I get it.

You need your job to feed your kids, pay your bills and to survive in this inflationary environment.

But… it doesn’t mean you can’t be a profitable Trend Follower trader.

In fact, it’s a good thing to have a full-time job.

Why?

Because you remove “the need to make money every month” attitude. And this greatly increases the odds of you being a profitable trader.

Here’s what you'll learn today:

- The 3 biggest reasons why most traders fail, and how to avoid it

- Everything you need to know about Trend Following

- How to trade less than an hour a day using a simple Trend Following strategy

- How to record your trades like a Pro

- How to do your “homework” on the weekends and still have family time

- How to schedule your trading without quitting your full-time job

Are you ready?

3 biggest reasons why most traders fail, and how you can avoid it

If you haven’t heard, the failure rate of traders is extremely high.

Based on what I’ve seen, for every 10 traders that attempt, only 2 will be consistently profitable (and I’m being optimistic here).

So what is the cause of such high failure rates?

1. Thinking it’s easy

If you wanted to be a doctor and eventually make a 6 figure income every year, you have to pass a slew of gatekeepers. Beginning with your first four years of university.

Then medical school gatekeepers ensure that only those that are academically suited enter the the school. During your years in school, there are numerous tests that judge your emotional abilities, to handle the job along with your intelligence.

Once you finish school, you know have to pass another gatekeeper, the licensing boards of each state.

Once you have your license, you now have to join a law firm, or hospital which means you have to get by their gatekeepers.

Once you’re in, you now have to bust your ass for years to make partner, or get to the point where you can open your own private practice.

The end result is that after 7-9 years of universities and 5-7 years of busting your ass for someone else, then and only then, will you consistently make a 6 figure income.

Now, let’s look at trading Forex. What do you need to become a trader? A frigging computer and $500. Yet everyone thinks they’ll be making a consistent 6 figure income in a few months or even years.

Forget the fact that the industry is full of some very, very intelligent people, who have spent years learning how to be a consistent trader.

Forget the fact that you’re going up against organizations that have millions of dollars to throw behind their traders in the form of support, such as analysis and system testing.

Forget the fact that these same organizations are playing on a different field than you are. All you need is a few indicators, a broker that doesn’t screw you too much, some money management, and in a year or two you’ll be living the high-life.

Is it any wonder so many fail?

Credits to Dopey from Forex Factory for the above post.

Look:

Trading isn’t easy. You need an edge in the markets, a ton of hard work, and iron discipline.

If you have all 3 ingredients, then you may have a chance of success.

2. No trading plan

Do you know what losing traders have in common?

No trading plan.

When you have no trading plan, you will:

- Trade based on your emotions

- Cut your winners too soon

- Hold onto your losers and hope it turns around

- End up blowing up your trading account

But if you have a trading plan…

It removes subjectivity in your trading, minimizes the roller coaster emotions, and keeps you prepared at all times.

Can you see the power of having a trading plan?

3. No risk management

Imagine:

You have a trading system that wins 60% of the time, with a 1 to 2 risk-reward.

Over the next 7 trades, your wins and losses look like this… “lose lose lose lose win win win”.

If you risk 25% on each trade, by the 4th trade you will have blown up your trading account (-25-25-25-25 = -100).

But…

…If you risk 2% on each trade, you will net a gain of 4% (-2-2-2-2+4+4+4 = +4).

Do you see the difference between blowing up your trading account and being consistently profitable lies in risk management?

So here’s the thing:

You can have the best trading system in the world, but if you have no risk management, you’ll still end up broke.

The most important rule of trading is to play great defense, not offense. – Paul Tudor Jones

So, you’ve just learned how to avoid the biggest pitfalls in trading.

Now, let’s move on to Trend Following and answer this question together—is Trend trading profitable?

Everything you need to know about Trend Following

Trend Following is a trading methodology that, seeks to capture trends across all markets, with proper risk management.

And here’s 5 trading principles that, every successful Trend Follower or Trend Follower trader must follow…

Buy high and sell low

Imagine:

You walk into a supermarket and you see apples being sold, 3 for $1. So, you get some apples for a nice healthy snack.

The next day…

You go back to the supermarket and, realize the same apples are now being sold, 3 for $5.

Would you buy it?

Probably not because the price is too high. You’d rather wait for the price to drop, or find other alternatives.

Now you’re wondering:

What does buying apples have anything to do with trading?

