Whether you’re a seasoned trader or just starting, you’ve likely heard about the importance of keeping a trading journal.

But you might wonder, why even bother?

After all, your primary goal is to make money, not to document your feelings, isn’t it?

Well, in today’s article, I’ll shed light on why a trading journal is vital for trading success.

You’ll cover the following key points:

- What exactly is a trading Journal?

- How to create and structure your trading journal.

- The essential components of a trading journal

- Strategies for analyzing the data collected in your journal and enhancing your trading performance

Are you excited?

Great!

Then let’s dive in.

What is a Trading Journal and How Does it Work?

So, if a trading journal isn’t just about jotting down random thoughts about your life, what exactly is it?

Well, it can be a tool used to track and analyze your trading data.

The end goal is to help you improve in the future.

A journal can highlight areas that need improvement…

…as well as showcase your strengths!

It can be challenging to think clearly in the heat of the moment when trading.

But looking over what went wrong after a trade can help you achieve a clear head in the long run.

You’ll be amazed at the different perspectives and thought patterns that emerge.

So, are you convinced to start learning about trading journals yet?

Great!

Then let’s get into how to construct your very own…

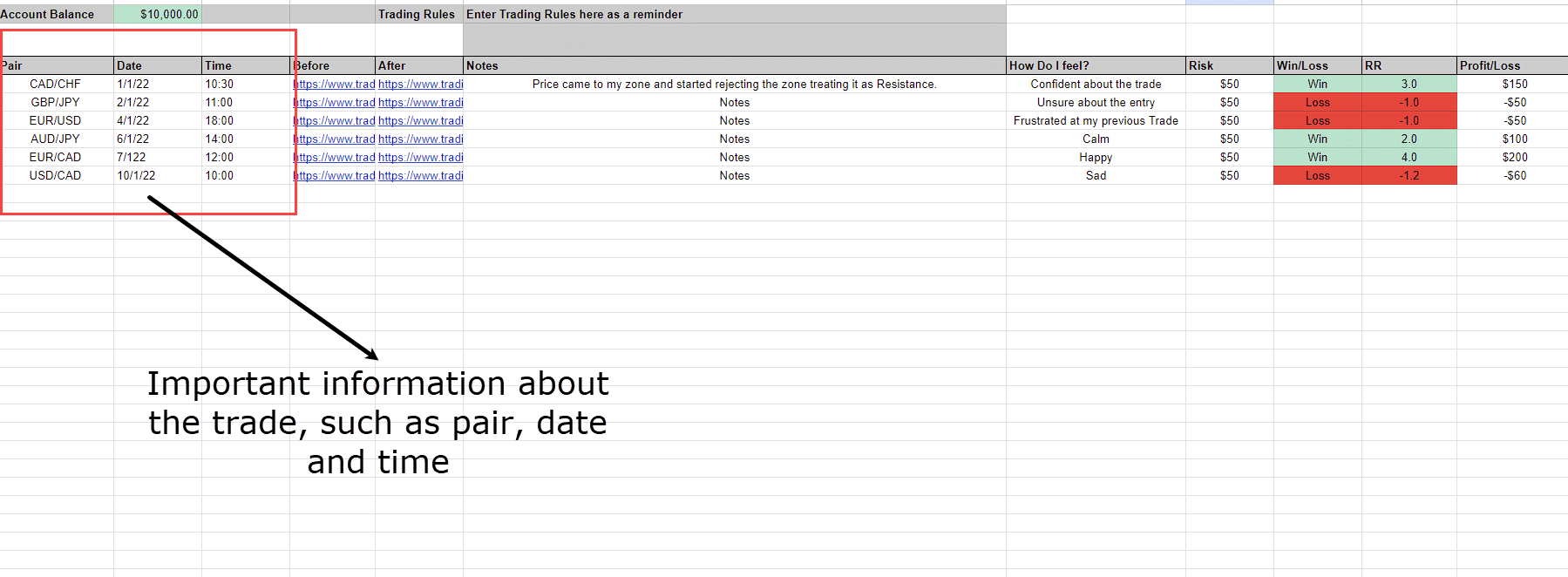

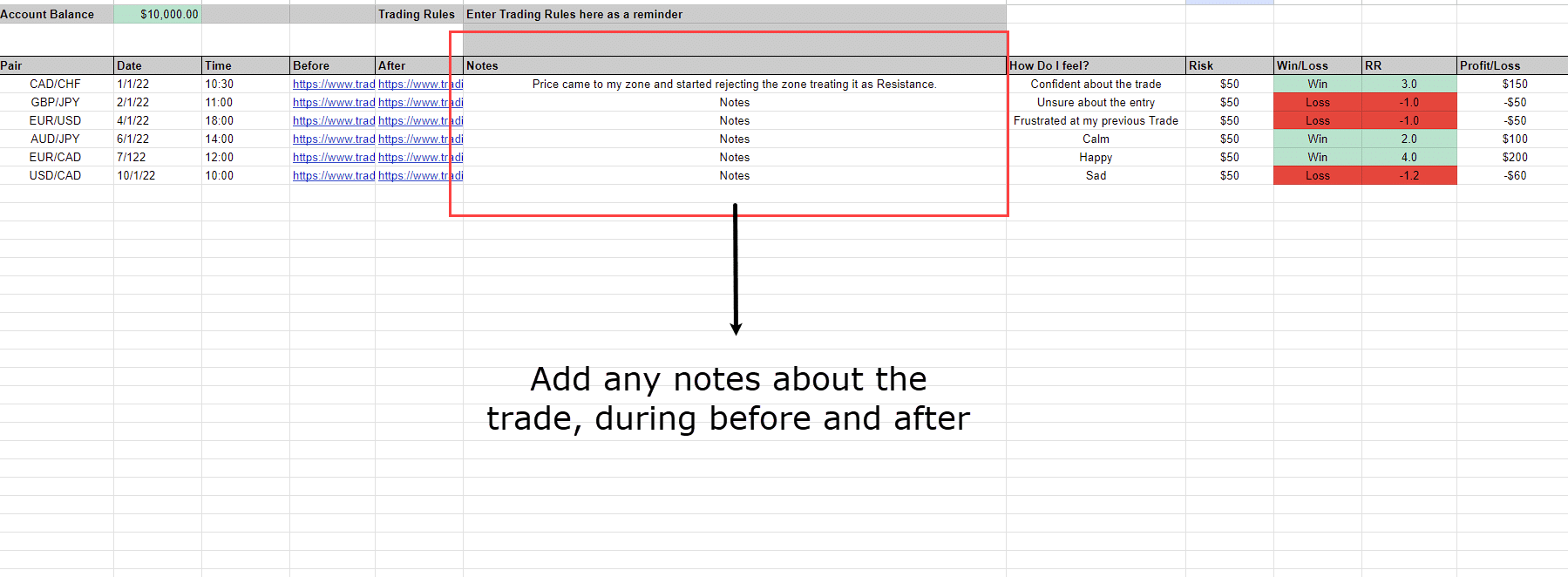

Pair, Date and Time Of Trade

Recording the pair, date and time of each trade can be crucial.

Especially if you have specific trading sessions or timeframes you prefer…

Trading Journal – Pair, Date and Time:

This approach may reveal patterns such as consistently losing trades at certain times of the day or even during particular sessions.

It may also reveal what pairs you tend to trade well and those you often struggle with.

All of it helps you adjust your trading strategy accordingly.

