#7: Moving Average Crossover Secrets

Lesson 7

Moving Average Crossover Strategy

You have probably already heard about this.

But the question is…

Does it work?

Or is it just another hocus pocus in technical analysis.

So that's what you'll discover in today's video.

And no, the answer is not what you think, so keep reading.

Testing a Moving Average Crossover Strategy On 3 Markets

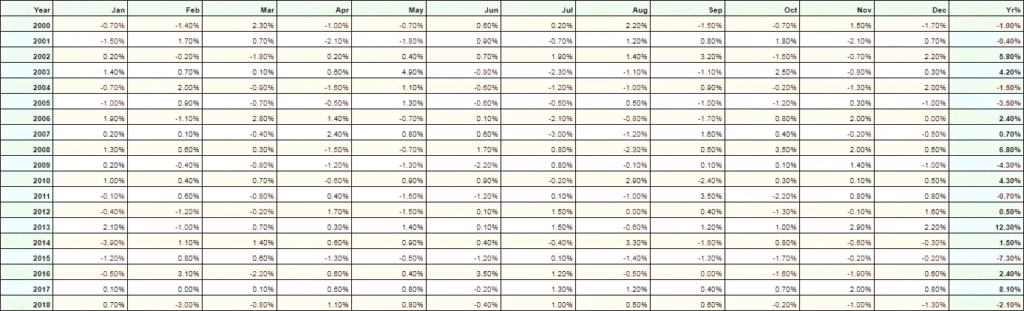

To test whether a moving average strategy works in trading, we will backtest it using historical data.

We will use a simple moving average strategy that should at least beat the S&P 500 or a buy and hold strategy to claim that it works as it beats the market.

Also, we will be testing this strategy on these markets…

Markets (2000 – 2018)

- S&P 500

- EURJPY

- US T-Bond

The Rules

- Go long when the 50MA crosses above the 200MA

- Go short when the 50MA crosses below the 200MA

- 3 ATR trailing stop loss

- 1% risk per trade

Before I go with the results, let me share with you an example of a long setup:

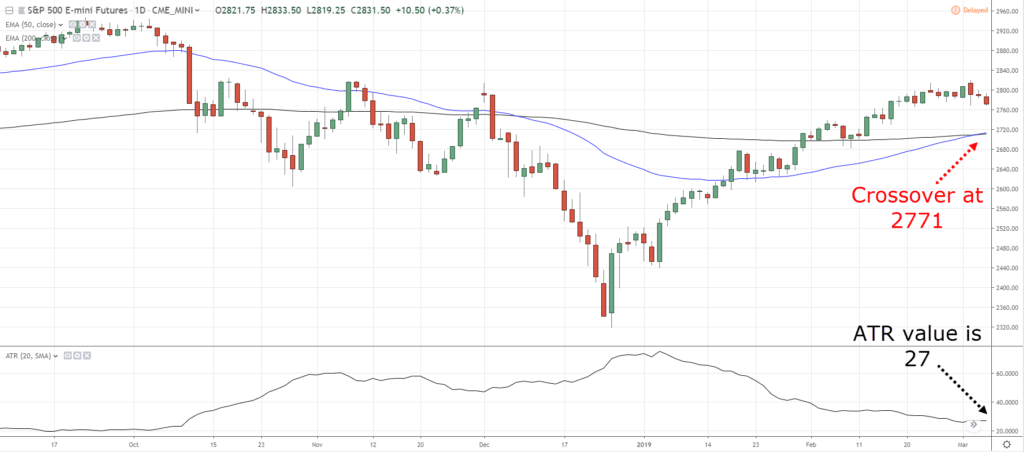

The 50MA crossed over the 200MA on March 6, 2019, and the entry is at 2771.

The current ATR value is 27 and since our stop loss is 3ATR, we multiply 27 by 3 and subtract from the entry price 2771.

You get a stop loss of 2690.

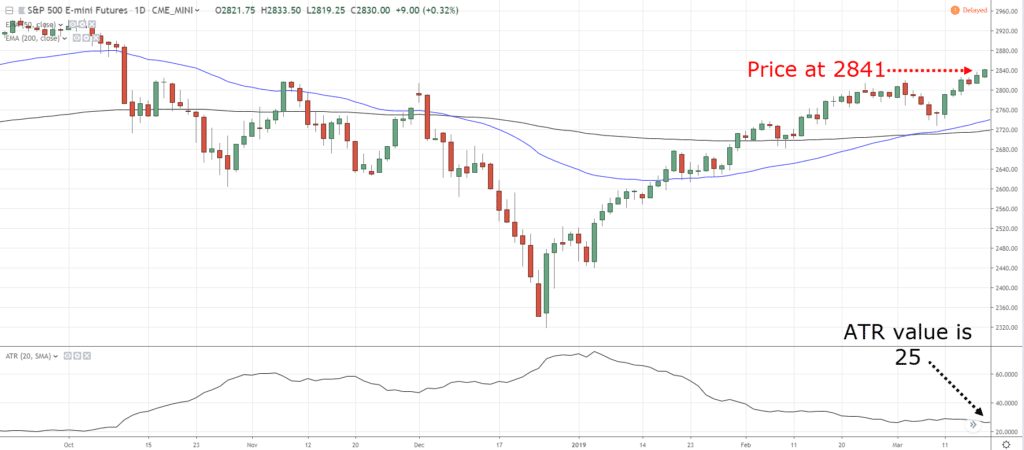

As the market moves in your favor, the ATR value will change.