A lot.

Because your attitude towards buying apples is brought over to your trading endeavor.

Here’s what I mean…

Looking overbought at (USD/JPY):

Price rallied higher at (USD/JPY):

Looking oversold at (EUR/USD):

The takeaway is this…

[easy-tweet tweet=”The market is never too high to long, or too low to short” user=”Rayner_Teo” usehashtags=”no”]

Just follow price and you’re on the path of least resistance

You want to be right.

It feels good to know you called the tops and bottoms in the market.

However, when you start making predictions in the market, it clouds your judgment, and you start losing objectivity of the markets.

This leads to fatal trading mistakes like:

- Refusing to take a loss because you want to be right

- Averaging into your losses because you can get it “cheaper” now

- Revenge trading because you want to make back your losses

Now, what should you do instead?

The best thing you can do as a trader is, just follow price.

Here’s what I mean…

Uptrend at (NDAQ):

If you notice the price is forming higher lows, with resistance constantly breaking, chances are it’s an uptrend. You should be looking to long.

If you notice price forming lower lows, with support constantly breaking, chances are it’s a downtrend. You should be looking to short.

So is trend trading profitable? Well, it depends if you do the following...

Risk a fraction of your equity to allow your edge to play out

As you’ve seen earlier, having a winning system without proper risk management isn’t going to get you anywhere.

Instead, you need a winning system with proper risk management.

Also:

The recovery from the risk of ruin is not linear. The more you lose, the harder to regain your losses.

If you lose 50% of your capital, you need to make back 100% to break even.

Yes, you read right. 100%, not 50%.

That’s why you always want to risk a fraction of your equity, especially when your winning ratio is less than 50%.

So, how much should you risk exactly?

This depends on your winning ratio, the risk to reward, and your risk tolerance. I would advise risking no more than 1% per trade.

No profit targets so you can ride massive trends

Although trend followers have no profit targets, it doesn’t mean we don’t exit our trades.

We exit our trades using a trailing stop mechanism, instead of having a profit target like support & resistance etc.

Here’s a couple of examples…

Missed the whole move at (BCO/USD):

MA trailing stop at (EUR/USD):

Missed the sell down at (XAU/USD):

MA trailing stop at (XAU/USD):

Some ways to trail your stop loss are:

- Moving average crossover

- Price closing beyond moving average

- Break of price structure

- Break of trendline

- Number of ATR away from the peak/trough

If you want to learn more, read The advanced guide to setting your stop loss.

The hardest part about Trend Following is riding your winners. Because you’ll watch many small wins turn into losses, while attempting to ride the trend.

This results in low winning rate but, high reward to risk.

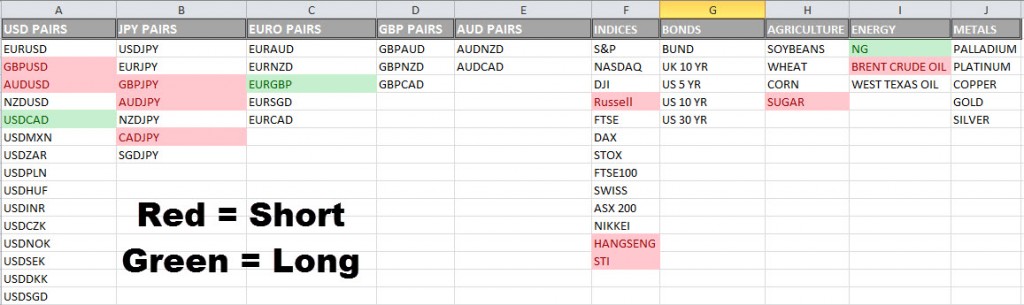

Trade all markets to increase your odds of capturing trends

Markets spend more time ranging than trending. Thus, it makes sense to look at a variety of markets, to increase your odds of capturing trends.

Trend followers trade everything from currencies, agriculture, metals, bonds, energy, indices, orange juice, pork bellies, etc. You can view a comprehensive list here.

If you recall, most major currencies were ranging during the 1st half of 2014…

But if you looked at more markets, you could capture a trend…

Trading across different markets help reduce your drawdowns and improve your profitability.

And this is one of the biggest secrets behind a trend follower’s success.

Trade less than an hour a day using a simple Trend Following strategy

Now, let’s put the information to use and develop a trading strategy.

