So…

In my last post, you’ve learned Fundamental Analysis isn’t reliable to make trading decisions.

And Technical Analysis could work, but you’ll need to spend months (or even years) testing your strategies — and there’s no guarantee it’ll work.

If you missed the earlier post, then check it out below…

The Truth about Trading Nobody Tells You

Now you’re wondering:

“Is there a better method to trade the markets?”

Well, after many years of research and development, I can finally say…

YES!

And the answer is…. Systems Trading.

Now, don’t worry if you don’t know how to code or program, I’ll get to that in a minute.

But first… what is Systems Trading?

It’s a method where you’ll trade the markets in a systematic manner, with no discretion or subjectivity (everything is in black and white).

And because the strategies are systematic, it can be back tested accurately over 10 years (or more) — in less than a minute.

Yup, you read right.

Less.than.a.minute.

This means you’ll know whether your trading strategy has an edge in the markets in less than 60 seconds.

Can you see how this is a game changer for you?

Moving on…

You’ll discover 5 systems trading secrets professional traders hope you never find out…

Secret #1: Why you don’t need to code to be a systems trader

Here’s the deal:

You’re a systems trader, not a systems developer.

A big difference.

Let me explain:

When you turn on a lightbulb…

Do you need to know where the electricity comes from?

Do you need to know what the filament is made of?

Do you need to know who Thomas Edison is?

Heck no.

You just flipped on the switch and POOF — the light turns on!

And it’s the same for systems trading.

You just follow the rules and POOF — you have an edge in the markets!

Remember:

You’re not developing the system — you’re trading it.

And all you need to do is flip on the “switch”.

That’s the gist of what is system trading going to be for you.

Next…

Secret #2: How to beat the markets in less than 30minutes a day

Now:

When I mention Systems Trading, you might think its high-frequency trading (like scalping on the 5-minute timeframes).

Nope.

The Systems Trading I’m referring to is trading on the higher timeframes (like the Daily and above).

And if you ask me, trading probably takes you less than half an hour.

This means if you can spare 30minutes a day, then you have what it takes to become a successful systems trader.

The best part?

You profit from the financial markets and have the freedom to do the things you love.

Secret #3: The richest traders of the world use this trading method…

Check this out…

David Harding, founder of Winton Capital has a personal fortune of US$1.5 billion, at the age of 55.

John Henry is known as the trader who bought the Boston Red Sox for $700m.

Jim Simons, founder of Renaissance Technologies earned $1.7 billion in 2006, $2.8 billion in 2007, and $1.2 billion in 2014. And according to Forbes, he has a net worth of $20 billion as of 2018.

Now…

What do these traders have in common?

They adopt a Systems Trading approach.

Yes, you read me right.

The richest traders in the world are not discretionary traders but, Systems Traders.

They execute systematic trading systems which allowed them to amass huge fortunes in the markets.

Now…

I can’t guarantee you’ll make billions of dollars (nobody can).

But what if you just achieve 1% (or even 0.1%) of what they did?

Secret #4: How to become a consistently profitable trader in record-breaking time

Based on a survey I did with 500 traders, I realized many of you faced these issues…

- Lack of trading capital

- The “need to make money” syndrome

The solution?

Become a systems trader and get a job.

Here’s why…

You grow your capital quickly

By now, you know Systems Trading doesn’t require much of your time.

This means you can get a full-time job and use savings (from your job) to increase the capital of your trading account — and let the power of compounding work for you.

In my opinion… this is the secret to building SERIOUS wealth with low risk (I’ll explain more later).

It removes the “need to make money” syndrome

What is this syndrome?

This is where you break your trading rules (like shifting your stop loss, revenge trading, averaging your losers) just to avoid a loss.

Why?

Because you rely on your trading profits to pay the bills and you do whatever it takes to prevent a loss.

But if you have a job, things are different because you don’t rely on your trading profits to live.

Even if you have losing months, it’s not the end because your job will provide your living needs.

This means you can focus on executing your trades correctly and not worry whether you can pay the bills.

Won’t this help you become a profitable trader in the fastest possible time?

Secret #5: Trading multiple systems improve your performance and reduce your risk

Now you might be wondering:

“How does it work?”

