I think you’ll agree with me when I say:

It can be difficult to trade well with the amount of “noise” out there.

Price action, indicators, trend lines, Support & Resistance, Fibonacci, blah blah.

Where do you even begin?

Well, it turns out, you can use a forex trading plan checklist to skip all the fluff out there, and focus on stuff that really matters.

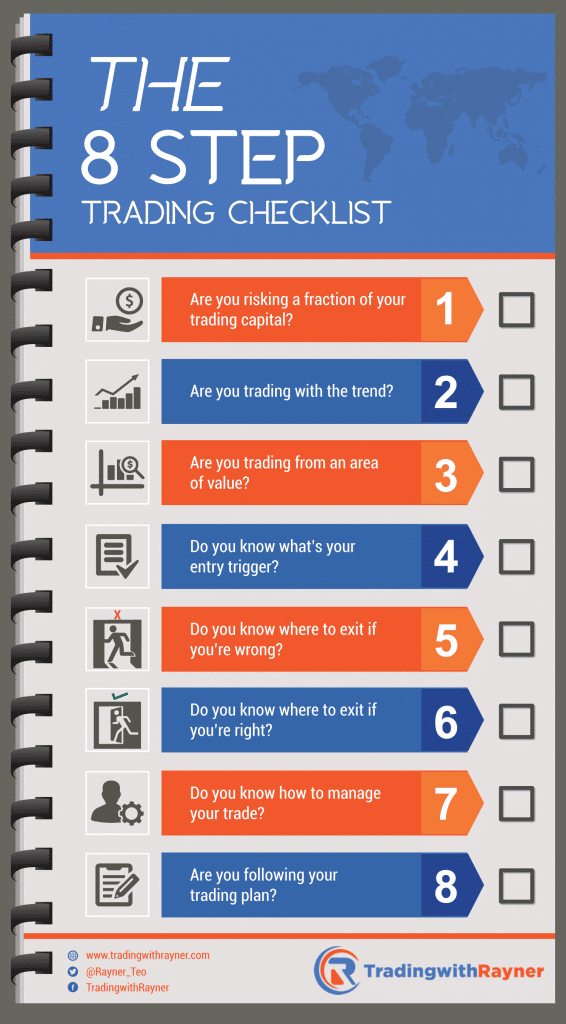

And in today’s post… I’m going to share with you, the 8 step trading checklist that will take your trading to the next level.

Are you ready?

Then let’s get started.

Trading checklist #1 — Are you risking a fraction of your trading capital?

Here’s the thing…

You can have the best trading system with the best forex trading plan checklist, but without proper risk management, you’re still going to blow up.

An example:

You have a trading system that wins 50% of the time with 1:2 risk reward profile.

And you have a hypothetical outcome of L L L L W W W W

Now…

If you risk 30% of your equity, you’d blow up by the 4th trade (-30 -30 -30 -30 = -120%)

But…

If you risk 1% of your equity, you’d have a gain of 4% (-1 -1 -1 -1 +2 +2 +2 +2 = 4%)

Having a winning system without proper risk management isn’t going to get you anywhere.

You need a winning system with proper risk management.

Not forgetting…

The recovery from the risk of ruin is not linear, it could be impossible to recover if it goes too deep.

If you lose 50% of your capital, you need to make back 100% to break even. Yes, you read right. 100%, not 50%.

That’s why you always want to risk a fraction of your equity, especially when your winning ratio is less than 50%.

So, how much should you risk exactly?

This depends on your winning ratio, the risk to reward, and your risk tolerance. I would advise risking no more than 1% per trade.

Here’re a few risk management tools for you:

And a quick training video on how to determine your position size…

Trading checklist #2 — Are you trading with the trend?

A mistake made by many traders is that they become so involved in trying to catch the minor market swings that they miss the major price moves. – Jack Schwager

Look:

I’m not saying trading against the trend is wrong.

But for new traders starting out, one of the best ways to improve your trading performance is, trading with the trend (and not against it).