Timeframe

Since you have a full-time job, its best to trade the Daily time frame as it requires lesser screen time (and allow you to catch big trends).

Risk management

You must risk a fraction of your equity on each trade to survive the inherent drawdowns. Keep your losses to no more than 1% on each trade.

Markets Traded

You should be able to trade about 60 markets from these 5 sectors.

- Agriculture commodities

- Currencies

- Equities

- Rates

- Non-Agriculture Commodities

**Disclaimer: I will not be responsible for any profit or loss resulting from using these trading strategies. Past performance is not an indication of future performance. Please do your own due diligence before risking your hard earned money.

A simple Trend Following strategy:

If 200ma is pointing higher and the price is above it, then it’s an uptrend (trading conditions).

If it’s an uptrend, then wait for “two test” at the dynamic support (using 20 & 50-period moving average).

If price test dynamic support twice, then go long on the third test (your entry).

If long, then place a stop loss of 2 ATR from your entry (your exit if you’re wrong).

If the price goes in your favor, then take profits when candle close beyond 50ma (your exit if you’re right).

Vice versa for a downtrend

Here’re a few examples…

Winning trade at (XAU/USD):

So, you’ve just learned a simple Trend Following strategy that requires less than an hour a day.

Now, let’s move onto something equally important…

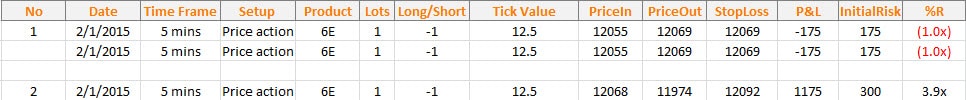

How to record your trades like a Pro

Executing your trades isn’t enough.

You must record down your trades so you can continuously improve your trading performance.

You can easily do this on an excel spreadsheet with the relevant metrics below:

Date – Date when your trade is entered

Time Frame – The time frame you are entering on

Setup – The trading setup that triggers your entry

Product – The financial product that you trade E.g. Apple, Gold, Eur/USD

Lots – Position size you entered

Long/short – Direction of your trade

Tick value – Value per pip. E.g. 1 standard lot of Eurusd is $10/pip

Price In – Price you enter your trade

Price Out – Price you exit, at profit or loss

Stop loss – Where you will exit if your trade is wrong

Profit & loss – Profit or loss from this trade

Initial Risk in $ – Nominal risk value of this trade

R – Your initial risk of this trade. E.g If you made 2 times your initial risk, you made 2R.

An example below:

How to screen capture your charts

After recording down your metrics, you’d want to save your charts for future reference.

Here’s how you can do it:

- Save the chart of your entry timeframe

- Save the chart after the trade is completed

Chart of the entry time frame

This chart is the time frame you entered on (which is the daily chart). You’ll mark out the entry and stop loss of your trade.

In this section, write down your thoughts like:

- What’s the setup

- At which price you entered

- Where is your stop loss

Here’s an example:

Chart after the trade is completed

After completing a trade, you’ll save the chart with your thoughts on it.

In this section, write down your thoughts like:

- Did you follow your plan

- What’s your profit/loss in R

- How did you exit your trade

- How could you improve on it

Here’s what I mean:

And there you have it. A detailed explanation on how to record your trades and screen capture your charts.

Of course, you don’t have to follow exactly what I do. Instead, you should “tweak” it according to your needs as a trader.

How to schedule your “homework” on the weekends

I wish you could simply enter your trades in the morning, and make a profit at the end of the day.

Unfortunately, it doesn’t work that way.

Instead, you need to do your “homework” on the weekends, to prepare yourself for the week ahead.

Here’s what you need to do…

1. Highlight a list of potential setups that may occur in the coming week

This is where you scan through the markets and identify potential setups that meet your requirements.

Once you’ve identified it, you can save it in an excel spreadsheet like this…

2. Write down your thoughts on how you’re going to trade the potential setups

Before you enter your trades, you need to know what’s the requirement you’re looking for.

Would you be waiting for a “confirmation” like Pinbar or Engulfing pattern?

Or are you going to trade without “confirmation”?

3. Write down your thoughts on how you’re going to manage your existing positions

You’d probably have some trades which are currently in profit. The last thing you want to do is to exit your trades based on emotions.

Thus, you need to write down how you’re going manage your existing trades.

