I get it.

You want a Forex broker you can trust.

But it isn’t easy to find one.

Most have negative reviews, unhappy clients, and you don’t feel safe putting money with them.

So the question is…

How do you find a trusted Forex broker?

Well, that’s what today’s post is for because you’re about to learn how to choose a good Forex broker without getting scammed.

PLUS…

How to “take revenge” against your Forex broker when they don’t play fair.

Sounds good?

Then let’s get started…

Forex broker reviews: Why you shouldn’t trust them

Here’s the deal:

Forex broker reviews can’t be trusted.

The good ones might be bad and the shitty ones might be awesome.

Here’s why…

The “dirty games” they play

Most Forex brokers know you’re looking for reviews before funding your trading account.

And what do they do?

They create a FAKE forex broker review and flood them all over the internet.

They smear their competitors with bad reviews and put good reviews for themselves.

This makes it difficult to verify whether a review is legitimate or not.

Bad reviews dominate, here’s why…

Let me ask you:

If your Forex broker widens the spread for no reason and you got stopped out, what will you do?

You’ll go online and write a bad review on it — to vent your anger.

But what if you have a good service from your broker, would you write a raving positive review?

Unlikely because that’s what you expect from your broker.

The end result?

Bad reviews get attention while good reviews are silent.

And that’s why you see so many bad reviews online.

Why Forex brokers are NOT equal…

Most Forex brokers have offices around the world.

And it works like this…

If you’re from Asia, you’re connected to the branch in Asia, etc.

However, not all branches are equal.

Some offer amazing customer support whereas some are horrendous.

And if you’re unlucky and get poor customer service, what do you do?

You write a bad forex broker review.

And this hurts the Forex broker’s reputation — including branches actually doing good work.

Now:

Can you see why most Forex brokers have shitty reviews?

That’s why it’s difficult for you to find a good Forex broker.

But don’t worry.

In the next section, I’ll share with you 5 most important things to look for when choosing a Forex broker.

How to choose a Forex broker — 5 IMPORTANT things to look for

If you don’t want to read, then go watch this video where you’ll learn how to choose a good Forex broker…

Here’s the thing:

Most traders always look for Forex broker with the lowest spread.

That’s a BIG mistake.

Because there are more important things to look for.

And I’m about to share with you…

1. Your Forex broker must be regulated (in the correct countries)

A regulated Forex broker means there’s a watchdog over them to ensure they don’t do “funny” things.

However…

Not all regulators are the same.

The good ones are strict and will enforce rules (like having sufficient capital, audit checks, etc.) to protect their citizens.

The poor ones?

They do nothing and traders get screwed.

As a general guideline, you want to go with Forex brokers regulated in Singapore, UK, or Australia.

Beware of those from Cyprus, Cayman Islands, or countries you’ve never heard of.

Because no matter how many forex broker review those brokers get from those islands…

A broker regulated in larger countries such as the US (and those mentioned above) will always be much more reliable and secure.

2. Good service and support

Now, what’s the definition of “good”?

If you ask me, your broker must offer live chat support 24/5 from Monday to Friday.

Why?

Because the trading platform might be down and you’ve got orders to manage.

Or perhaps you don’t have internet access and want to close your position.

And etc.

So, there’s no excuse for your broker NOT to offer live chat support when the markets are open.

Because having good customer support is one of the major hallmarks of the best forex brokers out there.

3. You should get your money back quickly

These days, money is moved quickly to almost anywhere (with PayPal and internet banking).

So, if you want to withdraw funds, you should get it within 5 working days.

If you get excuses like:

“The bank is closed for a month so we can’t transfer you the money”.

“You should keep your funds with us to earn higher interest.”

“You should top up your funds and earn bonus credits.”

Your Forex broker is probably a fraud.

(Sometimes, this can be spotted in advance from a few genuine forex broker review out there)

4. Does your Forex broker have the trading platform you want?

Many of you are trading on MT4, and it’s offered by most Forex brokers.

However, there are some who don’t offer it so please check with them.

5. Does your Forex broker offer the markets you want?

Here’s the thing:

Most Forex broker offers currency pairs like the majors and crosses.

However, not all offer exotic pairs like USDRUB, USDINR, USDMXN, etc.

