Jesse Livermore, the most famous trader of all time, made $100 million in 1929.

Richard Dennis, the founder of the turtle traders, made $400 million trading the futures market.

Ed Seykota, a Market Wizard, achieved a return of 250,000% over 16 years.

And do you know what is their trading approach?

Trend Following.

In this comprehensive guide, you’ll learn:

- What is Trend Following and how does it work

- The 5 secrets of Trend Following that makes it profitable over the last 200 years

- How do Trend Followers make money?

- Systematic vs Discretionary Trend Following, what’s the difference?

- Trend Following strategies you can use to profit in bull & bear markets

You’d want to read every word of it.

What is Trend Following?

Trend Following is a trading methodology that, seeks to capture trends across all markets, using proper risk management.

You’re wondering:

Why does Trend Following work?

The reason is simple.

Markets are driven by emotions, greed, and fear.

When either side is in control, there will be a trend, and Trend Followers can take advantage of this phenomenon.

I absolutely believe that price movement patterns are being repeated. They are recurring patterns that appear over and over, with slight variations. This is because markets are driven by humans, and human nature never changes. – Jesse Livermore

Here are a few pieces of research that further validates Trend Following:

- Studies by M Potters proves that Trend Following is profitable over the last 200 years

- Studies by Kathryn M. Kaminski validates that Trend Following thrives during crisis periods

- Following the trend by Andreas Clenow explains how hedge funds and professional traders have been consistently outperforming traditional investment strategies

Now, forget about finding the "holy grail" or the ultimate best trend following strategy, instead pick up the principles and concepts to make your own strategy.

Behind this trading methodology, lies 5 trading principles that every successful Trend Follower must follow.

And I’m going to reveal them to you, right now…

This is a monster blog post. So click below to download the PDF version for free.

Secret #1: Buy high and sell higher

Imagine:

You walk into a supermarket and you see apples being sold, 3 for $1. So, you get some apples for a nice healthy snack.

The next day…

You go back to the supermarket and, realize the same apples are now being sold, 3 for $5.

Would you buy it?

Probably not because the price is too high. You’d rather wait for the price to drop, or find other alternatives.

Now you’re wondering:

What does buying apples have anything to do with trading?

A lot.

Because your attitude towards buying apples is brought over to your trading endeavor.

Here’s what I mean…

Overbought on (USD/JPY):

Price Rally (USD/JPY):

Oversold on (EUR/USD):

More Oversold on (EUR/USD):

The takeaway is this…

The market is never too high to go long, or too low to short.

Secret #2: Just follow price

You want to be right.

It feels good to know you called the tops and bottoms in the market.

However, when you start making predictions in the market, it clouds your judgment, and you start losing objectivity of the markets.

This leads to fatal trading mistakes like:

- Refusing to take a loss because you want to be right

- Averaging into your losses because you can get it “cheaper” now

- Revenge trading because you want to make back your losses

Now, what should you do instead?

The best thing you can do as a trader is, just follow price.

Here’s what I mean…

Uptrend on (NAS100USD):

Downtrend on (XCU/USD):

What’s the takeaway?

If you notice the price is forming higher lows, with resistance constantly breaking, chances are it’s an uptrend. You should be looking to long.

If you notice price forming lower lows, with support constantly breaking, chances are it’s a downtrend. You should be looking to short.

Secret #3: Risk a fraction of your trading capital

Imagine:

You have a trading system that wins 50% of the time with 1:2 risk-reward.

And you have a hypothetical outcome of L L L L W W W W

It’s a profitable system, right?

It depends.

If you risk 30% of your equity, you’d blow up by the 4th trade (-30 -30 -30 -30 = -120%)

But…

If you risk 1% of your equity, you’d have a gain of 4% (-1 -1 -1 -1 +2 +2 +2 +2 = 4%)

Having a winning system without proper risk management isn’t going to get you anywhere.

You need a winning system with proper risk management.

