Here’s the truth:

No matter what strategy you have…

You must take profits at some point and cash in on your trades to compound your earnings over time.

But achieving that takes discipline and consistency—you can’t just randomly take profit anytime or anywhere you want!

But there’s good news for you.

Because in today’s guide, I’ll dive into take profit orders today and polish you into a consistently profitable trader.

Here’s what you’ll learn:

- What is a take profit order and how is it executed on a chart

- The good and the hard cold truth about take profit orders in trading

- Common mistakes traders make when using take profit orders (that you must avoid)

- How to use take profit orders to maximize your returns in different market conditions

Ready?

Then let’s jump right into it!

What are take profit orders in trading

In simple terms…

A take profit order gets triggered when the current price hits your pre-determined price that’s in favour of your trade!

Which means that your trade closes, and you are to receive the profit you’ve made on that trade.

That’s why it’s called a take “profit,” duh!

On the other hand…

A stop loss order gets triggered at a pre-specified price to close your open positions to limit your losses if a trade goes against you.

Basically…

Both take profit orders and stop loss orders are limit orders which you can typically place when executing your trades, or even after.

So, let me show you how it actually looks like when executing it on TradingView…

During trade execution

Trading platforms these days usually allow you to enter the price levels of your take profit and stop loss orders on a simple interface:

After trade execution

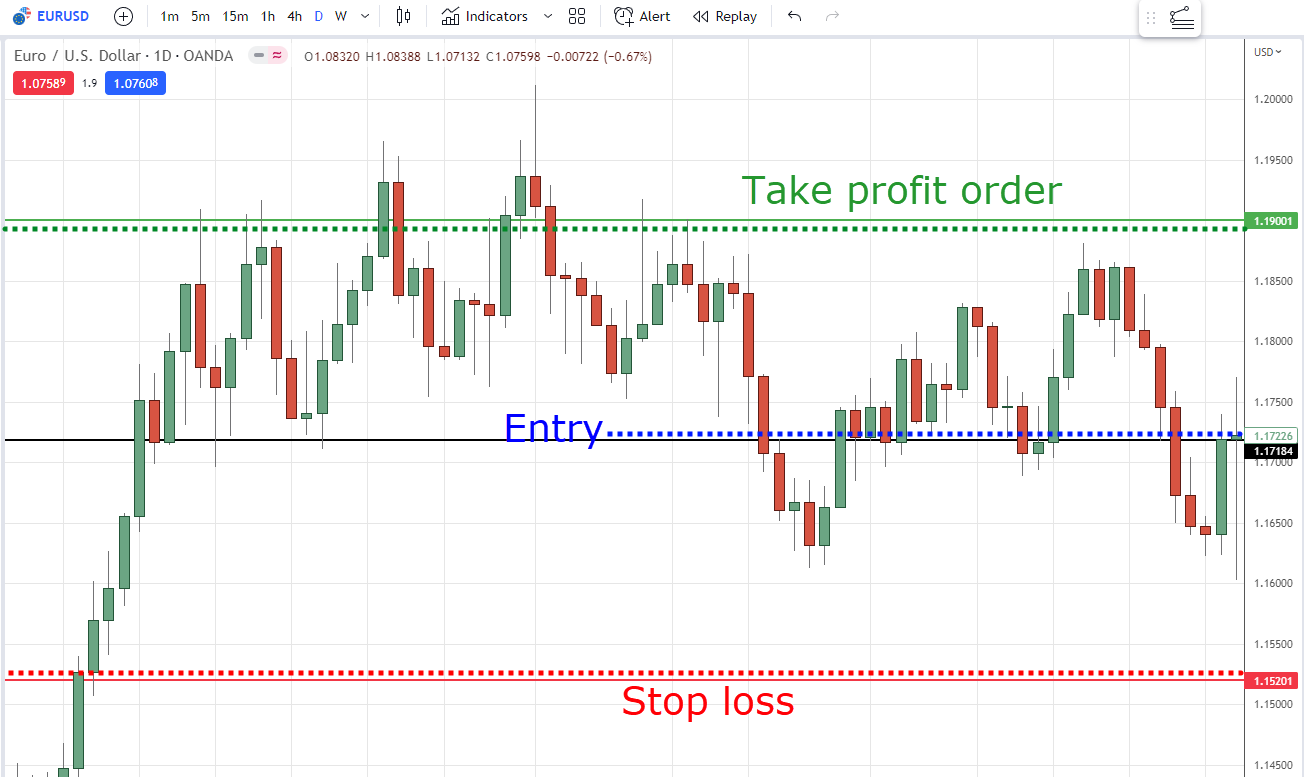

You’ll see 3 new lines on your chart, indicating:

- Your entry price

- Your take profit order

- Your stop loss order

Here’s what I mean…

In this example where you enter long:

- Your entry price for USD/JPY is 130.718

- Your trade will close with a profit if the price hits your take profit order at 136.876

- Your trade closes at a loss if the price hits your stop loss at 126.403.