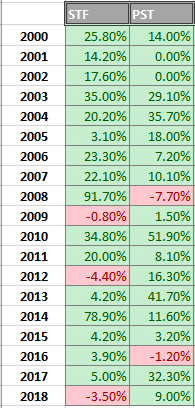

Look at the table below…

You can see the results of 2 trading systems from 2000 – 2018.

On its own, their trading results are decent with a few losing years in between.

But, when you trade both systems (by allocating 50% of your capital to each), that’s where the magic happens.

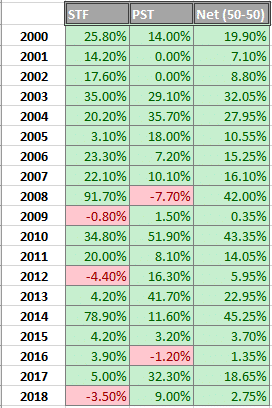

Look at this next table below…

Previously, you had losing years for both systems.

But when you combined them together, you have 0 losing years.

Now, I’m not saying you’ll never have losing years because the future is uncertain.

But one thing is certain is this…

When you trade multiple trading systems, you improve your performance and reduce your risk.

Pro Tip:

For this to work, you must trade trading systems which have little-to-no correlation with one another.

Because trading multiple systems which are correlated will only amplify your risk.

That’s why in my premium training program, The Ultimate Systems Trader, you’ll learn multiple systematic trading systems that work — and have little correlation with one another (more on that later).

Secret #6: How to grow your wealth to $1,311,816 even if you have a small trading capital

Do you know the magic of compounding?

Most traders don’t realize it as they are looking for a get rich quick scheme.

But no, you’re different.

You know trading is a long-term endeavour and it can help you build SERIOUS WEALTH.

Let me prove it to you…

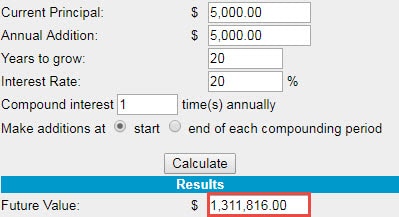

If you make an average of 10% a year with a $5,000 account, after 20 years it will be worth…

…$33,637.

Probably not enough for you.

So let’s work on it…

Since you have a job, you can take things a step further.

You can use a portion of your income to increase the size of your trading account.

Let’s contribute $5000 to your trading account each year (which is less than $420 a month).

Again, the same rules apply.

You make an average of 10% a year with an initial sum of $5,000 and you add $5000 to your account each year.

After 20 years, it’ll be worth… $348,650.

Now, this looks much better.

But is this the best you can do?

Well, if you’re a Systems Trader, you can do better than 10% a year.

Because if you follow the strategies I teach in The Ultimate Systems Trader, you can achieve 20% a year.

And let’s see what it can do for you…

Again, the same rules apply.

You make an average of 20% a year with an initial sum of $5,000 and you contribute $5000 to your account each year.

After 20 years, it will be worth… $1,311,816.

Now let me ask you…

Will $1.3m give you financial security?

Will $1.3m allow you to retire and have the freedom to do the things you love?

Will $1.3m give you peace of mind knowing you can better provide the needs of your family?

In other words…

If you have an initial capital of $5,000 and can add $5000 to your account each year, then you have what it takes to build serious wealth.

Now…

Don’t worry if you don’t know how to get started on Systems Trading.

Because in my next post, you’ll discover how to ethically “steal” systematic trading systems used by hedge funds and institutional traders.

For now, here’s what I’d like to know…

What do you HOPE to achieve from trading?

Leave a comment below and share your thoughts with me.

Its encouraging…I made $233 in profit this week using system trading…you just game more edge with this post ,because i was trying out my system.

Nice!

Hello Kesh

I am new here, which System Trading did you use, I like to try it,

Why should I trust you?

Why are you here?

From trading I hope to be able to execute trades that are highly accurate with minimal risk. I hope to do this consistently every day, so that i can stop working for a boss and create my own wealth for me and my family.

Thanks for sharing, Jermaine!

Consistently win trades not loose them

Thanks for sharing!

Interesting Rayner.

I have developed my own system and automated it to an EA.

Every single word you mentioned is like stripping days out of my life in front of the charts. I know as a coach you try not to encourage massive (unrealistic) gains but the reality is that double digits is the norm for annual growth in systems trading (especially on D1 and higher).

Thanks for sharing!

Great stuff, Vernon!

