Let me ask you…

Have you ever found it hard to trade using Japanese Candlestick charts?

There are too many green candles and red candles in the chart that you just can’t decide if you should be a buyer or a seller!

That’s why in today’s post…

I want to make your life easier by introducing the Heiken Ashi candlesticks.

Here’s what you’ll learn:

- What is the Heiken Ashi candlestick

- Why you should start using Heiken Ashi candlestick in your trading

- How not to use the Heiken Ashi (and what to do instead)

- Heiken Ashi trading techniques to profit in bull & bear markets

Cool?

So first, let’s get started with the basics.

Shall we?

What is the Heiken Ashi candlestick

The Heiken Ashi is a type of candlestick that is used in technical analysis.

It looks very similar to Japanese candlesticks that you must have seen before.

But!

There are slight differences that you must know.

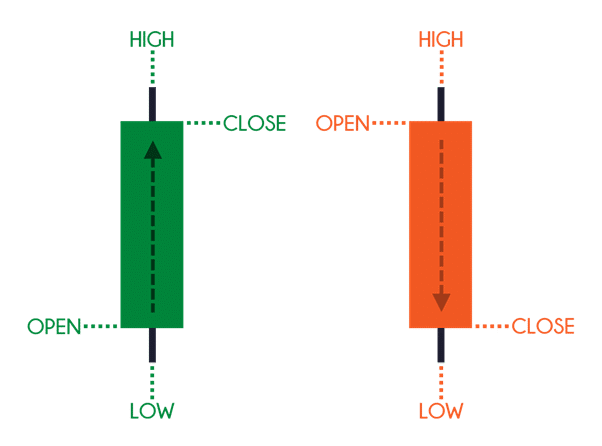

Each candle is independent of the other, and you’re pretty much just looking at actual Open, High, Low, Close prices for the period.

Here’s what I mean:

You can be looking at the daily chart, hourly or 1-minute chart.

But each candle is not affected by the other!

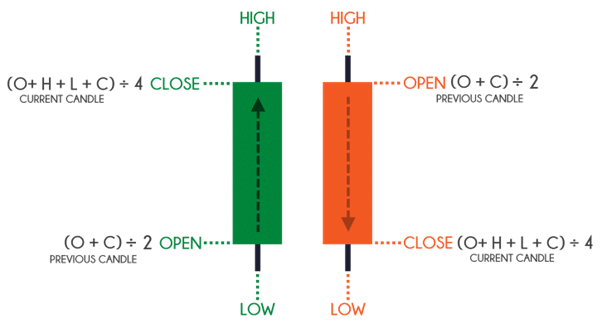

For Heiken Ashi, each new candle is calculated based on the previous candle.

Here’s what I mean:

Heiken Ashi Close price is an average of the actual O+H+L+C of the current candle!

Wherein…

The High is the maximum of H or O or C of the current candle.

The Low is the minimum of L or O or C of the current candle.

The Open price is half of the previous candle’s Open price + the previous candle’s Close price.

This means that a bullish and bearish candlestick is slightly different in Heiken Ashi as well.

To summarize things…

Here’s a brief explanation on what makes the two different:

For Japanese candlesticks:

- A bullish candlestick has its closing price above its opening price

- A bearish candlestick has its closing price below its opening price

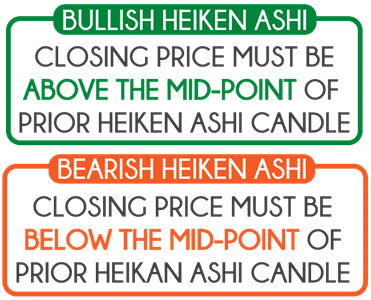

For Heiken Ashi candlesticks:

- A bullish candlestick has its closing price above the middle of the previous candle

- A bearish candlestick has its closing price below the middle of the previous candle

Makes sense?

So, now that you know the differences between a Japanese Candlestick and a Heiken Ashi bar…

Let me teach you “why” you’d want to consider trading with the Heiken Ashi.

Sounds good?

Then keep on reading!

Why you should start using Heiken Ashi candlestick in your trading

If you’re a newbie trend trader and can’t identify the trend for nuts…

Then the Heiken Ashi candlesticks will help you a lot.

