Here’s the thing:

There is so much “noise” in Forex Trading that makes it difficult to discover which are the best Forex Trading tips that work.

You get stuff like Hammer, Doji, Trendlines, Breakout, Pullback, RSI, MACD, Fibonacci, Pivot Points, and etc.

How do you know what works?

How do you know what to ignore?

How do you if it’s superficial fluff that just looks good in hindsight?

You feel me?

That’s why I’ve written this post to cut through the BS and share with you 12 proven Forex trading tips that work.

And some of the things I’m about to share has never been revealed before.

So are you ready?

Then let’s begin…

Forex trading tip #1: The longer it ranges, the harder it breaks

Here’s the thing:

The market is always changing.

It moves from a range market condition to trending market, and back to range market.

And in my experience, the longer the market is in a range, the harder it breaks.

Here’s why…

When the market is in a range, traders will look to long Support and short Resistance.

And can you guess where will they put their stop loss?

Probably below Support and above Resistance.

Now…

As time passes, this cluster of stop-loss will increase as more traders fade the highs and lows of the range.

But the market has to breakout, eventually.

Now let’s say for example, the market breaks out higher.

What happens next?

Well, there are momentum traders (or Trend Followers) who goes long on the breakout. Plus, you have short traders cutting their loss (from shorting Resistance) which fuel further buying pressure.

And this leads to a strong breakout and possibly the start of a new trend.

So the bottom line for this forex tips is this…

The longer it range, the harder it breaks.

Forex trading tip #2: Volatility contraction leads to volatility expansion

This is a fact of the markets that is hardly spoken about…

Volatility contraction leads to volatility expansion.

You’re probably wondering:

“What does it mean?”

This means volatility in the market is never constant.

The markets move from a period of low volatility to high volatility, and vice versa.

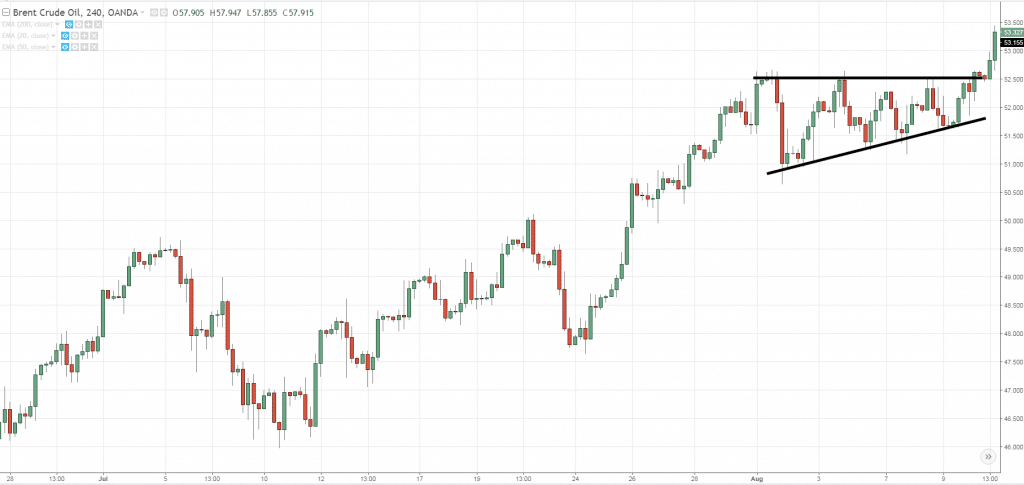

Here’s an example:

Now, looking at forex trade ideas such as this…

How can you take advantage of this phenomenon?

Well, you can use it to better time your entries, entering your trades when the market is in a low volatility period.

Why?

Because it allows you to have a tighter stop loss, thereby allowing you to increase your position size (for the same level of risk).

And if volatility expands in your favor, you’re already in the trade — while other traders are trying to “chase” the markets.

Can you see how important this is as one of the forex tips?

And this brings me to my 3rd Forex trading tip…

Forex trading tip #3: Trade breakouts with a buildup

You’re probably wondering:

“What is buildup?”

