This post is written by Jet Toyco, a trader and trading coach.

In today’s trading, we have a ton of trading setups to choose from.

Such as bullish flag pattern setups, ascending triangle pattern setups, cypher pattern setups, etc.

However…

What do you think is one trading setup that is:

- Simple enough to execute

- Easy to understand

- Is effective in most markets and timeframe

That, my friend, is the trend line breakout strategy.

Ready to know this awesome trading setup?

If so, then let’s get started.

What is a trend line and a breakout anyway

Before we get down to the nitty-gritty details…

You must know the nature of the trend line breakout strategy.

Because there’s no damn point using a strategy if you don’t know its major components.

So what are those “nature” you may ask?

Well, it’s none other than the:

- Trend line

- Breakout

Let’s get right into it…

Trend line

As you may know, a trend line is a trading tool.

That’s right.

It’s a trading tool, not some magic line on your chart!

It means that the effectiveness of this tool lies in how well you use it.

But here’s one thing it’s truly good at:

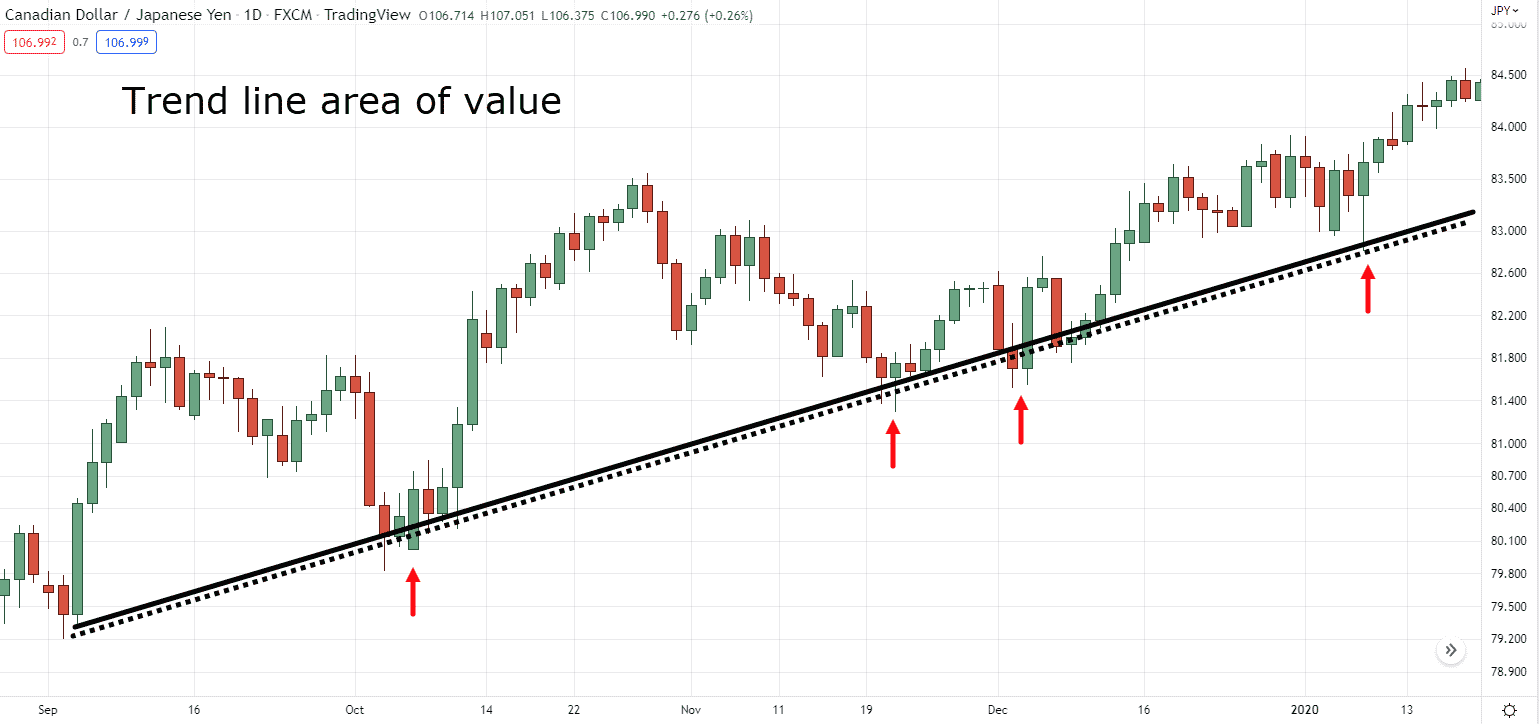

So, in an up-trending market, you’d want to consider buying in those areas!

Simple, right?

Now, what if the market is ranging or it’s choppy?

Is the trend line still useful?

Good question!

Because here’s another thing that a trend line is good at:

