What is a currency strength meter and how does it work?

Now, one of the struggles of a Forex trader is you’ve got many currency pairs to choose from.

For example:

You’re bullish on EURO but, you have the option to trade: EURUSD, EURJPY, EURGBP, EURAUD, EURNZD, EURCAD, etc.

So which currency pair do you trade?

Well, that’s where a currency strength meter (aka forex strength meter) comes into play.

It helps you to identify the strongest/weakest currencies so you can pick the right currency pair to trade (more on this later).

But first, I want you to avoid these common mistakes traders make when using the currency strength meter…

Do you make these mistakes when using a currency strength meter indicator?

If you google “currency strength meter”, it returns 8.3 million results — crazy.

And you know what’s crazier?

Almost none of them tells you the pitfall to avoid when using a currency strength meter.

That’s why traders lose money even with a “GPS” in their hands.

So here are the mistakes to avoid when using a currency strength meter (the stuff nobody tells you) …

Mistake #1: You randomly use a currency strength meter without knowing how it works

Now, a currency strength meter is like any other trading indicator.

There’s a formula behind it to determine the strength/weakness of a currency.

But if you don’t know the formula behind it, how can you trust the result of the currency strength meter?

What if the formula is wrong?

What if the currency strength meter only works on the daily timeframe but, you’re unaware of it, and use it on the lower timeframe?

That’s why no matter what tools or indicators you use, you must always know the formula behind the currency strength meter and how it works.

(And later, I’ll teach you how to create your own currency strength meter so you have confidence to use it.)

Mistake #2: You use the currency strength meter to time your entries

Now, a mistake many traders make is to blindly trade based on the currency strength meter.

For example:

You identify what’s the strongest currency pair right now and immediately buy, thinking the price will move higher — big mistake.

Here’s why…

A currency strength meter isn’t meant to generate buy/sell signals.

The currency strength meter only tells you which are the strongest/weakest currencies at a point in time.

Let me explain…

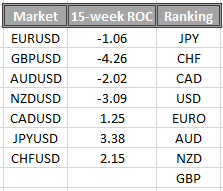

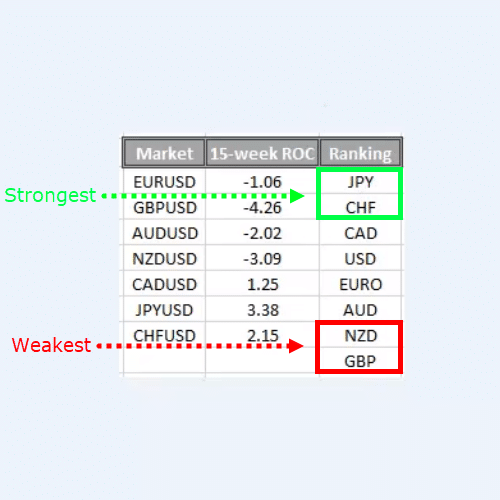

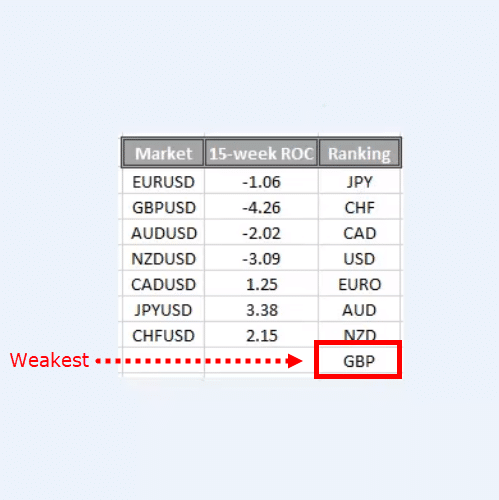

According to my currency strength meter right now, JPY is the strongest and GBP is the weakest…

Don’t worry, I’ll show you how to create a currency strength meter (free) later.

