Have you traded for less than 1 year?

Then Forex Trading for Beginners is perfect for you.

Here’s why…

When I first learned about Forex trading, it was frustrating!

I had so many questions on my mind.

For example:

What is a pip?

Why do traders focus on the London session?

How do I read the weird looking numbers on my screen?

It sucks that I had to figure so many things out before I can even start trading. Because if I don’t, I could lose my hard earn money — unknowingly.

Now… I don’t want you to go through the same pain and frustration I had.

That’s why I wrote Forex Trading for Beginners so you have a strong start in Forex Trading.

Here’s what you’ll learn on this forex trading guide:

- What is Forex Trading and the advantage of it

- How to read Forex currency pairs like a pro even if you’re new to trading

- What are the different Forex trading sessions and why it matters

- What are the different types of orders and how to use them correctly

- How to trade Forex using Fundamental Analysis

- How to trade Forex using Technical Analysis

- Which Forex trading style suits you best

- How much money do you need to start Forex trading

Sounds good?

Then let’s begin.

Forex Trading for Beginners: What is Forex trading?

Forex is a short form of Foreign exchange and it means trading one currency for another.

For example:

When you go to Malaysia for a holiday, you’ll sell Singapore Dollars in exchange for Malaysian Ringgit.

Now, unlike the Stock market where it’s traded on a centralized exchange, the Forex market is traded over the counter. And it’s connected electronically between banks and brokers.

Here’s an overview:

Now you’re probably wondering:

“Who are the biggest players in the Forex market?”

Well, it’s the banks as they are the market makers.

Followed by corporations who trade Forex to hedge their positions.

And lastly, individuals (like you and me) who speculate, shop online or travel overseas.

Next…

What are the advantages of Forex Trading?

Now let’s look at some of the huge advantage Forex Trading offers that you can’t get elsewhere…

High liquidity – According to the Bank of International Settlements (BIS), Forex is the largest market in the world with over $5,000,000,000,000 traded each day. That’s Trillion with a “T” This means you can enter and exit positions easily with minimal slippage.

Low barrier to entry – Most Forex broker allows you to open an account with as little as $100.

Better risk management – You can trade micro lots which allows you to better manage your risk. And unlike Stocks, the Forex market seldom has gaps which mean you will rarely lose more than intended.

Trade anytime you want – The Forex market is open 24/5. This means you can place your trades anytime from Sunday around 5 pm EST to Friday around 4 pm EST (depending on daylight savings).

Low transaction cost – Unlike Stocks, most brokers don’t charge you a transaction cost. You only pay for the spread.

So, what is a currency pair?

In Forex, you’re always dealing with currency pairs, and never just one currency alone.

For example:

EUR/USD: You exchange Euro for the US Dollar.

EUR/JPY: You exchange Euro for the Japanese Yen.

AUD/USD: You exchange Australian Dollar for US Dollar.

Here are the 6 major currency pairs that are traded the most often and have the most liquidity:

- EUR/USD

- GBP/USD

- AUD/USD

- NZD/USD

- USD/CAD

- USD/JPY

Let’s move on…

Forex Trading for Beginners: How to read a Forex currency pair like a pro even if you’re new to trading

You’ve probably seen numbers like these…

EUR/USD 1.1792

GBP/USD 1.5255

USD/JPY 113.22

And you’re thinking to yourself…

“What the heck do these numbers mean?”

Well, let me explain…

For example:

If you see EUR/USD 1.1792, it means 1 Euro is worth $1.1792 US Dollars.

If you see GBP/USD 1.5255, it means 1 British Pound is worth $1.5255 US Dollars.

If you see USD/JPY 113.22, it means 1 US dollar is worth $113.22 JPY.

Does it make sense?

Good. Now let’s take things a step further on this forex trading guide…

What is a pip?

Here’s the thing…

A Forex currency moves in units called pips (price interest point) which is the smallest incremental value of a pair.

Most Forex pairs are quoted at the 4th decimal place, except for JPY pairs, which are quoted at the 2nd decimal place.

This means for every 0.0001 change in price, it represents a 1 pip move.

For JPY pairs, every 0.01 change in price, it represents 1 pip move.

Example 1:

If EUR/USD is now trading at 1.1802 and 1 hour later it’s trading at 1.1807.

