When it comes to price action patterns, most traders will think of…

“Hammer”

“Shooting star”

“Engulfing pattern”

Now, these are easy price action trading patterns to learn for beginners.

But, if you want to take your price action trading skill to the next level, then you must master new price action patterns.

All price action patterns can be used to help you trade in different market conditions.

That’s why in today’s post, you’ll discover 5 price action patterns that work—so you can develop sniper trading entries to trade market reversals, trend continuation, and even breakouts.

Ready?

Then let’s begin…

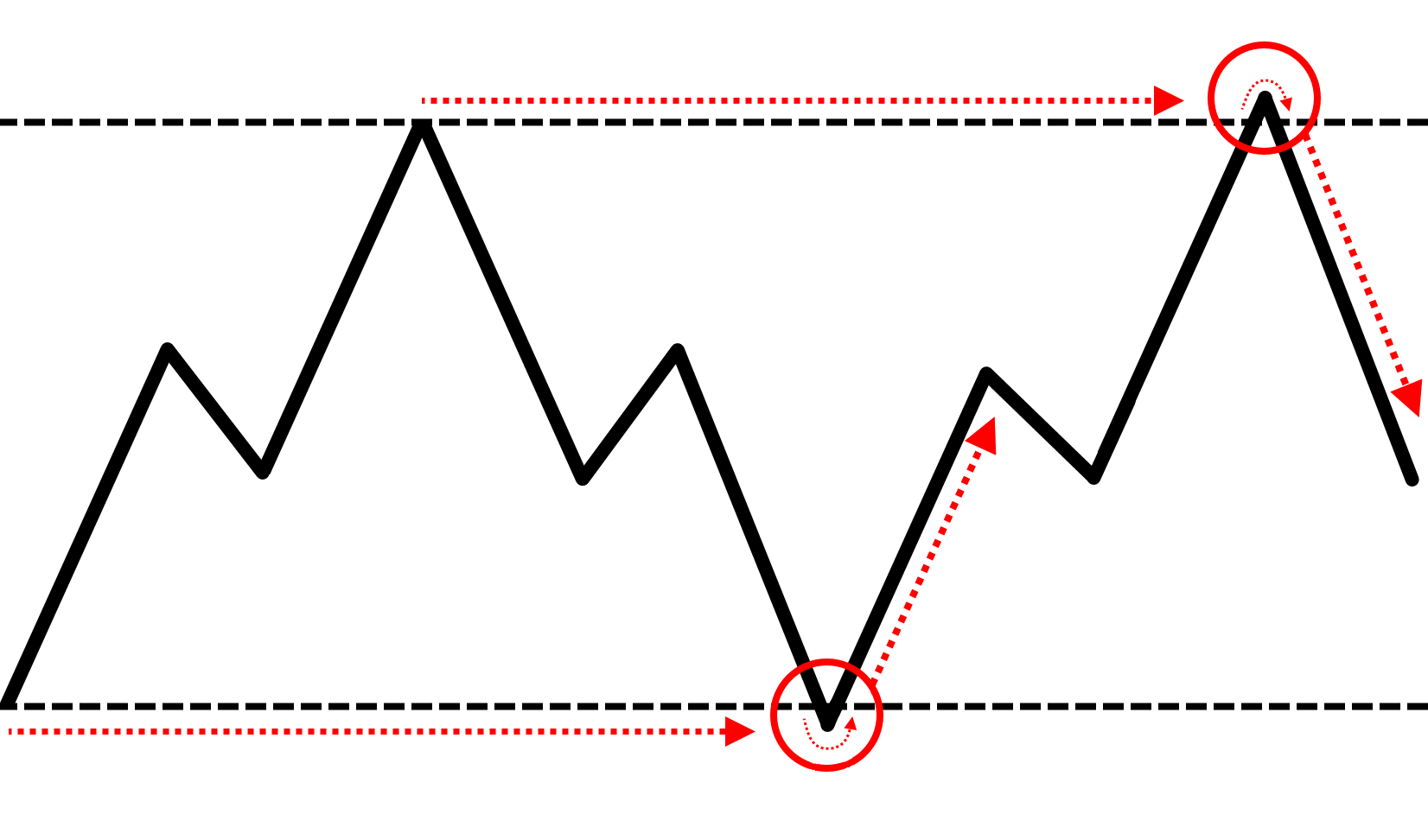

Price action pattern #1: False break

The false break is a reversal price action pattern that allows you to buy low and sell high.

