This post is written by Jet Toyco, a trader and trading coach.

I’m sure almost every retail trader wanted to engage in intraday trading.

What is intraday trading, or heck, what is intraday in trading?

It simply means buying, selling or trading within the day itself.

Some traders realize it’s not for them, while others decide to pursue this high-risk, high-reward trading style.

If you are that trader, then you’ve come to the right place.

Because in today’s guide…

I will teach you the exact process of HOW you can become an intraday trader.

From managing and maintaining an intraday trading portfolio to reducing potential risk to increase returns, this guide’s going to be intensive.

So get your pen and paper and prepare to learn if you wish to inch closer towards that Lambo money.

Ready?

Let’s get started…

#1: Be consistent trading the higher timeframe first

I know…

It’s probably the last thing that you want to hear.

But here’s the thing:

Consistency is the name of the game here in trading.

If you start trading without being consistent, you’re going to have a damn hard time intraday trading!

“I know what is an intraday trade, but why would it be tough?”

Intraday meaning you’re going down to lower timeframes to trade within the day.

If you can’t even consistently execute your trades on the higher timeframe, what makes you think you can do it in a fast-paced and stressful environment like intraday trading on the lower timeframe?

Now, I want you to pay attention…

I’m not focusing on the profits here.

I’m focusing on the behavior itself, which is “consistency.”

You want to build this behavior before you even think about building up your portfolio!

Can you see my point?

So what’s the solution then?

Execute 30 “good trades” on the daily timeframe

At this point, you need two things.

1. Complete trading strategy

Having a complete trading strategy means knowing exactly when to enter, manage, and exit your trades before you even hit that buy button and without other traders’ opinions.

Feel free to check these articles with a complete strategy in them:

Donchian Channel Strategies That Work

Swing Trading Techniques That Work

Turtle Trading Rules: Does It Still Work Today?

The Essential Guide to Momentum Trading

Here’s the thing…

No one trading strategy fits all.

So you’ll need to ask yourself:

“What trading strategy makes the most sense to me, and I can execute it consistently over the next 30 trades?”

P.S. I highly suggest you start with a demo trading account first, then getting into the trenches and begin live trading as soon as you can.

2. Risk management

Similar to a complete trading strategy…

Applying risk management means that you know exactly how much money you’re going to lose before you enter a trade.

That’s right.

You don’t just put random numbers when buying a stock and YOLO the position size.

You’ll need to know:

- Where your stop loss is

- What your maximum risk per trade is

- What your position size is so that you don’t lose more than your risk when your stop loss is hit

I’m not going into the nitty-gritty details on how exactly to do it, so I suggest you read through this article here: Forex Risk Management and Position Sizing (The Complete Guide)

Once you’ve already formed the habit of consistency in your trading…

Then you can consider opening a separate portfolio for intraday trading and develop a strategy to trade the lower timeframes, which you can get some insights here.

So, the following psychological barrier you’ll face in intraday trading is your portfolio size.

Let me explain in the next section.

#2: Intraday portfolio is 30% of your overall portfolio

I know I’m starting to throw some scary numbers but let me give you an example.

If you have $2,000 capital, then you’ll want to put $600 into your intraday trading portfolio and $1,400 into your higher timeframe portfolio.

Now you’re probably wondering:

“Is this necessary to go intraday trading?”

“Can’t I just have one portfolio?”

“I’m poor and can’t raise extra funds to have a new portfolio. I’m doomed!”

Now now, I hear you. Don’t worry.

Here’s the thing:

Trading is not a job or a game you can find excitement on; it’s a business.

So from a business and psychological point of view, this concept makes sense.

Frequency

The higher the frequency of the trading strategy, the more emotions will be involved.

That’s why to “balance” those emotions and reduce the impact on them…

You have to keep your higher-frequency (intraday trading) portfolio smaller.

Diversification

Don’t lie.

You’re here right now because you know that you can make more money intraday trading than trade the higher timeframes.

But is that true?

Yes!

A sigh of relief, I know, but while intraday trading can produce better rewards…

It can also produce more considerable risk due to short-term volatility of open profits/losses and trades, affecting your decision-making as a trader.

That’s why, again, to balance that risk, you must keep your intraday (high-frequency) portfolio lower than your lower-frequency portfolio.