How much did the price increase?

5 pips.

Example 2:

If USD/JPY is now trading at 120.55 and 1 hour later it’s trading at 120.15.

How much did the price decrease?

40 pips.

And finally, there’s one last thing you must know about reading a currency pair…

What is the spread?

The spread is the difference between the Bid and Ask.

You’re probably wondering:

“What is the Bid and Ask?”

Good question.

The Bid is the price you can sell right now (always the lower value).

The Ask is the price you can buy right now (always the higher value).

So, if you see something like EUR/USD trading at 1.1551/1.1552.

This means if you want to sell EUR/USD now, you will sell at 1.1551.

If you want to buy EUR/USD now, you will buy at 1.1552.

So, the spread is what your broker earns from you (think of it as a transaction cost).

Now…

If you’re new to trading, all these concepts in this forex trading guide might seem like a mess.

Because this is how I felt when I started Forex trading. But trust me, in time, it will all make sense.

Now let’s move on…

Forex Trading for Beginners: How to read a Forex currency pair like a pro even if you’re new to trading

You’ve probably seen numbers like these…

EUR/USD 1.1792

GBP/USD 1.5255

USD/JPY 113.22

And you’re thinking to yourself…

“What the heck do these numbers mean?”

Well, let me explain…

For example:

If you see EUR/USD 1.1792, it means 1 Euro is worth $1.1792 US Dollars.

If you see GBP/USD 1.5255, it means 1 British Pound is worth $1.5255 US Dollars.

If you see USD/JPY 113.22, it means 1 US dollar is worth $113.22 JPY.

Does it make sense?

Good. Now let’s take things a step further…

What is a pip?

Here’s the thing…

A Forex currency moves in units called pips (price interest point) which is the smallest incremental value of a pair.

Most Forex pairs are quoted at the 4th decimal place, except for JPY pairs, which are quoted at the 2nd decimal place.

This means for every 0.0001 change in price, it represents a 1 pip move.

For JPY pairs, every 0.01 change in price, it represents 1 pip move.

Example 1:

If EUR/USD is now trading at 1.1802 and 1 hour later it’s trading at 1.1807.

How much did the price increase?

5 pips.

Example 2:

If USD/JPY is now trading at 120.55 and 1 hour later it’s trading at 120.15.

How much did the price decrease?

40 pips.

And finally, there’s one last thing you must know about reading a currency pair…

What is the spread?

The spread is the difference between the Bid and Ask.

You’re probably wondering:

“What is the Bid and Ask?”

Good question.

The Bid is the price you can sell right now (always the lower value).

The Ask is the price you can buy right now (always the higher value).

So, if you see something like EUR/USD trading at 1.1551/1.1552.

This means if you want to sell EUR/USD now, you will sell at 1.1551.

If you want to buy EUR/USD now, you will buy at 1.1552.

So, the spread is what your broker earns from you (think of it as a transaction cost).

Now…

If you’re new to trading, all these might seem like a mess.

Because this is how I felt when I started Forex trading. But trust me, in time, it will all make sense.

Now let’s move on…

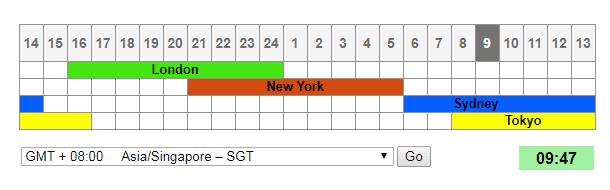

Forex Trading for Beginners: What are the different Forex trading sessions?

The Forex market trades 24 hours a day, 5.5 days a week.

It starts with the Syndey session, the London session, the New York session, and then back to the Syndey session.

If you’re on (GMT + 8), then these are the start and end of each session…

If you want to know what time the market opens in your time zone, you can use a tool like Forexmarkethours.

Now…

It’s important to know that not all trading sessions are equal.

In terms of volatility, the London session is the most volatile, followed by New York, and then Asian.

So, if you’re a short-term trader, you must trade the London session when the market is the most volatile as you have a better chance of making money.

Because think about this…

If the market is not moving it’s impossible to make a profit from it — like squeezing water out of a rock.

Right?

What are the different types of orders and how to use them correctly?