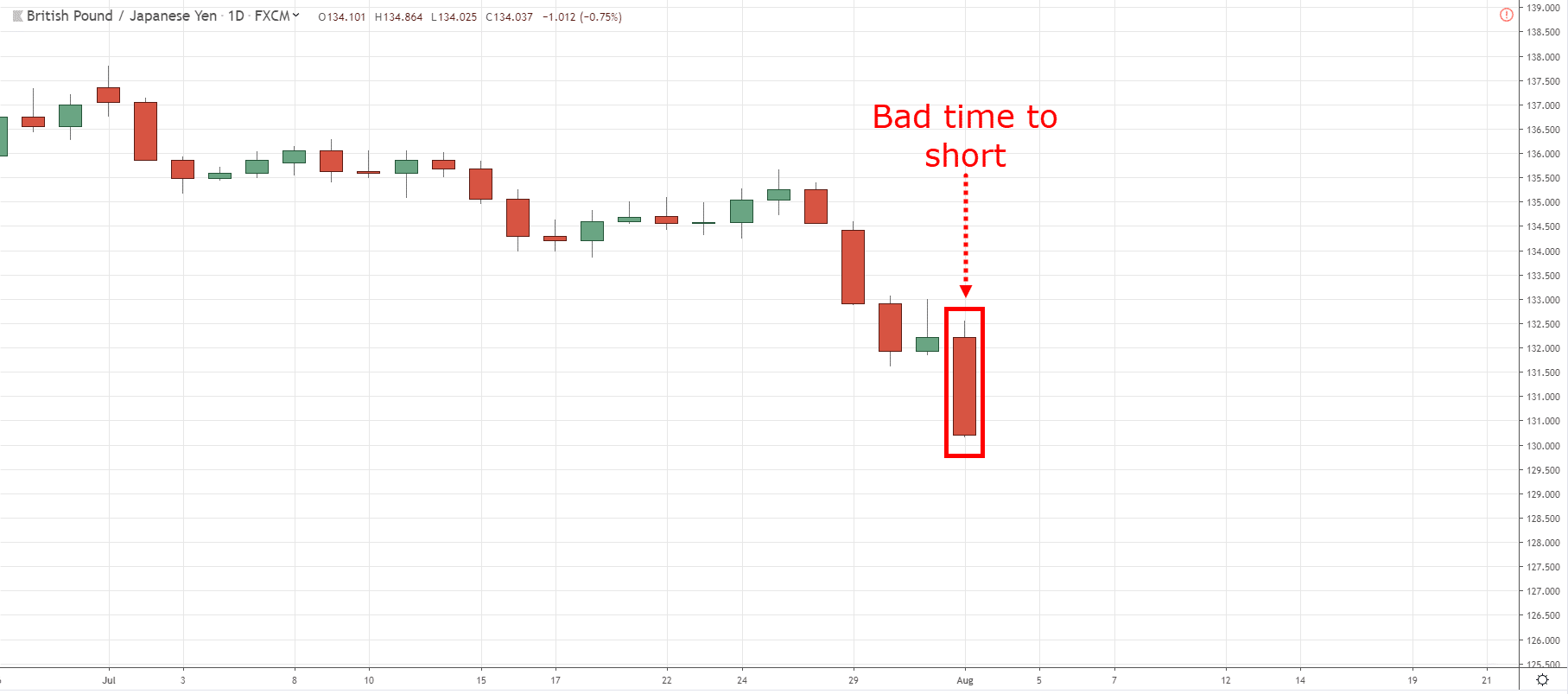

But if you look at the charts right now, it’s a bad time to short the GBP/JPY…

Why?

Because you’re chasing the markets lower after it has made a big move.

There’s no logical place to set your stop loss and you’ll likely get stopped out on the pullback.

Next…

Mistake #3: The lower timeframe is prone to false signals

Here’s the thing:

Most currency strength meters calculate the change in price (over a fixed period) to determine which currencies are strong or weak.

But this is prone to false signals on the lower timeframe.

Why?

Because high impact news can cause a “spike” in the price which misleads the strength/weakness of a currency pair.

That’s why you want to use a currency strength meter which calculates the change in price from the higher timeframe.

And here’s how you do it…

How to create a currency strength meter that works (and without coding)

All currency strength meter works in a similar manner.

The idea is to calculate the change in price over a given period and then determine which are the strongest/weakest currency pairs.

Of course, you can complicate things by adding formulas, weightages to different timeframes, etc. — and it’ll not make much of a difference (besides confusing yourself).

You can even come up with a live currency strength meter with all of those, but the gist of the currency strength meter is below.

So, for this currency strength meter, there’s no complicated formulas or any complex algorithm.

Here’s how this currency strength meter (free) works…

- Create a list of major currency pairs

- Calculate the percentage change over the last 15-weeks (for the major currency pairs)

- Rank them from strongest to weakest

Let me explain…

#1. Create a list of major currency pairs

The list includes EUR/USD, GBP/USD, AUD/USD, NZD/USD, JPYUSD, CADUSD, CHFUSD.

Now you’re probably wondering:

“Why do you use JPYUSD instead of USDJPY?”

Simple.

You want to standardize USD as your quote currency so you can compare them “apple for apple”.

#2: Calculate the percentage change over the last 15-weeks

Here’s how…

- Insert the Rate of Change (ROC) indicator onto the weekly timeframe

- Change the settings to 15-period

- Do it for all major currency pairs

Here’s how to do it on TradingView:

#3 Rank them from strongest to weakest

Now once you’ve got the values, you want to rank them from the strongest to the weakest.

The currency pair with the highest value would rank at the top, followed by the second, third, fourth, etc.

Here’s how it’ll look like on excel:

Pro Tip:

You can add exotic currency pairs like USDZAR, USDTRY, USDRUB, etc. so you have more markets to trade.

How to tweak the currency strength meter for your own trading strategy

Now, by using the weekly prices to determine strength and weakness, you can avoid false signals from the lower timeframe.

But if you’re a short-term trader, using a 15-week ROC as your currency strength meter is too long.

So, what now?

That’s where you can tweak your currency strength meter for short-term trading.

So here are some guidelines for you:

- If you trade below the 4-hour timeframe, use 4-weeks ROC

- If you trade between the 4-hour and weekly timeframe, use 15-weeks ROC

- If you trade above the weekly timeframe, use 30-weeks ROC

Now at this point:

You know how your currency strength meter works (without any black-box algorithm). And you know how to tweak it to your own trading style.

So now the question is…

How do you use the currency strength meter for your own trading?

Well, that’s what you’ll discover next, so read on…

How to use a currency strength meter and find the best currency pairs to ride massive trends

Here’s how…

Use the currency strength meter and pair the strongest currency with the weakest one — so you get a strong trending market.

For example, look at the currency strength meter below…

You can see GBP is the weakest and JPY is the strongest.

And when paired together, you get GBP/JPY which is in a strong downtrend…

Remember:

A currency strength meter doesn’t help you time your entries. It helps you filter out the best currency pairs to trade.

This means you need a trading setup to get you into a trade (like breakouts, pullback, candlestick patterns, etc.).

