Let me ask you…

Do you know how to apply forex risk management so your losses feel like an “ant bite” to your account?

Do you have the ability to trade any markets or timeframes, and not blow up your trading account?

Do you know the secret to finding low-risk high reward trades?

If you answered NO to any of the above…

Then good luck to you.

I’m just kidding.

Now…

Today’s post is going to be one of the most important you’ll ever read. Because if you apply the forex risk management and position sizing strategies, I can guarantee you’ll never blow up another trading account — and you might even become a profitable trader.

And to prove my point, here’s what you’ll learn today:

- Forex risk management, what does it really mean

- What is position sizing and why it’s the closest thing to the “holy grail”

- How to calculate position size in forex

- How to calculate your position size in stock trading

- Forex position sizing calculators

- The secret to finding low risk and high reward trades

- Why leverage is irrelevant and what you should focus on instead

Are you ready? Then let’s begin…

Forex risk management, what does it really mean?

Risk management is the ability to contain your losses so you don’t lose your entire capital. It’s a technique that applies to anything involving probabilities like Poker, Blackjack, Horse betting, Sports betting and etc.

Here’s the thing:

If you have a $10,000 trading account, would you risk $5000 on each trade?

Of course not.

Because it only takes 2 losses in a row and you’ll lose everything. And even a profitable trading strategy won’t save you.

Don’t believe me? Then let me prove it to you…

Imagine:

There are two traders, John and Sally.

John is an aggressive trader and he risks 25% of his account on each trade.

Sally is a conservative trader and she risks 1% of her account on each trade.

Both adopt a trading strategy that wins 50% of the time with an average of 1:2 risk to reward.

Over the next 8 trades, the outcomes are Lose Lose Lose Lose Lose Win Win Win Win.

Here’s the outcome for John:

-25% -25% – 25% – 25% = BLOW UP

Here’s the outcome for Sally:

-1% -1% -1% -1% +2% +2% +2% +2% = +4%

Can you see how powerful this is?

Clearly, you should never risk too much per trade and definitely never go all-in on a single trade.

Now…

To further manage your risk, you can avoid trading during major economic events.

This way, you’ll avoid the volatility spikes that will easily whip you out of your trades.

The price pattern will also be clearer when there are no major economic events.

Risk management could be a deciding factor on whether you’re a consistently profitable trader or, losing trader.

Remember, you can have the best trading strategy in the world. But without proper risk management, you will still blow up your trading account. It’s not a question of if, but when.

What is forex position sizing and why it’s the closest thing to the “holy grail”

Now you’re probably wondering:

“How do I apply proper risk management?”

The secret is…

Position sizing.

A technique that determines how many units you should trade to achieve your desired level of risk. And this is the closest thing you can get to the “holy grail”.

But before you calculate your position size, you must know these 3 things:

- Value per pip

- The dollar value you’re risking on each trade

- The distance of your stop loss

Let me explain…

1. Value per pip

Value per pip is the change to your P&L if the price moves by 1 pip. To calculate this, you need three things: The currency of your trading account, the currency pair traded, and the number of units traded.

Example 1:

Your trading account is in SGD.

You’re trading EUR/USD.

You long 100,000 units of it.

Now…

If EUR/USD increases by 1 pip, what is the impact on your P&L (in SGD)?

Step 1: Determine the value per pip of the currency pair you’re trading

Since you’re trading EUR/USD…

The EUR is the base currency and the USD is the quote currency.

To determine the value per pip, look at the quote currency.

If you’re long 100,000 units of EUR/USD, the value per pip is $10USD.

Step 2: Determine the spot rate between the currency of your trading account and the quote currency

The currency of your trading account is in SGD.

Thus, look at the spot rate of USD/SGD.

Step 3: Multiply the spot rate with the value per pip of the currency you’re trading

Let’s assume the spot rate of USD/SGD = 1.30

So…

1.30 * 10 = 13 SGD

This means every 1 pip movement in EUR/USD is worth $13USD to you.

Now to make your life easier, you can use this FREE pip value calculator that I’ve created for you.