I like your moving average trading strategy and i am slowly becoming more confident in my approach on buying or selling in market

Awesome to hear that, Endy!

I want to attain financial independence and retire young

Nice.

Iwant finacial freedom an fire my job

Sweet!

So far your posts are improving my knowledge on financial markets.Thnkx alot

I’m glad to be of help!

I am enriched by your valuable post….

Cheers

Financial freedom

Nice!

All good but it’s so hard to find a consistent profitable system. Running it’s the easy part

Thanks for sharing, Dave.

I want to be a profitable trader, buy a big car n house

Thanks for sharing!

Provide financial security to my family

Awesome!

Eventually financial freedom. But in the short term supplemental income for my primary income.

Nice!

thanks Rayner, i am kind of new here, so i don’t understand much, because i just registered with a binary option, my broker is iq options, but i really want to help myself and my family. can you please write something on the binary option.

Please stay clear of binary options, whilst l don’t personally know of is options, binary option brokers tend to be scam, set to give great results on a demo account, but once you give them your hard cash, it’s gone in a blink of an eye. Don’t trust, they are salesmen,not trader’s.

You could instead learn to trade options, whilst on the face of it may appear similar method of trading it is very different. Please use a regulated broker!

I don’t trade it so I can’t comment.

Run for ur life iq option are scammer u can register with the following brokers icmarket,forextime,xmglobal,tradersway….all these are good brokers with low spread

hi mugri. binary option is type of “trading” that i personally say “high return” BUT with “very high risk”. If you know what are you doing in binary option, yes it will profit much. but if you dont know what are you doing, then you will lose great amount of money in no time.

and actually, you never trade anything in binary option. It is just gambling and the object of gambling is comodity price. it is actually simillar with gambling soccer, but in gambling soccer, the soccer is the object of gambling,But instead in binary option, the gambling object is comodity market. sorry for that kind of fact. Yes they will pay you if you win, and yes the price is quite same with normal market (if you dont believe me, you can open your binary option, and also open Metatrader 4, lets open eurusd for both of them, and you will see the price will move in quite simillar movement. So if there is someone say that binary is tricking you, broker is editing the price. well it is absolutely wrong. they are fair in price).

Well it is again up to you sis.

Well Rayner, I have always have that in mind but most often my fear haas been leaving all those monies with your broker for that number of years. Is it advisable. If yes can give me one two trusted brokers.

I don’t publicly discuss brokers because in this day and age, we have no idea what goes on behind the scenes.

If you want a recommendation, drop me an email me and we can discuss it.

Trusted broker

You really teach well and have some great concepts on trading, thank you for your help

My pleasure!

Financial freedom

Cheers

I think onepart hard to overcome as our capital gets bigger by topping up annually is our psychology. 1% risk of $5000 vs 1% of $25000 after 5yrs is still same risk, but different quantum.

I realized as your net worth increases, the risk per trade gets easier to handle.

For example, a 10k loss might be a lot to someone with 100k net worth, but not to someone with 100m.

to become profitable and provide a better life for my family.

Thanks for sharing, Ben!

I just want to become very good at trading, then all things will follow…..

Nice.

hi rayner nice work , i have a question if you can answer me please , what’s the difference between discritionary trader and system trader

Discretionary traders have an element of subjectivity in their trading like drawing of SR, trendline, etc.

Systems trading has zero subjectivity.

Hey Rayner, thanks for these incredible trading lessons, I wanted to start trading to provide myself and my family with an additional income so we can all do the things we love and enjoy this beautiful world of ours. I finally feel with your help and guidance I can finally accomplish that.

Thank you so much….

Awesome to hear that, Gideon!

Rayner, thank you for your emails that have open my mind to much needed knowledge. I am nearing retirement and want to start and grow account for retirement and more. I look forwRd to your next emailwithmore knowledge. Thank you

You’re welcome!

Now I am retired, looking for regular family maintenance income as well as protecting my capital including inflation cost.

Thanks for sharing!

Hi Rayner,

First of all, congratulatios for your honest work and statements…

I personally intend to develop my own system, which I can backtest and, therefore, trust and really know (drawdowns and system idiosyncrasies), so I can be consistent, profitable and manage risk properly.

I also count on you… to achieve that goal. 🙂

And I’ve been learning a lot with you till now, my friend.

Really!

