Do you want to buy stocks that make monster moves?

But, not sure how to go about it.

Not to worry!

I’ve got you covered!

In this explosive guide, you will discover all there is to know about finding and trading a parabolic stock.

So here’s what you will learn:

- Gaining the Edge: Learn the vital insights that will set you apart in the trading arena.

- Cracking the Code: Detecting Parabolic Stocks – Where and What to Hunt For.

- Crafting Expertise: The common mistakes to avoid so that you can level up rapidly.

- The Final Step: Learn the correct ways to trade a parabolic stock.

Excited?

Well, let’s go!

What is a parabolic stock?

Simply put, a parabolic stock is a stock that makes a big move in a relatively short period.

In this article, I will focus more on stocks that make tradable parabolic moves over a slightly longer period…

…rather than those stocks that fizzle out as quickly as they ignite!

But before I get into the juicy details of the characteristics of a parabolic stock, as well as how you can identify and trade it, there is one really important thing you need to know…

Understand this and blaze past the competition

To be honest, if you are serious about entering the business of trading/investing in stocks that make parabolic moves, you need to understand this deeply:

Sometimes you will find stocks that take off like rockets…

But sometimes you will find duds…

…while the real parabolic stock moves away from you!

So, the first step is – to make your peace with regret and FOMO.

File them away – as a cost of doing the parabolic stock business!

If you can manage to do this, you will be way ahead of two kinds of people who often enter this business:

- Those who get caught up in regret of missing a parabolic stock, and give up thinking that it is impossible…

- Those who get caught up in FOMO, and EITHER chase stocks that are way above their ideal buying area,

OR buy any and every stock that comes in front of them, fearing that they will miss out on a move.

This leads to the second step…

Zen and the art of trading a parabolic stock

So, can you wait?

Do you have the patience to sit and do… nothing?

Or are your fingers itchy to push buy/sell as soon as the market opens?

Can you maintain a calm composure, when the stock you buy does nothing, while the stock you decided not to buy turns out to be the real parabolic stock?

These are not light questions, and you should spend some time honestly answering them.

Because there’s a lot of waiting for the best chart setup to come to you, letting the average ones go…

So having the qualities of patience and acceptance will give you a huge edge over the majority.

Now,

I’ve told you about the psychological aspect, but there’s something more…

…there are thousands of stocks in the market, and any one of them is likely to make a big move.

But which stocks should you focus on?

If you want to increase the odds of finding a potential parabolic stock, you have to ensure you are looking in the right places and for the right characteristics…

Where and what to look for in a parabolic stock

Here are some tips to help you separate the wheat from the chaff…

1. Look for stocks making a huge move on heavy volume

Usually, a parabolic stock move is kicked off by a gap-up and a huge single-day gain in the price of 10% or more – with very heavy volume on the day.

This big gain in the price may be due to an earnings announcement, or any other story about the stock that is perceived to be game-changing for the business.

It is therefore really important to assess the quality of the story.

I know, I know… It’s kind of subjective, but it is a skill that you will develop over time.

One trick to assess the reliability of the story is to wait and see whether the price sustains, or quickly gives up its gains.

You should be monitoring the top gainers every day and check whether there is a compelling story behind them – or not!

If you think the story is worth your consideration, you can add the stock to your watchlist and monitor it to see whether the price sustains or fizzles out.

The top gainers each week can be found very easily on many sites like Tradingview or Finviz.

Have a look at this example…

Carvana Daily Chart:

As you see in this chart, there was a huge gap in price in response to earnings, on very heavy volume.

If you were still unsure and wanted to wait, you would see how the price sustained its gains – by consolidating sideways and then breaking out.

A beautiful 500% move followed in just under 3 months…? *chef’s kiss*

This brings me to the second point…

2. Focus on stocks that are making new highs

To increase your odds of finding a parabolic stock, direct your focus toward stocks that are making new 3-month, 52-week, or All-time highs after emerging from a consolidation/base.

Here’s a common-sense statement that holds a lot of wisdom if you think deeply about it:

The best way to find stocks that will go up is to look at the stocks that are going up.