As the ATR value changes, you would modify your trailing stop loss:

Multiple the ATR by 3 and subtract from the current price.

Your new stop loss would be 2766.

The Results

The strategy has only achieved an annual return of 1.31%

Generally, this is a losing trading strategy.

So, the first secret is this…

Secret #1: Moving Average Crossover don’t work well with a small number of markets

Before we claim that this trading strategy doesn't work, I want to ask you a question…

How does a Moving Average Crossover make money?

This is not a trick question.

I'm sure you can agree…

That it makes money when there's a trend, right?

And how does it lose money?

When the market is in a range.

You get chopped up and down, that's how you lose money.

Now…

How can we improve on this?

Maybe if we trade more markets, we could ride more trends!

And if we ride more trends, we might be able to make more money!

Testing a Moving Average Crossover Strategy On 3 Markets

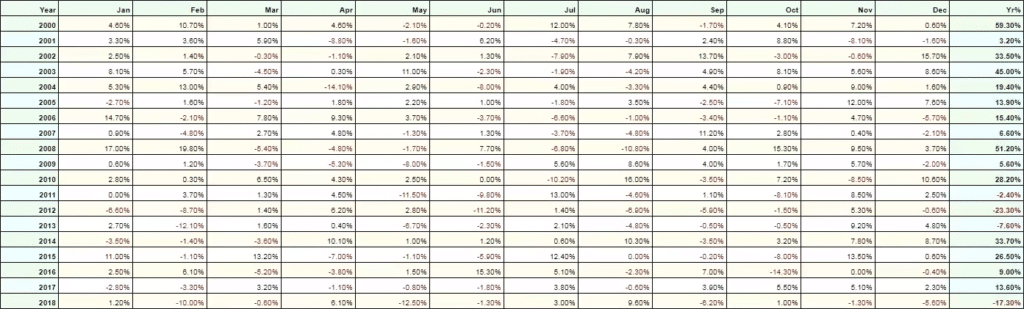

So let's try to test it again, but instead if 3 markets…

We now trade 20 markets.

Markets (2000 – 2018)

- Gold, Copper, Silver, Palladium, Platinum

- S&P 500, EURJPY, EURUSD, USDMXN, GBPUSD

- US T-Bond, BOBL, BUXL, BTP, 10-Year Cad

- Heating Oil, Wheat, Corn, Lumber, Sugar

The Rules

- Go long when the 50MA crosses above the 200MA

- Go short when the 50MA crosses below the 200MA

- 3 ATR trailing stop loss

- 1% risk per trade

The rules are exactly the same.

The Results

The annual return of this strategy is now 14.30%

See, it's much better!

So much better than the results you have seen earlier.

Did we make any changes to the rules?

No, we only traded more markets compared to the last one.

This leads to secret number 2…

Secret #2: Moving Average Crossover works best when you trade many different markets

The reason is simple…

It’s because you know that this strategy makes money during trending periods.

And if you trade more markets, you can capture more trends.

Secret #3: Focus on the concept, and not the parameters

A big mistake that traders make is that they focus a lot on the parameters.

If you would only change the parameters of the moving averages such as the 50MA and 200MA to 35MA and 189MA…

The strategy will never work.

This is what we call curve fitting.

It's like memorizing the answers to last year’s examination paper.

If you take the test this year, what are the chances that the questions and answers appearing in this year’s examination are the same?

Very unlikely, right?

And it's the same for curve fitting this moving average crossover strategy.

But if you don’t memorize the answers but understand the concept behind the questions…

No matter how they change the questions in your next examination, you will still be able to answer it without memorizing the answers.

This is the point that I’m trying to bring across, it’s to focus on the concept and not the parameters.

And as a trader, there are many different concepts out there.

For example, the concept that I just shared with you is about market exposure.

The concept of market exposure

It’s when you expose your trading system to more markets so that you can increase the odds of riding trends and making more money.

Now, this concept is definitely for the moving average cross over.

But that's not the only way…

The concept of trend filters

If you are a pullback trader and want to buy pullbacks in an uptrend and short pullbacks in a downtrend…

You want to have a trend filter to objectively define trends that make sure you are trading in the direction of the trend.

The concept of market volatility

Now, what if you tend to buy breakouts and you realize that the market always reverses after you buy the breakout.

Well, maybe that’s because you're buying a breakout when the volatility is high and the market has exhausted itself.

So, why not consider buying breakouts when volatility is low or when the market is still in a tight range?

Buying breakouts in such a market environment might be more profitable for you.

So that’s yet another concept with market volatility.

With that said, let’s do a quick summary…

Summary

- Moving Average Crossover Strategies don’t work when you trade a few markets

- Moving Average Crossover Strategies works best when you trade many different markets

- Focus on the concept and not the parameters