Let me ask you…

Have you ever bought a breakout because you think the price will move higher?

After all, the textbook says a breakout is “confirmed” when the price closes above Resistance.

So, you go long.

And the price moves in your favor (a little).

But the next thing you know…

The market does a 180-degree reversal and BOOM, you got stopped out — now you’re sitting in a sea of red.

Here’s what I mean…

Bull trap at EUR/USD Daily:

Now…

What I’ve just described to you is called a Bull Trap (and the opposite is called a Bear Trap).

What is a bull trap you may ask?

Well, it means that the buyers are “trapped” as their trade went against them (and they are sitting in the red).

Now you’re probably wondering:

“So how do I avoid the Bull Trap?”

Well, that’s what you’ll discover next…

Read on…

How to Avoid the Bull Trap

Now here are 2 tips you can use to avoid getting caught in a Bull Trap:

- Don’t “chase” parabolic breakouts

- Trade breakouts with a build-up

Let me explain…

1. Don’t “chase” parabolic breakouts

I know.

You’re tempted “chase” a breakout.

After all, you’re thinking:

“The candles are so bullish. How can it possibly reverse?”

And that’s when shit is about to happen.

Why?

Because when the price has exploded higher, there’s no “floor” (like swing low or Support) to hold these higher prices.

This means the price can easily reverse in the opposite direction (until it finds the nearest “floor”).

Here’s what I mean…

Nearest floor on BTC/USD Daily:

And also…

When you “chase” a breakout, there’s no logical place for you to set a stop loss so you’re likely to get stopped out, even on a pullback.

So the bottom line is this:

If you want to avoid a Bull Trap, stop “chasing” breakouts!

Because that is what gives the bull trap meaning.

2. Trade Breakouts with a build-up

Now you’re probably wondering:

“Then how should I trade breakouts?”

The secret is this…

You want to trade breakouts with a build-up.

So what’s a build-up?

A build-up is a tight consolidation that you see on your charts.

It should be so tight that the candles have “no space” to move.

Here’s an example…

Buildup at GBP/CHF Daily:

But why wait for build-up?

Here are 3 reasons why…

#1: Favourable risk to reward

You have a logical place to set your stop loss (below the low of the build-up), and this offers a more favorable risk to reward.

#2: A sign of strength

When the price forms a build-up at Resistance, it’s a sign of strength.

Because it tells you the buyers are willing to buy at higher prices (even in front of Resistance).

#3: Profit from losing traders

Imagine…

If the price is at Resistance, what would most traders do?

They’ll go short and have their stop loss above Resistance, right?

And the longer the price hovers at Resistance, the more traders will short and buy stop orders that would cluster above Resistance.

But what happens if the price breaks above Resistance?

This cluster of buy-stop orders gets triggered which fuels more buying pressure (and this increases the odds of a successful breakout).

This is powerful stuff, right?

Then let’s move on because I’ve got more to share…

The Bull Trap Pattern: How to profit from “trapped” traders

At this point…

You’ve learned what is a bull trap and how to avoid a Bull Trap and not get caught on the wrong side of the market.

Now, it’s time to trade the Bull Trap pattern and profit from “trapped” traders.

I call it:

The trapping candle strategy

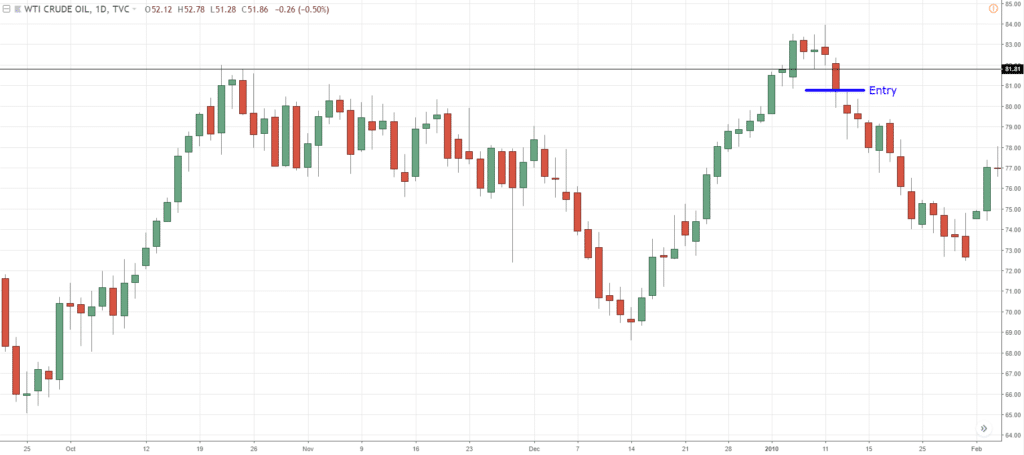

Here’s how it works in a ranging market…

- Identify a strong power move coming into Resistance (the stronger it is, the better)