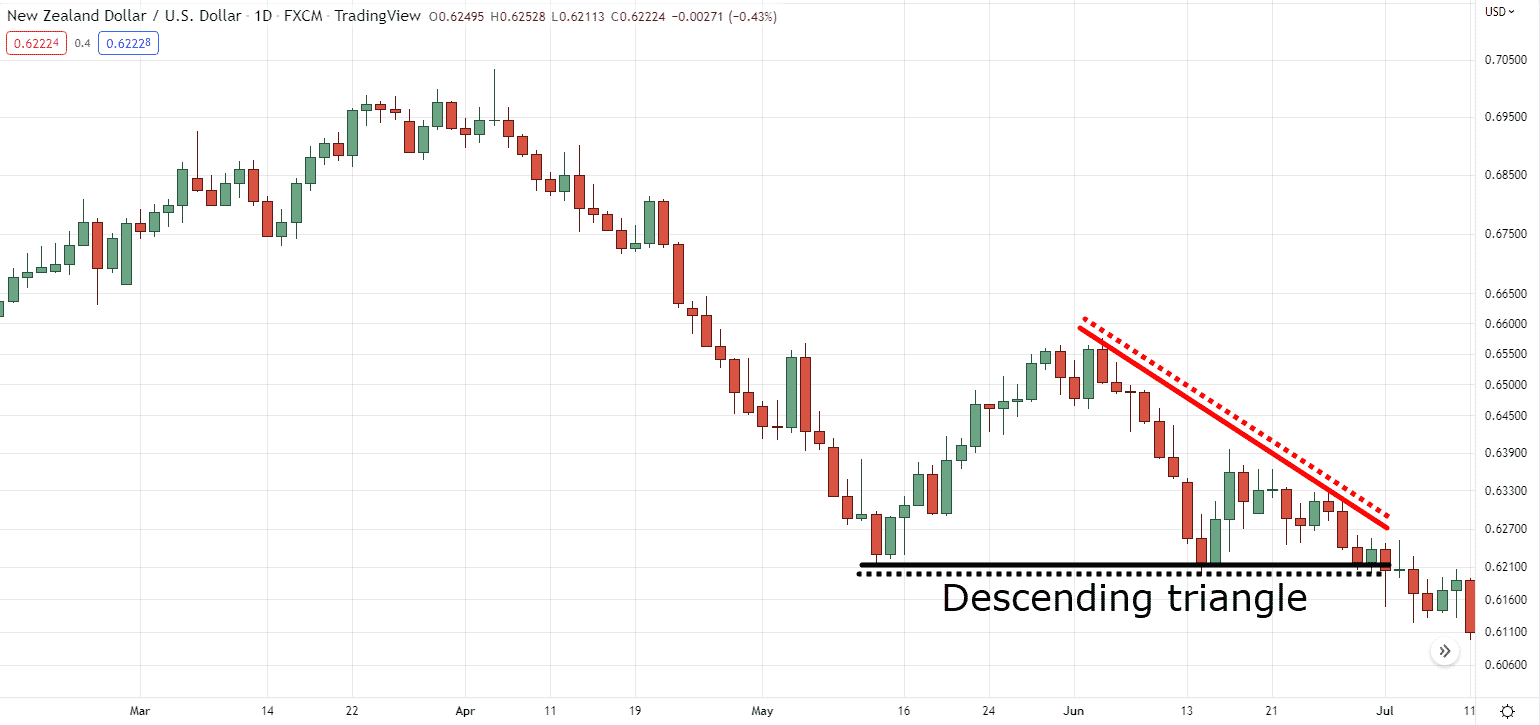

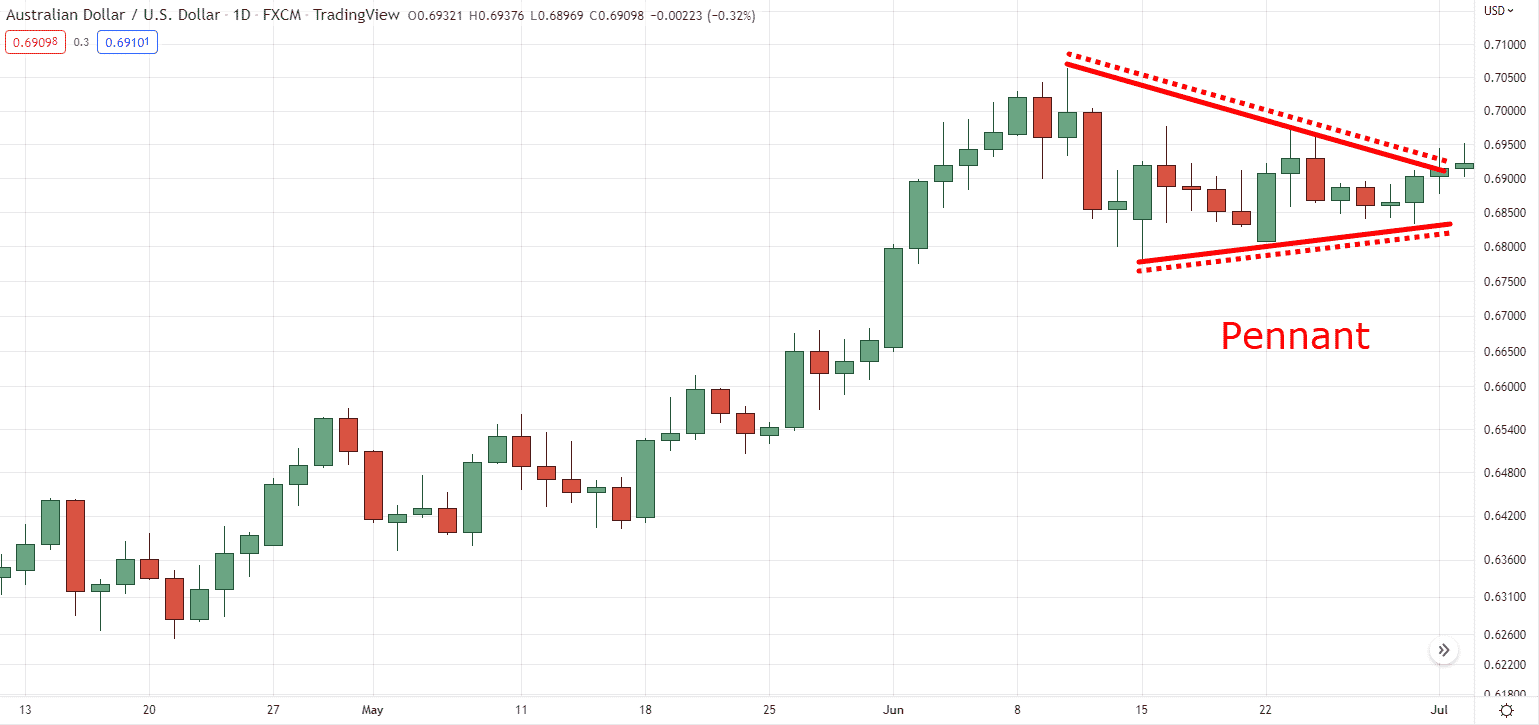

To help you identify chart patterns.

Here’s what I mean.

Such a pretty versatile tool, right?

So I’m sure you’re now wondering…

How EXACTLY do you apply the trend line?

Listen closely.

Because this is crucial to understand when it comes to the trend line breakout strategy that I’ll share with you later.

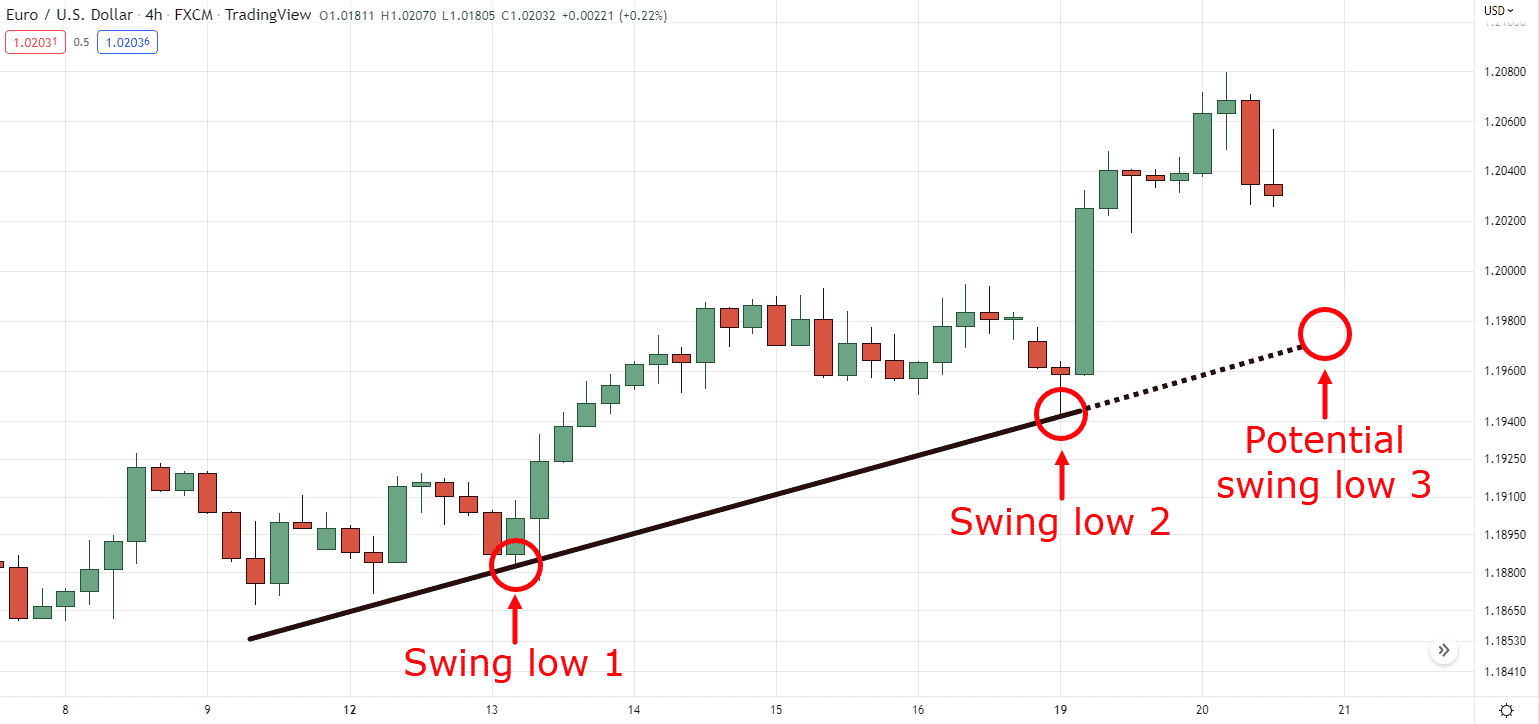

Now, using a trend line only needs two components:

(Vice versa for shorts)

Makes sense?

But If you want to learn all there is to the trendline tool and more, you can check out this guide: The Complete Guide to Trend Line Trading

Next.

Breakout

Here’s the truth:

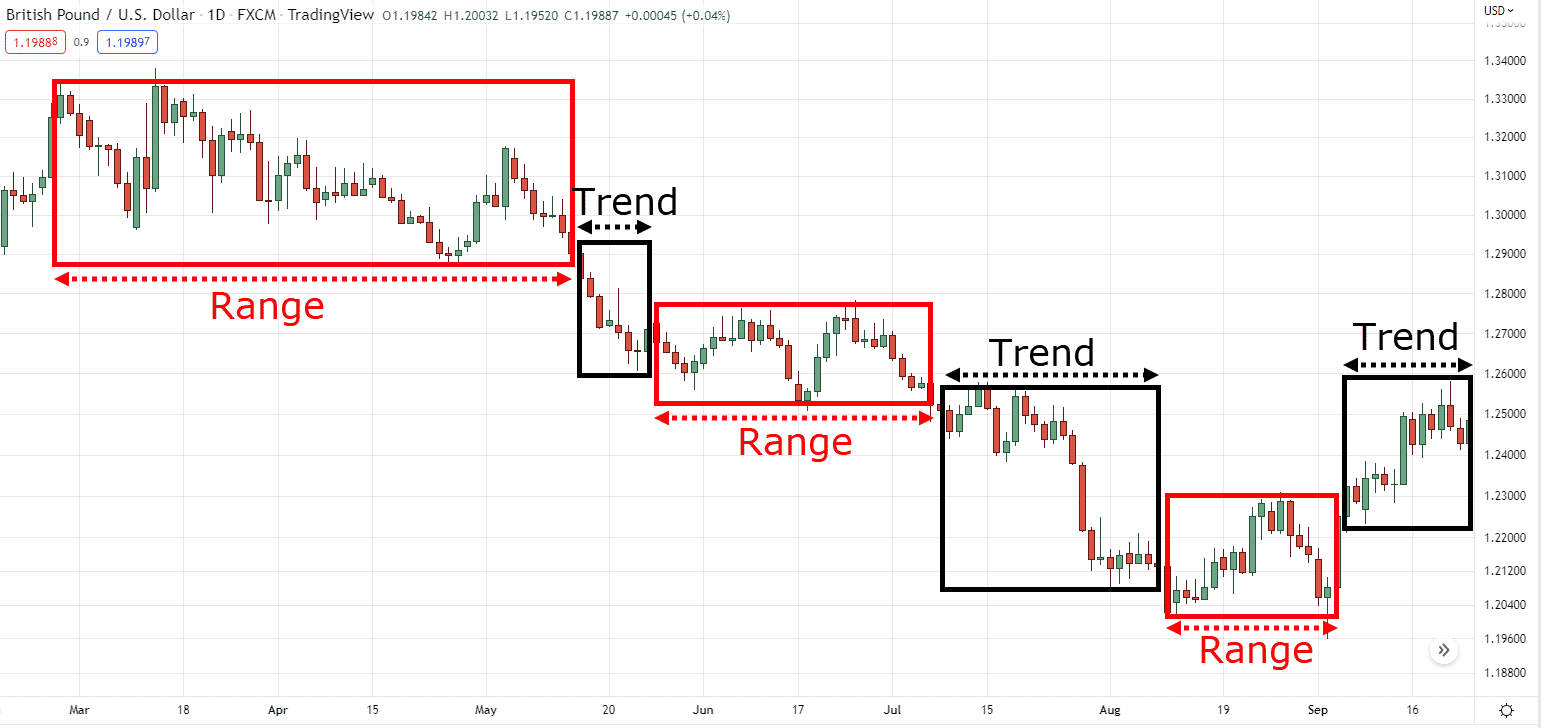

The market moves in cycles.

From trending to ranging, to trending, to range, and so on…

So here’s the question:

Where exactly can you enter this market?

The answer?

During breakouts:

You see…

Before the market goes from ranging to trending, in between those, there are breakouts.

It’s like receiving your diploma as you graduate from college and are now about to be unemployed.

That makes sense, right?

Of course, there are “false breakouts” like the diploma you received is not your name.

But that’s another story for another day.

So now that you know what a trend line and breakout are, what is a trendline breakout?

Keep reading…

What is a trend line breakout and how important can it be?

Recall:

A trend line is a tool to identify an area of value in a trending market.

It’s a tool to tell you that the trend is most likely going to continue!

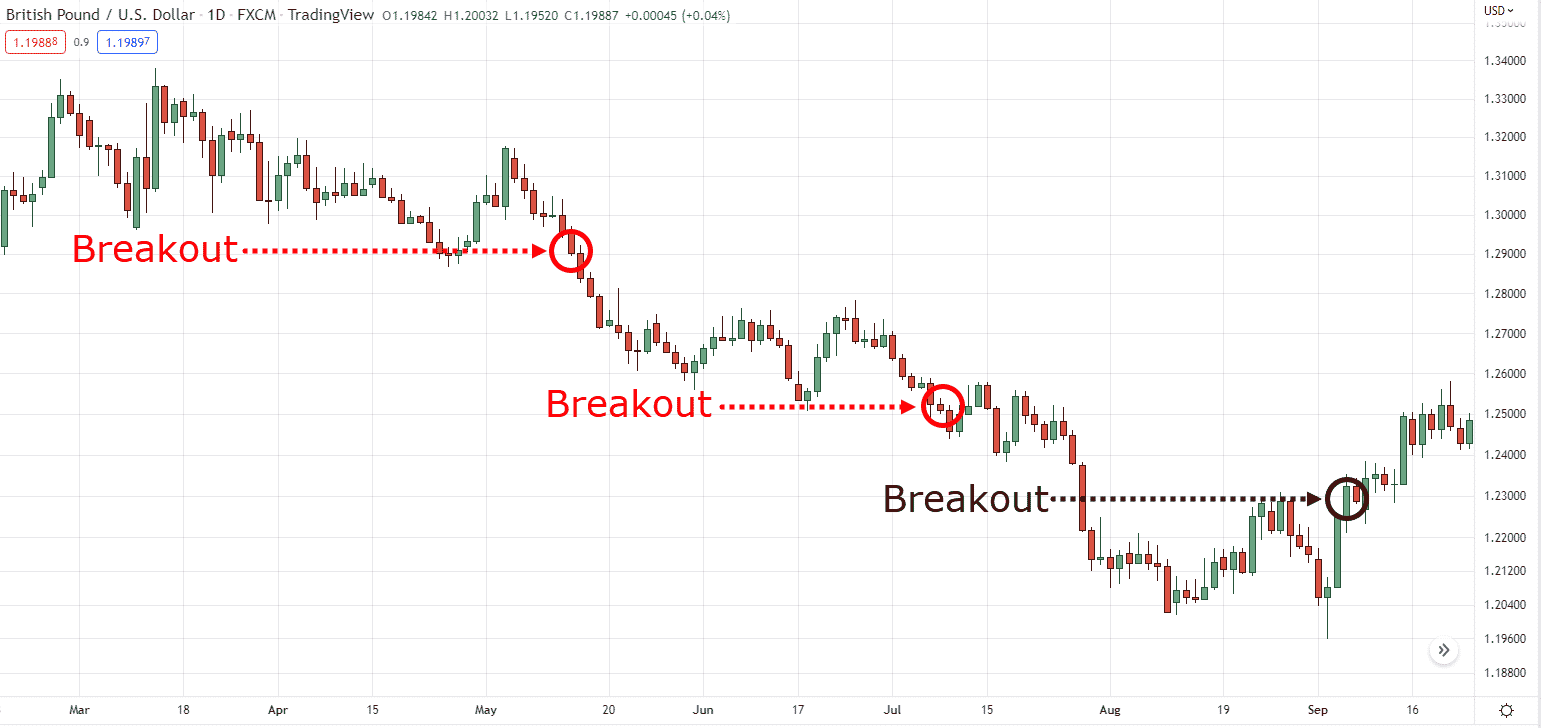

But, what does this tell you when the market closes beyond a trend line?

Does this mean that the banks have manipulated the market?

The market is heading into a recession?

Your broker is scamming you?

No, no, my friend.

It simply means that the trend has reversed!

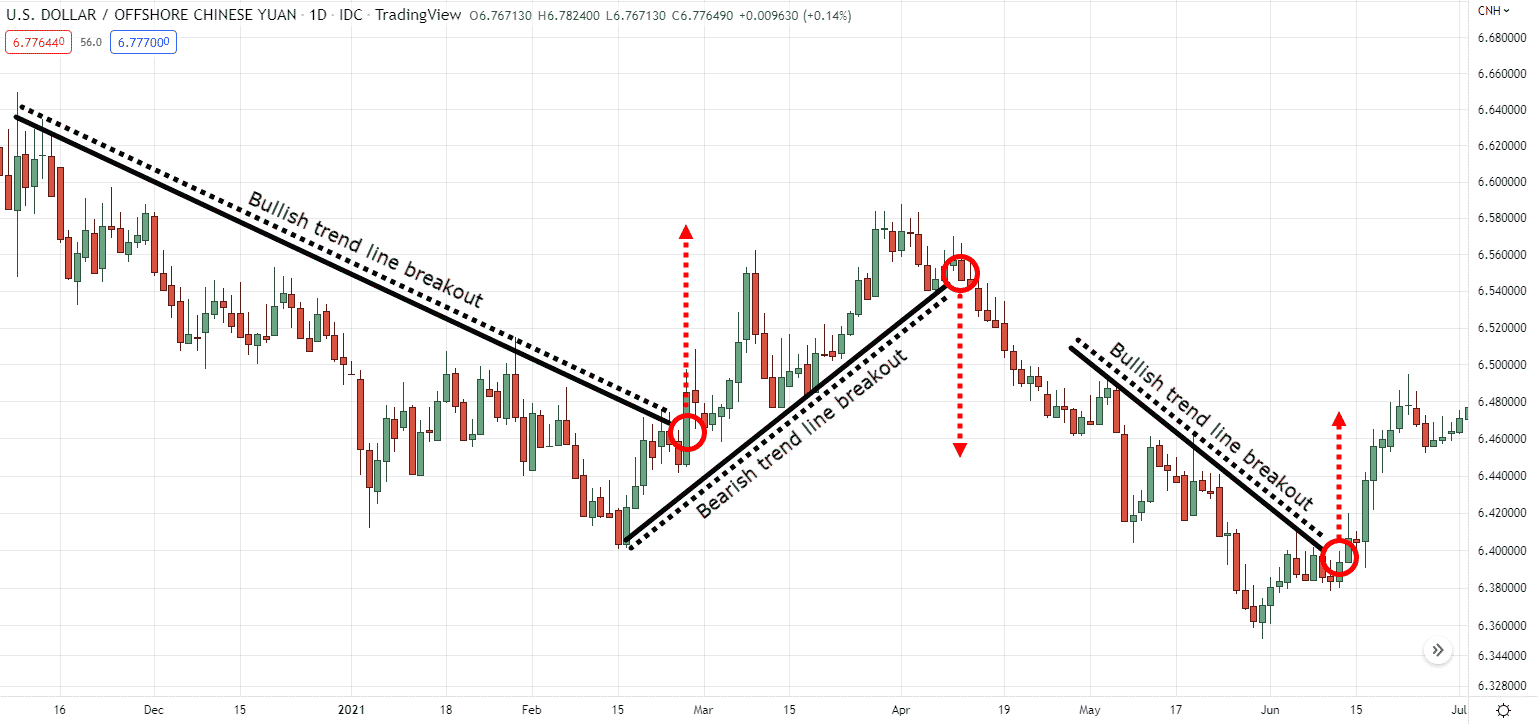

To make sure we’re on the same page, here’s an example of a chart with multiple trend line breakouts:

At this point, you might be wondering…

“Okay cool, but how is this important and how can this improve my trading?

