Trading daily timeframe is not exciting to most traders.

It is slow.

It requires a ton of patience.

It has fewer trading opportunities.

Still…

Trading daily timeframe is the answer for most traders (with many “hidden” benefits) — especially if you have a full-time job.

Here’s why…

The truth about trading daily timeframe

You might not know this but, trading daily timeframe or having a daily chart trading strategy offers many benefits not found on the lower timeframe.

I’ll explain…

1. You’re more relaxed and make better trading decisions

Let me ask you:

Have you ever traded on the 5mins timeframe?

Then you’ll agree it can be stressful because a new candle is formed every 5 minutes.

You’ve got to make a decision to buy, sell, hold, or stay out in a short period of time.

This means you have less time to think which causes you to make wrong trading decisions (like chasing the markets).

On the other hand…

If you trade the daily timeframe or have a daily time frame forex trading strategy, a new candle is formed every 24 hours.

You have more time to think, plan and execute your trades — so you’re less prone to making the wrong trading decision.

The end result?

You make better decisions, your results improve — and trading becomes more relaxed.

2. News events don’t matter

Here’s the thing:

When you trade on the lower timeframe, news events (like FOMC, NFP, etc.) is a big thing.

You’ll notice the price goes “crazy” and flies up and down on your charts.

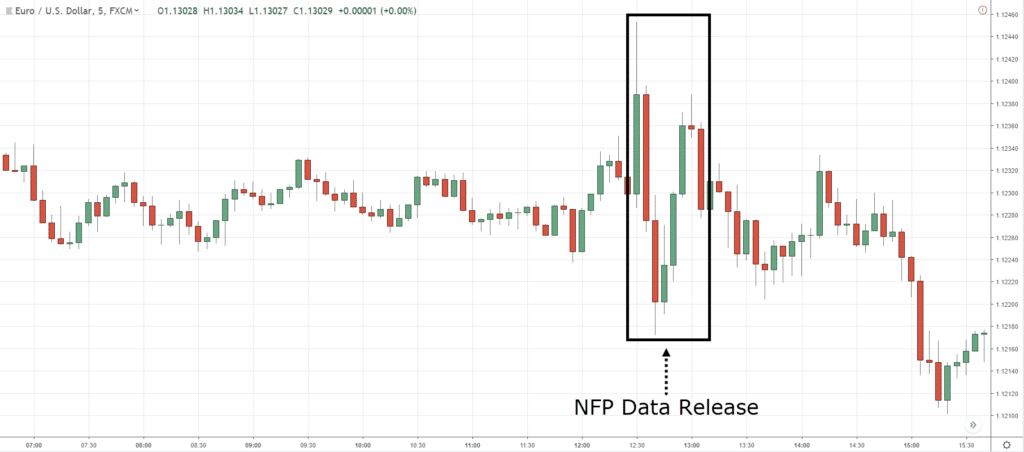

Here’s an example: NFP on EURUSD 5mins timeframe:

This means if you trade the lower timeframe you must be aware of the news or, you’ll get stopped out for nothing.

But…

If you trade the daily timeframe, then news event hardly matter.