Moving on…

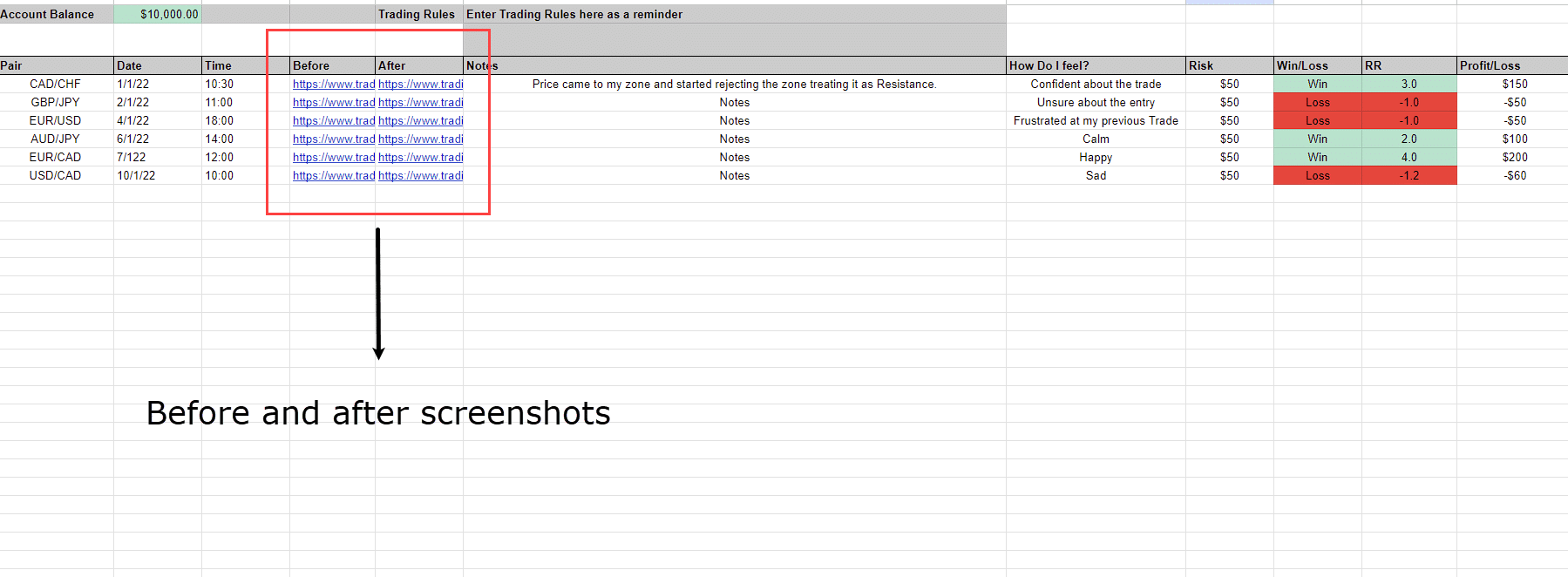

Screenshots of Before and After

Capturing screenshots before and after a trade is essential…

Trading Journal – Before and After Screenshots:

They allow you to review how the market conditions were and make sure you made an informed decision.

With emotions set aside, you can assess whether you followed your trading plan or executed the trade in the best way you could.

While not essential, some traders also include a screenshot of the chart a few days after the trade.

This can provide extra insight into your exit timing and help identify any patterns of exiting trades too early or too late.