Here’s why it works:

Imagine, the price makes a strong bullish move into resistance—and breaks out higher.

At this point, many traders have this thought process…

“The market is so bullish”

“Look at how big those green candles are!”

“It’s time to buy!”

So, this group of traders buy as the price breaks above resistance and their stop loss is likely below the previous candle low, below support, etc.

This means if the market makes a sudden reversal, you can agree that these cluster of stop loss will be triggered which puts selling pressure in the market.

Plus, if bearish traders step into the market and sell near the highs of resistance, you can expect the market to collapse lower and erode the gains it made earlier—that’s the power of the false break price action pattern.

Now that you’ve understood the logic behind the false break price action pattern, then here’s how to trade it…

- Look for a strong bullish momentum into resistance (the bigger the candles, the better)

- Let the price take out the extreme highs of resistance (so that more traders will buy the breakout)

- Wait for the false break pattern where the price makes a sudden reversal and closes below resistance

- Go short on the next candle’s open

(And vice versa for a long trade)

Here’s an example of one of the Forex price action patterns (false break):

Make sense?

Then let’s move on…

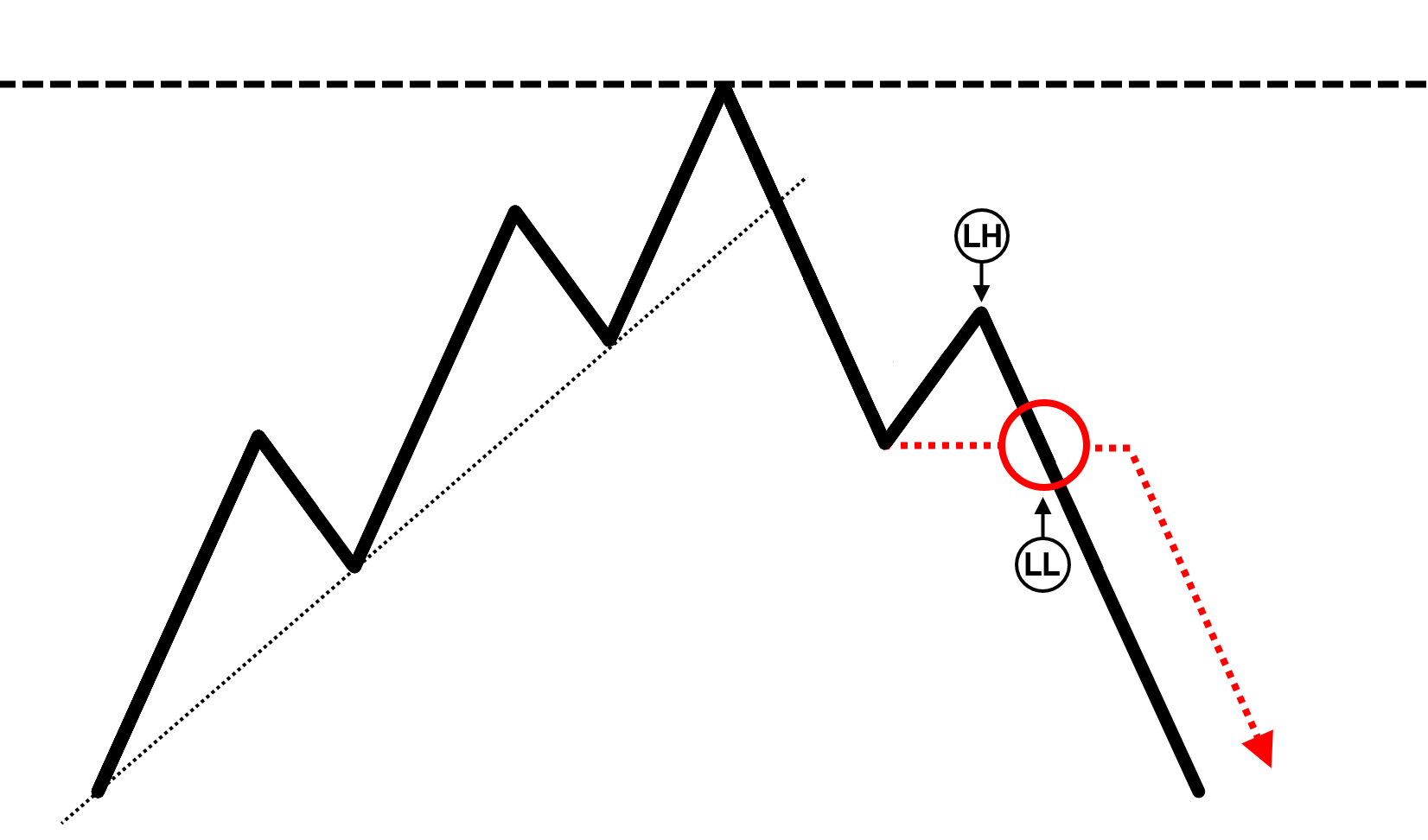

Price action pattern #2: Break of structure

The break of structure is a reversal price action pattern that allows you to enter the start of a new trend—with low risk.

Here’s why it works:

Imagine, the market has been in an uptrend over the last 200-candles.

But as you know, the price cannot go up forever. Eventually, the market gets “expensive” which attracts short sellers into the market.

And that’s not all because traders who bought previously will look to take profits which puts additional selling pressure.

Now here’s the thing:

Just because the market is “expensive” or there’s profit-taking doesn’t mean we blindly short the markets because it could expose us to huge risk.

So, what now?

Well, this is where the break of structure comes into play.

Here’s what to look for:

- An uptrend approaching resistance which can be seen on the higher timeframe (you want the resistance area to attract attention from the sellers on the higher timeframe)

- The price fails to make a higher high but instead, made a lower high (this gives us a reference point to set our stop loss)

- Go short on the break of swing low or support

(And vice versa for a long trade)