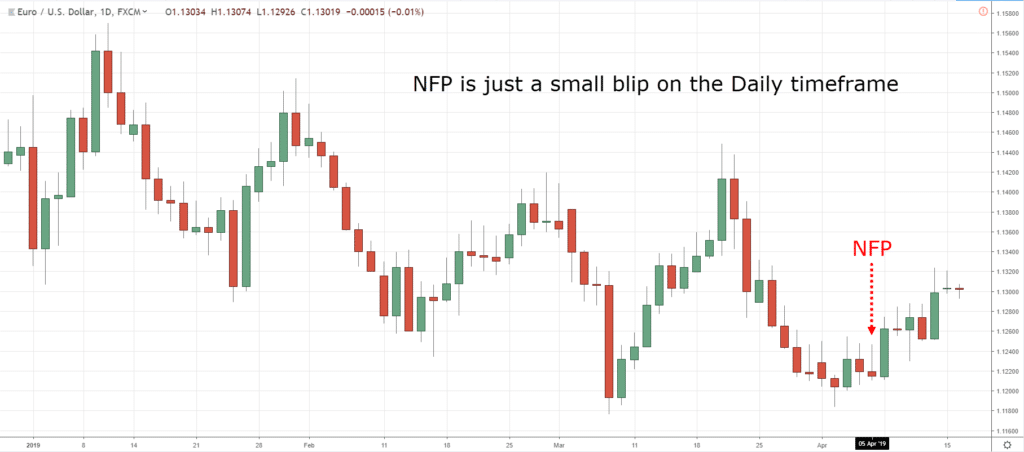

Here’s an example: NFP on EURUSD daily timeframe:

Notice there’s only a small blip on the chart?

You’re unlikely to get stopped out of your trades as your stop loss is wider (and can accommodate the “crazy” swings on the lower timeframe).

So the bottom line is this:

If you trade the higher timeframes with a daily chart trading strategy, the less impact news has on your trading.

3. You have freedom

Here’s the thing:

The daily timeframe only paints a candle once per day.

So there’s no need to constantly watch the markets because there’s “nothing” to do till the market closes (and a new candle is formed).

Imagine, how much more freedom you’ll have when you’re no longer a slave to the markets by having a daily time frame forex trading strategy?

4. You can compound your returns and grow massive wealth (even with a small trading account)

Now as a daily timeframe trader, you don’t need to spend all day watching the charts.

This means you can get a full-time job and combine with trading to grow massive wealth.

Let me prove it to you…

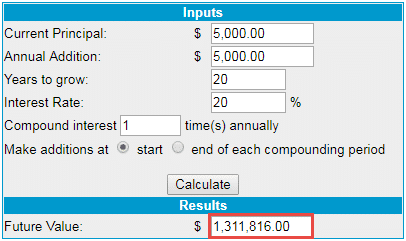

Let’s say you make an average of 20% a year with an initial sum of $5,000 and you contribute $5000 to your account each year.

Do you know how much it’ll be worth after 20 years?

After 20 years, it will be worth… $1,311,816.

BOOMZ!

5. You can focus on the process and become a consistently profitable trader, fast

I’ve seen many traders who go all in to trade full-time, and fail.

Now it doesn’t matter if their trading strategy works or not because the odds are against them.

Why?

Because they encounter the “need to make money” syndrome.

This is where you break your trading rules (like widening your stop loss) to avoid a loss, whether or not you have a daily time frame forex trading strategy or not.

The reason you do it is that you rely on your trading profits to pay the bills — and you’ll do whatever it takes to prevent a loss.

But if you’re trading the daily timeframe, then you can have a full-time job.

And now the odds are in your favour because you don’t have to rely on your trading profits.

Even if you have losing months, it’s not the end because your job will provide your living needs.

This means you can focus on learning how to trade and not worry about whether you can pay the bills.

Won’t this help you become a profitable trader in the fastest possible time?

6. You put the odds in your favour

Now…

One of the biggest reasons why traders fail is because they don’t pay attention to the transaction cost.

And that can be a difference between a winning and losing trader.

Let me explain…

Imagine…

- You have a $10,000 account

- Transaction cost is $10 per trade (buy and sell)

- You place 500 trades per year (from day trading)

If you do the math, you need a return of 50% just to break even!

But what about trading daily timeframe?

Again…

- You have a $10,000 account

- Transaction cost is $10 per trade

- You place 50 trades per year (longer-term trading)

Now, you just need 5% to breakeven when trading daily on forex trading time frames — a big difference.

Can you see how transaction cost is a killer?

So if you want to put the odds in your favour, trade smarter and trade lesser.

So, is trading daily timeframe for you?

Now I’ll be honest.

Trading daily timeframe is not for everyone because different traders have different goals.

So, if you fall into any of the categories below, then trading daily timeframe (or higher) isn’t for you.

Trading daily timeframe is NOT for you if…

- You want to generate a consistent income

- You want “fast action”

- You’re into proprietary trading

Here’s why…

Why trading daily timeframe don’t offer you a consistent income

When you the higher timeframe, you have a lower trading frequency.