- Let the price breaks above Resistance (to trap the breakout traders)

- Look for a strong bearish close below Resistance (entry trigger)

Here are a few examples…

Bull trap set up on WTI Daily:

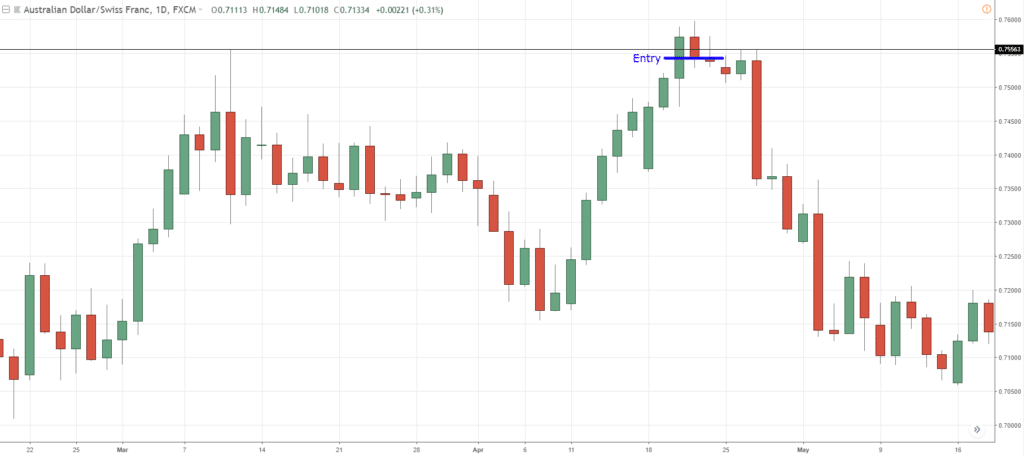

Bull trap set up on AUD/CHF Daily:

Bull trap set up on EUR/USD Daily:

Alternatively…

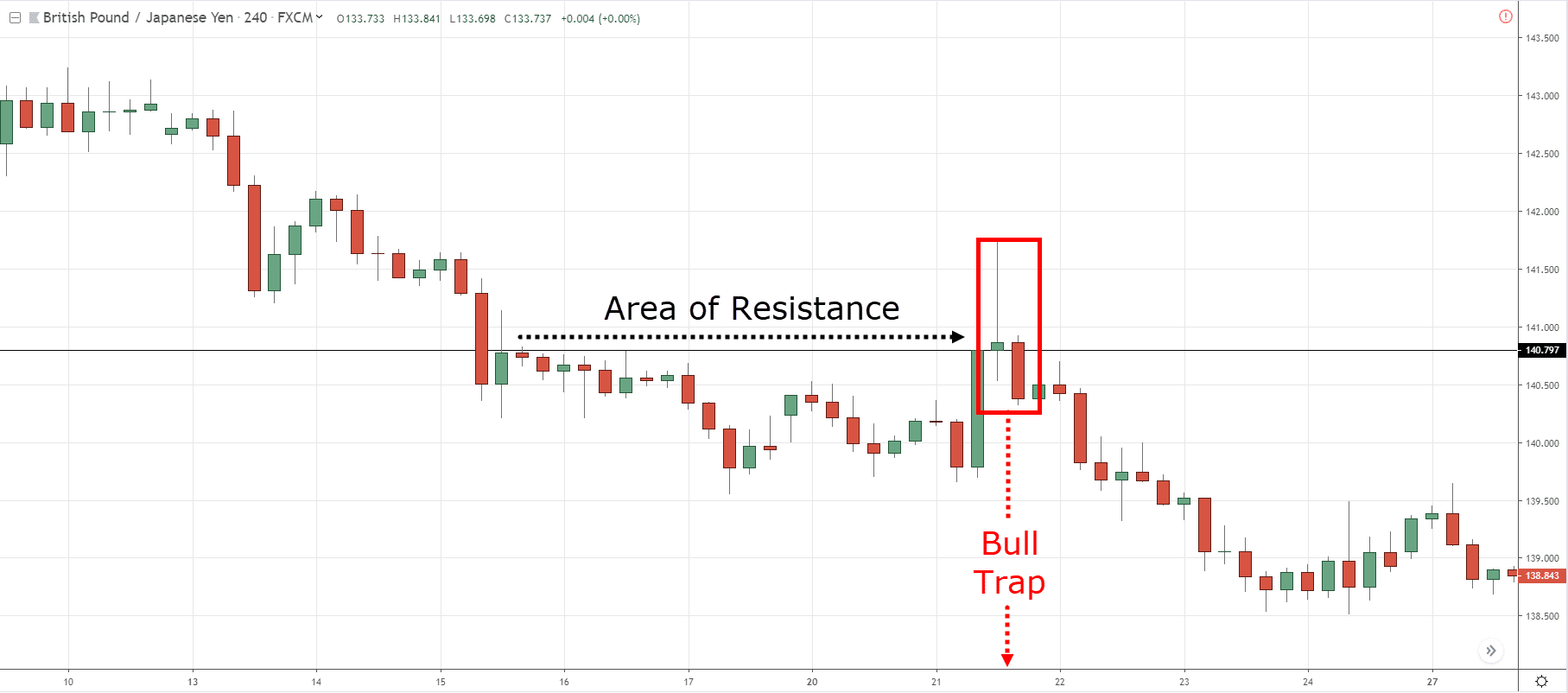

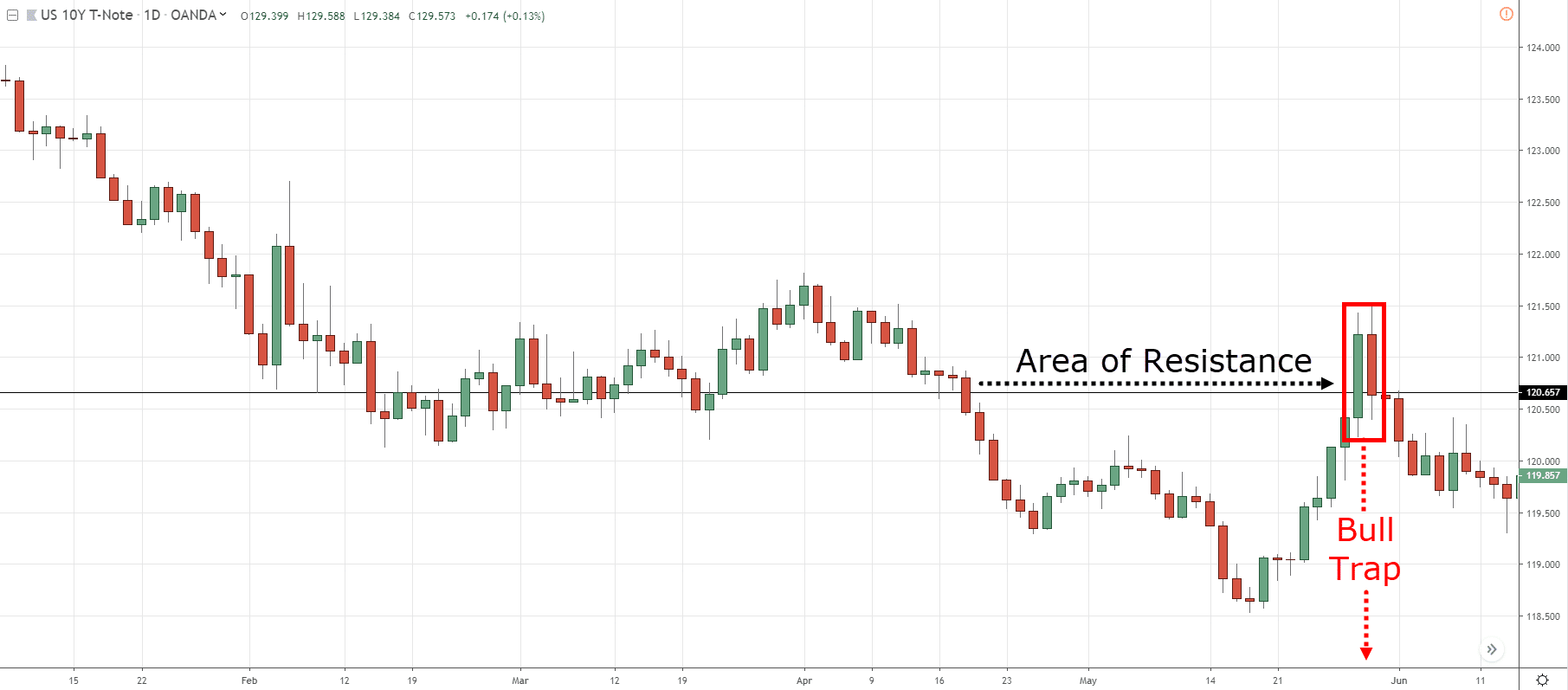

You can also profit from “trapped” traders hoping to score a huge bullish reversal in an existing downtrend.

Here’s how it works:

- Identify a deep retracement to previous Support (in a downtrend)

- Let the price break above the Support turned Resistance (to trap the bullish reversal traders)

- Look for a strong bearish close below the Support turned Resistance (entry trigger)

Here are a few examples…

Bull trap set up on GBP/JPY 4-Hour:

Bull trap set up on SGD/CHF Daily:

Bull trap set up on US 10Y T-Note Daily:

Next…

How to set your stop loss

Well, you can set your stop loss 1 ATR above Resistance.

This way, your trade has room to breathe and you avoid getting stopped out on a “sudden spike”.

Because volatility is what gives the bull trap meaning.

Here’s what I mean:

If you want more details, go watch this training video below…

Moving on…

How do you exit your winning trades?

If you realized:

The Bull Trap pattern requires you to go short against strong momentum.

Now if you’re correct, the market could quickly reverse lower quickly (and poof, profits).

But if you’re wrong, the market could quickly move higher (and boom, stopped out).

So, how do you exit your winners?

Well, what I’d like to do is trail my stop loss on the previous candle high.

This way, I’ll ride the move lower if the price continues lower.

But if it shows signs of strength by closing above the previous candle high, I exit the trade.

Here’s what I mean…

Trailing stop loss on WTI Daily:

Of course, this isn’t the only way to manage your trades.

You can also exit your trades at the nearest swing low, Support area, etc.

If you want to find out more, go watch this training video below…

Conclusion

So in today’s post, you’ve learned:

- A Bull Trap occurs when you buy a breakout only to have the price reverse lower

- 2 ways you can avoid a Bull Trap: 1) Stop “chasing” breakouts 2) Trade breakouts with a build-up