A stock making new highs after emerging from a consolidation is a sign of strength and you should pay more attention to it!

It’s much better than a stock that is down 50% and looks like a cheap bargain.

Take a look at this example…

Super Micro Computer Daily Chart:

Do you see how the stock made a new 52-week high after consolidating and then had a superb 190% move in roughly 3.5 months?

Also, notice – that the move was kicked off by a huge one-day move of 28% on heavy volume.

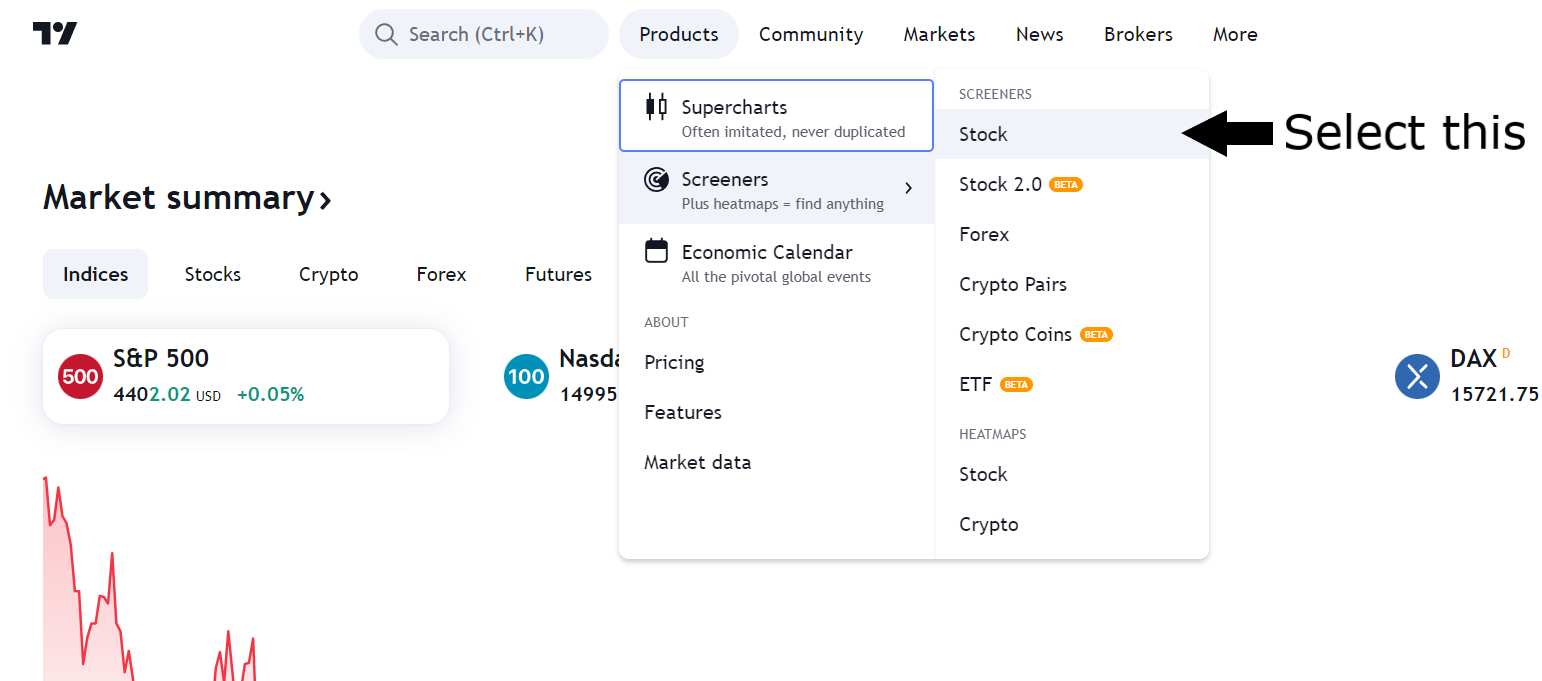

You can easily find such stocks by using the Tradingview screener tool.

