Let me ask you…

Have you ever taken a loss only to see the market reverse back to your intended direction?

And you can’t help but feel that “someone” is stop hunting you.

It sucks.

The world is unfair.

The market is rigged.

But is that really the case?

Or did you put your stop loss at the worst possible level — which makes it easy to get stop hunted?

If that sounds like you, don’t worry.

Because in this post, you’ll learn:

- What is stop hunting

- Does your broker hunt your stop loss (it’s not what you think)

- How the smart money hunts your stop loss

- How to set a proper stop loss and avoid stop hunting

- A Forex stop hunting strategy

You ready?

Then let’s begin…

What is stop hunting and why only losing traders suffer from it?

You might wonder:

“What is stop hunting?”

Well, it’s a term often used by losing traders who got get stopped out of their trades, only to see the market reverse back in their intended direction.

Now…

Why do I say losing traders?

Because only losing traders blame the market, their broker, the smart money, and everything else — besides themselves.

And this is a big problem!

If you blame others, it means you’re not taking 100% responsibility.

If you don’t take 100% responsibility, you are giving up your power to change.

If you give up the power to change, you’ll never improve for the better.

Here’s the deal:

You don’t see winning traders complain they are getting stop hunted.

Why?

Because they take 100% responsibility for their actions!

So…

The first step to avoid getting stop hunted is to take 100% responsibility — and only then can you become a better trader.

Now, let’s move on and answer a burning question that’s on your mind…

Stop hunting: Does your broker hunt your stop loss?

You might be wondering:

Is there actually a stop loss hunting tactic that brokers use?

Most regulated brokers don’t hunt your stop loss because it’s not worth the risk.

Why?

Think about this:

If the word gets out that ABC broker hunts their client stops loss, it’s only a matter of time before existing clients pull out of their account and join a new broker.

If you are a broker, would you want to risk doing that over a few measly pips?

I guess not.

Most brokers don’t hunt your stops as the risk far outweighs the reward.

Now, you are probably thinking…

“But my broker widens the spread and stops me out of my trade.”

There is a reason for this. Let me explain…

A broker widens their spreads during major news release because the futures market (which they hedge their positions in) has low liquidity during this period.

If you look at the depth of market (aka the order flow), you’ll notice the bids and offers are thin just before major news release (like NFP) because the “players” in the market are pulling out their orders ahead of the news release.

Thus, you get thin liquidity during such period which results in a wider spread.

And because of this, the spreads in spot forex is widened (because if it isn’t, there will be arbitraging opportunities).

So, it’s not that your broker is widening their spread for fun, but they are doing it to protect themselves. But it’s commonly misunderstood as brokers doing stop hunt in forex.

The bottom line is this…

Most brokers do not employ stop loss hunting because it’s bad for business in the long run. And they widen the spreads during major news release because the futures market is thin during this period.

How the smart money hunts your stop loss

Here’s the thing:

The market is to facilitate transactions between buyers and sellers. The more efficient buyers and sellers transact, the more efficient the market will be, which leads to greater liquidity (the ease of which buying/selling can occur without moving the markets).

If you are a retail trader, liquidity is hardly an issue for you since your size is small. But for an institution, liquidity becomes the main concern.

Imagine this:

You manage a hedge fund and you want to buy 1 million shares of ABC stock. You know Support is at $100 and ABC stock is trading at $110. If you were to enter the market you will likely push the price higher and get filled at an average price of $115. That’s $5 higher than the current price.

So what do you do?

Well, you know $100 is an area of Support, and chances are, there will be a cluster of stop-loss underneath (from traders who are long ABC stock).

So, if you can push price lower to trigger these stops, there will be a flood of sell orders hitting the market (as traders who are long will exit their losing position).

With the amount of selling pressure coming in, you could buy your 1 million shares of ABC stock from these traders. This gives you a better entry price, instead of hitting the market and suffer a slippage of $5.

In other words, if an institution wants to long the markets with minimal slippage, they tend to place a sell order to trigger nearby stop losses.

