This post is written by Jet Toyco, a trader and trading coach.

Have you ever experienced a time where no matter what you do in trading, nothing works?

Where you keep on revenge trading even though “you know” that what you’re doing is not right?

And by the time you know it, you’ve lost more than half of your portfolio already?

Good.

You’re not alone, as it has happened to me before.

So, the question now is:

What are the root causes of these bad trading habits?

What are the concrete steps you can take to conquer them?

Don’t worry.

Because the answer lies in today’s comprehensive trading guide where you’ll learn how to start making changes almost instantly.

Sounds good?

Then read on…

Trading Psychology Tip #1: Detach yourself from the results and attach yourself to the process

I get it…

You want to make money from the markets (who doesn’t?).

To quit your 9-5 job and be your boss.

To make trading your main source of income.

To help you pay off your debts and medical expenses.

Now let me tell you as early as now…

All of those things are entirely possible!

But being attached to those goals too much will give you the false impression that the markets have an obligation to fulfill them.

That you think the markets must hit all of your take profits and avoid your stop losses!

However…

Having such expectations is incompatible in a trading environment.

This will move money further away from your pocket and limit your growth as a trader.

Don’t believe me?

Let me prove to you…

Let’s say that you’re currently on a losing streak and that you’ve entered a trade on Silver on the 4-hour timeframe:

This time, you’ve done your due diligence.

You’ve made sure that the:

- Technical analysis

- Fundamental analysis

- Statistical analysis

- Sentiment analysis

All goes in favor of your trade.

So of course, you’d expect the markets to shoot up like this and give you all the gains, right?

Now, what if the market immediately goes against your favor…

What would you do?

How would you feel?

If you lost the trade, would you increase your risk on the next trade?

Will you move your stop loss lower, or will you remove it altogether and become an “investor?”

Do you see what I mean?

Imposing your expectations in the markets makes you focus only on potential gains:

While trying to put yourself a blind eye to potential losses:

Some traders even insult and attack other traders whenever they are being met with information against their position, and it doesn’t make any sense why!

So, how do you trade without expectations?

Will I tell you to make sure you have a well-defined trading plan with an edge?

Sure, but not for today, because you can learn more about it in this article here.

Instead, one solution that you should look into is to…

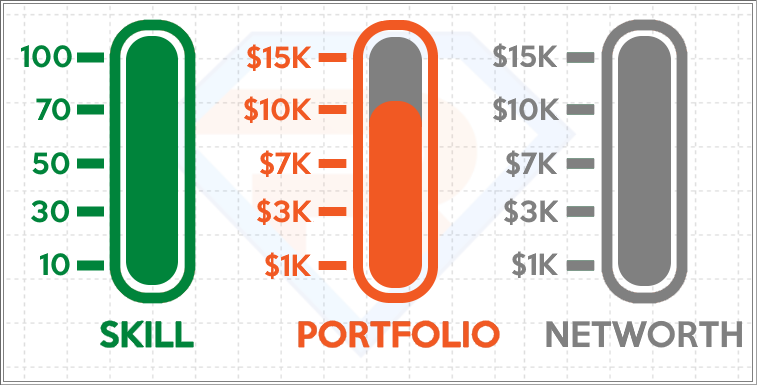

Reduce your trading balance relative to your networth

Just because you have $10,000 in your pocket doesn’t mean that you have a $10,000 mindset when trading such an account size.

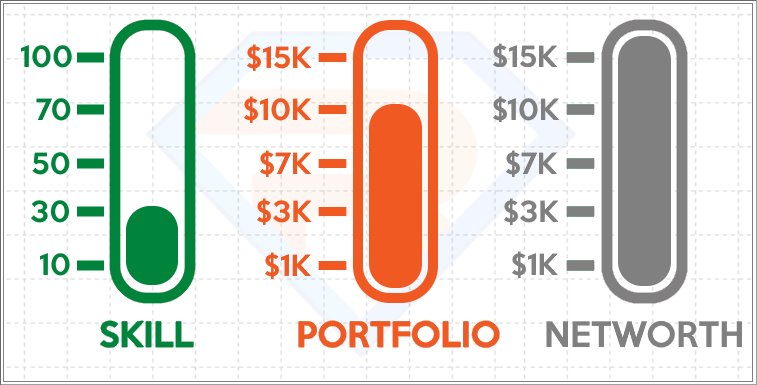

Let me show you what I mean:

Imagine this…

You have a $10,000 trading portfolio which is more than half of your networth.