- A Bull Trap trading strategy to profit from “trapped” traders

Now here’s a question for you…

What do you think of the Bull Trap pattern?

Leave a comment below and share your thoughts with me.

Superb, simple, short, effective. Learnt new way of looking at break-outs…

Cheers Gemini!

Hi can u send this guide PDF to me

I don’t have it in PDF.

You are the best

Cheers

Rather you are smart person I learn from you a lot and I keep learning from you …what super man you are …all best wishes

Thank you, Ali.

Best!

Great Article, you doing great job brother.

Thank you, Rahul.

Superb. Learnt to trade breakout

Awesome to hear that, Doc!

How would you know when to buy the bullish breakout with confidence that it is not set up as a trap (ie wont reverse)… continuation. is there an indicator that you use?

I’d like to look for a buildup first to form prior to the breakout.

Following on further from this question, is there any recommended timeframe?

Hi, Dave!

Jarin here from TradingwithRayner Support Team.

There’s no recommended timeframe. It really depends on the timeframe you are trading on and what type of trader you are.

Here is an essential guide to trading multiple time frames:

https://www.tradingwithrayner.com/multiple-timeframes-trading/

Hope that helps!

This is an eye opener. Thanks very much for the tip.

My pleasure!

thank you rayn !

You’re welcome!

thank you Rayner. Perfect

Cheers

Rana, my problem in trading is not entering or exiting but consistency in WINNING!!! Is there an EA I can use to get winning always??? I am tired of blowing up my account always!!!

An EA won’t help you if you don’t have proper risk management.

Focus on your risk management first before anything else.

Thanks Rayner for such good Tip

My pleasure!

I have no words to say how good you are at your work. I am amazed!

Following you since couple of months and almost watched every single video you made and I swear I have polished my skills in a way that I never thought. I learned alot from your teachings and my prayers are with you. Love from Pakistan.