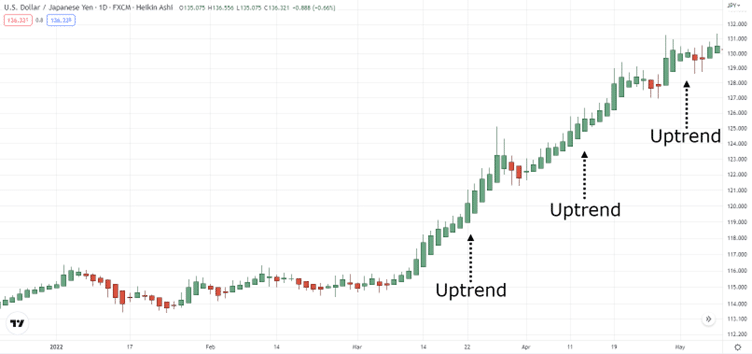

Here’s a quick example!

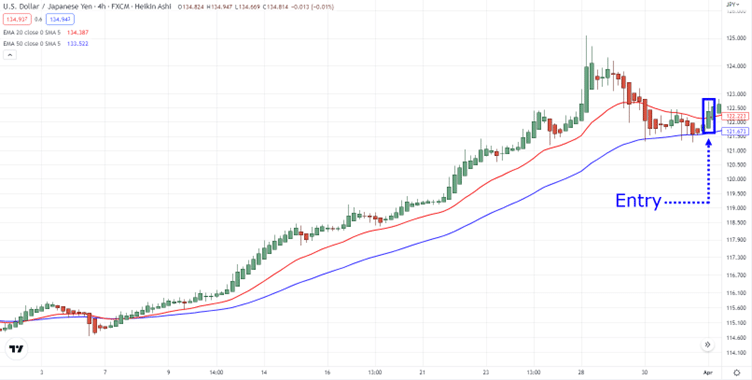

Look at this Japanese candlestick chart of USDJPY:

Now let’s compare that with the Heiken Ashi chart of the same USDJPY:

Now tell me…

Which allows you to see the trend at a glance?

Without having to second guess…

You can clearly see trends on the Heiken Ashi chart of the USDJPY!

Still not convinced?

Then let me show you more examples of how these perform in multiple trading conditions…

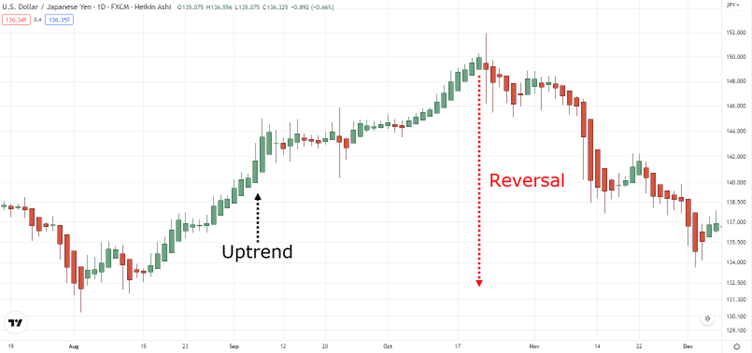

Uptrend

You can see the uptrend characterized by these green candles with:

- Big bodies

- No lower wick

- More often than not, they have a longer upper wick

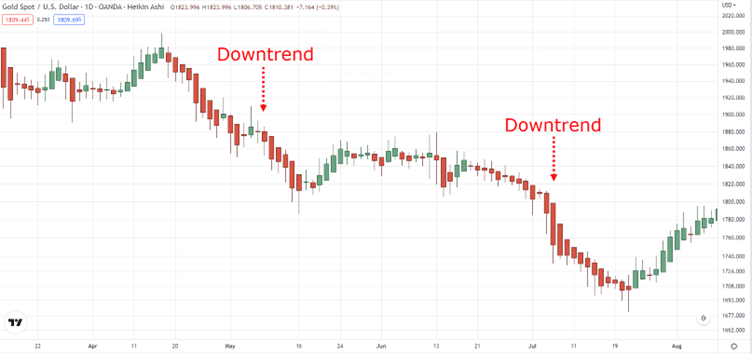

Downtrend

Over here you can see minor pullbacks or downtrends, by red candles with:

- Big bodies

- No upper wick

- Usually have a longer lower wick

Reversal

Now, how do you tell that the market is about to reverse?

