Have you heard of Forex Factory?

You probably do since it’s the leading forum for Forex traders since 2004.

But here’s the thing…

…most traders don’t take the full advantage of what Forex Factory has to offer.

All they do is to go into the forum, enter the “Trading Systems” thread, and look for new trading systems.

Then they apply the strategies for a while and when it fails, they got back to the forum and look for “the next best thing”.

And the cycle rinse repeats itself.

No wonder most traders fail because they are in the cycle of hopping from one trading strategy to the next.

Now…

Forex Factory is more than just a place to find new trading strategies. In fact, they offer useful trading tools that will improve your trading experience, and it doesn’t cost you a dime.

Do you want to know how?

Then read on because you’ll learn:

- How to read Forex Factory news and use the Forex Factory calendar to stay ahead of the news and never get caught with your pants down

- How to use Forex Factory sentiment indicator and find high probability trading setups

- How to monitor your trading positions in real time (even if you’re at work)

- How to find the correct Forex trading broker

- How to set up a trading journal in Forex Factory and improve your trading results

Are you ready?

Then let’s begin…

Forex Factory calendar — stay ahead of the news and never get caught with your pants down

The Forex Factory calendar highlights key fundamental news that’s coming up.

You’re probably wondering:

“If I’m a pure technical trader, does it matter to me?”

Yes it does, especially for short-term traders.

For example:

You don’t want to enter your trades just ahead of a big news event because the spread could widen and put you at a huge disadvantage.

Or if you’re in an open position, you might want to reduce your risk exposure so you don’t get stopped out on the volatility spike.

Make sense?

Good.

Now, if you want to know how to read Forex Factory news, let’s learn how to use the Forex Factory calendar to your advantage…

1. Select your timezone

Here’s how to do it:

- Go to Forex Factory website

- Select the “Time” button at the top right-hand side of the page

- Then, select the time zone you’re in. And that’s it!

An example:

2. Filter your news

Now…

There is plenty of news coming out each day from different countries. Like CPI, PPI, Retail Sales, Inflation, Central Bank, and etc.

And most of it does not affect the markets as they are not a major news event.

So, how do you know which news event to pay attention to and which to ignore?

Because the key to how to read Forex Factory news is knowing which news to ignore and to focus on.

Well, this is where the Forex Factory news filter comes in handy.

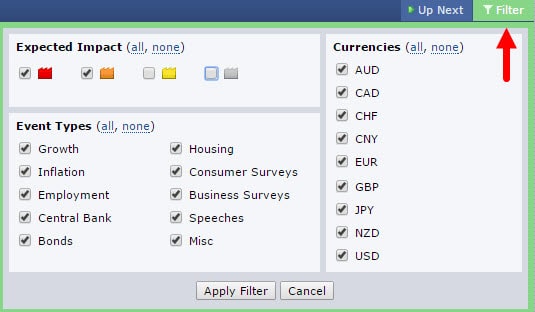

Here’s how to do it:

- Select the “Calendar” tab at the top of the page

- Then select the “Filter” button at the top right-hand side of the page

You’ll see something like this…

Next, check the red and orange box. This means the calendar will only reflect high and medium impacts news event (if you want to include the low impact event, feel free to do so).

Then, check all the event types as you don’t know which events are the high impact ones. So it’s safer to just check them all.

Lastly, you can select which country news you want. I suggest checking all of them so you’re aware of the important fundamentals going on around the world.

Bonus: Never miss a piece of breaking news that might ‘break’ your trade

With a single tweet, Donald Trump can snap your profits back into the red.

What you’ll want is to at least be aware of such news as soon as it occurs to reduce your risk exposure.

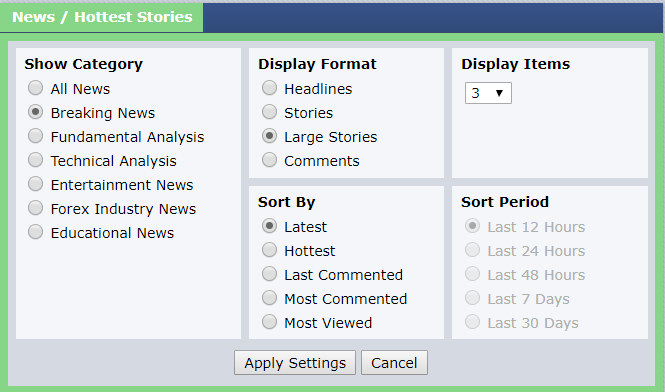

Here’s how to do it:

- Select the “News” tab at the top of the page

- Then select “News / Hottest Stories” at the right-hand side of the page

You’ll see this…

Next, check “Breaking New” and “Latest”.