If you don’t trade exotic pairs, don’t worry about it.

But if you do, please check.

But what about the spread?

The reason I didn’t mention the spread is because the industry is highly competitive and most brokers offer low spreads.

So when choosing a Forex broker, your concern should be:

- Is it regulated?

- Does it offer good support?

- Is withdrawal easy?

- Does it have the platform you want?

- Does it have the markets you want?

And one last thing…

Don’t go all in.

Fund a small live account and watch how they “behave”.

If it’s okay, then add more funds.

Because even if your friends, family, or even your dog says good things about the best forex brokers, you must see the results yourself, and that’s starting always with a small account.

Moving on…

What’s the difference between ECN, STP, and MM?

You’ve probably heard of the different types of Forex brokers like ECN, market maker, and STP.

So what does it mean and how does it work?

I’ll explain…

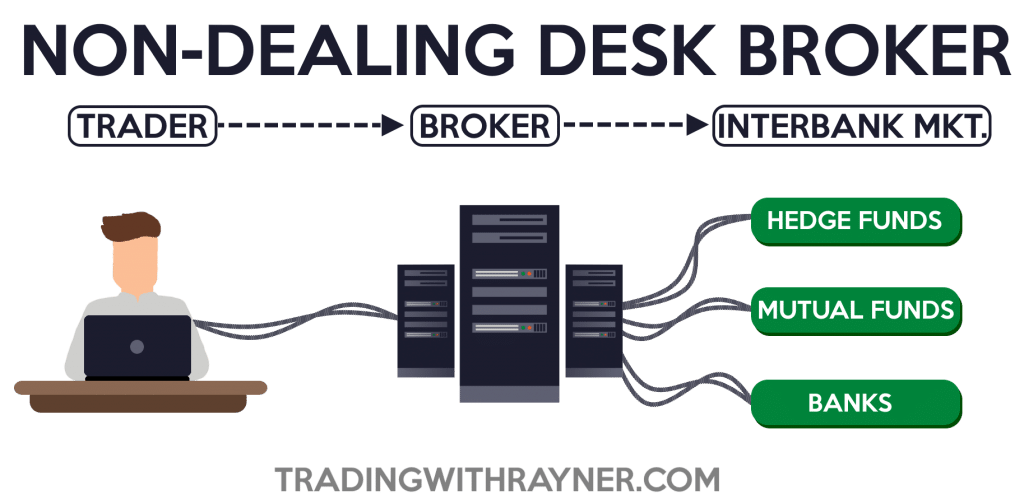

Electronic Communication Network (ECN) broker

An ECN (a non-dealing desk broker) does NOT take the opposite side of the client’s trade.

It acts like a “bridge” that connects retail traders to liquidity providers (like Banks or hedge funds) and charges a commission on each trade.

So, how do you identify an ECN broker?

- You’re charged a commission on each trade

- You can interact with the order flow (bids and offers)

- There’s a minimum size required

Next…

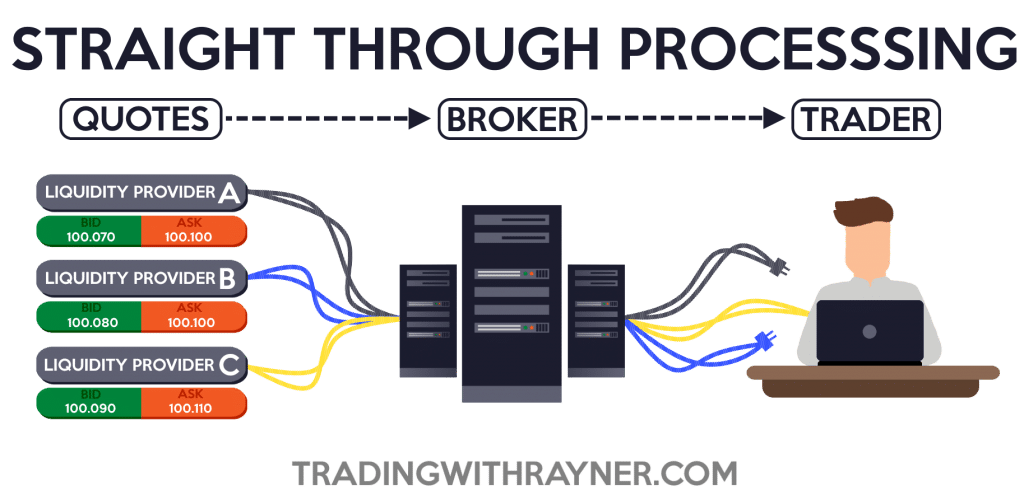

Straight through processing (STP) broker

Similar to an ECN, an STP broker acts as a “bridge” and connect you with other liquidity providers.

