Swing trading is one of the few trading approaches that’s suitable for the retail trader — even if you have a full-time job.

Why?

Because it doesn’t require you to spend all day in front of your screen, and it still offers enough trading opportunities so you can generate a consistent return from the markets.

Do you want to learn more?

Then today’s swing trading guide is for you because you’ll learn:

- What is swing trading and how does it work

- Where to find the best swing trading opportunities

- How do you time your entries for swing trading

- Where to set your stop loss so you don’t get stopped out prematurely

- Where to take profits before the market does a 180-degree reversal against you

- A swing trading strategy that works

Are you PUMPED?

Then let’s begin!

Swing trading basics: What is swing trading and how does it work

Swing trading is a trading methodology that seeks to capture a swing (or “one move”) in the markets.

The idea is to endure as “little pain” as possible by exiting your trades before the opposing pressure comes in.

This means you’ll book your profits before the market reverse and wipe out your gains.

Here’s an example:

Here’s an example of swing trading on USD/JPY:

And here are the pros & cons of swing trading…

Pros:

- You don’t need to spend hours in front of your monitor because your trades last for days or even weeks

- It’s suitable for those with a full-time job

- Less stress compared to day trading

Cons:

- You won’t be able to ride trends

- You have overnight risk

So far so good?

Then let’s move on to cover swing trading entry exit strategies…

Swing trading methods: Where to find the best trading opportunities

Let me ask you:

When you go down to a supermarket and you’re looking to buy apples, would you buy it when it’s for $10?

Unlikely.

You’d rather wait a few days to see if the price drops so you can buy it for $2 or less.

And it’s the same for swing trading!

You don’t want to go long when the price is sky-high.

Instead, you want to enter from an area of value where the price is “cheap”.

You’re probably wondering:

“How do you define an area of value?”

Well, you can use…

I’ll explain…

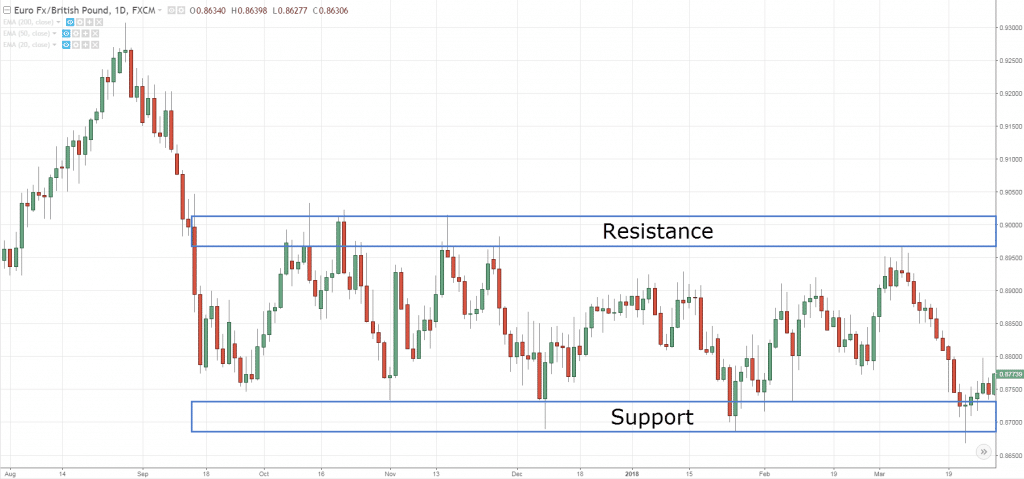

Support and Resistance

Support – an area on your chart with potential buying pressure

Resistance – an area on the chart with potential selling pressure

An example:

So if you want to “buy low sell high”… then long Support and short Resistance.