It’s a Forex lot size calculator that automatically takes into account your current balance and currency to manage risk more efficiently.

Example 2:

Your trading account is in USD and you long 500,000 units of EUR/GBP.

If EUR/GBP moves by 1 pip, what is the impact on your P&L (in USD)?

Step 1: Determine the value per pip of the currency pair you’re trading

Since you’re trading EUR/GBP…

The EUR is the base currency and the GBP is the quote currency.

To determine the value per pip, look at the quote currency.

If you’re long 500,000 units of EUR/GBP, the value per pip is $50GBP.

Step 2: Determine the spot rate between the currency of your trading account and the quote currency

The currency of your trading account is in USD.

Thus, look at the spot rate of GBP/USD.

Step 3: Multiply the spot rate with the value per pip of the currency you’re trading

Let’s assume the spot rate of GBP/USD = 1.25

So…

1.25 * 50 = 62.5USD

This means every 1 pip movement in EUR/GBP is worth $62.5USD to you.

Now to make your life easier, you can use a pip value forex risk calculator like this one from Investing.com.

2. The dollar value you’re risking on each trade

This means how much you’re risking on each trade (in terms of dollar value).

I suggest risking not more than 1% of your account per trade. Why?

Because you don’t want a few losses to put you in a steep drawdown, or wipe out your trading account. And not forgetting, you need proper risk management to survive long enough for your edge to play out.

Here’s how to calculate your dollar risk per trade:

Let’s assume you have a $10,000 account.

You’re risking 1% of your capital on each trade.

Here’s the math: 1% of $10,000 = $100

This means you’ll not lose more than $100 per trade.

Remember, the risk of ruin is not linear. This means the more money you lose, the harder it is to recover back your losses.

3. The distance of your stop loss

The final ingredient is finding out what is the size of your stop loss (in terms of pips, or ticks if you’re trading stocks and futures).

I’m not going into full detail on how to set your stop loss. But the way I do it is by placing my stop loss at a level where if it’s reached, it will invalidate my trading idea. If you want to learn more, go watch the video below:

If you ask me, risk management and position sizing are two sides of the same coin. You can’t apply risk management without proper position sizing.

Next…

You’ll learn how to calculate your position size for every trade, so you will never blow up another trading account. Let’s go!

How to calculate position size in forex

Let’s assume:

- You have a $10,000USD trading account and you’re risking 1% on each trade

- You want to short GBP/USD at 1.2700 because it’s a Resistance area

- You have a stop loss of 200pips

“How many units do you short so you only risk 1% of your trading account?”

Forex risk management — position size formula

Here’s the formula:

Position size = Amount you’re risking / (stop loss * value per pip)

So…

- The amount you’re risking = 1% of $10,000 = $100

- Value per pip for 1 standard lot = $10USD/pip

- Stop loss = 200pips

Plug and play the numbers into the formula and you get:

Position size = 100 / (200*10)

= 0.05 lot (or 5 micro lots)

This means you can trade 5 micro lots on GBP/USD with a stop loss of 200 pips; the maximum loss on this trade is $100 (which is 1% of your trading account).

Now you’re probably wondering:

“Rayner, this is so cumbersome. Is there a faster way to calculate it?”

You bet.

All you need to do is use a forex position sizing calculator and I’ll explain more in this video…

However, just keep in mind that you can easily make a forex risk calculator on your excel spreadsheet by using the formulas mentioned above!

How to calculate position size in stock trading

Once you understand how position sizing works, you can apply it across all markets. This means you can manage your risk like a pro no matter what instruments you’re trading.

Here’s an example for stock:

- You have a $50,000USD trading account and you’re risking 1% on each trade.

- You want to long Mcdonalds at 118.5 because it’s an area of Support

- You have a stop loss of 250 ticks (which is $2.5)

How many shares of Mcdonalds do you buy so you risk only 1% of your trading account?