A build-up is a tight consolidation otherwise known as volatility contraction.

And the location where a buildup occurs gives you a BIG clue to where the market is likely to break out.

For example, if there’s a buildup formed at Resistance, the market is likely to breakout higher.

Let me explain…

You know Resistance is an area to short the markets (after all the textbook says buy Support and sell Resistance).

But what if you go short Resistance and the price is still hovering at that area.

What does it tell you?

To an amateur price action trader, they will think Resistance is getting stronger as the price fails to break above it.

But…

To the seasoned price action trader, this is a sign of strength from the buyers.

Why?

Because if there is a strong selling pressure, the price should move quickly away from Resistance.

The fact that price is still at Resistance is telling you there are buyers willing to buy at higher prices — and that’s a sign of strength.

And that’s not all for this forex trade idea…

When the price breaks above Resistance, it will trigger a cluster of stop-loss (from traders who are short) which fuels buying pressure.

Plus, breakout traders will long the break of the highs which adds strength to the move.

An example:

So…

One of the forex tips that you should always remember is that whenever you see buildup form at Resistance, it’s likely the price will breakout higher (and vice versa for Support).

Continue reading…

Forex trading tip #4: Higher lows into Resistance is a sign of strength

Old Rayner: “Oh look! The price is coming to Resistance, time to short this market.”

New Rayner: “Not so fast…”

Here’s the thing:

You don’t go short just because the price is at Resistance.

Why?

Because how the price approaches Resistance matters a lot.

For example, if you see higher lows coming into Resistance, it’s a sign of strength.

It tells you the buyers are willing to buy at higher prices and the sellers are unable to push price lower (than it did previously).

And this looks like an Ascending Triangle on your chart:

Can you see the higher lows approaching Resistance on this?

If you do see this on different forex trade ideas that you see out there, this is a sign of strength.

And more often than not, the price breaks out higher.

Let’s move on…

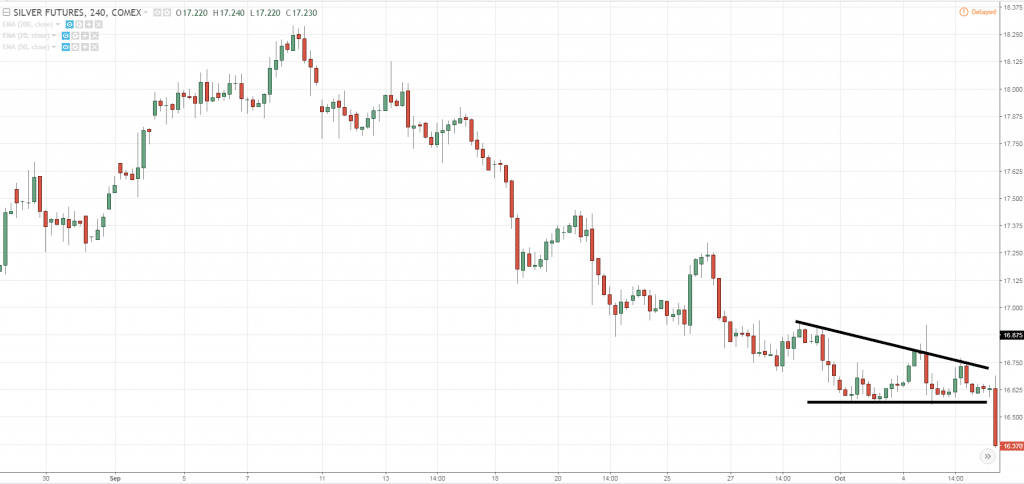

Forex trading tip #5: Lower highs into Support is a sign of weakness

If you’ve read what I’ve said earlier, then this is a no-brainer (though most traders don’t get it).

So…

Why are lower highs into Support a sign of weakness?

Because it tells you the buyers are unable to push the price beyond the previous swing high.

Here’s why:

If the buying pressure is strong, it should have no problem breaking above the previous highs.

If it can’t, it means there is a stronger selling pressure and sellers are willing to sell at lower prices.