So only the important news will be shown on the right-hand side of the page.

That, my friend, is how to read Forex Factory news and how to use it to your advantage!

Moving on…

How to use Forex Factory Sentiment Indicator and find high probability trading setups

This is a trader’s sentiment indicator derived from Forex Factory Trade Explorer. It’s converted into a visual chart showing you how many % of traders are long or short (on a currency pair).

Here’s how to access it:

Select the “Trades” tab at the top of the page. Then scroll down a little and you’ll see something like this…

Now here’s the thing:

I’m sure you can agree that most retail traders enter the market at the worst possible time. Like “chasing” the market after it has made a huge move, or trying to pick market tops and bottoms.

Knowing this fact, you can then use the sentiment indicator as a contrarian approach.

You’ll look to go long when most retail traders are short, and long when most retail traders are short.

Here’s how to do it:

- Identify a currency pair that reaches an extreme reading of at least 60%

- Wait for a valid trading setup that is against the herd

An example…

As you can see, EURJPY has 63% of traders short this market.

This means as a contrarian, you want to go against the herd. So, you’ll look for a long trading setup.

Moving on… the EUR/JPY 4-hour timeframe looks like this:

So, how do you enter this trade?

Well, you could look to get long at the area of Support if there’s a price rejection like Pinbar, Engulfing pattern, and etc.

If you want a full explanation on entries, exits, and stop loss… go read The Complete Guide to Finding High Probability Trading Setups.

And one last thing…

You don’t want to enter a trade just because the sentiment indicator is at an extreme. It can remain at an irrational level longer than your account can remain solvent.

That’s why you need a valid trading setup with precise entries and exits so you can better manage your risk.

How to monitor your trading positions in real-time (even if you’re at work)

I know.

You have a full-time job and it’s difficult to monitor your positions while at work.

You’ll probably sneak to the toilet every 30 minutes or so just to see how your positions are doing.

But I’ve got good news for you…

…because it’s possible to monitor your trading positions in real-time, without sneaking off to the toilet every few minutes.

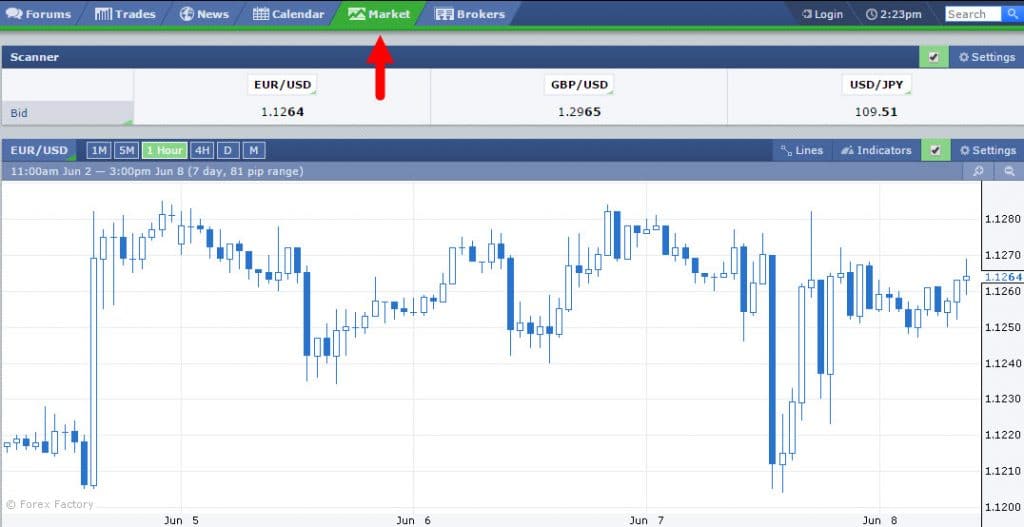

Here’s how to do it…

Select the “Market” tab on the top of the page.

It’ll look like this…

Tada!

Live Forex charts in front of your screen. No downloads, login, or subscription required.