A trend line breakout can improve your trading in three ways:

- Better entries

- Potentially massive risk to reward

- Trailing stop loss

I’ll explain each of them in detail.

So make sure you’re taking notes!

Better entries

How does it feel to be the first one to order at a fast-food restaurant?

To be the first one to go inside Disney land and be the first to hop on a ride?

Feels great, right?

And it’s the same with the trend line breakout!

Being able to time your entries on a trend line breakout means that you’re the first one to hop on a newly developing trend:

This leads me to my next point…

Potentially massive risk to reward

If you’re a swing trader I’m sure you understand that there will be a lot of times when you enter a trade…

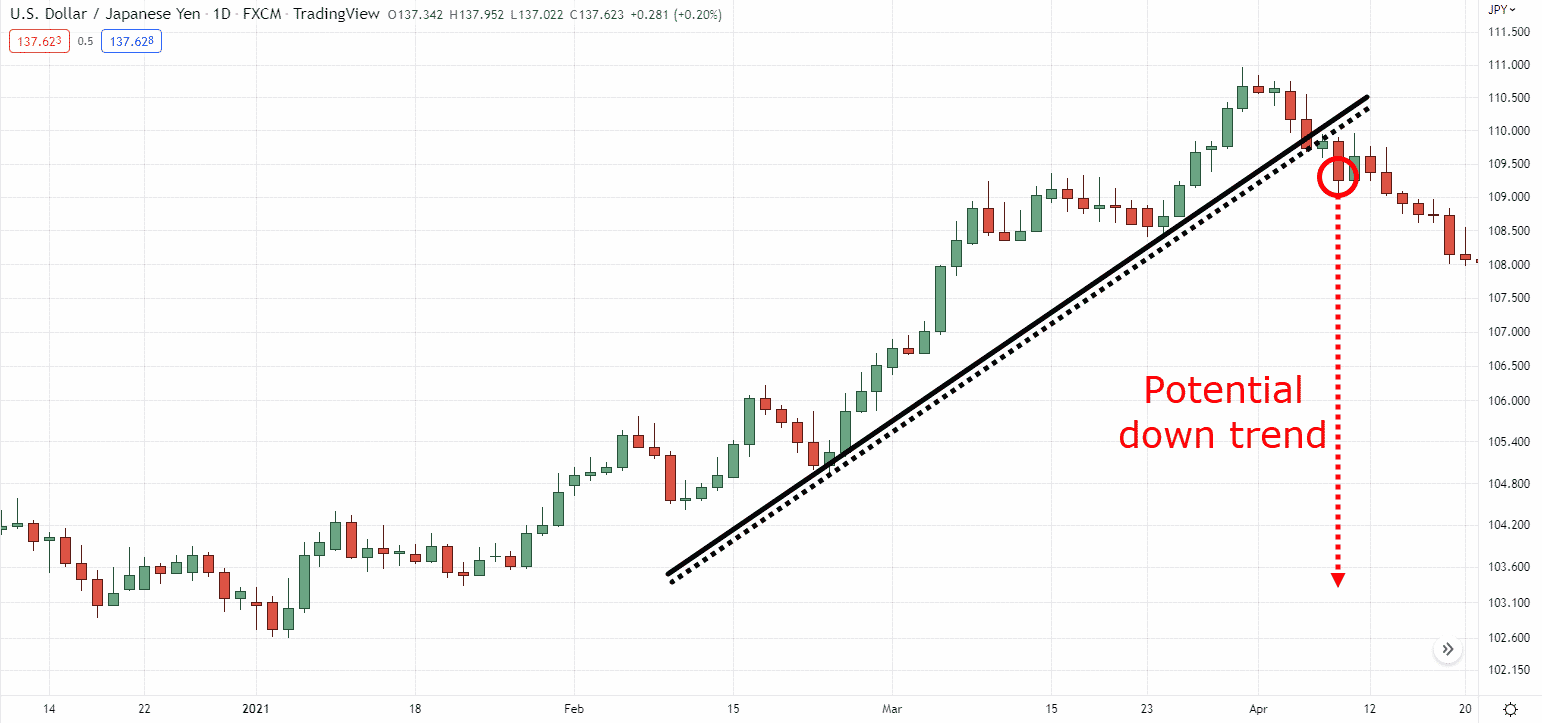

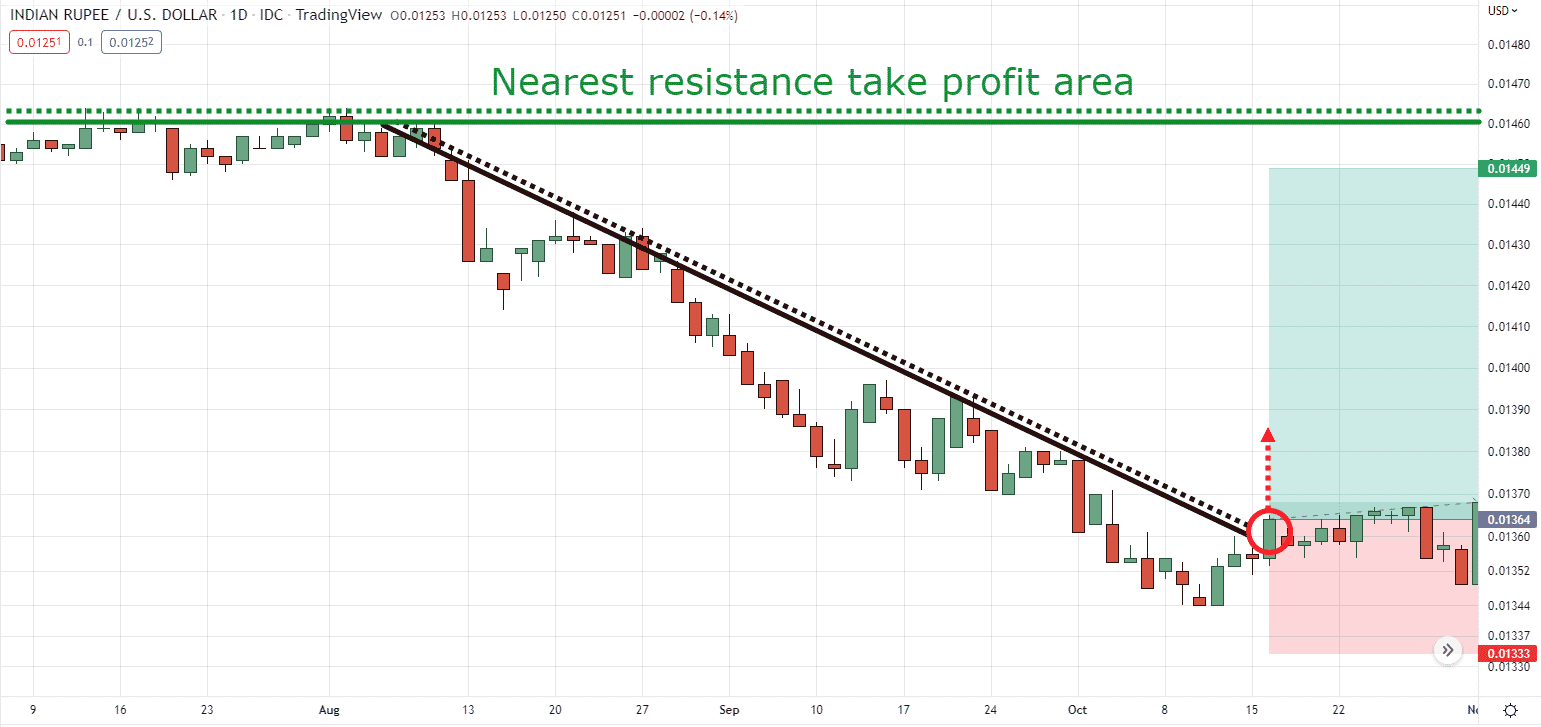

But the nearest resistance is too close that you decide to skip the trade:

Or how about this…

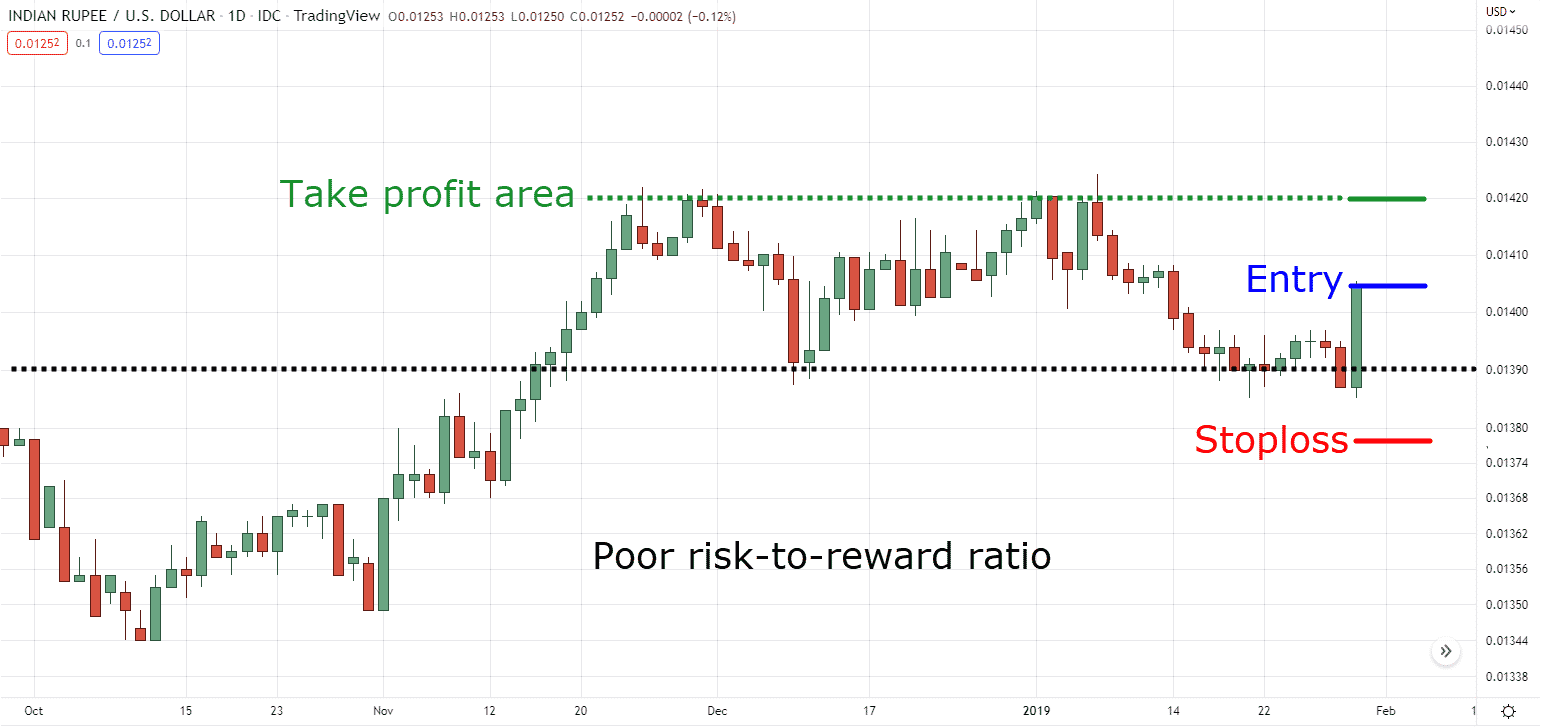

You’re a chart pattern trader.

But you’re limited to a 1:1 risk-to-reward ratio because you have to “project” the lows from the highs to identify your take profit.

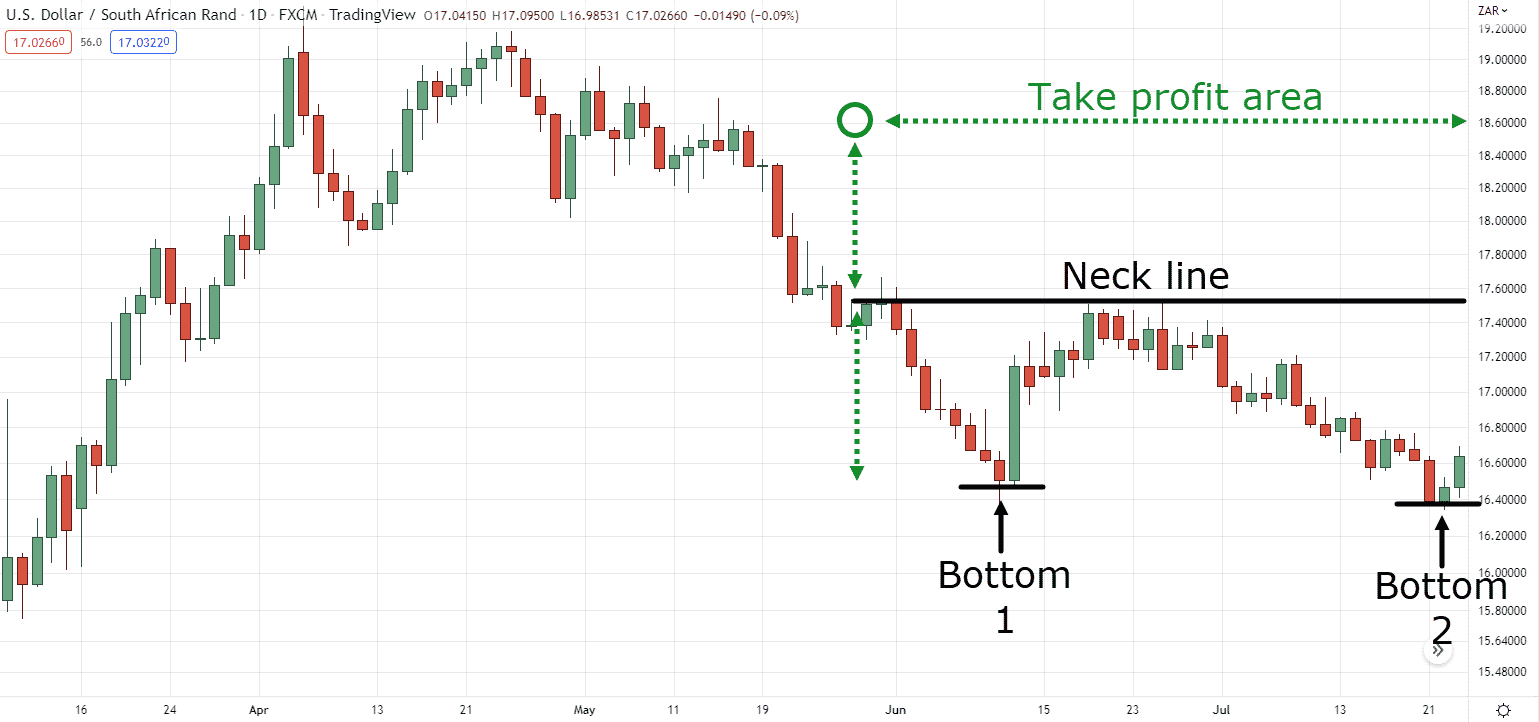

Here’s a double-bottom example:

It sucks whenever it happens, right?

What’s the solution?

Add the trend line breakout setup to your arsenal.

Because a trend line breakout mostly gives you enough room to capture massive risk-to-reward ratios!

Here’s what I mean:

I know, I know.

