Richard Dennis’ a trader. He was a Systematic Trend Follower who trades the Futures market (during the 70s and 80s)

Richard Dennis’ books include Market Wizards, which he famously talked about how he took a $1600 trading account and turned it into $350 million.

He is also the founder of the Turtle Traders (came from a bet he made with his partner to determine if trading can be taught, or not).

And yes, he won the bet and Richard Dennis’ Turtle Traders proved that trading can be taught.

However, not all stories have a happy ending.

According to sources, Richard Dennis’s hedge fund suffered huge drawdown (in excess of 50%) due to aggressive risk management, and he eventually shut it down.

However, there are valuable lessons you can learn from Richard Dennis’ trading strategy and advices — which are still applicable today.

And I want to share them with you right now…

1. Whatever method you use to enter trades, the most critical thing is that if there is a major trend, your approach should assure that you get in that trend.

If you think about it…

Breakouts are the only entries that will ensure you’ll catch every single trend — every single time.

And that’s why most Systematic Trend Followers trade breakouts as their entry method, including Richard Dennis’ turtle traders.

You might be wondering:

“But what about pullbacks?”

I know pullbacks are psychologically easier to execute because you’re buying low and selling higher.

But it comes with a price — and that’s missing the entire trend because the market didn’t offer a pullback.

So if you want to be involved in every trend that comes along, then you must trade breakouts.

2. A good trend following system will keep you in the market until there is evidence that the trend has changed.

Here’s a fact:

There’s no way to predict how high the market will go.

So, the next best thing you can do is trail your stop loss as the market moves in your favor.

However, you don’t want to have a tight trailing stop loss as you’ll get stopped out on the retracement.

Instead…

Widen your trailing stop loss to accommodate the deep retracement that might occur — and you have the best chance of riding a trend.

And chances are if you get stopped out, it’s because the trend has reversed.

Pro Tip:

You can use indicators like Moving Average or the Average True Range to trail your stop loss.

3. When you have a position, you put it on for a reason, and you’ve got to keep it until the reason no longer exists.

This is the opposite of what most traders do — and it HURTS them big time.

Here’s why…

Most of you tell me you want to ride big trends.

And it’s no secret that the KEY to riding massive trends is to trail your stop loss (I covered that earlier).

However…

You have difficulty holding on to your gains because…

You see profits.

You see green.

You see money.

BUT…

You have the FEAR of losing those gains.

So, you exit your trade even though the market hasn’t hit your exit signal.

The end result?

Big losses and small winners.

So here’s the lesson:

If you want to be a consistently profitable trader, you must follow your rules and exit your trades ONLY when the reason no longer exists.

4. You should expect the unexpected in this business; expect the extreme. Don’t think in terms of boundaries that limit what the market might do.

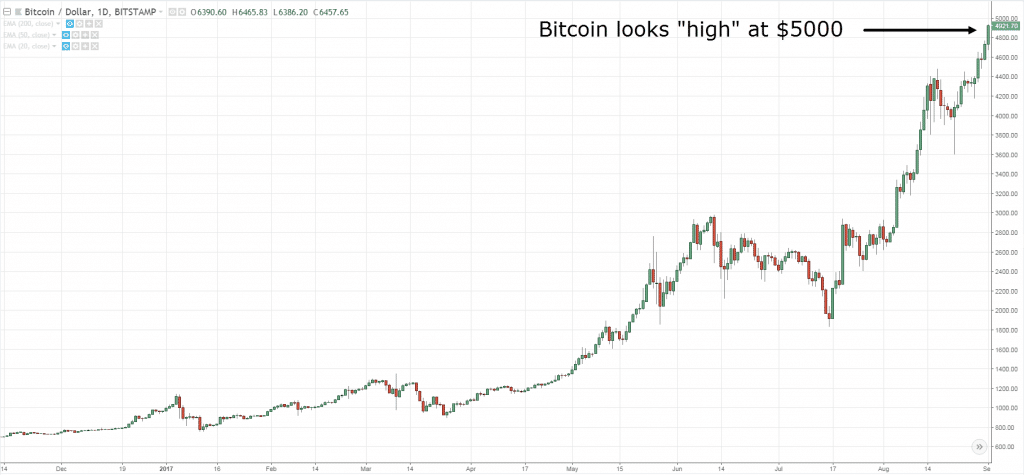

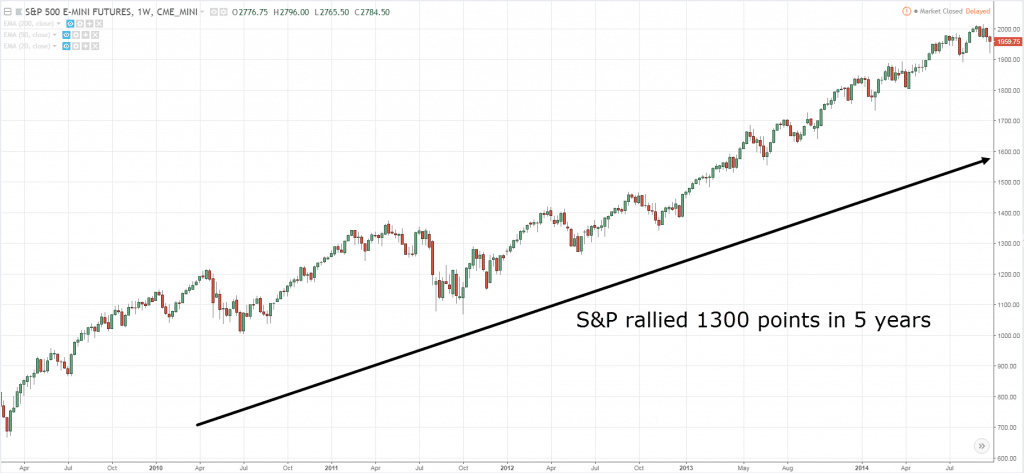

Look at the chart below:

You’re probably thinking:

“Insane! The price is so high. I’m sure the market is about to reverse lower.”