At this point, can you see why this is important?

Now I suggest that you maintain a 70:30 ratio every quarter instead of balancing them every month to let your edge play out.

But keep in mind that you can change that ratio depending on what you’re comfortable with.

P.S. This is a concept I’ve learned from Yvan Byeajee from Trading Composure, so I must credit him for it.

With money and strategy out of the way, the next section is critical because a lot of traders tend to overlook this.

Do you know what that is?

It’s developing a trading routine.

#3: Develop a Robust trading routine

If you think you can trade when you “feel” like it, such as:

- When you’re feeling bored

- While you’re busy at your full-time work

- While you’re at your bathroom taking a dump

It’s time to stop (trading at random times, I mean).

Recall:

Trading is a business and not just a hobby or a game; that’s why you need a specific schedule and routine in place.

However, each routine can be unique for each trader.

That’s why you must always keep in mind that:

- Your trading routine & schedule allows you to be focused on your session without distraction solely

- Your routine must never degrade your relationships & responsibilities

Because in the end, you’d want your lifestyle to define your business instead of letting your business determine your lifestyle.

It makes sense, right?

So with that out of the way, let me show you how you can create your unique trading routine.

Determine the best time to trade the market

It will depend on which markets you wish to trade, but let’s take the forex market as an example.

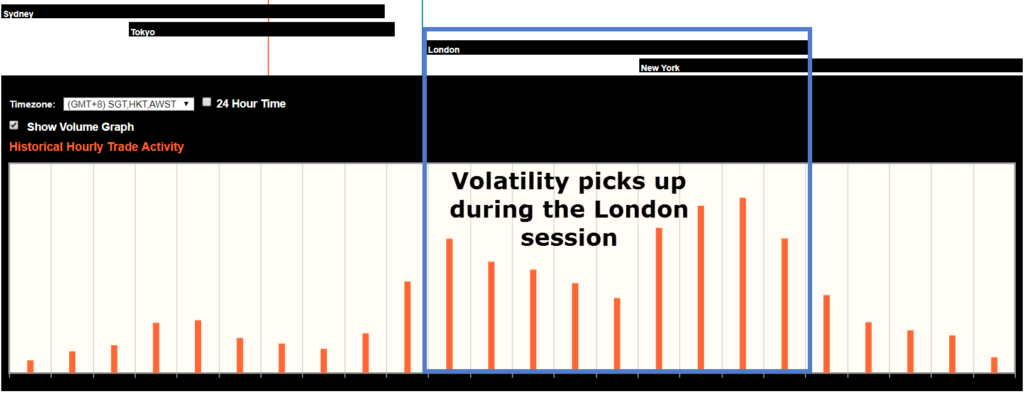

As you can see, volatility is at its peak when the London session overlaps with the New York session.

So blocking your schedule around those times is something you should keep in mind.