I need to ask one thing brother. I am facing some issues in my trading that I am not able to determine the TP level. I have practiced alot for the SL and its good now but sometimes for the TP, I mark the very next support/resistance as my TP but what happens is that my trade won’t even gets 1R. I want you to make a detailed video on how to determine what TP level will be good for a particular trade. OR, If you can simply reply to my quetion here that would also be very appreciable. Thank you soooooo much for your efforts to teach us man. May GOD bless you with every thing you want!

Thank you, Diabu. I’ll look into it, cheers.

Thanks Rayner… good and very practical strat…. I have now a different look and approach whenever there’s a break-out,… I already know where to put my entries…..

Awesome to hear that, Toni!

I always learn something new from your post. Thanks

You’re welcome, Tony!

Learned a lot. Thanks Rayner.

Cheers!

Yeah really amazing, you have a great way to explain things so clearly. Its very appreciated.

My pleasure, Dan!

Hey Rayner i was trading s&p 500 futures this week and i got caught by the “Bull Trap”,just as i was about analyze what went wrong i saw this article on my email. For the first time in 1 year i am becoming consistently profitable.Thanks a Lot

Awesome to hear that, Ashford!

Really useful stuff. Was struggling on entry and stop loss but this has helped alot.

Awesome to hear that, Darren!

You are genuine person to help traders, it will help lot for me sir, thank you sir

Cheers Shiva!

Thanks very much nice job

My pleasure!

wow..awesome learning with you always

Cheers

Hi Rayner, you is the best teacher I ever seen, Previously I used to trade Cryptocurrency with no any basic, I appreciate on your articles especially in your website through Academy , Now I know many things in Forex trading and after one month I will start to trade after finishing to study what you have provided in the site. Receive many Congratulations on this

From Dar es Salaam Tanzania

Awesome to hear that, Switbert!

Its been am amazing learning process going through your youtube videos, blogs and books. I am able to choose and trade on my own more confidently these day unlike the days when I was more dependent on tips providers. Thank you

Awesome to hear that, Ashoke!

Thanks for the time and effort you put into this, Rayner. You have helped me a lot.

I love a strong trend thanks to your books, this specific email will help a lot.

Awesome to hear that, Eric!

Thanks a lot for sharing your valuable knowledge… Many people are cheating innocent people by charging hefty fees for useless courses.

Your course contents cannot be compared with any of those people who are offering paid course which is of no use.

We are very thankful to you for helping people like us because of we are able to learn and earn in the market.

I’m happy to be of help, Rajesh!

Good point to note rayner

Cheers

Thanks Rayner, this is so timely. Thanks for sharing..so grateful.

My pleasure!

I don’t have clear how to calculate the ATR for the stop loss.

This post might help… https://www.tradingwithrayner.com/atr-indicator/

I learned very required knowledge from your posts and videos. Thank you so much

My pleasure!

Excellent information and very useful guidance when thinking about entry and stop loss.

Cheers Darren.

Great article with full of common sense. By chasing no one can make money. Thank you for the information

You’re welcome!

Simple and straight to the point, thanks Rayner.

Cheers

Thank you Rayner. That is how I my account got stoped out trying to trade breakouts. I have learnt alot today.

You’re welcome, Roelien!

I super celebrate you.Rayner.Thanks alot

My pleasure!

RESPECTED TEACHER ,I am glad to say it is best of all

Hey Rayner, could you please guide us on some of technical indicators?

I’ve written a number of articles on it here… https://www.tradingwithrayner.com/category/blog/trading-indicators/

I’ve learnt a lot from you this past months. Thanks and God bless you.

Awesome to hear that!

This is helpful Rayner,thanks!

Have a wonderful day.

Cheers

Great stuff only no fluff you are my superhero in trading RAYNER TEO always saving my ass thanks for the effort you put to save retail traders from self-destruction thanks thanks…Yu are the best

Cheers bud

You are a genius

I do what I can.

can we use bollinger bands along with support and resistance to understand whether a stock is consolidating or not before breakout

how can i join your blog. please send me link for join your blog

You’re here now.

Hi good Rayner. I hope that everything is ok. A bull trap I think that is very good because we have a tiny SL.

hi dear Rayner. Your lessons are precious gems. I’m so glad learn from you, a big man with a big heart. At the moment I’M not currently profitable because I have to fight against my brain, with metodology, wellness. I have a demo account of 1000 euros. My brain is not too fast, I need to watch and revieuw a lot of time. You gime me a interior power for a better life. I’m a dreamer, ever since I was a child, now I’ve almost reached one of it.I’m a dreamer, ever since I was a child, now I’ve almost reached it. At the moment I live with the pennies of money, they are hard times in the mountains…

GREAT!!!!. VERY USEFUL INFORMATION.

