Let me ask you a question:

Do you know how to run?

Of course, you do!

What a silly question!

Now since you know how to run, do you think you can complete a marathon?

Unlikely, unless you train yourself to meet the necessary requirements.

You’re probably thinking:

“What has running a marathon got to do with trading?”

A lot.

I’ll explain…

Just because you’ve read some books on Technical Analysis, or know how to insert an indicator, doesn’t mean you can make money as a trader.

In fact:

You can have the best Technical Analysis tools, charting platforms, extensive trading knowledge, etc. and still remain a losing trader.

Unless…

You train yourself to meet the necessary requirements.

Want to know what they are?

Want to know whether or not you can you lose money with technical analysis?

Then read on…

Your Technical Analysis must have an edge in the markets

Any Tom, Dick and Harry can insert indicators on a chart, identify candlestick patterns, or calculate their risk-to-reward ratio.

But, it doesn’t mean they have an edge in the markets.

So what is an edge?

You can define it as…

(Average gain * winning rate) – (Average loss * losing rate) – Transaction cost

And if the number is positive, it means you have an edge (otherwise known as a positive expectancy).

So if you’re asking yourself:

“Is technical analysis profitable?”

Then go check your numbers, as results using technical analysis can vary from trading to trader.

Now you’re probably wondering:

“How do I get an edge in the markets?”

Well, there are 2 approaches you can consider when making a technical analysis system…

#1: The DERR framework

Here’s how it works…

Develop your trading plan

First, you develop a trading plan using a fixed set of trading rules to guide your actions. This includes entries, stop loss, risk management, target profit, etc.

Execute your trades

Next, you execute your trades according to your trading plan. Ideally, you want to have a minimum sample size of 100 trades, so you don’t get fooled by randomness.

Record your trades

After your trade is over, you want to record down the metrics for each trade. This includes the entry price, stop loss, target profit, R gain/loss, etc.

Review your trades

Finally, you want to review your trades and find out how you can improve your trading results.

You want to identify “patterns” that lead to your winners and focus on trading more of it.

Also, you want to identify “patterns” that lead to your losses and avoid those trading setups.

Because sometimes, it’s not right to ask:

“Is technical analysis profitable?”

As it is possible that you are just not applying the concepts correctly.

Nonetheless, if you want to learn more as to how you could develop your own technical analysis system and a complete trading plan, check out How to become a profitable trader within the next 180 days

Next…

#2: The RETT framework

Here’s how it works…

Read trading books that share trading systems with backtest results

First, you want to find trading books that come with backtest results.

This way, the hard work has been done and you’ve got a “template” to work with.

So instead of creating your own technical analysis system, you’re pretty much working on-top of what already works.

Pro Tip:

It doesn’t have to be just books, it can be blog posts, research papers, anything!

Extract the trading concepts

Now, just because someone shares with you their trading system doesn’t mean you trade it immediately.

Instead, you must understand the logic and concepts behind it.

So ask yourself questions like…

- What’s the core principles behind this trading system?

- Why does it work?

- When does it underperform?

- Is this something that will suit me?

Test the trading system

Once you understand the concepts behind the trading system, then you want to test it out for yourself to make sure your findings are similar to the backtest results shown.

This is the number one solution on how you won’t be fooled by technical analysis, and it’s by testing and seeing it yourself whether it works or not.

Now, it’s unlikely you’ll get identical results due to the difference in data feed.

But if you get close to 80% similarity, it’s good enough.

Tweak the trading system to your needs

After you’ve validated the trading system, then it’s time to tweak and adapt it to your own needs.

For example:

You might have tested a long-term Trend Following system that uses a 10 ATR trailing stop loss.

But if you don’t want to ride a long-term trend, you can tweak it to a medium-term Trend Following system by using 5 ATR trailing stop loss.

Then, test your “new” trading system and see how the numbers stack up and whether it’s within your expectations.

Make sense?

The most important thing in every technical analysis system

Take a guess…

It’s not the winning rate.

It’s not the risk-reward ratio.

It’s not the percentage gains.

It’s this:

The logic of the trading system.

Yup, every trading system you trade must be backed by logic.

If not, it’ll be difficult to continue trading the system when you’re in a drawdown.