And not forgetting…

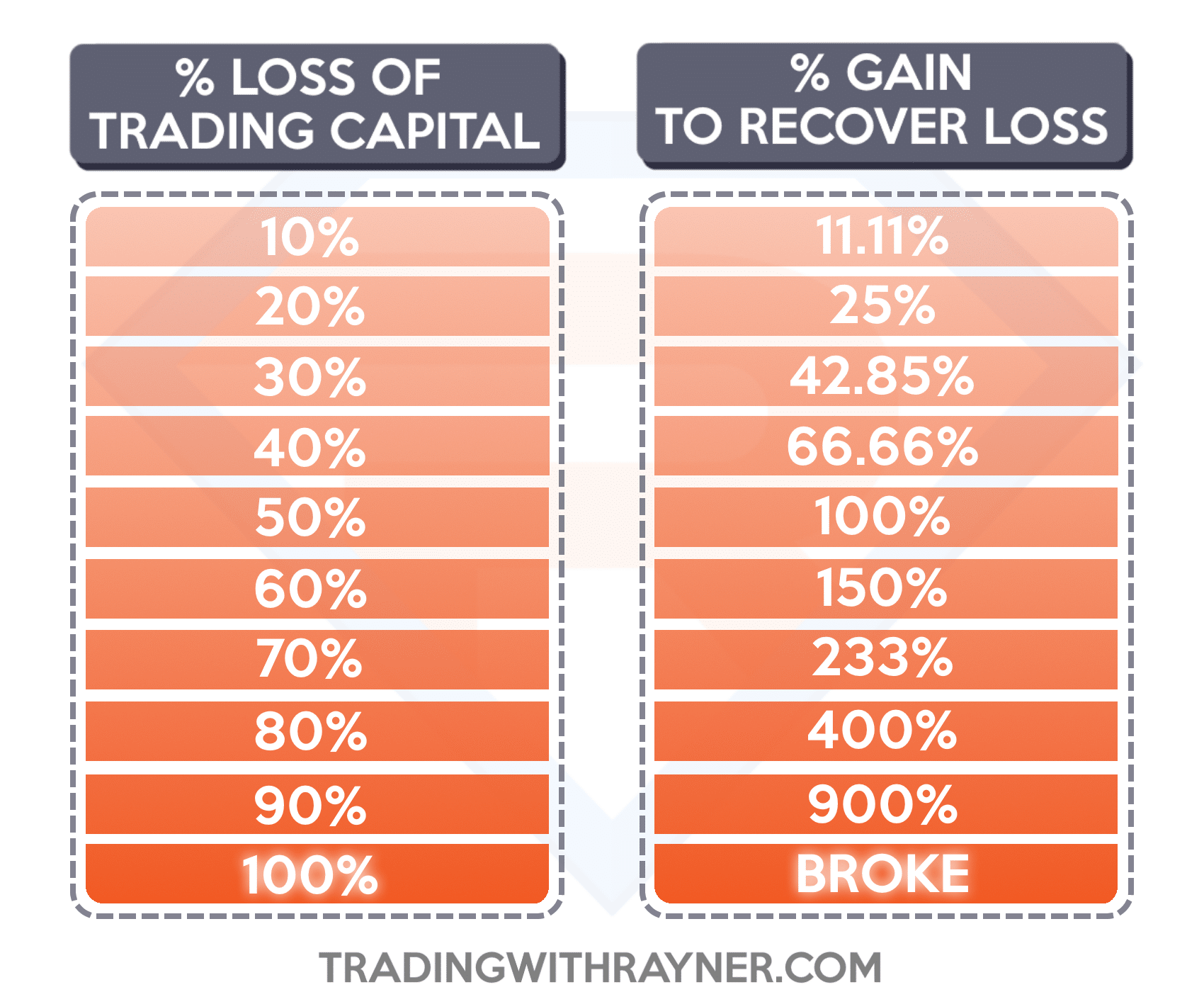

The recovery from the risk of ruin is not linear, it could be impossible to recover if it goes too deep.

If you lose 50% of your capital, you need to make back 100% to break even. Yes, you read right. 100%, not 50%.

That’s why you always want to risk a fraction of your equity, especially when your winning ratio is less than 50%.

So, how much should you risk exactly?

This depends on your winning ratio, the risk to reward, and your risk tolerance. I advise risking no more than 1% per trade.

If you want to learn more, then check out The Complete Guide to Risk Management and Position Sizing.