However, you don’t get to interact with the order flow when dealing with an STP broker.

Instead, your broker acts on your behalf and sends your order to the liquidity provider (unlike ECN which is direct).

So, how do you tell if you’re dealing with an STP broker?

- You’re charged a spread on each trade

- You can’t interact with the order flow (bids and offers)

- You get re-quotes

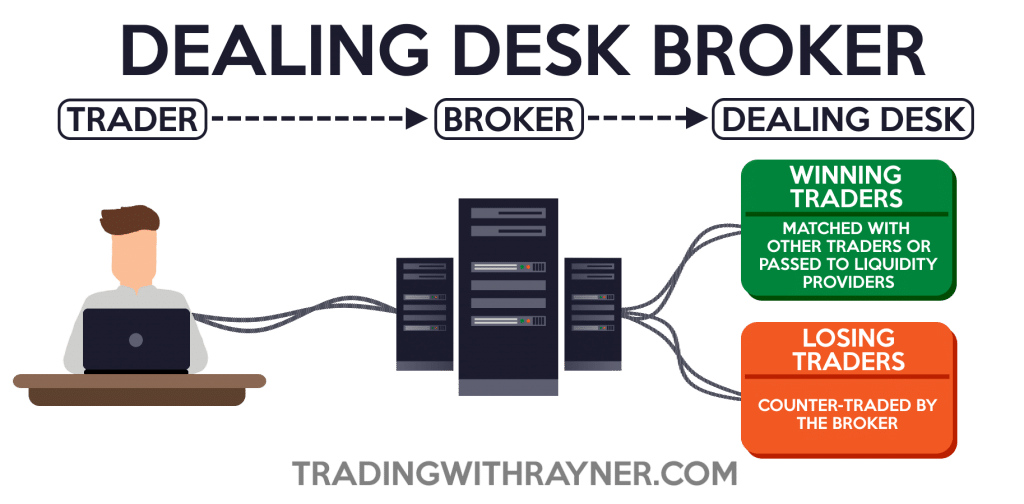

Market Maker (MM) broker

A market maker often takes the opposite side of a client’s trade (otherwise known as a dealing desk) and it charges a spread on each trade.

Now, I know most of you don’t want to trade with a market maker because you think they’re trying to rip you off.

But that’s not entirely true; it’s the way the business model works.

Here’s how…

- If you’re a profitable trader, they’ll match your order with an opposing order of another client

- If they can’t match it, they’ll hedge it in the interbank (or futures market)

- If you’re a losing trader, they’ll take the opposite side of your trade, and make a profit from you

So, how do you tell if your broker is a market maker?

- You can’t see the order flow or interact with it

- You can trade Nano lots (below 1000 units)

- The spread is usually fixed

Now you’re probably wondering…

“Which Forex broker should I use?”

As a general guideline:

The best Forex broker for beginners is market makers because you can trade Nano lots — which helps your risk management.

If you’re a profitable short-term trader, go with an ECN broker as you’ll save more on transaction costs.

If you’re a swing or position trader, it doesn’t matter because the spread has little impact on your trading performance.

Now…

I don’t recommend any specific Forex broker because I don’t know what goes on behind the scenes.

But if you want, drop me an email and we can discuss privately.

How to protect yourself from your Forex broker

Now, what if your broker did something “unfair” to you?

Perhaps your price feed had a sudden spiked, and you got stopped out.

Or, you tried to withdraw your funds, but it’s met with excuses, etc.

If that’s the case, here’s what you can do…

- Record everything

- Ask your broker for an explanation

- Share on social media

- Report to regulators

I’ll explain…

1. Record everything

This means screenshot all the charts, chat logs, and everything so you have a case for argument.

