Look:

A bodybuilder has a journal to track his diet, weight, and strength.

A scientist has a journal to track their latest findings and the results of experiments.

A chess master has a journal to record down his plays and his thought process of the game.

And it’s the same for trading!

But here’s the thing…

Most traders don’t have a trading journal or don’t even know what it is.

Why?

Perhaps you don’t know how to create a trading journal.

Perhaps you don’t know the importance of it.

Perhaps you don’t know what to write in it.

Well, no worries.

Because in this post, I will explain to you (step by step) on how to create a trading journal.

And by the end of it, you’ll have what it takes to find an edge in the markets so you can become a consistently profitable trader.

Sounds good?

Then let’s roll…

What is a trading journal and why you need one

Your trading journal is like a “diary” that records your trading activity.

If you ask me, a trading journal is a deciding factor of whether you’ll be a consistently profitable trader — or loser.

Here’s why…

A trading journal helps you identify your strength and weakness

Here’s the truth:

No one is a perfect trader, it doesn’t exist.

Instead, you must play to your strengths and prevent your weakness from jeopardizing your trading account.

Take me for example:

I used to lurk around forums and look for the latest trading strategies. Or, I’ll read a new trading book and see what trading systems it offers.

Obviously, I enjoy learning new trading strategies. But unknowingly…

…it cost me BIG TIME.

Why?

Because I didn’t know what worked, my results were inconsistent, and I didn’t how to progress forward.

That’s my weakness… hopping from one system to the next because “it feels right”.

But how did I realize my mistake?

Because I had a trading journal and I realized my trading setups were always different.

And that’s the problem. I couldn’t pinpoint what worked and what didn’t because my strategies were always changing!

But thank god I “woke up” from my mistake and I lived to tell you about it…

A trading journal helps you find an edge in the markets

One of the biggest takeaways I had in trading is this…

If you want to be a consistently profitable trader, then you must have a consistent set of actions.

Now, it doesn’t mean if you’re consistent in your actions, you’re guaranteed to be a profitable trader.

Why?

Because you might not have an edge in the markets. And your consistent actions lead to consistent losses.

But here’s the deal:

If you have a trading journal, you can look back at your past trades and identify which patterns are costing you money — and stop trading it.

Then, focus on the ones that are the most profitable for you… and you‘ll find your edge in the markets.

Next, let’s dive into how to make a trading journal (before, during and after the trade)…

How to create your trading journal (before the trade)

The way most traders create their trading journal is to write down their entries, exits, profit & loss, and etc.

However, it’s not enough because it doesn’t dig deep into the factors that AFFECT your trading performance (like your emotions, your analysis of the markets, and etc.).

That’s why your trading journal should be split into 3 parts — before, during, and after the trade.

Only then you’ll get a full picture of the factors that drive your trading performance.

Now you’re probably wondering:

“What do I put in my trading journal before the trade?”

Your analysis of the markets and the setup you’re looking for

You might be wondering:

“What’s the purpose of it?”

So here’s the thing:

If you don’t write down your thoughts or prepare yourself ahead of the markets, you’ll find yourself missing obvious trading setups (which look obvious in hindsight).

So, by doing this, you will miss lesser trading opportunities and make more money.

Now…

Depending on your trading approach, you should do your analysis before the market opens or during the weekends (if you’re a longer-term trader).

Here’s an example on a forex trading journal:

On the daily timeframe, EUR/USD is in a healthy uptrend and it has bounced off the 50-period moving average (MA) the last 3 times.

If there’s a pullback towards the 50 MA, then I’m looking for a bullish candlestick pattern to get long.

My stop loss will be 1 ATR below the swing low with target profit just below the swing high.

Note: Your trading setup must be aligned with your trading plan. If you take any setup outside of your trading plan, then you’re not trading, but gambling!

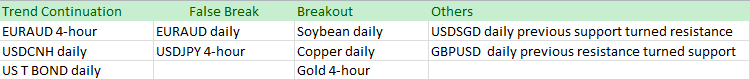

A quick overview of potential trading setups

Now, if you’ve done your homework, you’d realized your trading journal can get lengthy (especially if you trade more than 20 markets).

So…

What you can do is summarize your analysis of the markets and the trading setups into a few words.

This means at a glance, you can quickly identify the potential trading setups that are about to happen.

