Swing trading is a methodology that seeks to capture “one move” in the markets.

This is done by exiting your trades just before opposing pressure steps in.

For example, if you buy at support, then you want to exit your trade before resistance, where selling pressure might step in to erode your profits.

Here’s an example of what is a swing trade:

Swing trading can be applied across most timeframes. But generally, you’ll swing trade on the 1-hour timeframe and higher.

If you want more details on swing trading, then check out The No BS Guide To Swing Trading.

But if you’re familiar with it, then let’s discuss a few powerful techniques to improve your swing trading results.

Read on…

#1: The best market conditions for swing traders

Here’s the deal:

As a swing trader, you want to identify market conditions which have the potential to swing in your favour.

And the 2 ideal market conditions for it are:

- Healthy trend

- Weak trend

Let me explain how you can do swing trading with indicators to identify the right market conditions…

Healthy trend

A market is said to be in a healthy trend when it respects the 50-period moving average and remains above it.

But why a healthy trend for swing trading?

Firstly, you put the odds in your favour by trading with the trend.

Next, you can easily identify the ebb and flow of the market (the price goes higher, then makes a pullback, then goes up higher again, etc.).

So as a swing trader, you want to buy when the market makes a pullback towards the 50-period moving average, and sell just before it reaches the previous swing high.

Also, the distance from the 50-period moving average to the swing high is your potential profit—and usually offers a 1-to-1 risk-reward ratio (or more).

Here’s an example:

Makes sense?

Weak trend

Now, another market condition that’s ideal for swing traders is a weak trend.

In this market condition, the market is still in an uptrend but, the pullback is much deeper and tends to respect the 200-period moving average or support.

Here’s an example:

Now, the approach to swing trade a weak trend is the same as a healthy trend—you’re looking to buy at an area of value, and sell before opposing pressure steps in.

So you can do swing trading with indicators, like the moving average, to identify market conditions to trade in.

We’ll discuss entries and exits later, but for now, let’s move on…

#2: Trade near the area of value, not far from it

At this point, you’ve learned that healthy and weak trends are favourable for swing trading opportunities.

However, just because a market is in an uptrend doesn’t mean you’ll blindly hit the buy button.

Why?

Because you don’t have a logical place to set your stop loss.

Let me give you an example. Look at this chart below…

The market is in a healthy uptrend and approaching the swing high.

Now if you were to buy right now, where would you put your stop loss?

You’ll realize there’s no logical place to set your stop loss, until at least below the 50-period moving average.

And if you were to do that, it’ll offer you a poor risk-to-reward on your trade.

Here’s what I mean…

So, what’s the solution?

Well, it’s quite simple actually—trade near the area of value, not far from it.

So if your area of value is the 50-period moving average, then let the price come closer to it before taking a long position.

Here’s how things would change now…

Risk to reward from 50-period ma

Do you see what I mean?

Pro Tip:

Your area of value can be support/resistance, trendline, channels, etc. and the concept still applies.

#3: Price rejection to time your entry

Once the price comes into an area of value, what’s next?

Well, you want to do swing trading with patterns which represents price rejection—it signals that the buyers are momentarily in control (and could push the price higher).

Now, price rejection can appear in the form of reversal candlestick patterns like a hammer, shooting star, engulfing pattern, etc.

But the key thing is, for the price to “quickly leave” the area of value.

Here’s an example of swing trading with patterns like the hammer:

Noticed how quickly the price left the area of value? This signals a rejection of lower prices.

Now, candlestick patterns aren’t the only way to identify price rejection because it can appear in this manner as well…

Remember, the key thing is for the price to “quickly leave” the area of value—not the candlestick pattern.

Reversal candlestick patterns help you to define a price rejection, but it’s not the only way.

Pro Tip:

Not all swing trading strategies require “confirmation” or price rejection to time your entry.

One example is The Pullback Stock Trading System.

#4: How to avoid getting stopped out of your trades prematurely

Here’s the deal, you can:

- Wait for an ideal market condition

- Trade from an area of value

- Wait for a valid entry trigger

But if you set your stop loss at a poor level, you’ll get stopped out of your trade prematurely (before the market even has the chance to move in your favour).

So, don’t set your stop loss based on some random level because the market doesn’t care.

Instead, use the area of value to your advantage and set your stop loss beyond it.

