Now…

To run this backtest, I’ll keep things simple and trade only the short-term breakout and without scaling in.

Also, some of the markets no longer exist (like Deutschmark, French Franc) so we will exclude these markets.

Results of the turtle trading rules

- Number of trades: 4322

- Winning rate: 36.83%

- Annual return: -0.38%

- Maximum drawdown: -95.38%

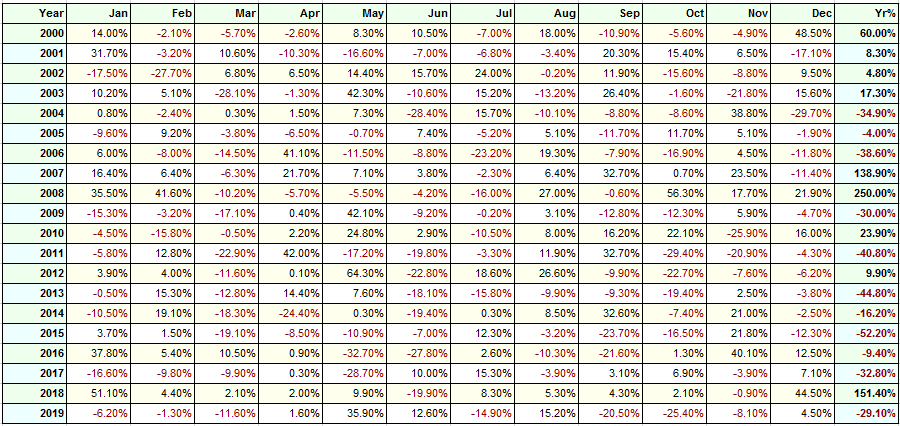

And here’s the full breakdown over the last 20 years…

Clearly, we can agree the turtle trading strategy isn’t doing well over the last 20 years.

Now you’re probably thinking…

“Does it mean the turtle trading rules have stopped working?”

Well, the answer is yes and no.

Yes, you can say the original turtle trading rules have stopped working given the poor trading results you just saw.

However, does it mean that trend following is dead?

To answer that question, let’s first understand the principles of trend following…

- Buy high and sell higher (sell low and cover lower)

- Risk a fraction of your capital on each trade

- Trade a variety of markets from different sectors (as many as possible)

- Trail your stop loss to ride the trend

- Don’t predict, react

Now, if you take the turtle trading rules and compare it to the principles of trend following, you’ll notice there are a few things we can improve on.

For example, you can increase the number of markets to trade, reduce your risk per trade, and increase the length of the breakout (to reduce whipsaw).

So, let’s modify our earlier turtle trading rules and see if we can make things better…