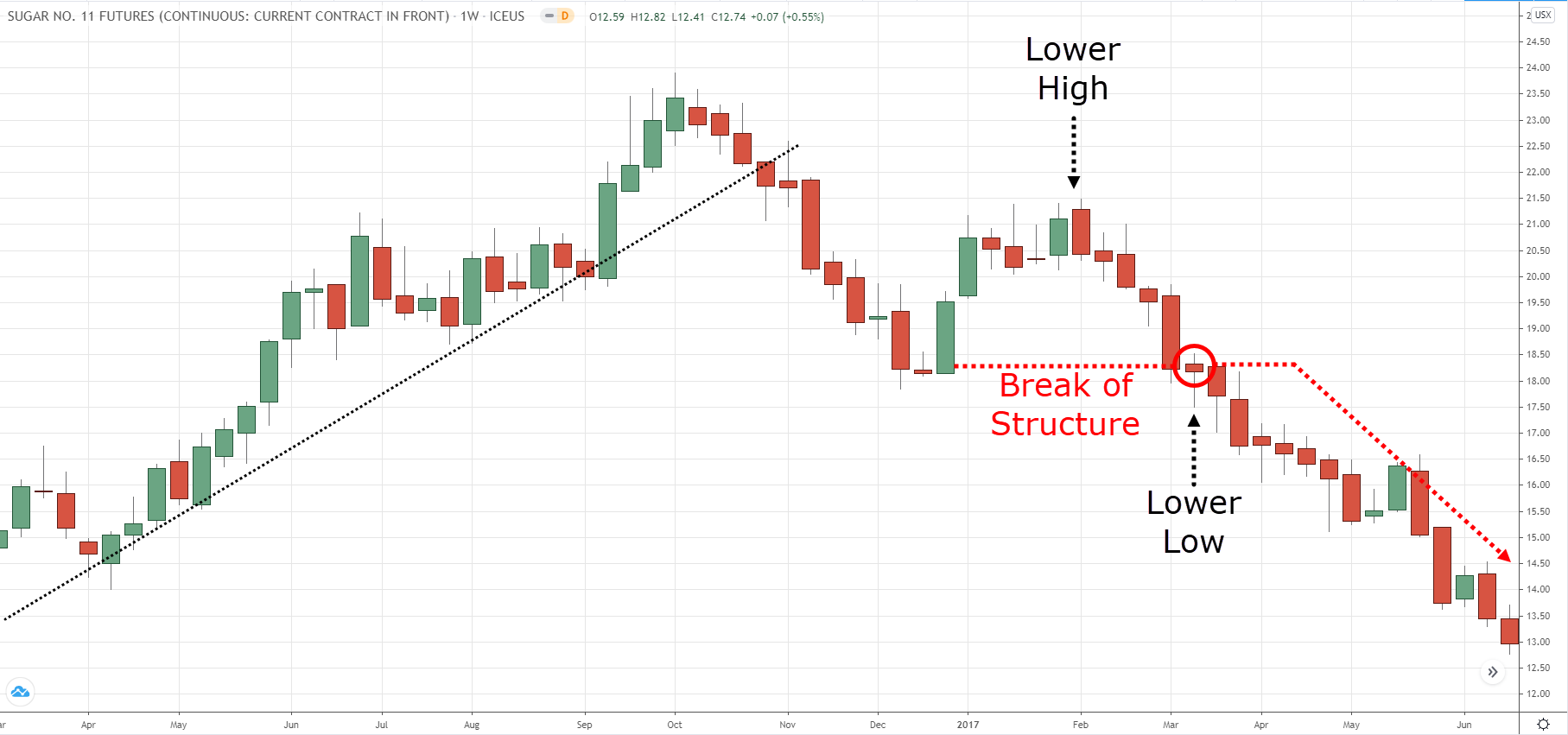

Here’s an example of one of the Forex price action patterns (break of structure):

Pro Tip:

On the trending move, you want the range of the candles to get smaller to signal that the buyers are getting weak.

And on the retracement move, you want the range of the candles to get larger to signal that the sellers are stepping in.

If you want to learn more about trending and retracement moves, then go read The Complete Guide to Candlestick Chart.

Price action pattern #3: Breakout with a buildup

The breakout with a buildup is a price action pattern which helps you identify high probability breakouts.

Here’s the idea behind it…

Imagine, the price rallies into resistance and then starts to consolidate.

Bearish traders will short the market because the price is at resistance (as that’s what most textbooks would teach you).

So, they go short and set their stop loss above the highs of resistance.

Now, as the market consolidates longer, more traders will go short—which means more buy stop orders (stop loss from short traders) will accumulate above the highs of resistance.

At this point, you have two things going in for you if you were to buy a breakout of resistance.

- If the price breaks above resistance, the cluster of buy stop orders will fuel more buying pressure (as short traders scramble to exit their trade)

- You can reference the lows of the consolidate to set a tighter stop loss (which offers favorable risk to reward on your trade)

Make sense?

Then here’s how to spot the breakout with a buildup…

- The market is in a range for at least 80 candles or more (the longer the market ranges, the harder it breaks)

- The price forms a buildup (or consolidation) at resistance (the tighter the range of the candles, the better)

- The 20-Period Moving Average rises to touch the lows of the buildup (a signal that the market is ready to make a move)

- Go long when the price breaks above resistance

(And vice versa for a short trade)

Here’s an example:

Moving on…

Price action pattern #4: First pullback

The first pullback is a trend continuation price action pattern that allows you to capture the “meat” of the trend.

Here’s why it works…

Imagine, the price breaks above resistance with big bullish candles.

For the early buyers, some of them will book their profits which puts a little selling pressure in the market (and the price stalls).

When this happens, counter-trend traders will think the market is “too high” and about to reverse lower, so they go short and have their stop loss above the swing high.

Now if the market collapses lower, then counter-trend traders will make a profit.

But if the trend continues higher, the cluster of stop loss above the swing high (from counter-trend traders) gets triggered which exerts buying pressure.

That’s not all, because traders who missed the earlier breakout will want to get a piece of the action, so they’ll buy the breakout of the swing high (which adds more fuel to the rally).

So if you’re reading this now, then you want to be the astute trader who buys the breakout of the swing high so you can capture the next burst of momentum.