You’ll have thoughts like…

“Does this trading system still work?”

“Should I continue trading or stop trading altogether?”

See my point?

But, when you’re trading a system that has logic to it, you’ll be more confident and have the conviction to trade through your losing streak.

Here’s an example…

Trend Following makes money when the market is trending.

So, for Trend Following to stop working, it means markets have to stop trending.

Now, what are the odds of that happening?

If you agree the odds are slim, then it makes sense to continue trading a Trend Following system.

Do you agree?

You must have this ONE thing for your edge to play out (or you’ll fail)

Imagine:

There are 2 traders, John and Sally.

John is an aggressive trader and he risks 25% of his account on each trade.

Sally is a conservative trader and she risks 1% of her account on each trade.

Both adopt a trading strategy that wins 50% of the time with an average of 1:2 risk to reward.

Over the next 8 trades, the outcomes are Lose Lose Lose Lose Win Win Win Win.

Here’s the outcome for John:

-25% -25% -25% -25% = BLOW UP

Here’s the outcome for Sally:

-1% -1% -1% -1% +2% +2% +2% +2% = +4%

So here’s the lesson…

If you don’t have proper risk management, you’ll still end up a losing trader even though your trading system has an edge in the markets.

Discipline: How to know if you have what it takes?

Have you ever seen the lifestyle of a professional bodybuilder?

If not, then check this out…

5:00 AM – Wake up

5:30 AM – Breakfast

7:00 AM – Lift weights

9:00 AM – Post workout meal

12:00 PM – Lunch

1:00 PM – Pre-workout meal

2:00 PM – Reflect and work on weaker body parts

4:00 PM – Post workout meal

6:00 PM – Dinner

8:00 PM – Cardio and stretching

9:00 PM – Supper

10:00 – Bedtime

Now…

This is what we call Discipline.

The ability to stick to a routine through high or low, every single day without missing a beat.

Of course, I’m not asking you to lift weights but, the discipline required is the same.

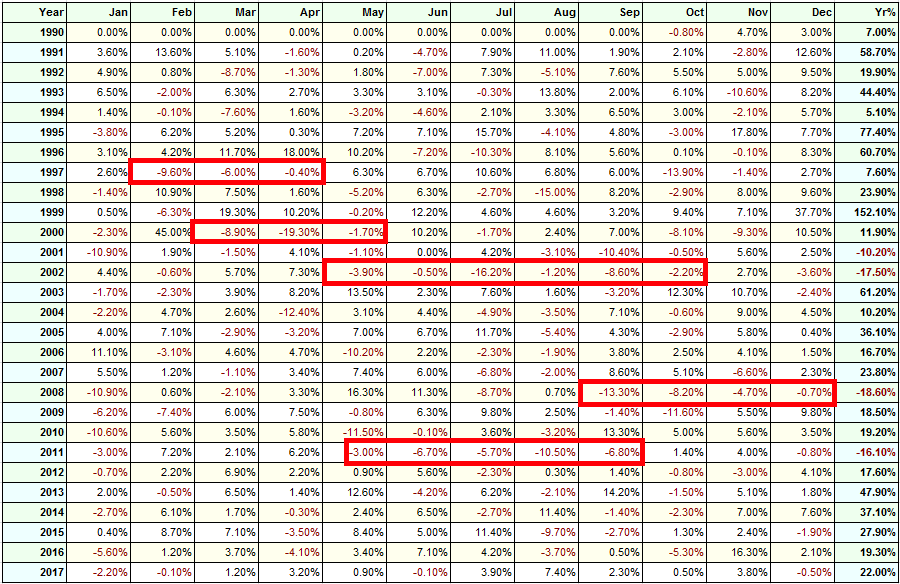

Look at the results of this trading system below…

Yes, in the long-run it makes money and even beats the markets.

But that’s not the only thing that matters.

Because if you look at the “red boxes” above, you’ll notice multiple losing months in a row.

So here’s the thing…

- Do you have what it takes to ride out the drawdown?

- Do you have what it takes to follow your trading system?

- Do you have what it takes to continuously execute your trades even after a series of losses?

For most traders, it’s a resounding no.

You’ll likely abandon your trading system after a few losing trades and look for the next “holy grail”.