But that’s not all because you can also use…

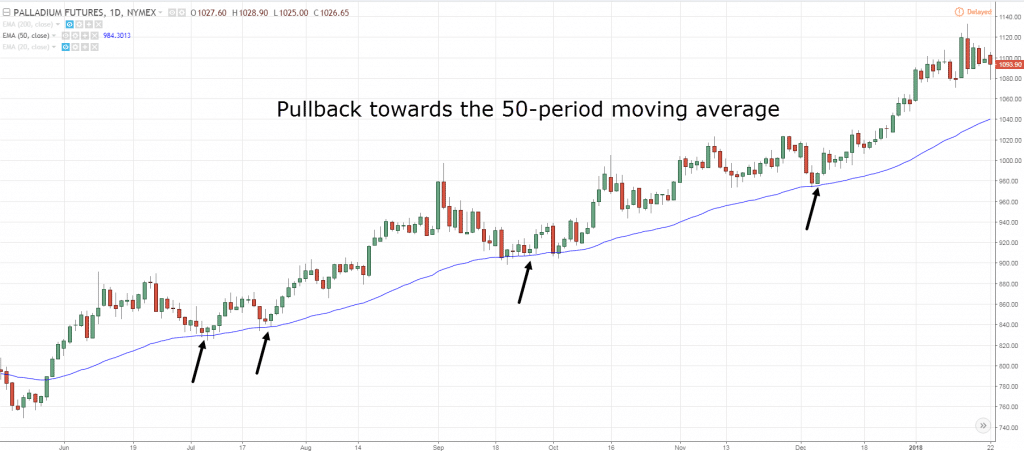

Moving Average (MA)

Here’s how it works:

When the market is trending, it doesn’t go up in one straight line.

Instead…

It moves higher, pullback towards an area of value, and then continue trading higher.

And where does the market retrace to?

Possibly towards the Moving Average.

An example:

Pro Tip:

In a strong trending market, the price tends to pullback towards the 20MA.

In a healthy trending, the price tends to pullback towards the 50MA.

In a weak trend, the price tends to pullback towards the 100MA and beyond.

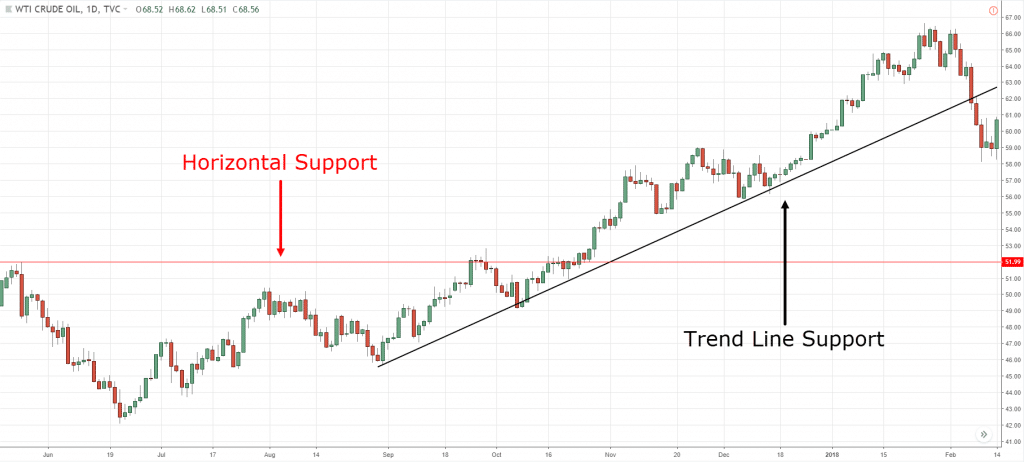

Trend Line

Upward Trend Line — “Sloping” area on the chart that shows upward buying pressure.

Downward Trend Line — “Sloping” area on the chart that shows downward selling pressure.

Here’s an Upward Trend Line example:

Next:

You’ll discover more on swing trading entry strategy and how to better time your entries when swing trading.

Read on…

Swing trading: When do you enter a trade?

There are generally 2 ways you can go about it.

You can enter a trade the moment the price reaches an area of value or, let it show signs of reversal before putting on a trade.

Now there’s no right or wrong, both approaches can work.

