Forget what you’ve learned. The Pinbar trading strategy isn’t what you think.

To tell you the truth:

I once believed the Pinbar trading strategy was the “holy grail” of trading.

All I needed to do was, spot this trading setup, enter the break of the Pinbar, set your stops, and make consistent profits every month.

I thought to myself…

“How difficult can this be?”

So, I started looking through the charts for a Pinbar. On the daily, 4-hour, and 1 hour and even 5 minutes timeframe.

The outcome?

I got nowhere, really. Sometimes I won, sometimes I lost. The bottom line is, I didn’t know what the heck I was doing. And it’s not until I learned how to read the price action of the markets, that everything started to make sense to me.

Now, if you are trading Pinbars and not getting the results you want, then today’s post is for you.

Because you’ll learn:

- What does a Pinbar candlestick really mean

- Three biggest mistakes you must avoid with the Pinbar trading strategy

- How to improve your odds when trading the Pinbar

- A Pinbar trading strategy that works

Are you ready?

Then let’s get started.

What does a pinbar candlestick really mean

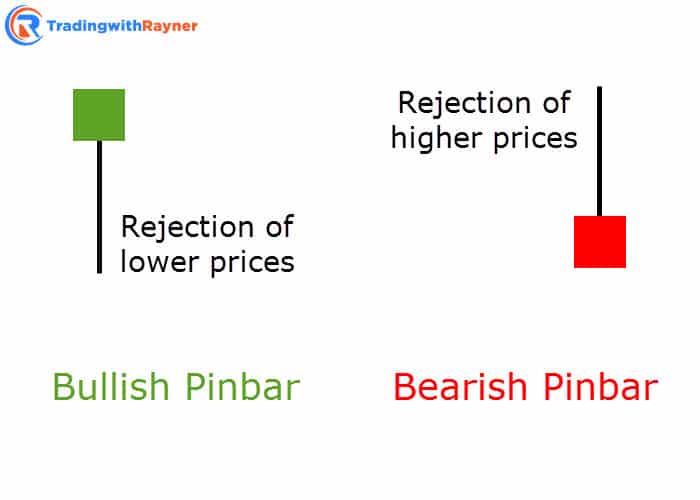

A bullish Pinbar shows rejection of lower prices. The lower wick of the pin bar candle shows the bears were in control earlier but was eventually overcome by the bulls.

A bearish Pinbar shows rejection of higher prices. The upper wick shows the bulls were in control earlier but was eventually overcome by the bears.

Here’s how the bullish pin bar and bearish pin bar look like:

The Pinbar is usually a retracement on the lower timeframe.

An example of the bullish pin bar:

If you’re trading the Pinbar by itself, then what you’re doing is trading against the trend on the lower timeframe.

Now, I’m not saying the Pinbar trading strategy doesn’t work. But you need other factors of confluence to make this work out (more on this later).

Three biggest mistakes you must avoid with the Pinbar trading strategy

Mistake #1 – Assuming the market will reverse because of a Pinbar

Look:

An uptrend will not reverse just because there’s a bearish Pinbar on the chart. It takes much more than a single candlestick to reverse a trend.

Heck, even a major news release has difficulty reversing a trend, what more of a Pinbar?

So…

If you spot a Pinbar against the trend, watch what happens next. The odds are the trend will continue.

An example of the trend continuing even as there is a pin bar candlestick in each instance:

Mistake #2 – Giving too much attention to the Pinbar

Earlier, you’ve learned the Pinbar represents price rejection.

But here’s the thing…

Price rejection can come in different forms (and patterns). If you focus only on the Pinbar, then you’ll miss lots of trading opportunities.

My point is… stop memorize chart patterns.

Instead, learn to read the price action of the markets. An invaluable skill that lets you better time your entries and exits.

Once you’ve learned it, you’ll never need to memorize another pattern again.

Mistake #3 – Treating all Pinbars equally

Here’s the deal:

What happens before the Pinbar is more important than the pattern itself. Because it tells you who’s in control and whether the price rejection is significant or not.

Let me explain…

If you see strong momentum followed by a small bearish Pinbar, it’s likely to be a pause (as the bulls are in control).

And if you see weak momentum followed by a huge bearish Pinbar, it’s likely to be a reversal (since the preceding price action tells you the bulls are getting weak).

Does it make sense?

So… don’t treat all Pinbars the same because they’re not. Remember, the bigger the Pinbar (relative to prior candles), the stronger the price rejection.