Generally, there are 4 common order types that every forex for beginners should know:

- Market Order

- Limit Order

- Stop Order

- Stop Loss Order

Let me explain…

Market Order

A market order gets you into a trade right now at the current price.

This order is used when you absolutely must enter the market and you’re willing to pay whatever the price is right now.

This order is usually used by longer-term traders since they would rather pay a premium price and get in the trade now than miss a potential move.

Pros – You know for sure that you’ll be in the trade.

Cons – You pay a premium for this certainty.

Limit Order

A limit order gets you into a trade only if the market has come to your desired price.

For example:

If Apple is trading at $100 and you place a buy limit at $95. This means you’ll only get filled if Apple trades down to $95, else you’ll not be in the trade.

Here are two diagrams to illustrate my point:

Buy Limit Order

You’ll enter a long position only if the market trades low enough to your desired price level.

Sell Limit Order

You’ll enter a short position only if the market trades high enough to your desired price level.

This order is usually used by short-term or swing traders because they want to get the best possible entry price as it improves their risk to reward.

Pros – You enter your trades at a “cheaper” price.

Cons – 1) You might miss the move. 2) You are trading against the current momentum.

Stop Order

A stop order gets you into a trade only if the market has moved in your favour (the opposite of a limit order).

For example:

If Google is trading at $100 and you place a buy stop at $110. This means you’ll only get filled if Google trades up to $110, else you’ll not be in the trade.

Here’s what I mean:

Buy Stop Order

You’ll enter a long position only if the market trades high enough to trigger an entry.

Sell Stop Order

You’ll enter a short position only if the market trades low enough to trigger an entry.

This order is used by breakout traders because they want to enter their trades with momentum.

Pros – You enter your trades with momentum.

Cons – It might be a false breakout and you’re long at the highs (or short the lows).

Stop Loss Order

Now…

Unlike the earlier types of order (which gets you into a trade), a stop loss order gets you out of the trade when the price moves against you.

This is an important order you must know because it protects you from blowing up your trading account.

Here’s how it works…

In a long position, the Stop Loss (red dotted line) will always be below the entry price (green dotted line)…

In a Short position, the Stop Loss (red dotted line) will always be above the entry price (green dotted line)…

Pros – It contains the “damage” done to your account so you can live to fight another day.

Cons – You might get stopped out of your trade prematurely (but it beats blowing up an entire account).

Now, if you want to learn how to set a proper stop loss, then go watch this training video below…

Nonetheless, if you want to know how to trade forex for beginners, then knowing the different types of orders is a must.

Forex Trading for Beginners: How to trade Forex using Fundamental Analysis

You might be wondering:

“What is Fundamental Analysis?”

“Is Fundamental Analysis crucial when it comes to forex for beginners?”

Fundamental Analysis considers information like economic data and political events because these affect the strength/weakness of a currency.

There is a lot of fundamental data coming out every day and as a trader, you must filter out the ones that matter and the ones to ignore.

As of right now, these are some of the most important ones you should know.

- Non-Farm Payrolls (NFP)

- Federal Open Market Committee meeting (FOMC)

- European Central Bank meeting (ECB)

Let me explain…

Non-Farm Payrolls (NFP) – USD

NFP happens on the first Friday of the week every month.

It indicates the strength of the US economy as it reflects on consumer spending and job creation.

Federal Open Market Committee (FOMC)

The FOMC represents the US central bank.

This meeting discusses how well the US economy is doing and to hint whether there are plans to increase/decrease interest rates.

Euro Central Bank (ECB)

The ECB represents the central bank for countries in Europe who uses the Euro as a currency.

This meeting discusses how well the Eurozone is doing and to hint whether there are plans to increase/decrease interest rates.

Pro Tip: Go to Forex Factory and check out their news calendar.

The ones marked in “Red” are usually important and worth paying attention to.

Here’s what I mean:

Now, let’s move on…

Forex Trading for Beginners: How to trade Forex using Technical Analysis

Unlike Fundamental Analysis which uses “concrete” data, Technical Analysis relies on price and volume.

And you can apply mathematical formulas to price (or volume) which results in trading indicators (that you see on most trading platform).

The belief behind technical analysis is that all market information is reflected in the price — and that’s all you need to trade the markets.