Here’s how you can optimise your forex trading journal to achieve that:

- Divide your trading setups into its respective categories

- Write the setups and the timeframe of it

An example on how to make trading journal (before the trade):

And if you want more details on your setups, just refer to the trading journal you created.

Does it make sense?

Good. Then let’s move on…

How to create your trading journal (during and after the trade)

Now…

Here’s what you need to record during and after the trade:

- Relevant metrics

- Charts of your trade

Let me explain…

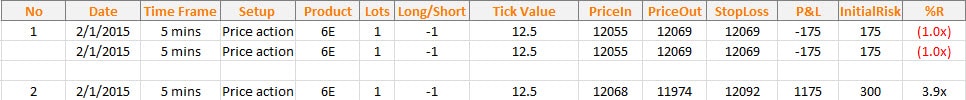

The relevant metrics for your trading journal

They are:

Date – Date you entered your trade

Time Frame – Time frame you entered on

Setup – Trading setup that triggers your entry

Market – Markets you’re trading

Lot size – Size of your position

Long/Short – Direction of your trade

Price in – Price you entered

Price out – Price you exited

Stop loss – Price where you’ll exit when you’re wrong

Profit & Loss in $ – Profit or loss from this trade

Initial risk in $ – Nominal amount you’re risking

R – Your initial risk on the trade, in terms of R. If you made two times your risk, you made 2R.

An example on how to make trading journal (during and after the trade):

Next…

The charts of your trade

At this stage, you’d want to save the charts of your trades.

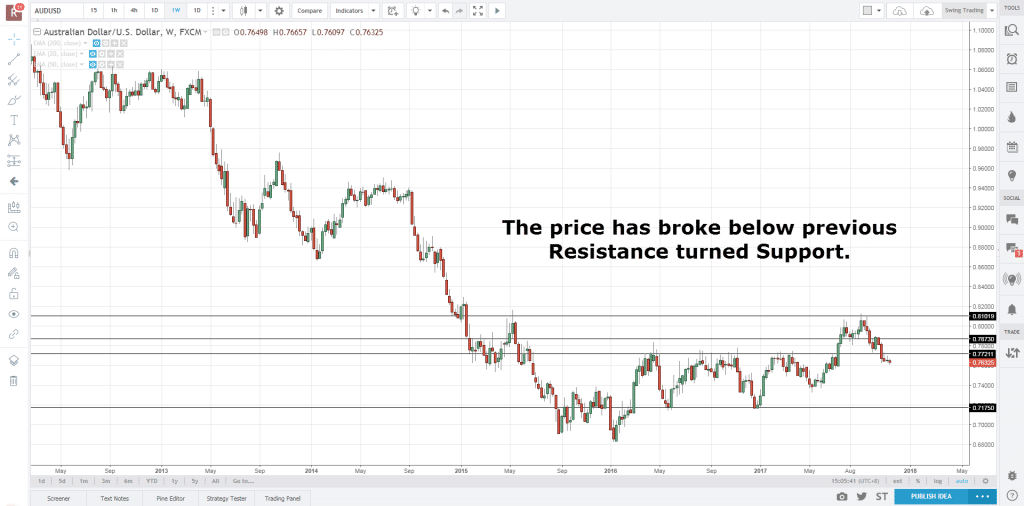

Higher timeframe chart

This tells you where you are in the “big picture” and to identify key Support & Resistance areas.

Entry timeframe chart

This is the chart of your trading setup. You’ll want to state your setup, mark down your entry level and stop loss on it (I use green and red respectively).