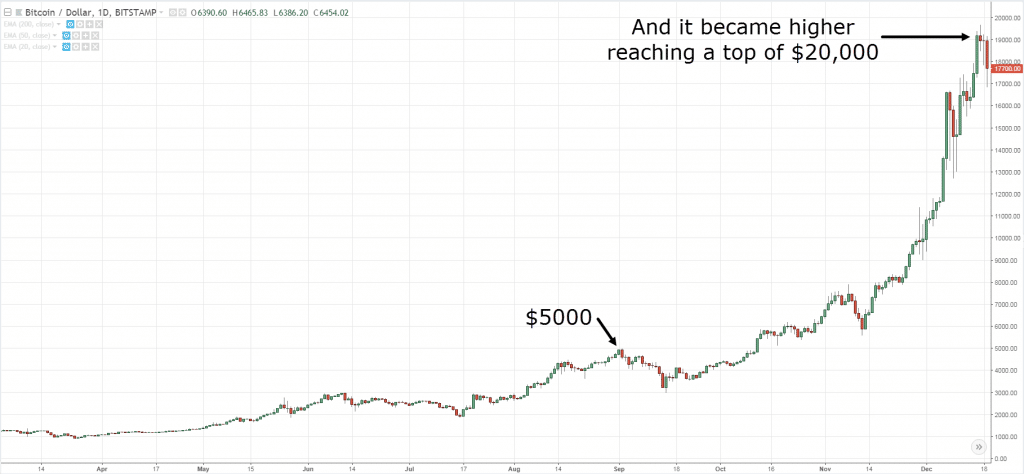

And here’s what happens next…

BOOM!

The market exploded even higher.

I know it’s hard to believe the market can just continue to make new highs especially when it looks “overbought”.

So the lesson is this:

You can never tell if the market is too high to buy or too low to short.

Because what’s high can go higher and what’s lower can go lower.

Now if you want to discover my secret technique of buying high and selling higher, then check out this video:

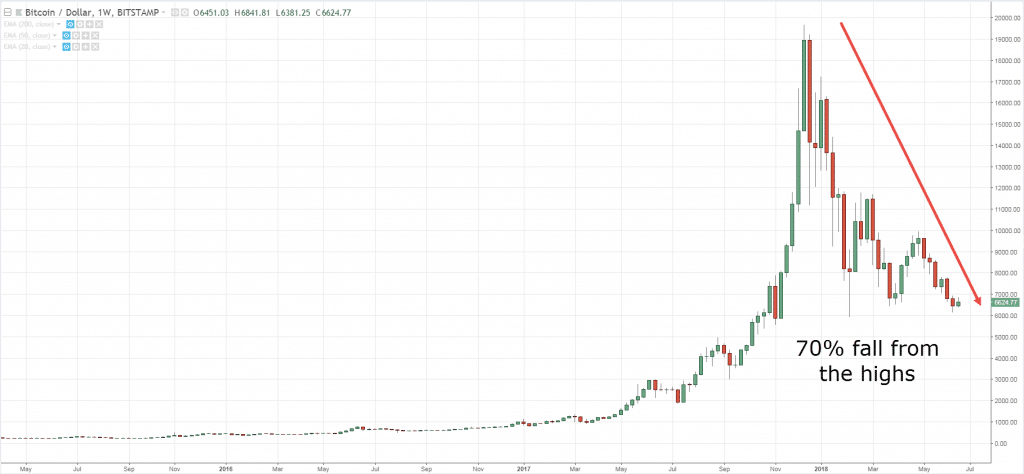

5. If there is any lesson I have learned in the nearly twenty years that I’ve been in this business, it is that the unexpected and the impossible happen every now and then.