Here are some common Technical Analysis tools:

- Support and Resistance

- Moving average indicator

- Candlestick chart

Let me explain…

How to use Support and Resistance

Here’s the definition of Support and Resistance…

Support – An area on the chart where there’s potential buying pressure to push price higher.

Resistance – An area on the chart where there’s potential selling pressure to push price lower.

An example:

You’re probably wondering:

“What is the use of Support and Resistance?”

Well, it allows you to time the markets and get a favorable entry point.

If you want to learn more, go read The Support and Resistance Trading Strategy Guide.

Next…

How to use the Moving Average indicator

The Moving Average is an indicator that “smooth out” past prices and it appears as a line on your chart.

Now, there are different ways to calculate Moving Average, but honestly, it doesn’t matter which method you use because the concept is what matters.

This means no point figuring out which is the best moving average — it doesn’t exist.

Instead, it’s more important to learn how to use the moving average correctly.

For example, you can use the Moving Average to:

- Identify the direction of the trend

- Identify the strength of a trend

- Better time your entries

- Set your stop loss

- Trail your stop loss

Now, it’s not within the scope of this article to go into the full details on how to use the Moving Average indicator.

So… if you want to learn more, go read The Moving Average Trading Strategy Guide (you’ll not be disappointed).

Moving on…

Candlestick chart

There are different ways you can plot prices on your chart.

For example:

You can use a bar chart, Renko chart, Line chart, Candlestick chart, and etc.

However, in this post, I’ll discuss the Candlestick chart because it’s the most popular approach.

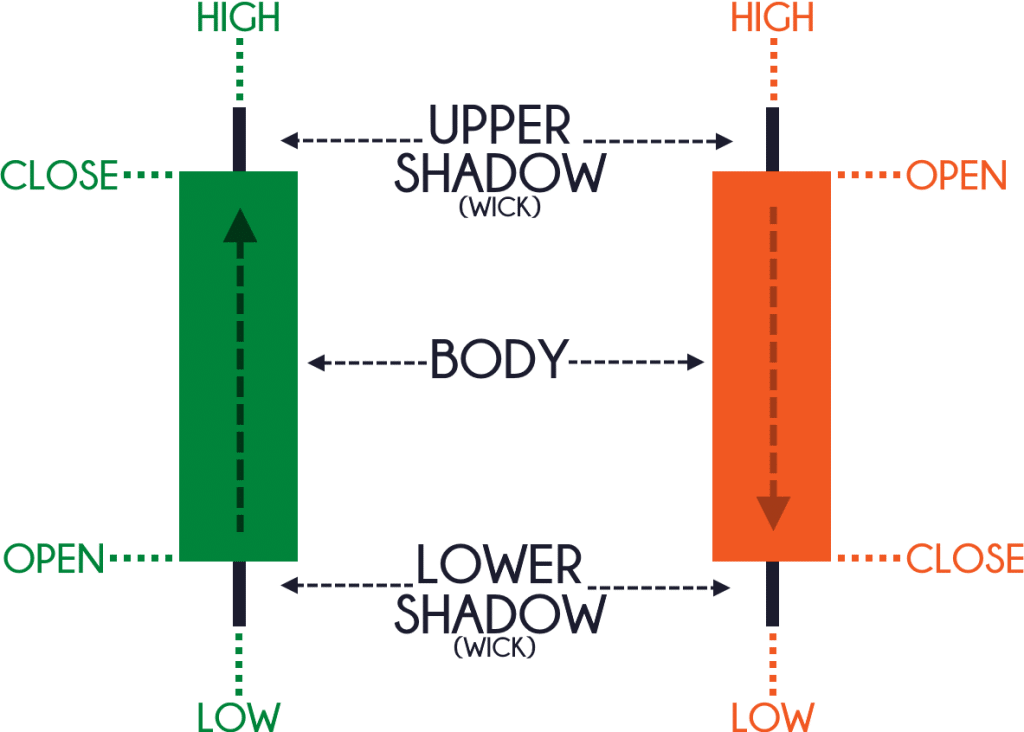

So, what is a Candlestick?

Well, a Candlestick shows the open, high, low and close on your chart.

And it looks something like this:

But wait, that’s not all.