Do you know what else I like about it?

Just below the charts, you can see what the current market session is (whether it’s Sydney, Tokyo, London, or New York).

An example:

This is useful for traders who are wondering what time does the London or New York session opens, and whether there are daylight savings or not.

With this tool, you never need to second guess yourself again — plus it is synchronized with your local time.

How to find the correct Forex trading broker

I’m sure you’ll agree with me that it’s difficult to find a broker you can trust.

You never know if the broker is on the opposite side of your trades, whether they are financially strong, or would simply vanish after taking your money.

And this is one reason why I never recommend brokers publicly because you never know what’s going on behind the scenes.

Well, the good news is…

Forex Factory can help you filter down a list of brokers that you might consider trading with. They provide a list of brokers you can compare with side by side, so you can identify the ones that meet your needs.

Here’s how…

Select the “Brokers” tab on the top of the page.

An example:

Now, there are many things you can compare across brokers. Their real-time spread, markets available, minimum deposit, platforms available, languages, regulatory bodies, headquarters, and etc.

And I know it can be overwhelming to look at so many things when selecting a broker.

So, here’s my top 5 list to consider:

- How many countries is the broker regulated in?

- What is their real-time spread like during normal hours and major news release?

- How many markets can you trade?

- Is it easy to deposit and withdraw your money?

- Is their customer support responsive?

So do your own due diligence and find out which brokers suits you best.

And one last thing…

There’s an important disclaimer on Forex Factory website that states:

Brokers pay Forex Factory a fee to be listed on this page, so a claim of complete independence cannot be made. However, this product was entirely designed from a trader’s perspective, and several practices have been implemented to ensure information is presented impartially.

This means there are other good brokers that aren’t mentioned on Forex Factory and you must do some digging to find out for yourself.

Now let’s move on…

How to set up a trading journal in Forex Factory and improve your trading results

Here’s the thing:

If are serious about trading, then you must have a trading journal. It’s the only way to keep track of what you’re doing so you can improve on it.

Without one, you might as go gambling in a casino (and it still provides free booze and babes).

However, I bet that 80% of you reading this right now don’t have a trading journal, or you don’t properly record your trades.

So in this section, you’ll learn how to do it using a trading journal from Forex Factory.

But you’re wondering:

“Why set up a trading journal in Forex Factory when I can do it on my computer?”

That’s a good question and here’s why…

3 reasons why you should set up a trading journal in Forex Factory

1. Accountability

The reason why traders give up on their trading journal is that there’s no one monitoring them.

So, by having a trading journal in a public domain, you’re making a commitment and have someone to be accountable to.

This increase the odds of you doing it since it makes you look bad if you go back on your word.

2. You can learn from other traders

Once you start journaling your trades, it will attract like-minded traders to your thread. From there, you can exchange ideas and feedback to improve your trading together.

3. It’s stored in the cloud so you don’t risk losing your information

Have you ever had your computer crash on you? There goes all your precious information that goes along with it.

But by having your trading journal hosted on a cloud, that risk is greatly minimized and you can be certain it will be there for years to come.

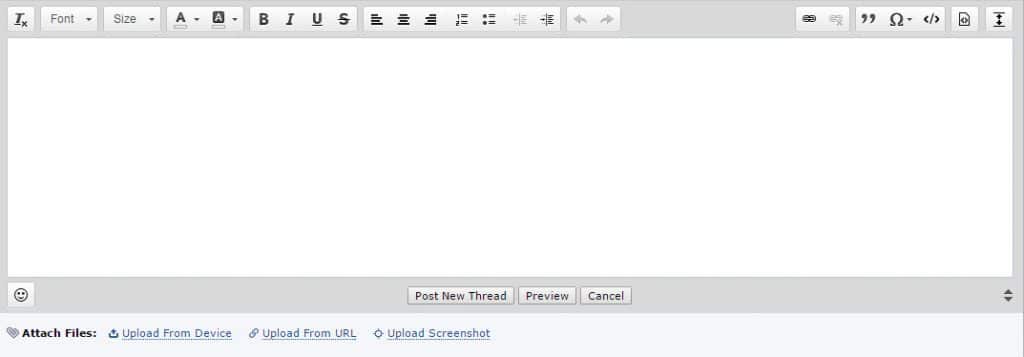

How to set up your trading journal in Forex Factory

Here’s how:

- Select the “Forum” tab at the top of the page

- Then select the “Trading Journals” link in the middle of the page

- Then select “Start New Thread”

Once you’ve done it, you’ll see something like this…

Now you’re probably wondering:

“But Rayner, what do I post in my thread?”