So, here’s what to look for…

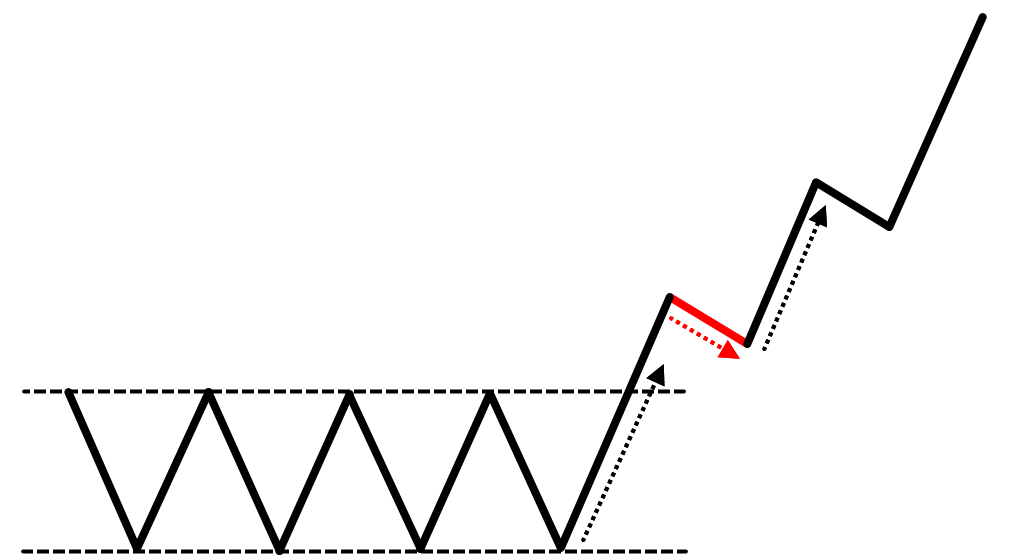

- The market broke out of resistance area and makes the first pullback

- On the pullback, the range of the candles are smaller compared to the breakout move

- The 20-period Moving Average has caught up with the price (touching the low of the pullback)

- Go long when the price breaks above the swing high

(And vice versa for a short trade)

