Have you made money in some months, only to lose them all later?

Or…

You find a new trading strategy that makes money at the start, but stops working after a while?

What’s going on?

The reason is simple.

The markets are always changing.

It’s never fixed, but always in transition from one phase to another.

This means…

If you’re using a trend trading strategy, then you’ll lose money in range markets.

And… if you’re using a range trading strategy, then you’ll lose money in trending markets.

So, in this post you’ll learn:

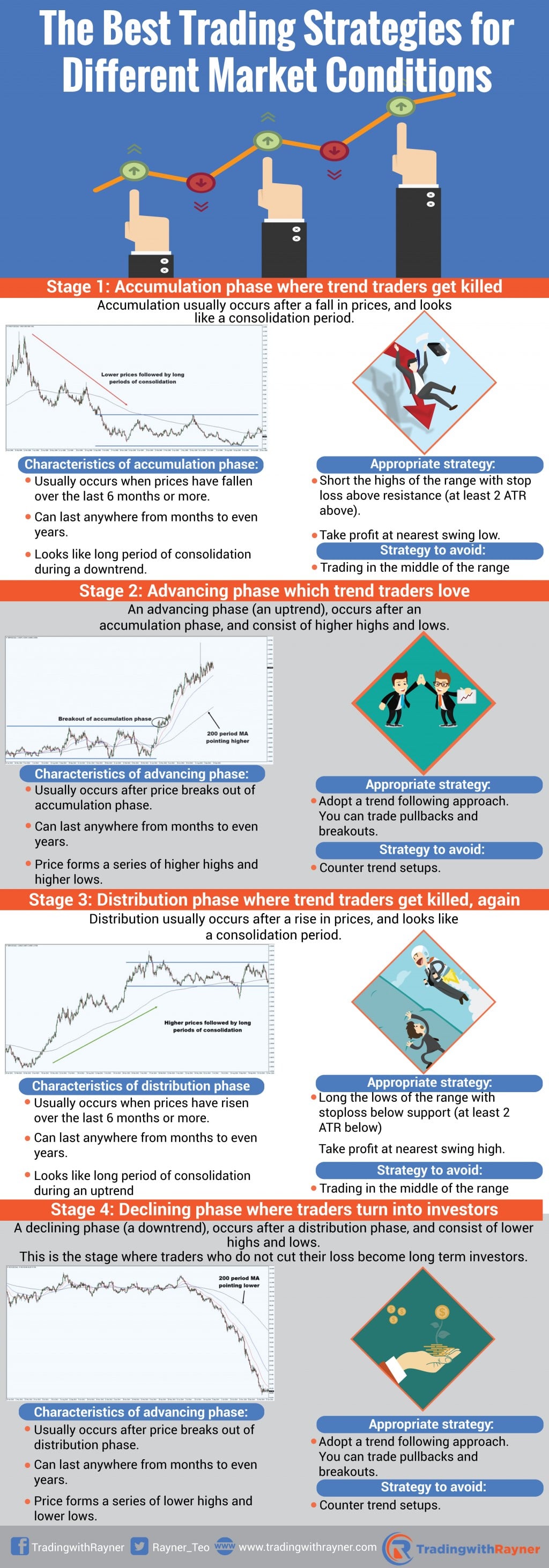

- Stage 1: Accumulation phase where trend traders get killed

- Stage 2: Advancing phase which trend traders love — Best trading strategy is to long the uptrend

- Stage 3: Distribution phase where trend traders get killed, again

- Stage 4: Declining phase where traders turn into investors — Best trading strategy is to short the downtrend

You’d want to read every word of it.

The profitability of trading systems seems to move in cycles. Periods during which trend following systems are highly successful will lead to their increased popularity.

As the number of system users increases, and the market shift from trending to directionless price action, these systems become unprofitable, and under capitalized and inexperienced traders will get shaken out.

Longevity is the key to success. – Ed Seykota

The 4 Stages of the Market Every Serious Trader Must Know

Stage 1: Accumulation phase where trend traders get killed

Accumulation usually occurs after a fall in prices and looks like a consolidation period.

Characteristics of accumulation phase:

- It usually occurs when prices have fallen over the last 6 months or more

- It can last anywhere from months to even years

- It looks like a long period of consolidation during a downtrend

- Price is contained within a range as bulls & bears are in equilibrium

- The ratio of up days to down days are pretty much equal

- The 200-day moving average tends to flatten out after a price decline

- Price tends to whip back and forth around the 200-day moving average

- Volatility tends to be low due to the lack of interest

It looks something like this:

Which is the best trading strategy to use?