Here’s what I suggest…

- Introduce yourself and declare a commitment of 6 months

- Explain your trading methodology and write down your trading plan

- Post the charts of all the trades you’ve entered

- Post the charts of all the trades you’ve exited

- Post your thoughts and reflection for the trading week

- After 25 trades, find patterns that lead to your winners and losers

- Rinse and repeat

Now the key here is CONSISTENCY.

Just like when it comes to how to read Forex Factory news and learning strategies…

There’s no point doing it for a few days and then stop doing it because it defeats the purpose.

To see results, you must commit yourself to do it for 6 months. If you follow what I said, your trading results will improve.

If you want to discover more on the latest Forex trading tools that I’m using, then you must check this out.

Frequently asked questions

#1: Does using the sentiment indicator as a contrarian approach mean that we are going against the trend?

It does not necessarily mean that you’re going against the trend, because the trend is relative to the timeframe that you’re trading.

For example, if the market is in a downtrend on the 1-hour timeframe, it could be an uptrend on the daily timeframe.

#2: Whenever there’s a news release, the price moves so quickly that I miss the trade. Is there any way to anticipate the move?

In essence, you want to wait for the market to make the first move and breakout of the highs before it makes a reversal, where you’ll enter short.

If you want to discover more on how to trade during a news release, then check out my training video over here.

Summary

I hope you’ve realized that Forex Factory is more than just a forum to learn new trading strategies.

You should take advantage of their useful trading tools like:

- Forex Factory calendar to stay ahead of the news

- The sentiment indicator to help you find high probability trading setups

- The charting tool to monitor the Forex markets in real-time

- The broker comparison tool to find the best broker for your needs

- Forex Factory trading journal to improve your trading results

Now I’ve got a question for you…

How do you use Forex Factory for your trading?

Leave a comment below and let me know your thoughts.

Hey Rayner, Thanks for this detailed post on the ins-and-outs of how to use Forex Factory. I totally appreciate what you mean about the beginners cycle, where traders just keep looking out for new trading systems. But as you’ve shown, there’s a lot more you can do on this site.

Specifically, thanks for mentioning the news calendar filter, so that we can focus only on high impact events. This is a great little tip that I’m going to start using.

Thanks again and have a great day!

Jay

You’re welcome, Jay.

Have a go and let me know how it works out for you.

cheers

Hello Rayner

Thank you for providing us information on how to go about and use Forex Factory. On my side I appreciate as they are useful and of great help to me.

On my side as I am expecting to start trading as a beginner I find my self having a point to start moving.

Thanks and Stay blessed!

Frank

You’re welcome, Frank.

Don’t hesitate to let me know if you’ve got any questions, I’ll be glad to help.

I’ve been using forexfactory economic calendar.

But I didn’t know how to use it to monitor my trades.

Thanks for opening my eyes to new trading tools using forexfactory.

You’re welcome bud.

cheers

Hi Rayner,

Thank you for your article!

In the sentiment indicator section, your mention that “most retail traders enter the market at the worst possible time”.

As this may be truth for most traders but how about top traders? Because I came across this “Using Top Traders’ Insight in your next trade”

What is your opinion if we follow the sentiment of the top traders in this/other trading society?

Cheers,

O Utan

Hey O

I’ve not used that indicator so I can’t comment on it.

But one question to ponder is who are these top traders?

I agree it’s a great resource.

I use it to see which way the wind is blowing. Part of my daily process is to check the news section for a look at the fundamentals (shorter term)and to get a sense of the “big boys” bias for each currency and region.

I have been using the calendar as part of my daily process for over a year now.

I try not to get involved in the forums too much, its mostly noise and is a huge distraction. I only have an hour or two to manage and look for opportunities in the morning before work, so I have to use my time wisely.

And the strategies section, well…. that’s more for amusement. I try to avoid that section, as it also very distracting. Some of the ideas are useful but only to add another “filter” to my current system to help me fine tune it.

Occasionally I will actually learn something from a trader on the forum, but it hard to figure out which are great traders and which have no idea.