Because you can use this information and develop different Candlestick patterns (like Shooting Star, Hammer, Doji, and etc.) and they have a different meaning to it.

Now if you are new to Candlestick patterns, then go study my free Candlestick Trading Course that teaches you everything you need to know about Candlestick patterns.

Moving on…

Which Forex trading style suits you best?

Here’s the thing:

Every trader has a different trading goal.

If you’re trading for an income, then you’ll adopt either an intraday trading or scalping approach.

Intraday trading

Intraday trading requires you to look for profitable setups to trade almost daily.

And you’ll look to close your open positions within the day itself.

You have to be comfortable staring at the 5-Min to 1-Hour timeframe charts the whole day.

Scalping

Scalping is essentially a subset of intraday trading.

But you’ll be getting in and out of your trades in a matter of minutes or even seconds.

So you’ll take on many small trades for very small profits and losses in a day.

However…

If you’re trading to grow your wealth, then you should adopt either a swing trading or position trading approach.

Swing trading

Swing trading doesn’t require you to stay glued to your screen all day.

Because you’ll look to capture a swing in the market, and you’ll hold your positions for a few days or even a few weeks.

You’ll mostly be finding trading opportunities in the 1-Hour to Weekly timeframe charts.

Position trading

Position trading is similar to swing trading.

But you’re looking to capture the bulk of the trend in the markets without getting stopped out.

So in this case, you could be holding your positions for weeks or even longer.

Moving on…

Forex Trading for Beginners: How much money do you need to start Forex trading?

Here’s the thing:

Before you fund a live account, I suggest you demo trade first.

I know you’ve probably seen other traders saying…

“Demo isn’t the real thing.”

And I agree it’s true.

But before you can even start, you must familiarize yourself with your trading platform.

And that’s when demo trading can come in handy.

It allows you to get familiar with your charting platform (like how to buy, sell, manage your trades, and etc.) without risking any real money.

Now once you’ve learned how to use your trading platform, then you can consider funding a live account.

So, how much money you should put in a live trading account?

There isn’t a magic formula to this because it depends on your personal finance, risk tolerance, and circumstance.

But if you want a guideline, here’s what I suggest:

- Decide an amount of money you’re willing to lose (that will not affect your lifestyle even if you lose it)

- Put half of it in your bank

- Fund the remaining half into your trading account

- When you’re consistently profitable, fund the remaining half (from your bank) to your live account

Now…

The beauty of this approach is that you pay lesser “tuition fees” to the market because half of the money is in your bank.

And when you’re ready, you can fund the remaining and scale your way up.

This isn’t a get rich quick scheme but, a get rich slow approach that keeps you in business for years to come — which is far more important than anything else.

Frequently asked questions

#1: Do you trade the other markets like gold, stocks and commodities the same way as you trade the forex market?

Yes, I apply the same concepts to the other markets as well

#2: Is there a good forex platform for beginners with a small capital to get started with?

Most brokers will offer a demo account for you to trade with paper money. Alternatively, you can also check out free charting platforms like TradingView before starting a live account.

#3: Do you have other books or courses that can help a newbie trader like me gain more knowledge on trading quickly?

Yes of course. You can check out my trading academy over here for a list of courses to get you started.

I’ve also compiled a list of trading books to help you level up your trading, which you can find here.

Summary

So here’s what you’ve learned in this Forex Trading for Beginners guide:

- Forex is traded by the banks, corporations, and individuals

- The 3 main Forex sessions: Asian, London, and New York

- A pip represents the smallest price change in Forex

- The 4 main types of orders are: Market, Limit, Stop, Stop loss

- You can use Fundamental and Technical Analysis in Forex trading

- It’s best to start on demo before funding a live trading account

I know I’ve packed a ton of information in this guide.

So take your time and digest the materials.

Lastly, is there any question that I’ve not answered about Forex Trading?

Leave a comment below and I’ll be glad to help.

Hello Coach, even though I am a relatively intermediate trader, I benefit from the write up. God bless you.

Awesome to hear that, Alimi.

osum coach ur bro…. iam frm india and i love the way u teach in simple way //…keep up the goodwork bro..waiting for ur more videos

Cheers bud

What’s up friend…do you have anything on correlation and/or market movers, I’m really struggling with this subject…even book suggestion will be highly appreciated

Thank you in advance and God bless

Hi Andile

I don’t have anything on it. But I believe John J Murphy wrote a book on market correlations, you can check it out.