Modified turtle trading rules and results

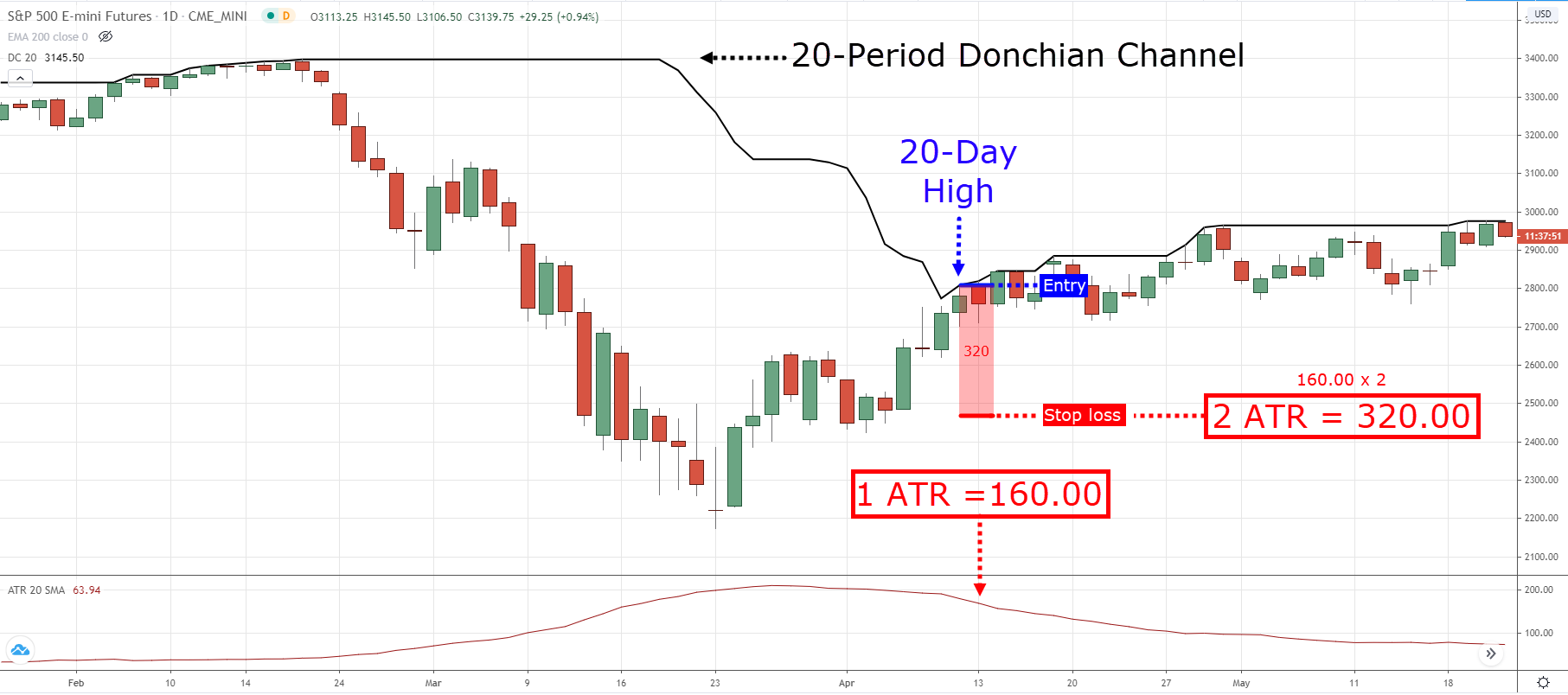

- Entry: Buy when the price breaks above the 200-day high (previously was 20-day breakout)