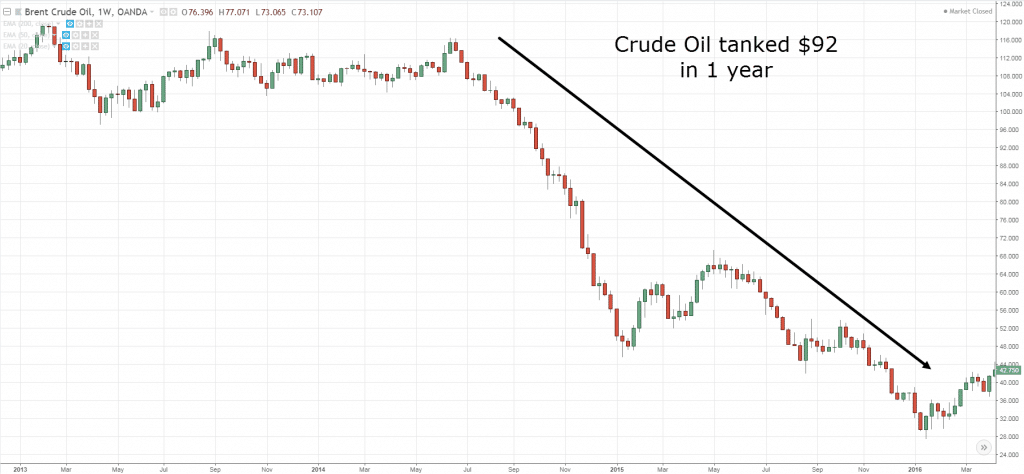

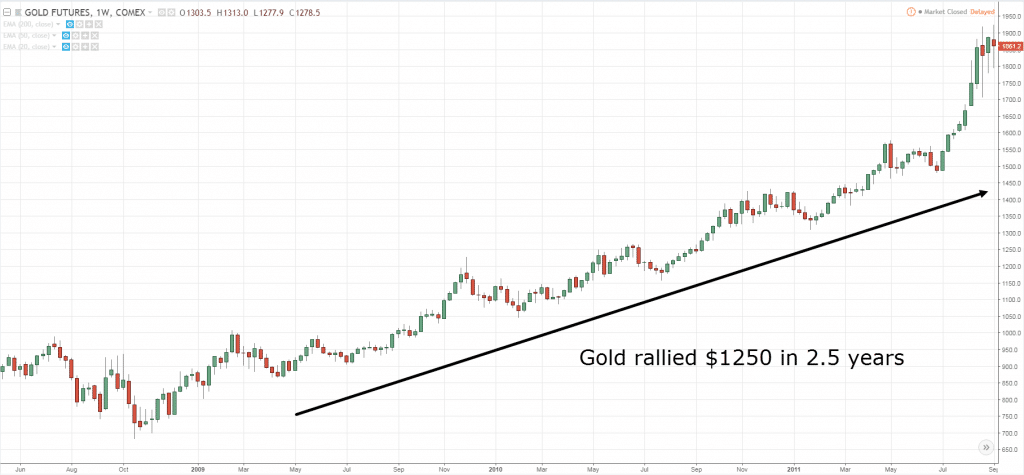

If you saw the earlier Bitcoin example, you might think that such “extreme” moves rarely occurs.

Wrong!

Here are more examples…

Now don’t get me wrong.

You shouldn’t expect these moves every week or month.

But chances are, you can find these trends once every few years (and they can last for YEARS).

The bottom line is this…

If you have the discipline to ride your winners, it’ll be a matter of time before you catch one of these “monsters”.

6. Trading decisions should be made as unemotionally as possible.

If you trade based on emotions:

You’ll buy at the highs when things are moving “fast”, hold onto your losses hoping they will rebound, trade larger hoping to make back what you’ve lost, and etc.

Clearly, you know that trading based on emotions is a recipe for disaster,

Instead, you’ve got to think, act, and trade like a machine!

Now the question is, how?

Here are a few tips to get you started…

- Develop a trading plan with clearly defined buy & sell rules

- Risk not more than 1% of your capital on each trade

- Focus on executing your trading plan consistently (this is so important)

- Don’t get swayed but the short-term results, think long-term

If you want to learn more, then go check out this trading guide: How to be a Consistently Profitable Trader within the Next 180 days.

7. Trade small because that’s when you are as bad as you are ever going to be. Learn from your mistakes.

Let me ask you…

If you want to be a brain surgeon, will you immediately operate on a live human brain?

Of course not!

You’ll probably start off practicing on a “dummy” brain.

As you get better, you’ll work on a live human but only on a minor segment of it (so it doesn’t cause danger to the person).

Then as you level up, you’ll work on the major parts and finally, you have the confidence to do it on your own.

And it’s the same for trading!

You want to trade small because you’ll make mistakes — plenty of it.

So, why pay more in “tuition fees” to Mr. Market when you can do so at a fraction of the cost?

8. I could trade without knowing the name of the market.

You’re probably wondering:

“How is that possible?”

Well, that’s because you’re trading the price in front of you without concerning where the price is derived from.

It could be Soybean, Crude Oil, Copper, Rubber, or Cotton, who cares.

The only thing that matter is price, and nothing else.

Because the price is moved by an imbalance of buying & selling pressure which is based on emotions like fear, greed, hope, and regret.

These emotions or biases can last for a long time which in turn becomes a trend — something Trend Followers can capitalize on.

And that’s why you don’t need to know the name of the market.

All you need to know is…

- Buy what’s going up

- Sell what’s going down

- Repeat

9. In the real world, it is not too wise to have your stop where everyone else has their stop.

Let me ask you…

Do you always get stopped out only to watch the market reverse back in your intended direction?

Because you put your stop loss where everyone else puts it (like below Support) — which creates an incentive for the “smart money” to hunt your stop loss.

So, how can you avoid it?

By setting your stop loss AWAY from the obvious market structure.

This means don’t place your stop loss smack under Support, or just above Resistance.

I cover in more details here: How to Avoid Stop Hunting While Other Traders Get Stopped Out

10. You could publish trading rules in the newspaper and no one would follow them. The key is consistency and discipline.

This is true for 99% of traders out there.

Most would not have the conviction to take someone’s trading rules and trade it consistently even though its profitable in the long-run.

Why?

Because when the drawdown comes (which all systems will have), they will abandon it and look for the next trading system — and rinse repeat this cycle again.

So, the question is…

How can you gain confidence in your trading strategy or even someone’s trading system?

There are 2 ways you can go about it…

1. Backtest the trading strategy

This allows you to understand how a trading strategy performs historically.