Chart when the trade is over

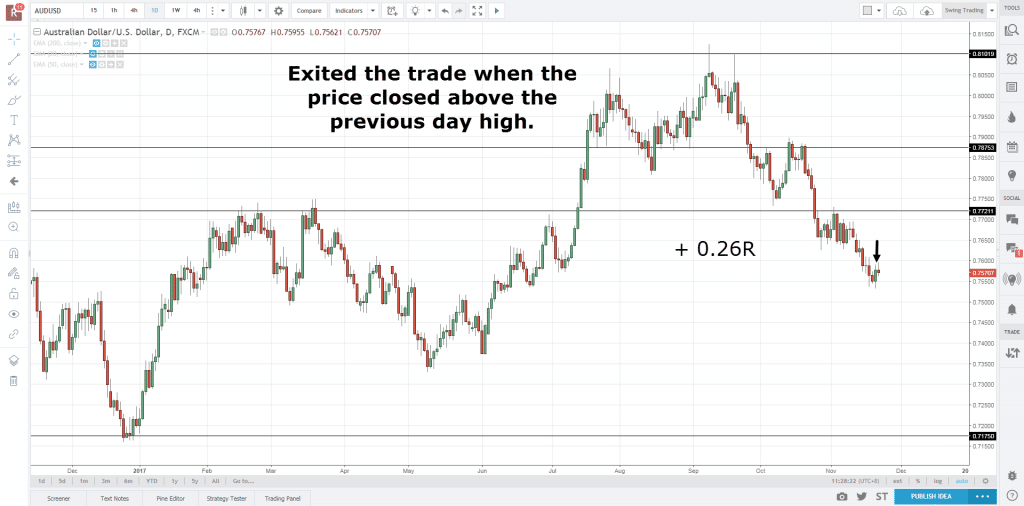

This is the chart after the trade is over. You want to state the end of result of the trade with the R multiple gained/loss.

Here’s an example…

Higher timeframe chart:

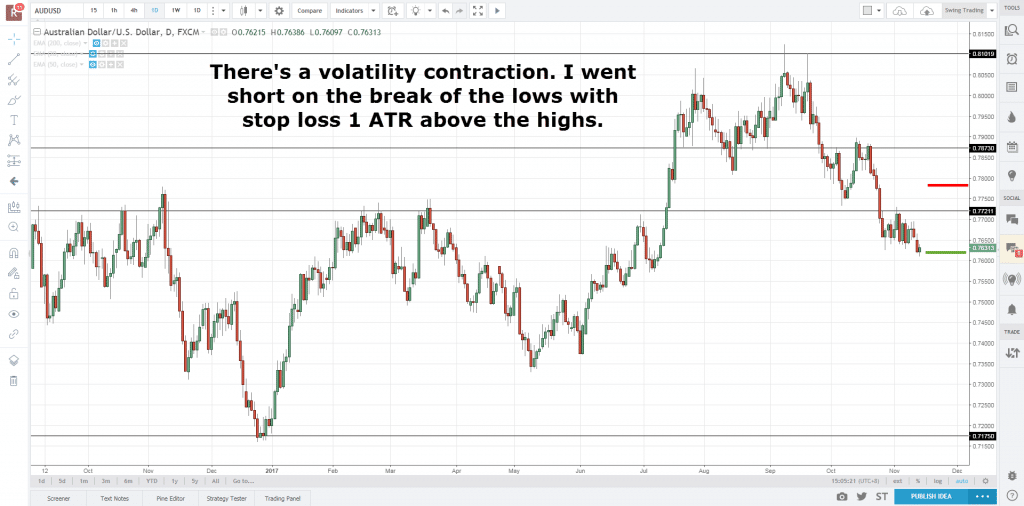

Entry timeframe chart:

Chart when the trade is over:

And that’s all to it.

In the next section, you’ll learn how to use your trading journal to find an edge in the markets.

Let’s go!

How to review your trading journal and find your edge in the markets

This is where the magic happens!

If you had consistently updated your trading journal, you can now review it and improve your trading results.

Here’s how…

- Identify patterns that lead to your losses

- Identify patterns that lead to your winners

- Find ways to minimize your losses

- Find ways to maximize your gains

Let me explain…

1. Identify patterns that lead to your losses

Here’s the thing:

Among the different trading setups, there might be some which are causing you to lose consistently.

So, look through your trading journal and identify the worst performing setup — and stop trading it.

This simple adjustment will reduce your losses and ultimately increase your net profits.

Moving on…

2. Identify patterns that lead to your winners

Next, you’d want to identify your best trading setups. These are the ones that bring in the dough consistently.

So, look through your trading journal and identify the best performing setup — and focus on it.

If you want to find more trading opportunities, trade more markets, trade a new timeframe, or both.

Onward…

3. Find ways to minimize your losses

Now, let’s take things a step further.

After you’ve identified your best trading setups, you’ll still have losers on it.

So, look through the losers of your best trading setups and ask yourself…

“How can I minimize my losses?”

Perhaps you can cut your losses earlier.

Perhaps you can use a filter that reduces your losses.

Perhaps you can avoid trading certain time of the day (or week).

Next…

4. Find ways to maximize your gains

Do you want to take your trading up another level?

Great!