Secret #4: No profit targets so you can ride massive trends

Although trend followers have no profit targets, it doesn’t mean we don’t exit our trades.

We exit our trades using a trailing stop mechanism, instead of having a profit target like support & resistance etc.

Here’re a couple of examples…

Support take profit on (UKOIL):

Trailing stoploss on (UKOIL):

Resistance take profit on (XAU/USD):

Trailing stoploss on (XAU/USD):

Some ways to trail your stop loss are:

- Moving average crossover

- Price closing beyond moving average

- Break of price structure

- Break of trendline

- Number of ATR away from the peak/trough

If you want to learn more, here are 13 ways to exit your trades to reduce risk, and maximize profits.

The hardest part about Trend Following is riding your winners. Because you’ll watch many small wins turn into losses while attempting to ride the trend.

This results in a low winning rate but, high reward to risk.

Secret #5: Trade all markets to increase your odds of capturing trends

Markets spend more time ranging than trending. Thus, it makes sense to look at a variety of markets, to increase your odds of capturing trends.

Trend followers trade everything from currencies, agriculture, metals, bonds, energy, indices, orange juice, pork bellies, etc. You can view a comprehensive list here.

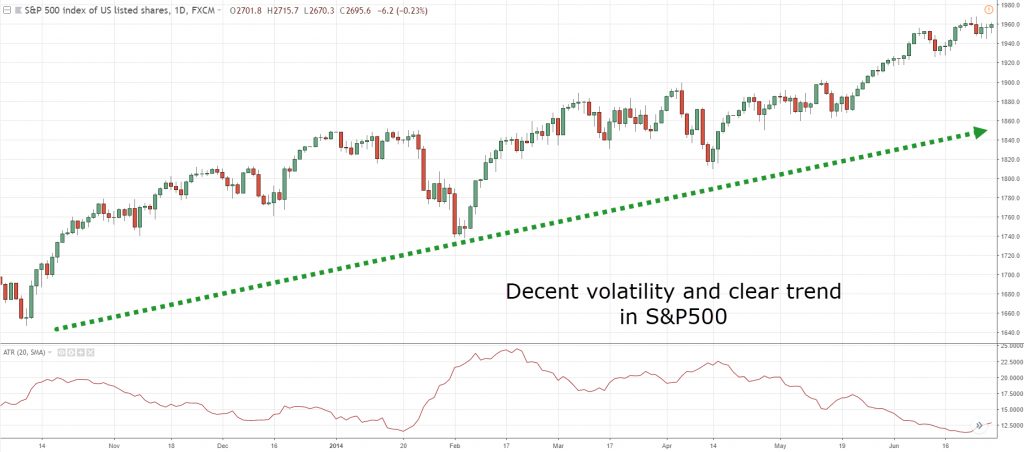

If you recall, most major currencies were ranging during the 1st half of 2014…

But if you looked at more markets, you could capture a trend…

Low volatility on (EUR/USD):

Low volatility on (AUD/USD):

Decent volatility and trend on (DE10YBEUR):

Decent volatility on (SPX):

What’s the key takeaway?

Trading across different markets help reduce your drawdowns and improve your profitability.

And this is one of the biggest secrets behind a trend follower’s success.

Now, you’re probably wondering:

How do Trend Followers make money?

Imagine this:

A company called Orange has been trading higher over the last 6 months.

Orange currently trades at $100 and you think it’s overvalued. You decided to short 1000 shares of Orange, at $100 with a profit target at $90, using no stop loss.

You apply this trading principle across all markets you’re trading. A small profit target with no stop loss.

What do you think will happen?

You’ll win often but, eventually, there will be a trade that goes against you, till you blow up your trading account.

Now imagine…

What if I’m on the opposite side of your trade?

I would lose often but, all I need is one trade to make it all back, and more.

And this is the same trade that caused you to blow up your account.

A few examples in real life:

- Fall of Long Term Capital Management

- Destruction of Bear Stearns

- The 2008 financial crisis

These events caused investors and traders to lose tons of money. But in a zero sum game, someone loses and someone wins.

And the winner happens to be Trend Followers. This is our edge.