For example:

If there’s a spike on your broker’s platform but it didn’t occur elsewhere, you must save those charts.

2. Ask your broker for an explanation

Now with evidence on hand, demand an explanation from your broker.

If they are wrong, they’ll probably refund your losses.

But if they don’t, close your account and take your business elsewhere.

And if you want to get “back” at them, you can…

3. Share on social media

Please do this ONLY if you’re certain you have a winning case.

Else, you look like a fool.

Here’s how…

Share your “bad experience” and provide evidence of it.

If it goes viral, your broker will probably settle it to prevent further damage.

4. Report to regulators

And finally…

If nothing works, go report to the regulators (like MAS if you’re in Singapore).

This is powerful because your broker could pay a fine or risk losing their license altogether.

Frequently asked questions

#1: How do we know for sure if a broker is indeed an ECN or not?

You’ll never know for sure because it’s always a grey area between ECN and STP.

#2: Hey Rayner, can you recommend me a forex broker?

Please write to support@tradingwithrayner.com and we will discuss over email.

Conclusion

So before you fund a trading account, here are 5 questions to ask…

- Is the Forex broker regulated in the correct countries?

- Does it offer live support?

- Is withdrawal quick and easy?

- Does it offer the platform I want?

- Does it offer the markets I want?

And if your broker treats you “unfairly”, remember to record everything and ask for an explanation.

If that fails, you can share on social media or report to the regulators.

Now here’s my question for you…

Which Forex broker would you recommend and why?

I look forward to hearing from you.

You should add Switzerland to the list of well-regulated countries. At the retail level, that basically means Dukascopy Bank, but they have a very strong offering with a somewhat better client than MT4 for manual traders and the best API in the industry for algo traders. They also have inter-bank agreements that offer unmatched security of funds for larger accounts. Their fees and liquidity beat most London Prime of Primes. Their spreads are decent, but not quite as sharp as the best Australian brokers like Pepperstone and IC Brokers. And for traders that can make responsible use of leverage, they are not bound by the new ESMA rules. We are happy customers

Thank you for sharing, Scotpip.

Thanks for the good work you are doing to help. I have really gained from your YouTube videos and articles on your blog.

I have been trying to download the guides to no avail. It keeps taking me back to where I started even after confirmation of my email.

Hey Samson

Drop me an email and I’ll send it over.

Great information! Thanks for your help!

You’re welcome!

Excellent info Rayner! I would like to add that brokers offering swap free accounts might be more attractive to swing traders due to lower overhead costs.

Hey Cedars

I believe those brokers charge a daily spread to the positions even though they don’t charge a swap.

Het Rayner!

Long time. Some time ago I contacted you about what forex broker to choose and your recommendation for ICM was awesome! Thanks to you I’m in profit and want to make more!

The timing on your email though. As you might’ve probably heard, Canadians got kicked out of ICM and are looking for a broker. One they can trust.

So again I’m messaging you and asking you for a favour. Another recommendation so I can peacefully earn my money.

If you’re too busy I can understand. It’s been a long time and your posting less videos. I’m assuming because your spending more time with your wife, your life.

Anyways, wanted to thank you for the recommendation and looking forward to another. Hopefully.

Your friend,

Seung-Ki (Funky with an S)

Is icm stands for icmarkets? Or what? Thanks

Hey Seung

I don’t publicly discuss brokers because in this day and age, we have no idea what goes on behind the scenes.

If you want a recommendation, drop me an email me and we can discuss it.

I am very grateful to Rayner for this wonderful, awesome exposition. Thanks so much.

You’re welcome!

how would we know if in fact a broker is ECN, they could lie ? In the UK there is an Ombudsman connected to FCA which you do not mention.

Yes, they could. But it’s not worth the risk.

Nothing can replace your own due diligence.

Anybody ever heard about avatrade before?

Is it a good brooker or not?

To get back to Scam broker’s, you may want to add the powerful tool of a ‘Chargeback’ Rayner. This is offered by Visa and MasterCard

A lot of people think, you cannot call your credit card centre in case you authorized the transaction and the broker messes up later. A ‘Chargeback’ is possible even if the broker breaches their terms and conditions.