Look at these candles with:

- Super long upper and lower wicks

- But very small bodies

They look exactly like a doji reversal candlestick.

It’s really straightforward, right?

You pretty much get a less noisy chart and look beyond minor pullbacks in a trend that prevents analysis paralysis.

This means you can use the Heiken Ashi as a trend filter for the markets and decide if you want to go long or sell short!

But just like every other tool and concept out there, it’s not the holy grail.

There are some strengths, while there are some weaknesses.

Since I’ve shared what Heiken Ashi is capable of, I’ll now share with you what it’s not.

Curious?

Then let’s move on…

How not to use the Heiken Ashi (and what to do instead)

Recall…

Heiken Ashi’s Close price is an average of the actual O+H+L+C of the current candle.

Its Open price is half of the previous candle’s Open price + the previous candle’s Close price.

This means as a scalper on the 1-min timeframe…

You don’t want to be using the Heiken Ashi candlesticks.

Why?

Because the Open and Close prices are calculated based on average prices which take time to form!

So, you’ll never be able to make quick scalping decisions!

If you’re a scalper who needs the latest price…

It’s best to stick with Japanese candlesticks.

So, to unlock Heiken Ashi candlesticks’ full potential, do this instead…

Trade using Heiken Ashi on the higher timeframes, like the hourly timeframe and above.

You can use then use it to easily identify the trend and hop into a trade (which I’ll explain more about next).

Moving on…

Heiken Ashi trading techniques to trade with the trend in bull & bear markets

In this section…

I want to share with you the Heiken Ashi trading techniques along with examples so you can start to crush your trades.

Even as a newbie trader!

So let’s get straight to the point…

How to use Heiken Ashi for bullish trend continuation

There are 4 parts to this bullish trend continuation technique:

- Identify the trend on the higher timeframe using Heiken Ashi candles

- Wait for pullback into an area of value using 20 & 50 EMAs on the lower timeframe

- Go long on a valid entry trigger

- Stop loss 1 ATR below recent swing low and take profit before previous swing high

Let me explain…

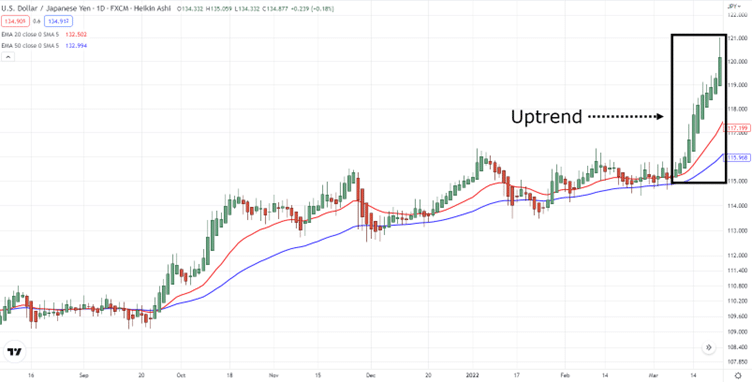

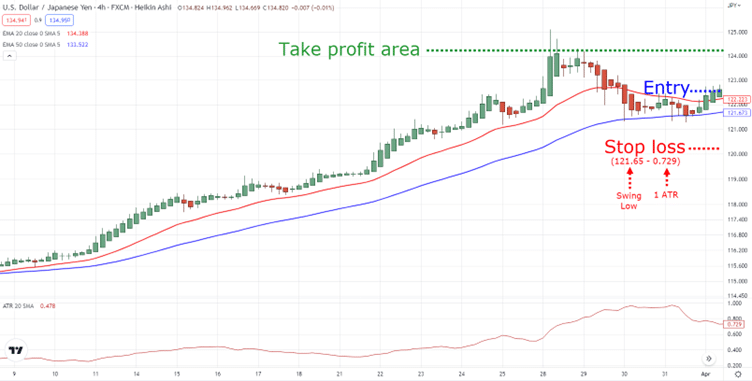

Firstly… Identify the trend on the higher timeframe using Heiken Ashi candles.

On the right-hand side…

You can see USDJPY is clearly in an uptrend at this stage as the Heiken Ashi candles are green, with big bodies and little to no lower wicks.

However, the price has moved quite a bit and you don’t want to jump in straight, in case it makes a huge collapse against you.

