on the 5-minute timeframe and it’s in a downtrend, then you should say the market is in a downtrend.

- If you’re trading on the daily timeframe, then you should pay attention to the trend on the daily timeframe.

If the timeframes are too far apart, then it’s irrelevant. Because it doesn’t make sense to be following the trend on the daily timeframe if you’re trading on the 5-minute timeframe.

At most, you can take into consideration the trend one timeframe higher than what you’re trading. For example, if you trade on the daily timeframe, you can consider the trend on the weekly timeframe to make sure the trend aligns.

#3: How can I know if it’s going to be just a pullback or a reversal altogether?

On a pullback, the range of the candles is relatively small.

Whereas on a reversal, the range of the candles gets larger and the price tends to break key market structures, like previous swing lows or area of support.

Also, if the price forms a series of lower highs and lower lows, then chances are, the market will enter a range or reverse altogether.

A quick recap of what you have learned:

- Trend trading increases your win rate, improves your risk to reward, and can be applied across all markets

- You can define the long-term trend using the 200-period moving average

- In a strong trend, it’s ideal to enter your trades on a breakout (or on a lower timeframe)

- In a healthy trend, it’s ideal to enter your trades on a pullback (towards the moving average)

- In a weak trend, it’s ideal to enter your trades at Support or Resistance

- In a trending market, you can set your stop loss using moving average, trendline, or structure

Now here’s what I like to know…

Do you follow a trend trading strategy? What’s your experience with trend trading strategies?

Leave a comment below and let me know.

Thanks for another great trend trading post Rayner. I think you’ve touched on pretty much all of the key trend following in a single article. For me, it’s always amazing to see how trends persist across so many time frames and asset classes. Thanks for putting this together!

Hey Jay,

Glad you enjoyed it.

Cheers bud!

Hi Rayner, I always thought that trend-trading would decrease your win-rate because most markets tend not to trend.. they either range or do a bit of everything! With the low win-rate comes a better risk/reward though i guess? I’m confused when you say trend-trading increases your win-rate?

Hey Go,

Trend trading and trend following are two different things. For trend following you get a lower win rate since you are trying to ride the trends.

For trend trading, you’re simply trading with the trend, but you could adopt a swing trading approach and take swings out of the markets.

Hi ray,

Bro your strategy work until you don’t use your own intuition brother your strategy works . Just give this caution stop using your brains go with the trend don’t expect it to change , just coz u have a feeling. , bro I will like to invite you as guest lecturer to India (Mumbai) capital of share trading market, to my institute to give some tips. I’m only into intraday trade in equities, people need money today not a year after. So help me with my quest to get people some money.

Mail me on …aniketolas@gmail.com

Hi Aniket,

Thanks for sharing your thoughts my man.

Hi Rayner

if I remember correctly, you had a PDF book on Amazon. What is the name of the price action book?

Thanks

Ron

Hi Ron,

I don’t have any book on amazon.

Hi Rayner, thanks for the great info.

One thing I don’t understand,

U mention to determine the trend first, if it’s downwards, den look for short signals – trade in the same direction as the trend.

However , one of the examples, u spotted a swing high in a down trend in a higher time frame and u mention to look for long signals in the entry time frame.

Could u enlighten me. Thanks

Could you point out the example to me, not sure which you are referring to…

Hi Rayner! We need to use 50MA or 100MA (like in your video)? And we only enter trade when all the three MAs in the agreement?

I don’t quite understand your question… could you explain?

In your video “How To Define Trend”, you use the MA100, but here in this page you use 50MA. Which MA need to use?

And the trade is only allowed, when the all three MAs in agreement? e.g. when all of the 3 MAs going to up, and all show strong trend, then we can enter with buy?

But what if e.g. the 50MA (or 100MA) going down, but the 20MA and 200MA going up?

And all of the MAs need to show same strenght of the trend?

Hey Laslo

I use the 200ma which is the long term trend.

So if the price is above it, I’ll look to long and vice versa.

Thank you!