Here’s what I mean…

Next…

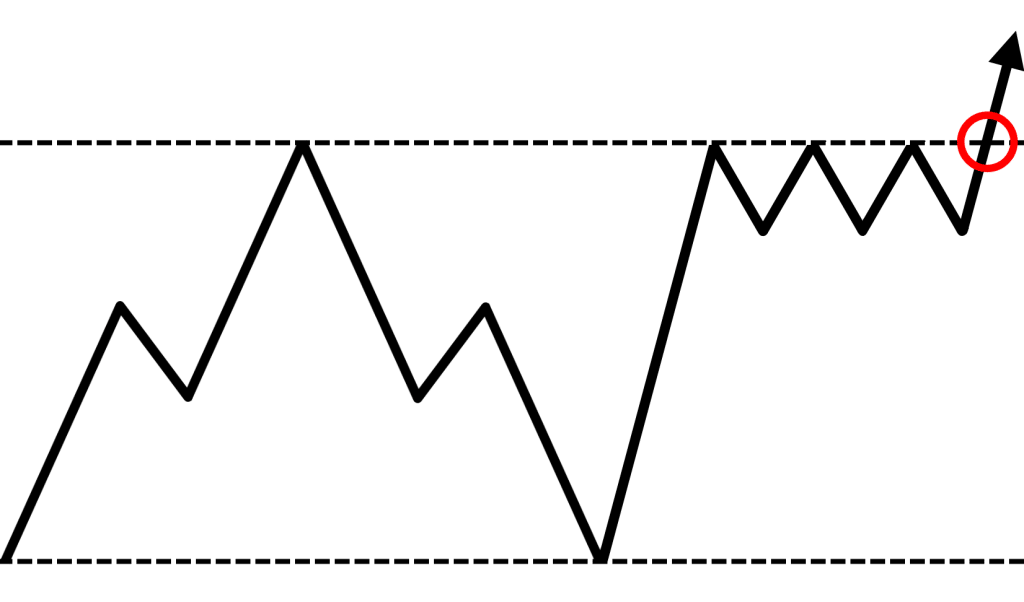

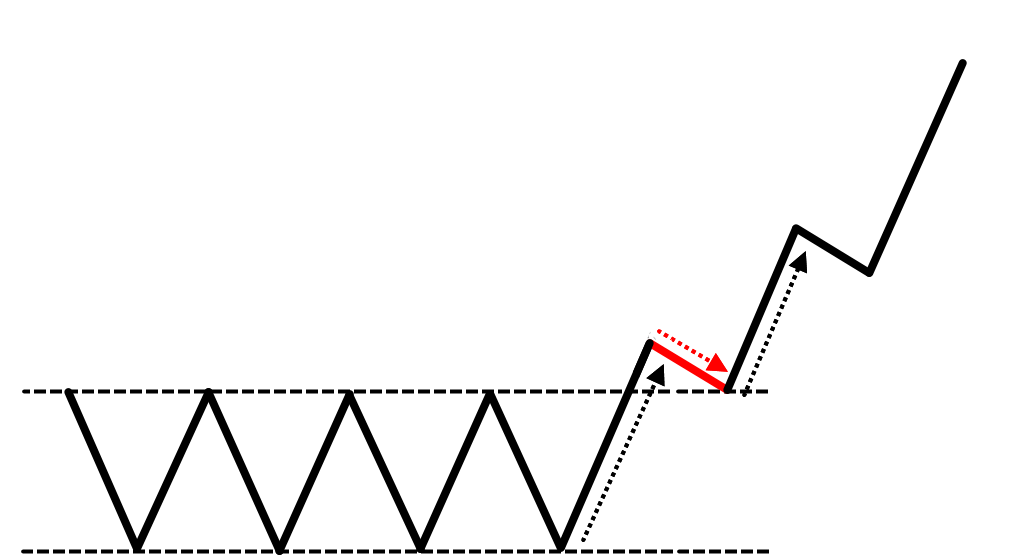

Price action pattern #5: Break and re-test

The break and re-test is a trend continuation price action pattern which allows you to hop onto an existing trend, with low risk.

Here’s why it works…

When the price hits resistance, there will be bearish traders who will short the market.

Now if the price breaks above resistance, this group of short traders will be in the red and the smart ones will immediately cut their loss.

However, the stubborn ones will hold onto the trade and pray for the market returns back to their entry price.

If that happens, they will exit their trade at breakeven which puts buying pressure in the market (as they need to buy to cover their short position).

With this in mind, you can look for buying opportunities at previous resistance which could become support—so you can get a low-risk entry into the existing trend.

Here’s what to look for:

- The market broke out of resistance and makes a pullback towards the breakout level (where previous resistance could become support)

- The price re-test the breakout level and forms a bullish candlestick pattern (like a hammer, bullish engulfing, etc.)

- Go long on the open of the next candle

(And vice versa for a short trade.)

Here’s an example:

At this point:

You’ve discovered 5 powerful price action patterns that work and how to trade them step by step.

But, if you want to find the highest probability price action pattern, then you must consider the context of the market and that’s what I’ll cover next…

Trade near the higher timeframe area of value, not far from it

I know this sounds confusing, so let me explain with a few charts.

Look at the chart of Nasdaq below:

Nasdaq (Daily) is in an uptrend and the area of value is around the 20-day Moving Average where it has bounced off multiple times.

At this point, the price is a distance away from the 20-day Moving Average. So, if you were to have a false break setup on a lower timeframe (like 4-hour) to go long, you want to avoid it.

An example:

Now you’re probably wondering:

“Why is that?”

Simple.

Because this market tends to retrace towards the 20-day Moving Average (the area of value), and it could do so again and reverse higher from there.

So, a much better setup would be for the false break setup (on the 4-hour timeframe) to coincide with the 20-day Moving Average as you have the area of value on the higher timeframe working in your favour—not against it.

Cool?

Price structure confluence: How to find low risk and high reward trading setups (95% of traders miss this out)

Here’s a pop quiz for you, which of these 2 events is more significant?

- Your wife’s birthday

- Your wife’s birthday which coincides with Christmas—and also happens to be your wedding anniversary

You’d go with #2, right?

Because there are multiple “events” coming together and that attracts more attention—which makes that day even more special!

Now, you’re probably wondering:

“What has this got to do with price action trading patterns?”

Well, the concept is the same!