Here’s what I mean…

- You do not require precise entry to make a profit

- You have better odds for the trade to work out

- You have a greater profit potential as the impulse move is stronger

Now, if you want to learn how to define a trend, go watch this training video below:

Trading checklist #3 — Are you trading from an area of value?

I’m sure you’ve heard the saying, buy low and sell high.

If you’re buying groceries, you know how much you’re willing to pay based on your past experiences. Anything above your expectations, you’ll not buy it.

But when it comes to trading…

How do you identify an area of value?

How do you identify what’s low and what’s high?

This is where Support & resistance (SR) can help you.

Support – An area with potential buying pressure to push price higher (area of value in an uptrend)

Resistance – An area with potential selling pressure to push price lower (area of value in a downtrend)

Here’s what I mean…

Dynamic Support & Resistance

What you’ve seen earlier is what I call, classical Support & Resistance (horizontal lines)

Alternatively, it can come in the form of a moving average. This is known as dynamic Support & Resistance (and I use the 20 & 50 EMA).

This is what I mean…

Some benefits of trading at support & resistance (SR):

- You are trading from an area of value

- It tells you when you’re wrong

- It improves your winning rate

- It improves your risk to reward

Watch this short training video below and learn how to use SR and improve your trading performance:

Trading checklist #4 — Do you know what’s your entry trigger?

Here are 3 fundamental facts of trading:

- Position sizing determines how much you’ll wager

- Exit determines whether you win or lose

- Entry determines the frequency of your trades

Entry determines the frequency of your trades, and that’s it.

Do not spend most of your time on it because there are far more important things to consider (like risk management, trend, trade location etc).

Now you’ve understood it…

Let’s look at some ways you can enter a trade:

- Pullback

- Breakout

Pullback

A pullback is when price temporarily moves against the underlying trend.

In an uptrend, a pullback would be a move a lower.

Here’s an example:

In a downtrend, a pullback would be a move higher.

An example:

According to the work’s of Adam Grimes, trading pullback has a statistical edge in the markets as proven here.

You may wonder:

What are the pros and cons of trading pullbacks?

Advantages of trading pullbacks:

- You get a good trade location as you’re buying into an area of value. This gives you a better risk to reward profile.

Disadvantages of trading pullbacks:

- You may potentially miss a move if the price doesn’t come into your identified area.

- You’ll be trading against the underlying momentum.

Breakout

A breakout is when price moves outside of a defined boundary.

The boundary can be defined using classical support & resistance.

Breakout to the upside:

Breakout to the downside:

You’re wondering:

What are the pros and cons of trading breakouts?

Advantages of trading breakouts:

- You will always capture the move.

- You are trading with the underlying momentum.

Disadvantages of trading breakouts:

- You get a poor trade location as you’re paying a premium.

- You may encounter a lot of false breakouts.

Whether you’re trading pullback or breakout, there’s always one question on your mind…

Do you wait for a candle close before taking a trade?

Here’s the thing…

There’s no right or wrong about it. Ultimately you need to find an approach that suits you best, and which you can execute consistently.

Some traders would prefer to wait for a candle close, whereas some are fine without waiting for “confirmation”.

With that said, here are some pros and cons for you to bear in mind.

Pros of waiting for candle close:

- Improve your winning rate

- Easier to execute psychologically as the price has moved in your favor

Cons of waiting for candle close:

- You may get a candlestick which closed higher but has bearish annotation to it e.g. shooting star at area of support

- You may get a poorer risk to reward if price moves away from SR quickly

Remember… entry only determines the frequency of your trades (and you shouldn’t spend all your time and energy here).

The exit determines whether you’ll win or lose, which is vastly more important. This is what we’ll cover next…

Trading checklist #5 — Do you know where to exit if you’re wrong?

“Place your stops at a point that if reached, will reasonably indicate that the trade is wrong. Not at a point determined primarily by the maximum dollar amount you are willing to lose.” – Bruce Kovner

Now you’re probably wondering:

How do I know when I’m wrong?

And the answer is simple. You’re wrong when your trading setup is invalidated.