But personally, I’d prefer to let the market show signs of reversal first.

Here’s how…

- The False Break

- Bullish reversal candlestick patterns — Hammer

- Bearish reversal candlestick patterns — Shooting Star

Let me explain…

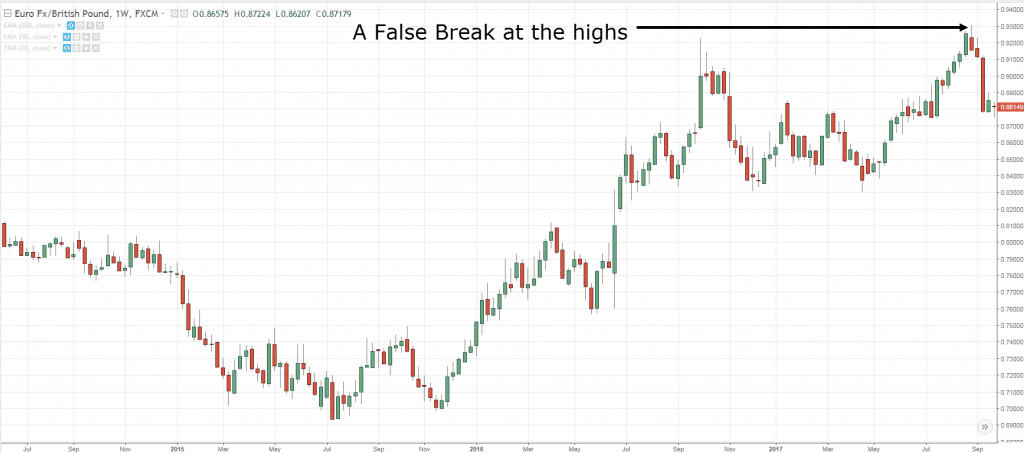

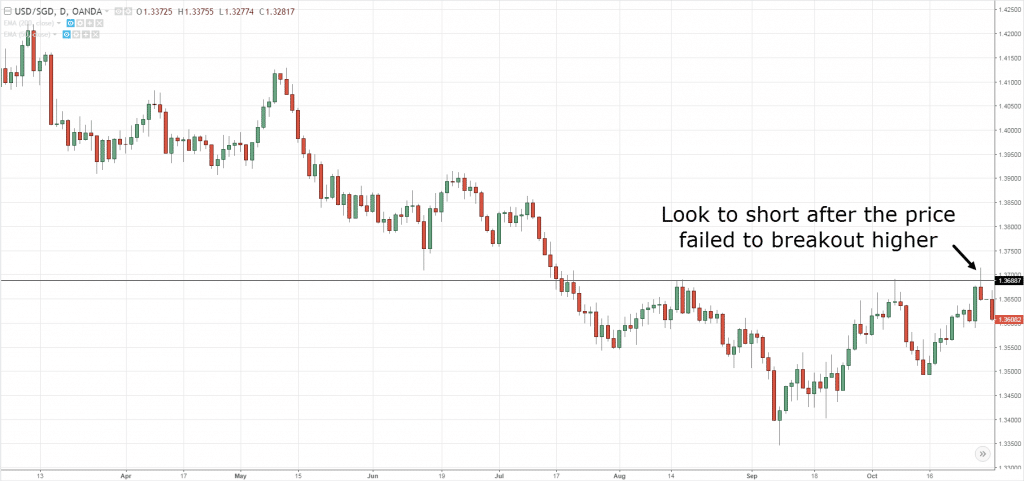

The False Break

This swing trading entry strategy takes advantage of breakout traders who are “trapped”.

Here’s how it works…

Breakout traders tend to go long on the break of the highs.

But what happens when the market breaks out higher, only to reverse towards the downside?

Well, now the breakout traders are “trapped” as their long positions are in the red.

And if the market continues to lower, it will trigger their stop loss which fuels further price decline.

And this is how The False Break can serve as an entry trigger into a trade.