Then you must learn how to maximize your gains.

Here’s how:

Look through your best trading setups and ask yourself…

“How can I maximize my profits on these trades?”

For example, you can…

- Scale out a portion of your trade and let the remaining run

- Identify patterns that lead to monster winners and trail your stops on it

- Think on your own two feet and figure something that works for you

If you can do these 4 things, then you’re close to becoming the best trader you can be.

Can you see the power of having a trading journal?

But at this point…

What if you’ve done everything yet you’re still a losing trader?

- You created a simple trading journal

- You screenshot your trades before, during, and after religiously

- You discard setups that makes you lose money

Yet you’re still losing money consistently.

What should you do?

Why is this happening?

Let me tell you in the next section.

Why You Are Still Losing Money Even With A Trading Journal

When it comes to money, you often hear things like:

“Money is the root of all evil”

“Money can’t buy you happiness”

“You can’t bring money to heaven”

And other things.

But the truth is that money makes you more of who you are; money is neutral, an amplifier.

So when you start experiencing financial problems…

Money sometimes isn’t the problem itself, but your money habits.

It’s the same with having a trading journal…

When you’re experiencing consistent losses…

Your trading journal itself sometimes isn’t the problem but your trading habits and multiple factors such your:

- Trading psychology

- Risk management

- Trading strategy

Let me explain…

1. Trading psychology

When you’re losing consistently despite having a trading journal, this should be the very first thing you should be tackling.

Having issues with your trading psychology basically means that your actions starts being dictated by your emotions.

Therefore producing consistent bad trading habits:

- Adding into a loss

- Holding into a big loss

- Taking trades too early by breaking your rules (fear of missing out)

- Immediately hopping strategies (lack of confidence)

- Overtrading by taking trades outside your rules (impatience)

Sounds familiar?

Now, I won’t say stuff like:

“Trade like a sniper, not a machine gunner!”

“Think long-term and let your edge play out!”

Because I’m not here to motivate you but to guide you.

So, to dispel most of the trading habits you are producing, one thing I suggest is for you to…

Withdraw half of your account

For example, you have a $1,000 trading account.

If you think that you are consistently producing bad trading habits from that account then I suggest you withdraw half of it.

Why?

Because reducing your account in half almost immediately reduces your attachment towards money.

Therefore helping you think objectively by attaching yourself to the process.

So, what do you do with the money you withdrew?

Why don’t spend it of course!

Now’s not the time to buy a new Playstation 5.

Instead, deposit your funds back slowly as you gain consistency with your actions every month or quarter.

Makes sense?

2. Risk management

If you’ve lost or gained 50% of your trading account with just 5 trades…

You literally have no risk management in place and you’re treating trading as gambling.

I’m not going to lie to you…

I’ve been through this as well.

Making a lot of money in a few trades only to give those profits back to the markets just as fast as I made them.

I know how it feels like.

It was a major problem.

However…

I’ve met traders who think that this isn’t a problem at all and that they enjoy it!

So, which side are you on?

If you believe and enjoy “jackpot” trades by betting it all in one trade, then the casino might be the right place for you instead of the financial markets.

But if you’re in this for the long-term and believe in achieving small losses but consistent gains then…

Risk 1-2% of your account and apply position sizing

Here’s the main objective:

When your stop loss price is hit, you won’t lose more than 1-2% of your account.

That’s right, you know when to exit when you’re wrong and exactly know how much you’re going to lose before you enter the trade.

Unfortunately, applying position sizing can depend on what markets you trade.

Fortunately, there are a lot of position sizing calculators readily available!

So if you trade the Forex market, I suggest you check out MyfxBook’s position size calculator here.

Finally, if you trade stocks, I suggest you check out InvestmentU’s stock position size calculator here.

Cool?

At this point you’re probably wondering:

“Should we risk 1% or 2% of our account per trade?”

To be honest, it depends on the trader itself.

You could have $500,000 on your day trading account and risk 0.25% per trade, or have $500 on your swing trading account risking 5% per trade.

But the concept is this:

- The bigger your trading account is relative to your net worth and/or you trade the lower timeframes, the less you could risk per trade (below 1%)

- The smaller your trading account is relative to your net worth and/or you trade the higher timeframes, the more you could risk per trade (above 1%)

Sounds cool, right?

Finally…

3. Trading strategy

This should be the last thing you should think about improving when you are losing consistently.