To continue…

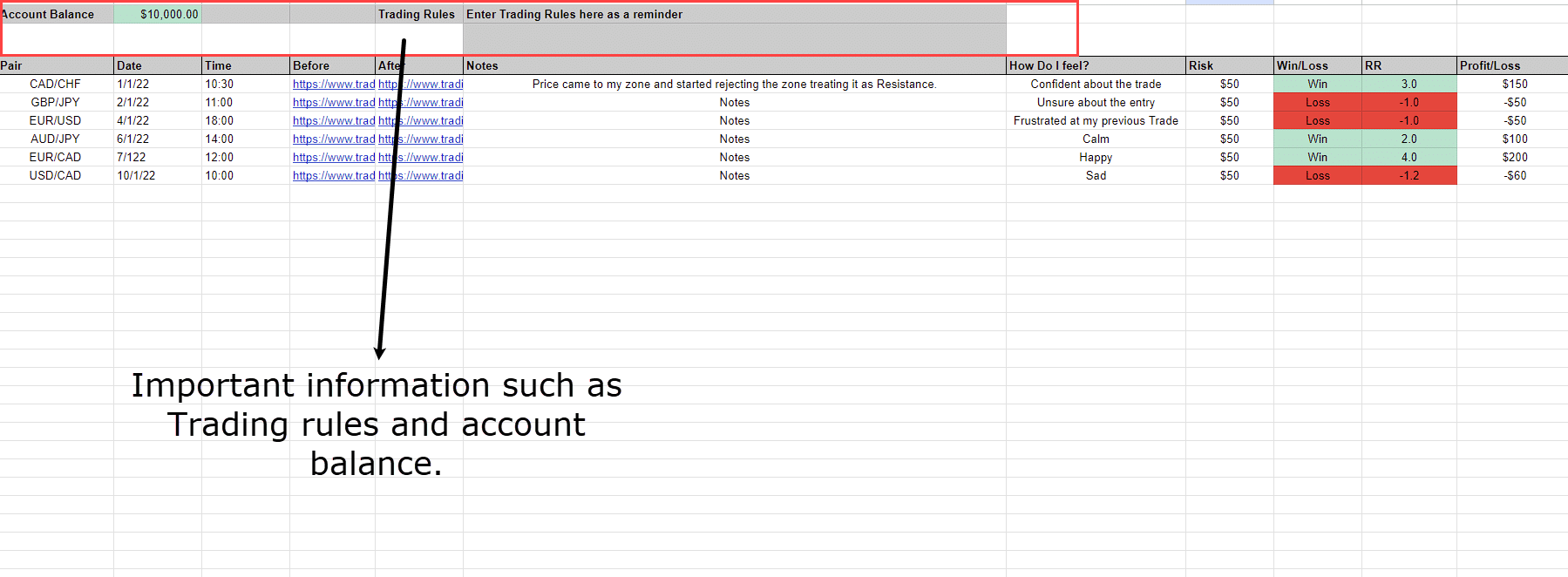

List of trading Rules for your Strategy

These guidelines can be very useful, especially for novice traders…

Trading Journal – Trading Rules:

Some traders prefer to use a checklist-style approach, where specific targets must be met before taking a trade.

This checklist ensures that traders align their actions with their predefined strategy, rather than giving in to emotional impulses or fear of missing out.

It’s all about having something to refer back to later!