Then it is enough for me too. 🙂

You’re welcome, Laslo

Hi Rayner,

On H4 its good using 200,50,20 EMA?

Here’s the deal:

There’s no best timeframe out there. Likewise, there is no best indicator, strategy, or whatsoever.

It all boils down to YOU — your goals and what you want from trading.

Once you nailed that down, then you can find an approach that suits you BEST.

First! Thanks for Great! posts.

I read this

“I would suggest risking no more than 1% of your account on each trade, to avoid the

risk of ruin.”

– It means : I have $1,000, risk 1% => my stop $10 is it right?

– Most trade’s 2ATR over $10

How can i understnad this situation?

Hi Daniel

Yes, that means you don’t risk more than $10 on the trade.

You can achieve it through proper position sizing. The post below explains more…

https://www.tradingwithrayner.com/forex-risk-management/

Hey Rayner,

Great post. Can you please clarify where you set your take profit targets?

Thanks.

It depends on the trading approach.

If it’s swing trading you can target at the prior high/lows.

Hey Rayner,

Great post. what is your avg R:R n win rate,

i am not a big fan of trend trading but i know its foolish to go against strong trend,

i trade near strong support n resistance with risk to reward ranging between 1:3 to 1:9

but i am struggling with win rate i would like know your thoughts

It depends on the trading approach I’m using.

For Trend Following, it’s about 30% win rate and 1:3 risk reward ratio.

so you didnt take profits when candle close beyond/above 50ma?

its just set to 1:3 risk reward ratio?

im confused.

I didn’t mention anything about 1:3 risk reward ratio.

The exit is at the nearest swing high/low.

Great post Raynar. I am looking forward to seeing more of wisdom such as this. I am trying trend following on demo and so far I am still assessing. I like your views though, keep it coming and who knows?…. The future looks good

Glad to hear that!

very informative . could u plz share some edge strategist

Please look around my website, I’ve provided a lot for you to get started.

Dear Rayner,

Could you please detail, while identifying trend What if 200 MA is above current price in 4hours / any lower time frame and price is above 200 MA in daily timeframe/ Higher timeframe. We should trade it treating uptrend / downtrend, specially if its a weak trend

Minor correction: in lower timeframe 200MA is below and in higher timeframe its above current price.

You should reference it to your trading timeframe and not the lower timeframe.

How to sopt trend reversal early.before that how can identify pullback started. I know when it is ending .

How to identify whether it is pullback or reversals

This post will help… https://www.tradingwithrayner.com/how-to-identify-trend-reversal/

Well done!

I have a question for you..

In the strategy template you said “look to take profit at the nearest swing high/low”.

How do I identify it without too much lagging? Any examples?

Thanks!

(also i noticed in eurNzd chart exit is before entry.. Maybe a mistake?)

Swing low is identified on the left side on the chart, e.g. EURNZD you saw earlier

Hello Rayner, it has taken me out of an error that I had been making, a clear and logical explanation. In my case I work D following the trend and I try to improve my entry in 4H, I do not use the average of 200 in 4H I only leave 20 and 50, the average of 200 I only see it in D to see main trend and so I do not get involved when low to 4H. His explanation of the three types of trend have clarified much what I do, thank you very much and even the view.

Translated by Google

Can you give a more precise way to enter the market?

These posts will help with your entries…

https://www.tradingwithrayner.com/high-probability-trading/

https://www.tradingwithrayner.com/when-is-the-best-time-to-enter-a-trade/

Great posts thanks

Cheers

hey rayner, must we get out at the recent swing high?

how to tell if i should stay in the trade – as the uptrend will continue allowing us to ride the trend OR

how to tell if its going to be a strong resistance at the recent swing high – good idea to take profits near the swing high

There’s no way to tell for sure.

It depends on which matters more to you, ride a trend or just capture a swing.

You can also take partial profits and do both.

Hi Rayner, ITS amazing tO watch ur explanation. I have a question? how tO deal with super trend trading? For a week ITS kept went uptrend and in everyday it Alway shows Above 200 Ema? How tO enter This market? Wait for reversal or just wait for the nee breakout?