If you want to learn how to time your entries, then check these out…

The Complete Guide to Breakout Trading

The Monster Guide to Candlestick Patterns

The Shooting Star Trading Strategy Guide

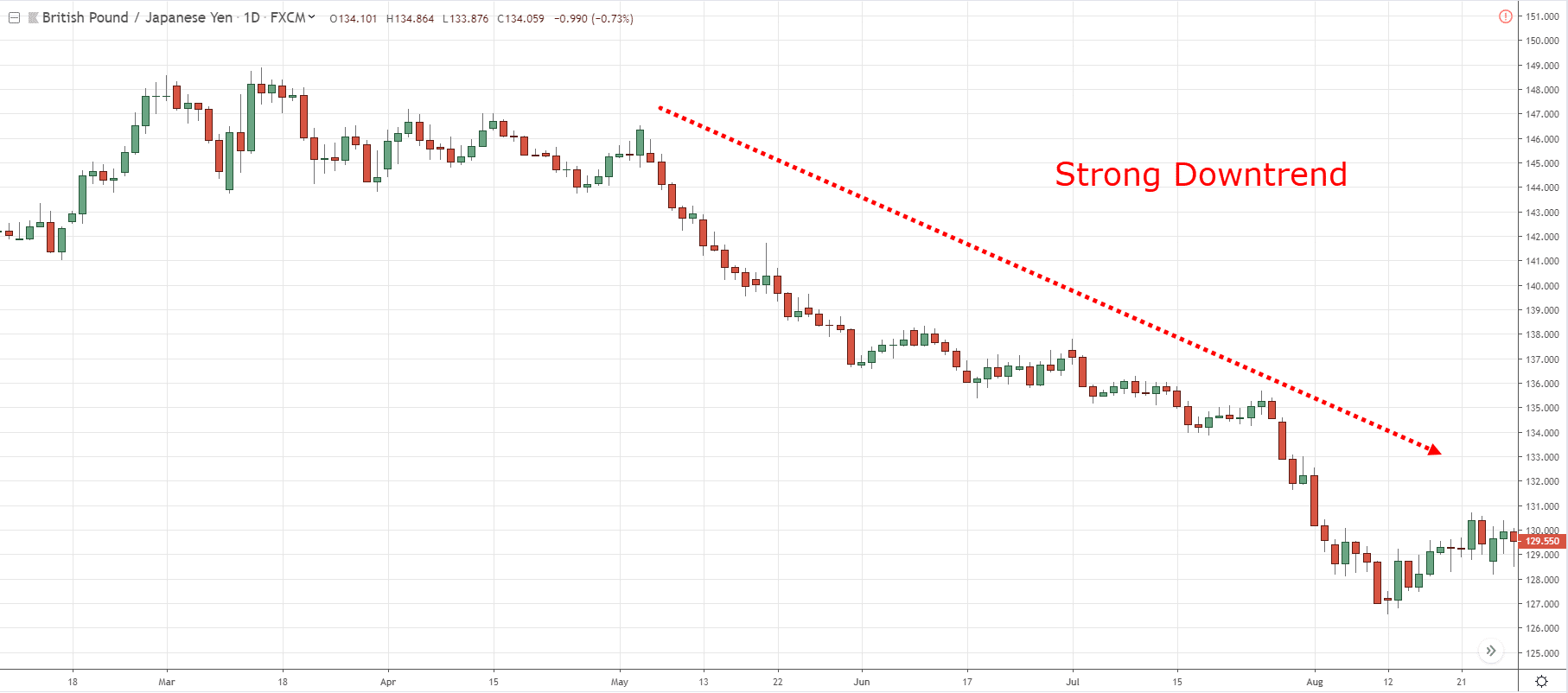

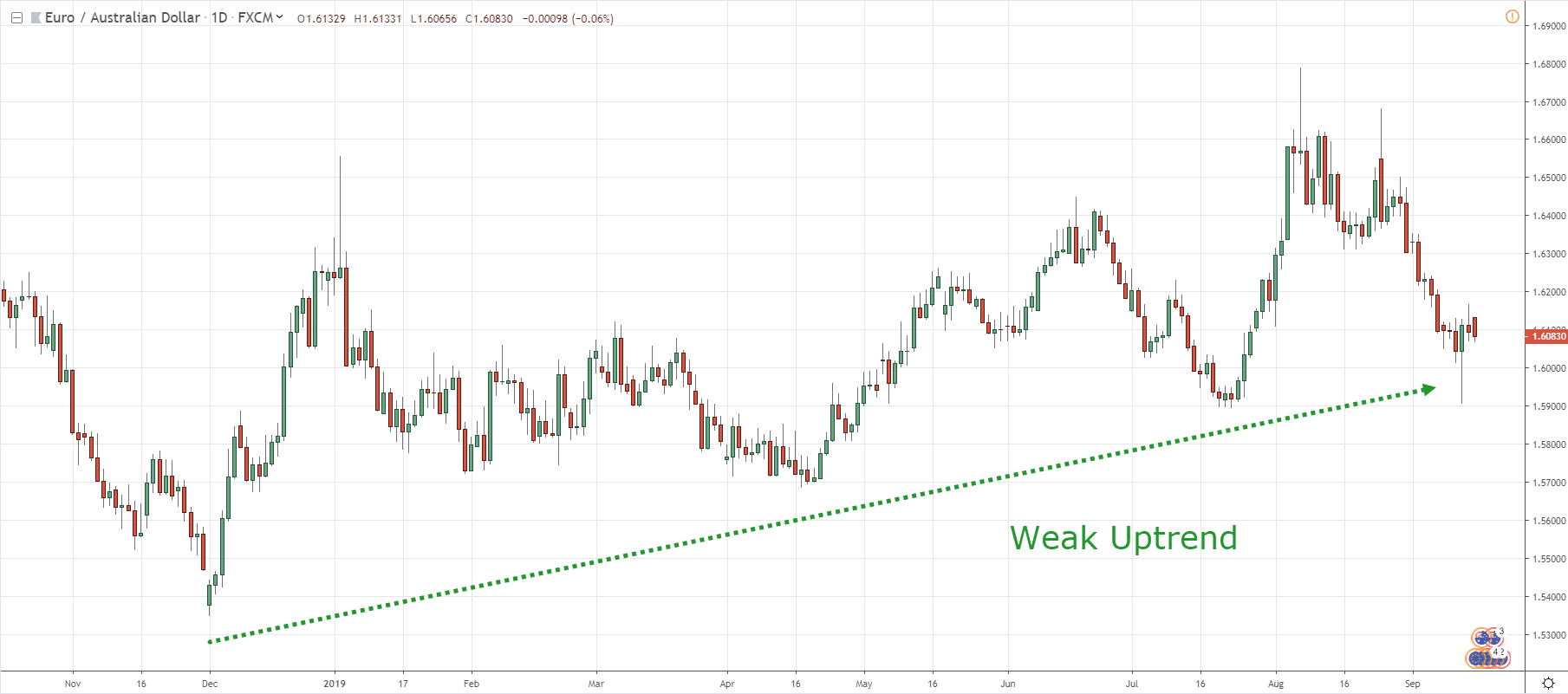

How to use a currency strength meter and find the best currency pairs for swing trading

When it comes to swing trading, you want the market to be either in a weak trend or range — so you can capture a swing within it.

So can a currency strength meter help with it?

You bet!

Here’s how…

You want to pair currency pairs which are of similar strength or weakness.

An example:

If you look at the currency strength meter below, EURO and AUD are ranked closely to one another (both relatively weak).

And if you pair them together, you’ll get EUR/AUD which is in a weak trend now…

And as a swing trader, you could look for buying opportunities around the 1.6000 – 1.5900 area.

If you want to learn more about swing trading, then check these out…

The NO BS Guide to Swing Trading

Swing Trading Strategies That Work

Conclusion

So here’s what you’ve learned today:

- A currency strength meter (aka forex strength meter) calculates the % change in price to rank currency pairs from strong to weak

- A currency strength meter doesn’t tell you when to enter a trade, it only helps you to filter for potential currency pairs to trade

- You can tweak your currency strength meter to adapt to different trading timeframes

- If you want to trade strong trending markets, pick a strong currency against a weak one

- If you want to capture swings in the market, pick currencies of similar strength or weakness

Now here’s what I’d like to know…

How do you use a currency strength meter?

Leave a comment below and share your thoughts with me.

Very helpful. Explains things simply. Does NOT over sell the idea. Makes strong intuitive sense. Offers some trading ideas to use this with. Many thanks – helpful contribution.

Glad to help out.

Cheers bud

currency strength at Tradingvview.com

when you start searching for example

USDJPY*USDCAD*USDCHF*1/EURUSD*1/GBPUSD*1/AUDUSD*1/NZDUSD

then you will get the currency strength for the dollar.

if you have an abo you can even see the change in M1(one minutes). This kind of display is much better than a table because you see the currency strength directly as a graph.

