Do you want to ride MASSIVE trends that leave traders with envy?

You know:

The type of trend that just goes on without “taking a break” while other traders are on the sidelines waiting for a pullback — or wishing they were in the trade.

If you want to learn more, then welcome to Position Trading.

If that’s something new to you, don’t worry.

Because in today’s post, you’ll learn:

- What is position trading and how does it work

- Where to find the best position trading opportunities

- How to better time your entries for position trading

- How to set a proper stop loss when doing a position trade

- How to trail your stop loss and ride massive trends

- A position trading strategy that works

You EXCITED?

Then let’s begin…

What is position trading and how does it work

Position trading is a trading methodology that seeks to capture trends in the market.

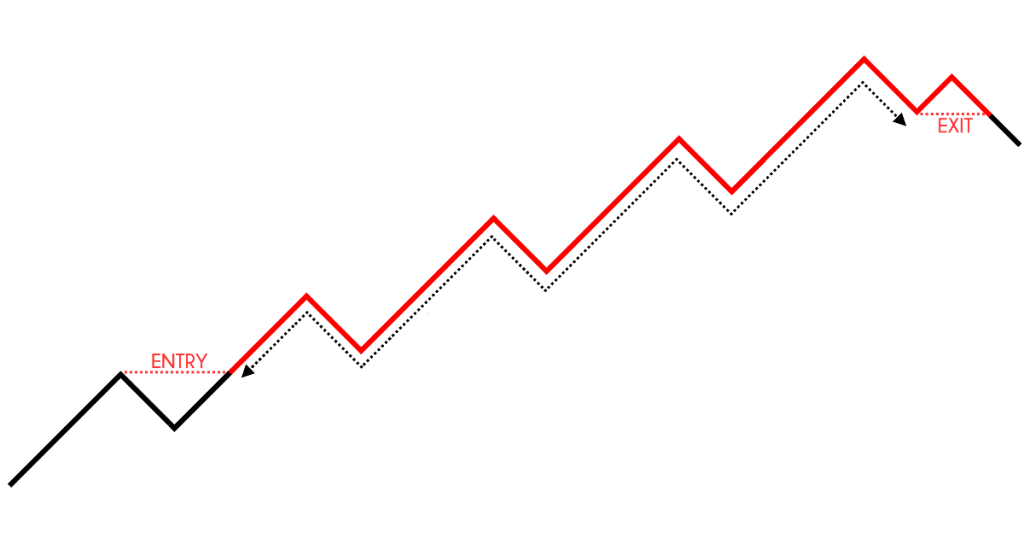

The idea is for a position trader to catch the “meat of the move” without getting stopped out on the retracements.

Here’s what I mean:

And here are the pros & cons of position trading…

Pros:

- It requires less than 30 minutes a day

- It’s suitable for those with a full-time job

- Less stress compared to swing and day trading

Cons:

- You’ll watch your winning trades turn into losing trades, often

- Your winning rate is low (around 30 – 40%)

Is this something you can accept?

Great!

Then let’s move on…

Position trading: Where to find the best trading opportunities

What I’m about to share with you is GOLD.

Because in my experience, these are the best times for a position trader to enter a trade because the trend is in its “early stages”.