Here’s how…

Note: I think it is important to reiterate that you must focus on stocks making new highs from a consolidation period…

Focus on fresh breakouts…

Also, you must avoid stocks that have already moved up significantly after breaking out from their consolidation.

So now onto the third point to look at…

3. Sister stock strength

If you see several stocks from the same sector/industry on the new-highs list or the top-gainers list, it’s probably no coincidence!

It could be a sign that there is a big demand for the sector as a whole.

This means institutions are likely moving their money into that sector…

…and you should be closely monitoring stocks from there as well!

Further, if there is any factor/news that positively impacts the sector as a whole then it is serious icing on the cake!

So you should pay close attention to stocks from those sectors, too.

And yet another way to utilize sector confluence…

If you find a stock that is making new highs, but it belongs to a sector that is struggling, you are better off focusing on another stock from a stronger sector.

Alright, so here is another point to check…

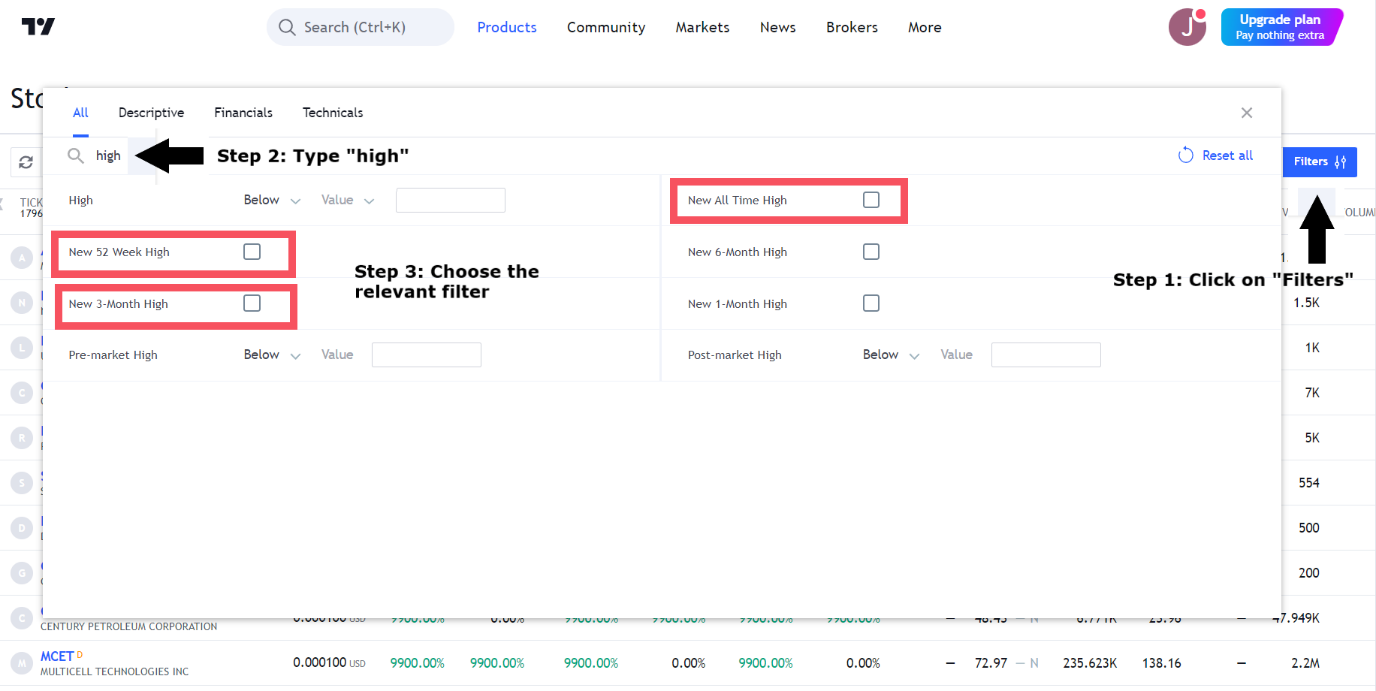

4. Which way are the stairs headed?

One important characteristic of a parabolic stock is that the price moves up in a stair-like manner.