So, what you want to do is this…

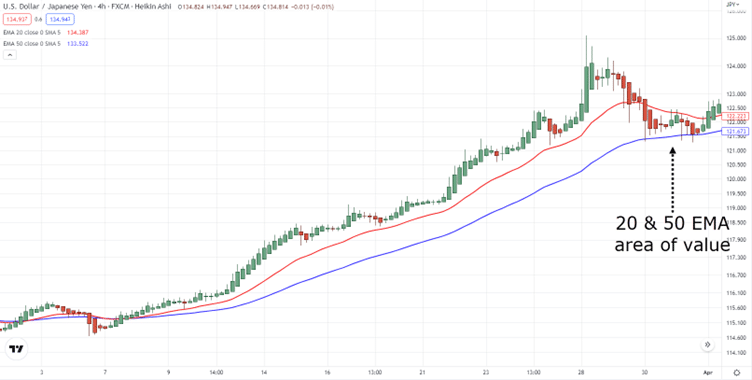

Secondly, wait for pullback into an area of value using 20 & 50 EMAs on the lower timeframe.

At this point…

The price has pulled back within the EMAs and resting right above the 50 EMA.

This is when the market is “taking a break” and the area between 20 EMA and 50 EMA serves as an area of value for you to start looking for an entry trigger.

Thirdly, go long on a valid entry trigger.

Your entry trigger will be the big, green-bodied candlestick with little to no lower wick after the price bounces off the 50 EMA.

Go long on the next candle after you see this candle form.

Why is that big green candle a good entry trigger?

Recall that the closing price of a Heiken Ashi candle is the average of the actual O+H+L+C of the current candle.

And despite being an average value (which could have been affected by highs and lows of the day), it still closes above the previous Heiken Ashi candle’s high.

This means there is momentum behind the move, so it serves as a valid entry trigger for a bullish trend continuation.

And finally, stop loss 1 ATR below recent swing low and take profit before previous swing high.

Your stop loss will simply be 1 ATR below the most recent swing low (below the 50 EMA).

If you want to learn more about stop loss hunting secrets, you can check out this video. I’ll not be diving into too many details here.

You’ll also want to take profit before the previous swing high.

You don’t want to be too greedy with your profit target if you’re just starting with this simple trend continuation technique.

Next…

How to use Heiken Ashi for bearish trend continuation

For a bearish trend continuation, it is simply the opposite:

- Identify the trend on the higher timeframe using Heiken Ashi candles

- Wait for a pullback into an area of value using 20 & 50 EMAs on the lower timeframe

- Go short on a valid entry trigger

- Stop loss 1 ATR above the recent swing high and take profit before the previous swing low

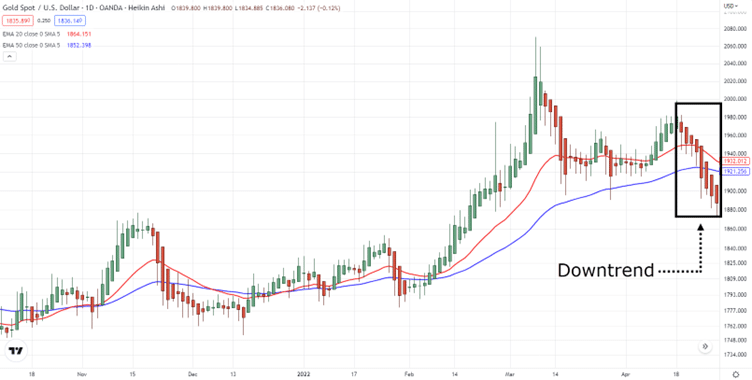

Firstly, identify the trend on the higher timeframe using Heiken Ashi candles.

Using just the Heiken Ashi candles on the Dailly chart, you can see the price is currently bearish with big, red-bodied candles, with little to no upper wicks.