They are…

- Support and Resistance

- Breakout of a long-term range

- The first pullback is the best pullback

Let me explain…

1. Support and Resistance lets you “buy low and sell high”

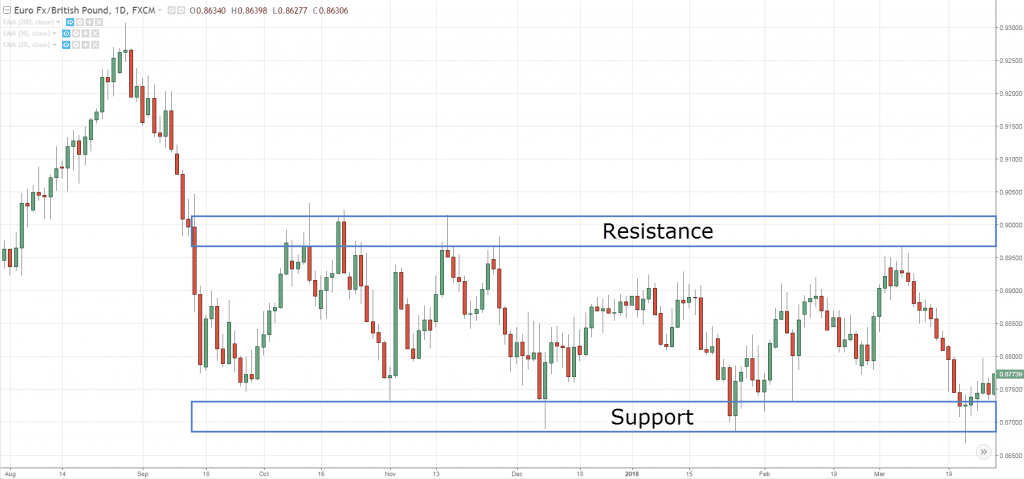

Support – an area on your chart with potential buying pressure

Resistance – an area on the chart with potential selling pressure

An example:

Now think about it…

An uptrend develops only after breaking above the highs of a range.

So, if you want to enter your trades BEFORE the price breaks out, you must do so when the market is ranging.

And where is the best place to go long when the market is ranging?

BOOM!

At Support.

2. Breakout of a long-term range puts your trading on steroids

Here’s the thing:

The market is always changing.

It moves from a range market to a trending market, and back to range market.

And in my experience, the longer it’s in a range, the harder it breaks.

Here’s why…

When the market is in a range, traders will long Support and short Resistance.

And where will they put their stop loss?

Probably below Support and above Resistance.

Now…

As time passes, this cluster of stop-loss will increase as more traders fade the highs and lows of the range.

But the market has to breakout, eventually.

Let’s say, for example, the market breaks out higher.

What happens?

Well, there are momentum traders, position traders and Trend Followers who buy the breakout.

Then, you have short traders cutting their loss (from shorting Resistance) which fuel further buying pressure.

The result?

You get a strong breakout which could start a new trend.

So the bottom line is this…

The longer it range, the harder it breaks.

3. The first pullback is the best pullback, here’s why…

A pullback is when the price temporarily moves against the trend and it offers a trading opportunity for you.

In my experience, the best pullback is the first pullback (after a breakout).

Here’s why…

When the market is in a range, it must break out eventually.

And as you know, the longer it range, the harder it breaks.

So, when the market finally breaks out, traders who miss the move can’t wait to enter on the first pullback.

These pullbacks have shallow retracement as few traders want to trade against the strong momentum.

So what you can do is, buy the break of the swing high and get on “hop” onto the trend.

Here’s what I mean:

Now:

You’ve learned the best trading opportunities are at Support and Resistance, the breakout of a long-term range, and the first pullback.

And in the next section, you’ll learn specific entry triggers to enter your trade with low-risk.

Let’s move on…

How to time your entries for position trading

There are 2 entry techniques you can use for position trading.

They are:

- The False Break

- Volatility Contraction

I’ll explain…

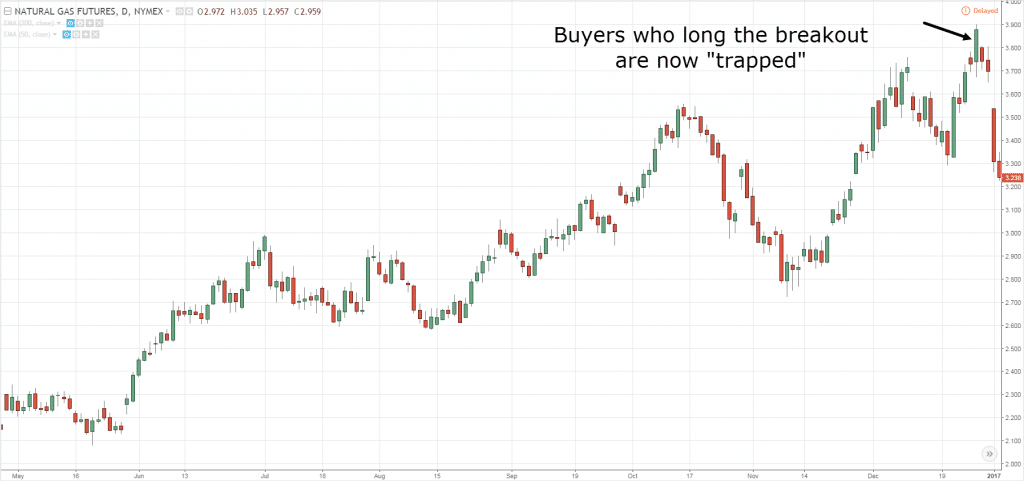

The False Break

This entry technique takes advantage of breakout traders who are “trapped” and it’s suitable for trading Support and Resistance.

Here’s how it works…

Breakout traders tend to go long on the break of the highs.

But what happens when the market breaks out higher, only to reverse lower?

Well, the breakout traders are “trapped” as their long positions are in the red.

And if the market continues to lower, it will trigger their stop loss which fuels further price decline.

And this is how The False Break can serve as a position trader’s entry trigger into a trade.

Here’s an example: A False Break at the highs

Now, the False Break isn’t an exact pattern as there are variations to it.

For example, it can appear in the form of reversal candlestick patterns (like Hammer, Shooting Star, and etc.).

If you want to learn more, then go read The Monster Guide to Candlestick Patterns.

Volatility Contraction

This entry technique gets an entry in a low volatility environment.

So when volatility expands in your favor, you can earn high R multiple on your trade due to a larger position size (from your tight stop loss).

Now you’re probably wondering:

“So what does a Volatility Contraction look like?”

Well, it’s a tight consolidation with small ranged candles.

And you can go long when the market breaks out of the volatility contraction.

An example:

Moving on…

In the next section, You’ll learn how to set a proper your stop loss so you don’t get stopped prematurely.

How to set a proper stop loss so you don’t get stopped out prematurely

Now:

One of the biggest mistakes you can make is to have a TIGHT stop loss.

You’re probably thinking…

“But a tight stop loss reduces my risk and improves my risk to reward.”

Nope.

Because more often than not, you’ll get stopped first before the market can move in your favor.

This means your analysis might be correct but you still end up losing money because your stop loss is too TIGHT.

So, what’s the solution?

Increase the size of your stop loss so you can withstand the “noise” of the markets.

Here’s how…

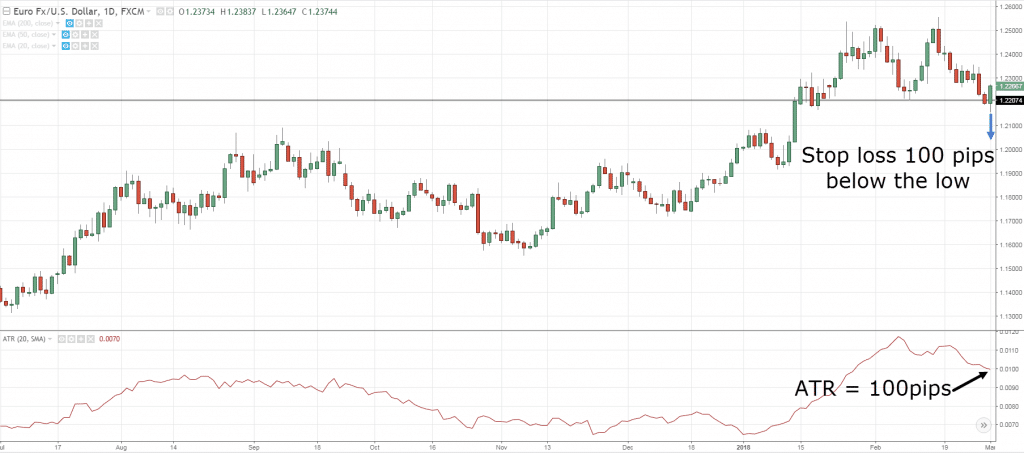

Your stop loss must be at a location where if reached, will invalidate your trading setup.