The price moves up and then consolidates – not pulling back much – before making another move higher.

If a stock has to make a parabolic move, it is not going to do so in one flash of a move, OK?

It will move up, consolidate, drop out of the public’s eye, and then make another move higher.

That’s why you should always be monitoring those stocks that are consolidating within the context of a long-term uptrend.

Take a look at this example…

Tesla Daily Chart:

See how Tesla made a massive move in a stair-like manner?

Alright, so if I sum everything up for your quest to find a parabolic stock – here are the pointers you need to keep in mind:

- Keep an eye on the top-gainers every day. A parabolic stock move is usually kicked off by a huge move on heavy volume.

- Focus on stocks that are making new highs after emerging from a consolidation/base.

- Pay special attention if many stocks from the same sector start acting strong. Prioritize stocks that have sector confluence over those that don’t.

- Make sure the stock you pick is stair-stepping up in price.

Now that you know the right characteristics of a parabolic stock, let me also offer you some extra advice…

Make sure you don’t make these common mistakes

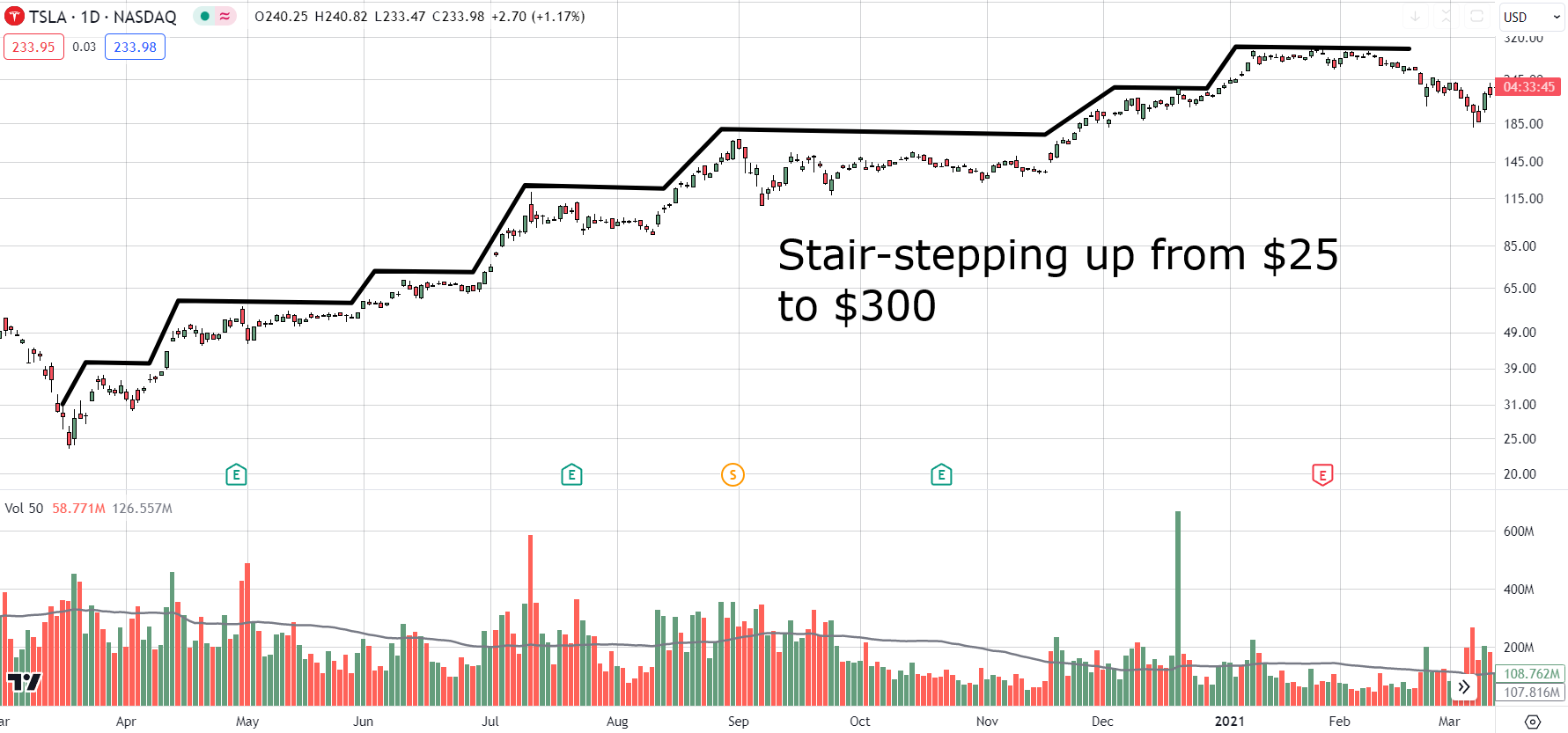

1. Which way are the stairs headed? Pt. 2

As mentioned, you should focus on stocks that are stair-stepping up.

But at the same time, you must also make sure to avoid stocks that are stair-stepping down!

It’s a mistake many people make, to be honest.

They get so fascinated by the story and news flow surrounding the stock – that they don’t check to see what the trend is!

So, remember that a stock that is stair-stepping down is likely to continue to do so.

Here’s an example…

Advance Auto Parts Daily Chart:

Do you see why it is not a good idea to buy stocks that are stair-stepping down?

Also, notice how the stairs got steeper as time progressed…

Scary, right!?

Another mistake often overlooked is…

2. Is the stock too extended?

Now, I know I’ve told you to focus on stocks that are making new highs, but if the stock has already made a significant advance from its consolidation area – it is not a good idea to buy it!

You might say that this is pretty common-sense advice, and I agree…

But it is all too common to get carried away by FOMO.

I mean, how many times have you bought without giving any consideration to the risk-reward relationship?

Exactly!

So, you must guard yourself against FOMO, only focusing on stocks that are making highs after freshly emerging from a consolidation…