Some ways you can trail your stops are:

- Moving average

- Trend lines

- Structure of the markets

If you want to learn more, go read The advanced guide to setting your stop loss.

4. Review your past trades and improve on it

When you’re reviewing your trades, you want to ask yourself questions like:

- Is there a better way to enter my trade?

- Is there a better way to manage my trade?

- Is there a better way to exit my trade?

- Did I make any mistakes?

- Did I feel good taking the trade? If not, why?

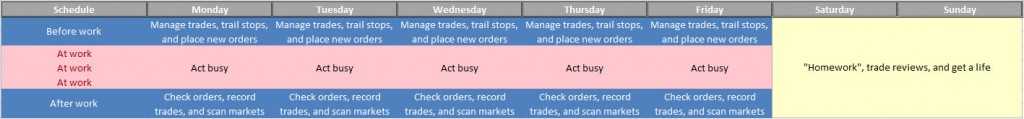

How to schedule your trading while having a full-time job

Here’s a quick guide on how to manage your trading while having a full-time job.

Before work (7:00 – 7:15 AM)

Manage your existing positions and trail your stops accordingly.

If there’s a new setup, place your orders in the market.

This will take you no more than 15 minutes, and it’ll be even faster when there’re no trading setups.

Lunchtime (12 PM)

There’s nothing to do here since you’re trading off the daily charts.

After work (9:00 – 9:15 PM)

Check if your orders are triggered. If they are, record down your trades and screen capture your charts.

Scan all the markets you’re trading and identify potential opportunities for the next day. If there are, write it down and update your excel spreadsheet (so you can prepare for the next morning).

This won’t take you more than 15 minutes because the bulk of the work is done on the weekends.

Here’s how your schedule would look like:

Pro Tip:

Use limit orders to get in at more favourable price levels

So, what’s next?

I’ve just shared with you step by step, on how you can capture massive trends in the market while keeping your full-time job.

As you’ve learned, the bulk of the “homework” is done on weekends, with minimal screen time required on weekdays.

I believe you have greater odds of success trading in this manner because your full-time job will provide the financial security you need.

Now it’s time to put these techniques into practice.

The first step?

Click on the link below and enter your email to get access to The Ultimate Guide to Trend Following.

This guide will teach you everything you need to know about Trend Following (and additional trading strategies that I’ve no space to share here).

Hi Rayner!

Prodigious post!!

Thanks for sharing from your experience in trade recording and schedule, it’s very important for me to find the right way to manage my time better.

Shlomi

Hey Shlomi,

Thank you for your feedback.

I hope this post can better help you to manage your own schedule for trading.

Don’t hesitate to let me know if you’ve got any questions, I’ll be glad to help.

Rayner

Hi Rayner,

Thanks for the valuable information!

It is exactly what I do.

I Trade on daily chart.

In Europe End of Day is at 11:00 pm. So I scan the market, open any new positions and manage my open trades between 10.30 pm and 11.30 pm, before going to sleep.

Same process the next day.

On the weekend I upgrade my Market Analysis (excel spreadsheet), where, for each symbol, in addition to comments, I added 3 columns to record the visible trend on the monthly, Weekly and Daily chart.

That’s it 🙂

Thank You Very Much!

Marco

Hey Marco,

Amazing planning you got there. A good work life and trading balance, all in one.

Thank you for sharing, and I hope to hear more from you soon!

Rayner

Hi Rayner!

I have a full time job and trading every day (I’m a scalper). I’m lucky I live in Australia and Europe opens at 6PM my time, US opens midnight. After work I can trade. Some days it takes only few minutes, other days few hours. As you wrote above the pressure to make the money for living expenses will screw with your mind and lots of losses will follow. And eventually you will need to go back to work…

Until a trader can make enough money for few years living expenses, he or she shouldn’t quit the full-time job.

Another big barrier or pressure for a trader is when losing money from the initial trading capital. I found losing back from the profit I already made is much more bearable.

Rayner? Do you have a full time job beside trading?

George

Hi George,

Thank you for sharing your trading schedule with me.

Yes you’re right, the pressure to make money is one of the biggest downfall for most traders.

I’ve got business and my wife works full time. So this helps a lot with my own trading psychology.

Hope to hear more from you in the near future buddy.

Rayner

sir

thanks for guideline

very much use full

life good feel good

enjoy n cheers

Hi Ramli,

Great to hear from you once more.