Stock risk management — position size formula

Here’s the formula:

Position size = Amount you’re risking / (stop loss * value per tick)

So…

- The amount you’re risking is 1% of $50,000 = $500

- Value per tick for 1 share = $0.01

- Stop loss = 250 ticks

Insert these numbers into the formula and you get:

Position size = 500 / (250*0.01)

= 200 shares

This means you can trade 200 shares of Mcdonalds with a stop loss of 250 ticks. If it’s triggered, the loss on this trade is $500 (which is 1% of your trading account).

Remember, when you’re trading stocks, the price can gap through your stop loss — causing you to lose more than you intended. This is a common occurrence during earnings season.

Now…

I know this is a slow way to calculate your position size for stocks. That’s why you can use a position sizing calculator to make your life easier, which I’ll explain more in this video…

Forex risk management — position sizing calculators

To make your life easier, you can use one of these forex risk management calculator below:

MyFxBook – Position sizing calculator for forex traders.

Daniels Trading – Position sizing calculator for futures traders.

Investment U – Position sizing calculator for stock and options traders.

The secret to finding low risk and high reward trades

Here’s a fact:

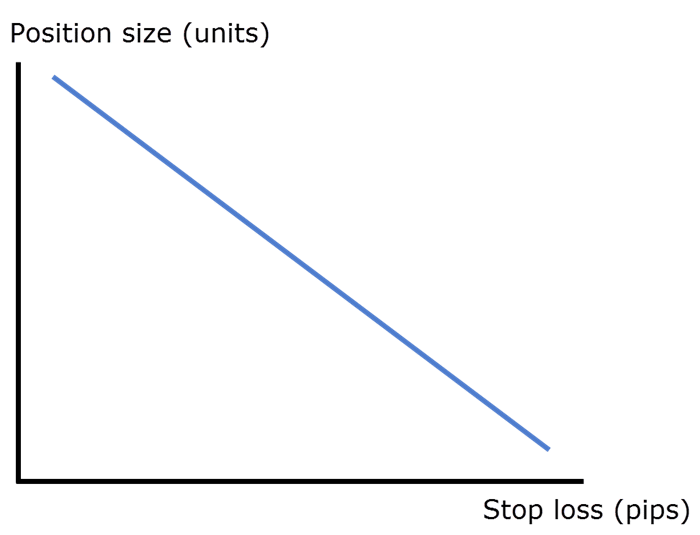

The larger the size of your stop loss, the smaller your position size (and vice versa).

Visually, it looks like this:

Now, let me prove it to you…

- Assume you’re risking $1000 on each trade

- Value per pip for 1 standard lot is $10USD/pip

- Your stop loss is 500 pips on EUR/USD

So, how many units can you short?

Position size = 1000 / (500 * 10)

= 0.2 lot (or 2 mini lots)

For this trade, if the market moves 500 pips in your favor, you’ll gain $1000.

But what if you can reduce your stop loss to 200 pips?

Position size = 1000 / (200 * 10)

= 0.5 lot (or 5 mini lots)

For this trade, if the market moves 500 pips in your favor, you’ll gain $2500.

Naturally, it’ll be obvious as you use a forex risk management calculator, but the bottom line is this…

A tighter stop loss allows you to put on a larger position size — for the same level of risk.

So, how do you apply this concept to your trading?

Simple.

By being patient and letting the market come to your level.

Here’s what I mean:

Both A & B have the same stop loss.

The only difference is where you’re shorting the market — and this makes a huge difference to your bottom line.

So, do you want to short A or B?

Why leverage is irrelevant and what you should focus on instead

This is one of the most common questions I get from traders…

“Hey, Rayner, how much leverage do you use?”

If you are unfamiliar with the term leverage, it means how many times larger you can trade relative to your account size.

So, if you have 1:100 leverage and your account size is $1000; this means you can trade up to $100,000 worth of the underlying instrument (like stocks, currencies, futures).

But here’s the truth:

I don’t bother about leverage. Why?

Because it has zero relevance to your risk management.