Thank You Rayner for this guide I don’t trade Forex at the moment, but I will keep this in my trading tool box. It is something that I have been thinking about

God Bless You and your family.

Have a Happy New Year

You’re welcome William.

And happy new year to you!

Excellent write up..

On your market videos you also talk about technical set ups for gold , silver, and other commodities.

Do you trade these the same way as you trade currencies? Will you be doing a write up on beginners guide to futures?

Yes, I do trade it in a similar manner.

That’s a good suggestion, I’ll look into it.

hi Thrayer, I live in Mexico and would like to trade the USD/MEX..where can I do this …which USA brokers please ?? thanks !

I’m not sure which US brokers offer it, but there are other brokers that do.

The forex market is betting me up on technical so I would like to have a book on technical analyses. Thanks for everything and have a blessed New year with your family and friends

Thank you Billy, you too!

Thank you Rather.

Enjoy the new year.

You too, Roy!

My dear Friend,

This is good work as usual. I wish you write further more in 2018.

Wish you a happy new year!

And you too, Lakshman!

Hi thanks for your time to open our eyes in a very simple and understandable manner God Bless u. I read about confluence but i do not understand can u plse explain its meaning and its purpose. Thanks

It means the coming together of different technical tools (that point to the same direction) and it increases the odds of a trade working out.

your article has really build me. Thanks Rayner

Cheers

Hi Rayner,

I am what you would call a newbie. Do you have anything on find a good entry point? I love your website and YouTube channel. They are both made up of the perfect combination short, simple and straight to the point.

These posts will help with your entries…

https://www.tradingwithrayner.com/high-probability-trading/

https://www.tradingwithrayner.com/when-is-the-best-time-to-enter-a-trade/

Great! Thanks for sharing these points very well like, what is forex trading, advantages currency etc. All information is very useful for us. Keep posting.

I’m happy to help!

Will I become a successful trader if I will choose to be a Price Action Trader with the top 3 Fundamental Factors and with the Three Tech indicators above?

Nope, it takes a lot more than that.

Thanks for sharing this informative blog. You explain very well about forex trading.

I’m happy to be of help!

Amazing share! I’ve learned a lot and understand more about trading. You have me as a beginner with this knowledge. I just want to ask on what you think about forex trading signls like fxleaders.com ? I’ve heard they have nice features.

I’ve not used it so I can’t comment. cheers.

Thanks for the blog Rayner. It was straight forward and to the point for a newbie.

Awesome to hear that, Julie.

I learned alot from this post, as a new to the trading world, this article served as an eye opener to me. Thank you very much for your help.

You’re welcome!

this is so helpful.thanks a lot

You’re welcome!

hello Sir,what would be the best platform here in asia that allows minimum amount to create an account and what would that amount be. and what platform do you use. ive watch some youtube videos explaining same topic as yours but you know what, i cant understand them not like you, you explain it in a very simple way and friendly that is well to understand. Thank you

I don’t publicly discuss brokers because in this day and age, we have no idea what goes on behind the scenes.

If you want a recommendation, drop me an email me and we can discuss it.

You are amazing,if I am an expert trader I will keep learning from you,

Thanks for your great help for the beginners like me

You’re welcome, Ali!

I do like to know if i can copy your trade and i share profit monthly with you. Respond to my email below

evicdonltd@gmail.com

I don’t offer it.

Hello, and thank you for spending your time in writing this page as I personally found it very helpful, I want to get started properly but have still to take the leap from demo to real money. Do you know of any good books or courses that would help me even further?

Hey Tony

You can check out my trading academy here, free… https://www.tradingwithrayner.com/academy/

Hello Coach, I am about to start for the first time in forex trade and for that, I needed basic and fundamental knowledge to kick up. Thank you very much for your post boast and equip me with confident to join the trade. God bless you richly sir

Hey Tonia,

You can check out the trading academy.

https://www.tradingwithrayner.com/academy/

Cheers.

Hey Rayner you have some great tutorials, when confidence is lacking reviewing your videos gets me motivated again!

Awesome, Forex!