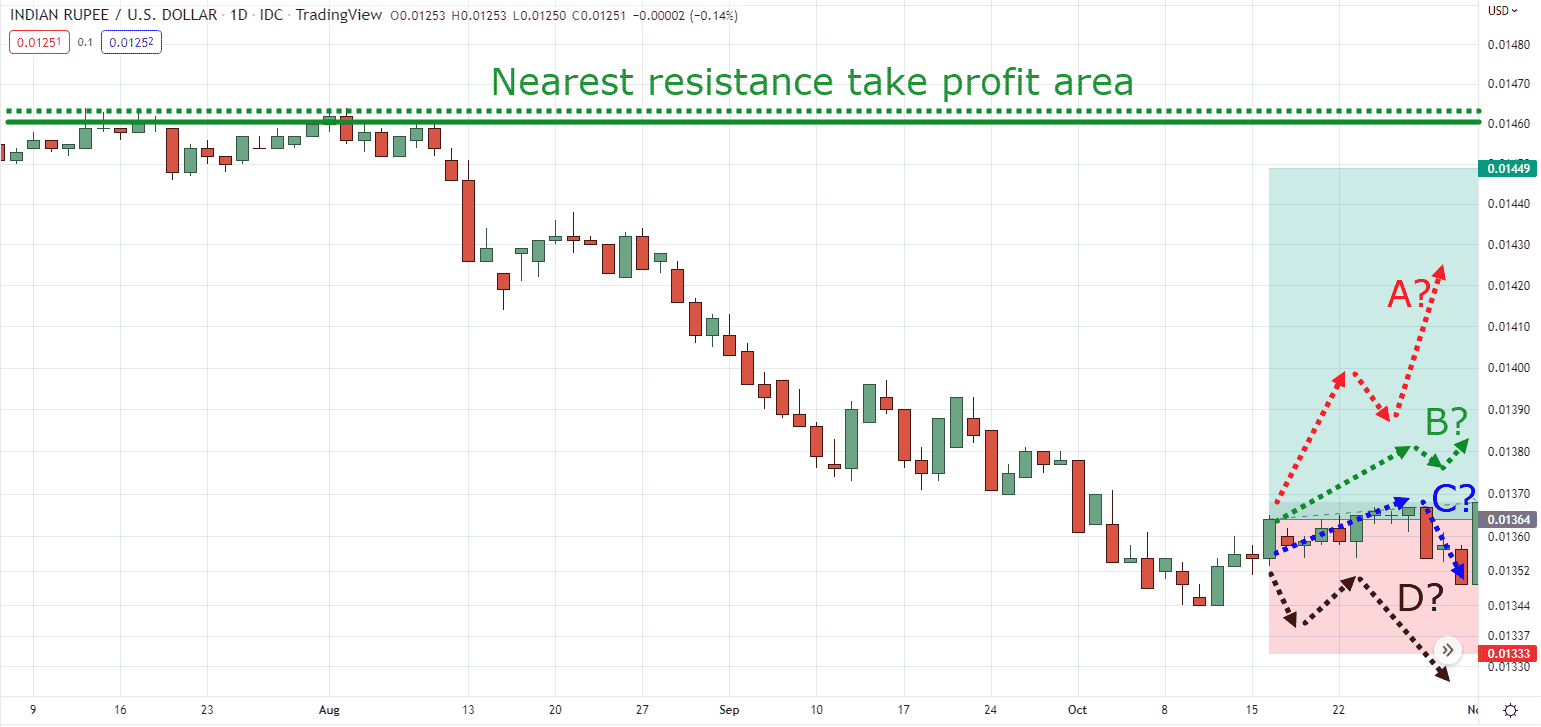

A lot of things can happen between your entry and your take profit level:

So, what would you do in case the market goes into a range or makes another bullish trend line breakout?

Let me tell you…

Trailing stop loss

The best part about the trend line breakout is that not only you can use it to time your entries.

You can also use it to trail your stop loss!

Let me explain…

Let’s say that you managed to hop on a trending market and you decide to trail your stop loss:

How would you exit this trade with the trend line breakout?

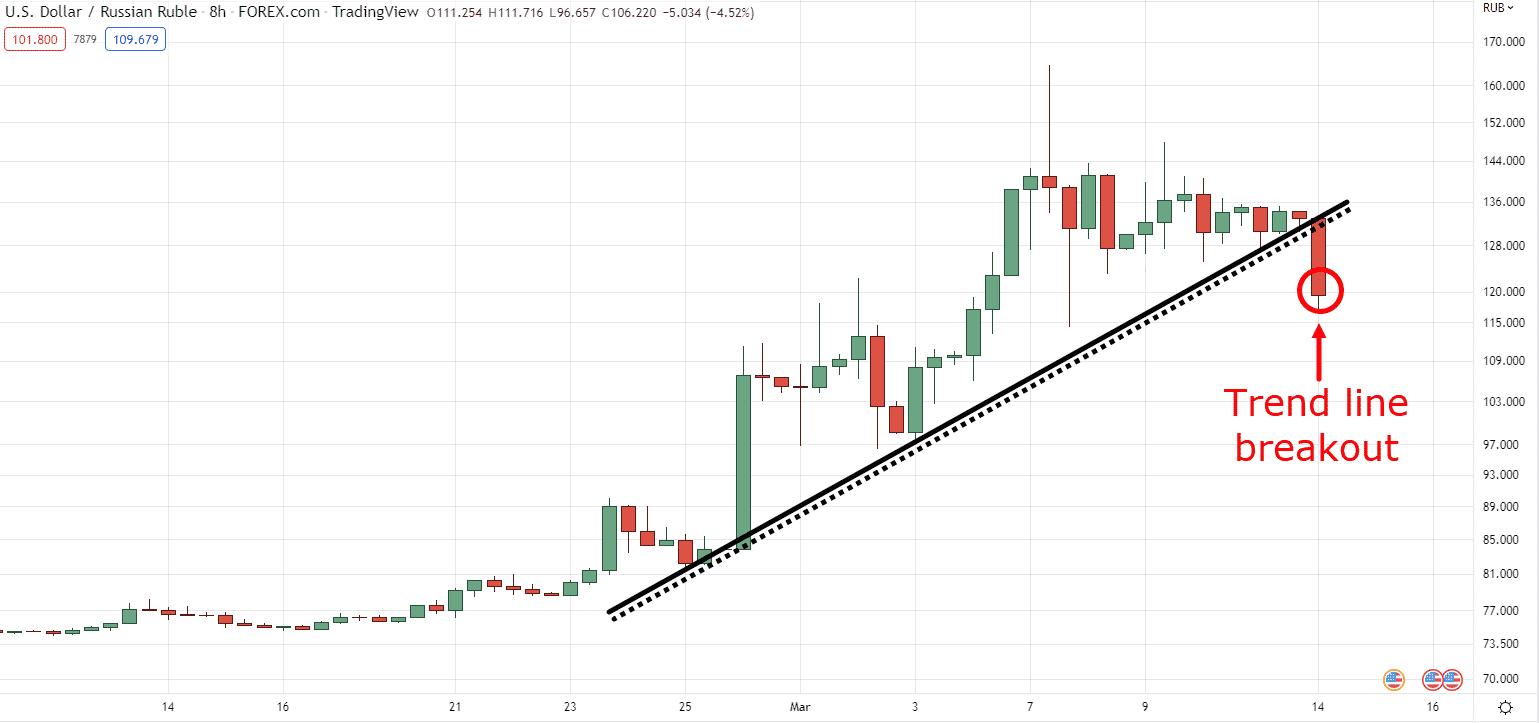

First, plot your trend line:

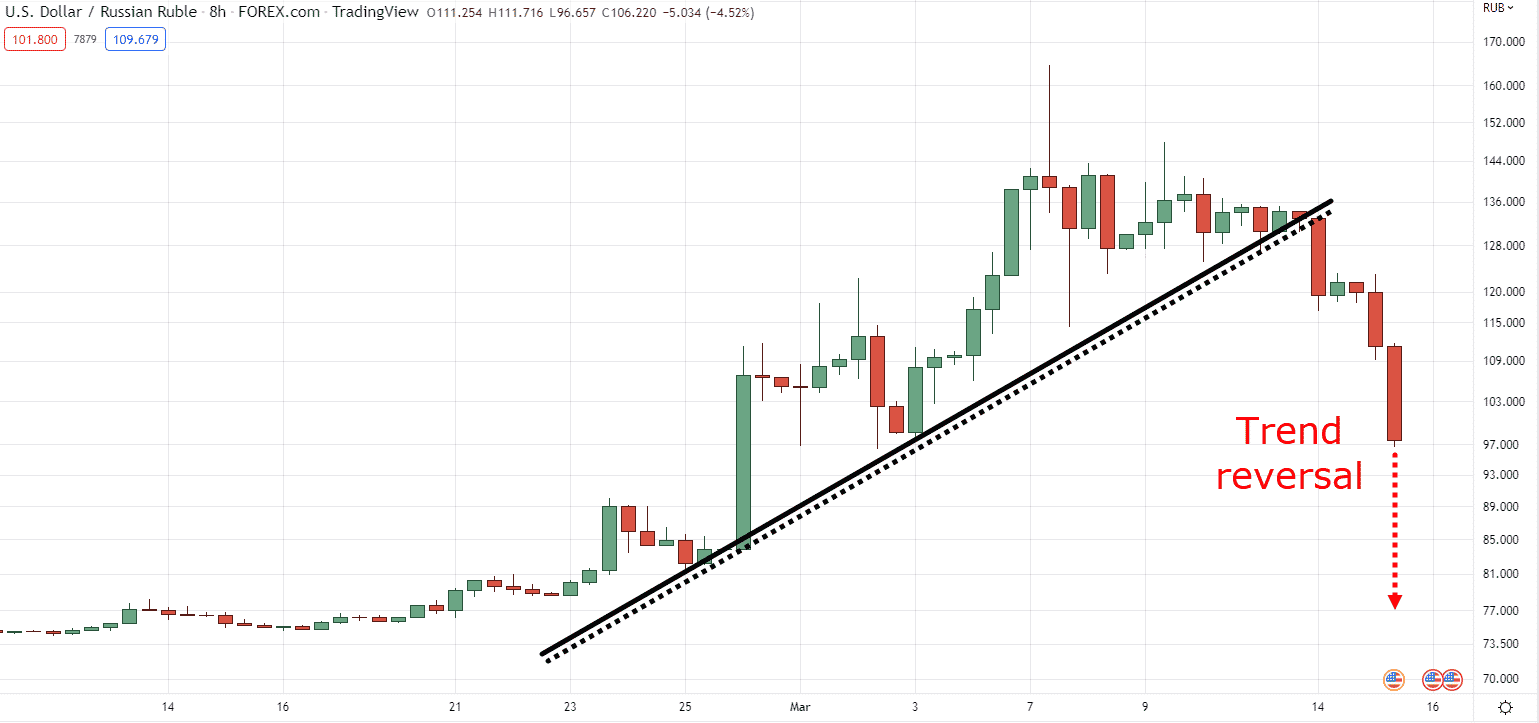

Then wait for the price to close above the trend line resistance (a.k.a. a trend line breakout opposite to your open trade):

Basically, if the market makes another trend line breakout…

Then you can exit before it hits your original take profit:

(Because it indicates that a new trend/leg of the move might occur.)