And this looks like a Descending triangle on your charts…

Now:

When most traders see the price approaching Support, they’ll get long.

But you’re smarter now.

Since you’re better at generating forex trade ideas, you’ll analyze how the price approaches Support.

And if it forms lower highs into Support, you’ll leave it to those amateurs to go long — only to get stopped out.

Onward…

Forex trading tip #6: How to find low risk and high reward trading setups

Here’s the thing:

Most traders enter their trades when the price is in the middle of nowhere.

It doesn’t make because there is no logical place for you to put your stop loss.

Even if there is, it’s usually wide and this results in a poor risk to reward setup.

But don’t worry, there’s a tip for forex trading on this one.

And if you can do it, you’ll see a huge difference in your results.

Want to know what’s the secret?

Well, it’s to enter your trades close to Support and Resistance and then leaning your stop loss against it.

Here’s what I mean: A poor risk to reward trading setup…

This is a much more favorable risk to reward setup…

Green = Entry

Red = Stop loss

Blue = Target Profit

See the difference?

You have the same target profit in both scenarios, but a huge difference in potential risk to reward.

Out of all the tips for forex trading you’ve read so far, can you see how this is important?

Pro Tip:

Use a trading alert to inform you when the price has reached your desired level. So you don’t have to spend all day in front of your monitor.

If you want to know how to do it, TradingView has one such feature.

Forex trading tip #7: Don’t put your stop loss at the same place as everyone else. Here’s what you should do instead…

Let me ask you…

Do you always get stopped out, only to see the market reverse back in your direction?

Well, that’s because you place your stop loss at the same level as everyone else, and this gives the smart money an incentive to hunt your stop loss.

So what can you do?

Simple.

Don’t put your stop loss at an obvious level.

Now you’re probably wondering:

“So where should I set my stop loss?”

Well, the forex trading tip and trick is this…

Identify the level on your chart where it’ll invalidate your trading setup — and give your stop loss a buffer away from the level.

Let me explain…

Most traders place their stop loss below Support and above Resistance (after all that’s what the textbooks and courses tell you to do).

But the problem with this is that’s where everyone else places their stop loss — which makes it easy for you to get stop hunted.

Instead, a better way is to set your stop loss a buffer away from Support and Resistance, away from the noise of the markets (or everyone else).

An example:

And this tip for forex trading applies to Trendline, moving average, and etc.

If you want to learn more, go watch this training video below that shows you how to set a proper stop loss (step by step)…

https://www.youtube.com/watch?v=M79kxiOMJJg

Forex trading tip #8: Trading with the trend gives you bigger profits

It baffles me whenever I see traders trading against the trend.

Even though you’ve learned tons of forex trading tips secrets in your trading journey…

Why would you want to do that?

Perhaps it’s an ego thing, to call market tops and bottoms. But here’s the thing…

If you’re serious about making money in this business, it’s far easier to trade with the trend — not against it.