Which is the best trading strategy to use?

A good approach to trade in an accumulation phase is to trade the range itself.

This means going long at the lows of the range, and shorting at the highs of the range. Your stop loss should be placed beyond the end of the range.

Here’s what I mean…

In an accumulation phase, I would be more inclined to go short than long. Why?

Because you never know when it’s an accumulation phase until the fact is over. I’ll explain more on this later…

Nonetheless, I’ll trade along the path of least resistance, which is towards the downside.

Disclaimer: Please do your own due diligence before risking your money. I’ll not be responsible for your wins or losses.

Here’s an example of a trading strategy you can consider…

If 200 EMA is flattening out and the price has fallen over the last 6 months, then identify the highs/lows of the consolidation.

If price reaches the high of the range, then wait for price rejection before going short (could be in the form of Pinbar or Engulfing patterns).

If price shows rejection, then enter your trade at the next open.

If entered, then place your stop loss at the high of the candle, and take profits at the nearest swing low.

Which trading strategy to avoid?

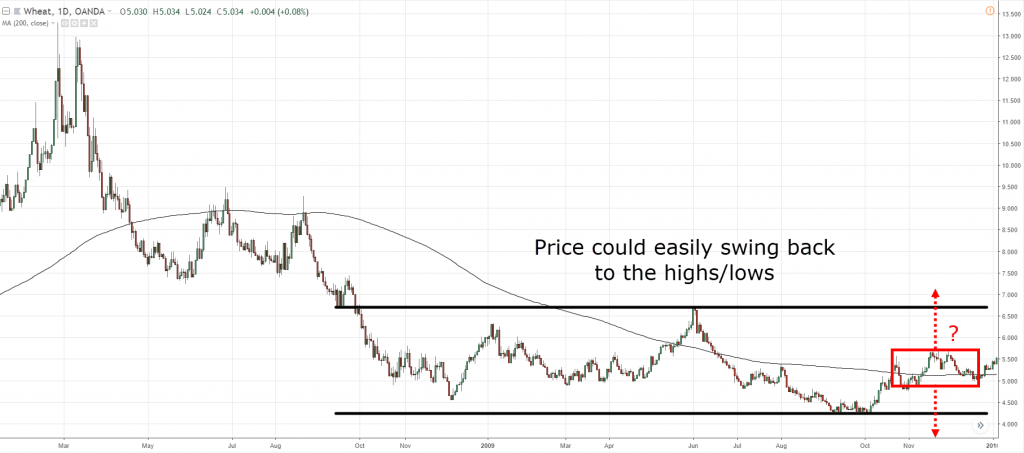

Do not trade in the middle of the range as it has a poor trade location. Price could easily swing back towards the highs/lows.

This would result in you getting stopped out of your trades at support & resistance area. It looks something like this…

How do I know if it’s an accumulation and not just another consolidation within a trend?

Something like this…

You don’t know until the fact is over.

Because even the best-looking accumulation in the markets could turn out to be a consolidation within a trend.

Until the fact is over, I’ll trade along the path of least resistance, which is towards the downside.

Stage 2: Advancing phase which trend traders love — Best trading strategy is to long the uptrend

After price breaks out of the accumulation phase, it goes into an advancing phase (an uptrend) and consists of higher highs and lows.

Characteristics of advancing phase:

- It usually occurs after price breaks out of accumulation phase

- It can last anywhere from months to even years

- Price forms a series of higher highs and higher lows

- Price is trading higher over time

- There are more up days than down days

- Short term moving averages are above long-term moving averages (e.g. 50 above 200-day ma)

- The 200-day moving average is pointing higher

- Price is above the 200-day moving average

- Volatility tends to be high at the late stage of advancing phase due to strong interest

It looks something like this…

Which is the best trading strategy to use?

Which is the best trading strategy to use?

In an advancing phase, you want to employ a trend trading strategy to capture trends in the market.

There are two ways to do it:

1) Trade the pullback

You can look to long when price pullback to key areas like:

- Moving average

- Support area

- Previous resistance turned support

- Fibonacci levels

An example…

You can look to long when price:

- Breaks above swing high

- Closes above swing high

An example…

When I am buying, I must buy on a rising scale. I don’t buy stocks on a scale down, I buy on a scale up. – Jesse Livermore

Which trading strategy to avoid?

When the price is in an uptrend, the last thing you want to do is to go short, aka counter-trend.