it is possible to apply indicators to this chart.

I have been using this for a long time and can highly recommend it.

Here are some examples:

Hong Kong dollar currency strength

1/USDHKD*1/CADHKD*1/CHFHKD*1/EURHKD*1/GBPHKD*1/AUDHKD*1/NZDHKD*1/JPYHKD

NOK currency strength

1/EURNOK*NOKJPY*NOKCHF*1/GBPNOK*1/AUDNOK*1/NZDNOK*1/CADNOK*1/USDNOK

CHF currency strength:

1/EURCHF*1/USDCHF*1/GBPCHF*1/AUDCHF*1/NZDCHF*1/CADCHF*CHFJPY

Thanks Rayner this was an interesting piece

Great help to me! In fact I am new to FX CFD trading. Thanks

Hey Jiang,

You are most welcome!

In when and what time do we often use the strength meter is it every weekend or every month after the fundamentals analysis is been released…?

And how long do we stay on the trend.?

Hey Collins,

Every weekend would be fine!

Cheers.

Hey Rayner, what if I want to use Currency strength Meter across other markets like bonds,indices,metals and other markets… Isn’t going to work?

It will require a different method of defining strength and weakness as it’s not like currency where you have multiple markets with the same base currency.

I appreciate the work and your time you have spent to prepare this post.Its very clear and understandable…Thanks

I’m happy to hear that!

Do you have this beautiful piece in YouTube video?

Not at the moment.

Hey hey ma Man. Thanks man I ve been hungry for this info.for a long time ….so now

Hope it helps!

So …is there any app for this?

There’s a ton in the market, free and paid.

But the math behind is probably not explained.

Many Thanks Rayner for the info.

You are making sense… I was so confused about different time frames not been accurate.

You’re welcome!

Tanks boss

My pleasure!

what is an roc indicator & where do i get it

TradingView has it.

It’s the Rate Of Change indicator I think

Hi!

The value of USD is zero in your ranking example?

Yes, it’s always 0 since it’s the base currency we are comparing against.

Great topic! Excellent.Thanks Rayner a lot for your sincere, helpful training sections to trader community! Appreciate your works!

You’re welcome!

Thank Super Rayner !

Cheers

Hey Rayner,

Can you able to tell how do you manage the “Swap Charges” ? How many day you get “Swap Free” from your broker ?

I just accept it as the cost of doing business.

