Before Starting the Trading Tips, Have you heard of Ed Seykota?

You should.

He was featured in the book Market Wizards and returned 250,000% over a 16-year period. Comparable to the likes of Warren Buffet and George Soros.

A little background:

Ed Seykota has an Electrical Engineering degree from MIT and is a systematic trend follower.

His trading is largely confined to the few minutes it takes to run his computer program, which generates signals for the next day.

If you want to get into the mind of one of the best traders around, this is your chance.

Here are the 39 best things said by Ed Seykota.

Trading Tips by Ed Seykota

Technical analysis

1. In order of importance to me are: (1) the long-term trend, (2) the current chart pattern, and (3) picking a good spot to buy or sell. Those are the three primary components of my trading. Way down in very distant fourth place are my fundamental ideas and, quite likely, on balance, they have cost me money.

2. If I were buying, my point would be above the market. I try to identify a point at which I expect the market momentum to be strong in the direction of the trade, so as to reduce my probable risk.

3. If I am bullish, I neither buy on a reaction nor wait for strength; I am already in. I turn bullish at the instant my buy stop is hit and stay bullish until my sell stop is hit. Being bullish and not being long is illogical.

4. I set protective stops at the same time I enter a trade. I normally move these stops in to lock in a profit as the trend continues. Sometimes, I take profits when a market gets wild. This usually doesn’t get me out any better than waiting for my stops to close in, but it does cut down on the volatility of the portfolio, which helps calm my nerves. Losing a position is aggravating, whereas losing your nerve is devastating.

5. Before I enter a trade, I set stops at a point at which the chart sours.

6. Getting back in is an essential part of trend following.

7. I don’t implement momentum, I notice it and align my trading with it.

8. The markets are the same now as they were five to ten years ago because they keep changing – just like they did then.

Risk management

9. Trading requires skill at reading the markets and at managing your own anxieties.

10. Risk is the uncertain possibility of loss. If you could quantify risk exactly, it would no longer be a risk.

11. Risk control has to do with your willingness to allow your stop to do its job.

12. Speculate with less than 10% of your liquid net worth. Risk less than 1% of your speculative account on a trade. This tends to keep the fluctuations in the trading account small, relative to net worth.

13. Reliance on Fundamentals indicates a lack of faith in trend following.

14. Risk no more than you can afford to lose, and also risk enough so that a win is meaningful.

15. I usually ignore advice from other traders, especially the ones who believe they are on to a “sure thing”. The old timers, who talk about “maybe there is a chance of so and so,” are often right and early.

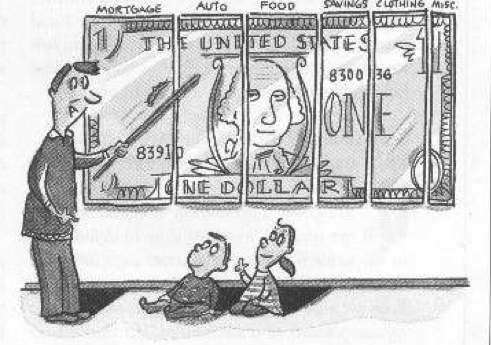

16. Pyramiding instructions appear on dollar bills. Add smaller and smaller amounts on the way up. Keep your eye open at the top

Longer term trading

17. Having a quote machine is like having a slot machine on your desk— you end up feeding it all day long. I get my price data after the close each day.

18. Intraday trading is tough since the moves are not as big as for long-term trading and there is no comparable reduction in transaction cost.

19. In general, short-term trading systems succumb to transaction costs and execution friction.

20. Trend systems do not intend to pick tops or bottoms. They ride sides.

21. The shorter the term, the smaller the move. So profit potential decreases with trading frequency. Meanwhile, transaction costs stay the same. To compensate for profit roll-off, short-term traders have to be very good guessers. To improve guessing skills, you can practice dealing cards from a standard deck, one at a time. When you become very good at it, you might be able to make money with short-term trading.

Money management

22. The key to long-term survival and prosperity has a lot to do with the money management techniques incorporated into the technical system. There are old traders and there are bold traders, but there are very few old, bold traders.

23. The manager has to decide how much risk to accept, which markets to play, and how aggressively to increase and decrease the trading base as a function of equity change. These decisions are quite important—often more important than trade timing.

24. The profitability of trading systems seems to move in cycles. Periods during which trend-following systems are highly successful will lead to their increased popularity. As the number of system users increases and the markets shift from trending to directionless price action, these systems become unprofitable, and undercapitalized and inexperienced traders will get shaken out. Longevity is the key to success.

Trading a system that suits you

25. Systems don’t need to be changed. The trick is for a trader to develop a system with which he is compatible.

26. I don’t think traders can follow rules for very long unless they reflect their own trading style. Eventually, a breaking point is reached and the trader has to quit or change or find a new set of rules he can follow. This seems to be part of the process of evolution and growth of a trader.