However, you’ve only entered less than 30 good trades (low skill) with discipline with little results to show.

So, you’re trading with confidence you don’t have yet.

What do you think’s going to happen?

Well…

You will have this IMMENSE pressure while trading the markets, of course!

Going almost all-in on trading the markets means that you’re expecting to grow your account.

There’s also an emotional attachment to your portfolio.

Since you know that expectations in the market don’t work…

What’s likely going to happen is that your portfolio would decline along with your networth while you’re also not improving as a trader:

See what I mean?

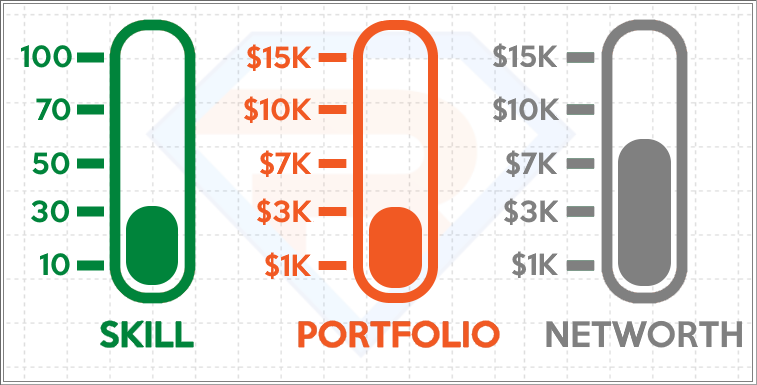

So as a trader who hasn’t found consistency yet, what should you do instead?

Simple.

Start trading with a small account size relative to your networth.

This time…

You’re trading almost without any attachment to your portfolio.

You’re not afraid to take a couple of small losses in the markets.

You’re focused on improving your skill and your growth as a trader by taking one good trade at a time.

You’re now treating trading as a business and not a hobby.

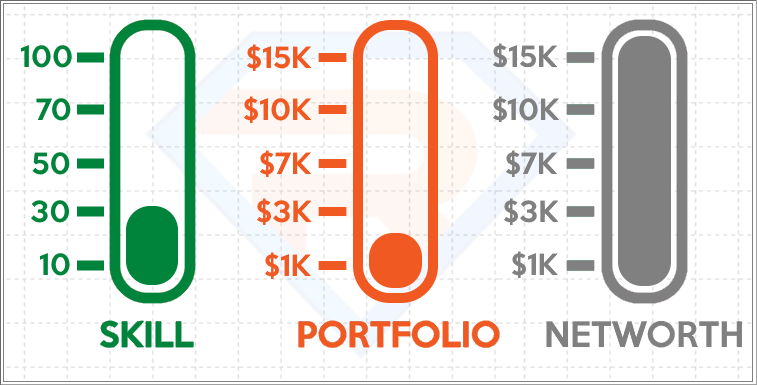

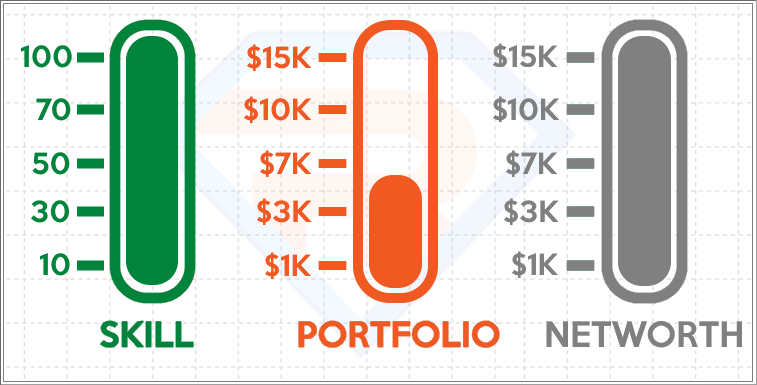

Now, what would happen once you’ve consistently played your edge and executed more than a hundred trades?

Your confidence as a trader would be at its peak!