Now that you’re all caught up with the basics, let’s dive deeper into take profit orders.

While the focus of this guide is on take profit orders…

I’ll also bring up stop loss orders where appropriate to help you see the full picture.

Sounds good?

Moving on…

The pros and cons of take profit orders in trading

You must already know that take profit orders are essential for you to lock in your trading profits.

But here’s the tricky bit:

While you need to remember to set your take profit orders for every trade…

It doesn’t mean that you should always set them in the same way.

Here’s what I’m talking about…

If you’re swing trading and buying into a range market…

You should place a take profit order before the nearest resistance or swing high.

Here’s what I mean:

Because you know that’s where the price is likely going to face some selling pressure and you’ll want to secure your profits before that happens.

However…

If you’re buying into a breakout, where would you place your take profit order?

It’s hard because there’s no point of reference like resistance or swing high.

Plus, if you set a take profit order when buying into breakouts—you’re limiting your profit potential!

It could be the start of a monster trend!

So, the last thing you want is to tell Mr. Market that you’re happy to reap just X number of pips off that trend.

The bottom line is this, take profit orders are:

- Useful in a range market or when you’re swing trading

- Not ideal for breakouts or strong trending markets (I’ll share what you should do instead later)

Now that you know when a take profit order is relevant…

Let me tell you the worst mistake about take profit orders.

Common mistakes traders make when using take profit orders (that you must avoid)

If you want to be a consistently profitable trader…

Then you must not commit these fatal mistakes:

- Being overly concerned about getting every single trade right

- Not being disciplined and lacking in conviction

Let me tell you what I mean…

Mistake #1: Being overly concerned about getting a trade right

If you don’t know what you’re doing and you simply want to secure a win on each trade…

You’ll likely end up setting a tight take profit order (and a much wider stop loss order).

The risk-reward will be unfavourable against you!

This is a huge mistake for a newbie trader just so they feel good about being right to stroke their egos!

It’s a huge waste of time to do all the analyses just to earn pennies and be right 90% of the time, but when you lose 10% of the time, all your earnings get wiped.

Now, what if you’re only right 50% of the time (or less) with the same risk reward?

Your trading account will bleed even more.

Mistake #2: Being ill-disciplined and lacking in conviction

If you don’t have conviction in your trades…

What happens is you’ll keep adjusting the take profit orders (and even the stop loss orders).

You’ll eventually end up cutting your profits short or extending your losses.

And the root cause of this problem?

You don’t have a solid trading plan that you religiously stick to.

If you want to be a disciplined and consistently profitable trader, then you must start having a trading plan and getting into the habit of journaling your trades.

I won’t dive into those in this guide.

But you can discover more here: A Complete Guide To Creating And Using A Forex Trading Journal

So, now that you know how a take profit order should and shouldn’t be used…

Let me now teach you how to use take profit orders in your favour.

Shall we?

How to use take profit orders to maximize your returns in different market conditions

I want to share with you more on how to use take profit orders to profit both in a range market and a trending market.

1) Range markets: use a fixed take profit order

In a range or in a sideways market where you’re swing trading, you should use a fixed take profit order.

Because you’ll want to capture short-term profits in either direction whenever the price swings between support and resistance.

Here’s a short example of what a trading plan looks like in this case:

- Identify a range market bounded by support resistance

- Enter the trade at an area of value with a valid entry trigger

- Place stop loss order 1 ATR away from previous swing low/high

- Place Take profit order before resistance/support

First, identify a range market bounded by support resistance

We’re now on the Daily timeframe of EURUSD, where it’s in a range market, bounded by support and resistance.

Second, enter the trade at an area of value with a valid entry trigger

You want to start getting ready to go long when the price reaches the area of value, which is the support here.

You’ll only go long at the open of the next candle after the price closes bullishly back into the range.

In this case, the price closed back into the range with a big bullish engulfing candle.

Third, place stop loss order 1 ATR away from the previous swing low

You’ll want to place your stop loss order 1 ATR away from the support.

This takes into consideration the volatility of the price of the recent periods to give your trade some buffer space.