If it’s proven to work in the past, there’s a possibility it could continue to work in the future (although no guarantee since it could be curve fitted).

2. Understand the logic behind WHY a trading strategy works

Most trading strategy that works have an underlying logic behind it.

For example:

Trend Following works because human biases and emotions cause the market to trend.

So, if a trader can cut his losses and ride his winners, he can capitalize on the long-term trend that comes about.

Or how about Value Investing?

It works because investors dump stock during “bad news” and that pushes the price of the underlying security below its intrinsic value.

This allows savvy investors to buy low (below the intrinsic value), and sell high (when the price increase back towards the intrinsic value).

11. There are lots more false breakouts, perhaps because there are more computer-based trend followers.

Here’s the deal:

Not all breakouts will work out.

In fact, half or more of your breakout trades are likely to fail.

However, it doesn’t mean trading breakouts is a losing strategy, far from it.

Remember, it’s not how often you win that’s important.

It’s how much you win when you’re right and how much you lose when you’re wrong — that’s what matters.

Also…

If you want to increase your odds of capturing a trend, you must trade across different markets.

This includes Forex, Indices, Energy, Metals, Agriculture, and etc.

If you want to learn more, then go read The Ultimate Guide to Trend Following.

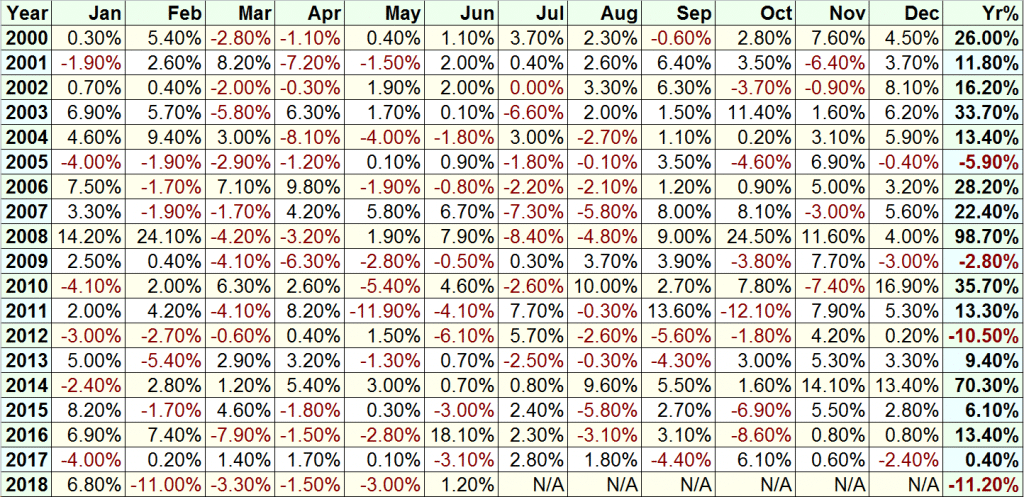

12. It is misleading to focus on short-term results.

I’ll tell you this:

Your short-term results are random.

Because when you’re dealing with probabilities, anything is possible in the short run.

It’s only in the long run (after a large sample size of trades) that your results will align towards its expectancy.

Don’t believe me?

Then let me prove this to you…

Look at the performance of this trading system over the last 5 months…

Now, most of you would say this performance is crap and you’ll likely abandon this system after few losing months.

Now, look at this trading system below…

This looks like a much better system, right?

But guess what?

This is the same EXACT system as the one above.

The only difference is I’ve shared with you the results over the last 18 years instead of the 5 last months.

Do you see my point now?

In the short run your trading results are random but eventually, it’ll align towards it’s expected value.

13. You have to minimize your losses and try to preserve capital for those very few instances where you can make a lot in a very short period of time. What you can’t afford to do is throw away your capital on suboptimal trades.

Here’s the deal:

No matter which trading strategy you’re using, there will come a time where trading is so easy and it feels like you’re “printing” money.

But don’t be too happy just yet because…

There are also times where it sucks so bad you feel there’s no light at the end of the tunnel — and you just want to quit trading altogether.

So…

The “trick” is to minimize the damage during the bad times so you can survive and THRIVE during the good times.

This means:

- Have proper risk management in every trade

- No revenge trading even if you’re angry with the markets

- No over trading hoping you can make your losses back quickly

- Follow your trading system no matter how hard it is to pull the trigger

If you can do it, then you’ll likely overcome your drawdown and reach new equity high again.

14. I learned that a certain amount of loss will affect your judgment, so you have to put some time between that loss and the next trade.

There are 2 ways to look at this…

If you’re a discretionary trader, then yes, it makes sense to put some time between your loss and the next trade (especially if you have sustained a series of losses).

Because as a discretionary trader, your trading decisions are based on your analysis of the markets.

If you are carrying emotional baggage, you won’t objectively analyze the markets which lead to sub-optimal trading decisions.

However, if you’re a systems trader, then things are different.

Because the more losses you face, the closer you’ll be towards your next winning trade.

So, if you have a proven system that works, the last thing you’d want to do is to skip your trades because you have the fear of losing.

Instead, you must trade your system consistently so you don’t “mess up” the results of it.

15. Trading has taught me not to take the conventional wisdom for granted. What money I made in trading is a testimony to the fact that the majority is wrong a lot of the time.

The reason why most traders fail is that they want to be spoon-fed.

They don’t want to put in the hard work to find out what works and what don’t.

They trust what “gurus” say instead of spending time and effort to figure things out themselves.