Let me share with you a few examples…

Knowing when wrong at (AUD/USD):

Knowing when wrong at (USD/CAD):

Knowing when wrong at (EUR/GBP):

If you want to learn more, go watch this training video below:

Let’s move on…

Trading checklist #6 — Do you know where to exit if you’re right?

I’ll be honest with you.

You’re never going to consistently exit your trades at the highs/lows.

What’s important, however, is to exit your trades based on your objectives.

With that said, here are some ways you can exit your trades:

- Support & resistance

- RSI overbought/oversold areas

- Trailing stop loss using structure

Support & resistance

It works by asking yourself the following questions:

- If you’re long, where would seller come in?

- If you’re short, where would buyers come in?

And here’s the answer…

Support & resistance.

This means if you’re long, it would be prudent to take profits at nearest resistance since there’s potential selling pressure to push price lower.

And if you’re short, it would be prudent to take profits at the nearest support since there’s potential buying pressure to push the price higher.

Here’s what I mean:

RSI indicator

You can use RSI indicator to identify overbought and oversold areas (above 70 for overbought, below 30 for oversold). This can also act as Support & Resistance in the markets.

I’ve learned this technique from Steve Burns, in his book, Moving Average 101.

Here’s an example:

This approach works well when the market is in a range, or the trend is weak.

You’re probably wondering:

But what about strong trending markets?

This is when trailing your stop loss is the best thing to do…

Trailing stop loss using structure

You know an uptrend consists of higher highs and lows.

You can use it to trail your stop loss below the previous swing low, till it gets broken.

In a downtrend, you can use it to trail your stop loss above the previous swing high, till it gets broken.

Something like this…

If you want to learn more, go read The Advanced Guide to Setting Your Stop Loss.

Next…

Trading checklist — #7 Do you know how to manage your trade?

Trade management can be an entire topic in itself.

But in essence, it boils down to 2 things:

- Scaling out your trade

- Scaling in your trade

Let’s dive in…

1. Scaling out your trades

This means you’re exiting a partial of your position as the price goes in your favor.

An example:

You’re long 1000 Apple Shares at $100… and you sell 500 shares at $150, and another 500 shares at $200.

Here’s the thing…

There are different ways to scale out your trades, and different traders have a different approach to it.

The most common techniques are scaling out once a specific risk to reward is met, or at Support & resistance.

Pros of scaling out your trades:

- More consistent equity curve

- Easier on your psychology as profits are “locked in”

Cons of scaling out your trades:

- Lower profitability as position size is reduced when the price moves in your favor

2. Scaling in your trades

This means you’re adding positions as the price goes in your favor.

An example:

You’re long 1000 Apple Shares at $100… and you long another 500 shares at $150, and another 500 shares at $200.

And again…

There are different ways to scale in your trades, and different traders have a different approach to it.

The most common techniques are scaling in on pullbacks, or breakouts.

Pros of scaling in your trades:

- Huge profit potential in strong trending markets

Cons of scaling in your trades:

- Harder to manage psychologically

- More volatile equity curve

Here’s the thing:

There’s no right or wrong way in trade management. Some traders prefer to scale in their trades, some prefer to scale out, and some do a combination of both.

Ultimately, you need to find something that you’re comfortable executing consistently over time.

Trading checklist — #8 Are you following your trading plan?

This is important.

If you’re not following your trading plan, then it’s impossible to find success in trading.

Why?

Because you will:

- have no idea why you’re winning

- have no idea why you’re losing

- have no idea how to improve your trading

- be fooled by randomness

To put it straight… you’re gambling.

Now you’re probably wondering:

How do I develop a trading plan?

Just answer these 7 questions…

What is your time frame?

You must define the time frames you’re trading. If you’re a swing trader, then you’ll probably be trading the 4 hour or daily time frames.

What markets are you trading?

You need to state which markets you’ll be trading. It could be equities, forex, futures etc.

How much are you risking on each trade?

This boils down to risk management. You must know how much you’re prepared to lose on a single trade. For starters, I would suggest no more than 1%. This means if you have a $10,000 account, you cannot lose more than $100 on each trade.