I’m not saying it’s wrong, but the path of least resistance is clearly to the upside.

By trading with the trend, you’ll get a bigger bang for your buck as the impulse move is stronger than the corrective move.

Here’s what I mean:

Stage 3: Distribution phase where trend traders get killed, again

Stage 3: Distribution phase where trend traders get killed, again

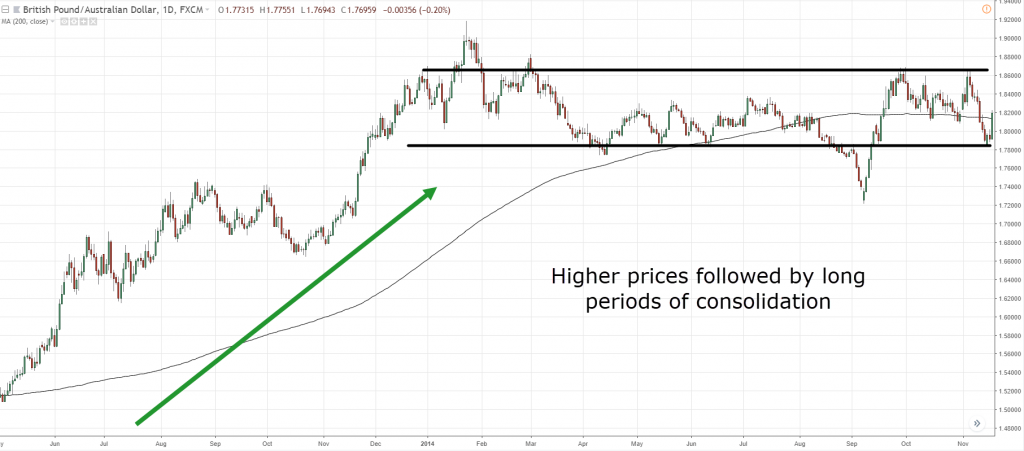

Distribution usually occurs after a rise in prices and looks like a consolidation period.

Characteristics of distribution phase:

- It usually occurs when prices have risen over the last 6 months or more

- It can last anywhere from months to even years

- It looks like a long period of consolidation during an uptrend

- Price is contained within a range as bulls & bears are in equilibrium

- The ratio of up days to down days are pretty much equal

- The 200-day moving average tends to flatten out after a price decline

- Price tends to whip back and forth around the 200-day moving average

- Volatility tends to be high because it has captured the attention of most traders

It looks something like this:

Which is the best trading strategy to use?

Which is the best trading strategy to use?

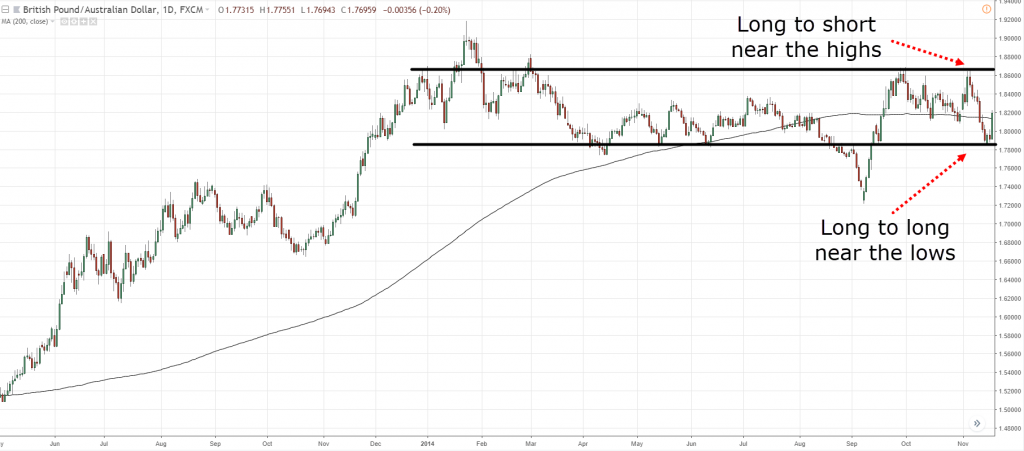

A good approach to trade in a distribution phase is to trade the range itself.

This means going long at the lows of the range, and shorting at the highs of the range. Your stop loss should be placed beyond the end of the range.

Here’s what I mean…

In a distribution phase, I would be more inclined to go long than short. Why?

Because you never know when it’s a distribution phase until the fact is over. I’ll explain more on this later…

Nonetheless, I’ll trade along the path of least resistance, which is towards the upside.

