It’s funny.

I see new traders losing their pants in the markets when it can be avoided.

How?

If they learn how to trade forex from the experience of other traders.

Think about this…

Why pay “tuition fees” to Mr Market when you can learn the same forex lessons for free?

So in today’s post, I want to share with you the 8 forex trading lessons I learned from 8 years of trading.

For example, you will learn:

- Why you don’t need to know where the market is going to make money

- How to use indicators effectively even if they are lagging

- What is the best trading method in the world

- And much more…

And the best part?

These top lessons in forex cost me more than 5-figures but, it won’t cost you a single cent.

Let’s begin…

It’s fine to celebrate success, but it is more important to heed the lessons of failure – Bill Gates

Forex trading lessons #1 — Lagging indicators are useful

Most indicators are lagging in nature because they’re a derivative of price.

Still, they can be useful tools in your trading arsenal.

The question is not whether indicators are lagging but, whether you can use them effectively.

Here’s how…

Using Moving Average to identify dynamic support

Often, when the price is in a strong uptrend, it may not retrace back to previous resistance turned support.

So what can you do?

You can use the Moving Average indicator to identify dynamic support. These are areas where you’ll look for trading opportunities.

Using Moving Average to define a trend

You know an uptrend is defined by higher highs and lows. And a downtrend with lower highs and lows.

But the problem is, it can be subjective. You need to decide which swing highs/lows to take into consideration.

So what can you do?

This is when Moving Average comes to the rescue.

You can define a trend when:

- 50 MA cuts above 100 MA (uptrend)

- 50 MA cuts below 100 MA (downtrend)

That’s how Andreas Clenow defines it based on his best-selling book, Following the Trend: Diversified Managed Futures Trading.

It looks something like this:

Using Stochastic to identify trading opportunities

When the price is in an uptrend, you’ll want to look for long opportunities on the pullback.

You’re probably wondering…

“But where will the pullback ends?”

This is when you can use the Stochastic indicator to identify…

- In an uptrend, do not look for shorting opportunities when Stochastic is overbought. Chances are price will continue higher

- In a downtrend, do not look for long opportunities when Stochastic is oversold. Chances are price will continue lower

An example:

Using Average True Range (ATR) to set your stop loss

The Average True Range measures the volatility of the markets.

By using the ATR indicator, you can set your stop loss, like how the famed turtle traders did it. You can learn more here.

Similarly, I use the ATR indicator to place my stop loss, but with a twist.

Watch this video below to learn how:

If you want to learn more about indicators, check out The NO BS Guide to Forex Indicators.

Forex trading lessons #2 — You need a consistent set of actions to be a consistent trader

In my early years of trading, I was the most inconsistent trader ever.

I traded with Bollinger bands, candlesticks, harmonic patterns and everything I could get my hands on.

Needless to say, my trading results were inconsistent. Sometimes I made money, sometimes I lost money.

And here’s the thing…

…by trading inconsistently, I didn’t know how I was making money, or how I was losing money.

So, how do you become a more consistent trader?

- Develop your trading plan.

- Write down your trading plan in black and white.

- Follow your trading plan day in and out.

The fact is this:

If you constantly break your rules and do not follow your trading plan, then you’re going to have an inconsistent trading performance.

If you constantly follow your rules and trading plan, then you’re going to have a consistent trading performance.

Makes sense, right?

If you’re interested, read How to be a Consistently Profitable Trader for a detailed explanation (you’ll also learn how to trade forex like a pro).

Forex trading lessons #3 — The price leads news

It’s easy to get caught up with happenings around the world.

One moment, you’re hearing about the Greek financial crisis.

Next… China missed their GDP forecast.

Then… the US central bank is about to raise interest rates.

How do you know which news are important?

You’re afraid of putting on a trade, for the fear that a news event comes out, and you’re stopped out for a loss.

Now:

What if I told you price leads news?