How to improve your odds when trading the Pinbar

Here’s how…

- Trading with the trend

- Trading from an area of value

- Wait for break of structure (on the lower timeframe)

- Trade Pinbars with 1.5 times the average true range (ATR)

Let me explain…

Trading with the trend

This is the easiest way to turn a losing strategy into a winning one.

By trading with the trend:

- You do not require precise entry to make a profit

- You have better odds for the trade to work out

- You have a greater profit potential as the impulse move is stronger

An example:

And if you want to learn how to identify trends objectively, go watch this training video below:

As Jack Schwager said: “A mistake made by many traders is that they become so involved in trying to catch the minor market swings that they miss the major price moves.”

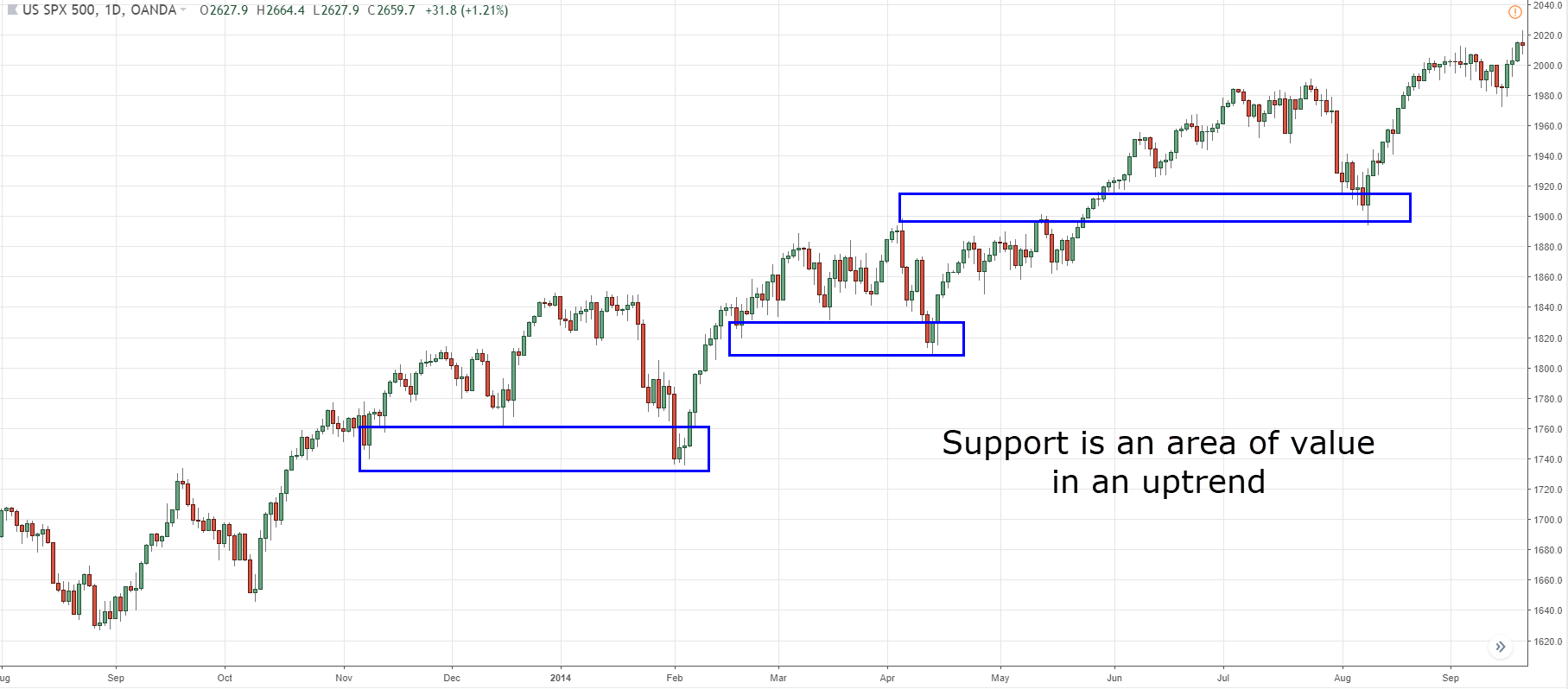

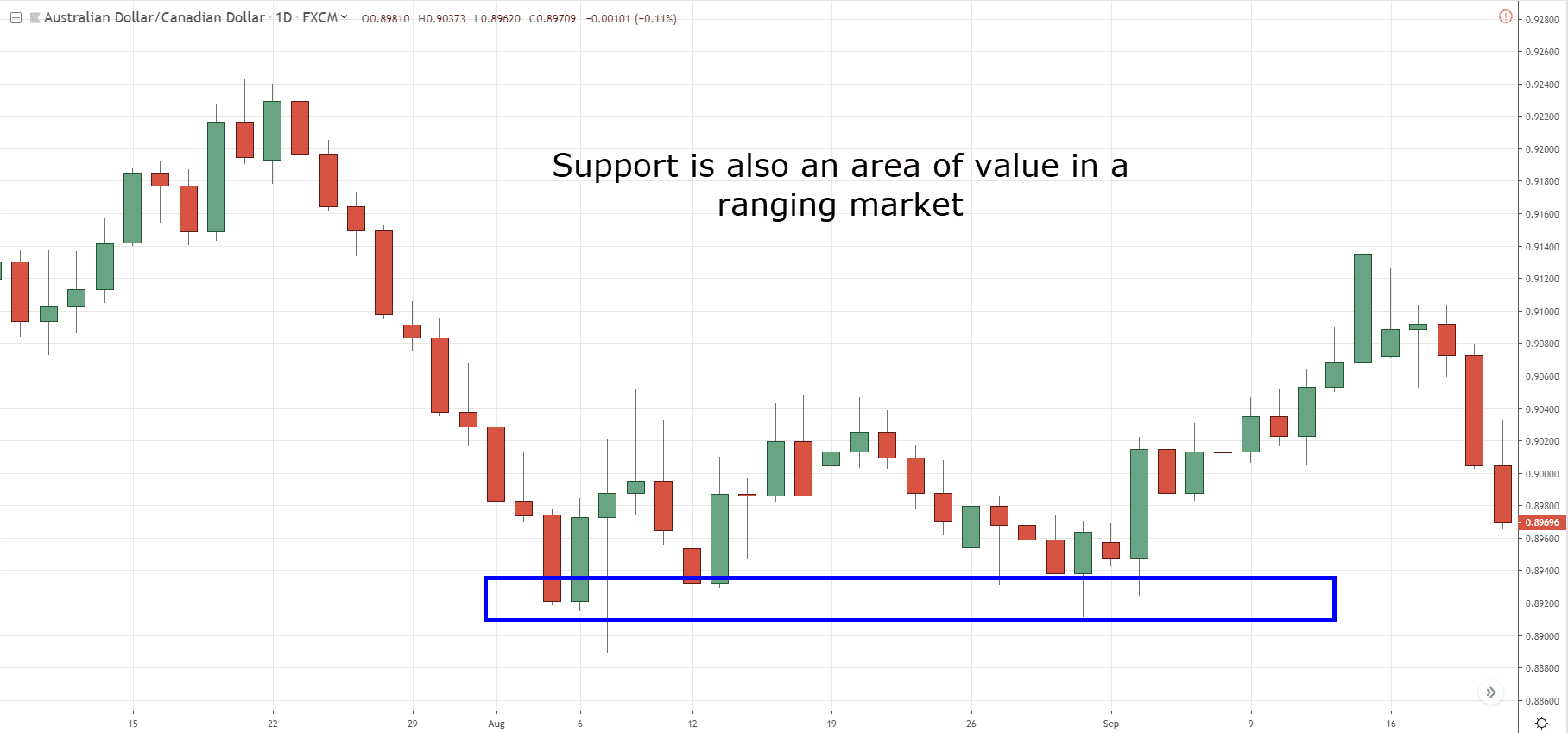

Trading from an area of value

If you’re buying groceries, you know how much you’re willing to pay based on your past experiences. Anything above value, you’ll not buy it.

But in trading… how do you identify value?

This is when Support and Resistance (SR) can help you.

Support – An area with potential buying pressure to push price higher (area of value in an uptrend)

Resistance – An area with potential selling pressure to push price lower (area of value in a downtrend)

Here’s what I mean…

And resistance is just an opposite of support.

(Let’s focus on trending markets for this guide.)