Because if you try making tweaks with your trading strategy but your trading psychology is whack then no strategy in the world can help you.

At the same time…

If your trading psychology and risk management is on-point but you don’t have a consistent trading psychology…

Then you’re going to experience death by a thousand cuts as you don’t have an edge in the markets.

Now, I won’t be going through how you can make tweaks and improve your trading strategy using your trading journal, because that’s what you’ve exactly learned in the previous sections.

But always keep in mind…

That your trading psychology and risk management problems is something your trading journal may not be able to see.

You must tackle them in order before you try tackling your trading strategy.

Got it?

Free tools you can use to create your trading journal

Now, here are some tools you can consider using to help create your trading journal…

This is a free word processing tool by Google. You can use it to write down your thoughts and analysis of the markets.

This is a free spreadsheet by Google. You can use it to record down the relevant metrics of your trading journal.

The good thing about using Google is you can save it to the cloud so you don’t have to worry about losing your information.

This is a free image editing tool by Microsoft. You can use it to edit your charts and add any annotations if needed.

This is paid screen capture tool by Techsmith. You can use it to save your charts, edit your images, and annotate with ease.

Bonus tip: Look out for brokers with this special feature

Now before you scramble to get everything in place for your trading journal…

Check if your broker’s trading platform has an integrated trading journal.

It’ll contain the full details of your trading history.

So all you’ll need to do is to just:

- Take a screenshot of your trades before and after entry – so you’ll have a visual reference

- Write down the trading setups of the trades – to reflect on your thought process

And one more thing I want to share is this:

Some brokers have an in-built performance tracker that comes with your trading history.

That’s where you’ll get to see:

- Your win rate & risk to reward at a glance

- Your best and worst-performing instruments

- Your performance based on trade duration

- Interesting stats like the best months, days of the week or even time to trade according to your trading history

That pretty much saves you all the trouble, isn’t it?

Frequently asked questions

#1: Hey Rayner, isn’t it time-consuming to capture screenshots and reasons for my trades if I’m a scalper? Is a trading journal more suitable for swing trading or long term trading instead?

Yes, I agree, a trading journal is more suitable for traders who are trading on the higher timeframes like the 15-minute timeframe and above.

For scalpers, you could record key metrics like your trading setups, your P&L for the day, and how you were feeling during your trading session.

#2: Hey Rayner, are there any apps or software that you currently use to jot down your trades?

I pretty much use Excel to jot down my trades.

Conclusion

You must have a trading journal because it helps you find your edge, identify your strength & weakness, and improve your trading results.

A trading journal can be split into 3 parts: before, during, and after the trade.

Before the trade: This is where you analyze the markets for potential trading setups so you don’t miss trading opportunities.

During and after the trade: This is where you record the relevant data so you can review them and find ways to improve on it.

Now, if you can do this consistently, your trading results will get better. And before you know it, you are already a consistently profitable trader.

Yay!

Now before I end this post, here’s a question for you…

What do you write in your trading journal?

Leave a comment below and let me know your thoughts.

Well, a journal is a great thing. I have a couple of trading accounts and every week I write down the outcome of all different strategies. But I am about to start writing down my thoughts, just like you say. Sometimes I forget why I took a trade and what indicators or whatever it was I was looking at. I usually try to add something about it in the comments field, but too bad I can’t add comments after a trade is open. That would be a great thing in MT4, then every trade could have things like that to look back at.

But I will start to run a journal now to see if I can find out whatever it was that made a trade go where I wanted it or why it wasn’t. The last two weeks my trades have gone wrong, not like they used to do most of the time. But sometimes the market is doing things it wasn’t doing before and I think this was the problem for me lately.

I’ve been using Excel for my weekly and then saving it to Dropbox, but I will try with Google Sheets now. Could be a good thing.

Thank you for sharing!

Hi. Thanks for the nice review.

To add on to your post, i use Evernote for my trading journal.

That’s a good one.

It is better if you write TP and SL in pips than in price numbers.

Thanks for sharing.

Hey Rayner, awesome article!

I’m still in the process of improving my trading journal but I do use the formula you have been emphasizing which is very valuable:

E= [1+ (W/L)] x P – 1

The rest is more of:

• Maximum drawdown

• Losing Streak

• Average Win ($)

• Average Loss ($)

• Win Rate = Wins/Wins+Lose (%)

I’m also looking at Edgewonk and Psyquation to get some inspirations to add into my trading journal as I improve it, making one sure is tedious but it’s worth it 🙂

Awesome to hear that!