Check this out…

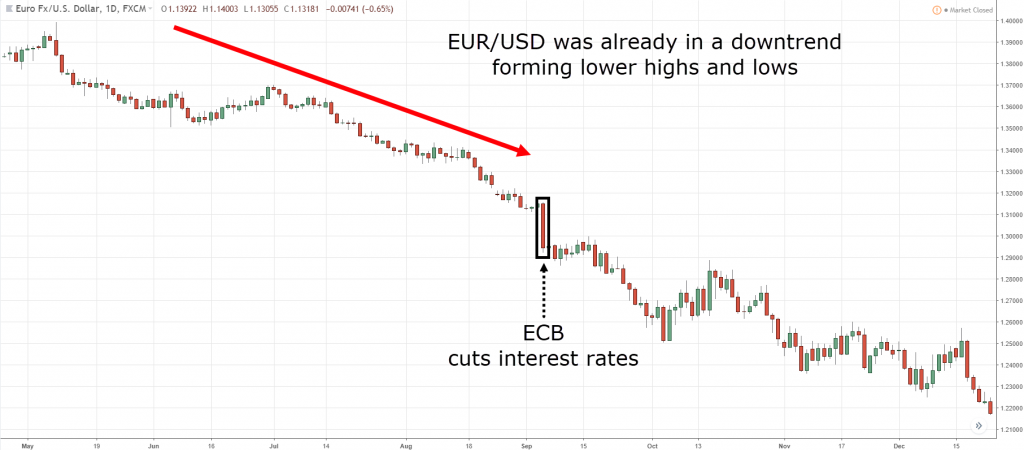

NZ central bank cuts rates

BOJ announced the expansion of its bond-buying program

ECB cuts interest rates

If you’re still bombarded by the amount of financial news each day, relax.

This is one of the forex lessons you must remember:

Price leads the news. Focus on price and you can ignore the rest.

Reliance on fundamentals indicates a lack of faith in trend following. – Ed Seykota

Forex trading lessons #4 — This is the most important thing in trading

No, it isn’t the frequency of your wins.

Because you can win often and still lose money in the long run.

An example:

Over the next ten trades, you win nine trades and lose one trade.

Each win earns you $1, and each loss cost you $10.

After ten trades, you have a loss of one dollar (9 – 10 = -1).

Clearly, you’re still losing despite winning more often.

Okay, maybe it’s the size of your wins?

Unfortunately, that’s not the case either.

Because you can have larger wins than losses, and still lose money in the long run.

An example:

Over the next ten trades, you win one trade and lose nine trades.

Each win earns you $5, and each loss cost you $1.

After ten trades, you have a loss of four dollars (5 – 9 = -4)

Clearly, you’re still losing despite having larger wins than losses.

So, what is it that matters?

- Your winning rate

- The average size of your wins

- Your losing rate

- The average size of your losses

With these four metrics, you can compute your expectancy to know whether you’ll be profitable in the long run.

Expectancy = (Winning % * Average win) – (Losing % * Average loss) – (Commission + slippage)

If you have a positive expectancy, you can be confident of your trading method as it’ll make you money in the long run.

But, if you have a negative expectancy, you’ll be losing money over the long run.

This is one of the top lessons in forex that you must not forget.

It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right, and how much you lose when you’re wrong. – Stanley Druckenmiller

Forex trading lessons #5 — You don’t need to know where the price will go to make money

Think about this for a moment:

Do casinos know whether they’ll make money in the next betting round? No.

Do casinos know whether they’ll make money in the next 1000 betting rounds? Yes.

You’re wondering…

“How does it work?”

It works by the law of large numbers.

The law of large numbers is a theorem that describes the result of performing the same experiment a large number of times. According to the law, the average of the results obtained from a large number of trials should be close to the expected value and will tend to become closer as more trials are performed. – Probability Theory

This means, your results are random in the short run but will be closer to the expected value in the long run.