This means you need time for your edge to play out (possibly over a few months).

So, if you’re looking for a consistent income from trading, this approach is not for you.

Why trading daily timeframe is not for “fast action” traders

Here’s the deal:

Every candle on the daily timeframe is painted once per day.

It’s a slow trading approach for traders who don’t want to be glued to the screen all day.

Why trading daily timeframe is a proprietary trader’s nightmare

The goal of a proprietary trader is to generate a consistent income from trading (by trading frequently).

But as you’ve learned, trading the daily timeframe doesn’t allow your edge to play out fast enough to generate a consistent income

Does it make sense?

Great!

So decide now whether trading daily timeframe is for you.

Because if it isn’t, then you can stop reading and find something else that suits you.

But if you know it’s for you, then read on…

A daily chart trading strategy

The 2 most common ways to trade the daily timeframe are…

- Swing trading

- Position trading

I’ll explain…

Swing trading

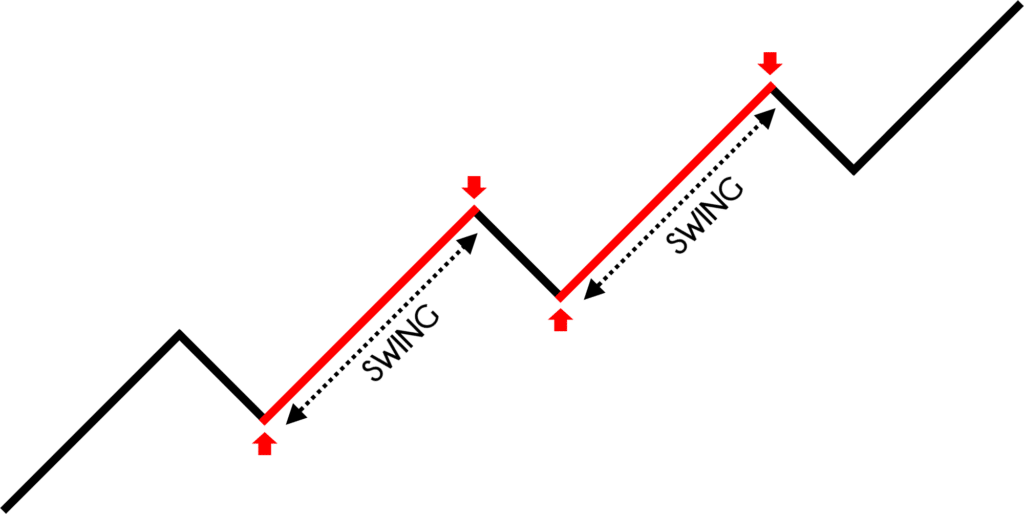

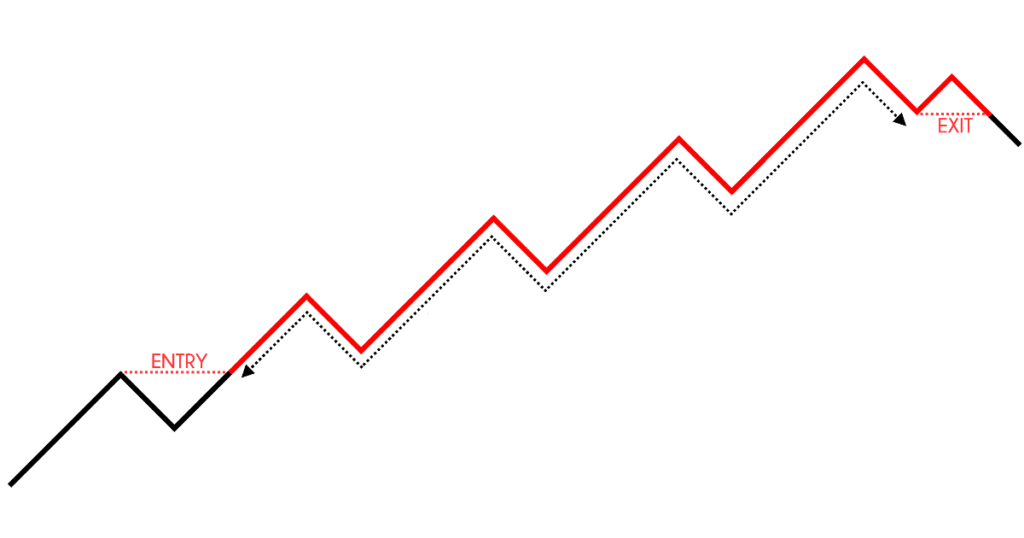

Swing trading is an approach which seeks to capture “one move” in the market.