When you trade from an area of value that coincides with a higher timeframe support/resistance, it makes it even more “powerful”.

Want an example?

Great. Here you go…

Here’s a chart of EUR/NZD on the 8-hour timeframe:

Now you’re probably thinking…

“Who in the right mind wants to be buying right now?”

Well, if this is the only chart I have, then I won’t be interested to buy either.

But, if you realize the 1.7700 area is a support area on the weekly timeframe, then it changes everything.

Here’s what I mean…

As you can see, the weekly timeframe is in an uptrend and the 1.7700 is an area where previous resistance could become support.

What you saw earlier on the 8-hour timeframe is a false break price action pattern which offers you a low-risk entry to hop on board the weekly trend.

If the price re-tests the swing high on the weekly timeframe (around 1.9900), that’s a potential 2200 pips move.

Can you see how powerful this is?

Conclusion

So here’s what you’ve learned today:

- False break is a reversal price action pattern which allows you to buy low and sell high

- Break of structure is a reversal price action pattern which allows you to enter the start of a new trend (with low risk)

- Breakout with a buildup helps you identify high probability breakout trades

- First pullback is a price action pattern that allows you to capture the “meat” of the trend

- Break and re-test allows you to hop onto an existing trend with low risk

- The best trading setups lean against the higher timeframe area of value (like support & resistance, moving average, trendline, etc.)

Now here’s what I’d like to know…

Which is your favorite price action pattern and why?

Leave a comment below and share your thoughts with me.

Very nicely written and very useful practical stuff, thanks Rayner

You’re most welcome, Prakash!

Hiiiiiiì

Hey hey!

False breakout topic is my favorite because new trading setup I know this day

Thanks for sharing!

Break and retest is the one I prefer most. Because I give me confirmation that the price is good to continue, especially wen d retest candles are reversal candles or indicision candle.

Thank you for sharing!

Breakout with a buildup. It’s easy to recognize and has a very high probability of success. There are two ways of trading it. You can either a) enter after a breakout or b) you can enter at the bottom of the buildup. Method b) has the advantage that you can set a fairly small stop loss, but it might be a while before the breakout occurs and anything (sudden news) might happen over that time. Method a) has the advantage that your money is not in the trade until the breakout actually occurs, so you are less exposed to sudden news.

Thank you for sharing, Geoff!

Very informative, Thanks!

Anytime!

Thank you for sharing very usefull especially for beginners they do lot of mistakes and they can learn from this…

Once again thank you

You’re most welcome!

Bro, excellent stuff. Learned a lot. Keep it up.

Many thanks!

That build up strategy is very nice!

Because it has very easy recognisation 1st have resistance than price should spend time their and then it will break than take entry.

I am definetely going to try this strategy , if you have more content on build up strategy than pls send.

Awesome, let me know how it works out for you!

Honestly you make this science simple to learn it , and how it works is the amazing part .

Thank you, Mahmoud!

Thanks . Keep Up

You are welcome, Mahmoud!

You are my GURU…You are my MENTOR….I am always learning great things from u…..You are the best…..

You are awesome, Rajesh!

You are amazing. I read all ur article that u send me and they are really improving my trading. Thanks raynor. Love u bro.

Thank you, Deepak!

beautiful.. these entries are getting me paid and increasing my income… i can easily see them thanks to rayner..

Awesome, Luzige!

great content, but i cat afford your book so i will buy it latter and very soon…i hope i will find more advance concept in PA secrets book.

Thanking you for today’s teaching. all the patterns can be use base on market structure.

Great learning

Thank you, Prakash!

Very Precisely explained patterns in a simple language… grateful for the new knowledge learnt from your experiences.. Thank you Rayner..!

Extremely well explained with examples. I really learned a lot!!!

It’s our pleasure to help you, Radhi.

You may check this link to our Academy if you wanna learn more. Don’t worry, it is free!

https://www.tradingwithrayner.com/academy/

nice

Thank you, Satyam!

Dear Mr Rayner Teo.

Your teaching explanation is very nice. I don’t have words for you. Really I am very much impressed. Keep it up.

May God bless you!

Hi, Sunil!

Thank you for your feedback! I am glad that you are really satisfied with Rayner’s blogs and teaching materials.

Cheers!