Thank you very much!

You’re welcome and awesome to hear that!

Great article, Rayner! Good points and helpful!

One other point I’ve been waiting for while reading your article: how to backtest our strategy over 10 years or more in less than a minute without knowing how to code — isn’t forthcoming even by the end of your great article.

Is it what you’ll cover in the next article? I’ll be waiting!

Thanks!

Hey John

Yes, the next post will be how to backtest your trading strategy even if you don’t know how to code.

Hi, I don’t just hope but I really want to achieve financial freedom by the age of 50. Currently I’m 28 and doing my best to achieve my goal by the age of 50.

Great one!

I want to make quick profit

Oh no.

Soo good sir

Cheers

Sir i really want to what are levels. Several times i heard this. And some tips provider use this and it works please tell us what are these levels of intraday.

I’m not an intraday trader.

I’m just a final year student from OAU. I just want to be a very good trader before I leave school. Thanks for the mails they are really helping me

Awesome to hear that!

i hope to achieve freedom in the long run from trading

Sweet!

I have been looking for financial freedom for the past few years and I got interested in forex for the past few years and I have been blowing accounts due to lack of knowledge but I’m glad that now I’m starting to see a difference in Forex from your videos and I watch them everyday

Awesome to hear that!

I hope to achieve financial security by trading.

Nice.

Hello Rayner,

Having explained above in depth, you know that 90% of people will agree and want to know how could they make 20% each year, especially with little work.

What worries a person like me is that, why did Rayner not write to check or buy his “that” program and further failed to disclose its cost? What kind of the game is being played here?

It would be honest, fair, and nice for you to tell us the costs rather than leaving us with puzzling questions to write comments for future reading.

Being honest and truthful to yourself, you already know that not too many stupid people will say that your above offer was either not understood or ridiculous. Many of us are unsuccessful with Trading thus far, but we aren’t stupid.

So, please just let us know the costs and benefits of such “system.”

Thank you. Moe

PS: Please do not get upset with my remarks. My above suggestions of being brief and straight forward could help build “Trust” in you and in your product.

Thank you for sharing your concern, Moe.

I’ll share the full details in a couple of posts later.

But for now, I want to explain and teach the important concepts about trading.

Daily income

Thanks for sharing!

I hope I can trade successfully all the time and get to financial freedom

Nice.

Systematic trading should be confluence mindset, strategy and skills over time to define your own system.

Thanks for sharing, Yip!

Hello,

Are you giving training for indian market

Nope.

I want to be a consistent profitable trader.

Nice!

Like most people I know they and I would like financial freedom.

Awesome!

How can you be my mentor mr rayner?

I’m not doing any mentoring right now.

Hi Rayner

Is your moving average trading strategy discretionary or system trading strategy?Bit confused here.

As always I appreciate your selfless guidance and education.

My main goal is to get a better return on my money than what the banks offer.Thats why I’m learning to trade

Best regards

It’s discretionary if you’re referring to the 50ma bounce.

Thanks for sharing!

I want to make a career on trading.

Thanks for sharing!

That financial freedom, i want to taste it and the satisfaction I get gives immence pleasure.

Thanks for sharing!

Establish a strategy and be a system trader

Nice!

Good, my goal with trading, initially is to be consistent, second to obtain a financial freedom and therefore capitalize in the future. Thank you rayner for your teachings

Awesome to hear that!

Freedom from the corporate world. Freedom!

Nice!

I want to build a long term fortune from trading.

Thanks for sharing!

Extra money for more security

Nice!

I want to be a full time mom

Thanks for sharing!

Financial freedom from paid job

Mmmmm

Hello Rayner. I’m wanted to trading but I dono from where to start. Can you teach me bro? Sorry if asked anything wrong.

I would like attain financial stability for myself and my family.

I feel there is more to life then to be stuck at a JOB for 40+ hours a week. I feel like a prisoner to everything LIFE has to offer. My children are very young 2 and 3. For once in my life I am putting making money 2nd and instead reprioritizing my 1st priority, to making MEMORIES. Which is the only treasure I can access on my death bed. I feel like becoming a successful trader, can one day free my from being a slave to the punch in clock, just for survival. The know the road is hard in this new venture of mine but the payoff is worth every penny to me. I appreciate and thank you to you Raynor, for your amazing YouTube videos. It has made me see so many different trading setups and opportunities, I have gained so many useful tools and knowledge from you, I am still in the testing mode with all I have learned from you so far, but because of you, my future as a day trader is so much more brighter. I always refer everyone who is wanting to learn to just watch TradingwithRaynor!