What are the conditions of your trading setup?

You need to know the requirements of your trading setup. Whether you’ll trade with the trend, within a range, or both (For starters I would suggest trading with the trend).

How will you enter your trade?

You could enter on a pullback or breakout. Will it be a limit, stop or market order?

Where is your stop loss?

No professional trader would enter a trade without a stop loss. The first thing you need to ask yourself is, “where will I get out if I’m wrong?”

Where is your profit target?

And if the price moves in your favor, you need to know where to take your profits.

Now…

If you want to learn more, go read The Complete Guide to Becoming a Consistently Profitable Trader.

Now what I’d love to hear from you is this…

What are some of the things you look out for before putting on a trade?

Leave a comment below and let me know what you think.

Excelente post, have it all !

Hey Jose,

Great to hear you have it all!

Rayner

Thank you Rayner. Armed with “8 steps trading checklist” I feel more confident in trading.

Hi Dave,

Glad to know it’s a confidence booster for you.

Just refer to this checklist everytime you put on a trade, and you are good to go.

Rayner

thanks Rayner

I have learnt a few pointers from you as you have explained it well

Hi Lucy,

You’re welcome. Glad you found something useful.

Rayner

Great post Rayner, really am learning a great deal from you.

£9,100 demo account up to £10,200 in one 4 days but using 10% risk because practising for Demo trading competition, would not risk more than 1% normally.

Many many thanks.

Hi Beej,

Yes, I hope you don’t risk 10% in a live account. That’s pushing the buttons big time.

Cheers

Rayner

Hi Rayner,

Great great post. Learning many things as a begainer. You have great skill which you can see very complex thing in very simple way and can explain it very very simple. Thanks once again.

Regards

Syed

Hello Syed,

I’m glad to could understand it.

Don’t hesitate to let me know if you’ve there’s anything, I’ll be glad to help.

Rayner

Excellent post which describes so many aspects in a concise and clear way. Thanks Rayner a lot for helping.

You’re welcome, Muhammad.

Happy to help in any way I can 🙂

Rayner

Hi Ray,

This is a great post. It gave me more confidence of doing trading without leaving out any step.

Thanks & regards

Hi Saleh,

Good to know it helps.

Don’t hesitate to let me know if you’ve got any questions, I’ll be glad to help.

Rayner

Very insightful, doable and needed armour especially for new traders.

Thanks Rayner!!!

You’re welcome, Natasha.

Glad to hear that!

Rayner

Very well written

thanks for the info

Don’t mention it, Satish.

Rayner

Hi Rayner,

I appreciate the time and effort you have spent to share your insightful trading knowledge .

You have covered almost everything here in a simple and sharp way to deliver the guidelines.

Well done…You are always kind to share with your knowledge and I really enjoy reading your post each time.

I have few questions here as below :

1) As you always mentioned that do not risk more than 1% in a single trade.

What if I have enter 5 trades and I would be risking 5% of my capital, does it advisable

or am I risking too high ?

2) Do you limit yourself or do you suggest any number of trade that we should take ?

For example if we identify 10 potential trade set up ( pull back or breakout ), shall we

enter all the trades based on 1% risk each trade ( which equal to 10% risk) .

I greatly value your advise and your opinion.

Thanks

Steve

Hello Steven,

1) If it’s in different markets with low correlation, then it’s fine for me.

2) This depends on your maximum risk exposure and how comfortable you are with having 10 different open positions. There’s no one size fits all here.

I hope it helps!

Rayner

Excellent, thank you.

You’re welcome, Charlie.

Rayner

Brilliant Rayner,

Any statistics to be good like Rayner….We have started getting good results catching your words meaningfully doing good trades…

Thanks please..

Great to hear that, Mahesh!

Rayner I think you are truly genius.Though i am a bit slow at my work.How much time do I require

to practice everything?

Hi Mahesh,

I suggest trading the higher timeframes. It would require lesser screen time.