- Stop loss: 2 ATR from the entry price

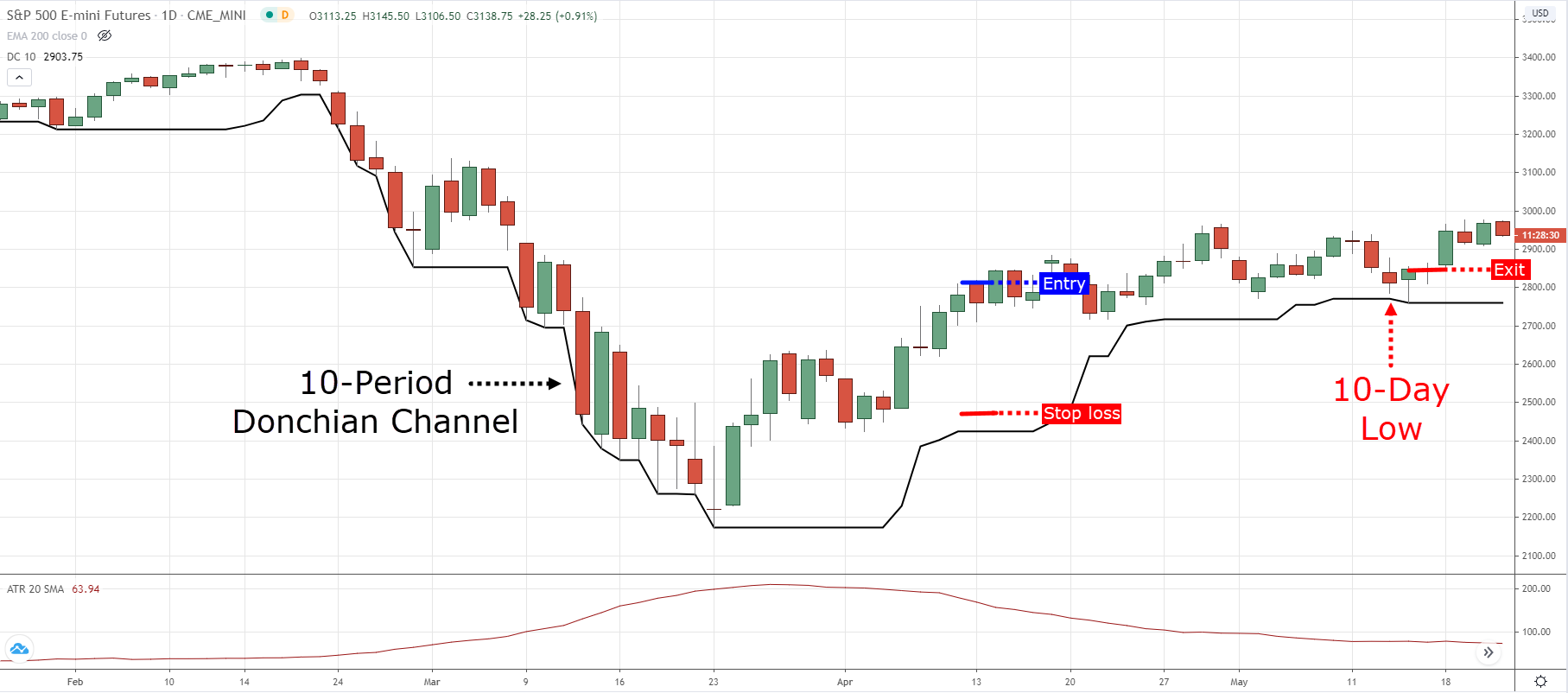

- Trailing stop loss: 10-day low

- Risk management: 1% of your account (previously was 2%)

- Vice versa for short trades

Markets traded:

Agriculture: Feeder Cattle, Rough Rice, Sugar, Coffee, Soybean, Soybean Meal, Soybean Oil, Wheat, Corn, Lumber

Bonds: 30-year T Bond, 5-year T Note, Buxl, Bund, Bobl, BTP, Gilt, Canada Bond

Currencies: EUR/USD, GBP/USD, AUD/USD, NZD/USD, USD/MXN, USD/ZAR, USD/INR, USD/RUB, USD/CNH, USD/JPY

Indices: S&P 500, Nasdaq, Euro Stoxx, CAC 40, S&P/TSX 60, Nikkei, Hang Seng, China A50

Non-agriculture: Brent Crude Oil, Gasoline, Heating Oil, Natural Gas, Gold, Silver, Palladium, Platinum, Copper

Results of modified turtle trading rules

- Number of trades: 2957

- Winning rate: 40.95%

- Annual return: 32.12%

- Maximum drawdown: -41.51%

Here’s an example of the trading setup:

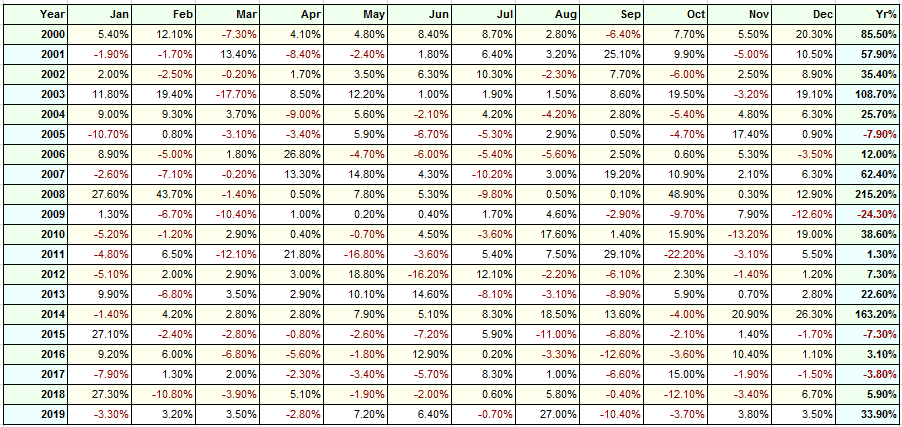

And here’s the full breakdown over the last 20 years…

As you can see, the results have dramatically improved.