Here’s an example: A False Break at the highs

Next…

Bullish reversal candlestick patterns — Hammer

Bullish reversal candlestick patterns signify that buyers are momentarily in control.

Now, there are different bullish reversals candlestick patterns like Hammer, Bullish Engulfing, Morning Star, and etc.

But for this article, I’ll cover the Hammer:

A Hammer is a (1- candle) bullish reversal pattern that forms after a decline in price.

Here’s how to recognize it:

- Little to no upper shadow

- The price closes at the top ¼ of the range

- The lower shadow is about 2 or 3 times the length of the body

And this is what a Hammer means…

- When the market opens, the sellers took control and pushed price lower

- At the selling climax, huge buying pressure stepped in and pushed price higher

- The buying pressure is so strong that it closed above the opening price

In short, a hammer is a bullish reversal candlestick pattern that shows rejection of lower prices.

Bearish reversal candlestick patterns — Shooting Star

Bearish reversal candlestick patterns signify that sellers are momentarily in control.

Now, there are different bearish reversals candlestick patterns like Shooting Star, Bearish Engulfing, Evening Star, and etc.

But for this article, I’ll cover the Shooting Star:

Shooting Star

A Shooting Star is a (1- candle) bearish reversal pattern that forms after an advanced in price.

Here’s how to recognize it:

- Little to no lower shadow

- The price closes at the bottom ¼ of the range

- The upper shadow is about 2 or 3 times the length of the body

And this is what a Shooting Star means…

- When the market opens, the buyers took control and pushed price higher

- At the buying climax, huge selling pressure stepped in and pushed price lower

- The selling pressure is so strong that it closed below the opening price

In short, a Shooting Star is a bearish reversal candlestick pattern that shows rejection of higher prices.

Now, if you want to learn more about the different candlestick patterns, then go check out The Monster Guide to Candlestick Patterns.

Let’s move on…

Swing trading: Where to set your stop loss so you don’t get stopped out prematurely

Now:

One of the biggest mistakes you can make is to have a TIGHT stop loss.

You’re probably thinking…

“But a tight stop loss reduces my risk and improves my risk to reward.”

Not true.

Because more often than not, you’ll get stopped first before the market can move in your favour.

This means your analysis might be correct but you still end up losing money because your stop loss is too TIGHT.

It’s ridiculous.

So, what’s the solution?

Increase the size of your stop loss so you can withstand the “noise” of the markets and watch the market move in your favour.

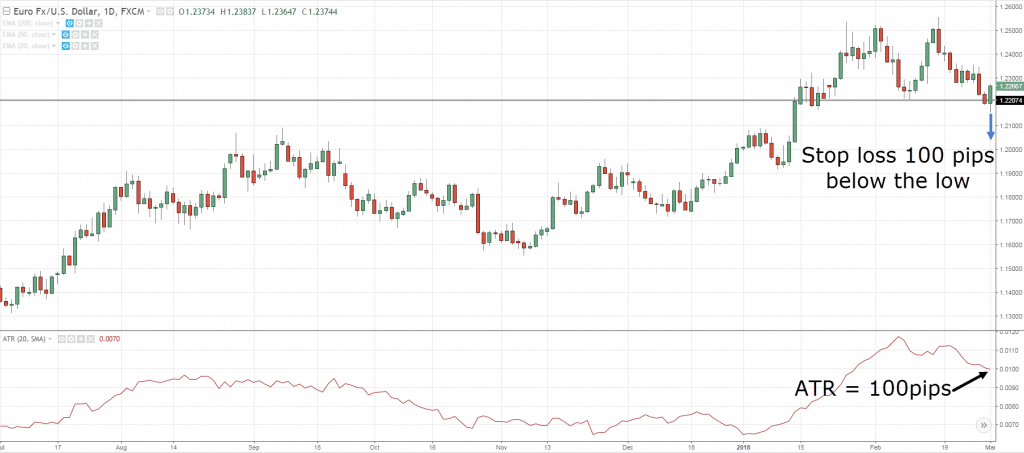

Here’s how…

Your stop loss must be at a location where if reached, will invalidate your trading setup.