The idea is to endure as “little pain” as possible by exiting your trades before the opposing pressure comes in.

This means you’ll book your profits before the market reverse and wipe out your gains.

Here’s what I mean…

Pros:

- You don’t need to spend hours in front of your monitor because your trades last for days or even weeks

- It’s suitable for those with a full-time job

- Less stress compared to day trading

Cons:

- You won’t be able to ride trends

- You have overnight risk

If you want to learn more, then go read…

The NO BS Guide to Swing Trading

Swing trading strategies that work

Next…

Position trading

Position trading is an approach that seeks to ride trends in the market when trading daily time frame.

The idea is to capture “the meat” of the move and exit your trades only when the trend shows signs of reversal.

Here’s what I mean…

Pros:

- It requires less than 30 minutes a day

- It’s suitable for those with a full-time job

- Less stress compared to swing and day trading

Cons:

- You’ll watch your winning trades turn into losing trades, often

- Your winning rate is low (around 30 – 40%)

If you want to learn more, then go read…

The NO BS guide to Position trading

5 Powerful Ways to Trail Your Stop Loss

Now, once you’ve developed your trading strategy by trading daily time frame, the next step is to develop a routine to ensure your trading success.

Continue reading…

The secret to daily timeframe trading success

(This is important so don’t skip this section.)

Now…

A trading strategy is only one part of the equation.

Because you still need a trading routine or you won’t find trading success. If you ask me, this is the secret between winning and losing traders.

You’re probably wondering:

“So, how do I develop a trading routine?”

Well, there are 3 parts to it…

- Create and update your watch list

- Commit to your schedule (execute and record)

- Review your results

Let me explain…

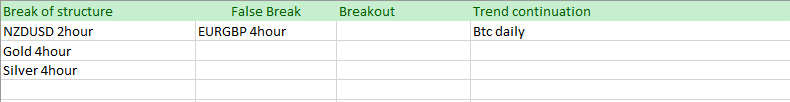

1. You create and update your watch list of markets

(This can be done on the weekends when the markets are closed.)

After you’ve developed a trading strategy, create a watch list of markets to trade (whether it’s Forex, Stocks, Futures, etc.).

Next, scan through your watch list and identify the markets which offer a potential trading setup (this should be according to your trading strategy).

You want to “mark” these markets so you can focus on them in the coming week.

You can do it on excel like this…

Or if you’re using TradingView, you can highlight it like this…

Next…

2. You commit to your trading schedule

Since you’re trading the daily timeframe with a daily time frame forex trading strategy, then it makes sense to make your trading decision after the close of the daily candle.

This could be morning, afternoon, or night (depending on where you are) — so create a schedule where you can commit to it no matter what.

For example:

If you’re in Asia, then the daily close would be in the morning for you.

So, every morning you’ll check the markets from your watch list and see if there’s a potential trading setup.

If there is, then you move onto the next step…

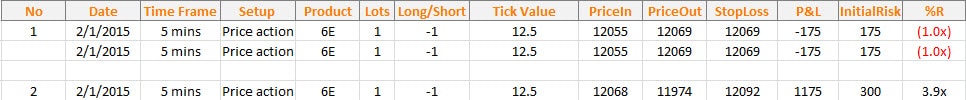

3. You execute and record your trades

Now if there’s a valid trading setup, you execute the trade with proper risk management.

Then, you’ll record the metrics like…

Date – Date you entered your trade

Time Frame – Time frame you entered on

Setup – Trading setup that triggers your entry

Market – Markets you’re trading

Price in – Price you entered

Price out – Price you exited

Stop loss – Price where you’ll exit when you’re wrong

Initial risk in $ – Nominal amount you’re risking

R multiple – Your P&L on the trade in terms of R. If you made two times your risk, you made 2R.