Next…

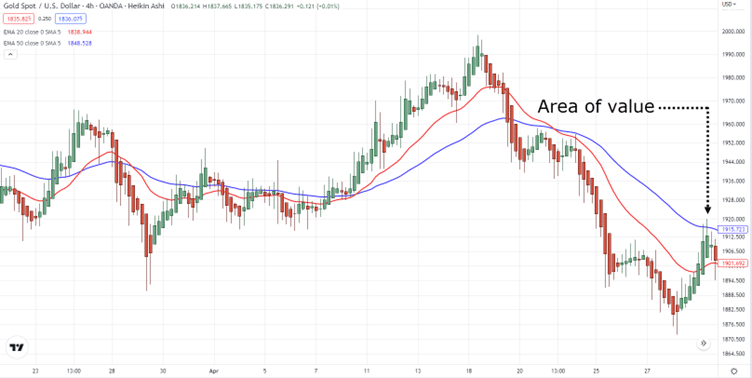

Secondly, wait for pullback into an area of value using 20 & 50 EMAs on the lower timeframe.

Let the price come into the area of value within the 20 EMA and 50 EMA.

You can see that even within the 20 EMA & 50 EMA, there’s a doji that formed.

This means that the short-term bullish candles are about to lose momentum and the market is about to turn bearish.

Thirdly, go short on a valid entry trigger.

This latest red Heiken Ashi candle with no upper wick but a long body with its closing price much lower than the previous candle is your entry trigger.

You’ll go short on the open of the next candle.

And finally, stop loss 1 ATR above recent swing high and take profit before previous swing low.

Having your stop loss 1 ATR above the previous swing high gives your trade some space to “breathe”, so you don’t get stopped out of your trade too early.

You can then take profit before the previous swing low.

However…

You don’t want to set your profit target beyond the swing low because the market is more likely to reverse altogether without touching it.

Makes sense?

So, that’s it!

That’s how you trade the Heiken Ashi across different market scenarios!

With that said, let’s do a quick recap on what you’ve learned today.

Shall we?

Conclusion

To summarize everything in this training guide…

Here’s what you’ve learned today:

- Heiken Ashi candlesticks’ OHLC prices are calculated differently from Japanese candlesticks

- Use Heiken Ashi candlesticks as trend filters to know when to be a buyer or seller

- Avoid using Heiken Ashi for scalping as the candles take time to form and are not exact open or close prices of the period

- Heiken Ashi trend continuation techniques to profit in both bull and bear markets

Now over to you…

Have you used Heiken Ashi in your trading before?

If not, will you give the Heiken Ashi a shot in your trading?

Let me know in the comments below!

How do we change our chart from Japanese candlestick to Heiken Ashi candlestick?

A bullish engulfing pattern on a chart of one of my holdings on the regular candle chart looks completely different with the Heiken Ashi chart. It goes from big and green to red with a small body and long upper and lower wicks. How does this affect the chart patterns we use as triggers? Is this mostly a trend identifying chart option? Thanks.

Very interesting technique – should we use Heiken Ashi candles on the lower timeframe as well (where we look at the 20 and 50 EMA)? Also, what length do you use for your EMA smoothing (default is 5 it seems in TV). (btw, really enjoyed your book! also, not sure your “Login on website” option works here in the comment section – when I click it nothing happens)

Greetings to you my Boss! Am very impressed with all your teachings but to be more emphatically this your lecture on Heiken Ashi has brought about deeper understanding of the perception I have been looking at Heiken Ashi, I can boldly trade with this now absolutely thanks so much for sharing your knowledge with us. Regards.

Happy to know you like it, Francis!

Awesome learning sir

Thanks, Dalpat!

I will like to practice heiken ashi but I have smaller accounts now so I’m going to open another account that I can use to ready on a higher time frame, it look easier to make profit on higher time frame with if I can apply it the way you thought. Please advice me, I started trading about 3 years now but it has been back and front, so I want to know if is ok for me to trade in a higher time frame as a beginner.

Thank you so much I have been watching you video, though I have gained some experience.

You might find the links below helpful…

https://www.tradingwithrayner.com/your-trading-plan-the-important-tool/

https://www.tradingwithrayner.com/course/how-to-use-multiple-timeframes-and-improve-your-trading-entries/

Cheers!

Is heiken ashi an indicator or a candle chart

It is not an indicator.

Heiken Ashi is a type of candlestick that used in technical analysis.

Hope this clarifies!

Very good!

Thanks, Nguyen!

Using Heiken Ashi with 10/30 EMA has made trading easier for me and profitable. With 2RR , I have seen consistency. Thanks for this additional information too.

That’s awesome to hear! It sounds like you’ve really found a strategy that works well for you.

Wishing you all the best, Remmy!