This means if you short a head & shoulders pattern, then your stop loss should be at a level where if the market hits it, the entire pattern is “destroyed”.

Or if you’re long Support, then your stop loss should be below Support so if the market hits it, chances are, Support is broken.

Now, I don’t suggest placing your stops just below Support or Resistance because you’ll get stop hunted easily.

Instead, give it some “buffer” so your trade has more room to breathe.

If you want to decide how much “buffer” to give, you can use the Average True Range (ATR) indicator and set your stop loss 1ATR below Support.

Here’s what I mean:

Now if you want a more detailed explanation of this concept, then go watch this training video below…

How to set a trailing stop loss and ride big trends

Here’s a fact:

If you want to ride a massive trend, the kind that makes other traders go green with envy, then you must…

Trail your stop loss.

This means:

No target profit.

No second guessing yourself.

No bailing out even when it feels “uncomfortable”.

You honor your trailing stop loss and get out when the signal tells you to.

Are you prepared for it?

Then here are 2 ways you can do it:

- Average True Range

- Moving Average

Let me explain…

Average True Range

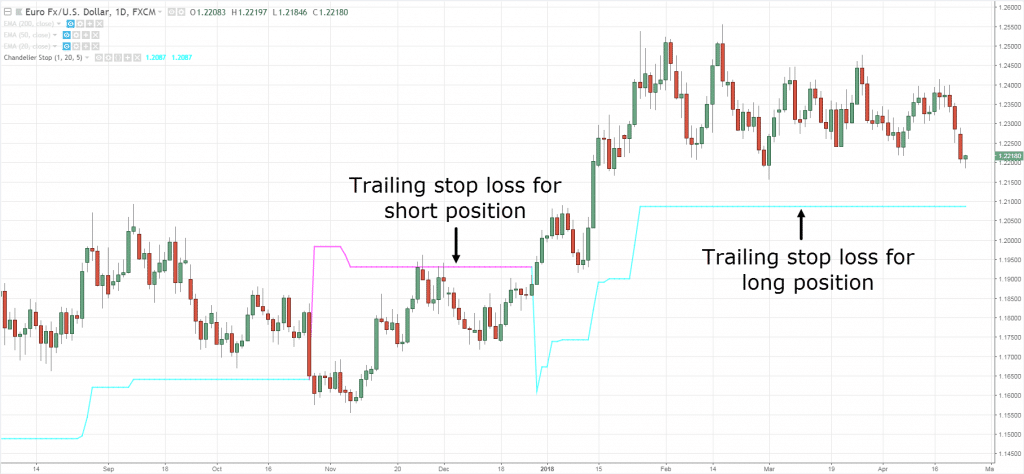

The Average True Range is an indicator that measures volatility.

So what you can do is take a multiple of the ATR and use it to trail your stop loss.

For example:

ATR = $10

Multiplier = 5 (you can choose any number you want)

Trailing stop loss = 10 * 5 = $50

So if you’re long, you’ll subtract $50 from the highs to determine your trailing stop loss level.

Or if you’re short, you’ll add $50 from the lows to determine your trailing stop loss level.

Pro Tip: You can use an indicator called “Chandelier Stop” from TradingView to help you calculate and highlight your trailing stop loss level.