Now you might be thinking…

“How do I know if you’re not curve-fitting the results?”

That’s a good question.

So, let’s test the robustness of the modified turtle trading rules using different breakout entry.

Here are the results of trading a 189-day breakout:

- Annual return: 31%

- Maximum drawdown: 44.51%

Here are the results of trading a 227-day breakout:

- Annual return: 32.12%

- Maximum drawdown: 41.51%

Clearly, both variants of the breakout entry still yield a positive expectancy.

So, what can you learn from this turtle trading “experiment”?

3 important lessons you can learn from the turtle trading strategy

Based on the data you’ve seen, the original turtle trading rules don’t work anymore. However, the principles behind it still work.

So here’s the takeaway…

#1: Understand the concept behind your trading strategy

You must understand the logic and concept behind your trading strategy because that’s what powers your trading strategy (like how an engine powers a car).

And if you understand the concept behind it, you can develop multiple trading strategies around it and diversify your risk.

But without an understanding of it, you’ll abandon the trading strategy when the drawdown comes—and you’ll have no idea how to fix it.

#2: Manage your risk

Now you might have a winning trading strategy, but without proper risk management, you’ll still blow up your trading account.

Here’s the proof…

Earlier, the modified turtle trading strategy produced an annual return of 32.12% and a maximum drawdown of 41.51%, with a 1% risk per trade.

Now, what if we increased our risk to 4%?

Well, you’ll get an annual return of 75.84% and a maximum drawdown of 96.82%. In other words, you blew up because it’s near impossible to recover from a 96% drawdown.

Moral of the story?

A trading strategy is useless without proper risk management.

#3: Adapt to changing market conditions

Here’s the thing:

Market conditions change. This means a trading strategy won’t work all the time and it’ll go through a period of drawdown.

However, there are times when a trading strategy stops working altogether (like the turtle trading strategy).

So what now?

Well, here’s what you can do…

#1: Find out if it’s the trading concept that fails or the trading strategy. Because if it’s the trading strategy, then you can tweak it and improve on things.

#2: But if the concept has stopped working, then save your time and move onto another trading concept.

#3: Develop trading strategies around the new concept that you’ve learned.

Conclusion

The original turtle trading rules don’t work anymore.

But it doesn’t mean that trend following is dead, because with a few tweaks, we managed to develop a sound trend following strategy.

The key thing is to focus on the trading concept and not blindly follow a trading strategy. Because once you understand the concept, you can build multiple trading strategies from it.

Now here’s what I’d like to know…

What are your thoughts on the turtle trading strategy and the turtle trader's rules?

Leave a comment below and share your thoughts with me.

Does the market traded make much of a difference to results – so how would it work on stocks?

Yes, the markets you trade makes a huge difference.

If you want to apply trend following to stocks, things will be a bit different as you won’t look to short.

Instead, you’ll only be long, or in cash (during a bear market).

Andreas Clenow covered this topic well in his book “Stocks on the move”.

Could you run the numbers to see how different?? Would love to see the difference visually.

So if you did the opposite of turtle trading, you’d have a 63%. Not bad :)))

Yup.

And with a horrendous risk to reward ratio.

Epic thinking

Nice experiment, Rayner; the Turtle Rules remain as fascinating as ever. 😉 Which of your tweaks do you think made the most difference?

Hey Lucas,

Trading a variety of markets.

Increasing the length of the breakout.