Amazing, am I right?

You can always use the trend line breakout to both enter and exit your trades.

Now…

Let’s put everything that you’ve learned so far and make them into a complete trading strategy.

So that after you’ve finished this training guide…

You’ll immediately be able to apply them to your charts.

Fair enough?

Good.

Then let’s get right to it.

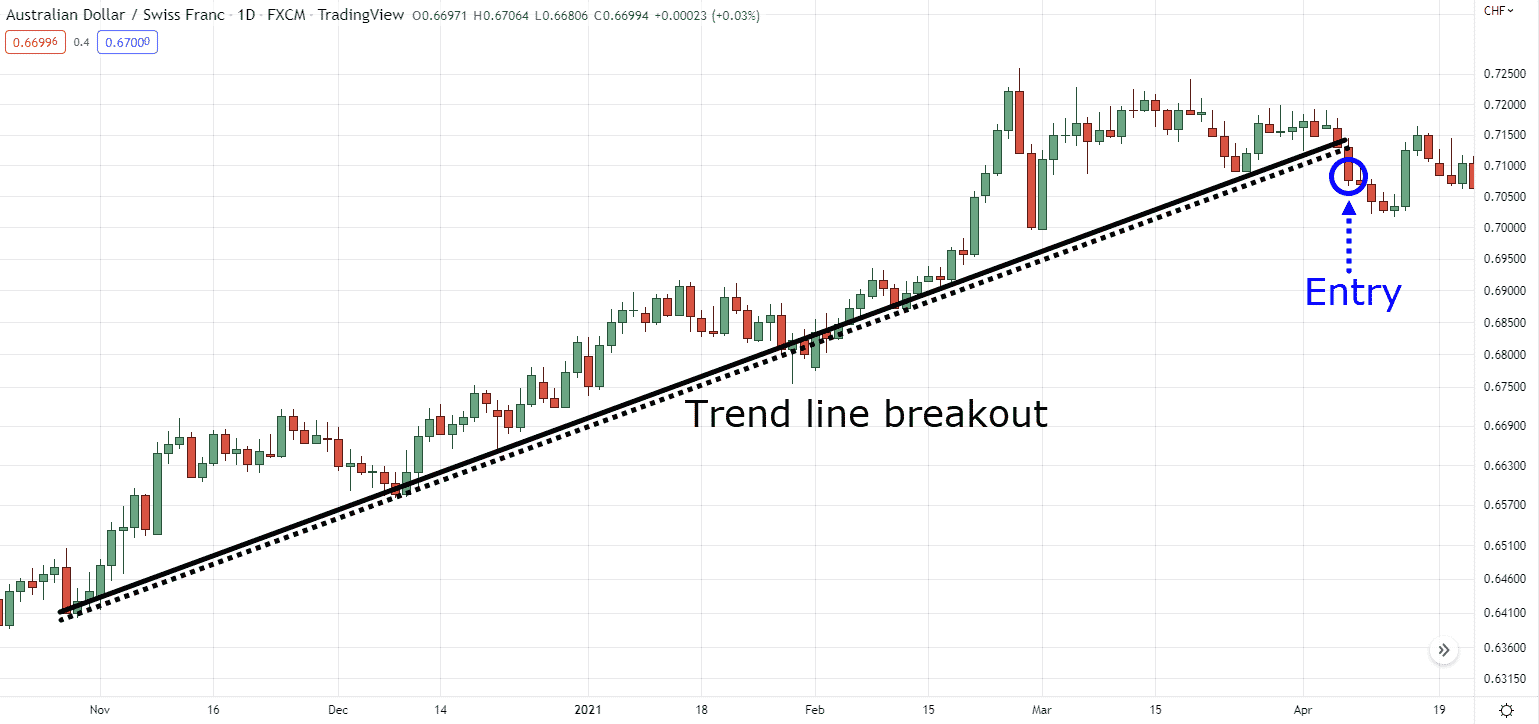

A trend line breakout strategy to dominate the markets

Let’s get straight to the point.

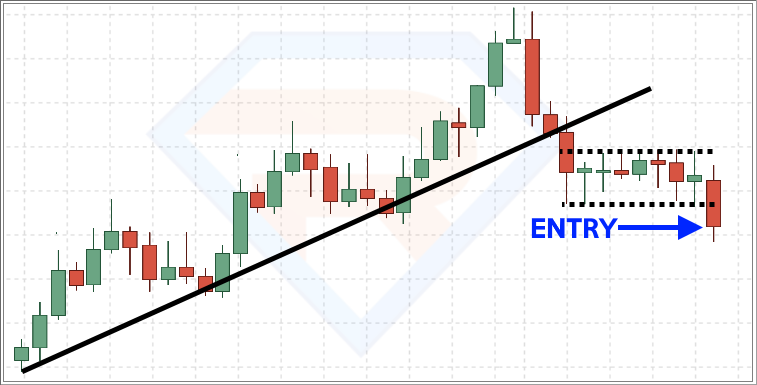

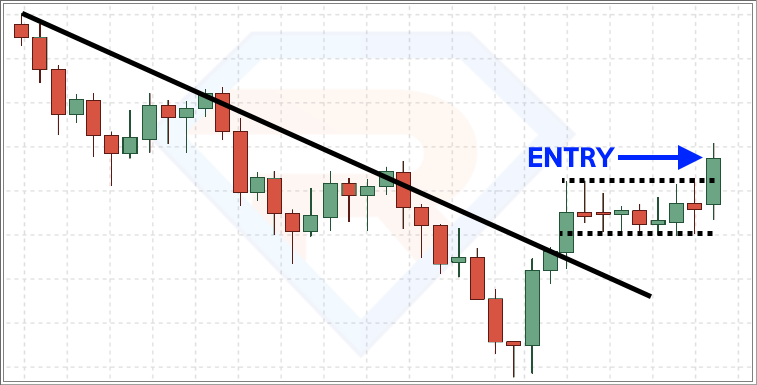

This strategy will always tend to look like this:

So, every time you look at your chart and you want to trade the trend line breakout, always look out for this pattern.

Stuck in your head already?

Awesome.

Now, every strategy comes in three parts (or else it isn’t one):

- Entry setup

- Stop loss

- Take profit

Let me teach them to you.

1. Entry setup

Before this trend line breakout setup is fully cooked, it needs two ingredients:

- Trend line breakout

- A bearish flag pattern breakout (or a bullish flag pattern breakout for long setups)

You’re probably thinking:

“Hold up, why is the bearish flag pattern involved now?”

Here’s why:

To reduce the chances of a false breakout.

Here’s what I mean…

You see, having a bearish flag pattern after a trend line breakout is a confirmation that the move is valid.

Can you see how important this is?