Let me explain…

- Assume you have a $100,000 account

- You risk 1% of your account on each trade

- Value per pip for 1 standard lot is $10USD/pip

- Your stop loss is 50 pips on EUR/USD

So, how many units can you trade?

Position size = 1000 / (50 * 10)

= 2 lots

This represents $200,000 worth of EUR/USD, or in other words, a leverage of 1:2.

But…

What if your stop loss is 500 pips?

Again, apply the position sizing formula and you get…

1000 / (500 * 10)

= 0.2 lot

This represents $20,000 worth of EUR/USD, or in other words, a leverage of 1:0.2.

Do you see my point?

In both scenarios, the maximum loss on each trade is $1000, even though you’re using different leverages. Why?

Because the leverage you use depends on the size of your stop loss. The smaller your stop loss, the more leverage you can use while keeping your risk constant. And the larger your stop loss, the less leverage you can use while keeping your risk constant.

So…

Don’t bother too much about leverage, especially when it comes to knowing how to calculate risk management forex because it is largely irrelevant unless you don’t have a risk management and a stop loss method altogether.

Instead, focus on how much you can lose per trade, and adopt the correct position size for it.

Frequently asked questions

#1: Did you always start with a 1% risk per trade?

In the beginning, I didn’t risk 1% per trade, I was risking about 2-3% per trade because my account back then was much smaller. But as my account grew over time, my current risk on each trade is not more than 1%.

So, when I use a forex risk management calculator, I make sure that I don’t lose more than 1% of my capital per trade.

#2: In your example, if you’re long 100,000 units of EUR/USD, the value per pip is US$10. How did you derive that $10/pip?

This is a commonly used value set by most Forex brokers, where they’ll use US$10/pip for each lot that you’re trading.

#3: Can I use a fixed lot size for each trade to keep the trades simple?

Yes, you can. But bear in mind, that since the value per pip and volatility for each instrument are different, the size of your stop loss would also likely differ for each trade as well. So it affects your risk on each trade in dollar amount.

Conclusion

I hope by now you realized that forex risk management is KING. Without it, even the best trading strategy will not make you a consistently profitable trader.

Next, you’ve learned that forex risk management and position sizing are two sides of the same coin. With the correct position sizing, you can trade across any markets and still manage your risk.

This is the position sizing formula that lets you achieve it, so that you can also create your own forex lot size calculator:

The amount you’re risking / (stop loss * value per pip)

Then, you’ve learned how to find low risk and high reward trades. The secret is entering your trades near Support and Resistance. Because you can have a tighter stop loss, which lets you put on a larger position size — and still keep your risk constant.

Lastly, I explained why leverage is irrelevant because it doesn’t help you manage your risk. The only thing that matters is proper position sizing that lets you risk a fraction of your trading capital.

Now I’m curious…

How do you apply forex risk management to your trading?

Leave a comment below and let me know your thoughts.

Hi Rayner – great stuff here. I do some MT4 programming. I created a Trade Risk Calculator indicator for MT4 that does everything you outline above right on your MT4 chart, Settable risk by percent, pips to risk, pip value, etc. I would be willing to donate this to you to give out to folks that want it for free. Email me if you are interested and I’ll send it to you so you can have a look at it.

Regards

Steve

Hi Steve,

Thank you for your generosity.

You can share it in our group here… https://www.facebook.com/groups/forextradingwithrayner

Best!

Hi Rayner,

Would you mind your sharing position sizing calculator with me? Thank you.

You can use the one that I shared in this post.

Hey I need it this’s my email sarikizamani17@gmail.com

Hello Steve. I’m messaging you from Rayner’s blog posts. You can please help me with the calculator here oyebadelucius@gmail.com

Awesome post Rayner. You have been lighting it up with awesome content this week, thank you!

I don’t think this topic of risk management and position sizing gets enough discussion. I believe it’s actually much more important than entry/buy signals to long-term success in the markets. So thank your for doing such a good job putting all this together for us!

Hello Jay,

Thank you and I’m glad you appreciate it.

It’s a dry boring topic but, like you said, it’s one of the most important thing a trader can master.