Onto the next point…

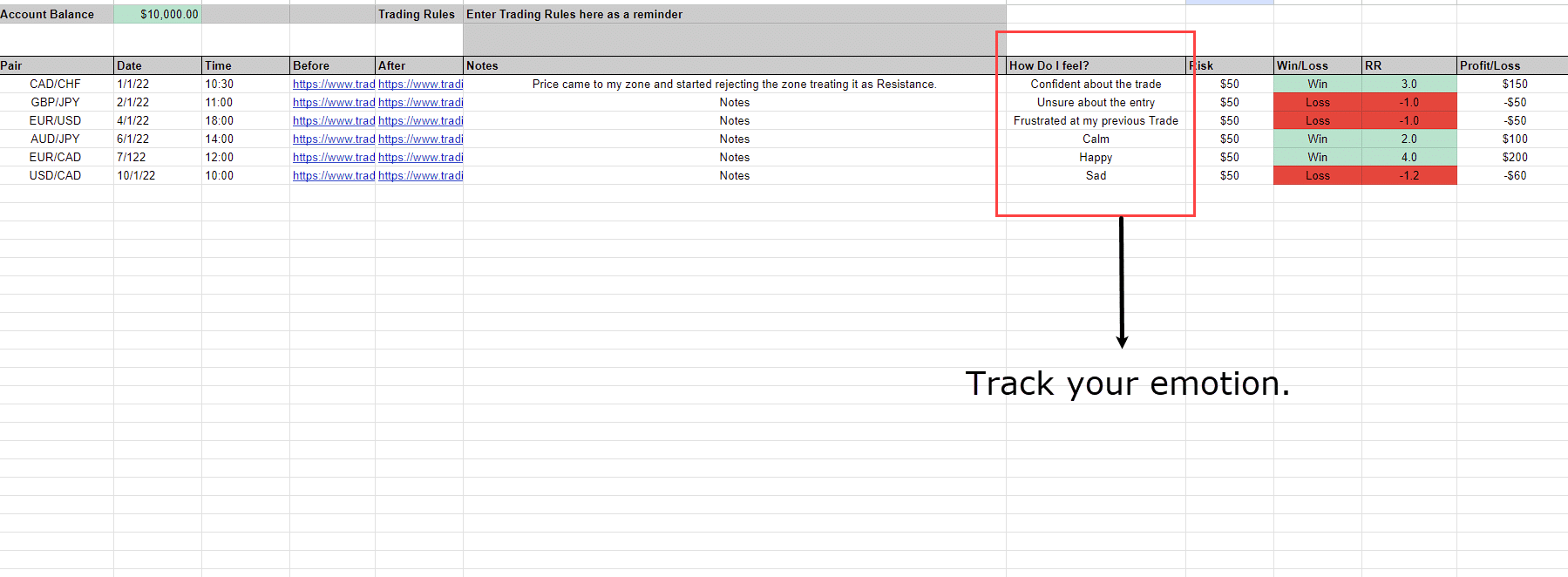

Emotions

Recognizing and managing your emotions is a top priority in trading.

While it’s ideal to make decisions with a clear, rational mind, emotions can easily take over.

So understanding how your emotions change before, during, and after a trade can help you find patterns in your trading behavior…

Trading Journal – Emotions:

You may uncover something that affects your performance, such as stress, anxiety, or distractions coming from personal life events.

Being aware of it is what helps you adjust.

Let’s look at some notes now…

Notes about the Trade

These are a great way to sum up anything else you noticed.

They should be short and focused, capturing key thoughts and observations before, during, and after the trade…

Trading Journal – Notes:

Avoid writing lengthy text, or any excuses for missed opportunities…

Instead, focus on anything that might help you understand your trades better.

This way, you can extract meaningful lessons and identify where to improve your trading strategy quickly.