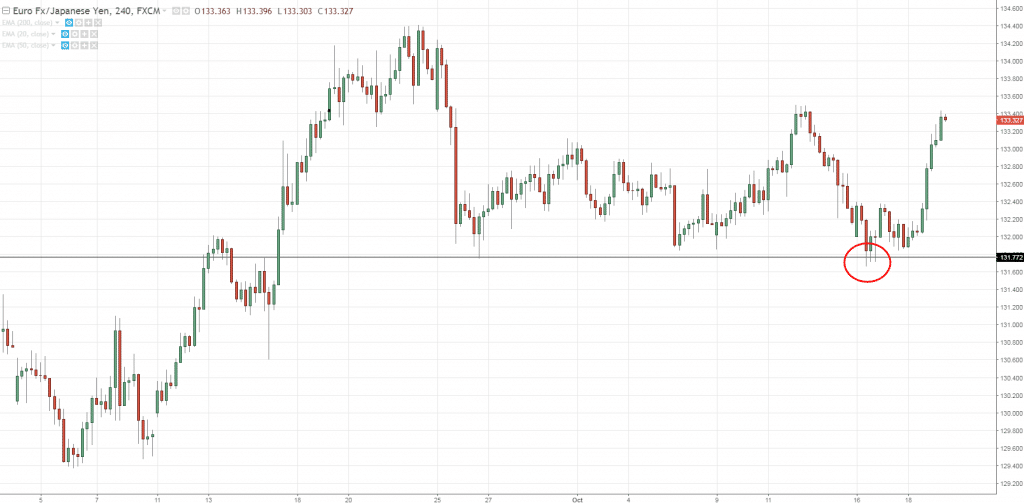

This allows them to buy from traders cutting their losses, which offers them a more favorable entry price. Go look at your charts and you’ll often see the market taking out the lows of Support, only to trade higher subsequently.

An example:

Now, let’s move on to something really important…

How to avoid stop hunting by setting a proper stop loss

Here’s the deal:

There’s no way to avoid stop hunting completely because that’s like saying “how do I avoid losses entirely?”

It’s impossible.

The market goes where it wants to go and all you can do is participate in the move and cut your loss when you’re wrong.

Still, how to avoid stop loss hunting then?

You want to set a proper stop loss so you don’t get stopped out “too early”.

Here are 3 techniques you can use:

- Don’t place your stop loss just below Support (or above Resistance)

- Don’t place your stop loss at an arbitrary level

- Set your stop loss at a level where it invalidates your trading setup

Let me explain…

1. Don’t place your stop loss just below Support (or above Resistance)

Now it’s clear to you that setting your stop loss just below Support (or above Resistance) is a bad idea.

Why?

Because that’s where most traders place their stop loss.

And this incentivizes the smart money to push the price to that area as it offers them better entries & exits on their trades.

You’re probably wondering:

“So, how should I set my stop loss?”

You should set your stop loss a distance away from Support/Resistance.

For example: You can use the Average True Range (ATR) indicator to decide how much “buffer” you want to give.

It can be 1 ATR, 2 ATR, or even 3 ATR away from Support & Resistance area.

If you want to learn how to use the ATR indicator to set your stop loss, then go watch this video below…

2. Don’t place your stop loss at an arbitrary level

It’s funny.

Most traders are fixated with the perfect entry, trying to nail the absolute top and bottom in the markets.

But when it comes to placing your stop loss… where do you put?

At an arbitrary level. What the f***, seriously.

You do it because it’s the “right” thing to do — to apply proper risk management.

So you place your stop loss in the most convenient way possible. Perhaps it’s 50pips, or maybe 100 pips, or even 200 pips.

But here’s the deal:

The market doesn’t care where you put your stop loss. It moves from an area of liquidity to the next area of liquidity, and if you place your stop loss at a random level — it will get eaten alive.

Now you’re probably wondering:

“So Rayner, how should I set my stop loss?”

The general rule is this…

You should set your stop loss at a level which invalidates your trading setup. I’ll explain more in the next section.