So…

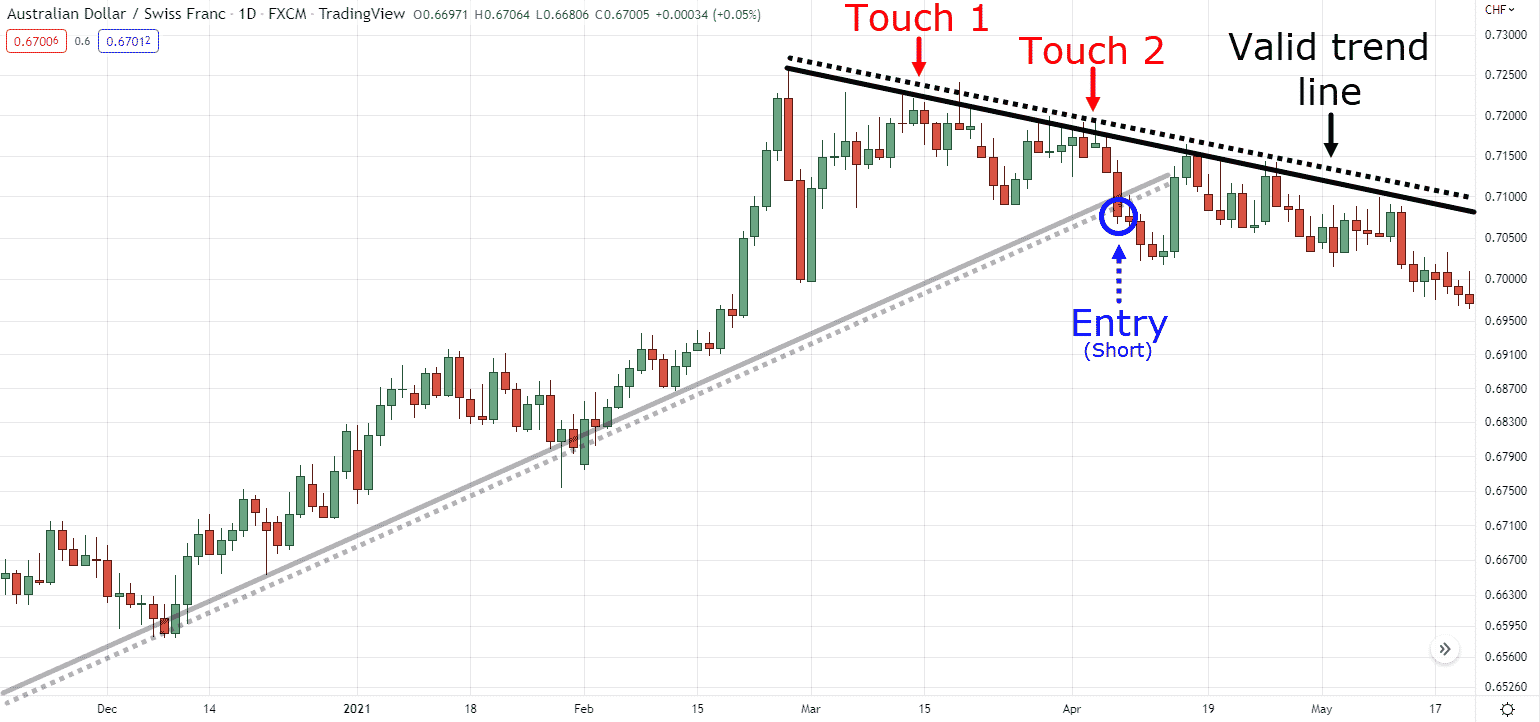

Once you both have a trend line breakout and a bearish flag pattern like this:

Wait for a breakout and enter the next candle open:

Next.

2. Stop loss

Take a look at this:

Let me ask you, what’s the logical place you would place your stop loss?

Chances are you’d place it here:

That’s too damn wide!

But if we add a bearish flag pattern to the mix, where do you think you would place your stop loss now?

Just below the bullish flag pattern, of course:

Isn’t this better?

By having the bearish flag pattern involved in the trend line breakout…

Not only do you get to confirm the pattern, but you also get to have a tighter stop loss!

So what do you do now when you’re in the trade?

How will you take your profits?

Let me show you.

3. Take profit

Similar to what I’ve taught you in the previous section, you can consider to:

- Have a fixed target profit

- Trail your stop loss

- Or both

And there you go.

The trend line breakout trading strategy!

Now, I know that I’ve shared with you a strategy in this guide.

However, keep in mind that you still need two things aside from a good trading strategy.

And they are:

- A good risk management

- A good market selection method

- A good trading routine

All of these are crucial to your trading, so I highly suggest you read them here:

Forex Risk Management and Position Sizing (The Complete Guide)

The Essential Guide to Currency Strength Meter

Part-Time Trading – How To Do It Successfully Without Quitting Your Job

So with that said…

Let’s—

Wait, you want more trading tips?

Alright.

Let me give you one more “technique” to reduce your risk and increase your rewards with the trend line breakout trading strategy.

Bonus: advanced trade management techniques for the trend line breakout setup

I know you’re probably wondering:

“There’s a way to reduce risk and increase rewards?”

“That’s impossible!”

Of course, there’s no such thing as a “holy grail” get-rich-quick trading concept.

There will still be losing trades.

But yes, it is possible and I will prove it to you…

Trend line breakout strategy advanced trade management

Here’s how it works.

Once you enter a trend line breakout strategy along with a bullish flag pattern.

You’d want to consider risking 0.5% of your capital.

It means that if the market hits your stop loss, you won’t lose more than 0.5% of your capital.

Now…

If that percentage doesn't make sense to you, go read the articles I’ve mentioned above first!

But anyway.

Once the market makes another bullish flag pattern breakout…

Move your stop loss to breakeven then open another position by risking another 0.5% risk per trade:

Repeat the same process until a trend line breakout has occurred or if the price hits your take profit level:

Pretty cool, right?

By scaling in, your “actual” risk, if the trade goes south, is still the same as you move the first trade’s stop loss to breakeven!

Essentially…

You want the market to confirm your trading idea first by risking small, then scaling into the trade as the market makes another second bullish flag pattern.

But listen closely:

Make sure to never scale in if the next bullish flag pattern is too close.

Got it?

Also, listen closer…

Today, I have shared with you winning trading setups to help me illustrate this trading concept.

But in the real world of trading, there will be losing streaks.

So, promise me that you will backtest and own this strategy yourself before you risk your hard-earned money.

Aright?

Pro tip 1: You can continue repeating this process by continuously scaling in until it hits your fixed take profit level

Pro tip 2: You can risk 1% per trade on your first position, but only scale and risk 0.5% on your second position.

With that said...

I have come to the end of this trend line breakout strategy guide.

So let’s do a quick recap on what you’ve learned today.

Conclusion

- A trend line is a tool that looks for areas of value in a trending market, while a breakout is a sign that the market condition is about to change

- A trend line breakout is when the price closes beyond a trend line area of value, signaling a potential trend reversal in the markets

- Using a bull/bearish flag pattern to compliment the trend line breakout strategy can give you a better risk-to-reward ratio

- You can consider risking small on an initial position, and scale in as the market confirms your trading idea

So, with everything that I’ve shared with you so far…

What have you learned?

What are some concepts are you going to apply immediately to enhance your trading?

Let me know your thoughts in the comments below!

Please can you produce an Indicator that can do all that for us because drawing that trend lines will be very difficult

Hey there Chukwuemeka, a trend line is a discretionary trading tool

So while there are “trading robots” that can help us detect trend lines, those trend lines may not be drawn in context with the trend as discussed in this article!

Yes, it can be difficult at times, but with practice, you’ll be able to capture the effectiveness of this tool, if you’re not keen on spending the time to get to know the tool, then I suggest you focus on systematic trading.

Go do the work man

Thank you so much , your channel is so educative. I will order for your books soon.

You’re welcome, AGfx!

Very well explained Rayner. So easy to understand. Hopefully I could apply this successfully. Thanks so much!

You’re welcome, Jayr!

You’re doing justice by giving us these priceless information

Thank you for the kind words, Dzikamai!

All time best strategy

Definitely, Jagan!

Thanks brother

You’re most welcome, Anand!

☺️☺️Great content guys, I never knew trendlines and breakouts are this deep!!!

Trendlines can get quite deep, but not too complicated!

More to come!

Thanks, Naomi!

Very useful

Thanks, Dominic!

Allah bless you Jet! This strategy is kinda tricky and it’s not an everyday thing. But the good thing about it is that the one time it works, it pays crazy reward. In my experience, it works shorting it than longing. Especially when price is testing the upward trend line for a long time and suddenly break with a big bearish candle and also consolidate at/below previous residence turn support. Even though sometimes, it breaks lower, form some funny stuffs, go up and hit stop loss and continue trending even higher.

Interesting insight, Mohammed

Thank you for sharing, bless you as well!

I really learn a lot from you Rayner,keep up the good work

I really understand the way you elucidate your thing in term of teaching Rayner(hat-off)for you Rayner

You make me understand the Breakout trend line strategy along side with bearish and bullish flag pattern easily,Once again Thanks a lot Rayner Teo(The founder of Crytoner) I’m so Grateful bro

Awesome, great to know that Oyelayo!

Price action is my only one and best strategy that am using and it, and sincerely am getting good results by using it .

Thank you boss by these ur wonderful explanation am getting more Experience and confidence about this strategy

Thank you for sharing, Mustapha!

I’ve been executing this setup for some time now and have discovered a further view of it.

First, I want to see the daily timeframe chart above the 200 day moving average and in a range.

Second, the 4hr timeframe chart must touch the trendline 3 times and breakouts strongly on the 4th touch.

Third, the 1hr timeframe must show a clear bull flag pattern, at this point, a small flag has begun to from on the 4hr timeframe as well.

Fourth, there must be a bullish candle rejection on the Daily timeframe support.

I place stop loss on the 1hr timeframe chart and take profit on the 4hr timeframe resistance.

This setup takes several weeks to form and also several weeks to hit TP.

Hey Mohammed, these are invaluable insights, thank you for sharing!

Thank you for sharing, Mohammed!

Your strategy is super and your explanation is very clear, I will apply it in my trading.

Sure, Okamma! Thank you for your kind words!

I have difficulties to distinguish between e.g. broken bearish trendline with buildup beyond it and bearish rectangle. Both rectangle and buildup should be narrow.

Thank you for sharing, Onul.

You might find the link below helpful:

https://www.tradingwithrayner.com/breakout-trading-guide/

Cheers!

Thank you for sharing a trendline tool. I feel it will help me how to make profit using this strategy too in my trading venture.

Glad to hear that, Alexander!

Trendlines can be a great tool.

Wishing you success!