There’s no way to avoid it.

Thank you Rayner,

Your actually a good Mentor by always disclosing the best and simple Way to successful trading strategies to your subscribers,

I trade with currency mitres too and it pays me in my trading,but I never know I can create mine and even to use currency meter for swing trading by taking the weekest and the one close to it,

Thank you Rayner

You’re welcome!

For swing trading, we can take any pair with similar strength (don’t need to be weakest ones, like Zakari said).

So we may take two strong currencies with similar strength for swing trading?

Yes you can, they’ll likely be in a range or a weak trend which is favourable for swing trading.

Rayner – Thumbs up for the currency strength meter. Please explain in greater detail the currency strength meter. For example (1) Why 15 weeks and not 10 or 20? (2) if we need a trade setup to get you into a trade (like breakouts, pullback, candlestick patterns, etc.) Then why bother with currency strength meter in the 1st place? Please guide

Academic studies have shown markets that shows strong momentum over the last 3 – 12 months tend to continue showing strength. So 15-weeks is about 3 months of performance.

If you have a setup like a breakout and it coincides with buying the strongest market, it increases the odds of a breakout trading working out.

This is super helpful to find good set up. But I have one question, when should conduct the roc check? Is it on Saturday when all forex market are closed? Or daily routine? Or (your suggestion) … thanks a lot.

I check it on the weekends when markets are closed.

Hey Rayner, don’t it be better to compare using JPY, since there JPY pairs were using JPY as quote currency?

Yes you can apply the same concept to JPY if you wish to.

Hi Rayner:

You have a new and simple way to calculate strength.

Many strength meters use 28 pairs, you only use 7 majors.

Maybe it is not necessary to calculate 28 pairs, and your formula is just simple and works well.

Can you tell me: have you compared the results of your formula with other strength meters (like CSM by Hannover, and StrongWeak of FXCM), and got similar results?

Thanks and regards to your wife and little kid (not a baby anymore now :D).

I’ve not compared my results and I don’t know the exact formula they use to calculate it.

Day trader should use 4 weeks roc?

should we change those values every day ????????

Why would you do it?

Rayner you are great master, I always enjoy reading your books

Thank you, cheers.

Best article to filter out the trade.Thanks Rayner.

You’re welcome!

Good evening Rayner, being honest I did not know how to use this indicator correctly until your explanation, thanks for one more teaching.

My pleasure!

Hi Rayner,

How did you rank USD as number 4 in the above example?

I figured it out. It is a nice article Rayner. Will see how it unfolds in my trading.

Thanks Rayner! This is excellent. You always are.

As regards time of entering a trade, I believe your post on Moving Average Indicator guide (https://www.tradingwithrayner.com/moving-average-indicator-trading-strategy/) can be of great help. Right?

Yes, you can use that too to identify an area of value. cheers

THANK YOU FOR THESE GREAT INSIGHT. BUT THERE ARE SOME UNCLEAR PART. YOU SAID JPY (-1.06) AND CHF IS SECOND(-4.26) THE STRONGEST. BUT THERE IS CAD OF (-2.02) WHICH YOU TERM AS THIRD, BUT WHY IS “CAD” NOT SECOND. PLEASE EXPLAIN

JPY is not -1.06.

-1.06 is referring to EURO.

Ade, don’t align the entries in the ranking column to the first column. The position in the ranking column is determined by the value in the 15 week ROC column. So where you have the JPYUSD pair having the ROC of 3.38, that is the strongest ROC in the list so JPY is the strongest currency (against the USD) so it sits at the top of the Ranking column. That Ranking column could be placed below the table instead of alongside, so it doesn’t confuse. Hope that helps.

Thank you, Pete!

Hi Rayner, great stuff there. Great to know how to create a currency strength meter for free. I got perfectly how you arrived at the ranking of the major pairs except the USD. How did you arrive at the position of USD in the ranking? Many thanks.

The ranking is the “base” currency so it’s always 0.

This is a good work Rayner. You’ve really thought me an invaluable lesson. Thanks so much.

Awesome to hear that!

So how often do you update the excel sheet on the rate of change? Is it once a week?

I update it every weekend.

Hi Rayner, thanks for the awesome lesson. I’m just wondering if I can also use the ROC with currency indexes like DXY or EXY to know the strength of the individual currencies for further filtering. Is that advisable?

You might want to consider that those indices are weighted against a basket of currencies, and different currencies have a different weight assigned to it.

I see, thanks for the input! guess it will be easier to just pit one currency against one base (USD)

Thank you Rayner for your valuable inputs

My pleasure!

Are you not doing copy trading by the way?

Nope, I’m not.

yeah good idea. barchart.com currency strength meter, is created using this formular? can i trade based on their results?

I’ve no idea how they create theirs.

Hi Rayner! Great stuff here! I’m just a little confused about one part. Since we are using the USD as the base (0 value) and we reverse the pairs with USD in front (like USDJPY becomes JPYUSD), then should we reverse the ROC value as well? Like if the ROC value of USDJPY is 0.53, shouldn we make it -0.53 or something?

Yup, you should do that.

Hello Rayner, concerning the Currency Strength Calculation for JPY, should we simply invert the result of USD/JPY to get that for JPY/USD? because I cannot get the chart for JPY/USD. Thanks

I am sorry, I just noticed someone already asked similar question. But just a little modification, how do we determine the inverse, is it simply changing the sign or by getting the reciprocal? For instance if ROC for USD/JPY is 2.24, can we say ROC for JPY/USD is -2.24 or 1/2.24 = 0.44?