Since you now have high trading confidence, who’s to say you can’t continuously deposit more funds into your portfolio?

Can you see how exciting this is?

Once you’ve detached yourself from the results and attached yourself to the process…

You’ll start thinking about how to expand your trading business beyond your imagination.

You’ll start to out-grow your goals and have bigger goals.

And you’ll start to see charts objectively:

Now, wherever the market goes, you’ll have a plan ready to execute.

P.S. All of the illustrations shown recently are for educational purposes only and not financial advice, however, I do request that you extract the principles that I have shared with you.

Great!

Now…

I know that I’ve shared with you a robust concept of how you can grow your trading business.

But the next thing that I’m about to share with you will be your foundation to reach the end of that trading business plan…

Trading Psychology Tip #2: Be Financially healthy

Here’s the truth:

Trading amplifies your money problems, it doesn’t solve them. – Rayner Teo

If you have a gambling addiction with a get-rich-quick mindset (only to lose all your money)…

What more if you were to pick markets to trade?

If you have a habit of going into debt by racking up installment plans only to realize that you can’t afford the monthly payments…

What more if you keep on over trading not knowing your trading balance (or available margin), is close to zero?

You see…

Being financially healthy is a major contribution to your success as a trader.

That’s right.

Being a profitable trader should not dictate your financial health.

It’s the other way around!

Now, the definition of being financially healthy depends on each person.

But it boils down to this:

You’re aware of where your money flows and you live less than what you make.

How do we accomplish this?

Have a well-written budget plan

Having a budget plan means that you know exactly what to do with your paycheck the moment it arrives, plus how to manage and prolong it until the next one comes.

Every government and company in the world has some sort of budget plan that could make or break the organization.

So, why shouldn’t you?

Let’s break it down into three steps on how you can make one yourself, shall we?

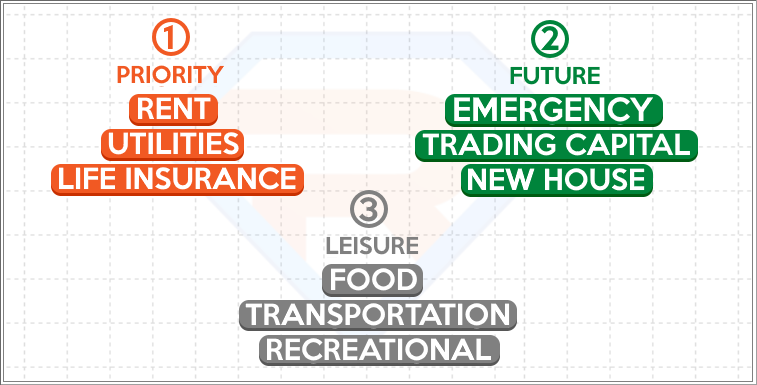

STEP 1: List down all types of expenses and potential savings

The priority expenses are the ones you need to pay to continue with your current lifestyle.

This could be your:

- Children’s education expenses

- Taxes

- Medical bills (maintenance)

Your priorities expenses could be non-existent if your responsibilities are few.

This is where your money goes first as soon as you receive your income.

Next…

The future savings are the ones you try to save up to preserve (emergency fund) or elevate your current lifestyle into the future.

This could be:

- Funding your trading account to boost its compounding effect

- Saving up for a trip to see your family from another country once again (or to stay there for good)

This is where your money goes next as soon as you finished paying the important expenses.

Finally…

The leisure expenses are your discretionary fund.

This could be your time to:

- Go to the spa

- Meet up with your friends

- Donate to your local charity (which can be placed on the priority expense if you wish)

This is where your money should go to LAST after you’ve accomplished the first two, and yes, this is the part where you set a maximum budget and try not to go over it!