Thanks Raynor

Happy to have found you!

Glad to help, Victor.

All the best!

I want the possibility to completely change my life around and become financially stable…

I don’t expect to become rich (Even though this would be nice) But I would like to get out of the debt pit and be financially comfortable.

Thanks for sharing, Debbie!

You are the best Technical Analysis teacher I’ve come across. You are truly appreciated Rayner!

Cheers

I want to be financial free.

We win by not losing….

Bamalli

Hi, thanks for the post. I am interested in system trading with the view of making the most out of the market trend.

Inspiring post,i want to be financially comfortable be able to create my own leverage and stop relying on employment

TO SAY THAT THE FUNDAMENTAL ANALYSIS IS NOT RELIABLE NON-SERIOUSLY !!!

Unfortunately, Theo and his site remain purely technically based, there are countless in the net. If you are working in a bank or hedge fund to trade people’s money, will you watch this or that candle … Or what the curves will tell you. At the bank where I work, my colleagues rarely look at the charts !!! Rather, they are interested in the fundamental factors driving this market.

The problem is that it is much easier to learn technical analysis. That is why such sites exist and everyone proclaims that fundamental analysis is not worth it and we should only look at the price action.

PLEASE DELETE THIS POST BECAUSE YOUR CUSTOMERS WILL BE DOUBTFUL

People’s reaction to fundamentals are too unpredictable.

I’d like to make trading my everyday job.

Thank you very much Rayner for all the facts you bring forward .You are absolutely true capital is the key to open all the gates. Getting the job is another issue in most places in this world. Once you are without a job, plans come to a standstill. Please correct me if I am wrong with this saying”If other people can survive critical situations and make a good progress in their lives,why can’t I”.

Your lessons are so motivational .Thanks

My pleasure!

This approach makes a lot of sense for younger, working age people, who have time to fortune build. I’m retired and I’m focused on making a modest contribution to expenses on a weekly basis, through price action day trading. Cheers, Keith

Cheers

Hi Rayner,

I have been following you for a while now and in all honesty I must say that to me you are one of a few people who teach tradingtechniques who seems cool and normal about the subject. You hand the information in a relaxed. That is what I was looking for.

Coming to this system trading, this seems really interesting.

I am looking forward to your next. Will you also tell more about your premium training program, The Ultimate Systems Trader?

Thx,

Erik

Hey Erik, I’ll share more details soon. Cheers

I want to know more about this, but I made 50% in 1.5 moonths with mine.

I’m trying to develop my own system, but it’s taking too long to back-test.

In the next lesson, I’ll share how you can speed up the process. Stay tuned!

Salut Teo, merci beaucoup pour tes formations. Elles changent complètement ma vision de TRADING.

Demn. Ur very good my friend. Stay awesome!

Great teaching.

I would like to start making 5000 a month by February 2020.

Consistant trading performance with high win rate, good RRR.

I want to make wealth in trading

Systems Trading seems the way to go, I need testimonials for people it has worked for with Teo’s leading and tutorials

love to read your work man ! i systematic trading doesn’t work , nothing works !

I want to be financially successful in trading with your systems Rayner

I just want to live life on my own terms!

Nice!

Good post and all sensible and common sense although not common practice. But what do you do if you have no job, can’t get one and low capital. Then you have to find a system to trade manually and use a gate system to scale up. Take half profits out and leave half in to give something for the bills and something to grow the account. And then eventually start to allocate capital to automated systems

I hope to achieve small but profitable trades only as a secondary income for the time being.

Hi Rayner

I want to learn more can you also send me link and info on your premium training program, the Ultimate Systems Trader.

I also want to learn more on multiple trading systems that work

Thanks

I’ll share more details soon, keep a lookout for it.

wonderful Rayner

Thank you so much!

You’re welcome!

To add another source of income

able to make profits more than losses, and spend more time with family.

I hoper that your ” Ultimate Systems Trader” will be available soon (again)

hope *

I am using stochastic oscillator as my trading strategy, what else can I use it with?