Cheers

very good info, as always. Keep up the good work, and continue to be informative and educational. Great way to pay it forward. I’ve only been reading your stuff the past 3 days. I do like what I read in your articles ad responses. Very genuine. Good Job Rayner.

Thank you Jake.

Glad to hear that, cheers

Rayner you said it best Risk management is the golden key to trading. One cannot stress the importance of Position sizing. Myself after going through my account not paying attention to it I just decide to read about it, and boy did I learn a lot.

Thank You

Rayner

Hi William,

Glad to hear it helps you.

Don’t hesitate to let me know if you’ve got any questions, I’ll be glad to help.

hi rayner

if im on 2000gbp account my leverage is 1:200 what should I do?

i just place my trades and risk 1%

I use myfxbook position size calculator to determine my lot size and place my trade

this is correct right?

Hi Charlie

That’s right. Focus on the risk per trade, leverage is largely irrelevant.

Hi Rayner,

Nice post on position sizing and money management. In your experience, did you always start with a 1% risk exposure? I am currently figuring out whether it will be good to scale down my risk during bad streaks and scale up during good streaks. Also do you take equity off after every year or do you continue to trade with your ending account balance while maintaining the same % risk exposure? Thanks.

Hi Ian,

I started with 2% initially but found it too much.

Yes, it’s possible to scale down your risk when you’re not performing well.

I don’t take my equity off but simply grow the account over time using the same % risk.

Cheers

Hi Rayner,

your Stock example must be …

Position size = 500 / (250*0.01) = 200 Shares!

Hi Pasquale

Thank you for pointing out. I’ve amended it.

Hi Rayner,

I enjoyed reading your articles and videos , and i am truly appreciative of your generosity to share among others.

I would like to understand something abt stocks. Often, i heard people saying Buy stocks traditionally. Today, i can hear Sell stocks. How is this different from the traditional method of buy and owning a stock vs trading? Can you enlighten me? Thanks.

Hey Emran

I suppose buying stocks traditionally adopt a buy and hold approach whereas trading involves buying and selling within a short period of time.

Hi Rayner,

fictive stock scenario: $50,000USD trading account; Long at 6$

Position size = 500 / (10*0,01) = 5000 Shares * 6$ = Position of 30.000$

This is a position of 60% of your hole Trading Account. What if the company blows up. Sounds not good for me. What you do?

So for Riskmanagement we have also to make Limits to the Max $Amount in a Position and Max Number of all Trades in the market and Max Risk of all Positions.

Hi Pasquale

I would decide where my stops is in the first place before deciding how much position size I’ll use.

Hi Ray,

Pls where is the excel sheet(calculates risk etc) that you shared at a time. thx

Hi Hope,

You can get it here…

https://www.tradingwithrayner.com/profitable-trader/

“Since you’re trading EUR/USD…

The EUR is the base currency and the USD is the quote currency.

To determine the value per pip, look at the quote currency.

If you’re long 100,000 units of EUR/USD, the value per pip is $10USD.”

how did y calculat it that 10$/pip ? i don’t understand

I didn’t come up with it. It’s default in the forex markets.

Hi Rayner,

Is it position sizing also must relevant to Risk:Reward and win:loss ratio? Why?

Hey Jeff

The answer is yes and no. It depends on whether you’re taking into account the time element of it.

Someone with 20 pips stop loss has a better chance of getting a 1:3 risk reward ratio in a day compared to someone with 200 pips stop loss. This means with a 20 pip stop loss you can put on a larger position size for the same level of risk compared to someone with 200 pips stop loss.

As for win rate, it’s also yes and no because you need to take into consideration your target profit. The closer it is to your entry, the better your win rate. But whether it has a positive expectancy is a different story.

As I trade, we know that we had to put a valid stop loss, mean each trade will have a different amount of pips to lose. Mean that we need to adjust the lot size each time we trade as well?

How can we be sure by adjusting the position size for each trade will help to enhance profitability?

Thank you

Yes, for every trade you’ll need to adjust your position size accordingly as different pairs have different tick value, and different setups have different size of stop loss.