Now, is it no wonder that most traders never make it?

So here’s the deal:

If you want to succeed in this business, you must TEST everything.

Trust nothing but question EVERYTHING.

If you’re unsure, backtest it, forward test it, and use your brain to think about it!

16. Almost anybody can make up a list of rules that are 80 percent as good as what we taught people.

You’re probably thinking:

“What? I could never come up with a profitable trading strategy.”

Here’s the deal…

Trend Following isn’t a difficult concept.

It’s basically…

- Trade a broad basket of markets

- Ride your winners

- Cut your losses

And that’s it!

How difficult can it be to come up with a set of trading rules based on the above criteria?

Still, I’m going to spoon-feed you further.

Go read the book Following the Trend by Andreas Clenow.

This book provides you with the exact strategy and markets to trade — so there’s no excuse anymore.

But please do your own backtesting first before trading it live.

Now…

The difficult part isn’t formulating the strategy but the execution of it — especially when the drawdown comes.

Will you be able to execute your trades consistently when you’re down 10%, 20%, or even 40% of your trading capital?

17. I’ve learned that markets, which are often just mad crowds, are often irrational; when emotionally overwrought, they’re almost always wrong.

After many years of trading, the one thing I’ve learned is to NOT trade with the crowd.

For example:

Back in 2017, Bitcoin was making new highs with a lot of attention from the media and the public.

To an astute trader, it’s a warning sign that the “party” is about to end.

Now, I don’t expect you to short Bitcoin because the market could continue to trend higher.

However, if you’re long, then you should tighten your stop loss and be prepared to BAIL OUT the moment the market show signs of reversal.

Because when the whole world has already bought, who’s left to buy?

Nobody.

And if there’s no one left to buy, the path of least resistance is DOWN.

Here’s a quote by Warren Buffet that says it best…

“Be greedy when others are fearful and fearful when others are greedy.”

Frequently asked questions

#1: How can a small trader like me with limited capital trade a diverse range of markets simultaneously?

You’ll probably want to trade with a broker who allows you to trade nano lots (as they are probably going to be market makers too).

#2: Hey Rayner, where are the results on point 12 from?

This is a systematic trend following system that I’ve developed.

Conclusion

The wisdom shared by Richard Dennis is still as applicable as they were decades ago.

Now, some of you might argue that Richard Dennis strategy doesn’t work anymore.

Well, the exact parameters used in Richard Dennis’ trading strategy might not work anymore.

But the principles of Trend Following still works and is currently used by some of the biggest hedge funds in the world (like Winton Capital).

So, don’t get caught up by the specific tactics but look at the big picture and understand the concepts behind it.

Now it’s over to you…

What’s the biggest takeaway you had from Richard Dennis quotes?

Leave a comment below and share your thoughts with me.

5. If there is any lesson I have learned in the nearly twenty years that I’ve been in this business, it is that the unexpected and the impossible happen every now and then.

If you saw the earlier Bitcoin example, you might think that such “extreme” moves rarely occurs.

Wrong!

Here are more examples…

Now don’t get me wrong.

You shouldn’t expect these moves every week or month.

But chances are, you can find these trends once every few years (and they can last for YEARS).

The bottom line is this…

If you have the discipline to ride your winners, it’ll be a matter of time before you catch one of these “monsters”.

6. Trading decisions should be made as unemotionally as possible.

If you trade based on emotions:

You’ll buy at the highs when things are moving “fast”, hold onto your losses hoping they will rebound, trade larger hoping to make back what you’ve lost, and etc.

Clearly, you know that trading based on emotions is a recipe for disaster,

Instead, you’ve got to think, act, and trade like a machine!

Now the question is, how?

Here are a few tips to get you started…

- Develop a trading plan with clearly defined buy & sell rules

- Risk not more than 1% of your capital on each trade

- Focus on executing your trading plan consistently (this is so important)

- Don’t get swayed but the short-term results, think long-term

If you want to learn more, then go check out this trading guide: How to be a Consistently Profitable Trader within the Next 180 days.

7. Trade small because that’s when you are as bad as you are ever going to be. Learn from your mistakes.

Let me ask you…

If you want to be a brain surgeon, will you immediately operate on a live human brain?

Of course not!

You’ll probably start off practicing on a “dummy” brain.

As you get better, you’ll work on a live human but only on a minor segment of it (so it doesn’t cause danger to the person).

Then as you level up, you’ll work on the major parts and finally, you have the confidence to do it on your own.

And it’s the same for trading!

You want to trade small because you’ll make mistakes — plenty of it.

So, why pay more in “tuition fees” to Mr. Market when you can do so at a fraction of the cost?

8. I could trade without knowing the name of the market.

You’re probably wondering:

“How is that possible?”

Well, that’s because you’re trading the price in front of you without concerning where the price is derived from.

It could be Soybean, Crude Oil, Copper, Rubber, or Cotton, who cares.

The only thing that matter is price, and nothing else.

Because the price is moved by an imbalance of buying & selling pressure which is based on emotions like fear, greed, hope, and regret.

These emotions or biases can last for a long time which in turn becomes a trend — something Trend Followers can capitalize on.

And that’s why you don’t need to know the name of the market.

All you need to know is…

- Buy what’s going up

- Sell what’s going down

- Repeat

9. In the real world, it is not too wise to have your stop where everyone else has their stop.

Let me ask you…

Do you always get stopped out only to watch the market reverse back in your intended direction?