Hi, Awesome article i have learnt a lot thanks.

Welcome!

Hey Rayner, you have helped me a lot these past few days.. thank you, I so needed this. have a blissful future.

Hi Alisa,

You are most welcome!

Cheers…

Thanks Rayner for the awesome article.

I have a strong feeling that if I follow your advices “religiously” my Trading results will improve so much that I will write a testimony?

Why?

Because up to now I hardly ever do a pre-trade plan or post-trade analysis.

I only do the middle bit that is:

Date I enter the trade-

Time Frame-

Setup –

Market-

Lot size –

Long/Short –

Price in –

Price out –

Stop loss –

Profit & Loss in £s

Also I don’t always do the pre and post charts.

Do expect my Testimony in a few weeks Rayner and I am really serious.

Once more a big THANK YOU and hoping the two beautiful women in your life are doing well.

(your wife & daughter of course!!)

You’re welcome, Abel.

I look forward to it, cheers.

what a good lesson.

cheers

Hey Rayner, i just use an actual journal to jot down my trades & thoughts. Soon I’ll record my trades on evernote or excel. Your videos on YouTube and your emails have fuelled my passion for trading the markets, so thanks a lot. I know that one day i will help other traders and help them battle the big guns in the market with precision. Take care !

Thank you for sharing, Charles.

Thank You Rayner.

I use One Note, and Excel to keep tract of my trading. Such as in One Note it’s broken down into Daily Trading Journal, Psychological journal, charts, and goals. In excel I keep tract of entries, exit, set up to entry & exit trades, and risk to reward.

I like how you discuss about before, during and after those concepts are very important.

Once again Thank You

Rayner

Thank you for sharing, William!

Yeah, This article are very important. Thx Rayner.

Cheers

I believe trading journals are a good habit of a pro trader. A beginner should start from this.

I feel the same way too.

Hey Rayner,

I’ll write my FIRST trading journal. N I’ll borrow from much of your advice.

Thanks for the precision and clarity; Am sure I am well guided.

Awesome, keep me updated!

Hello Rayner,

I want to thank you AGAIN !!!

I fall in love with Trend Following, and your article help me to build my trading Journal with more precision.

Awesome!

Hi Rayner,

I suppose it would be difficult to keep a trade journal, if you use a scalping strategy. As you could be in and out of trades within minutes. Capturing screenshots of the trade and reasons would become time consuming if you are doing a large number of trades a day e.g. 20+ trades.

So would a journal be better suited to swing trading or long term trading?

Hey Jo

You make a good point.

For scalpers, you’d probably need to make do with less information.

What I’ve shared above is for swing and position traders.

I scalp or trade 1 min chart off looking at longer term charts. So I would suggest that before trading you can note down how feeling and what you thing the charts are telling you. Then take your stats from the trade record. If have a great trade take a screen shot and if are struggling take a screen shot and step back to see what doing wrong. Then start the process again. I do press ups as well to break the chain if had a few losing trades. This approach has been helping my consistency a lot and have doubled my accounts during lockdown, which has been a welcome turnaround. Keep up your great and helpful posts

A journal is essential. Thank you.

You’re welcome, Roy.

Thanks for the trading journal idea. Hey Rayner, what app do you use in jotting down your trades?

I use Edgewonk to journal down my trades and excel to alert me to potential trade setups.

I use Trading Dive which has a simple trading journal and it’s free

Thanks for sharing!

I have a question rayner. In the sample charts above that you showed why would you put your stop loss so far away? I know that you follow the rule of 1 ATR away from your entry point as your stop loss but isn’t that kind of risk exposure quite too risky? I mean you just made 0.26R out of that risk exposure and if the trade goes bad then you’ll lose a lot more than the potential return.

Yes, it’s 0.26R gain on this trade since it hit my trailing stop loss.

But what you don’t see is IF the market does trend lower, it could just as well be a 5, 10, or 20R gain.

Yes, but if in case it’s a 50-50 situation, then it’s not a good setup since your exposing yourself to a risk of equivalent to 1 for a 0.26 gain. Is my logic correct or am I missing something?

I’m sorry for asking so much questions but I just really want to understand. I hope you don’t mind Rayner. 🙂

Thanks!