So what EXACTLY is the system? I still don’t understand after reading your article.

hoping that one day i will break even and then increase profit marginally to an enviable level

My aim is to generate US$2,000.00 per month. Anything above will be sweet.

I would love to build serious wealth with trading.

Hi there,

It’s great job by. .. Please continue.. .i am greatly benefitted by your posts.. . Thanks for all you are doing

Will do!

what software do you use to backtest your trading systems ? TradingView or other(s) ?

I use Amibroker. I’ll share more in the next post. Cheers

i am forex trader in sri Lanka. i lost huge amount of money.how to be system trader. i try to earn money in a short period of time. i lost,

Already retired. 80 years old and I am the sole caregiver for my wife nd daughter (both invalids). I have120K in equity and need to recoup what my fund manager lost in 2008. Believer in mechanical trading but can’t tolerate large draw downs. I rely on social security and trading to pay the bills. Looking for a trading method(s) for a reliable source of income

Hey Vince

Given the circumstance you’re in, trading isn’t the best approach for you since there’s always a risk of loss, and at times, the drawdown can be large too depending on how much you risk.

I want to achieve a financial freedom so that I can stop working full time one day and just do trading from home not from work. And I guess that can allow me to make more money when I’m giving trading full attention.

Thanks for sharing!

Nice to know more about system trading

I want to be an expert in trading

I will like to be a professional trader

I wish to achieve a sizable amount, ro be precise, $100000 to invest in real estate.

Sir I want to make financial freedom.

Thanks. How can i get the copy of this system?

so Rayner…..you are trading 2 systems and in x years you will be a multi millionaire right ?

Well, looks attractive. Please Share with me to live test it

I plan to replace my current 9-5 job with trading …..

Hi Rayner,

What does STF and PST stands for?

Where to read or how to get thoses trading systems/tactics?

Thanks!

Sandris

STF and PST are the names of my trading systems, systematic trend following and power stock trading.

Those numbers are % returns in a year.

youre good …i hope seen your @ 2012

Wow that’s a long time, thank you for your support!

I would like to build a house for my family and take my kids to better schools

Nice!

To have financial security

Thanks for sharing!

I want to have consistent profit for long time, I don’t need shortcut profit. I just want a process or system that work.

Great attitude.

I love you Rayner you are wonderful you always helping people with good advice, God will reward you. But for me I find it difficult to follow this advice because of low income 5000USD is too big, if I 500USD I would have been happy.

How to Ben profitable from trading and to provide that extra income for my family

I hope to make myself, my family and my fellow Nigerians financially free by trading.

Awesome!

Thank you for your hard work to help all of those who don’t know that much on Forex.

can someone teach me how this work?

My goal is live off my trading income as i approach retirement age – am 59. I thoroughly am grateful for the education and though i have been at this for 2 years have lots to learn and look forward to the next post on finding a system that works for me.

Thank you for sharing, Zee.

I am on the verge of retirement and would like to live off trading thereafter. I am interested in your systems trading which you just described. How ca I take advantage of it.

My trading approach isn’t to generate a consistent income but rather to grow wealth over time with reasonable drawdown.

It might not be a good fit for you based on what you just said.

I want system trading

Hi Rayner

My aim is to become financially independent through trading. I am 56 years old and my pension will not be sufficient to sustain my wife and I. So I need to learn the skills required to become a successful trader, to systematically build my account to a point where it will provide me with an additional income. I have been trading for 2 years and it has been hard, but I have not yet blown my $100 account yet! Since I have started following your posts, my attitude toward my trading has changed from trying to make quick money to systematically building wealth and I must say it is really starting to pay off!

I would like to make lots of money to have a better love cause i’m a single mother to my boy and I’m not workin.

Increasing profitable trades

Hope to make a steady stream of monthly income and compound a portion of it to build wealth for philantrophy in the future years

To eventually be financially free.

Nice post…. thank you for the help. I look for next update.

Definitely interested in making consistent profits.

Not to get rich quick stuff that everybody promotes.

Good

Thanks Rayner. am new to trading but catching up with game squarely. i will appreciate a most detail coaching on risk management. thanks

Check this out… https://www.tradingwithrayner.com/forex-risk-management/

I m interested in your ultimate trading systems, I can’t find it , is it still available? thanks

rayner. in your opinion, how much percentage of return in a month from total investment that we can get from trading safely.?

financial freedom