Read on…

3. Set your stop loss at a level where it invalidates your trading setup

Here’s the thing:

Whenever you enter a trade, it’s probably based on a technical pattern (like breakout, pullbacks, and etc.).

So, it makes sense that your stop loss should be at a level that makes your technical pattern invalidated.

This means…

If you’re trading a breakout, then your stop loss will be at a level where if the price reaches it, the breakout has failed.

If you’re trading a pullback, then your stop loss will be at a level where if the price reaches it, the pullback has failed.

If you’re trading chart patterns, then your stop loss will be at a level where if the price reaches it, the chart pattern has failed.

Now go watch this video below where I’ll explain it to you step by step…

And once you’ve defined a proper stop loss, the next thing is to apply proper position sizing so you don’t lose a huge chunk of capital — even if you’re wrong on the trade.

If you want to learn more, go read The Complete Guide to Risk Management and Position Sizing.

A Forex Stop Hunting Strategy

Here’s the truth:

You probably don’t have enough capital to push the markets and trigger other trader’s stop losses.

Still, you can take advantage of this phenomenon and enter your trades after they get stopped out.

Here’s how…

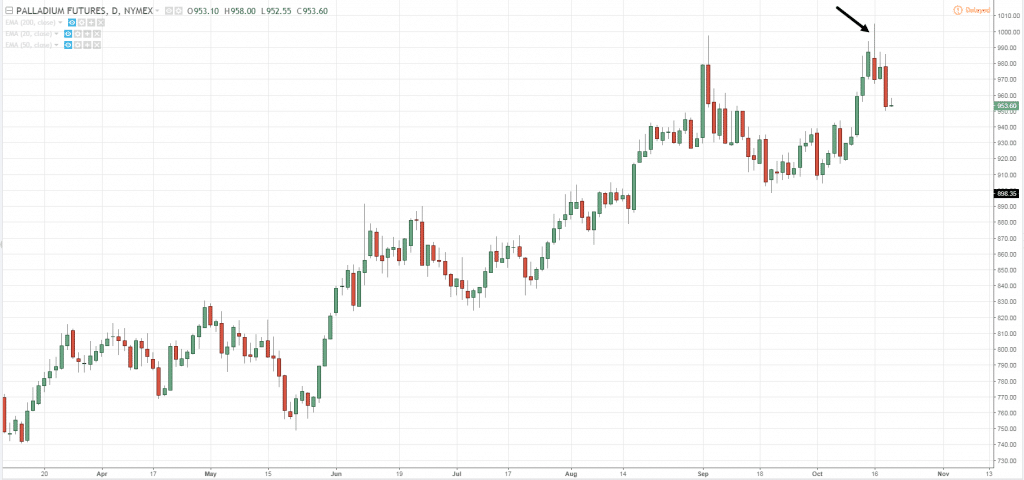

- If the market is approaching an obvious Resistance level, then let it trade above it (and trigger the stop losses)

- If the price trades above the level, then wait for a strong price rejection

- If there’s a strong rejection, then go short on the next candle

- And vice versa for long

An example:

Now that you’ve learned the Forex stop hunting strategy, you must also consider…

- Where will you put your stop loss?

- Where will you take profit?

- How much will you risk per trade?

- How will you manage your trade?

- Which markets will you trade?

These are important considerations that must be part of your trading plan.

Frequently asked questions

#1: But I won’t get stop hunted if I don’t put a stop loss at all, isn’t it?

Yes, you won’t get stop hunted if you don’t put a stop loss.

But if the market reverses against you such that you don’t have enough margin to support your existing position, you risk losing your entire trading account.

#2: What % of your trading account do you risk per trade usually?

I usually risk not more than 1% on each trade.

#3: If I use a smaller position size in order to have a wider stop loss, then wouldn’t my gains be rather small each time?

Yes, your gains will be smaller since the market needs to move more in your favour to earn a certain dollar value.

However, the upside is that your losses will be contained – which is key to staying in this business.