Rayner! I think I get it now. I’ve just read your blog post about the risk reward ratio and I’ve realized that risk reward ratio is not the complete picture. One must take into account also the win rate to see the complete picture.

Once again, thank you very much! Your blog posts are full of learnings and insights.

Best Regards 🙂

You nailed it!

The 0.26R gain isn’t planned since I don’t know it will be a 0.26R gain ahead of time.

Yes, but since you must first take into account your earliest possible exit level like a support blockage to know if the least amount of possible return would compensate the initial risk and is good enough to warrant entering into a trade then a 50-50 situation wherein there a 50% chance you’ll lose the whole R and a 50% chance you’ll gain a 0.26R assuming the earliest possible exit. In that case, it would be very risky.

Is my logic correct? or am I missing something?

I’m sorry for asking so much questions. I hope you understand Rayner 🙂

Best Regards,

I don’t have a predefined target profit ahead of time. I trail my stop loss and let the market decides how much it wants to give me.

Hi Rather, my journaling technique is still evolving as is my trading plan. What I’m finding effective at the moment is listing what I would trade based on the daily, hourly, 15 and 5 minute charts and indicators. Sometimes a buy on a 5 minute chart looks a sell on the hour etc. That’s the pre trade. At the trade I note which indicators have contributed to me making the trade (pattern, Macd, oscillator etc.) I then look post trade for trends of what’s working and what isn’t.

Thanks for sharing, Darren.

The phone autocorrected Rayner to Rather. Sorry

Good article,I am option scalper so how do I manage my general because I trade 200 to 300 trades daily thanks in advance

I can’t comment on it since I don’t trade options nor am I a scalper.

At last, you nailed it Rayner! Most traders are really guilty of this. Believe me, it’s a booster to your trading journey especially if you’re just starting out to build your first trading system.

— Cause mine enabled me to create 4 🙂

Hope the readers appreciate this article as much as I do.

Thank you, Adrian!

Hey Rayner, don’t even know how to thank you enough for all this good work you are doing for free. You are actually God sent to people like me. I think I would just wish you the return of your goodness in multiple folds. I also promised to work on creating a trading journal as analyzed by you. Thank you and God Bless.

You’re welcome, Rasheed!

Thanks Rayner for ur guidence … also do watch ur yourtube videos … and it is very helpfull… and thanks for the Price Action Guide.

You’re welcome!

Is this Ultimate Guide to Price Action Trading applicable to cryptocurrencies trading?

The concepts and principles can be applied to it.

Thanks for your article, Rayner.

I will try to journal my trades, since I’ve realised that this is one of my weakness in trading.

Go for it!

Thanks Rayner for this wonderful post

Thank you!

Thanks so much for sharing this information with us. I must start keeping a trading journal. Though the market can be likened to a mad whose actions are highly unpredictable but I guess you suggestions will go a long way in helping me maintain consistency and most importantly reviewing the trades I made in the past.

You’re most welcome!

This article is incredible for me, very first I read ,Thank a lots Rayner! I will do it Yay

Awesome, let me know how it works out for you!

Very nice Rayner. Very very useful. God bless you.

Cheers Rita!

This is powerful thanks Rayner

Cheers Frank

THNKU BRO THIS WAS VERY HELPFUL

Glad to help out!

Rayner your videos are really good and informative also you explain in simple way thus it’s easy to understand. And I read about write down treading journal in book The daily treading coach by Brett. N Steenbarger. It’s very effective to idientity our wrong decision and follow rules which resulted into profitable trades.

Thank you for sharing, Samir!

Doing trading from last couple of yrs. Tried to track my trades but failed to keep track of my trades consistently. I will definitely try to work on my trading journal in which at first I will analyze the trend first, then record the trades according to my setups like support – resistance breakout, scalping, etc. Then I will keep times frames and trade time, PnL and remarks. Also I will try to record charts before n after the trades. Thank you for explaining in details.

Hey Ramakant,

I’m glad to hear that!

Sir you are great . After studying I have felt my mistakes in trading. Good job

Hi Amjad,

Thank you!

You are genius man…I had bought a diary and was thinking what to write in it but after reading this article now I know how yo use trading journal for better results…thanks alot…keep doing this good work

Hi Shubham,

You are most welcome!

Thanks a lot Rayner. A trading journal is an effective mirror in terms of data and feedback. You’ve helped me a great deal

Hi Joyce,

You are most welcome!

