If you haven’t heard, the failure rate of traders is extremely high. Based on what I see, for every 10 traders that attempt only 2 will be consistently profitable (being optimistic here).

In this post I share with you the 6 biggest reasons why most traders fail, and hopefully prevent you from being one of them.

So what is the cause of such high failure rates?

Reason #1: Thinking it’s easy

You need to read this.

If you wanted to be a doctor and eventually make a 6 figure income every year, you have to pass a slew of gatekeepers. Beginning with your first four years of university.

Then medical school gatekeepers ensure that only those that are academically suited to enter the school. During your years in the school, there are numerous tests that judge your emotional abilities, to handle the job along with your intelligence.

Once you finish school, you know have to pass another gatekeeper, the licensing boards of each state.

Once you have your license, you now have to join a law firm or hospital which means you have to get by their gatekeepers.

Once you’re in, you now have to bust your ass for years to make partner or get to the point where you can open your own private practice.

The end result is that after 7-9 years of universities and 5-7 years of busting your ass for someone else, then and only then, will you consistently make a 6 figure income.

Now, let’s look at trading Forex. What do you need to become a trader? A frigging computer and $500. Yet everyone thinks they’ll be making a consistent 6 figure income in a few months or even years.

Forget the fact that the industry is full of some very, very intelligent people, who have spent years learning how to be a consistent trader.

Forget the fact that you’re going up against organizations that have millions of dollars to throw behind their traders in the form of support, such as analysis and system testing.

Forget the fact that these same organizations are playing on a different field than you are. All you need is a few indicators, a broker that doesn’t screw you too much, some money management, and in a year or two you’ll be living the high-life.

Is it any wonder so many fail? – Dopey

Let’s be honest here. I’m sure you ever thought that you could chill on the beach of Hawaii, enter a few orders into the market and poof, 5 figures starting pouring in every month.

Can it be done?

Yes but it takes sufficient capital and years of hard work to get there.

So this is the first reason why day traders fail, thinking it is easy to learn and easy to earn.

Reason #2: Analysis paralysis

After busting a few trading accounts, you will realize that trading is no easy feat, and you require more knowledge than simply knowing when to buy/sell. So you started reading books, browse through forums and sign up for trading courses to acquire more knowledge.

You learn about indicators that tell you when the price is overbought. Fibonacci numbers that projects price into the future. Candlestick patterns that signal reversals in the market. After a while, you encounter analysis paralysis, a state of over-analyzing a situation so that a decision is never taken.

You notice your RSI is oversold at the yearly lows and you are thinking of going long. But current momentum is against you, and price just formed a bearish engulfing pattern. So what now?

This is a typical example of analysis paralysis, where you have a so much information coming in at once, it cripples your decision-making process. You thought by acquiring more knowledge it will improve your trading, but it couldn’t be further from the truth.

If you encounter analysis paralysis in your trading, I would suggest you pick a few trading tools you are comfortable with and stick to it. Ignore the rest.

Nearly all successful traders I have known are one-trick ponies. They do one thing, and they do it very well. – Steve Clark

Reason #3: Going round in circles

In terms of trading, one of the most searched topics on google is trading strategies. Traders are simply fascinated by trading strategies, thinking there is a holy grail out there, to churn profits month after month. I wasn’t spared from it either.

I was lost and confused in my early years of trading. I was trying to learn different trading systems, thinking it will make me a better trader. I would try out a new trading system and made some money at the start.

Eventually, when the drawdown came, I would abandon the system and hop on to the next best thing. Rinse repeat all over again.

It is not hard to find a trading strategy. Go to any trading forums and you can find countless threads on it. But finding a trading strategy that has an edge in the markets and suits your personality, is a different thing altogether.

So how can you overcome this?

There is no better answer than to quote Anthony Robbins on this.

I’ll tell you now that the best strategy in almost any case is to find a role-model, someone who’s already getting the results you want, and then tap into their knowledge. Learn what they’re doing what their core beliefs are, and how they think. Not only will this make you more effective, it will also save you a huge amount of time because you won’t have to reinvent the wheel. — Anthony Robbins

So why do most day traders fail?

Simple, they spend too much experimenting instead of verifying.

That’s why they go in circles!

Reason #4: Poor risk management

A bank has 3 main office, the front, middle, and back. The front office is where sales are being made and all the glamour and hype is. The back office is the operation side of the business supporting the front office. One thing is no matter how great the front office is, it will not survive with a poor backroom operation.

And just like in trading no matter how great your trading system is, it will still fail if you have poor risk management.

Assume you have a trading system that wins 60% of the time with a 1 to 2 risk reward. Over the next 7 trades, your wins and losses look like this “lose lose lose lose win win win”.

If you risk 25% on each trade, by the 4th trade you will have blown up your trading account (-25-25-25-25).

If you risk 2% on each trade, you will net a 4% gain (-2-2-2-2+4+4+4=4).

Do you see the difference between blowing up your trading account and being consistently profitable lies in risk management?

This is why day traders fail; the lower the timeframe you go, the tighter your risk management should be.