Cheers

Rayner

Hi Rayner,

Thanks that i have happened to watch your youtube videos while searching for fx trading tips. I learned a lot from those. And still keep on learning. It is very straight forward. You are helping lots of inexperienced traders like me. Keep it up.

RLA.

Hey RLA,

Thank you for your feedback, glad to know its useful for you.

Don’t hesitate to let me know if there’s anything, I’ll be glad to help.

Rayner

Nice post Rayner. I trade while holding down a full-time job and for most people I would guess there is also someone else in there life so thats another reason to schedule your time effectively! I always read your posts and I cant think of another site where the advice is so straightforward and honest. I mostly trend trade these days as it fits with a busy lifestyle and for beginners its quite simple to understand. Keep up the good work.

Jeff

Hello Jeff,

Thank you for your kind words, I really appreciate it.

Yes, trend following is almost perfect for anyone holding a full time job because of its minimal screen time required.

I hope to hear more from you in the near future. Cheers!

Rayner

Hi Rayner,

I am a trend trader for commodities market.

I am a full time worker.

After trading for almost 2 yrs and my portfolio growing to 300 percent from my capital.

Can I consider myself is ready as trend trader and quit my current job?

If not, your professional advice is much help.

Thank you

Hey Ryan,

I think the more important question is, are you confident of relying trading as your only source of income?

And does the profits you make allow you to sustain your own living after deducting for expenses?

Rayner

Thanks Rayner. Again and again, great value posting.

You’re welcome, Hans.

Cheers

Hi Rayner

Thank you very much for these tips, I’m definitely gonna apply them in my trading.

Can I use this trend following strategy on shorter timeframes?

Regards

Hey Themba,

You can but you may want to take into account transaction cost.

Hi rayner, being a successful trader at Indian NSE I am able to enter and exit a stock at perfect time when required on my analysis but I am still not able to predict the time frame it will take to complete my exit cost how should I do that?! It would be great if you could help me learn things

Hi Jeet,

I don’t fully understand your question. Could you elaborate on it?

Cheers

Rayner, I’ll explain my question via an example- if a stock is at 200 INR on 20/1/2017 and suppose the stock Has the right trend and momentum of a rally so how should I calculate the time it will take to reach suppose 20% up from 200 how should I calculate that

Hi Jeet,

I’ve no idea how to predict when a stock will increase by 20%.

One important quibble : with proper risk management you ought to always risk a percentage of your account’s current value, a Kelly Criterion concept. If you do your math example of four 25% losses in a row leaves you with 31.64% of your starting capital. Furthermore, since your example is risk 1 for 2 if the next 3 trades are winners you end up with 6% more than you started with.

The Kelly method makes it all but impossible to blow up your account. For example if you start with a $10,000 account, risk 10% for a 20% gain and lose your first 21 trades you still have $1,000 left. If you win your next 13 trades you will have 6% more than you started with. This example is a 38% win percentage in total and it doesn’t matter in which order you win and lose, any combination of 38% winners where wins are twice the size of losses equals a 6% return.

There’s more to the formula, but my main point is to not pick a static dollar risk but rather risk a percentage of your account’s current value

Hi Rob,

That’s a fair point but it may or may not be possible depending on the markets you’re trading.

Is there a Raynor Bot that will do this for me? 😀

AWESOME guide, the best beginners guide I’ve seen.

I’m afraid there isn’t.

cheers

Hi Rayner,

What is the minimum starting capital that allows proper position sizing and risk management in trend following across all the mentioned asset classes (currencies, rates, commodities, indices)?

Thanks in advance.

Hi Ramon

If you can trade fx and cfds, I would say at least $5000usd.

Nice, i have been using 10,20,50 and 200 EMA for trading, good entries and keeps me out of trouble areas

Great stuff man!

Hey, Rayner!

Thanks for posting this. You are one of the honest teachers I have ever seen.

I have a question regarding trend following. At what time frame should I decide my enteries using 20 and 50 ema?

I suggest daily timeframe.

Hey .Rayner. ..many thanks….I live in Bangladesh , I can only trade in stock market as there is no forex or commodity /future markets…I like trend following …just asking at any time how many different stocks should a trend follower own if his time frame is 3-5 months ??..thanks in advance ..

20 to 30 stocks would be a good number.

Very interesting article, specially “How to schedule your trading while having a full-time job” but i agree with other previous informations and tips. Very good job.

You are welcome. Fillippo!