Hi Teo

According to me the formula for calculating the inverse:

Say Rate of change % for period of inverse ratio = b = JPY/USD

Say Rate of change % for period = a = USD/JPY

Use negative sign in the formula (“a”) when ROC % is a negative %.

b = [1/(1+a/100) – 1] x 100

ROC % for JPY/USD= b

For Ernest example

ROC % for USD/JPY = 2.24

b = [1/(1+a/100) – 1] x 100

b = [1/(1+2.24/100) – 1] x 100

b= [1/(1.0224) – 1] x 100

b =[0.97809077 – 1] x 100

b = -0.02190923 x 100

b = -2.190923

b is approximately -2.19%

Therefore ROC % for JPY/USD = -2.19%

I tested this by working out the currency change and prices for USD/ZAR. There will always be a difference when you swap the currencies around . You cannot just change from negative to positive or positive to negative.

Best regards

Francois

Yes, what you’ve shared would be the correct way to calculate.

Or alternatively, one can just look up the symbol JPYUSD and find out the ROC values straight from tradingview.

Hi Ernest

According to me the formula for calculating the inverse:

Say Rate of change % for period of inverse ratio = b = JPY/USD

Say Rate of change % for period = a = USD/JPY

Use negative sign in the formula (“a”) when ROC % is a negative %.

b = [1/(1+a/100) – 1] x 100

ROC % for JPY/USD= b

For your example

ROC % for USD/JPY = 2.24

b = [1/(1+a/100) – 1] x 100

b = [1/(1+2.24/100) – 1] x 100

b= [1/(1.0224) – 1] x 100

b =[0.97809077 – 1] x 100

b = -0.02190923 x 100

b = -2.190923

b is approximately -2.19%

Therefore ROC % for JPY/USD = approximately -2.19%.

I tested this by working out the currency change and prices for USD/ZAR. I also tested the formula on Excel to 15 digits-It gives the exact same result comparing the price changes of a currency to this above formula.

There will always be a difference when you swap the currencies around . You cannot just change from negative to positive or positive to negative. A percentage change on a number(currency price) will always be different from a percentage change on a different number(different currency price).

Best regards

Francois

Hey Ernest, you could just search for the inverse symbol on Tradingview, then get the ROC values from it.

For example, search for JPYUSD on tradingview instead of USDJPY.

No, you shouldn’t because the other pairs have USD as their base.

Just invert the sign of USDJPY and you’ll get JPYUSD.

Wow thanks alot for this free wonderful lecture,am so humbled and glad

Glad to help out!

Hey bro, what if my analysis timeframe is 30 mins and entry timeframe is 5 mins, what will be the period I could use? Thanks

Hi Rayner. Very helpful info. Just need some clarity. If I trade short term and use 4 period for ROC, then am I still using it on the weekly chart or dropping to a lower time frame, maybe H4, to determine strongest to weakest currencies?

You use it on weekly timeframe.

Sir, quick one please; don’t the ROC values display on mobile TradingView? I don’t get them at neither 4-, 15- nor 30-week periods.

Thanks!

You’ll have to check with TradingView since I don’t use it on mobile.

Hi rayner, first of all, thank you for this, and all your other documents, posts and videos. I have been trading for years, but not successfully. You put a different twist on a lot of what I have learnt and figured out for myself, so I am looking forward to improving my performance.

I have a question regarding the ROC indicator on Trading View. I have just set it up, and I can’t see anywhere that shows the current value of the ROC. Is the only way to put the cursor on the line and read it on the right hand scale? It would have been useful if the value displayed somewhere, but if it does, I can’t see it. Thanks in advance.

Yes, you’d probably have to move your cursor to identify the value of it.

This might be a solution, right click the scale on your chart and open settings near the bottom. Under the scales menu, check the box “Indicator last value label”. This should display the ROC value on the scale. Hope this helps. Cheers

currency strength at Tradingvview.com

when you start searching for example

USDJPY*USDCAD*USDCHF*1/EURUSD*1/GBPUSD*1/AUDUSD*1/NZDUSD

then you will get the currency strength for the dollar.

if you have an abo you can even see the change in M1(one minutes). This kind of display is much better than a table because you see the currency strength directly as a graph.

it is possible to apply indicators to this chart.

I have been using this for a long time and can highly recommend it.

Here are some examples:

Hong Kong dollar currency strength

1/USDHKD*1/CADHKD*1/CHFHKD*1/EURHKD*1/GBPHKD*1/AUDHKD*1/NZDHKD*1/JPYHKD

NOK currency strength

1/EURNOK*NOKJPY*NOKCHF*1/GBPNOK*1/AUDNOK*1/NZDNOK*1/CADNOK*1/USDNOK

CHF currency strength:

1/EURCHF*1/USDCHF*1/GBPCHF*1/AUDCHF*1/NZDCHF*1/CADCHF*CHFJPY

how do you switch for example : usd/chf to chf/usd to compare every currencies only with the usd ? thank you Rayner !

easy explanation!

I have a question concerning the rank of USD. It comes always at the 4th place or how I rank it compare to the others currency

How to calculate USD strength?

Thanks for the article I believe the more I read your context the more I become prospect trader

Glad to help!

Thank you Mr. Rayner! I have learned a lot from this, Ive been ising the the currency strength meter wrongly as you mentioned… Its great to know…

You’re welcome!

Actually am so happy to this lessons

Hi Rayner, I was just wondering on the pairs where you reverse them to keep the USD as the quote currency do you note the ROC data as it appears on the chart or does it have to be somehow inverted as well? Lots of great info here.

Cheers

Geoff

Hi Rayner, I just read thru the comments and found my question had already been answered. Apologies!!