Let me explain…

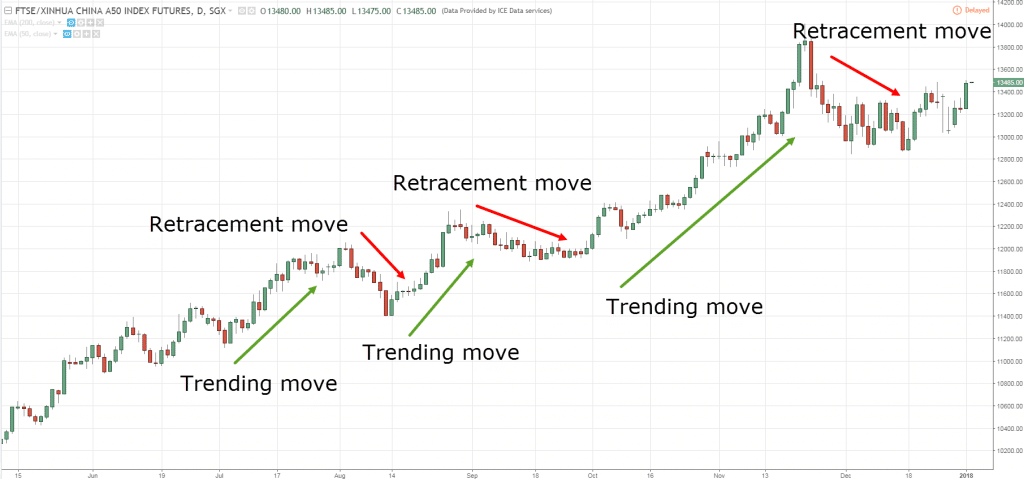

A trending market typically has 2 types of move; a trending move and retracement move.

The trending move – this is the stronger “leg” as it moves in the direction of the trend (and sometimes with strong momentum). This means it’s easy to stay in this type of trade as the market usually moves in your favor quickly.

The retracement move – this is the weaker “leg” as it moves against the direction of the trend. You can trade this type of move, but it’s more stressful as the market could quickly reverse against you.

Now, look at this chart below…

Do you want to trade the trending move or retracement move?

The choice is yours.

Forex trading tip #9: This is one simple trick that improves your risk to reward on every trade…

Now, correct me if I’m wrong…

But whenever you put on a trade, you look for at least 1 to 2 risk to reward ratio, right?

But here’s the thing…

If you’re the type of trader who waits for confirmation before entry, the candle might “close too much” in your favor (which offers a poor risk to reward ratio).

Before you know it, you are entering your trade right smack into Support and Resistance.

So, what can you do?

Well, there’s a simple solution to it.

Use a limit order.

Yes, use a limit order for your entry so you can enter your trades at a much more favorable price (instead of “chasing” the markets).

An example:

Pro Tip:

One way to set your limit orders is in front of Support or Resistance, swing highs or lows, to increase your odds of getting filled.

That’s one forex trading tips and tricks you should always have in mind.

Sounds good?

Forex trading tip #10: The best pullback is the first pullback

Here’s one of the most important forex trading tips secrets that you should know…

A pullback is when the price temporarily moves against the trend. And this provides an opportunity for traders to get on board the trend.

In my experience, the best pullback is the first pullback after a breakout.

Here’s why…

When the market is in a range, it must break out eventually.

And as you know… the longer it range, the harder it breaks.

So, when the market finally breaks out, traders who miss the move can’t wait to enter on the first sign of a pullback.

These pullbacks usually have shallow retracement as not many traders want to trade against the strong momentum.

And this offers a high probability pullback trade.

Here’s what I mean:

Now you’re wondering:

“How do I find such high probability pullback trades?”

Simple.

Just follow this 3 step process:

- Identify markets which are in a range

- Let the market breakout

- Trade the first pullback

Cool? Then let’s move on…

Forex trading tip #11: The market is unlikely to re-test the levels you’re looking at

Has this ever happened to you?

You noticed the market has broken out higher and you’re not in the trade.

So, you tell yourself…

“I’ll look to go long when the price re-tests previous Resistance turned Support”.

And of course, the market never returns back to the level and continues trading higher.

Why?

Because when the whole world expects the price to “test” a level, it probably won’t.

And even if it does, it will attempt to shake out as many traders as possible before continuing its move.

It stinks, right?

I know.

Now you’re wondering:

“Is there anything I can I do about it?”

Of course!

Here are 3 techniques you can use:

- If the market doesn’t re-test your level, look to trade the next breakout

- If the market doesn’t re-test your level, anticipate a new range to form and trade the highs/lows of it

- If the market re-test your level, let it show signs of reversal before entry

Let me explain…

1. Trade the next breakout

Now…

If you agree that the market seldom comes back to re-test your level, then it makes sense to enter your trade on the breakout, right?

This means you’re anticipating a bullish flag pattern to form and to trade the break of it.

An example (bearish flag):

Next…

2. Anticipate a new range to form and trade the highs/lows of it

Here’s the thing about this forex trading tip secret:

Sometimes the market may not breakout and neither does it re-test the level you’re looking at.

Instead… it forms a new range.

So, what can you do?