I prefer to use more reliable resources for education such as your site, Trading with Rayner. Your style is not exactly a match to mine, as I am developing pattern trader style, but a trend follower at the core. I learn something for consideration every video I watch, so it’s always of value to me. Keep up the good work. Stay awesome.

Hey Randal

Thank you for sharing your thoughts. I appreciate your kind words man!

Don’t hesitate to let me know if there’s anything, I’ll be glad to help.

Dear Rayner,

thank you for your information ,which is spectacular.

cheers bud

Thanx a lot Rayner ,i didnt even know that there site called forex factory,im looking foward to make use of it and to start journal.

Awesome.

Let me know how it works out for you yeah.

thanks for showing me how to use the website you are the best. also using the 200 moving average to help me stay in a trade when usually would have bailed on a trade too early.

You’re welcome, Albert.

cheers

Hi Rayner, thank you for adding value to readers on a weekly basis.

May I know why take on a contrarian approach “you can then use the sentiment indicator as a contrarian approach.”?

Thank you 🙂

Hey Wong

It’s contrarian in the sense that you’re trading against the herd.

But if you look at the chart, it’s still trading with the trend.

Great sharing as always Rayner.

Currently, I only use Forex Factory for news calendar and its online chart.

Never wonder the other tools provided can also be useful.

Thanks man…

you’re welcome, Arie.

cheers

if im trading on the 512tick and 30min chart whats the next time frame for each of them

do i just x4 the ticks for 512 and 2h for 30min?

and do i use the 100ma as reference trend since im trading short term and shld reference to a 1 medium term trend or 200ma will do?>

1. You can just multiply your time frame by a factor of 4.

2. This depends on the type of trend you’re trading. 200 is longer term whereas 100 is medium term.

HI rayner

i used to cheking forex factory calander but i want to ask you how to react when there’s a news with red impact should i wait the result of the news but the price action is so quick that i messe the train so is there any way to anticipate the move

tanks for you help

I suggest not trading it and leave it out altogether.

Hey Rayner, Hope you are well.

Interesting read, I do something similar with Sentiment

figures from Myfxbook. Being on the “wrong side” of their

trades can certainly be profitable…

Thanks for FF tips.

slim

you’re welcome, Slim.

cheers

How will I notice that my trades on the trading platform are being manipulated by my broker company.

Is there any robot/software available to protect my trading pairs on the trading platform against any manipulation?

Please advice

Why don’t you just find a new broker?

please can I trade with zero account?

Not that I know of.

Thanks Rayner for all the info you’ve given as regards benefitting from the Forex Factory website.

I deeply appreciate.

You’re welcome!

can’t i start with demo account ?

Of course you can.

I’m very new to forex. My mentor mentioned forex factory yesterday in the course of the training session that’s why I decided to read more about it. I can see that it’s a good place to be in order to minimize lost of trading forex capital

Hi Rayner,

May i know if the currency, example: (AUD) is in the ”red impact”, which currency pair for AUD should I look into (Buy or Sell) it?

It depends.

You can choose audusd, euraud, audnzd, etc.

It depends on which pair has a trading setup that makes sense to you.

I still don’t understand this part. So as long AUD is in the “red impact” it means it’s a ‘SELL’ for any of the pairs like AUD/USD , EUR/USD, AUD/NZD?. Appreciate if you can help me in this part. Thanks sir!

It’s not a sell.

It simply means there could potentially be a big movement on AUD, whether up or down is anyone’s guess.

Please how do you know when to buy or sell…. Or the currency to pair with to make your profit?

Yes, covenant asked a good question. I have been wanting to get clarified on this. If a news is released on the USD and it signals maybe bullish for the USD, how do I know which currency to pair with the USD that is weaker for the USD to go up sir Rayner? Because I get cutout of the market most times on wrong pairs

Hey there, Victor!

To check which currency is weaker, or which is stronger, you can use the currency strength meter.

You can check this link to learn more:

https://www.youtube.com/watch?v=5S-o99BUd2I

Cheers!

Ok noted. But is the currency strength meter a mobile application I can download or it’s stated in the video?

Nice to by here

Thanks, Patrick!

I need that book of candle pattern

Hi, Jeremia!

Please email us at support@tradingwithrayner.com so we can send you the Monster Guide to candlestick pattern.

Thanks!