Some benefits of trading at support & resistance (SR) are:

- You are trading from an area of value

- It tells you when you’re wrong

- It improves your winning rate

- It improves your risk to reward

If you want to learn how to trade with Support and Resistance, then go watch this training below:

Next, you’re going to learn something powerful…

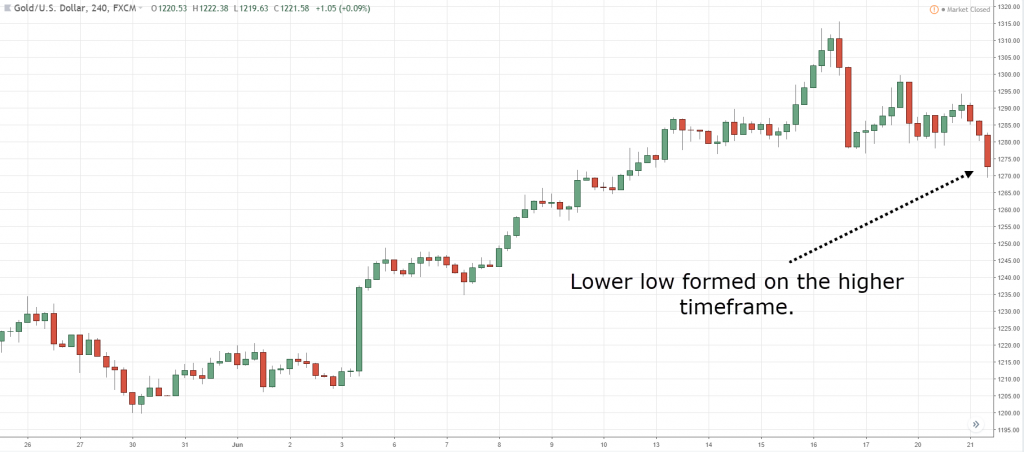

Wait for a break of structure (on the lower timeframe)

Recall:

You can have a bullish Pinbar that is a retracement against the trend (on the lower time frame). And this results in a low probability trade.

So, here’s what you can do:

If you spot a bullish Pinbar, then wait for a higher high to form (on the lower timeframe).

If you spot a bearish Pinbar, wait for a lower low to form (on the lower timeframe).

An example:

By waiting for a break of structure on the lower timeframe (in this case a lower high and lower low), you’re waiting for the price to confirm that sellers are in control before taking a short position. And this increases the odds of the Pinbar working out.

Next…

Trade Pinbars with 1.5 times the average true range (ATR)

Earlier, you’ve learned that the larger the Pinbar relative to prior candles, the stronger the price rejection.

Now, you’re probably wondering:

“But Rayner, how do I define what is large”

You can measure the range of the Pinbar against the average true range (ATR) of the market.

If the range of the Pinbar is at least 1.5 times the ATR, then it’s considered large.

Here’s what I mean:

This bullish pin bar’s range here is $30 which is more than 1.5 times the ATR.

So if you get a Pinbar at least 1.5 times the ATR, then it’s telling you there’s conviction behind the move.

A Pinbar trading strategy that works

Now:

Let’s put what you’ve learned and developed a Pinbar trading strategy.

You’ll need to answer these 5 questions:

- What are the conditions of your trading setup?

- How will you enter your trade?

- Where is your stop loss?

- Where is your profit target?

- How will you manage the trade?

The Pinbar trading strategy

If 200ma is pointing higher and the price is above it, then it’s an uptrend (defining the trend).

If it’s an uptrend, then wait for the price to come to your area of value (it could be SR or dynamic SR).

If the price comes to an area of value, then go long when you see a bullish Pinbar (or price rejection).

If you’re long, then place a stop loss below the low of Pinbar.

If the price goes in your favor, then take profits at the nearest swing high.

Here are a few examples…

Bearish pin bar losing trade at (AUD/USD):

Bullish pin bar losing trade at (GBP/CAD):

Bearish pin bar winning trade at (GBP/CAD):

Bearish pin bar winning trade at (CAD/JPY):

If you want more Pinbar training and examples, go watch this video below:

Important considerations:

- Which are the trending markets for you to trade

- What is the timeframe you’re trading

- How much will you risk per trade

- How will you exit your winning trades

- How do you identify which Pinbars to trade and which to avoid

- How do you define price rejection

These are important questions you must ask yourself — and there’s no right or wrong because we have different personality and risk tolerance.

Ultimately, you must find something that suits you best.

Here’s a tip for you:

In strong trending markets, the price is unlikely to pullback towards SR. Thus, you can look to trade from the moving average.