No worries, glad you found it!

Where can I found currency strength meter

You can create your own one based on the post I shared above.

Please, should one select the 4 hour time frame before changing the Tate of Change Period to 4 weeks?

Please I’m a bit confused.

This is worth gold. I could never get it right. Thanks Rayner

You’re most welcome, David!

Create a list of major pairs, calculate the %of ROC, compare the weakest to the strongest to get a healthy trend n remember If you using a timeframe between 4h to weekly use a 15period RANGE OF CHANGE

Useful information.

Thank you for your kindness and generosity.

My pleasure, James.

Hi Rayner – Thanks for such valuable info. Couldn’t understand how you calculated strength value of USD? Did you used Dollar index alone? Thanks

I set USD to default 0 since that’s the currency we are comparing against.

Thanks Rayner

This is massive,, I have been troubling in choosing currency pairs to trade but this is massive boost to me

And with this just new strategy given,, am hoping to capture to meat now on

You’re most welcome, Pat!

I didn’t even know what’s a currency meter, I am getting knowledgeable every time …just coz of u Rayner… indeed leveling my trading tips and will soon beat the markets

Well, never used all that before. Thanks much, appreciation.

After reading this i got enlightened the more on how to enter winning trades using currency strength meter but the problem I have is that I did not understand how to prepare or create this currency strength meter. Please, Sir can you make a video on this to make it clearer to us?

Thank you, sir

i don’t know how to use on my mt5 plateform

Thanks for sharing Rayner! Will the standard symbols for U/J,U/C,U/CHF work for MT4?

Hey Stan,

You are most welcome!

Kindly contact your broker.

Thanks a lot Rayner for this. It’s really helpful. What app would you recommend for calculating currency strength?

Thank you so much for this currency strength write up. I’ll do my own setup and practice it.

I want to know how long you can use the currency strength. Is it for a month or more. Or is the setup just once and you use it forever.

Please your prompt response will be highly appreciated.

Thanks

Vivian

Hey Rayner, very helpful information. Thank you very much. Can we do it also using ROC with the Currency indexes?

Hi Cem,

Yes, you can.

Cheers.

Very helpful and big thanks to you Teo. Please where can we find the ROC in the MT4 platform.

Hi Sam,

On MT4/MT5, Use CTRL+N, then search for ROC on the list.

Cheers.

On MT4 is not ROC indicator in standard

Hi Vojp,

That’s why you have Rayners Currency Strength Meter for MT4.

Thanks Rayner,Shared ua link to several people

Great info Rayner, thanks for the heads up!

Hi Akhuetie,

You are most welcome!

Im new here and still learning through your videos and this Email . Its quite inspiring for me to continue to reach my goal. I wish you the best and gain more more as expected.

Hi Joseph,

I wish you the best too…

Cheers.

Hi Rayner,

How will you know if USD is stronger than ERU let say today or ERu tomorrow.

Hi Akan,

Here’s how…

Insert the Rate of Change (ROC) indicator onto the weekly timeframe

Change the settings to 15-period

Do it for all major currency pairs

Use the currency strength meter and pair the strongest currency with the weakest one — so you get a strong trending market.

Cheers…

Hi solid info there, i had a question, i was looking forward to using this for binary options, on lower time frames of expiry 1-5 mins , i suppose we can use the 1 hrs to 4 hrs time frame when there is no new release and judge if market is tranding up or down based on the roc ? Please do let me know how we can make use of this for binary trading.

Good day Rayner…in terms of short term traders,if i apply the 4 period ROC..is it the value on the weekly time frame i will use in determing its value?

Hi Kingsley,

If you trade below the 4-hour timeframe, use 4-weeks ROC (Weekly)

Cheers…

Hey

But why do currency meter software’s change there value frequently?

Hi Gaurav,

The market is dynamic.

Cheers…

Sure because price is never static

Hi Rasheed,

I’m glad to hear that!

Cheers

i can’t setup the currency strength meter

Hello Okon,

Just read through the post again and then follow it step by step to prepare your meter

Hi Rasheed,

I love that!

Cheers.

Please do a video on the currency strength indicator Rayner.

Hi Chris,

You can have access to that and many more if you are a member of the UPAT.

Cheers…

Thanks Rayner. Really helping me. Cheers dude. What is the value of USD on the strength meter, 1, 0 ?

I have to say this is the greatest info I’ve ever received. You have the best.

HI Eagle,

You are most welcome!

Rayner you are great master

Hi Parviz,

Thank you!

Great and helpfull explanation. Never thought of using it this way.

Hi Erwin,

Thank you!

thank you for everything!! I can see profit now since I started study with you.

HI Shamir,

You are most welcome!

I’m glad to hear that.

Great insight

Hi Sammie,

Thank you.

a good guide to help trader choose which currency pair to trade. need more reading though from your free guide to learn more about forex trading thank you so much for all the ideas send to us your readers for free

Hi Bernardo,

You are most welcome!

Thanks alot Mr.Rayner Teo

Hi Soe,

You are most welcome.

Cheers.

Thank you very much for this eye opener please how do I get the value for USD and do I reverse the value of USDJPY inorder to convert it to JPYUSD?

Hello Ezinne,

To get the USD ROC, just use the dollar index and I think Rayner would still have to give more to we the ‘Oliver Twists’ on how to get the ROC for JPYUSD.

Hi Rasheed/Ezinne,

Check out this video.

https://youtu.be/5S-o99BUd2I

Cheers.

Thnks so much rayner. You really blew my head. Pls I suggest if you can release the strength currency quarterly .

Hi Tolu,

You are most welcome!