This means if you short a head & shoulders pattern, then your stop loss should be at a level where if the market hits it, the entire pattern is “destroyed”.

Or if you’re long Support, then your stop loss should be below Support such that if the market hits it, chances are, Support is broken.

Now, I don’t suggest placing your stops just below Support or Resistance because you’ll get stop hunted easily.

Instead, give it some “buffer” so your trade has more room to breathe.

If you want to decide how much “buffer” to give, you can use the Average True Range (ATR) indicator and set your stop loss 1ATR below Support.

Here’s what I mean:

Now if you want a more detailed explanation of this concept, then go watch this training video below…

Swing trading: Where to take profits before the market does a 180-degree reversal against you

Recall:

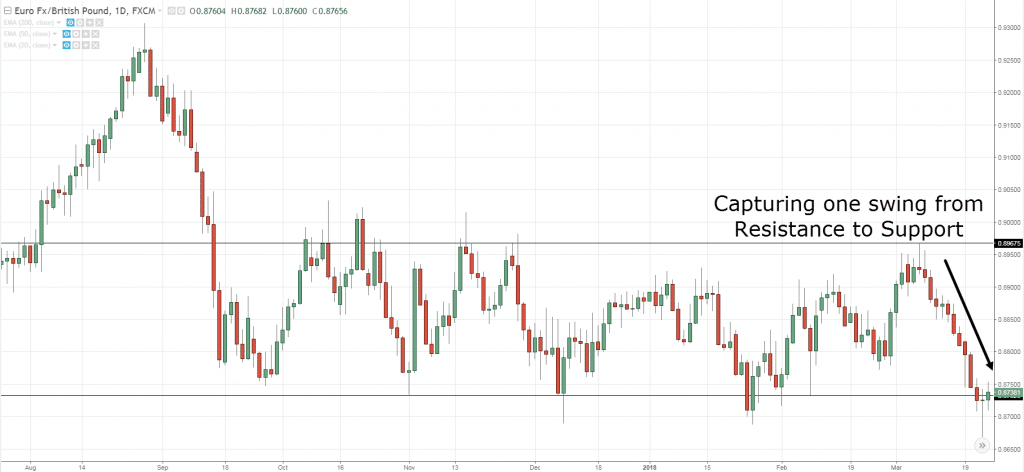

The idea of swing trading is to endure as “little pain” as possible by exiting your trades before the opposing pressure comes in.

So what exactly does it mean?

This means…

If you’re long, you’ll want to take profit at areas where selling pressure could come in (like swing high, Resistance, and etc.).

Or, if you’re short, you’ll want to take profit at areas where buying pressure could come in (like swing low, Support, and etc.).

An example:

Pro tip: Don’t set your target profit at the absolute high/low because the market may do a 180-degree reversal before it reaches your target.

Instead, look to exit your trades a few pips earlier before your target profit.

A simple swing trading strategy that works

Now, let’s piece the puzzles together and so you can develop a swing trading strategy that works.

Here’s how to do it:

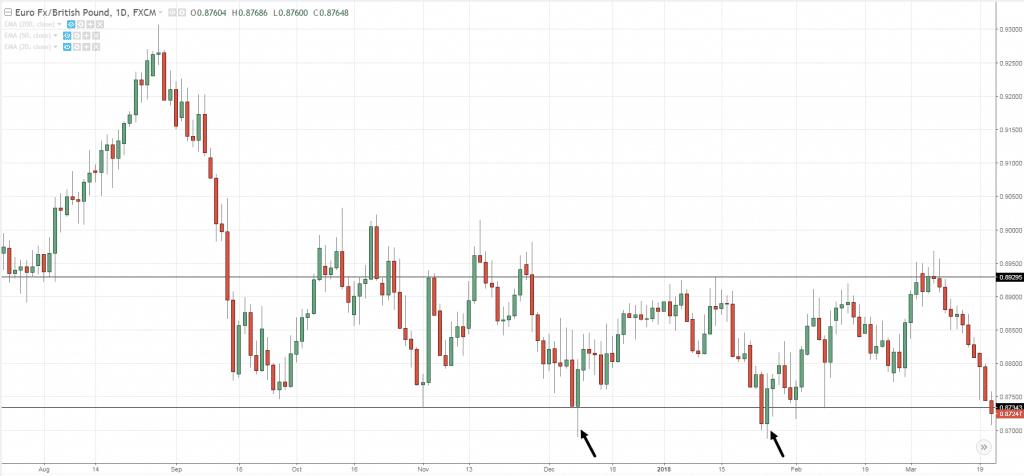

- Identify a range market (market condition)

- Wait for the price to reach Support (area of value)

- If the price reaches Support, then wait for a False Break (entry trigger)

- Set your stop loss 1 ATR below the candle low and take profits before Resistance (stop loss and target profit)

An example:

And here’s another (but in a downtrend):

Now…

This isn’t the only way to swing trade the markets.

Because by using the principles I’ve shared, you can also use different areas of value like (trend line, trend channel, moving average, and etc.).

If you want to learn more, check out Swing Trading Strategies That Work.

Frequently asked questions

#1: Which moving average do you apply to the charts?

On my TradingView, I have the 20, 50 and 200 MAs on standby. But I’ll only turn them on if they make sense. For example:

- If the price is in a strong trend, then I’ll display the 20 MA

- If the price is in a healthy trend, then I’ll display the 50 MA

- If the price doesn’t respect any MA, then I won’t have any MAs on my chart

#2: Which is the best timeframe to use for swing trading?

There is no best timeframe. The best timeframe is probably the one which you can commit to and trade consistently with. For me, I like to take swing trades anywhere between the 4-hour and daily timeframe.

#3: Which of these is the best to use in swing trading entry exit strategies – support resistance, moving average or trendline?

There’s no best one over here. It depends on the market condition:

- If the market is in a weak trend or in a range, then support resistance will be useful

- If the market is in a strong trend, then you might want to use the 20 MA

- If the market is in a healthy trend, then you could use the 50 MA

- If the market is respecting a trendline, then you could use that trendline

So it all depends on the market condition at the moment.

Conclusion

You’ve learned in today’s swing trading guide—swing trading is about capturing “one move” in the market by exiting your trades before opposing pressure comes in.

In essence, here’s what you’re doing:

- Identify an area of value to trade from

- Wait for an entry trigger

- Set your stop loss away from the “noise” of the markets

- Look to capture one swing by taking profits before the market structure

Now here’s what I’d like to know…

How do you swing trade the markets?

Leave a comment below and share your thoughts with me.

Very nicely explained about the Swing Trade. I do not think that anybody can explain more clearly and in simple language. It is explained step by step in opt way. All the best Renter.

Thank you Raju.

Thank You Rayner, for taking the time out and giving this great guide on “how to swing trade”.

I have learn so much from your videos it’s a God send.

once again

Thank You

Bill Latham

Awesome to hear that, William!

Thanks Raynor, always good. I’ve actually found myself gravitating towards swing trading without intentionally doing so, a case of the market telling me where my current strategy and comfort zone lies. It’s interesting that the longer you persist the more the market will lead you to your trading style.

Awesome to hear that, Pete.

Pls i want order flow guide pls pls

This is exactly how we trade PASR, Price Action at Support and Resistence, whether in a trending or ranging market, price action remains the king.

Thank you for sharing.

Thank s man for the insight.

You’re welcome bud!

Hi Rayner ,

Can you please specify which type of moving average to apply to the charts !

Simple or Exponential ?

Cheers

Theo

I use ema but it’s not going to matter much.

Thanks Ray,

You have explained it in the most simple terms ever. Amazing.

I appreciate it, Gloria!

Thank you Rayner. Your presentation is very effective and really help us… Just continue to help others and more blessings will pour…

You’re welcome, Toni!

wow… you good and very helpfull

cheers

Hi this was very well explained and I have a better understanding of swing trading. This is very much appreciated

Thanks very much sir!!!!