And this is exactly the same for trading. You don’t need to know where the markets are going to make money.

To make money in trading, you need two things:

Here’s what Peter Brandt, a forty-year veteran trader, has to say…

In this portion of my trading, I will usually trade between 25 to 35 signals per month.

When I wrote this speech in April, I took a look at the previous 3 months. Out of 91 trades, there were 31 profits or 34%. That means that 66% of the trades were losers.

But further, the net bottom line profit for all 91 trades was represented by only 4 trades. Less than 5% of the trades put in the bottom line.

More importantly, I am sure I would not have been able to predict which 5% it would have been before the fact.

If you admit not knowing where the markets are headed, it’s a good thing.

Why?

- You’ll have a stop loss in place because you know you can be wrong.

- You’ll risk a fraction of your capital because you don’t want to suffer the risk of ruin.

And these two trading principles are essential to survive in this business.

Forex trading lessons #6 — Pick the wrong markets and you’ll snooze

As a trend follower, one of the trade lessons I come to understand is that not all markets are created equal.

There are:

- Markets which are strong

- Markets which are weak

- Markets which are flat out boring

The only two types of market that interest me are:

- The strongest markets

- The weakest markets

Why?

Because when you’re trading the strongest/weakest markets:

- Pullback tends to be shallower

- Price tends to move further in your favor

Here’s an example, which market would you short?

Do you see why I love the strongest and weakest markets?

So…

If I’m looking to short a market, I want it to be the weakest one.

And, if I’m looking to long a market, I want it to be the strongest one.

This trading concept is called relative strength and if you want to learn more about it, go here.

Forex trading lessons #7 — The best trading method in the world

I’ve got your attention now, didn’t I?

The truth is this, there’s no best trading method in the world.

But…

…there’s a best trading method for you.

Now you’re wondering:

“How do I find it?”

This largely depends on two things:

- Your goal in trading

- Your personal characteristic

Your goal in trading

You must know what’s your goal in trading before you can find a method that fits your needs.

Are you looking to build a consistent income from it?

Or…

Are you looking to build wealth from it?

Now:

If your goal in trading is to build a consistent income regularly, day trading and swing trading suits you.

If your goal in trading is to build wealth from it, then position trading suits you.

Your personal characteristic

You must know your personal character before you can use a method that fits you.

Are you someone who prefers to win more often, but with smaller gains?

Or…

Are you someone who prefers to win less often, but with larger gains?

Now:

If you’re someone who prefers to win more often but with smaller gains, then day trading and swing trading suits you.

If you’re someone who prefers to win less often but with larger gains, then position trading suits you.

Ultimately, the best trading method depends on your goal and personal characteristic.

I don’t think traders can follow rules for very long unless they reflect their own trading style. – Ed Seykota

Forex trading lessons #8 —Trade your timeframe, everything else is NOISE

In my early days…

A mistake I made was trading across too many timeframes.

I was trading the 5mins, 15mins, 1-hour, 4-hour and Daily timeframe.

And the problem with this is… it gave me analysis paralysis. This means I could not pull the trigger because of conflicting signals on the different timeframes.