This way, the market must “work harder” to reach your stops, thereby giving your trade more room to breathe—and a better chance of working out.

Here’s how to do it (for a long trade):

- Determine the current Average True Range (ATR) value

- Identify the lowest price point in your area of value

- Take the lowest price point and minus the current ATR value—and that’s your stop loss

Now, this concept can be applied to any area of value like support & resistance, trendline, channel, etc.

If you want to learn more, then go watch this training video below…

#5: How to set a proper target so you can avoid watching your profits turn to losses

I laugh to myself whenever I hear traders comment:

“You must have a minimum of 1:2 risk-reward ratio if you want to be a profitable trader.”

Now let me ask you…

What’s so special about having a 1:2 risk-reward ratio?

Why not have a 1:10? Or even a 1:100?

So here’s the truth…

The market doesn’t care about your risk-reward ratio—it goes where it wants to go.

The only thing you can do is, observe what the market has done previously, and use it as a clue to where it might go in the future.

For example:

If the market previously collapsed at $100, then the next time it approaches $100, there’s a possibility of selling pressure coming in at that level.

As a swing trader, you don’t want to set your target at $105, $100, or $110 because the market might not get to that level due to selling pressure.

Instead, you want to exit your trade before opposing pressure steps in which is before $100 (around $99 or so).

This means if you’re in a long trade, you’ll want to exit your trade before:

- Swing high

- Resistance

- Downward trendline

(And it’s just the opposite for a short trade)

Here’s an example of exiting your trade before the price reaches resistance…

Make sense?

Bonus tip #1: Scale half ride half

As a swing trader, you usually have to forgo the opportunity to capture a trend.

But what if I told you there’s a way to capture a swing and still ride a trend?

Do you want to learn more?

Then let me introduce to you… the scale half ride half technique.

Here’s the idea behind it…

You want to exit half of your position before opposing pressure steps in.

Then for the remaining half, you can adopt a trailing stop loss to ride a trend.

Here’s an example…

Now…

The upside to this is, you can capture a swing for consistent profits and at the same time, be able to ride trends to increase your profits.

However, if the trend doesn’t play out, the market might go back to your entry price, or worse, hit your stop loss.

Cool?

Bonus tip #2: Know the characteristics of the currency pairs you’re trading

(This is meant for FX traders. If you don’t trade it, then you can skip this section.)

Here’s the deal:

Not all currency pairs are created equal.

Some have trending behaviour, whereas some have mean-reverting behaviour.

Now you’re probably wondering:

“How do I know if a currency pair has a trending or mean-reverting behaviour?”

Great question.

Here’s a backtest you can run to find that out on any currency pair…

- If the price breaks above the previous day high, go long

- If the price breaks below the previous day low, exit your long position—and go short

- If the price breaks above the previous day high, exit your short position—and go long

Clearly, when you run this “trend following” backtest, currency pairs with a trending behaviour should make money in the long-run.

And currency pairs which have a mean-reverting behaviour (with little-to-no follow through) should lose money in the long run.