My pleasure!

What time is best for this strategy

Like the one hour or four hour please let me know

Thanks

Keith Good

There’s no best timeframe out there. Likewise, there is no best indicator, strategy, or whatsoever.

It all boils down to YOU — your goals and what you want from trading.

Once you nailed that down, then you can find an approach that suits you BEST.

Hi Rayner! I’ve been a follower for more than a year I think and your posts & blogs are really helpful. Thanks.

On Swing Trading, I’ve been studying for the past few weeks on using STOCH-RSI on this type of trading. Did some back tests (on Philippine stocks) & found positive results . Stoch-RSI (Stochastic of RSI) set at 20,20,5,5 or 14,14,3,3. Entering when K-line is below 20 value and cross above D-line. Exiting (or Take Profit) when K-line value at 96-100% range, or when D-line is about to cross K-line.

What are your ideas & thought about this.

Kenjiru

I don’t use that indicator so I can’t comment on it.

Best is you journal down your trades and let the data speak for itself. cheers

Really man! NO BS Guide bruh! Cheers!

Cheers bud

Rayner, I am using the cross over method 8 ema, 20 ma on the 4 hour chart this fits my style for swing trading.

Thank You

Thanks for sharing, William.

Hi William, could u share your strategy with more

detail. Thx

This is very helpful. Thank you for the explanations and helpful tips.

You’re welcome!

Thank you my friend for that explanation, it works very well.I have been using the method to swing.

You’re welcome! And awesome to hear that!

Just like to say thank you. When you say no BS, it is really no BS. No padding, no etcs. You just get down to the beef. The juicy parts. Thank you my virtual mentor!

Very good information. Thanks Ryan.

You’re welcome!

Great article, easy to get lost in the sea of information. Keep it simple…

Thanks Barry!

This is a great guide to swing trading; simple to understand;easy to obey. Thanks Rayner.

You’re welcome, Mailk!

From the SL level, the chances of getting a reward higher than the risk are small. Would you encourage one to take the trade?

It depends on the context of the market. I can’t say which is better or not.

A larger stop would keep you in the trade longer at the expense of poorer risk to reward ratio.

A tighter stop would get stopped out faster but you have a better risk to reward.

Capturing big money moves

Im almost getting there Rayner ever since I joined the telegram I have been winning trades thank you for another on point read time to put in practice. You are the truth Rayner

Awesome to hear that!

Great guide rayner. Just one question for the Stop Loss you said to use 1ATR but in the video you said 2ATR. Which one should we use?

Once again thanks for such great guides.

Both are fine to use. The main idea is to set your stops away from the market structure, how you want to do it is up to you.

Hey Rayner, I really appreciated your article. I was wondering if it’s better to set your stop loss 1 ATR below the support and just leave it there and wait out the price movement to go to your sell target below resistance or to use a trailing stop loss of the 1 ATR value? Would a trailing stop loss of the original 1 ATR value be dangerous (possibility of getting triggered) due to the price fluctuation during the days following the trade or is that better in order to capture even some profits? Thank you!

Hi Rayner, great advice as always. Question: when looking for an entry or exit, do either of support/resistance, MA, and trendline tend to be more reliable than the other? Example if Im lookin for an exit, and I see a trend line that is lower than, say, a support line drawn by the candlesticks, is one usually a better bet than the other?

I won’t say so.

I’d go with the one which the market “respects” more and use it as a reference.

Hi Rayner

Perhaps an unusual question. I’m just starting to get serious re trading and would like to use my phone. I have an iPhone 5 at the moment but want to purchase a new phone. Can you recommend any phone that has any features good for trading. (What do you use). Also, any info re hardware/software most useful would be welcome!

Any info is appreciated!

I don’t use a phone for trading.

You should get a desktop or at least a laptop.

I have always found your explanation nice simple and clear without buzzwords. Great going. Happy to learn from you.

Glad to hear that!