This is a great guide to trading

Thank you, Muselepete!

Well! Thank you Rayner for the email, I think the turtle idea all boils down to proper risk management, less emotional you become the better your trades

Hi Rayner,

https://tradingwithrayner.com/wp-content/uploads/2014/11/turtle-strategy-revised.pdf

This is a link you uploaded a few years back, do you agree with the following points?

1) Using 90 day high and 45 day low for the donchian indicator for entries and exit

2) 5x ATR for initial stop loss

3) Exiting half the trade each time a profit of 10x ATR is reached.

I’ve not tested those exact rules so I can’t tell you how it’ll fare.

Hi I’ve just viewed your revised settings for the turtle strategy on the moving average what do you use sma or ema and the trailing stop loss 10 days does that mean you have to count back 10 cancels to move the stop on the daily chart.

Andy

Hey Andy, he uses a 10-period Donchian channel in this case. That’s help’s identify the 10-day low on the daily chart. So a SL could be manually (or coded) to trail this.

I’d like to have the following books

*ultimate guide to price action trading

*Pull back stock trading system

Hi Lesedi,

Get the books through the links.

https://www.tradingwithrayner.com/ultimate-guide-price-action-trading/

https://pullbackstocktradingsystem.com/

Rayner, thanks for the info—if the market goes sideways for 10 days do you still exit at the 10 day low?

I believe so – the logic being the trend/momentum is no more. Therefore you exit.

Thank you for sharing!

Hi Rayner,

Do you currently use this system?

I trade a variation of it.

Hi Rayner, thank you for an excellent experiment. I’m absolutely fascinated by the turtle story and am

Really enjoying the Top Traders Unplugged systematic trend following podcast at the moment, as well as Michael Covel’s podcast.

Could I ask which software you use for your backtesting?

Thanks

I use data from norgate. Backtesting software is amibroker.

Thanks for your analysis. I have been doing some research and found that some of the legendary systems don’t stand up to time, like Benjamin Graham’s. The concepts can be adhered to, as your analysis demonstrates. Trend following and learning how to stop yourself out are key to capturing gains.

Thank you for sharing, Mitch!

Rayner, what do you use to backtest these strategies

Hey, Sam!

You can check more info about backtesting here:

https://www.tradingwithrayner.com/backtesting/

Hope this helps!

Can you apply turtle to successful day trading strategies? meaning, if a trade is doing well, add more into the trade instead of pulling down 1/2 your profits?

What software do you use for backtesting your data?

Hey there, Robbie!

Jarin here from TradingwithRayner Support Team.

Here’s a link on how Rayner Backtest his strategies:

https://www.youtube.com/watch?v=nXKzcP1t8gU

Hope that helps.

Cheers!

How would you mock this up on ThinkOrSwim?

https://tlc.thinkorswim.com/center/reference/Tech-Indicators/strategies/A-D/Donchian

Entry Length:

Exit Length

ATR Length:

ATR Factor:

ATR Stop:

ATR Average Type:

While I appreciate your work in promoting Trading, I am a bit disappointed that the you seem to conclude that the Turtle Trading strategy does not work, even though you are not trading the strategies as they were originally designed.

I am not saying the strategy still work as I have not backtested them myself (yet), but to conclude they don’t work when you don’t backtest based on the same principles defined in the strategy, is not fair i.m.o.

Fx you are not testing using the same volatility based position sizing and also not scaling in on the positions. Remember that the strategy is not just “set and forget”.

That said, I am a big fan of yours, and one of my inspirations in my own personal trading journey – and I am also going to backtest you enhanced Turtle strategy, which I also appreciate

Martin,

I agree with all of your comments above. At that time, Nov ’22 you said you were going to back test the enhance Turtle strategy, did you do that? I’d love to see the results. If you are still interested in that style of trading I am also working on a variation of the original. Let me know.

Wayne

Hi Rayner, when you did this back test what was the dollar amount for your account. Also did you calculate in any slippage on the trades?