Do you hesitate to place a trade after losing 5 in a row?

Do you fear that your account will eventually blow up?

Most brokers and marketers want you to think that trading is easy. You click buy, the price goes higher, and you sell. Profit.

But in reality?

Your fears in trading are one of the biggest hurdles to overcome. In this post, I share with you the 5 biggest trading fears that destroy most traders, and how you can avoid it.

What is fear?

A distressing emotion aroused by impending danger, evil, pain etc. whether the threat is real or imagined; the feeling or condition of being afraid. – Dictionary.com

The key is whether the threat is real or imagined. In trading, the threat is often imagined and leads you to make sub-optimal decisions.

There are 5 different kinds of fear that arise when trading, and you would encounter them at one point or another.

But as you grow as a trader, you’ll learn how to overcome fear in trading and realize these fears can be embraced—and fear is what will propel you forward.

So, what are these 5 trading fears?

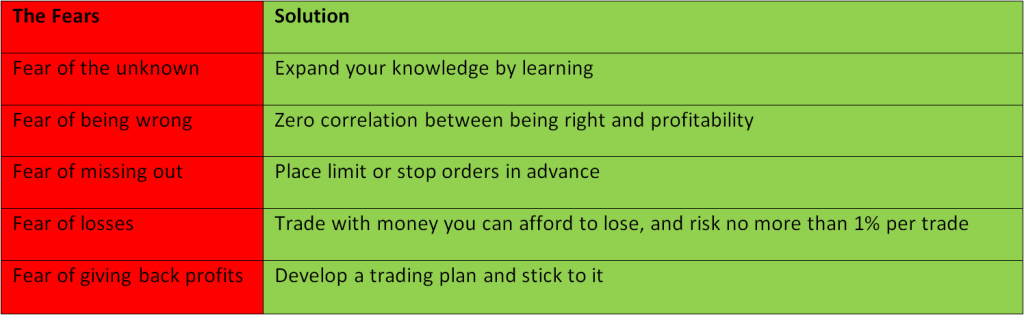

Fear of the unknown

When you don’t know how much you can lose, you are gambling. You are subjected to the unknown forces of the market when price goes against you, leaving you paralyze and helpless.

You don’t know if price will go back in your favor, and the only thing you do is hope. This is the fear of the unknown and is due to the lack of a proper trading education.

No surprise that new traders will likely encounter the fear of the unknown because the picture is painted bright and rosy, till reality sinks in.

Most are attracted to trading because of the freedom it can bring and the near-zero physical work involved, just a click of the mouse. However, what goes behind the scene is seldom talked about and much less publicized.

So, how to overcome fear in trading?

The best way to overcome the fear of trading is to understand what trading is all about. You can expand your knowledge by reading good trading books and taking up trading courses.

Fear of being wrong

Our educational system is rooted in the construct of right and wrong. We are rewarded for what are deemed to be correct answers and the ensuing higher grades, which generally lead to more successful lives. Being right affirms and inflates our sense of self-worth. As students we learn to avoid as best we can the embarrassment of being wrong. Getting the right answer becomes the primary purpose of our education. Isn’t it regrettable that this may be inconsistent with actually learning? – Mel Schwartz

In short, human beings are culturally wired wanting to be right. We simply hate being wrong and will do whatever it takes just to defend ourselves.

But translate that into trading what do you get?

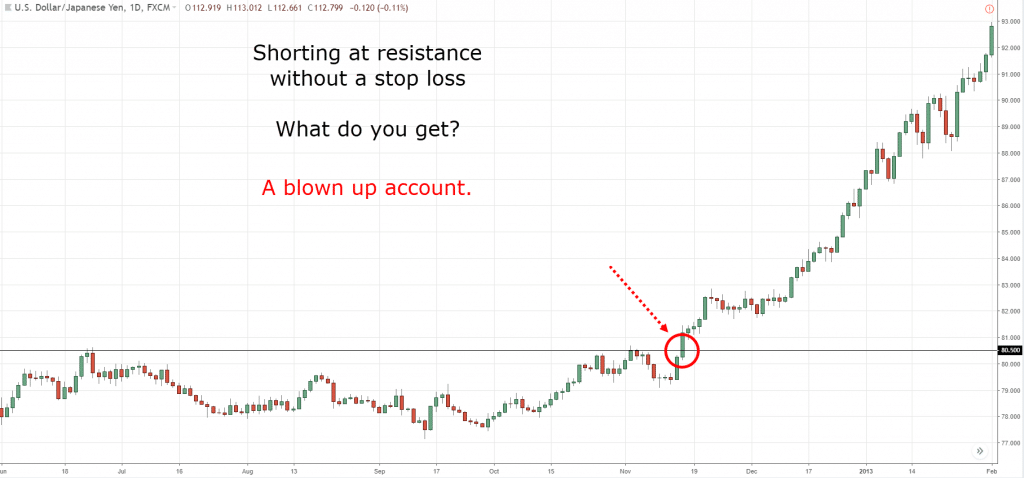

A trader who wants to win all the time at the expense of trading without a stop loss, and you know what happens in the end.