Let’s have a look…

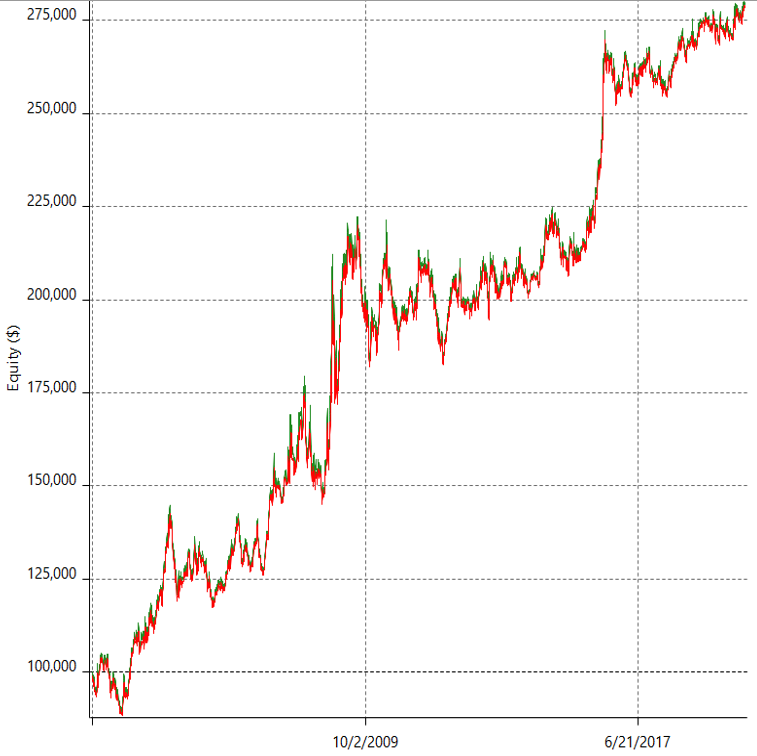

Trending currency pairs

For currency pairs that have a trending behaviour, this backtest will yield a positive outcome as the market continues trending in the direction of the breakout.

One example is GBP/JPY…

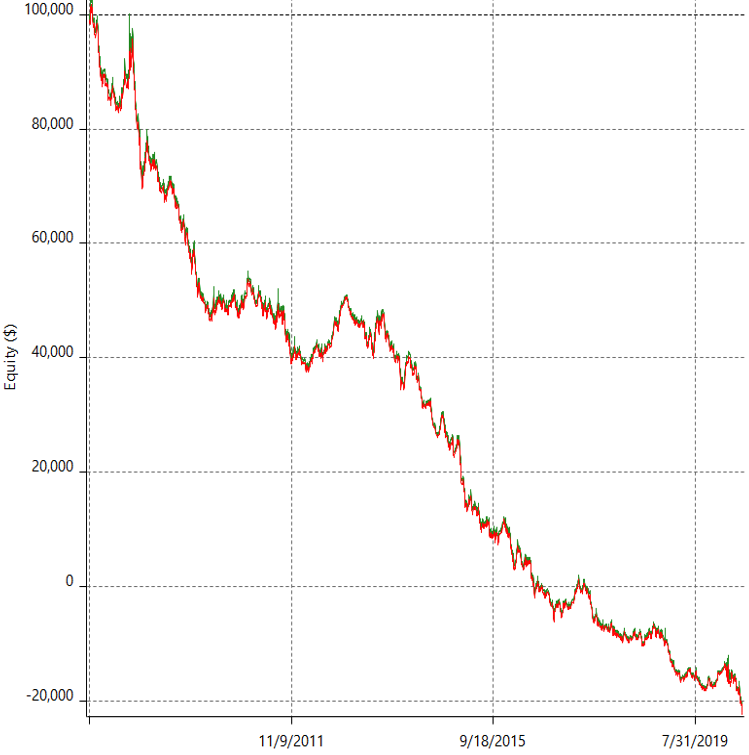

Mean-reverting currency pairs

As for currency pairs that have a mean-reverting behaviour, this backtest will yield a negative outcome as there’s a lack of follow-through whenever the price breaks out of the previous day high/low.

An example is AUD/CAD…

So now the question is…

“How do you profit from this knowledge?”

Simple.

If you know which currency pairs have a mean-reverting behaviour, then you can use that “natural behaviour” to time your entries & exits.

For example:

You know that AUD/CAD tends to reverse at the previous day high/low.

So if you’re in a long trade, then you can use the previous day high to exit your trade (as this currency pair tends to reverse at the previous day high).

Alternatively, if you’re looking to short AUD/CAD, the previous day high is a possible level to consider as it tends to reverse at the previous day high.

This is powerful stuff, right?

Conclusion

So, here are the swing trading techniques you’ve learned:

- The best market conditions for swing trading is in a healthy trend and weak trend

- Trade near an area of value so you can buy low and sell high (don’t trade far away from it)

- You can use candlestick reversal patterns like hammer, engulfing pattern, etc. to time your entries

- Set your stop loss 1 ATR away from the area of value so your trade has more room to breathe—and you can avoid getting “stop hunted”

- You want to set your target profit just before opposing pressure steps in (if you’re in a long trade, you can exit before resistance, swing high, etc.)

- You can exit half your position before opposing pressure steps in and use a trailing stop loss on the remaining position to ride the trend

- You can consider taking profits at previous day high/low for mean-reverting currency pairs like AUD/CAD

Now here’s what I’d like to know…

What are some swing trading techniques that you use?

Leave a comment below and share your thoughts with me.

Well explained. Thank you.

Awesome, Kiran!

Nice

Thanks, Chessy!

I learnt alot Teo

Great to know that, Benny!