AEHR Test Systems Daily Chart:

As you see in this pristine chart, the price had a great response to earnings, following which the price went into a consolidation.

Emerging from its consolidation period – the price made a new all-time high!

The ideal point to buy would be as soon as it broke out, somewhere between $8-$11 (blue shaded area).

If you had bought at the correct price, you would have experienced bullish bliss as the stock made a high of $27, right?

Even if you had trailed your stop-loss you could’ve gotten out with an amazing return within just 2 months!

But if you were late to buy and bought around $25… then isn’t it fair to say FOMO played a part?

This would have resulted in an unnecessary stoploss.

Also, it is okay if you want to wait for confirmation, but you must be aware of the fact that the more confirmation you wait for, the lower your reward-risk ratio gets.

One more trap not to fall into…

3. Are you going against the general market?

And here’s the thing,

If you want to catch a parabolic stock, you want to make sure there are as many factors in your favor as possible.

One important factor that determines stock returns is the general market condition.

If the general market is bearish, it is not the ideal environment for long trades.

Now, you can assess the general market conditions by checking what the major market indices like the S&P 500 are doing….

If they are in a structure of lower highs and lower lows, it is time to – sit out and wait!

That’s because in these markets, breakouts tend to fail and you will see your stop-losses getting hit very often…

S&P 500 Daily Chart:

As you see in this chart, when the index was in a structure of higher highs and higher lows, it would have been a great time to find and trade a parabolic stock…

But when the structure changed to one of lower highs and lower lows – time to hit the brakes and go easy on trading the long side!

Alternatively, you can also use something like a 50 SMA to assess the trend.

If the moving average is sloping up and the price is above it, it is a bullish environment.

Is it the other way around? – A bearish environment.

So,

Up until now, you’ve learned:

- The mindset required to trade a parabolic stock.

- Where to look and what to look for.

- The mistakes to avoid.

And now, for the grand finale…

Let me show you how you can trade a potential parabolic stock!

How to trade a parabolic stock

There are two ways in which you can go about applying what you’ve learned in this article.