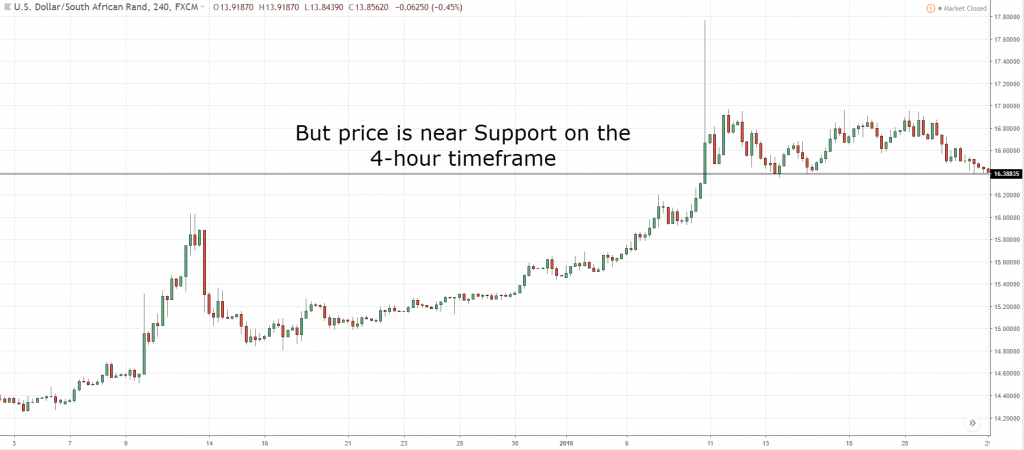

For example:

On the lower timeframe, the market is at Resistance and I have a signal to go short. But on the higher timeframe, the market seems “overextended” and a pullback is likely.

And I will think to myself…

“Do I short the market? “

“Do I wait for the higher timeframe to come to an area of value?”

“But what if I miss the move while waiting for the higher timeframe to align itself?

Here’s what I mean…

This was an issue I spent a long time dealing with, and the solution is really simple…

Trade your timeframe and ignore the rest.

This means…

If you are trading the daily timeframe, then focus on the daily and ignore everything else.

If you are trading the 1-hour timeframe, then focus on the 1 hour and ignore everything else.

If you are trading the 15mins timeframe, then focus on the 15mins timeframe and ignore everything else.

Get my point?

Now don’t get me wrong.

I’m not saying you can’t use multiple timeframes in your analysis.

You can.

But you don’t want to have multiple timeframes spanning across the 5mins, 15mins, 1 hour, 4hour, daily, and weekly timeframes.

That’s ridiculous and a sure way to mindfuc* yourself.

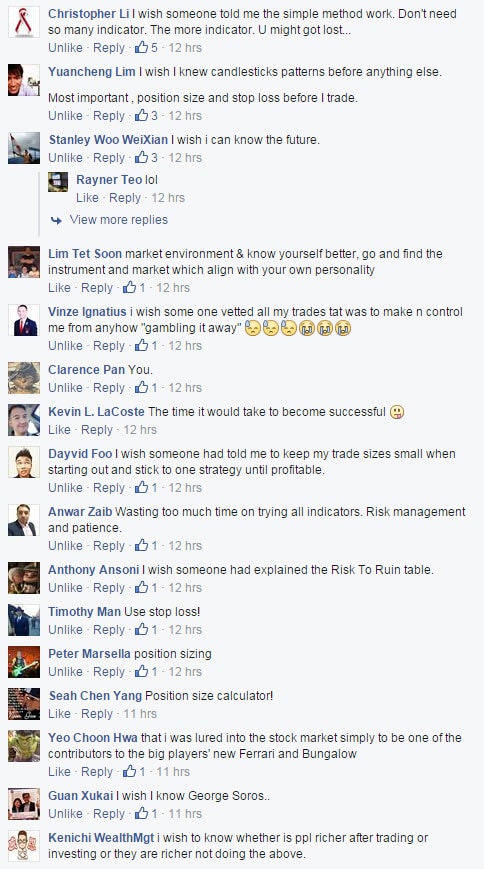

What’s the one thing you wish you knew when you started out trading?

This was the question I posted in our trading community…

And here’s what they said:

Frequently asked questions

#1: Do you trade a particular market more frequently than the rest of the markets out there?

I trade a variety of markets and I don’t emphasize any particular market. As long as there’s a valid trading setup, I’ll take the trade.

#2: Hey Rayner, is it important to know which moving averages are the ones used most often by traders, including institutional traders and analysts?

Honestly, I can’t say for institutional traders and analysts because I don’t know how they trade the markets.

But some of the more popular ones are the 50, 100, and 200 moving averages.