Different approaches to Trend Following

Trend Following can be further divided into 2 different approaches.

- Systematic trading

- Discretionary trading

Systematic trading

Systematic trading has defined rules that decide the entry, exit, risk management, and trade management.

This approach is widely adopted by big hedge funds like Dunn, Winton, and MAN AHL.

Although systematic trading is automated, there are still key decisions that a manager has to make.

Decisions like…

- How much to risk

- What markets to trade

The manager has to decide how much risk to accept, which markets to play, and how aggressively to increase and decrease the trading base as a function of equity change. These decisions are quite important—often more important than trade timing. – Ed Seykota

Discretionary trading

Discretionary trading has lesser defined rules that decide the entry, exit, risk management, and trade management.

It requires a trader’s attention, trading based on technical analysis, with more intervention.

This approach is widely adopted by smaller individual traders.

Although discretionary trading is more subjective, it is still guided by a trading plan.

So moving on…

Trend Following trading strategy

Now you’ve learned the 5 secrets of Trend Following. Let’s put the information to use and develop a simple trend following strategy.

To develop a Trend Following strategy, it needs to answer these 7 questions:

- Which time frame are you trading

- How much are you risking on each trade

- Which markets are you trading

- What are the conditions of your trading strategy

- Where will you enter

- Where will you exit if you’re wrong

- Where will you exit if you’re right

Timeframe

You must choose a time frame that suits your personality and schedule.

If you’re someone who holds a day job, trading the 4 hour and daily charts would suitable.

Risk management

You must risk a fraction of your equity on each trade to survive the inherent drawdowns. Keep your losses to no more than 1% on each trade.

Markets universe

You should be able to trade about 60 markets from these 5 sectors.

- Agriculture commodities

- Currencies

- Equities

- Rates

- Non-Agriculture Commodities

A Discretionary Trend Following Trading Strategy

If 200ma is pointing higher and the price is above it, then it’s an uptrend (trading conditions).

If it’s an uptrend, then wait for “two tests” at the dynamic support (using 20 & 50-period moving average).

If price test dynamic support twice, then go long on the third test (your entry).

If long, then place a stop loss of 2 ATR from your entry (your exit if you’re wrong).

If the price goes in your favor, then take profits when candle close beyond 50ma (your exit if you’re right).

Vice versa for a downtrend.

Here’re a few examples…

Winning trade on (XAU/USD):

Winning trade on (UKOIL):

Losing trade on (AUD/USD):

If you prefer less subjectivity in your trading, then consider this trading approach…

A Systematic Trend Following System That Works

Trading rules:

- Go long when the price closes the highest over the last 200 days

- Go short when the price closes the lowest over the last 200 days

- Have a trailing stop loss of 6 ATR

- Risk 1% of your capital on each trade

Markets traded:

- Gold, Copper, Silver, Palladium, Platinum

- S&P 500, EUR/JPY, EUR/USD, Mexican Peso, British Pound

- US T-bond, BOBL, BUXL, BTP, 10-year Canadian bond

- Heating Oil, Wheat, Corn, Lumber, Sugar

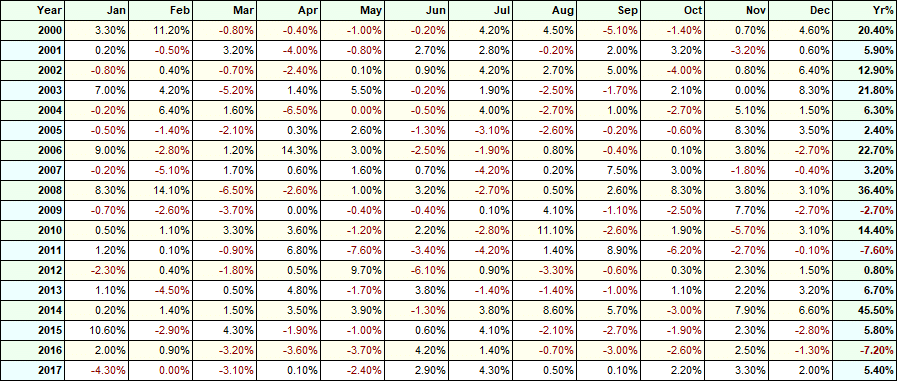

The backtest results:

- Number of trades: 937 trades

- Winning rate: 42.8%

- Annual return: 9.89%

- Maximum drawdown of 24.12%.