An example below:

For the full breakdown, check out this post below…

How to be a consistently profitable trader within the next 180 days

4. You review your trades and find your edge

Once you’ve executed 100 trades consistently, you’ll know whether your trading strategy has an edge in the markets.

Here’s how…

Expectancy = (Winning % * Average win) – (Losing % * Average loss) – (Commission + Slippage)

If you have a positive expectancy, congratulations!

It’s likely your trading strategy has an edge in the markets.

But what if it’s negative?

Then you apply my AFTER technique…

- Identify the patterns that lead to your losses — and avoid trading these setups

- Identify the patterns that lead to your winners — and focus on these setups

- Tweak your trading plan according to your findings

- Execute the next 100 trades with your updated trading plan and record the trades

- Review your trades

If you do what I just shared, you’ll improve your trading results and eventually, find your edge in the markets.

Now…

Whether you’re a winning or losing trader, the AFTER technique can be applied to you.

If you’re a winning trader, then it’ll take your trading to the next level.

If you’re a losing trader, then you have a method to get yourself into the green.

Conclusion

So, here’s what you’ve learned:

- The benefits of trading daily timeframe — you’re more relaxed, the news doesn’t matter, you have freedom, you can grow massive wealth, and you put the odds in your favour

- Trading daily timeframe is not for you if you want a consistent income or you want a career in proprietary trading

- You can adopt a swing trading or position trading strategy on the daily timeframe

- Your trading routine consists of creating your watch list, committing to your trading schedule, executing your trades, and reviewing your trades

And there you have it!

The truth about trading daily timeframe that nobody tells you.

Now here’s what I’d like to know…

Do you trade on the daily timeframe? Why or why not?

Leave a comment below and share your thoughts with me.

Hi Rayner,

This was very insightful and truly appreciate your efforts in educating retail traders. However, in position/swing trading, I’m quite skeptical about morning gaps which could ultimately drive the price beyond my intended stop loss. Would be grateful if you could help me in fixing this issue (at least to some extent if not fully).

You can avoid trading during earnings news release or have wider stops to take into consideration of gaps against you.

Very good article. If you wanted your trades to last 1-2 wks what time frames would you trade off? Thanks.

Your timeframe should be daily to monthly.

I’d say 4-hour and daily are suitable.

Hey Rayner

Thanks for this beautiful article.

Wish to add some points here:

Trade Journal:- last 2 months I have been religiously maintaining journal to analyze performance. I realized that my hit ratio as well as performance is way better on Daily over intraday or small timeframes. Usually i try to book out at 3:1. I mostly trade Indian market.

Nice work!

Wow Such A Nice Article Very Simple To Understand

Cheers

Really appreciate your effort, Rayner.This article speaks to me directly … I will put every thing to practice

Awesome, let me know how it works out for you.

Rayner- very good article. I just received your book too!! Super excited. So let’s say I have a full time job, but I also do have the ability to check the chart maybe 5-10 times through my work day. What time frame would be best. Hour or day still? Thanks

Hey Luke,

Daily/4H would be just fine.

Cheers.

Great read Rayner, I don’t trade the daily, but the 4 hr. with entry on the 1 hr. I fine it works best for me. Earlier I traded the lower time frames trades 89 & 133 tick charts , 1 & 5 minutes charts it’s just to much. I just decide to go with a higher time frame and have the peace of mind. Fewer trades, but I feel more in control so far the results are better

Thank You

Thank you for sharing, William.

cheers

very on point. however, I trade full time CFDs but only from the daily chart (weekly used for sup / res areas) – & for forex only futures again using daily chart.

Swing trader with some position trades – allow a swing trade to run…

but I trade agrressively…

Only take a trade that looks high probability and take a very large position.

If trade does not go in my favour within an hour or so after entry I exit trade (do not wait) for stop loss.