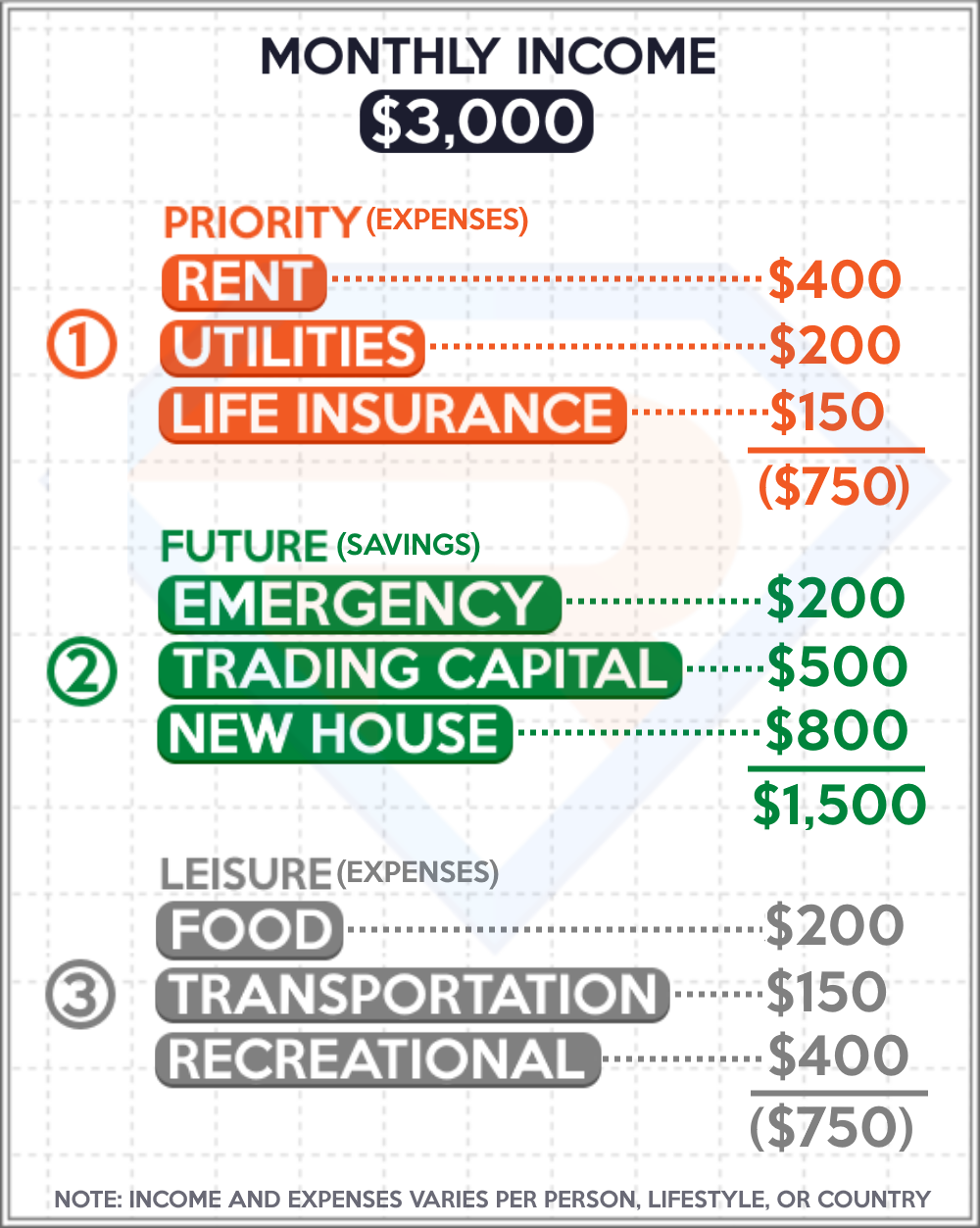

STEP 2: List down your exact expenses and savings amount

Now that you already know what your potential expenses and savings are in the weeks to come, you go down to the details on how much they would be.

This time…

You’d also need to take your monthly income into account and make sure that your budget plan does not exceed your monthly income.

Let me explain…

Looking at the example above, here’s what the budget plan consists of.

- Priority expenses: $750

- Future savings: $1,500

- Leisure: $750

Now, if you add them all up…

They amount to $3,000

Which is equal to your monthly income!

Again, the budget plan should be tailored based on your lifestyle.

These numbers do not represent the cost of living in your area and your income.

So, if you’re a freelancer (or a full-time trader) who makes irregular income…

Then you’d need to average your income for the past 3-6 months and make a budget plan on a longer time horizon.

Makes sense?

Last step….

STEP 3: Prioritize and follow your budget plan

This part is simple, yet it can be quite challenging to follow.