Finally, let’s take a look at Win Loss and RR…

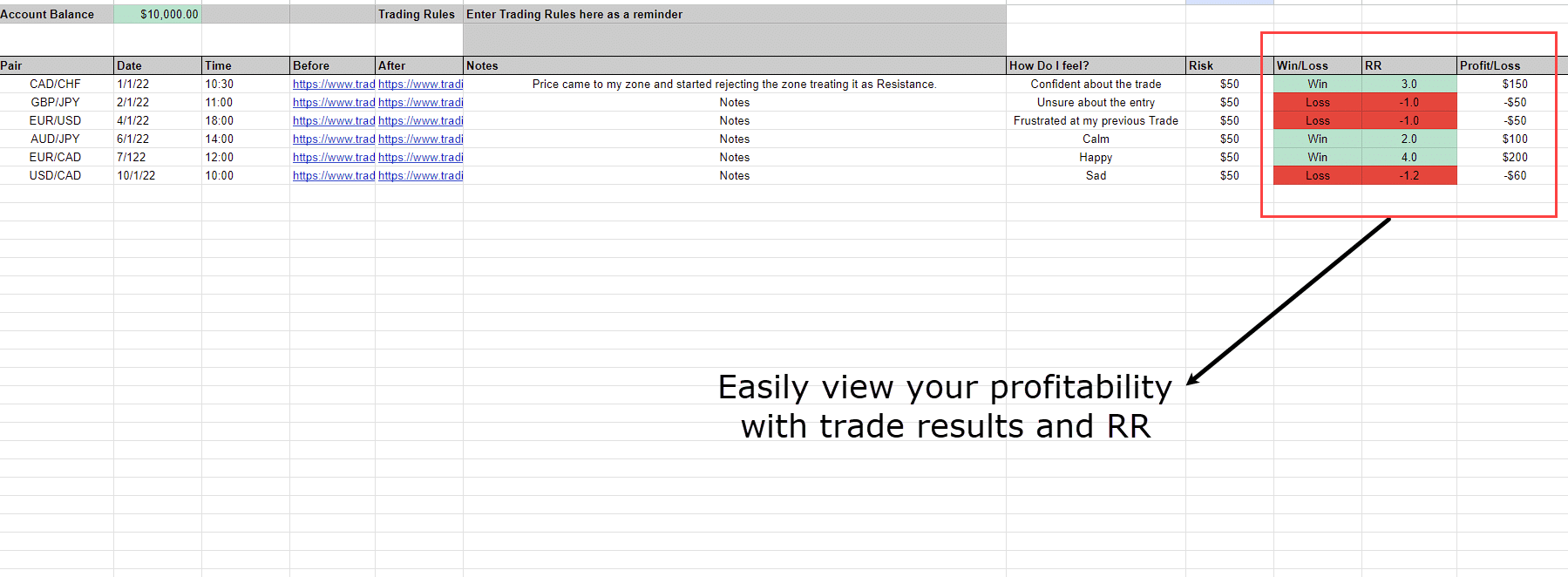

Win or Loss

Calculating your win-loss ratio is a core aspect of tracking your trading performance.

While many trading platforms provide this figure, it’s important to include it in your trading journal for quick reference later…

Trading Journal – Win/Loss and RR:

Never forget that seeing a string of losses may make you feel pretty negative!

If this affects your mindset or trading behavior, consider removing this for now, and looking into any underlying feelings you may have first…

Risk-reward ratio (RR) or Profit/Loss

The risk-reward ratio (RR) is a key factor that shows how well your trades work, measuring the ratio of potential profit to potential loss for each trade.

While some traders may have a low win rate, a favorable RR overall can still lead to profitability.

This data gives seriously useful insights into your trading strategy’s success.

You can work out whether your winners outweigh your losers and make adjustments to your trading approach.

What Is a Trading Journal: What Data Should You Analyze?

I find it important to break down your trading journal by picking apart this key data:

- Screenshot comparisons

- Your PnL and RR profitability

- Mistakes you are making

- Where you stray from your trading plan

- Your emotions throughout the trade process

- Post-trade information

- Missed trade opportunities and why

Let’s discuss each in greater detail and see what you can gain from each.

Screenshot Analysis

Incorrect analysis

You might see times when your first guess about a price range was wrong, which caused you to make bad trading decisions.

For example, you realize that a support or resistance level you identified was actually slightly lower or higher than you first thought…

Being aware of this could help improve your analytical skills and be more careful when looking for key trading zones.

Best Setups

Comparing winning and losing trades through screenshot analysis can reveal patterns or differences in your trade setups.

Carefully examine the formations of candles and price action leading up to your entry point for both winning and losing trades…

You should be looking for any similarities or distinct features in the setups of your winning trades that were absent in your losing trades.

This kind of analysis helps you learn how to successfully enter trades.

As always, it is important to make sure that this analysis has a large enough sample size to be reliable.

Avoid making hasty adjustments to your trading strategy based on single instances of success or failure!

Analyzing your PnL and Size of Losers vs. Winners

Analyzing your Profit and Loss (PnL) may seem simple, but there’s more to it than just calculating your win rate.

I need you to understand that Win Rate, in many cases, doesn’t mean all that much….

“Hang on Rayner… how can it not matter if you are not winning?!”

Well, win Rate by itself does not always mean Profitability.

You need to consider whether you make more on your winning trades than you lose on your losing trades.