Frequently asked questions

#1: I often see you placing your profit target at the previous swing points in this post, doesn’t this contradict with your philosophy of “letting your winners run” to ride massive trends?

I have different trading philosophies, one of them is to ride a trend, while the other is, if I were to capture a swing, then I’ll exit at a point before opposing pressure sets in.

I’m not just a trend follower. I also adopt different trading philosophies and principles, depending on the trading strategy that I’m trading.

#2: Can you explain more on how the break of structure on the lower timeframe work for a bullish pinbar?

Let’s say you identify a bullish pinbar on the daily timeframe. So on the 4-hour timeframe, what you’ll be looking for is a series of higher highs and higher lows after the bullish pin bar forms. And when price breaks above the resistance of these highs, that’s where you’ll be looking to buy.

#3: Where can I learn more about the other candlestick patterns?

You can refer to my Monster Guide to Candlestick Patterns. Alternatively, you can check out the modules in the TradingwithRayner Academy to discover more.

A quick recap…

Here’s what you’ve learned today:

- A Pinbar is usually a retracement (on the lower timeframe)

- Don’t assume the markets will reverse because of a Pinbar

- Focus on the price action, not price pattern

- Pinbars are not created equal

- You can increase your win rate by trading with the trend, trading from an area of value, and waiting for a structure break (on the lower timeframe)

- A Pinbar trading strategy that works

Now, here’s a question for you…

What are some of the things you look for when trading the Pinbar?

Leave a comment below and let me know.

Excelent videos you explain everything in a nut shell

Rayner,

Thank you so much for teaching great and practical stuff that is easy to understand and apply. These will definitely increase one’s winning rate.

Hey Joe,

Glad to hear that. Keep it going bud!

Glad to hear that, Antonio!

Thanks for sharing the details of this strategy, Rayner. I especially appreciate what you’re saying about avoiding pinbars that are retracements on a lower time frame – that’s a smart distinction and a good entry filter to add. For me, the most important thing is going with the long-term trend. I find that having this wind at your back can really help (as I’m sure you know).

Thanks again for the actionable tips.

Hi Jay,

You’re most welcome. yes, the long term trend is definitely something to trade with!

In mistake #3 you put the same chart for both examples

Hi Marco,

Thanks for pointing out. I’ve edited it.

Thank you Rayner. This is very helpful.

You’re welcome, Godfred 🙂

Tks again Rayner,

Great article. I don’t really get pin bars and have never really payed attention to them at all, let alone use them in my trading.

I don’t know if I will now, but tks to your article I understand more about them.

David

Hey David,

Glad to hear its helping.

Don’t hesitate to let me know if you’ve got any questions, I’ll be glad to help.

More excellent teaching with an appropriate EMPHASIS on rules and discipline. Keep up the good work.

Really enjoy your weekly videos.

Good job Rayner.

Thank you, Andante.

Don’t hesitate to let me know if there’s anything, I’ll be glad to help.

Excellent article Rayner. Enjoy your articles. Improves my understanding of technical aspect of price action.

Keep up the good work.

Hey Pankaj,

Real glad to hear that. Best!

Rayner, excellent read and video. You explain things so clearly and simply reflecting expertise and experience.

Always enjoy your work

Thanks

ken Sydney

Hi Ken,

Don’t mention it. Glad to be of help! 🙂

Hi Rayner,

Great article as always. In the definition of Bullish pinbar & beraish pinbar the images shown look like hammer & inverted hammer. Can we consider a hammer as pinbar aswell ( as both signal price rejection. Also apart from Support Resistance, in addition is there any other indicator which gives confirmation of a possible trend change .

Deepak

Hi Deepak,

I agree it looks similar to the hammer. In fact, I suggest taking into context of the markets you’re trading, irrespective of the candlestick patterns you’re trading.

Hi Rayner , Thank you posting all these educational videos for reatail trader like me .You have very simple presentation about the market .

Best regards

Mohammed

Hi Mohammed,

Don’t mention it. Glad you found it useful!

Hi rayner

Thank you these lessons are very usefull

I learned from these videos

Thank you

Hi Mahmoud,

I’m glad to hear that. Don’t hesitate to let me know if you’ve got any questions, I’ll be glad to help.

Hi Rayner, thanks for the lesson on pin bars, really good.

Glad to hear that, Mav!