You want to control your losses instead of worrying about how much you can potentially make. Why? Because when you’re trading with an edge, eventually, you can scale up the size of your trading account and that would increase the dollar value of your trades.

Conclusion

So here’s what you’ve learned today:

- What is stop hunting and why losing traders suffer from it

- The truth behind whether your broker trades against you, or not

- How the smart money hunts your stop loss and how to avoid it

- My 3 practical techniques to help you avoid stop hunting

- A Forex stop hunting strategy that works

Now here’s a question for you…

How do you avoid stop hunting?

Leave a comment below and let me know your thoughts.

Thank u so much Rayner….

Hi, Rayner

Great article. Keep it on.

Would appreciate if you could kindly recommend some regulated brokers from Singapore. I’m about to start venturing into Fx trading business. Thank you.

I don’t publicly discuss brokers because in this day and age, we have no idea what goes on behind the scenes.

If you want a recommendation, drop me an email me and we can discuss it.

cheers

you’re welcome, Nayan!

Thanks Rayner very well explained thanks for all you do keep up the good work.

The pleasure is mine, Barry

WAO Rayner, you just blow my mind in the post, i have followed most of your recommendations here and sincerely speaking, its working perfectly for me. What i have learnt for free through your videos and blog posts is more valuable than Forex strategy that i have paid for.

THANKS A MILLION!!!

Awesome to hear that, Ojo!

Rayner, you are awesome! Thank you for your reading material but I need time to digest because i am much, much older than you. I just venture to forex market two months ago and having hard times. Your reading material and videos are timely & helpful. Keep up the good work & God bless you.

Glad to hear it’s helping, CK.

Hey Rayner

Thank you very much, ever since I have started following you I have seen so much improvement in my trading.

We really appreciate the effort you apply as well as your time you spend just to save us retail traders. I just can’t thank you enough may God keep on increasing you with more wisdom.

I’m happy to hear that, Dave.

cheers

Thanks Rayner. That was helpful. God bless

You’re welcome, Agnes!

After this post I took some time scrutinising a few charts based on “How the smart money hunts your stop loss” and I have to say, this is the best investor psychology I’ve been waiting for. You have opened my mind to a new way of readings charts, its not just patterns and money management. I believe this is a great weapon to add to my arsenal. Thank you so much Rayner, Thank you!

I’m stoked to hear that, Thami.

cheers

Hi, well I’ve actually been SL hunted in the past from a well known broker.

I was actually sat in front of the charts when it happened, and the wife saw it too. I was long, price spiked down to where a logical place for stops would be, then price bounced upwards. Then the spike disappeared off the chart.

I checked on other charts and no spike showed up. Broker was a market maker, so be careful of those types. I closed that account quick smart, researched some more and opened a ECN account with another broker. I haven’t been SL hunted (as far as I know) since then.

Thanks for sharing, Phil.

Could you please share which broker you are using, Phil. Thank you.

I don’t publicly discuss brokers because in this day and age, we have no idea what goes on behind the scenes.

If you want a recommendation, drop me an email me and we can discuss it.

Your are wrong with the idea that stop loss does not exists! It is caused not by the brokers that just manipulate the spread but by market makers (banks, hedge funds, etc) that control the market. There are many videos on Youtube that illustrates this process. This happens not necessary at tops and bottoms but at fib levels as well. The explanation how to place a stop loss is too simple, it would be too easy then..Market create fake breakouts just to go in the opposite direction. I do not know many traders who would be able to keep 200-300 pip stop loss if you trade on H4 chart.

Thank you for sharing, Saulius.

I felt I almost have to feed the market some loss before I really know their intention. Recently my stop for FATE below 4 was triggered, then it came right back above 4. Then I bought again. This is a confirmation. My old me would not buy back. But now I know enough here I should buy more since probability is much higher. If my stop loss never triggered, or I never bought this stock, I would not be able to see it so clearly and catch it so perfectly. I have been thinking if I could avoid this loss by just watching, but somehow I never got the same gut feeling. … I wonder if that is some business cost I have to pay. It happens soo often, the accumulated small losses can not be ignored. I always use stops, but it is very frustrating, There is never a perfect place. Recently AXTI had a price jerk from 9.20 to 7. The minute it triggered my stop with 10% loss, I know it should be bought back. — Is this something I really have to live with? — This happens a lot, if it only happens occasionally I can live with it, but it happens so often it makes me wonder if the stop should be really an alert. — my constant struggle.