I make a reasonable income because I concentrate on my plan and the details of that plan – do not think about profits / money until month end when I do a detailed report to myself (yes, i know it sound odd..)

but I enjoy your ‘lessons’ and always get some new perspective..

As a not the greatest thing that helped me was reviewing my trades.. I followed all the other rules but did not really review.

The first detailed review I ever did was after a 5 month period of trading and it was an eye-opener.

Awesome stuff, Brian.

Yes, it’s a real eye-opener but most traders don’t do it.

Hi Rayner,

How would you differentiate between pullback and reversal?

Hi Shahul,

Check out these post…

https://www.tradingwithrayner.com/pullback-trading/

https://www.tradingwithrayner.com/how-to-identify-trend-reversal/

Thank you very much for this information.it is very impartful.

Thank you sir

Cheers

Hey Rayner, how long do you think may take for someone who trade daily timeframe to hit 100 trades, if s/he want to have enough sample size to review an edge in the market?

it depends on the number of markets you’re trading.

If you trade a lot of markets, it can take you a few months.

If you trade a few markets, it’ll take longer.

Thanks Rayner for sharing this useful article, God bless you and give you much years to live and give you more power to produce more helpful articles.

I appreciate it, Rajabu!

Hy Rayner, am just new in trading. i just funded my account with 100 USD thats the little i managed. tell me what some advice can i do to be a profitable trader by monthly. am from Malawi but currently i stay in Southafrica

very good article Rayner. I trade the daily charts for two years now and I can say it helps me a lot. especially with news events, I rarely worry about them. I have noticed that my stops are usually over 100 pips on most markets but I can accommodate that with good risk management.

Thank you, sir.

You’re welcome, Roy!

Hi Rayner

Thank you very much for your ever insightful guides.

What is Trade View? Is it a special software and if so, how do i access it?

Malebo

Tradingview.com

Thank you very much Rayner. This information was very usefull for me. Could you share some tips, how to create and update watch list of stocks or markets?

Hi Rayner,

I am the follower of your you tube channel and now reading the articles in your website to improve my Forex trading knowledge. My self was working in a Company, so I can’t do the trading full time but can watch the market frequently and at the same time I can’t hold the positions for long time. So If I want to open and close the position in a day, what is the time frame is best suited for me. i.e. Which Time frame I need to use for analysis and trade. Because I try to use the MA as you suggested, but when the Time frame is changed the results are confusing. So please need your advice.

Actually I was doing trading in my live account and lost the money, so now spending my time to understand my mistakes. Till that time I am planning to invest the money for Copy trading so that I can earn decent margins, Is there any possibility please advice.

Hi Raynor- Great stuff (like usual)! I watch all of your youtube videos… so I feel like you are one of my best friends. LOL. I use a hybrid strategy- trend follower leaning a little toward swing trading. The only technique I use that is missing from your article is something that has helped me IMMENSELY in my trend trading. Two words… Heiken Ashi!!! If your readers are having trouble finding or exiting trends tell them to try looking at the charts with some Heiken Ashi glasses on. It has helped me to find a really strong trend easier and stay in the trade a little longer. My win rate since switching to Heiken Ashi has had a dramatic improvement. First I look at a chart using Heiken Ashi candles, then if it meets my visual scan, I will switch to regular candles for a secondary confirmation. Again- Thanks for all the great info. BRAVO!

Hi Rayner- Sorry for the typo in spelling your name in my post above. I know its Rayner… I should have proofread before hitting submit.

No worries about it!

Thank you for sharing, Ivan.

Glad to hear that!

Hi Ivan,

On which timeframe do you use the Heikin Ashi ?

Can you give a little more information ?

Many thanks !!!

Hi Rayner

You’ve not mentioned the daily swap, this can really mount up over time if you’re holding positions for a few days or weeks! I would suggest trading in positive swap directions or at least pairs with fairly low negative direction.

Negative swap can come as a huge surprise for some not used to trading the daily, especially on Wednesdays when it’s triple!!

Thank you for sharing, Tony.