There’s no way to tell for sure how it will improve profitability besides having the numbers to validate. But one thing for sure is if you don’t, you’ll have inconsistency in your trading.

Your winners have too small position size, losers have too larger position size, and etc. Because your risk on each trade is not consistent.

dear rayner,

1) if position size calculator tells us to take 0.05 lot in a trade, can we take 0.02 lot trade in that case to further lower down the risk?

2) every time we get into a trade, can we take a fixed lot size trade always. for eg, in a $500 account, can we always take each trade of flat 0.02? (i dont want to use the lot size calculator as i want to keep my trading strategy simple, and also i dont want to compromise ‘risk mgmt’)

regards,

1. Sure you can, it all depends on your own risk management.

2. No, as different markets have different volatility and your stops aren’t always fixed.

Hi Rayner,

In your first example, trading EUR/USD on a SGD account… The eventual return of the trade should factor in the evolution of the USD/SGD pair, right? I mean, if the EUR/USD wins 10 pips and in the meantime, the USD/SGD loses that many, you’ll break even, won’t you?

Keep up the great work!

Tonio.

Hi Tonio

Yes, that’s right. But it’s unlikely the USD/SGD moves that much to trigger a conversion loss when the EURUSD only moved 10 pips.

Thanks!

So basically, you don’t care of that issue, whatever your account base currency and whatever the forex pair you trade?

Yes, that’s right.

Rayner,,

Great content!

For trading futures, what account size would you need before you could trade futures risking 1%? I am looking at /RB setting up for a trade, but a 2ATR loss would cost over $1,000 for the stop loss. You would need an account size of over 100k to trade this product. Correct?

Hi Russell

Yes, you need a large account to trade futures usually in the 6 figure range.

I suggest trading the spot fx or cfds as the margin requirements are lesser.

OK. Thanks. One more question.

You mention in other articles that you should be able to trade about 60 markets from these 5 sectors. 1. Agriculture commodities 2. Currencies 3. Equities 4. Rates 5. Non-Agriculture Commodities. Where do you get all of your products to trade if you can’t trade futures with a small account?

Hey Russell

You can use CFds to replicate the futures market.

OK. Thanks. I will check that out. Have you ever traded spreads (calendars) with futures? Do you have a preferred broker or platform? I am in the US. Thanks, for all you do.

Yes I have back in my prop days.

I don’t publicly discuss brokers because in this day and age, we have no idea what goes on behind the scenes.

If you want a recommendation, drop me an email me and we can discuss it.

Hey Rayner! I got a question! What if the recommended position size is 50shares but the normal boardlot requires at least 100 shares how do you overcome that problem? Do you buy oddlot then? Also regarding the leverage part, if the recommended position size is worth $200,000 and your trading account is just worth $10,000, how do you go over that?

Best Regards, 🙂

1. I don’t know of any way to overcome this besides have a bigger account size

2. Similar to above

Hi Mr. Rayner

In this Example that you mentioned above :

“But here’s the truth:

I don’t bother about leverage. Why?

Because it has zero relevance to your risk management.

Let me explain…

Assume you have a $10,000 account

You risk 1% of your account on each trade

Value per pip for 1 standard lot is $10USD/pip

Your stop loss is 50 pips on EUR/USD

So, how many units can you trade?

Position size = 1000 / (50 * 10)

= 2 lots

This represents $200,000 worth of EUR/USD, or in other words, a leverage of 1:20.

But…

What if your stop loss is 500 pips?

Again, apply the position sizing formula and you get…

1000 / (500 * 10)

= 0.2 lot

This represents $20,000 worth of EUR/USD, or in other words, a leverage of 1:2.”

You said that the Account size is 10,000 $ and your risk on each trade is 1% of the Balance. So, you should divide 100$ on (50 * 10) for the first example and 100$ on (500 * 10) for the second one, not 1000$.

Thanks a lot.