But what this step means is, before you start buying the finest gadgets or reserving a room in a fancy hotel (leisure expenses)…

You must first tackle your priority expenses and set-aside funds for your savings which can be placed in a separate bank account or low-risk investments.

Now…

I know that this is the last thing you want to learn in an article about trading.

But how you grow your trading business could heavily depend on how you manage your finances.

Believe it!

So let’s do a quick checklist…

Trading with almost no expectations?

Check.

Currently, have a budget plan in place?

Check.

Making consistent profits in the markets?

Hmm…

Now that’s a more challenging checklist to fulfill.

So let’s talk about this.

What if all that’s left is for you to have a profitable trading strategy?

You manage your risk pretty well but everything you try doesn’t seem to work.

Have you ever been in that scenario?

If so, then here’s the issue:

You see as traders, it’s normal for us to question things from trading ideas to trading indicators.

We like to experiment by combining different indicators and tweaking their values.

But here’s the biggest problem we’re not seeing here…

We’re spending more time experimenting than verifying.

So, what’s a cost-effective method of verifying what you know to save your money and time?

Here’s how…

Technique #3: Focus on finding trading concepts & strategies that work

That’s right.

You must not reinvent the wheel when you’re first starting out.

Why?

Because you don’t have a high level of confidence as a trader yet!

So, how do you find trading concepts and strategies that work?

There are two ways you can go about this:

- Read trading books with backtested results and execute the trading strategy (systematic trading)

- Model a consistently profitable trader (discretionary trading)

Let me explain…

Read backtested trading books and execute the trading strategy (systematic trading)

Reading backtested trading books is the closest you can get to a “shortcut” in trading.

Reading a trading book with backtest results shows you what an “edge” looks like and also shares with you the principles of why they work continuously.

So, what are some of these trading books you may ask?

Check these out:

- Following the Trend – Andreas Clenow

- Stocks on the Move – Andreas Clenow

- Unholy Grails – Nick Radge

- Dual Momentum – Gary Antonacci

- Mean Reversion Trading Systems – Howard Bandy

- Short-term trading strategies that work – Larry and Cesar

- Building Reliable Trading Systems – Keith Fitschen

Of course, don’t just blindly follow the strategies taught in a book.

You must know the ins and outs of the systems as if you were the one who invented them!

Now, what if you want to be a discretionary trader?

You want to learn and trade price action, Elliot waves, advanced harmonic patterns, or any trading style that involves technical analysis?

Then the next option may be for you.

Model a consistently profitable trader (discretionary trading)

Compared to systematic trading, discretionary trading cannot be backtested accurately, and you might be just wasting your time if you do.

Don’t believe me?