Method 1: Trading the parabola

In this method, you simply buy a potential parabolic stock as it is emerging from its consolidation and breaking into new high ground.

Let me explain it to you in detail…

Chart timeframe:

Daily

Criteria for a stock to qualify:

- Stock has recently made a big move on heavy volume.

- There is game-changing news behind the big move, such as a great earnings report or perhaps a large order.

- Stock consolidates sideways on low volume, hardly giving up its gains. If you see volatility reduce while the price is consolidating – that is a bonus!

Entry:

Buy as the stock breaks out from the consolidation.

Stop-loss:

Below most recent swing low.

Taking Profits:

You can sell at a pre-determined reward-risk ratio of 1.5:1. 2:1 or 3:1.

But since you are looking for a parabolic stock, it is a great idea to try and ride the trend, even if it’s with a partial position.

This will help you to be a part of some monster moves!

You can ride a trend with the help of a 20 SMA.

Stay in the position as long as the price is above the moving average and exit when there is a close below the 20 SMA.

So, a combination of the above two techniques – where partial profits are booked at a certain RR ratio, and a certain portion is kept to ride the trend – is a good idea!

Let me give you an example of a trade…

Celsius Holdings Daily Chart:

In a positive response to earnings, the stock gapped up and had a huge single-day gain of 33% on very heavy volume.

(This is where the stock would’ve come up on your radar if you had been tracking the top gainers list.)

So, you dutifully added the stock to your watchlist and saw that it climbed for a few more days before going into a long consolidation…

Let’s face it – the consolidation period would have tested your patience!

But, if you managed to stay put, you would have seen how beautifully the volatility contracted as the consolidation progressed, right?

And finally, the price broke out after a long time of waiting…

This is where you would need to be quick and enter a position!

If you had waited until the end of the day to buy, the price would have moved 19% from the breakout point of $26.80.

So remember, more confirmation equals less reward.

No doubt about it – the price had a stellar move.

If you had used the 20 SMA exit technique, you would have cashed out of the trade with a cool 100% return in 2.5 months.

Pretty sweet, no?

Well, that was one method, but because you are my good friend, I will tell you another one!

Method 2: The magical watchlist

Maybe you already have a strategy that you use to take long trades.

Or maybe you take swing trades that last only 3-5 days.

And in that case, having a watchlist of potential parabolic stocks that look very strong is a great idea!

Why?

Well, think about it…

Your trading performance will only be as good as the stocks that you track.

So if you look for long trades in stocks that have the potential to make a parabolic move, you are putting yourself in a very promising place.

And if you maintain and regularly look for long trades in a watchlist of potential parabolic stocks, you will greatly increase the odds of your long trades working!

Not to mention finding a greater magnitude move while you’re at it!

I know the second method looks basic – but it can work wonders for your trading…

…and with that, let’s quickly recap all that you learned!

Conclusion

In this article, you learned:

- The psychological edge that will put you ahead of the majority.

- The essential traits of a parabolic stock.

- The common slip-ups to watch out for.

- 2 superb methods to trade a parabolic stock.

Now,

Are you ready to embark on your journey of navigating and trading parabolic stocks with confidence?

How will you blend what you’ve learned today with your existing style of trading?

Tell me in the comments – I’m eager to know!

Thanks for reading!

Disclaimer: The contents of this article are for educational purposes only. They are not to be constituted as financial advice.

Nice information thank sir

No worries, Kiran!

indeed a very practical and resourceful article. learned alot. Thanks

You’re welcome, Farhan!

Very insight into parabolic stock trading. A great way to compound 20-30% return annually.

Yes, Indeed Robert!

Thank you Rayner.But Contrary to buying breakouts in an uptrend, i like to see a nice clean downtrend constantly making new lows for extended periods of time and then start to range, and I’ll be looking to buy the breakouts of the range and ride the new uptrend to where the downtrend started. I buy breakouts in a downtrend not in an uptrend.Hope that makes sense?

If it does and you would give a stock selection lesson that fit my method, I’ll be grateful. Cheers to tradingwithrayner.com

Thank you for sharing your insights and trading method, Mohammed!

Cheers!