Hi Amin

Thank you for pointing out, I’ve fixed it.

cheers

Hi Amin,

he never said account size is $10,000, but $100, 000. So 1% of the $100,000 account size is $1000. His calculation was correct. Thank you

Which way is best to calculate risk

1. Calculate using equity

2. Calculate using balance

3. Calculate using deposited amount

You can use your balance.

Hey Rayner,

We are using position sizing to avoid loss of capital in loosing trades.

But if the trade is winning trade then how to add more capital so we can get maximum out of it.

Thanks

Hey Jamir

This post might help… https://www.youtube.com/watch?v=-7EE0X-FEtE

That’s helpful… thanks you…..

You’re welcome, Jamir!

Hey Rayner,

I have some confusion , please help me to understand the position sizing concept.

Suppose I have $100000 trading capital.

I am risking 1% on each trade.

As a trend follower I will trade every winning position till it is in trend.

Position sizing is allowing me to take 10 to 15 trades with $100000/- capital.

Is it necessary to take more trades to get more %return?

If I took 5 trades from that 3 are winners and 2 are looser.

Can you please explain as trend follower how to trade these 3 winners with $100000 capital.

Thanks,

Jamir

Hi Jamir

1. As a trend follower, you’ll take every setup that comes as you have no idea which will be the big winner

2. I suggest trading a variety of markets to increase your odds of capturing a trend (like fx, commodities, bonds, indices, and etc.)

3. I’m not sure what’s your last question about…

Yes I got it….thank you Rayner…..

Thanks my mentor for the training and education. God bless you.

Glad to be of help!

Hi Rayner

thanks so much for this, so help

how can i follow, and good for you to be my FX mentor

You’re welcome!

Bro, your articles is one of the best I read. It has helped me greatly in the perspective of trading. Always come back to review my mind and skills when I read this article. Keep inspiring us and I will definitely follow u!:)

Thanks my mentor for helping us That’s helpful thanks you so much Rayner

Awesome to hear that!

Rayner, thank you so much for the article. It helps us a lot. When it comes to trading spreadsheet we can use Excel functions to calculate profit and loss if we are to enter pip value as an input. In this case should we use pip value of the closing moment of the trade to calculate profits or loss? Pip value changes from moment to moment and so to calculate P/L i feel we should get the pip value of the closing moment of the trade.

Your pip value is defined by the currency you fund your account with and the currency pair you’re trading.

It changes depending on the above 2 factors.

Hi Rayner,

I tried to used the Risk Management Calculator, but my question is that it seems it only allowed me to buy few stocks? I mean not enough volume to get huge gains?

TIA.

Full Metal Alchemist

It might be your capital size is too small?

Thanks Mr Rayner I have learned a lot. May the mighty God bless you for your work you’re doing in educating us.

Cheers

Hi rayner , a question do you dont take in consideration the fees when you calculate your position size

Yes, I do.

Thanks a lot for teaching . specially leverage factor irrelevant .you know before you, I have been studying from Babypips.com . Do you know it? what’s your opinion about that site?

Gracias Rayner. esta es una excelente clase de la que me hacía falta te agradezco por tu ayuda eres una gran persona saludos.

Hello Rayner

From your explanation does it mean that there are two methods in calculating stop loss

1. That is through position sizing

2. And through locating where your initial trading idea is invalidated

GOT IT THANK YOU But what if will if i want to put my stop loss above or below structure but the level is more than 1% of my trade or my risk to reward does not agree with this level

Hey Vengai,

Risk management is very important.

For hours I have been trying to figure out where you got 50 from with only this given info

Please explain bc in step three is we determined value of pip is $10usd why in step 3 is your input 50?

“Step 1: Determine the value per pip of the currency pair you’re trading

Since you’re trading EUR/USD…

The EUR is the base currency and the USD is the quote currency.

To determine the value per pip, look at the quote currency.

If you’re long 100,000 units of EUR/USD, the value per pip is $10USD.

Step 2: Determine the spot rate between the currency of your trading account and the quote currency

The currency of your trading account is in SGD.

The quote currency is USD.

Thus, look at the spot rate of USD/SGD.