Learn all about the ATR indicator here: The Complete Guide to ATR Indicator

Lastly, place take profit order before the area of resistance

You’ll want to also take profit before or near resistance so that you can lock in your profits before selling pressure steps in against your favor.

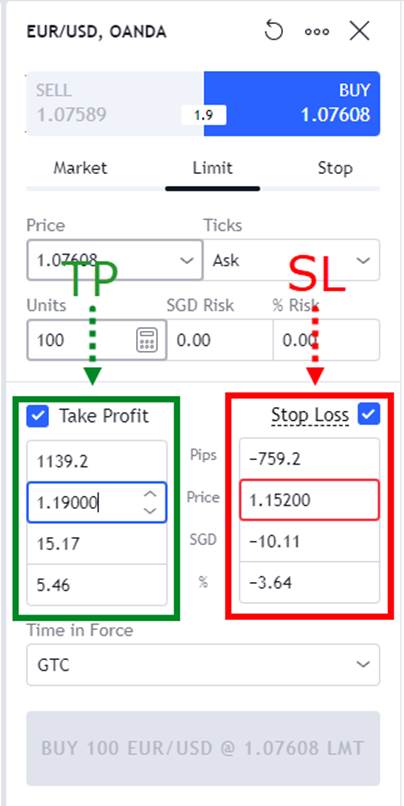

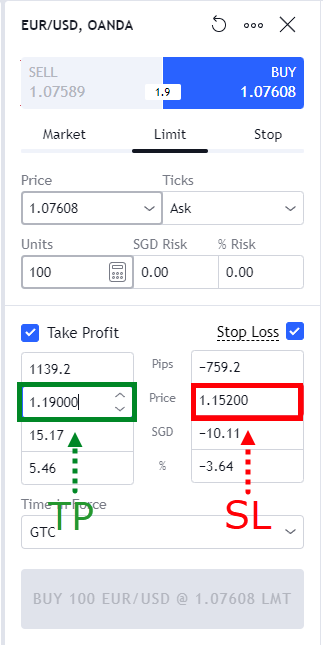

On some trading platforms, you can very easily enter the precise take profit levels and stop loss levels on a single interface:

Pretty straightforward, isn’t it?

Next…

2) Trending markets: use a trailing stop loss order as your take profit order for monster gains

Now you might be thinking:

“Hey Rayner, isn’t a trailing stop loss order used to cut our losses and it’s different from a take profit order?”

Yes, buddy, you’re technically right.

But the thing is…

If you want huge gains from a strong trending market, you can’t use a normal, fixed take profit order—else it’ll limit your gains.

Here’s a short example of how this works:

- Identify a trending market that is consolidating

- Enter the trade once the price breaks out of consolidation

- Set trailing stop loss order 1 ATR away from previous swing low/high

- Exit trade once the price hits the trailing stop loss order

First, identify a trending market that is consolidating

In this USDJPY example, the price is in an uptrend and is consolidating into an ascending triangle and the price is near resistance.

Second, enter the trade once the price breaks out of consolidation

As soon as the price breaks out, you want to be in the trade.

How do you ensure that?

You can place a buy limit order above resistance ahead of time so you won’t have to manually place a market order to catch the breakout.

Third, set trailing stop loss order 1 ATR away from the previous swing low

Look at the ATR indicator and minus that value from the previous swing low.

That’s where your trailing stop loss order will be.

Lastly, exit trade once the price hits the trailing stop loss order

At all times, the trailing stop loss order will:

- Move up whenever the price moves in your favor

- Not move at all whenever the price moves against you

And because it doesn’t re-adjust whenever the price moves against you…

You can expect your profits in these strong trending markets to be “automatically locked in” for you.

Of course, not every trading platform has a trailing stop loss order that automatically adjusts itself for you.

In that case, you can always manually trail your stop loss order using the moving average or market structure.

If you want to discover the secrets to trading breakouts like a pro, then read this: The Definitive Guide to Trading Breakouts

So, with that said…

Let’s do a quick recap on what you’ve learned today.

Shall we?

Conclusion

- A take profit order is a limit order which closes your open positions when the price reaches its level

- Use take profit orders in range markets but not in strong trending markets

- Stick to a trading plan and keep a trading journal to build your trading confidence

- Use a fixed take profit order in range markets, but use a trailing stop loss order in strong trending markets

Now, have you had issues committing to your take profit orders that you set?

How does it affect your trading?

I’ll be happy to hear your thoughts in the comments below.

Nice one Reyna

Thanks, John!

Thank God that I came across Reyner Teo’s platform. This is an eye opener.

Thanks, Abdulrazak!

Thanks so much Rayner

You’re most welcome!