Let me show you…

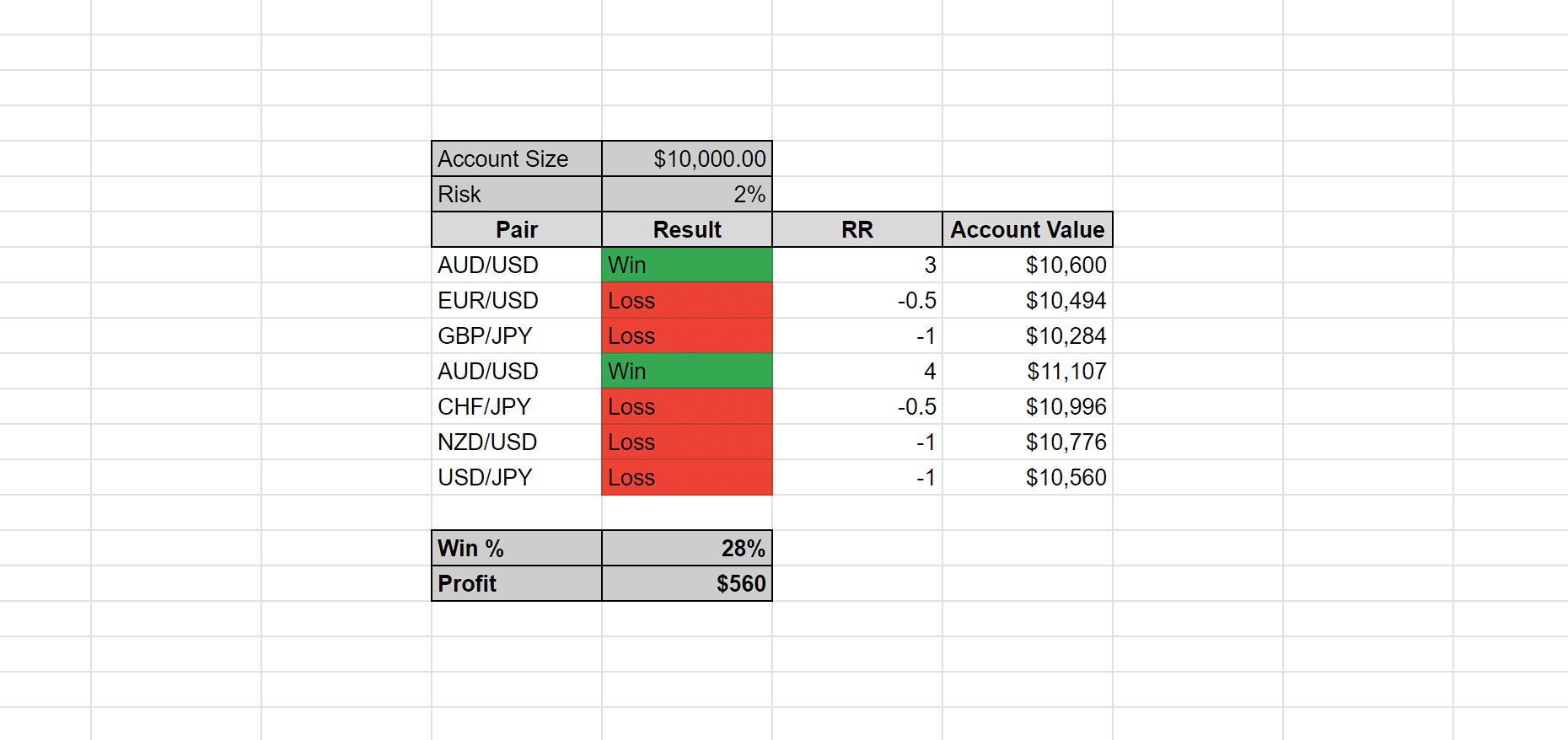

Trading Results Table:

OK, so here is a small sample size of 7 trades.

Even with a low win rate of 28%, a focus on risk management and maximizing profits on winning trades can still yield positive results…

In this example, with a $10,000 trading account and a 2% risk per trade, you would be up $560!

While this scenario may not be sustainable with such a small sample size, it highlights the importance of prioritizing the quality of trades over their quantity.

Analyzing your PnL data allows you to identify patterns, such as losing streaks or the need to minimize losses, which are key to refining and enhancing your trading system.

Identifying and Eliminating Trading Mistakes

Early in my trading journey, I realized the importance of reducing the number of mistakes I make.

Each mistake chips away at profitability, whether it’s a minor error or a major setback.

However, making mistakes is part of the learning process, and it’s okay to admit them.