Well, you take advantage of it by trading the range.

This means in an uptrend, you’ll get long near the lows (of the new range), with the possibility the market will break out of the highs.

3. Let it show signs of reversal before entry

As mentioned earlier, even if the market comes back and re-test a level, it’ll attempt to shake out as many traders as possible.

This means the market can retrace much deeper than you expect, and shake you out of your trade before it reverses back in your direction.

So, what’s the solution?

Simple.

Let the market show signs of reversal before establishing an entry.

Now you might get a later entry, but it improves your win rate (which helps your trading psychology).

Moving on…

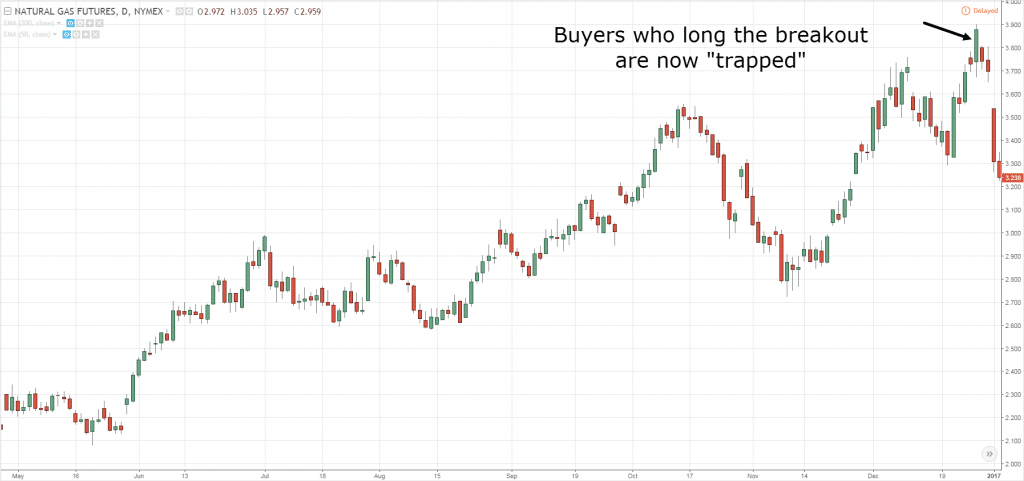

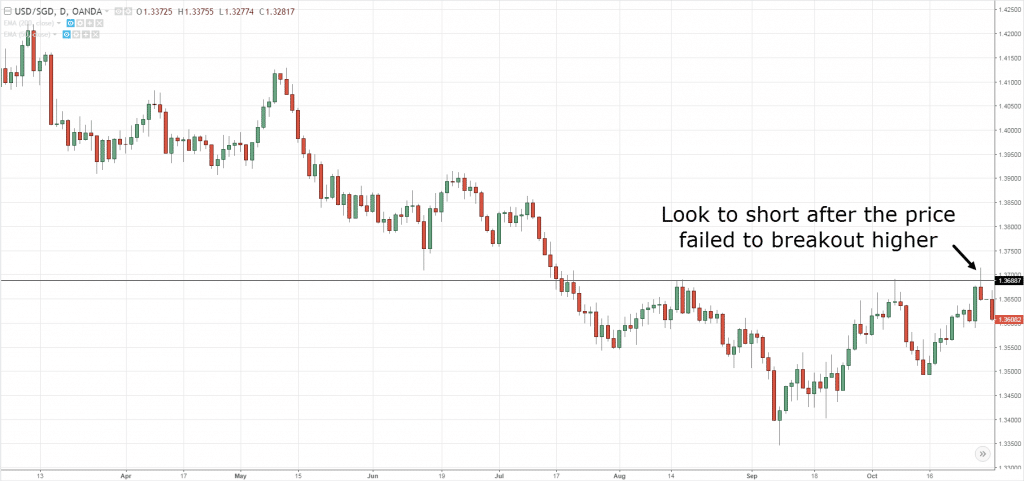

Forex trading tip #12: How to profit from the False Breakout pattern

Has this ever happened to you?