Step 3: Multiply the spot rate with the value per pip of the currency you’re trading

Let’s assume the spot rate of GBP/USD = 1.25

So…

1.25 * 50 = 62.5USD

This means every 1 pip movement in EUR/GBP is worth $62.5USD to you.”

But what if you can reduce your stop loss to 200 pips?

Position size = 1000 / (200 * 10)

= 0.5 lot (or 5 mini lots)

For this trade, if the market moves 500 pips in your favor, you’ll gain $2500.

The bottom line is this… a tighter stop loss allows you to put on a larger position size — for the same level of risk.

WOULDNT THE GAIN BE $2000…. NOT $2500?

Send me

Thank you very much, Rayner.

I have been 100% glued to your site for the past 3 three.

Your contents are very rich and easy to understand.

I pray and look forward to learning your styles and trading like you as well.

Hi Kenneth,

I’m so happy to hear that from you!

Cheers.

Thanks so much Rayner.

I took time to read through ur article.

was actually making my research to enbark on forex trading, I’m glad i came across ur article and it really helped me alot.

Pls sir, i need ur sincer answers for these questions of mine:

1. With ur experience in forex trading, will u encourage ur loved one to become a forex trader??

2. Can someone make a living with trading forex,i mean is it lucrative??

3. Is it possible to trade without blowing up ones account over a period of time??

Thanks in anticipation.

Hi Njoku,

There’s a learning curve to everything.

The road to success is bumpy.

The strong and consistent make it to the end.

The financial market is so big for everyone to benefit from it.

Cheers.

Why if I lose 50% I have to win 100% to the starting point? why not 50%?

For example, if my initial balance is 1000 $ and I lose 500 $, I have to win 1000 $ to get back to my original balance, and why not 500 $?

And is there a formula to calculate it?

I have understand why risk management is very important

Sure…

With what I have learned from this website, now I trade with confident and control,

I don’t trade with fear again,

Thank you my friend

My mentor

MY LEGEND

Awesome, Micheal!

Keep it going…

Hi Rayner!

Why did you have to risk 2-3% when you began trading instead of 1%, meanwhile your account balance was small?

[…] adopt proper risk management and keep your bets […]

Hey Rayner. Thanks for the article.

However, my broker uses fixed leverage per account, so my trading account has fixed leverage. How do I work this into my risk management strategy and calculations?

Hi Teo!

Love your ” Ultimate Stock Trading Course” for beginners!

Thank You for it!

Will it be possible to have the excel form for risk management calculation!?

I Love It!

Thank You.

Best.

jb…

Hey, Jb!

please email at support@tradingwithrayner.com regarding for risk management spreadsheet, then we’ll send it to you.

Cheers!

Hi rayner!

Your explanations thought me everything about trading and am now better at it, thank you so much.

I want to deposit $500 with a leverage of 1:100 and risk 12% in 10 pips which means my lot size will be 0.6, then how much will i lose in this case if it goes against my direction.

Will it be possible to have the excel form for risk management calculation!?

Please

Can I go to your webinar but I’m a crypto trader beginner I’m not a forex trader ? I go because I want more knowledge in trading .

Hey there, Mhardy!

Jarin here from TradingwithRayner Support Team.

Yes! As long as the topic is for the Price Action Trading, you may use the strategies in crypto, too!

Hope that helps!

Great article Rayner,

Can you please share your thoughts.

This is how I approach stock position sizing.

Value of one tick = one round lot × one tick

Value of one tick = 100 × 0.01

One tick value = $1

Excellent job you are doing. We need you and we love you!!!

Thanks, Thlou!

Feel free to explore Rayner’s blogs here:

https://www.tradingwithrayner.com/category/blog/

Cheers!

Hi thank you for sharing this information my brother

You are most welcome!

Hello Rayner,

that‘s very interesting,

I previously thought that leverage played a role in risk management.

Is it the case with other currencies such as indices, futures and crypto currencies that leverage doesn’t play a role?

Thank you and I appreciate you!

LG