Thanks for sharing, Kaiyu.

my new way of trading is buy everything small, when I get stopped out and got a price rejection, then I go bigger. But after all it is a cost, always makes me think if I can reduce this loss more. During a range, should I always wait for a price rejection to get in( that means I will miss some trades) or the size is so small in the first round and trades go my way and I make a very tiny no meaningful profit …. no perfect solution.

>> At an arbitrary level. What the f***, seriously.

>> You do it because it’s the “right” thing to do — to apply proper risk management.

Hi Rayner, good article.

Regarding that point above, I noticed that trying to put the stop loss where the trade is proved wrong (eg, a number of ATRs) meant that one has to use a much smaller position size to accomodate the extra risk, meaning that I was winning more often, but the winners were not meaningful in my account.

I then changed to arbitrary and minimum stop losses and I can take position sizes which are 25-30% of my account, which means that I am shakenout more often than before but without taking a big risk and in the trades where I am right, the percetage increase of my account is really meaningful until the point, that having one or two successful ones can make your year.

As we’ve been using the other approach, larger stops with smaller position sizes, what is usually the maximum % of the account you’ve got in one stop to have an idea?

Thank you.

Hey Mickael

For me, I’d risk not more than 1% of my capital on each trade.

Yes, your gains will be smaller. But it’s all about slow consistent gains and not betting the farm on every trade.

cheers

I see. I’ll have a look at that approach and see what how my trades would have performed with it from a P/L point of view.

Thanks Rayner

[…] it gets stop hunted […]

Wonderful article. Need a full day to digest this and perhaps many readings over and over.

No problem, take your time!

I’m happy… thanks brother

Cheers

There are no ECN all are market makers and all hunt stops. Better to not even put a stop.

does the forex stop hunting strategy work also for stocks?

I’d say the concept can be applied to it as well.

I avoid stop hunting by placing my stops at area where it invalidates my trading setups

Thanks for this block post Rayner Teo!

Awesome to hear that!

Thank u so much Rayner for a great article,i feel lyk u were reading my mind coz i was about to change my broker coz i felt lyk they were hunting my stop loss each time i placed a trade….even during my schooling days i never had a teacher who explained and cleared everything lyk u do….u are the best my friend….may the Gods bless u with more wisdom and a long life.

Glad to help out!

Thank you so much on this write up,before i always get stop hunting but now i have confidence on my stop loss ,may God bless you….

You’re most welcome!

Thanks a lot for your help! Very interesting!

Cheers Pham!

Hi Rayner

Today, 31st March 2020 at around 12.50am GMT, AUDCAD (and many other canadian pairs) plunged (sell off) around 140pips in 5 minutes and recover back within the next 5-10 minutes. It then resume back business as usual at its original price before the plunge.

I was 70 pips ahead before it happen, and in the end, it hit my stop loss with -70 pips. I just woke up and was about to move my stop to breakeven and the plunge happened. Talk about timing. And the bottom of the plunge is where my stop loss is.

One way to avoid such situation is to set a trailing stop loss (MT4 platform), but can you advise what is the best method to set trailing stop loss? A too tight trailing would get stop out easily (but would keep most of the profit) and a wide trailing stop loss would not easily be hit but would lose back quite some profit if it does. Any good method to suggest here?

Vin

What is more important than absolute value of the price is the trend. Stop hunting usually result in very brief dip or spike. One potential strategy to avoid stop hunting is to open a stop loss order only if the trend has really changed and one or multiple candles closed below/above the price that you consider would invalidate your trade. With this, you can put stop loss tighter, to compensate the fact that if you wait for a candle to close before stopping, you may increase loss.