You can be right 70% of the time and still lose money because your losses are much larger than your wins. E.g. Each winning trade makes you $1 and losing trade cost you $3. Assuming you win 7 trades and lose 3, netting you -$2.

Likewise, you can be right 30% of the time and still make money because your wins are much larger than your losses. E.g. Each winning trade makes you $3 and losing trade cost you $1. Assuming you win 3 trades and lose 7, netting you $2.

Remember, there is zero correlation between your winning % and your profitability.

Likewise, there is zero correlation between your IQ and your success as a trader.

I haven’t seen much correlation between good trading and intelligence. Some outstanding traders are quite intelligent, but a few aren’t. Many outstandingly intelligent people are horrible traders. Average intelligence is enough. Beyond that, emotional make-up is more important – William Eckhardt

Fear of missing out

Imagine you have been eyeing a new pair of sleek leather shoes for the longest time. One day you notice it is on sale but only for a limited time. What would you do?

I can almost guarantee you will rush to buy that pair of leather shoes without a second thought. After all, there isn’t anything to lose besides the money required to buy the shoes.

Why did you do it? Because the fear of missing out is so great that you quickly pounce onto the opportunity lest it gets away.

However, when you translate the fear of missing out into trading, that’s when things could get ugly.

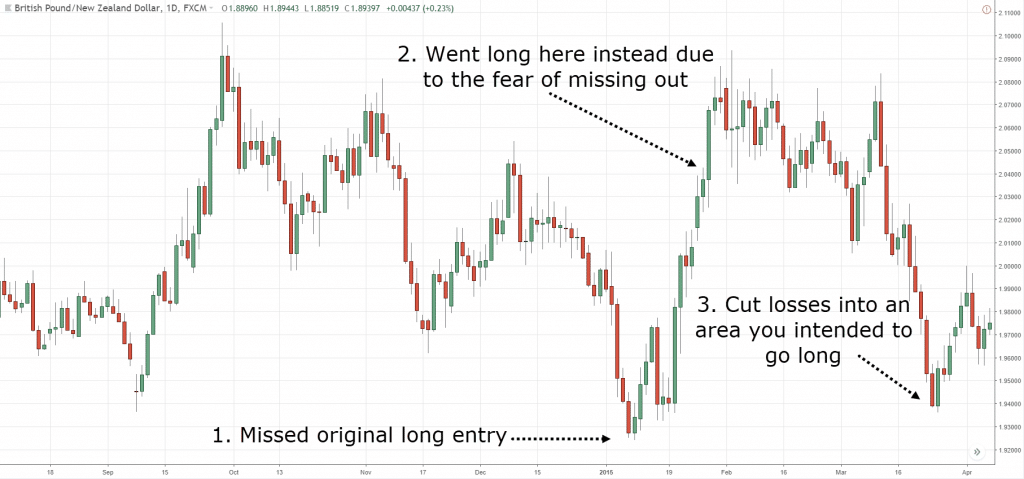

Let’s say you had a plan to long at support because you notice price has been respecting it over the last few weeks. Unfortunately, you missed that trade and now price has rallied higher without you.

To avoid the fear of missing out, you went long at a much higher price which is usually when the market starts to turn.

If you know your trading setups in advance, use limit or stop orders to get you into the trade.

For some reason should you miss your trading setup, simply let it go. There’s no point in chasing the market further and breaking your own trading rules, only to regret it later on.

Bear in mind that you cannot catch all moves in the market. Depending on your trading approach, some market conditions will be favorable to you, and some will not.

E.g. Trend follower is expected to capture trends in the market. Thus it does not make sense to have the fear of missing out at tops and bottoms in the market.

Next, I’ll touch on how to overcome fear of loss in trading…

Fear of losses

Loss aversion refers to the tendency for people to prefer avoiding losses than acquiring gains. Studies by Amos Tversky and Daniel Kahneman suggest that losses are twice as psychologically powerful as gains.

This means that human beings are afraid of losing and would do whatever it takes to avoid losses. However, by avoiding losses it leads to decisions that are detrimental to your trading.