What I learned from experience is the value of focusing on just one or two mistakes at a time…

Instead of trying to fix everything at once, I spend the next month fixing those one or two.

For example, if I see that I consistently trade too much or do not follow my risk management rules, that’s what I look at.

In this way, I can work on making the right trading habits a part of my daily life.

After that, I deal with the next set of problems.

This gradual approach allows me to make meaningful progress without feeling overwhelmed or spreading myself too thin.

Over time, this method has proven effective in helping me refine my trading process and become more consistently profitable!

Analyzing When You Didn’t Follow Your Trading Plan

Thinking about times when you did not stick to your trading plan can help you understand how you make decisions.

Attempt to figure out the real reasons for your actions…

Did your feelings get in the way of your rational thinking, causing you to stray from the plan?

Take a step back and honestly assess whether you are sabotaging your system!

By recognizing these moments and searching for the root cause, you can develop ways to prevent similar behavior in the future – becoming a better trader as a result.

Track Emotions throughout the Trade, not just Before and After

On longer timeframes, huge market movements can happen as trades play out – playing on your emotions as they do.

You may feel tempted to close trades early, either for a small profit or due to slight drawdowns.

These feelings can have a big effect on how you make decisions and lead to bad trading results.

That’s why it’s important to track your emotions not only before and after the trade but also during.

Consider making quick notes about your emotions and thoughts as the trade progresses, but don’t act on them straight away.

This approach allows you to see your feelings in the open, without letting them get in the way of your trading system.

It can help you stay disciplined and follow your trading plan, which will ultimately improve your trading overall.

Potentially Analyze what happened After you Exited

Analyzing your trades a few days after you’ve exited them is strongly recommended.

Why?

Firstly, once some time has passed, your emotions become detached from the trade.

It means you get a clear, realistic assessment of the trade’s actual performance.

Secondly, this analysis lets you see if any areas of your trading strategy could be better.

For instance, if you review ten trades and find that in eight of them, the price continued in the direction of your trade after you exited…

…it pretty strongly suggests that your exit strategy may have room for improvement!

Armed with this approach, you might adjust your profit-taking, perhaps even letting your winners run further before exiting.

Missed Trading Opportunities

Listing these opportunities in your trading journal is another valuable practice.

Once you identify a missed entry trigger, think about what was going on at the time.

Were you unavailable due to personal commitments?

Or did you simply miss the opportunity? (it happens)

Learning about the reasons you missed trades can help you improve your process and make better use of your time.

It can help you find out whether your strategy is true across different pairs and timeframes.

Thinking about why you missed these trades can also help you figure out deeper problems like fear, doubt, or laziness.

You can come up with ways to deal with these issues and be more disciplined in following your trading plan.

In the end, it’s the motivation that serves you, reminding you how important it is to stay alert and disciplined when trading.

Conclusion

In conclusion, I hope you can see how a Trading Journal is about much more than recording your feelings every day.

Whether for checking your emotional state before taking a trade or simply analyzing the data for ideas, creating one greatly improves your future trading prospects.

Armed with this new tool, you are now ready to properly analyze your trading life and overcome any market fears you may have!

To summarize, in this article, you’ve:

- Learned the definition and importance of a trading journal.

- Explored how to craft a personalized trading journal.

- Discovered the essential components of trading journals.

- Identified strategies for analyzing collected data to enhance trading performance.

Congratulations on uncovering another fundamental pillar of trading success!

If you use journal analysis to keep getting better, you will be well on your way to becoming a successful trader.

Now – I’m eager to hear your thoughts on trading journals…

Do you currently maintain a trading journal? If so, how do you structure it?

Have you gained new insights into trading journals from this article?

Share your thoughts and experiences in the comments below!

Excellent!

Kindly add a link to the sample spreadsheet you used so we can use it as template to journal our trades

You can email us at support@tradingwithrayner.com

Cheers!

Where can I open a tradin journal

Hi, Huggins!

You might find this interesting:

https://www.tradingwithrayner.com/trading-journal/

Hope this helps!