Here’s an example:

Next…

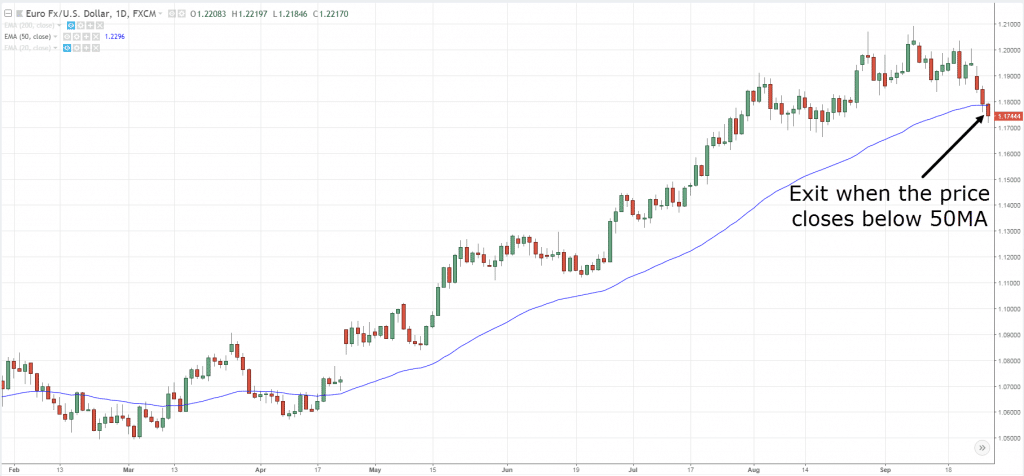

Moving Average

The Moving Average (MA) is a Trend Following indicator that’s useful in trending markets.

Here’s how you can use it to trail your stop loss:

- When the market is trending, trail your stop loss below the moving average (for longs)

- Exit the trade when the market closes below it

An example…

I know you’re probably thinking:

“So Rayner, is the 50MA the best?”

Here’s the deal…

There’s no such thing as the “best” moving average.

The idea is, if you want to ride a long-term trend, then trail your stop loss with a long-term moving average (and vice versa).

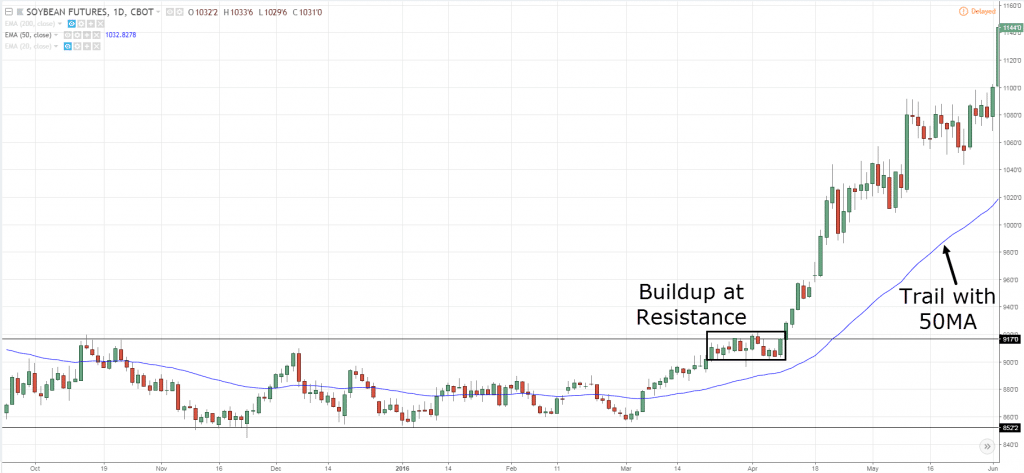

Position trading strategy

At this point…

You have all the ingredients you need to develop a position trading strategy.

Here’s an example of a position trading strategy:

- Wait for the market to form a volatility contraction (a buildup) at Resistance

- Go long if the price breaks above the high

- Set your stop loss 1 ATR below the low of the buildup

- Trail your stop loss with the 50MA and exit if it closes below it

Here’s what I mean…

As you can see, there’s nothing complicated about position trading.

The difficulty doesn’t lie in the position trading strategies you have, but in the execution — the willingness to ride your winners.

If you want to take things a step further, you can even adopt…

Short term position trading

Generally, position trading is traded on the higher timeframes.

But who says you can’t take this trading strategy to the smaller timeframes?