#3: If my trading timeframe and higher timeframe are showing me conflicting signals, what should I do?

Firstly, you can choose to stay out of the market and not trade the market since they have conflicting signals.

Secondly, however, if you still want to take that trade, then you want to be more conservative with your profit targets and avoid riding the move for too long.

This is because you’re trading against the higher timeframe trend which will likely resume itself to go against the trend on your trading timeframe.

Conclusion

I hope these trading lessons will prevent you from “burning” your hard-earned money and reduce your learning curve.

Remember:

Things happen for a reason. Don’t take setbacks as a failure.

Instead, take it as feedback to improve your trading.

Now, here’s what I want you to do next…

If you’ve got forex lessons to share, please share your story in a comment below.

Valuable insights and lessons!! thanks for sharing Rayner..

Hello Javier,

You’re most welcome.

Thank you for stopping by! 🙂

Rayner

Rayner, thank you abundantly for your knowledge sharing.

Regarding the law of large number, is it about frequency of trading or just statistical conclusion? Do you refer to do more trading in more than one instrument or more trading in some specific ones, or both? How about ‘quality over quantity’ principles?

Thank you.

Taufiq

Hey Taufiq,

The law of large number requires a large sample size to play out.

E.g. if you were to toss a coin 4 times, there’s a good chance it’ll not be 50 – 50 thing. But if you toss it a 1000 times, there’s a good chance it comes up head 50% and tails 50%.

I trade across all markets that is trending. No preference for any particular markets.

Sorry I don’t understand the quality VS quantity part. Could you please elaborate a little?

Rayner

dear rayner,

very well done ! rayner … although is simple describe .. but it need to pay out the price to get those exprience .

Hi Tet Soon,

Thank you for your kind words.

Yes those are experience I’ve come to learnt over the years, and I’m sure there will be more coming my way 😛

Rayner

Good article Rayner!

Thank you Ashley, hope it helped!

Rayner

well said and thanks for sharing…

To me its

… Keep it simple

…Stay true to your style that works best

… Doing nothing( ie staying on the sidelines) is underrated

… Do not use stop loss = Do NOT trade

Hope you’ll continue sharing and good luck 🙂

Farhan

Hey Farhan,

Thank you for sharing. I like your last rule especially.

I hope to hear more from you in the near future 🙂

Rayner

“What’s the one thing you wish you knew when you started out trading?”

I wish I met you (and your blog) when I started!

Eugene

Lol thanks Eugene! 😀

“Using Moving Average to identify dynamic support”

Few days ago I asked you why you use 20 and 50 EMA.

This is because I think in order to be an effective dynamic support, the MA must be the one used by most traders.

I used 50, 100 and 200 days SMA, because I feel (just feel, have no statistics) they are used by most institutional traders, since many analysts and bank traders talk about them.

Eugene

,

Hey Eugene,

The most commonly used one are the 10,20,50,100 and 200.

But you need to find something that suits you rather than throwing different MAs on a chart.

Rayner

Great article! One point however I would like to dispute.

Price does not lead news. If you subscribed to live squawk services, you would have notice from time to time there will be rumours of leaked data and announcements before the main event happened. Many retail traders don’t not have such access to live news hence it would appear to them as the price is leading the news but the actual fact is the big players have already frontrunned the news.

Hey Vincent,

Thanks for stopping by 🙂

Yes I would agree in the short term, news could lead price. Especially so with stocks.

But what I was referring to was major events like the 2007-2009 financial debacle etc, price usually shows it before the news pops out.

Again, I could be wrong as this is just based on my own personal experience.

Rayner

Hi!

Good post and restrospective. I always enjoy your blog posts 🙂

Best regards,

Julian

PS: I have also a Trading Blog. But it is in German 😉

Hi Julian,

Thank you, I’m glad you enjoyed it!

I hope to hear more from you in the near future 🙂

Rayner

Thank you Rayner for this amazing post.