Users must be aware of the power of a ‘Chargeback’ which is useful if the broker is a scam and doesn’t want to adhere to their published terms and conditions including withdrawal terms and account termination terms

Thank you, Kuhan.

I believe that would really help the rest of us! cheers

Kuhan,

Thanks for the info. Very good & useful info which a lot of us not aware.

Thanks again.

Which specific brokerS do you recommend to someone in Nigeria, Africa?

I don’t publicly discuss brokers because in this day and age, we have no idea what goes on behind the scenes.

If you want a recommendation, drop me an email me and we can discuss it.

hi rayner , i am new in forex i want open an forex account with $250 d0llar. i want your help. which broker are you recommand for me?

I don’t publicly discuss brokers because in this day and age, we have no idea what goes on behind the scenes.

If you want a recommendation, drop me an email me and we can discuss it.

HI Rayner,

Which borkers in Singapore provide good phone support and also provide third party trading charting platform like TradingView. Do they help us to install? Thank you.

I don’t know of any.

Dear ALL,

I have trade with many forex broker may be i do not find any honest broker or what is situation in which way market run, i never seen when i open trade buy or sell market move in my favour more than 1000 positions i have opened as i open my position suddenly market move against my trade. when i put stop loss market hit my stop loss and come back market go against me only to hit my stop loss. I have guess employee monitor our trade and hit our stop loss. i have worked with following borkers which all are regulated and dishonest,

1. Bforex

2. ifc Markets

3. Icmarkets Market maker

4. Fxtm do not give withdraw

5. Easy market fradulent

6. trade.com

7. FBS fradulent

8. XM Deal all to searching a honest broker i lost lot of my money but can not search one honest broker i opened more than 1000 positions with these brokers i never see when i open position market move in my favour every time market went against me. It the forex is fraud or i can not find honest broker in all over the world if you found some one honest let me know.thanks

Hi I just wanted to know is icm capital other name of icm market.

I’ve no idea.

Good day Rayner!

Im looking for a good broker to start a live trading. I can tell I certsily gained my confidence now after 3mons on demo. Do you think this is more than enough? I need an advice from you, man I trust you a lot! Would you recommend the best broker or atleast your broker for me to start live?

Thanks! More power!

I don’t publicly discuss brokers because in this day and age, we have no idea what goes on behind the scenes.

If you want a recommendation, drop me an email me and we can discuss it.

cheers

Hi Rayner, I would be grateful if you could recommend a good broker to me. Thank you

I don’t publicly discuss brokers because in this day and age, we have no idea what goes on behind the scenes.

If you want a recommendation, drop me an email me and we can discuss it.

cheers

please send to my email bro your broker recommendation.. let me see..

Sure just drop me an email.

I’m Currently Using IC MARKET There are Regulated By ASIC I Was Using Hotforex Before which Is Regulated In Uk By FCA But I Decided To Switch To IC MARKETS Because Of The Low Spread And I Can Also Deposit $20 Above Which Is Great For A Start For Me I Have Already Turned The $20 To $40 With Your Trading Guide I Must Say You’re A God sent Thnx For Ur Time And For Creating Such A Wonderful Blog

Cheers!

Pls.send me right forex broker list

Good idea, but I still think the spread is very much still important.

More so for short-term traders, longer-term traders not quite as much.

whats your email address Rayner? I want to discuss 1 broker with you,they said they are STP broker,but I still want to know more,can you help me?

You can reach me via the contact page.

Hi Rayner, which forex trading platform can offer SG citizens leverage of 1:100 and yet is governed by good regulatory body? Thank you

james here

Technically I’m not enquiring which platforms or brokers you recommend. I’m enquiring which platform you use to overcome this leverage issue of only 1:20 in SG. The margin locked up is simply too high. Even with good money management of 1% of capital amount of $10000, which is only $100, the margin locked up is already about $3000, with SL of 20pips. Thank you in advanc

Thanks for your support now I understand but most in our country ,Tanzania (AFRICA) we used brockers such as BINARY and TEMPLERFX , the first one is from Mt5 and the second one is from Mt4 so who is the best according to your experience

Hey Rayner dukascopy bank is good or not.what do you think

great content sir! thanks so much 🙂 God bless you!

Hi Jessica,

You are most welcome!