R:R has been a real pain in my trading because i was too excited when trading but after viewing your vedio a couple of times i made some serious reflection on my previous trading and i hope to make it a point to fpllow your advice seriously from now on.

Awesome Muton.

Do keep me updated on your progress.

Hi Rayner,

Thank you for this Lesson. Very helpful to keep reminding our self this knowledge.

You’re welcome, Thushani.

cheers

Can you plz send me you email ID because I want to discuss something . Cheers

You can contact me from the link above, cheers

can this be used to scalp the futures mkt?

the concept and principle can be applied to it

Rayner, you always advocate letting your winners run and getting into the big trends etc but then often I see you placing your TP at the previous swing point, this seems like a major contradiction to your philosophy, or are you just taking partial profit?

I have 2 trading approach, Trend Following and swing trading.

For Trend Following, I ride my entire position.

For swing trading, I tend a portion off at swing high/lows areas.

Dear Rayner,

This is the part that i’ve got confused “Wait for a break of structure (on the lower timeframe)”

Can you explain furthermore details about this part brother?

Hi Eddie

For a bullish pinbar on a higher timeframe, the lower timeframe will show a series of lower highs and lows.

What you’re looking for is for the price to break higher and form higher highs and lows (on the lower timeframe).

Hello Rayner ,

Very nice and informative article . Kindly make video on these type of set ups so it would more clear . Thank you

I’ll look into it bud. cheers

Absolutely great education Rayner, thanks. Appreciate your efforts to enhance

our trading experiences.

You’re welcome, Phil. Glad to hear that!

Great training!, what about in major trading ranges?Daily or weekly basis? These areas can last weeks or months and are often tradable events when recognized.

Sure, you can use those levels as part of your trading plan.

Thanks my friend,really open my opinion about trade the pinbar,ur vedeo are simple yet lot of knowledge I can gain from it,one more thanks my friend ur really help retail trader like me..

You’re welcome, Kudo.

Glad to be of help 🙂

Thank you Rayner

You’re welcome, Roy!

Thank you Sir Rayner. Very informative.

Bernard

Welcome!

Hi Rayner

I’m from Zimbabwe yes i try by all means to understand the candlesticks but hey my thick skull is not getting it can you please help me i’ve downloaded your book trying to read it.

This will help… https://www.tradingwithrayner.com/candlestick-patterns/

I didn’t understand the part where you showed charts with labels stating winning trades and losing trades. Can you elaborate what you mean by those? and where did you enter? What does those boxes refer to? and how can that be a losing or winning trade?

The blue box is where the entry trigger occurred.

The arrow is the level to take profits.

Huh? Then why is it on the left of the box (the entry part) ? Isn’t it supposed to be on the right?

Because I’m explaining where I’m looking for possible targets, which is on the left side (the swing low).

Hey Rayner,

How do we know which stock is going to form pinbar, how to sort the stock for the next day for pinbar strategy.

Just look through the charts after the market has closed and you can manually hunt for these price patterns.

The location of pin bar is fundamental issue.

I like to enter 75 % retracement of a pin on interesy ING area. It gives very good RR at least 1:4. Disadvantage is fact that we will miss some movements.

Thanks for sharing!

hello, thx for this strategy

i need to know if 200MA is suitable equally on both 4h and 5min chart?

before i was considering 50-50MA on 5min

Any suggestion please

The concept can be applied the same.

Hello Rayner. Thanks for the blog. I just want some clarification. Please what type of Moving Average do you refer to when identifying a trend? Is it the Exponential Moving Average? Or Simple Moving Average? Or another?

It doesn’t matter what type of MA calculation you use, the concept is what matters not the settings.

I generally use the 200ma to define the trend, whether it’s sma, ema, wma, is not important — the concept is.

In an example you gave

Trade pinbar with 1.5times the Atr

In the chart the art value is at 15.0000 how do you know its ATR value is 15 dollars

Secondly, how did you calculate the pinbar range to be 30dollars

You said putting your stop loss below the low of the pinbar

Isnt that a tight stop loss because you said you should put your stop loss where market structure invalidate not at very obvious levels

I wrote this article some time ago. I would set it 1 ATR below the low of the candle now.

Lower time frame means which time frame is suitable ? Can you tell me sir

Does your identifying a trend work with the 50 EMA instead of using the 100 EMA?

Hey Chris,

It depends on the kind of trend you are looking out for.

Check out this post.

https://www.tradingwithrayner.com/trend-trading-strategy/

Cheers.