27. A trading system is an agreement you make between yourself and the markets.

28. Trading Systems don’t eliminate whipsaws. They just include them as part of the process.

29. A computer can follow a system and place orders without making predictions or anticipation. Predictions and anticipations are objects you create. These objects may interfere with sticking to your system.

Rules to follow

30. The trading rules I live by are (1) Cut losses. (2) Ride winners. (3) Keep bets small. (4) Follow the rules without question. (5) Know when to break the rules.

31. The elements of good trading are (1) cutting losses, (2) cutting losses, and (3) cutting losses. If you can follow these three rules, you may have a chance.

Embrace losses

32. If you can’t take a small loss, sooner or later you will take the mother of all losses.

33. I handle losing streaks by trimming down my activity. I just wait it out. Trying to trade during a losing streak is emotionally devastating. Trying to play “catch up” is lethal.

34. (On losing streaks and over-trading) Acting out this drama could be exciting. However, it also seems terribly expensive. One alternative is to keep bets small and then to systematically keep reducing risk during equity drawdowns. That way you have a gentle financial and emotional touchdown.

The mindset of a winner

35. A losing trader can do little to transform himself into a winning trader. A losing trader is not going to want to transform himself. That’s the kind of thing winning traders do.

36. The winning traders have usually been winning at whatever field they are in for years.

37. It is a happy circumstance that when nature gives us true burning desires, she also gives us the means to satisfy them. Those who want to win and lack skill can get someone with the skill to help them.

38 The “doing” part of trading is simple. You just pick up the phone and place orders. The “being” part is a bit more subtle. It’s like being an athlete. It’s commitment and mission. To the committed, a world of support appears. All manner of unforeseen assistance materializes to support and propel the committed to meet grand destiny.

39. In your recipe for success, don’t forget commitment – and a deep belief in the inevitability of your success.

Ed Seykota’s Whipsaw Song

Frequently asked questions

#1: Are trend following strategies less effective on lower timeframes as the markets are more volatile and prone to whipsaws?

I’ve not tested trend following on the lower timeframes. But I’ve tested trend following on shorter-term breakout trades and what I discovered was:

The shorter-term trend following breakout trades did not produce results that are as good as the longer-term trend-following breakout trades on a risk-to-reward basis.

#2: Which timeframes do you usually trade?

Usually between the 4-Hour to the Daily timeframe.

Conclusion

You’ve just learned 39 powerful trading rules from Ed Seykota, one of the greatest Trend Follower of our time.

Do you want to learn more?

Click on the link below to access the Top 100 Trading Rules of all time.

These trading rules are personally handpicked by me and include the biggest names in trading, like Jesse Livermore, Paul Tudor Jones, and Ed Seykota.

Number 33 is most on point for me at present. In the last few weeks I’ve been on a losing streak and over trading trying to catch up.

Taking a break has been the best thing for me.

Hey Haroun,

I know how it feels to be in a losing streak, wondering when we will see better days again.

At this time consider reducing your trading size till you are emotionally stable once again to trade optimally. Taking a break isn’t a bad idea as well.

I hope things will turn out better for you in the days ahead.

Rayner

I noticed gold spiked in 2007 then the market got real ugly in 2008. Now my gold related stocks are spikey. So I am guessing the next bear will be biting down on my stocks soon.

Thanks for sharing, Ani.

Hi Rayner,

What is your opinion of trend following on lower timeframe (i.e. 1 H) vs higher timeframe (4H & above)? Does applying the strategy on lower timeframe makes it less effective as market is usually more volatile and prone to whipsaw?

Hi John,

Trading on the lower time frame would incur higher transaction cost which could potentially reduce the returns.

The same principles can be applied on lower time frame but bearing in mind that the trends will not last as long and the higher transaction costs.

Hope that answers your question

Rayner

Hi Rayner, i do agree with Ed about finding the trading system that are suitable to oneself.

I have tried different timeframes (daily, 4 hours and one hour) , the outcome was equally similar, some trades got stopped out, some made money.

I wonder what time frame that you usually use to trade, is it daily or 4 hours or one hour or even 15 minutes or less?

Because your sharing is mostly about daily and i know the reason is because by sharing the shorter time frame, the viewers or readers may not be able to “catch the ride”.

Anyway, always enjoy your video and you have a nice weekend.

Hey Pa Ya Ker

I trade off the 1hour, 4hour and daily.

But not all those timeframes are for trend following.

cheers

Hi, would you consider a 1 day, weekly, monthly, yearly, chart a better option for trend trading? i think i can also yield higher returns.

There’s no best timeframe if you ask me. It’s a matter of your trading style and time commitment to trading.

Hi!

I have started intraday trading 1 year before and till date i am loosing. I believe that one day i will bounce back but time making me weak. I study daily something new online. But help is not visible.

What to do? please help.

Read this post… https://www.tradingwithrayner.com/profitable-trader/

Thank you Rayner.

I trade mainly the Daily as it suits my style at the moment.

I noticed Ed seykota was a long term trader.

I know I’m on the right path.

Yes, I believe he trades the longer term trend. cheers

Thankyou what can I do to help you.

I’m cool, thank you for the offer though!