Source: Oanda

At the same time, you must also…

Determine the best day to trade

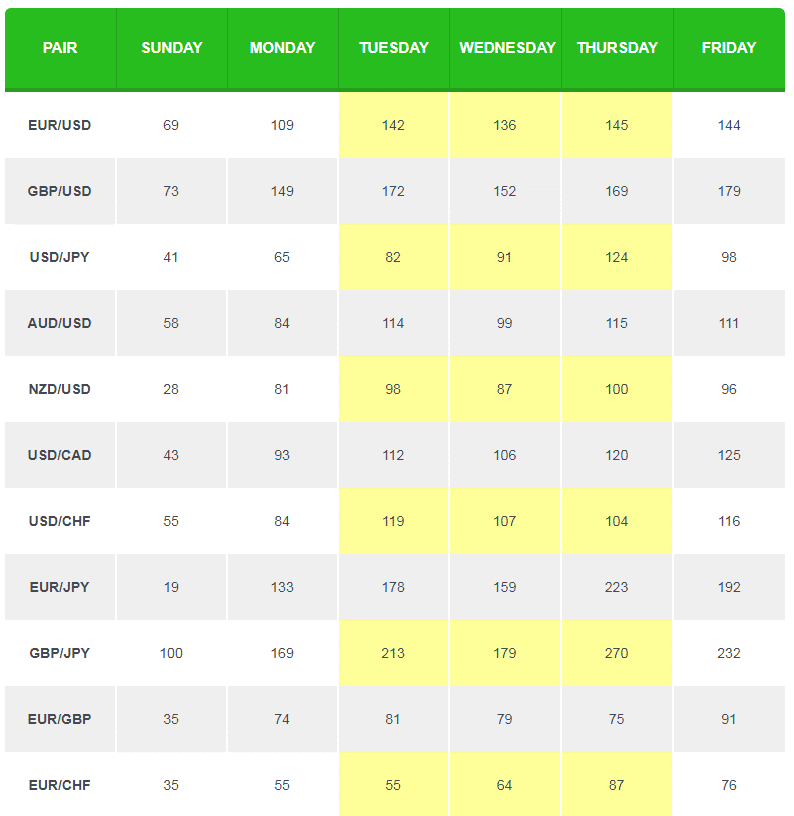

Based on the chart below, not all days are equal on the forex market.

So trading around those days could be favorable to you as an intraday trader.

Source: Babypips

Now that you know when is the best time and day to do intraday trading, you should notice by now that intraday trading doesn’t equate to full-time trading.

There will be days and hours where you aren’t trading and staring from your charts.

Finally…

Determine your best schedule & routine to trade the market

This section is about you this time.

However, I’m sure there are a lot of readers right now who come from different walks of life, so the best I can do is offer an example and let you find what’s best suited for you.

So, let’s say that you:

- Want to intraday trade the forex market

- Resides in Singapore (or countries in similar timezone)

- Has a full-time job in the morning

- Can only trade in the evening after work

- Single with no dependents

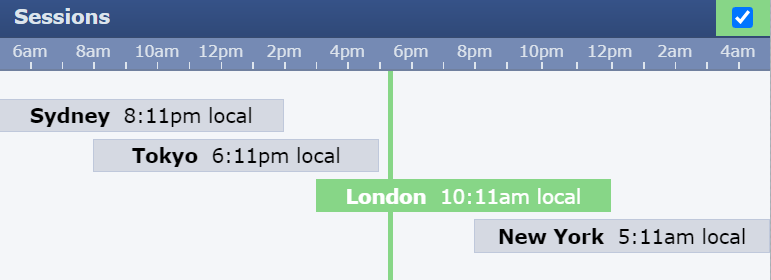

When looking at the best time to trade and taking your situation into account…

You’d want to target trading the London-New York session overlap at 8 PM and stop trading until 11 PM so that you can take a shower and rest:

Source: Forex Factory (timezone adjusted to Singapore)

When that’s already in place, you now need to break it down into three parts.

- Building your watchlist

- Execute your trading strategy

- Review your trading journal

Here’s an example…

7:30 PM – 8:00 PM = Look for trading opportunities and start building your watchlist

8:00 PM – 11:00 PM = Execute your trades free of distraction as the market opens

11:00 PM – 11:30 PM = Journal and review your trades and call it a day

Cool?

Alright, now what if you:

- Have a full-time job in the morning and part-time side hustle in the evening

- Want to intraday trade the forex market

- Living paycheck to paycheck

- You have five kids to take care

- You’re in debt

Then I’m sorry…

What is intraday trading to you is simply a liability you cannot afford as there are more important things that you should tackle.

Overall, having a robust trading routine is a striking balance between the capability of your lifestyle and proper market hours to trade.

So now that you’re consistent, you finally have an intraday trading portfolio and a robust trading routine & schedule tailored to you…

The next thing you should have in mind is how you’re going to last long being an intraday trader.

#4: Have tight risk parameters

Here’s a fact:

A trader’s primary purpose is not to be a money generator but to be a consistent risk manager.

That’s right.

Before you go offense, you must first master defense.

So, what are these “risk parameters,” you may ask?

Here’s what I’m going to share with you in this section:

- Maximum risk per trade

- Maximum risk per day

- Maximum risk per week

- Maximum risk per month

Let me explain…

Maximum risk per trade

Determining how much you can potentially lose before entering a trade is the most important here on the list.

Ideally, you’d want to be risking 0.25% to 1% risk per trade intraday trading.

Maximum risk per day (daily stop)

What makes intraday trading different from other styles is determining when to hit the brakes for the day to come back for tomorrow.

So when you’ve lost 4% to 6% of your capital for the day.

Stop trading and review your trading journal, and come back the next day.