But guess what? It doesn’t exist.

So, instead of hopping from one trading system to another, you should ask yourself…

How can I develop the discipline to stick to my trading system?

One way is to surround yourself with a community of like-minded traders, who trade in a similar manner as you.

For example:

If you want to be a systems trader, then join a community of systems trader.

This way, you can develop the winning mindset of other systems trader and get influenced by them.

You’ll be influenced by their positivity and actions which makes you more inclined to follow the rules of your trading system.

“You’re the average of the five people you spend the most time with.” — Jim Rohn

Conclusion

So here’s what you’ve learned in this post:

- Technical Analysis is a tool to give you an edge in the markets — it doesn’t guarantee it

- Your trading system must have a logic to it or you won’t have the conviction to trade through a drawdown

- A trading system is useless without proper risk management

- Surround yourself in a community of like-minded traders so you get influenced by their positivity and actions

Now here’s what I’d like to know…

What’s the #1 thing you’ve learned about Technical Analysis?

Leave a comment below and share your thoughts with me.

I have learnt to stick to trending system

Nice!

I‘ve learned the “doji-pattern“ because of a range strategy 🙂

It was more difficult than I thought!

Very good suggestions for strategic trading.

Thank you, Yub!

This is nice post

I will definitely follow it

Cheers

Wat a powerful insight..i really come to understand the importance of discpline and good risk management in support of technical analysis

Awesome to hear that!

DONT STOP JUST BEACUSE YOU LEARN THE BASIC, PRACTICE AND PRACTICE TO IMPROVE AND GROW

Hi Rayner, the math you have written in this post is actually incorrect, which leads an inaccurate conclusion:

https://gyazo.com/2bbc754f801e3bbd8178cefc0a016415

In fact, if the math is right .. then it looks like anywhere between 25% risk is the PERFECT risk to be taking with a 2R, 50% winrate.

This is assuming you will risk 25% of your account every trade, lose 10 times in a row, and then win 10 times in a row for a winrate of 50-50

Hey man, you gotta do the math! 😉

I would calculate the math for every R multiple, every % winrate, and then how many losses that can sustain before it hits 0, and where the bell-curve actually peaks.

Regardless, I don’t want to come off as a prick. In fact, without your help, I would not have figured this out.

So I want to THANK YOU SO MUCH for making me question this logic… I had a feeling something was off.. so I calculated this, and came to the conclusion that I should do this ALL THE TIME from now on.

Thank you, and I hope that maybe you this has helped you gained some insight as well.. 🙂

So after much time and calculation, I have discovered that risking anywhere from 5-10% of your account on each trade would result in an incredibly strong equity curve…

Notice how % risk is WAY more profitable than fixed $ risk! 🙂

This is soooo eye opening. This has literally changed my whole view on trading…

Hey Matteo

There’s a difference between theory and practicality.

As for the math part, I simplified it by not using fixed fractional position sizing — which still illustrates the concept I’m trying to explain.

For me, one thing that does ruin my plan is the fear of missing out. Seventy percent of losses came from that, for me, since I broke the rules.

Hey Krittayod,

Check this out…

https://www.tradingwithrayner.com/trading-psychology-6-practical-tips-to-master-your-mind-and-money/

I Have Learned Not To Listen To Anything Stan The Trading Man, Chris Randone, Or Yates Investing Say To Do On Twitter! They Need To LEGALLY Declare If THey Are Invested In A Stock Before THey Talk About It!!!

I’m a new trader but whener I do a set up I lose , help please

Hi Baraka,

Check out the trading academy…

https://www.tradingwithrayner.com/academy/

Luv ur nuggets mahn truly helpful…bah there’s one new trick I’ve learnt recently it’s about building EAs without coding on the Fxdreema website…am in that place where I have nice strategies bah can’t stomach the drawdown thus losing on profitable trades. I wish you could do videos on the website and how to manoeuvre it since it’s not easy for a rookie to piece together the puzzle.

Hi Owen,

Thank you for your contribution!

If my trend-following time horizon is short term, my stop loss is tighter, 2ATR. Is this correct Rayner.

Thanks sir

You are welcome, Rounak!

Good point

Thank you, Manasseh!