You noticed the market broke out of the highs and you think to yourself…

“This breakout is real. Just look at the HUGE bullish green candle.”

So, you immediately go long… hoping to catch a BIG move.

But shortly after you entered the trade, the market reverses in the opposite direction!

And it doesn’t take long before you get stopped out of your trade.

Here’s what I mean…

So, what just happened?

Well, I call this a False Breakout.

It’s when you trade a breakout only to get “trapped” and have the market reverse against you.

Now you’re probably wondering:

“How can I profit from the False Breakout?”

Here are three tips for forex trading on how you can profit from it:

- Identify the key Support and Resistance where traders will look to trade the breakout

- Wait for the breakout to fail when the price trades back into the range

- Trade in the direction of the False Breakout

Let me show you an example:

This is powerful stuff, right?

Can you see how all of the forex trading tips and tricks you’ve just learned can improve your trading and make things more efficient?

Frequently asked questions

#1: Is it possible to be a profitable trader by simply focusing on a single timeframe without looking into the higher timeframe?

Yes, you can be a profitable trader by looking only at one timeframe, especially if you’re a systematic trader or a quantitative trader.

But if you’re a price action trader or a discretionary trader, you’ll want to look at multiple timeframes to be aligned with the higher timeframe trend to increase the odds of your trades working out.

#2: Is it right to say that if the price consolidates at resistance, it is likely to be a breakout, compared to the price approaching resistance quickly in a short period?

Yes, if the price consolidates at resistance, it’s likelier to breakout compared to the price approaching resistance quickly in a short period.

However, do take note:

If the price consolidates at resistance, but the higher timeframe is in a downtrend, then the breakout is probably not going to happen. Instead, the market is likely to reverse down lower.

Now, if the price consolidates at resistance and the higher timeframe is in an uptrend, then the odds of it breaking out is higher.

#3: Hey Rayner, will all these forex trading tips apply to other markets as well?

The concepts shared over here can be applied to other markets as well.

Conclusion

As a recap, these are the 12 Forex trading tips you’ve learned:

- The longer the market is in a range, the stronger the later breakout

- A contraction in volatility leads to an expansion in volatility

- Breakouts with buildup have a higher probability of success

- The Ascending triangle pattern is a sign of strength

- The Descending triangle pattern is a sign of weakness

- Trading close to Support and Resistance offers favorable risk to reward on your trade

- Don’t place your stop loss just beyond Support and Resistance, give it some “buffer”

- Trading with the trend offers a greater profit potential

- You can use a limit order and improve your risk to reward

- The first pullback is the best pullback

- If the market doesn’t re-test the level you’re looking at, you can 1) trade the breakout 2) trade the new range that’s formed 3) let it show signs of reversal before entry

- The False Breakout is a profitable pattern to trade

Now here’s what I’d like to know…

Do you have any Forex trading tips to share?

Leave a comment below and let me know your thoughts.

I do miss a lot of trades because I like to see a return to the support or resistance. What I look for is a wick cutting through the support or resistance and a close above resistance and below support. I like to trade from the 4 H but use support and resistance from the daily.

Thank you for sharing, Pat.

Thank you Raynor for your proper explanation. I made profit of 400$ in GBP/USD short as per your suggestion

Sweet!

One thing I never miss is your weekly tutorials.

I’ll take that as a trading tip, heh.

These 12 tips summarize trading whether for professional, experienced or newbie traders. You’ve pointed out the intriques which many overlook and get burnt. I bet I struggled with most of these until recently. It’s the area of early entry that’s still tricky to me because entering with Limit orders are never easy as you could be entering against a subsisting momentum. On this, it’s more of psychology to me, and I believe I should get over it soon in order to confidently use Limit orders. Severally Limit orders have hurt me badly when I relied purely on Fibs and candlestick formations to time end of Retracement in order to trade in the direction of the main Trend. So I’ve tended to rely more on Stop orders but I realized they got me in late. I’ll check back my records and adjust my previous entry method but add support/resistance in the confluence to see if it was because I never took them close to support/resistance. Thanks Rayner.