Cheers…

E Book is best for free ,isn’t ….

I use the Trade Journal on StockTrader.com. It is free. I would be interested in anyone’s opinion on it. Tom

Hi RAYNER , we are far away from each other, but honestly say that What I am looking to do ?

You just give like always..

Thanks bro..

Hi Amit,

You are most welcome!

Cheers…

Hi Rayner,

Thanks for this explaination. I found it usefull and worth keeping or praticing. One thing that you mentioned that i dont know how to go about it, is how to anaylise the market before the market opens. What are the points or factors to look for, or to be considered when anaylesing the market before its open. I will be gratefull if you could through more light on this situation.

Happy trading Rayner. Waiting to read from you.

Agnes

Thanks for the article Rayner!

After long research, I decided to use Tradiry journal (https://tradiry.com). Online services like this one will be better than Evernote, Excel, etc.? What do you think?

Hi Alexey,

That’s fine. Practice with it.

Cheers.

Since I started trading I did not realize that the trading journal is important to be recorded and kept for the history of next decision in my trade. When I entry the market I usually apply the simple entry triggers by looking at the market trend, support or resistance and candlesticks in order to place a new Sell or Buy. But through your lesson here I will start keeping records of my trading journal which will be nice to know all records of my trading gain and lost; especially the trading journal will also help to know which trading pairs are good in profit and less profit by pips. Another good reason of keeping the trading journal will understand how many pairs and lots that have been placed in the trading market day by day; and easy to look back later for history of the trade records.

Hi Phearoka,

You are welcome!

Cheers.

I write the currency pair, the direction(long/short) when I entered the trade, the price at which I entered the trade, my TP and SL. The reason why I took the trade and the conclusion. Most of the time I don’t follow my trading plan and don’t Journal my trades regularly. Lack of discipline has cost me a lot.

Hi Jimmy,

Awesome, exercise some discipline.

Thank you very much Rayner. I didn’t even know about journal. This article was very helpful and I have a believe that it will improve my trading styles and results. Tsolonyane from South Africa

You are most welcome. Khekhemane!

I have been finding it difficult to use ATR on my mt4

ENTRY LEVELS, STOP LOSSES, TARGET PROFITS, AND HOW U FEEL IN THE TRADE(THE BEFORE, DURING AND AFTER THE TRADE)

Very interesting, iam coming alright. Thank you

Awesome!

thank you so much for yuor awesome notes.

You are most welcome, Sanh!

Thank you so much Rayner. I have been looking for I formation on how to properly record/journal my trades since I I learnt about it’s importance. Thank you for helping with the details.

You are most welcome, Msughter!

Thank you rayner but me i will write down my journal in normal exercise books and i will save the picture of trade in drive

Hi Rayner, Thank youfor your help , i like all your articles about trading. Now i almost know how to organize ma trading journal.

Hi Zenebe!

you’re welcome! Glad it helps! just do it consistently and for sure your trading results will get better and better! cheers!

Hey Rayner,thanks for your guide bro I really appreciate it I just want to know where we can store the snapshot of chart can we include in the sheet if yes can you tell me ho

Wow knowledge

Thanks a lot!

great book

Thanks, Mimi!

I don’t even have one,I just scrumble in a paper,but now I know,thanks

Glad to have helped, Ann!

i will follow the process

without strong reason i didnt take entry in tarade

I will write global market pressure on my market also.

i have a trading journal for all that i trade – not the plan and i include a comment section what i did, if i got whiplashed, lesson learned

Hey there, Sandra!

Jarin here from TradingwithRayner Support Team.

Happy to know you have your own trading journal. It will definitely help us to review our trades and find ways to improve them!

Cheers!

With your sharing, I will be able to improve mine and then it relieves me from unnecessary tracking so i can concentrate on trading.

Can you share Demo full journal

Hi, Ayen!

Jarin here from Tradingwithrayner Support Team.

The sample is already on the blog. A trading journal can be split into 3 parts: before, during, and after the trade. You have take note of the trades you’ve made so you can review them and see your edge in the market. If you can do this consistently, your trading results will get better. And before you know it, you are already a consistently profitable trader.

Hope this helps!

Cheers!

Hello brother really good teaching methods for bigginer also tq.

Thanks, Roopa!

Thanks Raynar for been there

this notes are very great has a lot to learn on thanks very much