Trading on the daily timeframe has turned my trading around. If your a beginner in the markets I really can’t stress enough to start with swing trading and then work your way down to a day trader (if that’s what you want to be). I have time to analyse my watch list, I have time to find where my area of value is and get an entry there, I have time to figure a stop loss and target profit….I HAVE TIME!!!! When I have an open trade playing out and nothing to do I study more videos, I look at charts in the past and back-test, I read books about risk/reward, case study’s etc. I also have time to walk my dog, work out, family etc etc. I just wish I started with swing trading, wasted money trying to be a day trader and hitting supernovas etc. Love your work Rayner, please keep

It going

Thank you for sharing, Samuel! I will!

Hi legend Rayner i hope you are healthy and happy .

Right now we are seeing the market are moving up and down and i think in these days profitional traders can’t also figure what is going in markets.

Most of the time down trend and up trend.

So my question is what i think is to set up an order above the support with a stoploss of one percent entery under it and also an order under resistant with stop loss of one percent above the resistance.

And you do this to 10 markets

the market which hits my order

and go little bit further from my order i update then my stop loss to where am satisfied with the profit i want.

So Rayner pls I need you to answer me and let me know if this strategy is a goed idea or not.

Your sincerely

Albaraa.

Doing very well on my demo account thanks to your insight. Made more money trading on the Daily and 4Hr than any other. I be lucky if i can start a live account with $500.00. What advice have you to make an small account work I do know i am not going to get rich to contribute $5000.00 per year not possible for me.

Sir golden principle Awesome

Hi Parasuraman,

Thank you!

Very insightful article. Thank You Rayner.

Hi Akash,

You are most welcome!

Cheers.

Can’t thank you enough for taking all the time to analyse and disclose a very vital aspect of trading that matters in the act of forex trading. Thanks indeed.

You are welcome, Mike!

I read this from the beginning to the end… Omg.. I really gained alot from this…. You’re a pro and a life savior ❤️

Thank you, Emmanuel!

Thank you. This helps a lot. Now I know using daily time frame best suits me. You’re really a blessing. . Thanks a lot Rayner.

You are most welcome, Bonnin!

Thank you very much for this timely .. priceless advice. My mentor is Ed Seykota.. I think this is his way to trade. Am new to trading .. never done it before and was searching n reading about it to get in.. now this will be a great help. Thank you

Awesome, Andre!

This has encourage me to put more effort in my trading

I’m glad to hear that, Kelly!

Hi Rayner! Let me start by saying thank yu for your good works.

My question goes like this, usually I trade a daily time frame with a ratio of 1(100pip):2( 200pip) and when i enter my trade, most times it will be going towards my favor later on the market just make a reverse and I exit my trade for about 20pip profit will I still call it a win, In respect to the formula below if yes how can I calculate my profit?

-1%, -1%, -1%, 2%, 2%, 2%

hey rayner do i need to worry about price gap in the 4h timeframe

Awesome all clear an simple to think about it

Cons – you wont be able to trade trends?

I am not sure which charts you look at, the largest trends are on the daily time frame, so I am not sure where this comes into it. I see trends on daily time frames about 4-9 times per month that last a week to a few weeks, not sure why you say they are not suitable for trends. The momentum is with the higher term time frames.

Thank you very much, awesome content…I trade 30M and 4H timeframe, but I think it’s time to backtest Daily timeframe as a way to build wealth, and you have explained it to me perfectly, thank you very much again…

Keep up the good work

It’s our pleasure, Macedo!

Cheers!

I am trading off weekly and monthly charts. If I wait for 100 trades, it will take decades. Is there any other way around this?

Dear Rayner,

I have a full time job and can check the chart 2-3 times a day only. I want to go for position trading, Which timeframes you suggest to me for higher time frame and entry time frame?

Hi Mr Rayner, I appreciate your good works here, i must comfess I have learned a lot from your teaching, but there is something I want to know, do you need to be consistent on the number of trade you take per day as a a trader

Hi, Christopher!

Jarin here from TradingwithRayner Support Team!

You don’t need to trade every day. Sometimes, it is best not to trade if there’s no really a trading setup for a day. We always need to protect our capital to survive on the trading journey.

I hope that helps!

that’s very interesting explanation

thanks

You are most welcome, Gnemdodiya!