You’re welcome bud.

Let me know how it works out for you. cheers

i struggle with getting stopped out of trades before they continue in the direction i anticipated

Do check out the trading tip on stop placement, it will help…

I get trading the false breakout for profit, but is there any clues to tell whether it’s a false breakout so you would be able to trade it that way? If you really think it’s a false break out , you wouldn’t really know that until it’s too late or just lucky you didn’t jump in.

By the way….thank you for everything you put out. I’m learning a ton from you!

You never know for sure, that’s why you have a stop loss in place.

Great tips as usual my friend!

Just to clarify, these can be used in all markets, (Stocks, ETF’s, Futures, etc.) not just Forex.

Price Action Trading Rules!!

Yes, the principles can be applied the same.

thanks rayner your videos also made me the trader tthat I am today. god bless

Nice!

I am learning a lot from you broe. You such a blessing. I can’t wait to fund my account

Cheers

Hi Rayner…Thax for your effort, time and money you investing in helping most of us, of which you don’t even know and you may even not ever come across. I have lost over R150k so far to fake Forex gurus and placing wrong trades due to lack of trading experience and teaching like yours. ever since I started focusing profusely on your free videos and almost all of your notes my trading skill and experience have taken a different shift.. thax to you .

Question I : I take in that you really do promote looking at higher time frame before taking any position. How do I do that during back testing, because it seems like most of the trading software do not incorporate multiple time frames as one of the trading building block for back testing my system? ( its only possible only in live market.)

Is it possible to be a profitable trader without looking into high time frame by just only looking into the underlying trend from a single time frame?

Hi Gift

1. There are simulators that allow you to look at higher timeframes for backtesting (for example Forex Tester)

2. I always look at the higher timeframe since it gives me better odds.

My god. Thank you rayner for sharing this with us. This is gold.

Awesome to hear that!

Thank you rayner

You’re welcome.

Thanks very much for sharing this with me it’s very helpful.and I also think of not putting stop so that you don’t get stopped out . What I do is I wait incase it doesn’t go in my favour

For instance if am selling at a resistance and the candle now break the resistance I’ll close the trade at if the candle closes above the resistance.

This you share is very helpful God bless you and I believe it will help many of we trader

Thanks one love✌️✌️✌️✌️

Thank you for sharing, Tunde!

Thanks for the info

Welcome!

Thank you a lot sir

You are a blessing in this world

You’re welcome!

thank you rayner, you are the best

You’re welcome!

Hi Rayner

Thanks for the good work God bless you .

You’re really making positive impact and improvement in my trading.

But as to the limit order,is it not risky to enter a trade when the candle have not close?

Like if a bearish engulfing candle is forming at a resistance can one enter the trade when the candle is still forming?

Wow, nice information about Forex Trading. You have shared a lot of important points that can give a lot of ideas to a person for earning big profits in the online trading market.

Thanks for the useful tips.

You’re welcome!

Hello Rayner. Thanks alot for these amazing tips. Please could you do an article specifically for day traders and scalpers. I’m sure alot of us here would appreciate that. Thanks

Check this out… https://www.tradingwithrayner.com/intraday-trading/

Thanks alot Rayner. You are my mentor, a big inspiration. Whenever i begin losing my head when it comes to trading, i always read your price action trading strategy. I must have read it a hundred times since I got it. Big thanks man

Thanks a lot, Rayner.

I look forward to you as a mentor.

Hi Rayner, thanks for this beautifully written post. Am I going in the right direction if I were to say that if the price approaches resistance slowly/consolidating, it is likely to be an actually breakout (tip 3) whereas if it approaches quickly, it is likely to be a false breakout (last tip)? If not, is there any way to gauge the likelihood of an actual breakout vs a false breakout?

Check this out… https://www.youtube.com/watch?v=xTd6nlbcIZc

Do you ever trade the right shoulder of the H&S pattern. I like to trade it. How do you see it?

Good trading idias for any market so very very thanks sir.

My pleasure!

Lovely post!!

Very informative, thanks for sharing this pos there with us

Thank you, Compare.