Glad to help, Pravin!

good examinations. thanks

Hey Refik,

You are welcome!

Excellent tactic. I have to try it or back test it and see it’s efficacy.

Hey Sanjay,

That’s good!

Cheers

I love your training I have learn much from you now I will put it in practice god bless you

Hey Ebueme,

You are most welcome!

Rayner, Thanks for explaining the real difference between true break out and a trap.

Hey Jay,

I’m glad to hear that!

Very Powerful stuff Man!!! you’re the real super man ( -.<)

Hey Matimu,

You are most welcome!

Hello Rayner,

I‘m an Austrian (Vienna) trader and english translation is sometimes difficult. What are „parabolic“ moves. Google translate is not helpfull. Can you please describe this term for my Vetter understanding? Trank you so much…

BTW:

Hermann

Hey Herman,

Parabolic moves are strong impulsive moves. Where you have a series of strong green or red candles breaking out.

Cheers!

Keep up good work Rayner, learnt a lot from you.

Hey Shaan,

You are most welcome!

very nice explained, but some times there are sudden moves that hits the SL and sometimes it goes very fast from uptrend to downtrend that is not stoppable, anyway good point I you mentioned

You make things really simple and powerful…thanks..

Hi Pranav,

I’m glad to hear that!

Thanks Sir, you have really added new things to my career in life

Hi Cornelius,

I’m glad to hear that!

Insightful, simple, logical.

Hi Bobby,

Thank you!

Sometimes , after giving breakout over resistance in bullish market, stock comes back below resistance and then consolidate for sometime, then how to predict in which direction it will move now.

Hi Rayner,

You explain as simple as it is understandable to layman, and its very very effective in implementation.

Thanks and keep it up.

My friend.

Hi Shreenivas,

You are most welcome!

Thank you…

Great lesson Rayner, i have to practice this on my demo, does this strategy also work on currencies and indices( vix75, boom and Crash).

Hi Cricious,

I’m glad to know you will be backtesting.

Backtest the strategy to find out.

Cheers.

Great teaching! For the first time, I now understand the Bull Trap trading strategy. Thank you so much.

Hi Halima,

I’m glad to know that!

Cheers.

Waaoh! This is a fantastic trading strategy. There’s so much to learn from you Rayner. Thanks a lot Brother!

Thank you Rayner for explaining it in simple terms.

Love from INDIA.

Regards

Rahul

Hi Rahul,

You are most welcome!

Cheers.

You simply the best, thanks Rayner I love your work…..

Hi Nwachukwu,

You are welcome!

Thanks for sharing your ebook Sir Rayner

Hi Sixto,

You are most welcome!

I couldn’t understand why the entry is above and exit is below for WTI daily. Wouldn’t it be a loss?

Hi Vinod,

That’s the principle of a bull trap.

Set your pending order and let the price come to you.

Cheers.

Always a pleasure to learn from your articles. Thanks

Hi Devyanshu,

You are welcome!

Cheers.

very nicely explained. Thanks Rayner

Hi Ganesh,

Thank you!

Cheers.

Great Rayner. You are an excellent teacher. My (demo) trading is improving a lot from what you have taught me.

Hey Mark,

You are most welcome!

I’m glad to hear that.

Thank you for the training. It makes a lot of sense. I have two questions to ask:

Does every buildup from a resistance lead to breakout (uptrend)?

Also, is it advisable to trade swings during buildup?

Your explanations are always insightful and revealing. Thanks.

Hi Gospel,

You are most welcome!

Hi Rayner! Thank you for the enlightenment.

It’s Bull trap is a fakeout that makes bullish trader lose the particular trade, because of wrong entering.

I’m glad to hear that, John!

Can you plz elaborate on parabolic move breakout…..

thanks

Hey hey mu friend 🙂

I love your lessen always easy to understand and always learning new things.

Thanks my friend

Thank you, Shim!

Hi Rainer, I read Price action trading secrets, your book. Your teachings are very easy to understand, your methodology is fantastic and is, all, practical stuff not pure theory. Today’s bull and bear traps excellent and is like a contrarian way of trading.

I’m glad to hear that, Alfred!

its easy to understand and simple there’s a lot I’ve learnt from it.

Glad to hear that, Ayavuma!