It depends on the type of trend you’re dealing with.

For a strong trend, you can buy the breakout or retest of 20ma.

For a healthy trend, you can buy on the pullback towards 50MA.

For weak trend, you can buy at Support areas.

Hi, Rayner

When i trade trend followings is it necessary to consider the fundamental events, or must i ignore them?

I ignore them and only pay attention to price.

Thank you Sir, your training is powerful and very effective

Hi Rayner,

do you ignore the fundamental events because you trade on a daily or higher time frame?

What if you were to trade intraday? Would you still ignore the fundamental events? Especially with a trend following approach.

Thank you for your reply!

If I’m a short-term trader I would pay attention to them as high impact news can widen spreads — and might stop me out.

Nice strategy…and profitable

Hi Rayner,

Just need some clarification here. I am trying to figure out which trading strategies best fit my personality.

Is this trading strategy among the three main different types you’ve mentioned before (i.e the other two being day trading and swing trading)?

If so, does this mean a day trader/ swing trader would not find this information useful?

Try this… https://www.tradingwithrayner.com/forex-trading-strategies-that-work/

Thanks!

Hey Rayner i’ve been following the trend trading stragey, the strategy is the best man

and you are the best man

Cheers

Thanks, you are God’s sent. More Grace.

Cheers

This is an answer to my confusion Thank you Rayner

Hey Vengai,

You are most welcome!

[…] if you’re a trend trader, these candlestick patterns present some of the best trading opportunities out […]

hee hee what’s up I am very happy to join dis website

first, of all, I get dis area more encouragement and more knowledge to trade as professional thank you Mr rayner teo

now I am satisfied trader and professional for your knowledge you giving me free thank you 100%

How to determine someone is Day Trader or Hourly trader? Is it based on the time we entry? Example :I use Daily chart to entry but I don’t sell it in 1 day(i only sell it if already hit the Resistance), which is we never know when it will happen == > what kind of trader i am? Tq so much

Thank you Sir,

I am trading since last 12 years but, no +ve results.

Loose and loss.. more than 10 lac rupees..

So many strategy’s are increasing my losses only..Now I will start your strategy from tomorrow..

Kindly help time to time..

…

Regards

Sanjay

[…] in a strong trending market, the market can be overbought/oversold for a sustained period of time (and if you’re trading […]

Hey – thanks for this great article. Quick question on examples. Looks like reward/risk is roughly equal ie 1R trades. So to be profitable over time, win rate needs to be over 50%. Can you expand on why these type of trades are attractive? Thanks

Hi . Thank you very much for helpful information.

You are most welcome, M!

Yes, i follow a trend trading strategy. It has given me 99% of all my profits in the forex market.

Awesome, Philip!

Please am new to forex. Trading l your mentorship sir

Hey there, Kingsley!

If you are a beginner in trading, you might wanna go through our Academy. It is a free course made especially for beginners. This will help you out big time!

Here is the link: https://www.tradingwithrayner.com/academy/

Cheers!

[…] So if you’re trading chart patterns, you’d want to be trading in the direction of the trend. […]

Thanks for sharing, George Thomas!

Hey rayner

What do you do when the market reaches a point where the 50 MA crosses the 20MA… do you have a way to enter or wait patiently for a setup to occur as displayed above?

Hey Malesia!

You can check this link about Moving Average cross-over secrets!

https://www.tradingwithrayner.com/course/moving-average-crossover-secrets-the-truth-nobody-tells-you/

Greeting Rayner , after my 6 months of learning what trade is all about , I have blow account over twice and I decided to take away the concept of me trying to win or make money from the market ,instead I basically focus on the study when I mean study like going back to old method of reading and making research

Finally at the end everything you explain so far , is what I have learn and experience through the course of my study

Thank you so much and I really appreciate you have make everything reliable and trustable to me with my learning without doubting what I have practice and learn so far

Hey there, Daniel!

Thank you for your nice words. Rayner is very glad to help!

Keep it up!

Cheers!