I don’t know if some brokers propose such feature for their stop loss but i would definitely be interested in that. If this is not available, another option would be to code a bot using the broker api to implement this behaviour.

Thanks makes perfect sense and I’m now at the point of selling into false breakouts and finally enjoying some of the benefits of market stops….

Awesome to hear that!

Rayner un saludo desde Ecuador. eres muy didactico.

He leido tantos documentos de forex y tu logras generar una comprensión única en esta materia. Felicitaciones!!!

RAYNER I GREET YOU. I will allow the trade to finish it’s python dance at my area of value before I join (patient).

Hey Eric,

I’m glad to hear that!

Hey Rayner, as a beginner, learning forex trading was the hardest thing I ever encountered until I met your telegram channel.Your blogs are simplified and reliable to an extent that anyone else can understand regardless of academic background.Please do something on volumes.

Hey Alfred,

I’m glad to hear that!

Thank You Rayner 🙂

Rayner thank you for making me understand forex more than I did earlier.

Hi Eze,

It’s my pleasure…

Thank you for the info

Hi Vinayak,

You are most welcome!

Cheers.

Great info, i love it, i hate to be hunted.

Hi Keaboka,

You are welcome!

Cheers

hi Rayner (or “Tochukwu / Team Twr”?) thank you for all your info and hard work! Your articles are great, and I’ve also been burned with many of these issues (being stop hunted and losing my position just before what would have been a great trade, or entering at the wrong time/ direction, etc).

I do have a question about the example chart above, however – while I agree in principle that you could go short at that point, isn’t it also the case that this example is a rather strong uptrend, with the lows moving higher each time (while resistance is staying flat), so doesn’t this suggest that an upward breakout is about to happen and we should instead wait for a reversal after hitting support, to go long instead?

If that’s the case, what would be a good way to identify support in a case like this, when it’s approaching resistance? Ie, how would we decide, in this example, between (1) going short as in the figure, (2) waiting a bit more for it to hit support, then going long, or (3) getting ready for an upward breakout instead? (where choice 2 could also place you in a happy early entry before the upward breakout).

Any insights into how to decide between the above 3 choices in this example would be appreciated.

thanks again!

Fantastic!! Thank you Rayner. Learned a lot from your videos.

Glad to hear that, Yoomes!

Hi rayner, thanks for the wealth of knowledge always shared with us.

I’ve been unable to purchase your latest best selling book “Price Action Trading Secrets” from Amazon.

Anytime i tried to order for the book, it tells me that the book is not available for purchase in my country. I’m from Nigeria, please how can i get the book?

Hey Elijah,

You can use this link.

https://priceactiontradingsecrets.com/

Cheers.

my answr. applying these rules learned in this lesson with effect.

thanks much #RAY.Can’t miss following your stuff

You are welcome, Cheborgei!

I tell everybody about Rayner and how he teaches the starter and makes him a better trader thank you very much you’ve really helped my strategies.

You’re welcome, Robert!

I bought a pdf of price Action trading secrets but I haven’t received it on my email 2hrs ago send the pdf my email address is rofhiwa50@gmail.com again

Hi Rofhiwa!

Please email support@tradingwithrayner.com so we can assist you with this matter.

Thank you!

A Masterpiece!

Standing Ovation Sir Rayner!

Thank you for appreciating Alfred!

Cheers!

I see this so often and this is the perfect explanation, thank you Rayner!

You’re most welcome!

Thank you my mentor for me in most cases i open a small lot and i leave it to move its way with no stop loss and it works for me better

Thanks Reiner for your free education may God bless you

You’re truly welcome, Daniel!

Thank u so much, Rayner. Your explanation made me understand why the market was chasing me.. Your article is highly appreciated..

Hey there, Bhubon!

Jarin here from TradingwithRayner Supoort Team.

I am happy to know you learn something from Rayner’s blog. I hope you don’t forget the tips and techniques that were mentioned.

Wish you good luck and good trading!

Cheers!