You can find these trading setups on the 1-hour, 15mins, or even 5 mins timeframe.

However, the shorter your timeframe, the shorter the trend you’ll catch — and the more screen time required.

Conclusion

So here’s what you’ve learned:

- Position trading is a trading methodology that seeks to ride long-term trends

- You can find the best position trading opportunities from Support and Resistance, break of a long-term range, and the first pullback

- You can use the False Break and Volatility Contraction to time your entry

- You can use indicators like Average True Range and Moving Average to set your initial and trailing stop loss

- The concept of position trading can be applied to the short timeframes like 1-hour, 15mins, or even 5mins

Now here’s what I’d like to know…

Do you prefer position trading? Why or why not?

What are some of your position trading strategies?

Leave a comment below and share your thoughts with me.

Raynor, you explained exactly what I do. I let the market take me out with a convergence of 3 exponential moving averages with 3 other factors. Use the Weekly chart to keep the noise out. My stop is exactly the same for every position, whether it is for taking a loss, or riding a big winner. I have had some short term winners, reverse and turn into a loss. But I have had HUGE winners, that run for well over 18 months at this point and they are still running. My biggest to date is up almost 300%. And I will let my trailing stop take me out. This also fits my personality perfectly, because I do not want to be trading in and out much, I am very PATIENT.

Awesome stuff, William!

Real stoked to hear that.

Hi! Could you explain your strategy with 3 emas?

i remember u mentioned position trading includes the analysis of fundamentals while trend followin doesnt and is stricly TA absed. So… is this trend following or position trading?

Position traders can take into consideration Fundamentals but that’s not to say it can’t be just TA based.

Trend Following is similar to position trading but with more idiosyncrasies to it (like trading across all markets).

Rayner, how do we scout for the patterns, do we daily scavange a watchlist of say 100 stocks.

That’s the way I would do it, I don’t know of any scanner that “hunts” for patterns.

Pretty interesting, I believe for position trading timeframe should be daily and above I presume, let say a market approach a daily support and we about to long at support is it advisable to switch to lower tf for cs reversal pattern or market structure if it is ,which tf should I go to the lowest , is it ok m1 or m5,thanks

What’s your goal?

If you’re a short-term trader, then yes. But if not, I don’t see the point of it.

Hi Rayner,

If using ATR for setting stop loss, what’s the ATR period? I guess a 5-day period ATR would be much different against a 14day or 20day periods , and thus different stop loss levels.

I use a 20-period ATR.

Currency pairs combination/matching analysis

Cross pairs and parallel pairs

Eg GBDUSD=GBPJPY/USDJPY

GBPUSD will have supertrend if GBPJPY more uptrend and USDJPY more downtrend

Now it is happening…..

Gold price is a basis for GBP EUR CHF USD JPY AUD CAD NZD , knowing their ranges for timeframes, shifting blocks etc

Knowing their Mthly, Wkly Daily etc strenght , pick strongest and weakest currencies and become our target pairs

No indicators required…..matching pairs with JPY and USD….

Hi Rayner, this by far is one of the best article you’ve written, every parts has been made very easy to understand. I’m a Position and Trend trader. would you be so kind to write an article or video discussion about detailed “Scaling and scaling out(If there is)”, I’ve watched your video titled “2 important things you must do to make big money” one of the thing is to Scale-in, but there wasnt any in-depth discussion of how it is done, i.e when do you scale-in?, How far ahead should you consider scaling-in?, what are the factors to consider? etc. Thank you very much for your time Rayner, May the trend be always in your favor.

Hi Cha

Thank you for your feedback, I’ll look into it.

Also, you can check this video out… https://www.youtube.com/watch?v=-7EE0X-FEtE

Thank you Rayner

Hi Rayner, when you are Trend following a position, how do you set your trail stop? I.e do you manually adjust your trail stop daily if necessary? Or you have a parameter like how many pips below price/MA etc or how many % etc. Then let it run its natural course? Thank you

Hi Cha

You can use different approaches like chandelier stops, moving average, etc.