Disclaimer: Please do your own due diligence before risking your money. I’ll not be responsible for your wins or losses.

Here’s an example of a trading strategy you can consider…

If 200 EMA is flattening out and the price has rallied over the last 6 months, then identify the highs/lows of the consolidation.

If price reaches the low of the range, then wait for price rejection before going long (could be in the form of Pinbar or Engulfing patterns).

If price shows rejection, then enter your trade at the next open.

If entered, then place your stop loss at the low of the candle, and take profits at the nearest swing high.

Which trading strategy to avoid?

Do not trade in the middle of the range as it has a poor trade location. Price could easily swing back towards the highs/lows.

This would result in you getting stopped out of your trades at support & resistance area. It looks something like this…

How do I know if it’s a distribution and not just another consolidation within a trend?

Something like this…

You don’t know.

Because even the best looking distribution in the markets could turn out to be a consolidation within a trend.

This is why you always trade with a stop loss and proper risk management until the fact is over.

Trade along the path of least resistance, which is towards the upside.

Stage 4: Declining phase where traders turn into investors — Best trading strategy is to short the downtrend

After price breaks down of the distribution phase, it goes into a declining phase (a downtrend) and consists of lower highs and lows.

This is the stage where traders who do not cut their loss become long-term investors.

Characteristics of declining phase:

- It usually occurs after price breaks out of distribution phase

- It can last anywhere from months to even years

- Price forms a series of lower highs and lower lows

- Price is trading lower over time

- There are more down days than up days

- Short term moving averages are below long-term moving averages (e.g. 50 below 200-day ma)

- The 200-day moving average is pointing lower

- Price is below the 200-day moving average

- Volatility tends to be high due to panic and fear in the markets

It looks something like this…

Which is the best strategy to use?

Which is the best strategy to use?

In a declining phase, you want to employ a trend trading strategy to capture trends in the market.

There are two ways to do it:

1) Trade the pullback

You can look to long when price pullback to key areas like:

- Moving average

- Support area

- Previous resistance turned support

- Fibonacci levels

An example…

You can look to short when price:

- Breaks below the swing low

- Closes below the swing low

An example…

Which trading strategy to avoid?

When the price is in a downtrend, the last thing you want to do is to go long, aka counter-trend.

I’m not saying it’s wrong, but the path of least resistance is clearly to the downside.

By trading with the trend, you’ll get a bigger bang for your buck as the impulse move is stronger than the corrective move.

Here’s what I mean:

Summary of what you’ve learned

Click here to save this infographic.

Frequently asked questions

#1: How can I know the difference between a “distribution phase” and a consolidation within a trend?

The truth is you’ll never know for sure. That’s why you must always have a stop loss and manage your risk properly.

#2: What’s the difference between a “accumulation phase” versus a “distribution phase”?

An accumulation phase usually occurs when prices have fallen over the last 6 months or more.

But a distribution phase usually occurs when prices have risen over the last 6 months or more.

Conclusion

You’ve learned the best trading strategy for different market conditions.

In accumulation or distribution, you’d want to trade the range, and avoid a trend trading strategy.

In advancing or declining phase, you’d want to adopt a trend trading strategy, and avoid taking counter trend setups.

So, what is your best trading strategy for different market conditions?

Dear rayner,

very good sharing to show us how to trade with the uptrend , downtrend and side way market.

Awesome !

Hi Tet Soon,

I’m glad you found it useful.

Cheers!

Rayner

Thank you so much Rayner for your kind sharing! I love the summary so much 😀 Can save it in my phone and review it anytime when I am free . he-he

Hi Jiaw Ling,

I’m glad the summary helps. Don’t hesitate to let me know if there’s anything, I’ll be glad to help.

I hope to hear much more from you 🙂

Rayner

Rayner,

Please I still have problem with emotion especially when I close a trade. I don’t risk more than 1% of my trading capital and the expectancy of my strategy is positive. Whenever I win a trade I feel happy but whenever I loss I equally feel bad. I don’t get emotional at entry or during the trade.

What should I do to overcome this problem?

Hey Sutiv,

The thing is this…

In the short run your trading results is random. But in the long run, if you have an edge in the markets, it will play out according to your system’s expectancy.

Tell yourself this:

You’re trading to make money, not to be right.

And you’ll only be consistent trader if you are consistent in your trading actions.