Pro Tip:

If you trade more markets, you can improve the returns and reduce the drawdown.

Now you might be wondering… “Does Trend Following work on stocks?”

Yes, Trend Following can be applied to the stock markets but with a few exceptions…

#1: Avoid shorting stocks because in the long run, the stock market is in an uptrend. Thus, it’s more profitable to remain on the long side or in cash (and avoid short selling).

#2: Have a filter to rank stocks as there are thousands of stocks available and you need to decide which ones you want to trade.

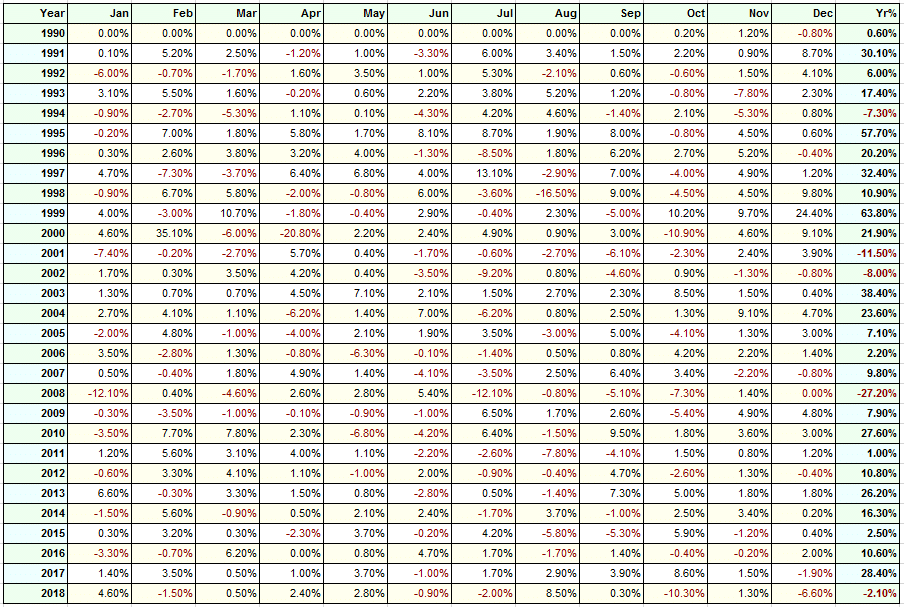

And here’s a simple Trend Following system for the stock markets…

Trading rules:

- Go long when a stock hits a 50-week high

- Have a 20% trailing stop loss

- If there are too many stocks to choose from, select the top 20 stocks with the largest price increase over the last 50 weeks

- Buy a maximum of 20 stocks with not more than 5% of your capital allocated to each stock

Markets traded:

- Stocks from the Russell 1000 index

The backtest results:

- Number of trades: 707 trades

- Winning rate: 48.66%

- Annual return: 12.81%

- Maximum drawdown of 40.75%.

Pro Tip:

If you add a trend filter, you can improve the returns and reduce the drawdown.

And there you have it.

A Trend Following system that allows you to profit in bull & bear markets.

To be honest, the strategy is least of your concern. Instead, you should focus on your risk management, markets universe and trading consistency.

There's no single best trend following strategy out there that's gonna make you a millionaire overnight. So please do your homework and verify everything.

**Disclaimer: I will not be responsible for any profit or loss resulting from using these trading strategies. Past performance is not an indication of future performance. Please do your own due diligence before risking your hard-earned money.

So, what’s next?

You’ve just learned what Trend Following is all about.

Now it’s time to put these techniques into practice.

The first step?

Click on the link below and enter your email to get access to The Ultimate Guide to Trend Following.

This includes all the trading strategies and techniques (and additional content that I’ve no space to write here).

Dear rayner,

thank for the well sharing !

You’re welcome, Tet Soon 🙂

Rayner

Hello my friend Rayner

Thanks so much for sharing info

Its a great knowledge and you are wonderfully willing to shared.

Life goods feel goods.