Failure to cut losses – When you are afraid to take a loss, you hesitate to cut your trades because you rather see a paper loss than a realized loss. And this eventually results in blowing up your trading account. (one of the reasons why human beings are not cut out for trading)

Hesitate to pull the trigger – When the fear of losses gets out of control, you hesitate in executing your trades when the time comes. The fear is always at the back of your head causing you to freeze like a deer in headlights. And this eventually causes you to miss profitable trades that could make up for the losses.

And if these isn’t enough, the fear of losses also leads to another problem. The fear of giving back profits.

So how do you handle the fear of losses?

1. Trade with money you can afford to lose (not money that is required to pay the bills)

2. Risk no more than 1% on each trade (you can lose 10 times in a row and the draw down is still manageable)

3. Understand that trading is dealing with probabilities never certainties (only death and taxes are certain)

If you can’t take a small loss, sooner or later you will take the mother of all losses – Ed Seykota

Fear of giving back profits

One of the biggest psychological hurdle a trader face is the fear of giving back profits. But how does it come about?

Let’s be honest, you enter the trading business because you thought it is easy, and do not know what you are actually getting into. Thus it is a norm for you to lose money during the initial stages of your trading. So what do you do?

Whenever you have a small profit in a trade, you do whatever it takes to protect it, fearing that it may turn into a loss. Otherwise known as the fear of giving back profits.

This is a function of how much you have lost in the past. The more you lost the greater your fear of giving back profits, and this vicious cycle repeats.

Looking at the example below you will see how a positive expectancy model is ruined by the fear of giving back profits.

Assume you have a 50% chance of making $10 for every $5 risk, and your next 7 trades look like this

L L L L W W W

L – Lose

W – Win

If you allowed the math to play out you would have netted a gain of $10. (- 20 + 30 )

However, you closed your trades whenever you saw a gain of $5 because of the fear of giving back profits.

This result in a net loss of $5. (- 20 + 15 )

Now how do you overcome this?

Develop a trading plan that has clearly defined entries and exits, and follow your plan. By having a clearly defined plan, you will be more objective in your trading instead of trading based on emotions.

If you want to discover more on how to overcome fear in trading, then check out this video over here.

Conclusion

As a human being, it is normal to have fears in trading. But whether it cripples you or push you to new heights is entirely dependent on you.

I hope these solutions will teach you how to overcome trading fear and push your trading to new heights.

Nice sharing !

Hey Tet Soon,

Thank you, hope it helps!

Rayner

Hi Rayner,

Thanks for the great article!

Personally I have been trading for a year plus and currently on my 13th loss in a row. I make sure I learn from each loss and move on

Been following your blog and read before that you have also gone through lots of challenges during your start as a trader.

Any tips you can share and what would you do if you were in my shoes? Thanks so much!

Hi Philip,

You are welcome!

13th losers in a row is no fun.

First thing you need to ask yourself is whether you are trading with a plan, or simply entering your trades when you feel like it.

1) Develop a trading plan and stick to it

2) Collect a sample of 100 trades to know if your plan has an edge in the markets

3) You can start on a micro account, so the damage wouldn’t be too big

4) Risk no more than 1% a trade

There are many different types of trading styles out there, and you need to find one that suits you.

You can consider reading Market Wizard .. to understand how traders are trading.

Hope that helps!

Rayner

hi RAYNER

Do you think Individual tarders can compete with Big traders who use algorithm . This is reason the chance of failure is above 80% for individual traders.

Hi Ven,

There are different playing fields in trading.

Bigger firms who employ algorithms to trade are typically trading on the lower time frame, with high frequency.

As a retail trader, your edge doesn’t lie in trading such low time frames, due to your transaction cost and technology.

You have higher odds of succeeding by trading the higher time frame, and you won’t be competing with these algorithms there.

Hope that helps!

Rayner

Hi Rayner!

In my beginning I had some fears, but when you become used to make a plan, it’s become easier more and more, and you can focus on another things in trading (and not seating too many hours in front of the screen).

Thank for Rayner.

Shlomi

Hey Shlomi,

I agree. Having a trading plan would help a trader immensely. I can’t imagine trading without one.

Cheers

Rayner

Hey Rayner, I was trading for a year now, and being profitable for quite a while until this month I was losing,not much but I just end up have a losing month. I’ve never experienced it before. Is it okay have a losing month or my edge doesn’t work anymore ?

Hey Valerian,

No strategy works all the time. It’s very fine to have a losing month

provided your wins compensate your losses.

Cheers.

I fear to take trades I have all set-ups , SL and even decided TGT also I implement them I backtest them but still in real market I fear or lose confidence to exicutive the trade

Hi, Rishi!

Jarin here from TradingwithRayner Support Team.

I hope these solutions will teach you how to overcome trading fear and push your trading to new heights.

Cheers!

Wow. This was truly helpful. Thanks

You are most welcome, Nathan!