Because you put your stop loss where everyone else puts it (like below Support) — which creates an incentive for the “smart money” to hunt your stop loss.

So, how can you avoid it?

By setting your stop loss AWAY from the obvious market structure.

This means don’t place your stop loss smack under Support, or just above Resistance.

I cover in more details here: How to Avoid Stop Hunting While Other Traders Get Stopped Out

10. You could publish trading rules in the newspaper and no one would follow them. The key is consistency and discipline.

This is true for 99% of traders out there.

Most would not have the conviction to take someone’s trading rules and trade it consistently even though its profitable in the long-run.

Why?

Because when the drawdown comes (which all systems will have), they will abandon it and look for the next trading system — and rinse repeat this cycle again.

So, the question is…

How can you gain confidence in your trading strategy or even someone’s trading system?

There are 2 ways you can go about it…

1. Backtest the trading strategy

This allows you to understand how a trading strategy performs historically.

If it’s proven to work in the past, there’s a possibility it could continue to work in the future (although no guarantee since it could be curve fitted).

2. Understand the logic behind WHY a trading strategy works

Most trading strategy that works have an underlying logic behind it.

For example:

Trend Following works because human biases and emotions cause the market to trend.

So, if a trader can cut his losses and ride his winners, he can capitalize on the long-term trend that comes about.

Or how about Value Investing?

It works because investors dump stock during “bad news” and that pushes the price of the underlying security below its intrinsic value.

This allows savvy investors to buy low (below the intrinsic value), and sell high (when the price increase back towards the intrinsic value).

11. There are lots more false breakouts, perhaps because there are more computer-based trend followers.

Here’s the deal:

Not all breakouts will work out.

In fact, half or more of your breakout trades are likely to fail.

However, it doesn’t mean trading breakouts is a losing strategy, far from it.

Remember, it’s not how often you win that’s important.

It’s how much you win when you’re right and how much you lose when you’re wrong — that’s what matters.

Also…

If you want to increase your odds of capturing a trend, you must trade across different markets.

This includes Forex, Indices, Energy, Metals, Agriculture, and etc.

If you want to learn more, then go read The Ultimate Guide to Trend Following.

12. It is misleading to focus on short-term results.

I’ll tell you this:

Your short-term results are random.

Because when you’re dealing with probabilities, anything is possible in the short run.

It’s only in the long run (after a large sample size of trades) that your results will align towards its expectancy.

Don’t believe me?

Then let me prove this to you…

Look at the performance of this trading system over the last 5 months…

Now, most of you would say this performance is crap and you’ll likely abandon this system after few losing months.

Now, look at this trading system below…

This looks like a much better system, right?

But guess what?

This is the same EXACT system as the one above.

The only difference is I’ve shared with you the results over the last 18 years instead of the 5 last months.

Do you see my point now?

In the short run your trading results are random but eventually, it’ll align towards it’s expected value.

13. You have to minimize your losses and try to preserve capital for those very few instances where you can make a lot in a very short period of time. What you can’t afford to do is throw away your capital on suboptimal trades.

Here’s the deal:

No matter which trading strategy you’re using, there will come a time where trading is so easy and it feels like you’re “printing” money.

But don’t be too happy just yet because…

There are also times where it sucks so bad you feel there’s no light at the end of the tunnel — and you just want to quit trading altogether.

So…

The “trick” is to minimize the damage during the bad times so you can survive and THRIVE during the good times.

This means:

- Have proper risk management in every trade

- No revenge trading even if you’re angry with the markets

- No over trading hoping you can make your losses back quickly

- Follow your trading system no matter how hard it is to pull the trigger

If you can do it, then you’ll likely overcome your drawdown and reach new equity high again.

14. I learned that a certain amount of loss will affect your judgment, so you have to put some time between that loss and the next trade.

There are 2 ways to look at this…

If you’re a discretionary trader, then yes, it makes sense to put some time between your loss and the next trade (especially if you have sustained a series of losses).

Because as a discretionary trader, your trading decisions are based on your analysis of the markets.

If you are carrying emotional baggage, you won’t objectively analyze the markets which lead to sub-optimal trading decisions.

However, if you’re a systems trader, then things are different.

Because the more losses you face, the closer you’ll be towards your next winning trade.

So, if you have a proven system that works, the last thing you’d want to do is to skip your trades because you have the fear of losing.

Instead, you must trade your system consistently so you don’t “mess up” the results of it.

15. Trading has taught me not to take the conventional wisdom for granted. What money I made in trading is a testimony to the fact that the majority is wrong a lot of the time.

The reason why most traders fail is that they want to be spoon-fed.

They don’t want to put in the hard work to find out what works and what don’t.

They trust what “gurus” say instead of spending time and effort to figure things out themselves.

Now, is it no wonder that most traders never make it?

So here’s the deal:

If you want to succeed in this business, you must TEST everything.

Trust nothing but question EVERYTHING.

If you’re unsure, backtest it, forward test it, and use your brain to think about it!

16. Almost anybody can make up a list of rules that are 80 percent as good as what we taught people.

You’re probably thinking:

“What? I could never come up with a profitable trading strategy.”

Here’s the deal…

Trend Following isn’t a difficult concept.

It’s basically…

- Trade a broad basket of markets

- Ride your winners

- Cut your losses

And that’s it!

How difficult can it be to come up with a set of trading rules based on the above criteria?

Still, I’m going to spoon-feed you further.

Go read the book Following the Trend by Andreas Clenow.