Thanks n Cheers

Thank You So Much! You my Friend are a GREAT MENTOR!

Thank you for your kind words, Greg.

Rayner

Hello Ramli,

Don’t mention it, I’m glad to be of help.

Cheers

Rayner

Great article for someone learning to trade which I am one.Thanks Mate.

Hey Abba,

You’re welcome, glad to know it helps.

I hope to hear more from you soon 🙂

Rayner

Thank for sharing this, you dont know how much it meant to someone like me…thank you very much

Very nice article. What timeframe is suitable to this Trend Following strategy? I’m a newbie in Trading, and I only have access to 20-ish forex pair (no commodities, stock, etc), does that mean I can’t learn this strategy?

Arianto

Hi Arianto,

This approach is suitable on the daily time frames.

If you limit yourself only to the currencies, then it decreases the odds of capturing a trend.

Rayner

Hi Rayner, will this strategy also work on 4-hour time frames?

Hey Rayner,

Very comprehensive post.

You suggested that you should be across the many different markets to capture trends everywhere. It’s obviously difficult to be across so many markets at the same time so do you know of any good script, service, website, blog or something that helps to draw attention to these as they are happening?

Hi Scott,

I trade about 60 markets and focus on trends on the weekly timeframe.

So it’s actually manageable to scan the markets manually for trending setups.

I don’t use any script or service in my scanning.

Rayner

Hey Rayner,

Nice ..

Just a small query , In the above example of Andreas Clenow system where will be the Stop Loss ?

Hi Subodh,

His stops are 3 ATR away from entry.

Rayner

Yeah , i am asking about trailing S/L ..

Hi Subodh,

He uses 3 ATR for trailing stops as well.

Rayner

3 ATR how many pips

Hi Rayner,

Very nice article, help me a lot to get started to trade.

You mention MA and Clenow use EMA in his above mention strategy.

What is best?

Hey Jens,

There’s no best out there. I believe if you use SMA the results aren’t going to change much.

Hi Raynor,

This is regarding Andreas Clenow’s Trend Following system.

How can we get the 50 day High? Is these an indicator?

Appreciate your kind reply.

Hey Shehan

You probably need someone to custom code it if you can’t find it on your charting platform.

Hi Raynor,

I’m using MT4. Can you pls let me know the name of the particular indicator usually available in MT4?

You can try Donchian channels.

Thanks Raynor.

I’ll try that.

Hi Rayner,

You are using bull candle/ bear candle on value zone to enter?

or

Just simple queue your order with buy limit/ sell limit on value zone?

I’d usually wait for a price rejection before entry.

okay thanks Rayner

Hi Rayner,

Thanks for the wonderful blog post. One question, how do you decide whether to keep 2 ATR as SL or 3 ATR? Is it based on the back test of that particular market to see what fits this type of market (and so may be different for different markets) , or are there any other trading rules applicable?

Regards,

Vipul

There are no best settings.

I use 2 ATR because I want to define the buffer space, that’s all.

Hi Rayner

Is averaging is really bad?. When you cant identify a single price point how about trading mini lots in many price points?

There are traders who do it but I don’t.

I won’t say it’s bad because there are pros and cons to it.

Hi Rayner,

Thank you very much for your articles and knowledge you provide, they have been very useful. How would you deal with a situation where price closed above/below the trailing stop moving average e.g 20 ema as a minor pullback and continues with the trend?

I would exit the trade if that’s my trailing stop loss.

Then, find a valid entry trigger to re-enter, if any.

When you are here to help me out then why I should prefer any other reference. Thanks.

Hi Rayner, I am not able to download PDF version this “trend following” Please help.

Drop me an email and I’ll send it over.

Hi rayner,

great post, thanks for sharing!

Anyway, would you please suggest the time horizon to analyze market on each time frame especially for 1H, 4H, and 1D ?

I’m not sure what you mean…

I mean, if you -for example- trade in 1D, how many days in the chart would you use to analyze the pattern?

I don’t have any fixed number of days.

Some patterns take longer to play out, some shorter. It depends on your trading strategy.

please send me this pdf file at afeefdse@gmail.com

Iv Improved so much as a trader from last 5 years following ur tips excellent, I guess your always student for life always learning something new

Awesome to hear that, Sam!