If you trade off the daily timeframe, then yes, it makes sense to check it once per day.

H!, Ever since I sign-up with you my trade improved. I thank you for your system of helping traders.

Awesome to hear that, Umaru.

Super

cheers

great lesson,thank you Ryaner

You’re welcome!

This is the type of strategy that i like and that i think fits me the most, thank you for the knowledge that you provide

You’re welcome, Anastasia!

Sir, By reading your every article every time I am becoming more smarter…that was another good one..But I have one request to you to write something on volumes and how to use volume studies to make trading better

I’ll look into it…

In position trading, should we focus on daily or weekly timeframe. Plus can you help me to trade SNR strength on daily and weekly. I trade daily but like you said in your trading journey article, I am always stoped out or market moves leaving me behind.

Both daily and weekly can work for position trading.

If you get stopped out too often, you might want to consider placing stops at less obvious level like away from market structure.

yes,lot of time to to exicute the trade

Hello Rayner,

Are there any differences between Position Trading and Trend Trading?

Thanks,

Aslan

Yes I prefer to trade position trading because it helps me to keep my chunk of profit when times are good to cover the losses of the bad trading days

Thanks for sharing!

Greatest info ever Reynar.. could you please make another one explain Gaps in the market

Hi Rayner,

I have been following lots of your articles and YouTube videos.

I would like to ask regarding the time to trade. I live in Jakarta and I have full time job during the day time.

I could read price action (not really good) and could see the price direction usually, but most of the time, when the time almost come to take the trade, it’s around midnight (I need to sleep since I wake up early in the morning).

Usually, how do you pick your trade? I don’t want to be glued to the screen.

Thanks for the response.

I have a very basic question. If nobody can predict the price tomorrow why would one want to carry the position? I mean why not Intraday though im pathetic at it. Wait for a proper set up and lose the daily moves…trade the daily moves and get hit many a times. A dilema im facing since years… Im good at reading the charts but have the pain of not making money intraday and as such not a very successful “trader” as im always confused as to what is the correct way take money and run or anticipate a bigger move

great. i started my trading career i

justabout two months ago, and since then, i have been following your mentorship, its really great, i am almost 80% sure of every prediction made. YOU ARE DOING WELL.

wld need a favor from you,

please can can you give us a clue on how to set a PENDING ORDER on a trend yet to be formed, with atleast 80-90% accuracy.

THANK YOU RAYNER

Hey Taiwo,

You are most welcome!

Check out this post…

https://www.tradingwithrayner.com/academy/trading-terminology/

Please can you send me a price action strategy that work am tried of losing my hard earn money on daily basis

Have you deleted the content of this page?!

With the knowledge I just got from you, I will like to go for position trading for a short timeframe. Thank you so much. You are very good in impacting knowledge to people and you don’t seem to hid anything.

Hi Kenneth,

I’m glad to hear that!

Cheers.

MEN I JUST WANNA SAY THANK YOU FOR THE INFORMATION YOUR GIVING OUT JUST FOR FREE,ANYTHING YOUR GIVING OUT IS JUST SIMPLE AND BEST UR THE BEST MEN….MAY GOD BLESS YOU

Hi Thapelo,

You are most welcome!

Cheers.

I would prefer to do positional trading in 1Day time frame as it will require less screen time and at the same you can catch short term to medium Trend.

Basically I prefer to sale option rather than doing day trade.

Thanks Rayner for great content for free.

#love for you from India.

What if there is no range on the market for a long time? what if there is a trend? wait for the range? or trade trending strategies?

The real challenge here is separating the breakouts from the fake outs.

Exactly! You can check this video on how to avoid false breakout and hopefully, this may help you:

http://www.youtube.com/watch?v=ScxDvXVX5yc

Cheers!

Hey rayner! thanks for this article. Im trying to get into position trading and I would like to learn more. Sadly its not as commonly covered as swing trading. I have questions that can’t seem to find the answer.. Do you know any good position trading resources i.e. books, websites, blogs, etc.? thanks a lot.