Let me prove it to you…

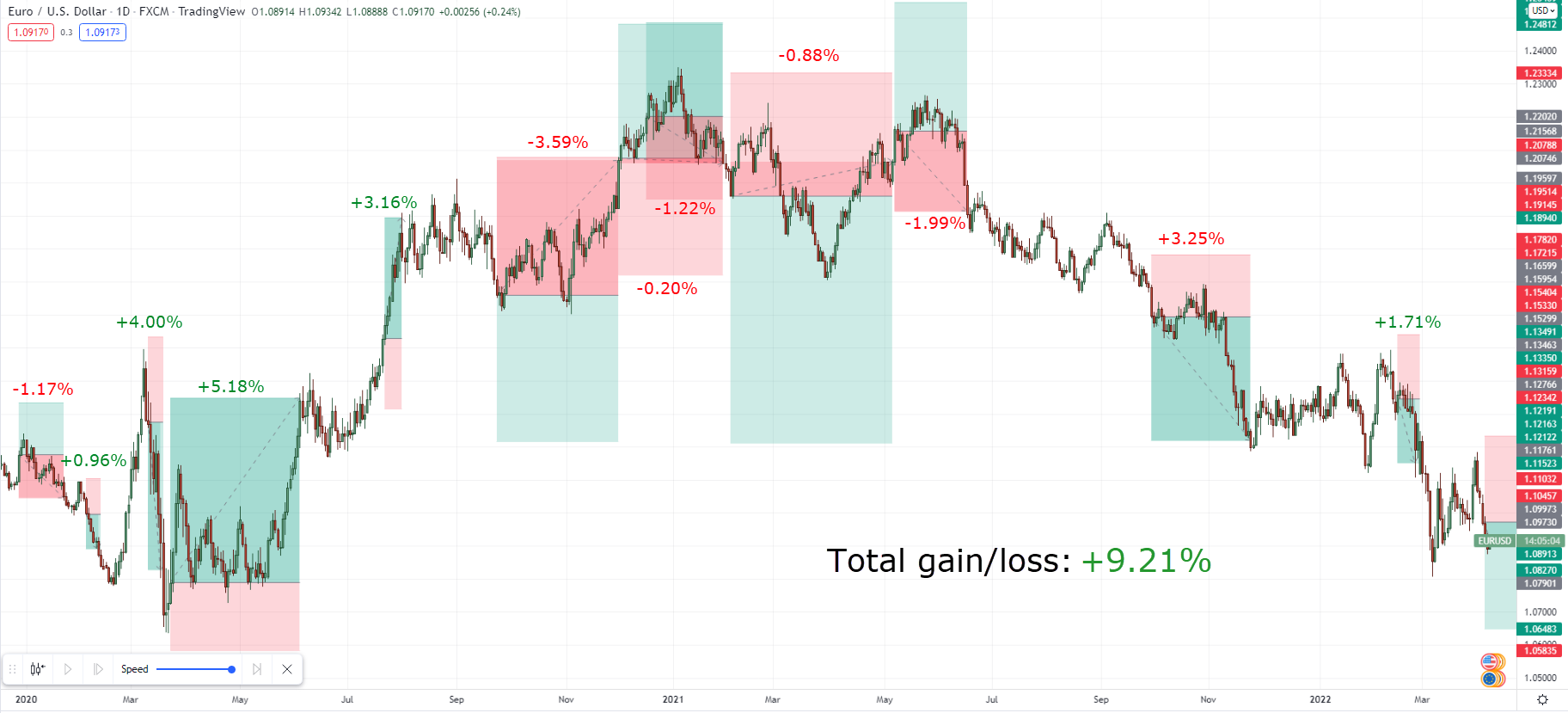

On my first backtest using pure price action on EURUSD from 2022, I gained a total of +9.21%

Now, what if I test the same market for the same period again.

Will the numbers still be the same?

Nope.

My perception of the market is different when I performed the same test on the same market, and you are free to try yourself if you’ve got time!

This is why as a discretionary trader…

Your focus should be on the trader whom you wish to learn from.

You’ll have to determine whether or not what that trader does, works!

So, how do we determine this?

Here are a few, concrete metrics that you can consider:

- Must have consistently live traded for at least two years straight (track record)

- Must have a track record of beating the markets consistently (achieved an average annual return of at least 10%)

- Respects other traders and is humble enough to learn new things and from mistakes (isn’t toxic)

- Is consistently teaching traders passionately (passing down the torch)

If a certain trader meets those metrics…

The only thing that’s left is for you to dive into his teachings and continuously practice them on your end.

This can be through buying their book, enrolling in their trading program, or simply investing your time watching their videos.

Here are some traders I know who have proven themselves throughout the year over and over that meet ALL of those criteria I mentioned above:

That’s pretty much it!

So with that said, let’s do a quick recap…

Conclusion

- Eliminate expectations in the markets and have patience by focusing on improving your skills as a trader

- Being financially healthy is a major contributing factor to whether or not your trading business will last

- Invest your time in finding trading concepts that work by reading books with backtested results, or following consistently profitable traders

Now here’s what I want to know…

Have you learned something new from today’s guide?

What trading psychology tips can you add?

Let me know what you think in the comments section below!

Thank you

You’re welcome, Jakes 🙂

You are most welcome, Jakes!

You’re indeed a God sent

Thank you for the kind words, Mayowa!

Once again, another great educational read. Thank you

You’re welcome, Emmanuel!

I love it

Thanks, Dominic!

Very educative..keep up the Good job

Hey Judy, thank you very much for the kind words!

Thank you was worth reading it

Great, you’re welcome, Siya!

I so much love you sir, your trading guide have really help me to understand trading better thank you so much

Awesome to hear that Okamma, thank you for the kind words!