This book provides you with the exact strategy and markets to trade — so there’s no excuse anymore.

But please do your own backtesting first before trading it live.

Now…

The difficult part isn’t formulating the strategy but the execution of it — especially when the drawdown comes.

Will you be able to execute your trades consistently when you’re down 10%, 20%, or even 40% of your trading capital?

17. I’ve learned that markets, which are often just mad crowds, are often irrational; when emotionally overwrought, they’re almost always wrong.

After many years of trading, the one thing I’ve learned is to NOT trade with the crowd.

For example:

Back in 2017, Bitcoin was making new highs with a lot of attention from the media and the public.

To an astute trader, it’s a warning sign that the “party” is about to end.

Now, I don’t expect you to short Bitcoin because the market could continue to trend higher.

However, if you’re long, then you should tighten your stop loss and be prepared to BAIL OUT the moment the market show signs of reversal.

Because when the whole world has already bought, who’s left to buy?

Nobody.

And if there’s no one left to buy, the path of least resistance is DOWN.

Here’s a quote by Warren Buffet that says it best…

“Be greedy when others are fearful and fearful when others are greedy.”

Frequently asked questions

#1: How can a small trader like me with limited capital trade a diverse range of markets simultaneously?

You’ll probably want to trade with a broker who allows you to trade nano lots (as they are probably going to be market makers too).

#2: Hey Rayner, where are the results on point 12 from?

This is a systematic trend following system that I’ve developed.

Conclusion

The wisdom shared by Richard Dennis is still as applicable as they were decades ago.

Now, some of you might argue that Richard Dennis strategy doesn’t work anymore.

Well, the exact parameters he used to trade might not work anymore.

But the principles of Trend Following still works and is currently used by some of the biggest hedge funds in the world (like Winton Capital).

So, don’t get caught up by the specific tactics but look at the big picture and understand the concepts behind it.

Now it’s over to you…

What’s the biggest takeaway you had from Richard Dennis quotes?

Leave a comment below and share your thoughts with me.

Every trader must have a reason to enter and exit a trade…discipline and consistency is the key in your trading plan.

Thanks for sharing!

The biggest takeaway is this: it takes guts, real substance to be a trader. You have to stick to your plan and that takes courage.

Thank you for sharing, James.

7. Trade small because that’s when you are as bad as you are ever going to be. Learn from your mistakes.

Let me ask you…

If you want to be a brain surgeon, will you immediately operate on a live human brain?

Of course not!

You’ll probably start off practicing on a “dummy” brain.

As you get better, you’ll work on a live human but only on a minor segment of it (so it doesn’t cause danger to the person).

Then as you level up, you’ll work on the major parts and finally, you have the confidence to do it on your own.

And it’s the same for trading!

You want to trade small because you’ll make mistakes — plenty of it.

So, why pay more in “tuition fees” to Mr. Market when you can do so at a fraction of the cost?

Investagram po ako nag practise ng system ngayon sir 🙂

English please?

I enjoyed writing that part.

Hey Rayner, whose results are those one in point 12?

It’s a systematic strategy I developed.

Is it trend following strategy?

So you are trading this strategy from 2000?

Yes, it is.

This is a backtested result dating back to 2000.

Thanks

This is the strategy you have in your paid course?

Yes, I teach it in The Trend Following Mentorship Program.

How to join the course? Can you share the link.

Rayner, this is one of the best overall posts I have read in a good while. I love you’re work. Some major nuggets of wisdom here. So many people think that they could be a successful trader, yet they do not put in the work psychologically to be able to have the discipline to follow their system, which they need to test to see if it has the edge, and then will let their emotions get the best of them, and do the exact opposite of what they should do, cut the winners short, and let the losers run. But those with the discipline need those traders, as those are where our profits come from in the zero sum game.

Thank you for your kind words, William.

I’m glad you got something away from it!

Hey Rayner ! That’s a very good post..One question..One of the key elements to successful trend following seems to be the ability to trade a diverse range of markets simultaneously. But how does a small trader like me, whose capital is very limited, do that?

You can consider trading forwards or CFDs.

Will trend following system work with micro future? Would the stop loss be too big for smaller account since some country cant use cfd?

for me/ you always press the right buttons… you did it again.. thanks again

Thank you, Gift.

DO NOT REVENGE TRADE at all this will cause bigger loses which I have done.Trade different markets. Do not overtrade because you are winning will not mean it will continue.Do not use real money until you have a strategy that you have a good idea that it will work.TEST TEST TEST

Nice, thanks for sharing Philip!

Rayner, first, thanks for all the good work. And yes, my big takeout from this pist is …. keet it simple and systematic … KISS

Nice!

Very informative . I have just resigned from my job to became a full time trader .This discussion came after 1 year studying 2 online courses one on fundamentals and the other on Technical also 6 months on dummy account . The material you are providing is improving my trading every day so big thank you for your work

I’m glad to be of help, Clint. cheers

Thanks for sharing Rayner.

Excellent insights .

My pleasure, Jay.

I love reading pieces of advice from legendary traders.

TIMELESS WISDOM.

Please continue posting more like this.

My advice to beginners:

Practice trading real money you can afford to lose. You should have skin in the game.

The harder you fall, the higher you bounce.

Failure is a better teacher than success.

Thank you for sharing, ER.

Well said!

Good read thanks for sharing! Will go and check out the recommended book!! Thanks a lot:)

You’re welcome!

I love your explanation on every point of it. Thank you so much, Rayner.