You are awesome.

thanks rayner

My pleasure!

Just saying may God bless u abundantly.

I appreciate it!

Hi, What trend filter do you recommand for improving Trend Following?

Does these Trend Following Strategies work on smaller timeframes as well like 5min, 15min, 1hr or should I only trade the daily timeframe?

thank you very very very much

cheers

Hi Ryan,

big fan! I know you don’t do options but can we use it for an option trading. Already am with UST.

I don’t have any specific trading strategies for options trading.

But you can take the concepts from The UST and apply them to options trading.

For example, buying strength in the stock markets which could translate to something similar with options trading.

Good day Rayner. thanks for this tutorial. Pls what are best parameterS for setting 200ma and 20ma. thanks

v good stuff but i have a Question Forex market remains 70% of the time in consolidation just 30 % in trading its mean we should wait for a long time and we waste maximum money in w8 period what you think??

So trade more markets (not just Forex) to increase the odds of capturing a trend.

Thanks a lot…I have seen the ULTIMATE GUIDE TREND FOLLOWING.

Don’t hesitate to send me more goods if you have…..

Thanks once more………you are my Facilitator……..in my Trading journey.

Cheers

Hey Rayner :))), it’s a summary of what you taugth in previous youtube lessons and blogs. These rules must to tatoo every trader on their forehead that would’t forget … and to remind them, then go every morning and evening to the bathroom brush teeth and look to themself in a mirror :)))). It must to become a psichological constitusion in trading. Conclusion – Rayner you simple guy who spited over thousand of “guru teachers”

Cheers bud

Hi Rayner…you are a great teacher. You advise us to increase the markets that we trade. but isn’t the cost of trading some markets too high (e.g. spread on Platinum and Palladium)? Or you just regard it as cost of doing business?

For CFDs, yes it can be high. Or you can trade the futures directly which is much cheaper but requires more capital.

Otherwise, that’s the cost of doing business.

Greate article!

How do you do backtesting?

Check this out… https://www.tradingwithrayner.com/how-to-backtest-a-trading-strategy/

how come you do not mention a video on trend trading. I thought you had videos on this & everything. I do not see you mentioning the video that would be included in Trend Trading.

I would love to contact you buddy, where do i go.

South Africa.

Hey rayner…I love your youtube videos and your books. I really appreciate your willingness to share these ideas. I want to ask, can someone wither $50 investment trade the stock market?

Hi Amio,

Thank you!

Yes, but it’s not meaningful.

Thankyou very much

Hi Pharm,

You are most welcome!

Do you trade crypto currency bro?

hi rayner, i’ve been trading for the past 6-7 months, been reading most of the books that you recommended, like reminisence of a stock operator, the little book of market wizards, currently reading trend following by michael covel. i’ve also read most of your blogposts and applied all that ive learned from you and the recommended books and the books i bought from you

but am currently at a 27%drawdown probably due to the mistakes that i made as a new trader , what really striked me the most was trend following.

just wanna ask you a question, why hold not more than 20stocks for trend following ? is it because to track the performance or that holding of 20 stocks will offer and edge in the markets ? i’m kinda confused here, hope that you will help me out.

cheers,

kevin

Infact Rayner you are just incredible, you are so receptive, willing to help and teach traders increase in thier profits, and trading system, which makes u phenomenon, and ever since I have been following you, oh my goodness, I have improved rapidly. Thanks for your good heart, more money,more knowledge for you.

Thank you, Oluwafemi!

Thank you Rayner.

Thanks for the well organized series of videos and lectures. Very informative. You mentioned about 50 week high stocks but how do you find these as most stock screeners give only 52 week high stocks ?

Thanks

[…] example, a Trend Following strategy is backed by 5 […]

Thanks a lot Rayner you’ve made me see trading from an entirely different and amazing perspective

Rayner you give the most amazing stuff that we need in fx market

Thank you, Berinyuy!

Rayner makes me a better trader as the day goes by……

That is our goal. To help traders to become better as the day goes by.

Cheers!

Great analysis. Would you mind sharing the software/application you used to backtest the stock strategy?

Hi teacher