It’s superb knowledge i have got today. It’s helpful to me. Thanks for sharing this.

I’m glad to hear this, Harsh!

Rayner, thank you!

You are welcome, Kat!

Great.

I Trade On Daily Time Frame.

Uptrend.

After Build up with few red doji , i got a bullish candle closes previous high.

Can i enter at this point ??

Suggest me.

Pullback back system is excellent! And prefer the build up breakouts. A fast osculatory like stochastic 8,3,3 may help as will a good volume indicator to help judge fake breakouts at a resistance point

Glad to hear that, Rori

This is powerful technic wonderfull explained breakouts

you r the best teacher in world sir

Thank you, Gaurav!

This is great stuff, inline with your book Price Action Trading Secrets which I read recently, where you explained the concept of build ups and breakouts, makes sense like a jig saw puzzle put together

Glad to hear that, Deepak!

Learning a lot from you.

Awesome, Trader!

Woow! This is really enlightening. Just amazing! What else can I say? Thanks, Rayner-The Man.

Awesome, You are the man, Karlo!

Rayner you amaze with each post….you have an awesome way to anyalyze and explain !!..God bless..

Thank you, BG!

Hey Rainer, thank you for your insight info and knowledge of trading. You opened a new world for me with many doors. Thank you very much for all the efforts and education of people like myself. I hope one day we walk into each other in Singapore and go for some amazing street food. Bless you

You are excellent, Rayner

I’m glad to hear that, Frederick!

WOW!!! Great info.

Can this be used on any ti.e frame?

Nice

Cheers!

Thanks you very much for what your shared knowledge that amazing.

You’re most welcome, Aung Naing Htoo!

Awesome

Cheers!

Quite easy to understand. I’m delighted to have you, Rayner!

Thank you for your kind words, Emmanuel!

Cheers!

Rich and easy-to-digest content

Thanks, Gaspar!

Im a new trader, thanks for this learnings. 🙂

U are great teacher. I learned lot from u. especially price action.

It was the least we could do, Brijesh.

You can also explore our free courses in our academy for additional learning. Here is the link:

https://www.tradingwithrayner.com/academy/

When you say, “Trade” after a build up, you should use the word “long” or the word, “short,” just to be clear.

Nowhere in this article are you specifying long or short.

great post, every natgas trader should read this before placing an order

Share the good news, BebaStarson!

Thank you so much For all this

God bless you

You are most welcome, Ravi!

A bull trap pattern is a tight build Up toward the resistance area before it’s breakout of the resistance zone and continue Higher. Thnks You so much Me Rayner for impacting knowledge on Us

Thank you for sharing, Ahmed!

Cheers!

Nice explanation

Thank you !

You’re most welcome, Joseph!

How do you identify those stocks that have a build up to put on your watch list

Hey there, Courtney!

Here’s how you can scan the stock market to put it on your watch list:

https://www.youtube.com/watch?v=4G1fIVPlX_w

Hope that helps!

Dear boss Rayner, I just want to let you knw you are blessing that God sent to me and money can’t buy the knowledge you are sharing everyday. Bull trap is another way and even simple way of good technical analysis.

Thank you for your kind words, Emiola!

Cheers!

Waooooo,

boss you are a gift.

Thank you for always exposing me to the wealth of your knowledge and especially for making it so easy and simple for beginners like me to learn and grow.

One day, I will have the opportunity of meeting you and telling you how much you have helped me in my financial freedom journey.

Thank you so much.

God bless you boss.

Cathyjewel.

Thank you for your kind words, Cathy!

Always a pleasure to help!

Nice concept I back check with GBPUSD it’s real. So can I use the same concept to trade bear trap?

Hey there!

Yes. That is the opposite of a Bull trap so you can use the same concept.

Hope that helps!

God bless you sir….

Likewise, Takim!

Hi Rayner, can I trade this on a lower timeframe like 15 minutes chart because I can see that this concept is similar to false break set-up ?

Hi, Oliver!

Jarin here from TradingwithRayner support team.

Yes. You can. This strategy may work on a lower timeframe, too.

Hope this helps!

Très enrichissant

Beyond grateful, Mamadou!

Thank you for the rich explanations of different trading subjects.

You are most welcome, Adnan!

Thank you so much, am a new beginner,am learning a lot from you

You’re welcome!

Wish you all the best, Alinur!

Thanks for the intriguing information. This is really worthwhile and eye-opener.

Hope it helps you, Ilbeh!