I’m glad to be of help!

What I learnt is that: follow any stretegy with strict stop loss and always start with minimum investment for study purpose .if you get success then increase the investment. thanks ryner as

a begginer it will help me in trading

Thank u MASTER TEO

You’re welcome, Sanjay.

Another wonderfull nugget of information.

People on your course should be very honourd!

Keep up the fantastic work. Your a credit to the industry.

Thank you for your kind words, Graeme.

I appreciate it.

Dear Teo, you are really great to share your mastery to traders’ world especially retailers who get be benfited maximum if your trading mastery digests and turn into action.we pray almighty to support you reaching your goals.

I appreciate your kind words, cheers.

EXCELLENT

Cheers

LOVE THIS: It does not matter whether your Right or Wrong! What Matters is How Much you Make when you are RIGHT and HOW much you Lose when you Are Wrong!; Truly This Article The Best advice I’ve Got!

Awesome to hear that, Km!

Thank you sir

You’re welcome!

I like this article .It’s change my think toward trend especially i want this time because I am facing problem after so many drawdown …

Cheers bud

Very effective and practical

Thanks Girish!

Take time to study the market and don’t be greedy and don’t quit when market is down.

Thanks for sharing, Abiola!

Thank you. I really appreciate your time and the value you so generously give to the trading community. My takeaway is sit on your winners and cut your losses short.

Thank you for sharing, Prabin!

Commitment,discipline and more practice keeps you perfect,Thank you so much Mr Rayner ..you are always great man …all best wishes

Cheers Ali!

Amazing read, thank you!

My pleasure!

Rayner bro can u manage my account plz

“LEARN FROM YOUR MISTAKE “ ,great words…..I bet if you go back & check your records , over 90% of the mistake you made ,is because of you didn’t follow your rules !! Let’s say if you have a plan in place which has a edge in the market (as little as casino have 52%) you are a WINNER in log run

thanks again Rayner

You’re welcome, Ali!

Hi Rayner, the %results you show in the 15 years table, what exactly they represent ?

The % returns.

“you’ve got to think, act, and trade like a machine!”

This part got me because personally I have been trading demo and making profits but when I use my real account I’m always scared making the calls and that has not ended well for me. Thanks for this wonderful piece

You’re welcome, glad to know it helps!

I learn everything here

Nice!

Wow wonderful , I will follow this guide, most usefull me, thank u Rayner

My pleasure!

There are a lot of learning here, the biggest one “A certain amount of loss can affect our judgement. So take sometime between your loss and the next trade.” Also minimizing loss and preserving capital.

Thanks a lot Rainer… I hope I can meet you in the future

You’re most welcome. Ivy!

That was awesome…

Loved it …

Hey Ashutossh,

Thank you!

Educative

Hi Vengai,

Thank you!

That i should trade with the trend at event areas,extreme low or high considering the rules and let it run with trailing stop.Thankyou for being here for the people.

Hi Mohammed,

It’s my pleasure!

Lesson learnt, the main strategy may not work today, but the principle behind still holds. Thank you Rayner

Hi Peter,

I’m so glad to hear that!

My take away is to trade a broader basket.

Thank you Rayner.

Hi Sham,

You are most welcome!

If the reason for placing the trade is still in play, don’t cut it short

Hi Heritage,

Thanks for your contribution.

Cheers.

We have to learn by mistakes,

By motivated speech

Hi P,

I’m glad to hear that!

Very inspiring…. thank you very much for sharing

Hi Joselito,

You are most welcome!

Cheers.

sir rayner in which market do you trade and earned how much?

this is very similar to playing poker…. know when to fold…. know when to play…. avoid going on tilt! poker is simply a game of managing losses…. make your wins larger than your losses!

Very education. I appreciate man!

You are welcome, Abdullahi!

I always feel there’s some confusion in the idea of following a trend yet thinking not to follow the majority … is the trend not created by the majority? Because how can the minority of traders be pushing the market? Perhaps you can do a video to clear up this confusing concept

you don’t need to know the name of the market. all you need to know is buy wht’s going up and sell wht’s going down.

Ride the breakouts like a professional yachtsman would ride the wild Atlantic waves in a storm… but wear a good life jacket.

Thank you for sharing, Michael!

“Trading is a little bit like hitting a ball.If you are thinking what your batting average should be, you are not concentrating on the right thing when you bat the ball. Dollars are the batting average of the trader”

Thanks for sharing, Nhlanhla!

thanxs for sharing bro 🙂

You’re most welcome, Dimazzu!

Hi Rayner,

I’m a beginner trader, still learning the basics and find your writing so inspiring and lots of insights.

Have you been trading as early as the year 2000? Just curious…

Excellent !!! I can understand all that you described but in practice, it’s very difficult to follow it …

However, each time whenever I see you on youtube I’ll have a more strong motivation

Thanks, Isok!

That is good to hear! Keep on practicing on a Demo account first so you won’t shed a lot of money, once you get consistently positive results, you can try trading on a live account.

Cheers!

Dennis is legend. I would say :Test your strategy, create and trust your belief, visualise the trend based on principles of market, position size trade, trade small and reinvest market money !

Thank you for sharing, G!

Thanks for sharing your thoughts, G!

Thankyou for sharing this piece.

No worries, Rizzario!

Plz May u be successful as u keep up teaching us secret in trading, and may u never lack

Thank you, Ever!

You, too! We wish you all the best in trading.

Cheers!