Hi Rayner,

Thanks for the precise checklist you have provided, and the detailed explanation for each of the 8 points.

I do not see you mentioning Bollinger Bands as one of the indicators. Could you provide an “How to trade with Bollinger Bands”?

Thanks

Hi Eric,

I don’t use bollinger bands. But this post here will help… http://www.tradeciety.com/bollinger-bands-explained-step-by-step/

Hi Rayner, thanks for this valuable post. It’s really helpful for me.

Keep it up.

Thanks once again.

Hi Hitendra,

You’re most welcome. Glad to hear that!

Don’t hesitate to let me know if you’ve got any questions, I’ll be glad to help.

Thanks for this post Rayner!

I learned a lot from it. Bless you!

The pleasure is mine, Bethel!

Great set of trading rules. Rules are vital but having a huge number of rules can be overwhelming. This 8 point checklist is just what is needed to make sure I’m following my trading plan and managing my risk.!

Hi Wolli

Glad to hear the checklist helps.

Go print it and stick it somewhere!

Very insightful. This step by step check list specially helps me to manage all the things that I have learned from you, draw a mental map in my mind for a good trading. Thanks you again.

Glad to hear that, Zamiul.

Don’t hesitate to let me know if you’ve got any questions, I’ll be glad to help.

Generous Rayner, pls can u convert most of ur tutorials in to PDF format for quick download. More blessing.

Thank you for sharing your thoughts.

I’ll look into it…

Good one. And keep up the work. Thanks

Thank you, Tebogo!

Damn Good,,,Great Post very nicely explained

Glad to hear that, Rino!

Hello.

How do you decide which futures contract month the trade? For instance if you were expecting a big move in gold futures which you expect to last for three months, which contract month would you choose? Thought needs to be taken in account concerning liquidity, contract rollover, slippage, these are all additional costs.

Hey Carl

I’ll go with the most liquid contract.

hi rayner, i have just been screaming wow at the checklist and its really encompassing in all ramification. its really inspiring how you willing share this knowledge just for our sake, you are truly a friend, right now i dont have questions but i want to say a big THANK YOU for the post. one love!

You’re welcome, Patrick.

Don’t hesitate to let me know if you’ve got any questions, I’ll be glad to help.

Excellent article Rayner thank you for this very useful checklist!

I have a question in checklist no.7. In scaling out your trades as price moves in your favor, can we use trailing stops instead?

Especially if the stop is now above our entry price, this has the same effect as locking in your profits.

What do you think is a better method of managing your trade, scaling out or trailing stops? Would love to hear your thoughts on this.

Again thank you for a very informative post!

Hey Eric

There is no right or wrong to either approach.

Scaling out improves your consistency as you’re taking profits along the way.

Setting it to breakeven will be a hit or miss thing. Either you get stopped out on everything… or you trail and capture a trend with more position size.

Hello Rayner,

Great material.

I really like the Risk of Ruin and Risk of Drawdown calculator. Very useful.

Thanks

Paul

Glad to hear that, Paul.

cheers

I will use this Trading Checklist from next Monday onward.Thanks Rayner, My good friend.

Awesome!

Let me know how it works out for you. cheers

you are just too good! Hopefully I will master this

Cheers

Good morning Rayner; I just can say: Thank you a million times !!! … thank you for the time, care, knowledge and love you put into every article.

Have the best year ever !!!

Thank you, Art. You too!

In section #6, section titled “Trailing Stop loss using Structure”. The 2nd screenshot should say “Set you stoploss Above….. ”

Am i right??

Yes that’s right. My mistake.

Thank you for pointing out!

I didnt understand that how to identify that the trends is pointing 2 ‘o clock ?4’o clock?

Hi Rayner

Great checklist for diverse trading styles.

For day trading I also check:

Momentum:

I have found that setting a minim level on ATR and Volume and RSI indicators by adding a horizontal line on these indicators helps avoid low momentum stalling particularly in day trading . If there’s not enough flame the pot won’t boil leaving you hanging in frustrating bull/bear traps.