Maximum risk per week (weekly stop)

If you’ve reached this third layer of defense, you now need to look at your trading journal and ask yourself:

“Am I consistent, yet I kept on losing?”

If you find that you kept losing despite your consistency, your current setup does not work on the current market condition.

Therefore you must adjust your trading parameters or adopt a different trading setup and stop trading for the week.

Nonetheless, I suggest you stop trading for the week once you’ve hit a 10% loss on your portfolio then trade again next week.

Maximum risk per month (monthly stop)

The final layer of defense on your intraday trading portfolio is by having a maximum risk per month.

At this point, you now need to ask yourself:

“Am I having a hard time executing my trades?”

“Do I keep on breaking my rules?”

If so, this means that you need to make tweaks to your trading routine.

So I highly suggest you stop trading for a month once you’ve reached a 20% loss on your portfolio.

Remember…

Intraday trading can produce good rewards but can also bring significant short-term risks as well.

That’s why we have multiple “brakes” in place to keep your business afloat during rough times for as long as possible.

It’s not sexy but it’s necessary.

Again, I want to credit Barry Burns as I have learned this concept from his book Trend Trading for Dummies.

Wow!

What a guide, am I right?

I know there’s a lot of things to cover on your end.

So as your reward reaching this far, I’ve made this free checklist just for you:

With that said, let’s do a quick recap…

Conclusion

- To increase your odds of becoming successful at intraday trading, you must first be consistent in trading the higher timeframe

- Your intraday trading portfolio should always be less than your higher timeframe portfolio

- Not only you must have a trading routine and schedule in place, but also ensure that it’s compatible with your lifestyle and does not hinder daily responsibilities

- Intraday trading can yield great rewards but at the same time can produce considerable risks in a short amount of time—that’s why having a daily, weekly, and monthly stop is necessary

At this point…

Intraday trading can be an “intimate” subject because everyone wants to engage in intraday trading (or at least at one point in time).

But I want to hear your thoughts.

Do you think intraday trading is for you?

How many of these checklists have you already nailed down?

Let me know in the comments section below!

If my job requires me to work from 2-11pm New York time, what times would you suggest for intraday trading? I live on the east coast of the United States and would like to start practicing Forex with paper money ASAP.

Thanks in advance, Jet! Keep up the good work!

Hey there Randall, I have to say that trying to squeeze in intraday with a full-time job is quite hard especially when the most liquid hours happen in the afternoon in forex (correct me if I’m wrong though)

So one thing I suggest is that to try to engage intraday trading on your local stock market which I believe opens around 9AM, then stop trading at 12PM during market break

I believe stocks are most liquid during the morning than the afternoon, and this might be more compatible with you if you wish to engage in intraday trading

I hope that helps!

Thank you for the quick response!

I appreciate the advice with regards to the forex trading. I will stick with just practicing for now until some point in the future when I have mid-week afternoons free to dabble.

Cheers!

Awesome, do try out a lot of things and adapt and adjust to see which one works best for you

Good luck!

Will read

Do so Charles!

Really nice article . keep us more informed. Thanks a lot. May God bless you

Glad you liked it, hope it helps!

Thank you. I will apply this to my intraday journey. Thanks Rayner for sharing this for free again!. God Bless.

Good luck Karen!

In India what time is better, thanks for providing this valuable information

Hey there Nakul, I suggest you check out Forex Factory and sync the market openings to your timezone!

But if you are referring to your local stock market, then I suggest you apply intraday trading on the first half of the session

I hope that helps!

Wonderful and wisely said..

Thanks for your encouragement ideas and wise advices..

You’re welcome, Mushabab!

Just came across your article, was very informative. I’ve just started trading, . My first question is how do I establish the best trading times I’m from Cape Town, South Africa. I’m not formally employed so I can do intraday trading with ease. I’m also finding it hard to narrow a successful trading strategy for myself, any suggestions???

Hey there Mpumi, first of all, I suggest you get a job first

Having a job with a steady stream of income reduces the psychological impact on your trading as you intraday trade as there will be losing days,

Now, it’s hard to narrow a “successful strategy” without knowing what you’ve tried already, but make sure to focus on one market as a starter then refer to this article again

Basically, do not trade without a source of income, trading is a business and in any business anything can go wrong at the start!