Happie Teacher’s Day Rayner

Thank you, Sanmuk!

Thanks a lot Rayner

Anytime!

Sir for trading which chart will u suggest ( 5 min, 30 min, hourly or day chart)

Your article is very good and I am applying it with your other strategies to my trading. I like your channel and some videos from wysetrade channel

Thanks for what you have shared

My pleasure!

hey rayen this was very useful you are doing a really great job

Glad to help out, Rajesh!

Its beyond what I used to except Reyner. It’s in your blood and you simply vomit the knowledge

Hi Rayner,

Happy to see you because I am searching swing trading strategy for two months none of the other members satisfied me but you are true genius I am thankful to you

And at last can you please help me .How select a stocks for swing trading is there any procedure for that…?

Hi Manjunath,

I’m glad to hear that.

Me reading this article is like handing a currency note to a baby and asking what it’s use for, honestly it will just be stared at and possibly smile at you.

Am a total newbie in this game, please @RAYNER I seriously need your help on recommended materials to begin with or if there’s any academy I need to be part of, thanks.

Hi Emxy,

Check out the trading academy, it’s FREE

https://www.tradingwithrayner.com/academy/

Okay thanks

Hi Emxy,

You are most welcome!

Cheers…

Hi Rayner Thank you very much for your wonderful article. Very Very helpful. I am a novice trader of six months, or since the Covid Pandemic began. I like Swing Trading and, I was hoping you could help me with a query I have. It’s regarding Stop Loss. When I initiate a Trade (Stocks Only) I set my Stop Loss at 1X ATR below my entry Price. As the Price hopefully goes up,should I move my Stop Loss up as well, or should I leave it where I originally placed it to give it as much room as possible but leaving me with a bigger loss if it goes south.

Thanks to you sir give me good knowledge , think me as your brother.

Hi Raghu,

You are most welcome!

There are several dates on your ultimate book do they all have the same info or does each date have more info

Thank you so much.

I have two questions to ask you.

What informs how many times one should multiply the ATR in order to get the best well-placed stop loss?

How will one know when the price doesn’t respect any MA?

Thanks dear rayner ,simply explained in detail

Hi Jayaraj,

Thank you!

Cheers.

Amazing Rayner, very simple to follow. I will apply it starting today and hope it gives the results. What percentage success have you got roughly with this strategy?

Well structures notes. Thank you Rayner.

You are most welcome, Kiran!

Hello Rayner ,

I have been following up with your videos and articles and indeed I will say am impressed. Am new to the forex market. Am still practicing on my demo account and honestly I will love it if you mentor me. I know you’re busy but

Once again thank you this contact was helpful.

Thank you for your appreciation, Jeffrey.

If you wanna learn more, you can check our academy for free:

https://www.tradingwithrayner.com/academy/

Or you may check this link for premium access:

https://www.tradingwithrayner.com/premium/

Cheers!

I am newbie and want to turn trading as a profession. I got introduced very late to your wonderful platform. The educational materials you provide in your blog and youtube channel is something very priceless. Hats off to you Rayner… Your lessons are worth taking….

You’re very welcome! That is our Goal here in TradingwithRayner, to deliver trading education that is purposeful to you guys!

Cheers!

I’m a swing trader, and/ but i like to trade breakouts, and when I do, I don’t know where to set my target because I don’t see the next swing high/low.

As a swing trader, can I trade breakouts?

I have been searching for a guide into swing trade. Wow!!! Rayner, I am blown away by your ideas and thought process, I watched your videos, you are a superman genius. Loved how u simplified my learning curve… I am so glad I found the best guide lines on swing trading…

Hi, Glamor girl!

Thank you for your kind words!

Cheers!

I’m reading this in 2022 and the embedded video discussing the use of the ATR is an old technique you use and very much differs from your current applications of that indicator. An updated video would be much appreciated. Thank you.

Plainly and simply explained. Thank you Rayner!

You are most welcome, Jose.

Trading with 50ema and trendline is most profitable strategy

Yes, Bongani!