I hope it helps! 🙂

Rayner

Emotions usually comes in when your risk is much. By the time you started treating trading as normal business, you will discover that losses are part of trading. Remember to keep your losses as minimum as possible for me the best way to get rid of emotions.

This is a very amazing post that you have made. very informative and you have helped the trader out there to follow the trend. But like you say, no one knows and it is indeed very hard to predict markets. Other tools that can be used is the cross of a smaller moving average with the longer moving average when on trend when volatility is still low and increasing. The times where this trends form, or also something I discovered by watching the 4 hour chart is to use the drawing tool the linear regression to see where price is at the moment (to see where price is within that range to follow buying the lows, selling short the highs) Great stuff.

For some reason, you make money for 2 weeks and then you have bad weeks. is very hard to keep consistent in my trading using a very similar system as what you have shown. very hard profession indeed.

Hello Geovanni,

Thank you for your feedback, I’m glad you find it informative.

Yes trading is the “hardest easiest money” you’ll ever make. Consistency is key here.

Don’t hesitate to let me know if you’ve got any questions, I’ll be glad to help.

Rayner

Hi Rayner,

Thank you for the perfect post 🙂

Shlomi

You’re welcome, Shlomi 🙂

Hello Rayner,

One thing I didn’t see in your post on trading on trend is using the market trend. One strategy I use when trading using trend in my system is to make sure that I am trading with the direction of the market.

If the market is trending higher then I use that as wind behind my back so to speak so that the stocks I trade have that added assistance to be pushed higher along with the market.

If the market trend is down, then I sit on my hands (I don’t short) and don’t buy any new stocks. Using moving average of the $SPX is an easy way to do that. Has worked well for me in my trading.

Thanks and great post here!

Jeremy

Hey Jeremy,

Yes looking at the direction of the overall markets would work well with stocks.

But in markets like futures, there’s no “authority” market to reference from.

Great comment by the way 🙂

Rayner

Amazing post, thank you for sharing, your website is a must and I like it so much. Good job Rayner, much appreciated.

Hi Lu,

Thank you for your kind words, I appreciate it.

Don’t hesitate to let me know if there’s anything, I’ll be glad to help.

Rayner

Hey Rayner,

Kindly to mention that you have a type error in the section – declining phase trading set-up. You should short instead of long, and you should trade the breakout when you see breaks below swing low/close below swing low.

Below are the bullets in “declining phase” you should fix. Thanks.

**************************************************

1) Trade the pullback

You can look to long when price pullback to key areas like:

***************************************************

2) Trade the breakout

You can look to long when price:

Breaks above swing high

Close above swing high

Hey Ohlala,

Thank you for your feedback. I’ll ammend it accordingly.

Cheers!

Rayner

Hi Rayner, what software do you use to make those infographics? They look awesome

Hi Schoolex,

I got it done on Fiverr actually.

Rayner

Hi..My friend Rayner…

Please look Into this…

Which is the best strategy to use?

In a declining phase, you want to employ a trend trading strategy to capture trends in the market.

There are two ways to do it:

1) Trade the pullback

You can look to long when price pullback to key areas like:

Moving average

Support area

Previous resistance turned support

Fibonacci levels

[…] The Best Trading Strategy for Trading Trend and Range […]

Great and very easy and simple to understand blog , thanks Rayner teo

Hi Anand,

You are most welcome!

Even in 2020, this still works like a beat! Thanks Rayner for sharing

[…] markets are always changing (I’m sure you’d realize this by […]

Hey Rayner,

It was excellent article. Gave a very basic & fundamental understanding.

I wanted to know whether we can call a trend which is less than 6 months.

There may be multiple high lows within 6 months breaking old high/lows.

Please consider me beginner.

Hey Amit,

The trend can be long-term or short-term so long as it has the properties of a trend.

Cheers.

ARE THE 4 STAGES SYNONYMOUS WITH TRANSITIONAL PHASES OR BREAKOUTS AND BREAKDOWNS IN UPTRENDS AND DOWNTRENDS?

THANK YOU

Hello Rayner is this 4 phases of market can you see them in a lower time frame like 15 MIN

Yes, Marwane. You can see it in all timeframes.

Hey RAYNER thanks you for helping me understand the four stages very well,l really thanks you for everything

Glad to know it helped you, Benjamin!

You’re doing well with your guide Rayner. There are things I have been seeing in the market which I was ignorant of but getting exposed to it in your write up. Thanks Rayner. Much appreciation. More profit and greater rewards for you I pray.

Thank you for your kind words, Samuel!

Wishing you good luck and good trades, too!