I wish if you could explain again how to combine 20-50EMA with 50-100SMA, should I put all of them to follow the trend? and where I take profit if the trend will keep going in my favor.

Hey Shlomi,

You can use 50-100 or 20-50, it’s entirely up to you.

You can consider trailing your profits until price close beyond the moving average.

Rayner

Thank you Rayner for kindness this amazing post.I wish if you could sharing the market flow .

Hi Chen,

You’re most welcome.

Sorry but I don’t understand what you meant by, market flow?

Rayner

Hi Rayner,

I came across your video when I was researching for pin bar candle stick explanation on youtube. I am quite happy to your explanation because it is straightforward, easy to understand and well structured. You are a great coach! Thank you very much!

Hi Chin Ming,

I’m happy to hear that. Don’t hesitate to let me know if you’ve got any questions, I’ll be glad to help.

Informative and enlightening article. Could you from time to time share your outlook on what are the strong and weak markets based on your weekly or even daily analysis (by tweets perhaps) as an added edge. This is not meant to be too dependence but rather compare our own analysis with yours for second opinion and evaluation. Thanks

Hey Ryan,

sure I’ll look into it.

cheers

Your shared 2 scenarios in this article …..

1. On the lower timeframe, the market is at Resistance and I have a signal to go short. But on the higher timeframe, the market seems “overextended” and a pullback is likely.

2. Your chart example… weekly over extended but 4 hr at support

If I were to use 2 timefranmes, how do you resolve that conflict for the two scenarios you shared in your article

Thand you rayner

Hi Henry

You can either skip the trade and wait for it to align, or be more conservative with your targets on you 4-hour timeframe.

I had the same question as Henry. How do you deal with conflict between 2 timeframes.

One could be trending and the other could be rangy.

Thx

Hi Amanda

I’ve replied. Let me know if that clears up.

cheers

Hi Ray, Do you have a detailed video for the following indicators (RSI, MACD, Sochastics)

Hey Antonio,

I don’t have.

Hey Rayner,

Excellent blog as usual. I’m ever so glad I found you BEFORE I started trading…still early days and continuously learning sometime causing me to have what you call Analysis Paralysis (I just love that term)

One thing that bugs me though, how can Moving Averages help to define the current trend when they are Lagging indicators? I know you really love MAs but what am I not getting about MAs ?

Thank you for all your time and dedication.

Hi Vigan

I agree MA lag. But if you think about it, anything that’s on your chart has already happened.

It’s not the tools but how you use it that matters.

I discuss more about MA here… https://www.tradingwithrayner.com/moving-average-indicator-trading-strategy/

Thanks Rayner,

“The price leads the news” solved my long term problem. I just saw it only after 6 months you wrote this article. Your writing also confirmed my “Time frame conflict” concept again.

Glad to hear it helped you.

cheers bud

Hi Rayner, firstly thanks a ton !! You r doing great job.. learning a lot from your book and posts. Have implemented some of them in my trading and seeing the positive results. Thanks again.

Also just wish to know, are there any online charting websites where I can place moving averages indicator on RSI?

Awesome to hear that, Nitin.

I’m not sure about that, but you can try tradingview.com

cheers

Thank you for the wisdom, Rayner.

You’re welcome, Vick!

I wish someone had told me about ATR when I started trading. After seven years all I use is ATR Channel after trying so many other unnecessary things.

Regards,

Abhinav

Better late than never. cheers

Use the momentum of the higher time frame, not the trend. This works

THanks for sharing, Bonnie.

Hey Rayner, thanks for such an amazing blog. Can you be my coach?

Thanks for all your support and useful ideas and concepts

The pleasure is mine, Tom.

Thank you Rayner.

I had that analysis paralysis thing as well. Looking at too many time frames.

Now I just focus on weekly and Daily and I feel so less stressed.

Thank you.

Nice!