Very helpful

Great insight more espetially for me as a beginner.

Thanks

Hi Theo,

Thank you!

Dear Sir,

Thank you very much for your method of calculating the Currency Strength Meters. It’s a good method to know how to get the strongest and weakest currenies in order to determine the next step before entry the market. I will prepare the list indicators of currency pairs which are using in my company.

Yes I agree and understand that the currency strength meter list cannot apply directly in the new entry market for FX trade but the list can help to choose the correct currency pairs to trade. However the time to trade should follow the “Ultimate Guide to Price Action Trading lesson” which consider three points “M.A.E:

1) Market structure – by look at the market stages about 200 days period and they are cycling around four stages (Accumulation stage, or Advancing stage, or Distribution stage, or market return back to Declining stage).

2) Area of value – by look at the market trends in the shorter priod which symble in three trends (upwards, downwards, and arange trends).

3) Entry trigger – is the key point to choose “Buy” or “Sell” which require to look at the candlesticks symble and the strength of prices.

Once again I would like to thank you for all your lesson and sharing knowledge to me personally. I would count on you as my Lecture on FX Trade.

Sincerely yours,

Phearoka

simple and helpful.Thanks

Hi Oren,

You are welcome!

Mr. Teo’

I am relatively new to trading and is just about getting the hang of the currency strength meter and I thank you so much for taking your very precious time explaining how to calculate same. I used to use it on my demo account where you just Buy or Sell in an effort to make money to no avail but now I wait patiently on price action reversal signals on the smaller timeframes and uses the M15 to time my pullbacks while trading the H1.

Hi Micheal.

I’m glad you are growing.

Keep it up!

Cheers.

Hi am yet to understand currency meter or strength correctly

Hi Hycienth,

Check out this video.

https://youtu.be/5S-o99BUd2I

Cheers.

Amazing tip. Thank you.

Hi Raymie,

You are welcome!

Great information really appreciated for sharing thank you so much

Hi Imran,

You are most welcome!

Cheers.

i still confused how to rank currency strength from strong to weak. are u ranking it looking at the number near ROC

Hi Dawa,

Check out this post

https://youtu.be/5S-o99BUd2I

Cheers.

Thank you rayner

You are welcome, Fuat!

Thanks alot for all the info u share. They’ve been very helpful. However I have this question: how often should one update the currency meter?

You are most welcome Enimedo,

It depends on the timeframe you trade with.

Thanks Rayner this is helpful your the best

Thank you, Liz!

How can someone put the Roc in Android phone

Thanks Rayner.

But I can’t find ROC indicator on my mt4, please help out

It’s really a nice technique

Thank you, Henry!

Thank you Rayner. I’ve been using a strength meter for months now, but I’ve finally given up using it.it gets me in too late, and then reverses on me. There are times. when the meter says one thing, and the mpair does the opposite. Too hard. Too costly. But I’ll give your ideas a go though, and hope it’s better. I believe what you say best.

Thank you, Michael!

Currency strength meter guides on how to select best currency pairs for trendy or swing trading for maximum profit. It is created by using ROC indicator on suitable timeframe depending on trading timeframe. It can be tweaked to suit timeframe of choice, It dies guaranty trade entry timing as one still needs basic entry methods such as pullbacks, candlestick patterns, breakouts etc.

Thank You.

Exactly information as always. Thank you so much for putting this info out. As a newcomer to the game your help and insight has been invaluable tools to help me learn. Thanks again keep up the good work my friend.

You are welcome, Wayne!

Hi, rayner thank you for the info.

How long do you think I can use this currency strength meter.? Let’s say I create it on Saturday and using it next Monday, how long I can depend on detail on this chart since the value keep on changing.

Thanks again.

Yea, I have one. It gives me the possible buy/sell entry after comparing the strongest and weakest currency.

Thank you for your insights. The way you explain things is very easy to digest. Keep up the good work

Glad to hear that, Dil!

You are more than excellent, Rayner.

I only have one challenge. Can yiu help me with the exact link to the tradingview chart. I don’t get the exact page that you used, please. I want to master how to calculate the currency strength, please

Hi Fred,

Check out this video on how you can use it as Rayner did.

https://youtu.be/Vqrkbcdmuqc

More features on Tradingview come with a subscription plan.

Cheers.

The contents are very useful.i am still learning through the emails you sent me by going through them.i will surely inform you when I am able to get consistent profit.Right now I earn little and lose big.iam trying to improve myself with the materials you sent me.Thank you for your great help and concern.

Please how can I learn advance course on forex trading to enable me to begin to profit regularly in trading.

You can check this out if you really wanna learn more about trading:

https://www.tradingwithrayner.com/academy/

Cheers!

Rayner thanks for this tutorial

You’re welcome, Wasper.

We’re happy to help!

Cheers!

Hi,

Thank you so much for valuable information, just one question i want to ask you if i want to analysis the market by currency strength on lower time frame, what will be the best time for calculate currency meter for intraday trading & how many time in a day & at what time will be best to calculate currency strength as per given strategy,,,?

please answer..! my email id yogeshkadam10291@gmail.com

Hey there, Yogesh!

Jarin here from TradingwithRayner Support Team.

Most currency strength meters calculate the change in price (over a fixed period) to determine which currencies are strong or weak.

But this is prone to false signals on the lower timeframe.

Here’s the link on how to use Currency Strength Meter:

https://www.tradingwithrayner.com/currency-strength-meter-indicator/

Hope that helps!

You are super sir

Your knowledge always easy to understand

Thanks, Alfred!

Glad it helps!

Rayner what if am using 15 minute timeframe how many week ROC should I use