News Feeds

I also check for announcements looming and news tweets (especially Trump/T-May activity these days) and market open/closing hours/Holidays.

Keep up the great work buddy.

Thank you for sharing, Bruce.

Hello Rayner very good post. I look if my bolinger bands are in phase 2 and i ride the bucking branco.

Nice!

Hey Ray,

Kindly asking who is your broker?

I don’t publicly discuss brokers because in this day and age, we have no idea what goes on behind the scenes.

If you want a recommendation, drop me an email me and we can discuss it.

Okey nice.

This was a great lesson for novice as well as experts. Nothing is left out. Great. Thank you

Welcome!

This is one of the best posts I have seen, have it all!

I’m happy to hear that, Andy!

Thanks Rayner!

Very informative post.

It can really help a lot.

Thanks for sharing. . .

God Bless!

You’re welcome, Nikko!

Amazing information. It resumes all you need to know. Thank you Reyner

Cheers bud

HI Sir Reyner,

What does it mean by “long” and “short” on the statements below from your article?

If you’re long, where would seller come in?

If you’re short, where would buyers come in?

And here’s the answer…

Support & resistance.

This means if you’re long, it would be prudent to take profits at nearest resistance since there’s potential selling pressure to push price lower.

And if you’re short, it would be prudent to take profits at the nearest support since there’s potential buying pressure to push the price higher.

thank you in advance for your advice 🙂

– carlo

You might want to check out some of the basic videos I have here… https://www.tradingwithrayner.com/academy/

Hi Rayner, great work I must say. I’ve been following your write ups for a while and they’ve really helped me a lot. I’m a newbie in Forex trading and I’m about to go live but still have a few things I’m not quite clear on and would like your help.

Say I want to trade the EurUsd pair, I have a $100 account, I want to risk 1% of my account , I’m trading a micro lot and want to set my stop at 100 pips. 1% of the account would be $1 and if I get stopped out I should loose $1. I know the EurUsd pair goes 100pips on the daily time frame. Now say I enter a BUY trade at 1.17705, will a 100pips ST be 1.17605?

Thanks

This post will help with your risk management and position sizing

https://www.tradingwithrayner.com/forex-risk-management/

Hey, Rayner, I think this is your best post, because it resumes it all. And it’s also very easy to understand. Thanks for sharing with us this useful information no many people tell you.

You’re welcome, Humberto! cheers

Hi Rayner

Have you got an explanatory note on the workings of your “Trading Spreadsheet”.

Your information is very helpfull.

Geoff

Hi Geoff

I’ve got an accompanying video that comes with it.

Hi Rayner,

Is it just me or does the link for the Losing Streak calculator on EdgeWonk not work now?

Keep up the great work!

Kris

Hey Kris

It’s best you ask them about it.

Rayner,

Frankly speaking m yet to start trading but m learning/studying how to trade stock as well as forex.

M impress your teaching (youtube) and thanks for the materials that you have send me from time to time. Hope, you will surely continue guiding the needy like me whenever demands. One find day I love to meet you and learn more from you.

Regards

Cheers Samson

I have been trying to be a successful trader for 4 years now. I have to say that i have not been disciplined so i have myself to blame. I have already baied thousands of dollars to get a decent education. The education material you have done och made free for everybody Rayner is unbelievable beacuse this material is the kind that people would pay to have. Nevertheless the quality, clarity, simplicity is really waaaw. I just dont get how you get the time to do this. I am really impressed by your work and your character! I just dont know what to say but really thank you !!!!!

Thank you, Milla!

I appreciate your kind words, cheers.

Hello reynar

I have loss almost 1 lac INR

in trading and I am focussing in learning and now I concluded my strategy that I only trade with support and resistant is my thinking is true ???

Thank you Rayner…Keep up the good work

I will, cheers

Thanks, very useful

Hi Naresh,

Glad to hear that!

Cheers…

This is an amazing strategy.

I use the same one and hope to be in the fund markets for many years

Thank you!

Hi, Mihail!

That’s good to hear. We wish you the best in trading!

Cheers!