You can have the best trading strategy in the world, but poor risk management, you still end up in the poor house.

No surprise risk management is a turn off to most traders, which could explain why most traders fail. If you want to succeed in this business, learn everything you can on proper risk management.

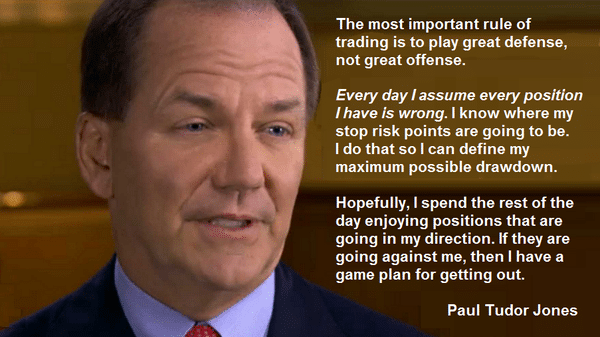

Reason #5: No plan to exit losing trades

I’ve seen many traders placing trades in the market with only an endpoint in mind, target profit. This is saying I know the markets will definitely go in my direction and I have no need to worry about a loss.

You put on a long trade and watch price moving in your favor almost immediately, hooray! Damn it feels good, makes you feel like you are in control of everything. Another 35 pips more to profit target!

Then you notice your trade starts going against you, and you have given back all your profits. You are now in the red. You believe it is a matter of time before it turns in your favor once more. So you hold on to that belief, but the ticker continues to move further against you.

Heck, you’re no longer thinking about your target profits now, you simply want to get out at break even, and call it quits! Price slowly creep back in your favor, but not enough to put you in the black. You hold on to the same believe still, as price now shows it is about to reverse.

Guess what?

The reversal didn’t come, and price broke new lows. Your trading account starts to race along with it. Your margin gets depleted day after day, eventually, the dreaded call comes in, margin call.

Sounds familiar?

Now let’s look at it this way…

When you are driving a car, you require having a pair of brakes in it. Because you know there will be opposing traffic against you, requiring you to slow or even stop. If not you will be in an accident.

Likewise, when trading, you require a stop loss. Because you know the markets can go against you, no matter how good your analysis is.

Putting on each trade without a plan for exit is like driving a car, with no brakes on. It is a matter of time before you crash.

Trading is a game of probabilities. This means you always have the possibility of a loss on each trade, so always, always have a stop loss in place!

So, the next time someone asks you why do day traders fail…

You now know why.

Reason #6: No trading plan

A trading plan is to guide your trading towards the right direction. It covers everything from entry, exit, risk management, markets traded, time frame and position sizing. It is your blueprint for success. And no 2 traders will have the same trading plan, due to different risk appetites and personality.

Most traders enter the trading business with no trading plan. Trading based on gut feel, emotions or no trading plan is pure gambling. When you have no trading plan, you will be trading aimlessly and have no idea which area of your trading needs to be improved on.

There can be many reasons why you are not profitable. It could be discipline issues, psychological factors hurting your trading, or simply having no edge in the markets. Without a trading plan, you will never know what is the cause.

But when you have a trading plan you follow religiously, there will only be 2 outcomes. Whether it made you money or cost you money.

If it made you money, then you may have an edge in the markets. But if it cost you money, it tells you your trading plan needs to be worked on.

In other words, a trading plan allows you to filter out what is working and what is not.

This is why most traders never succeed, it’s because of the absence of a trading plan!

Frequently asked questions

#1: Hey Rayner, can you share with us an example of your trading plan?

If you want to discover how to develop your trading plan to become a consistently profitable trader, then check out this article I’ve written.

Conclusion

Trading is just like any professional career as an engineer, doctor or lawyer. It takes years of commitment and effort to get good at it, and you must be willing to learn from your mistakes.

The beautiful thing about learning is that you can profit from the experience of others, to reduce your learning curve.

If you can reduce the number of trading mistakes, then you’d be a step closer to consistent profitability.

So, what do you think is the reason why most traders fail?

Hi Rayner,

Perhaps you could display a specimen or sample of your trading plan for traders to emulate. Thank you.

Hi Lieng Seong,

That’s a good suggestion. I will do up something in the near future.

Cheers

Rayner

I feel that most ppl would taking the assumption that the price will bounce back after it falls.

Hey Yuan Cheng,

Yes that is a good one. And it’s true that price tend to do a bounce after a drastic fall.

But for traders trading without stops, all you need is one time that price doesn’t bounce, and it’s enough to wipe you out.

Rayner

Hi Rayner,

Everywhere I see and read about having a stop loss, I simply cannot grasp how anyone could trade without one.

Looking back from where I am now on how much time I put in I agree with you, but someone coming into it is so eager to make it work and cannot imagine putting years in.

Thanks for the newsletters and videos.

Hey Ashley,

Yes you’re right. Most new traders who enters the trading business only think of the upside, the profits and what not.

In reality, the downside is more important to protect.

Trading is just like any other skill, it takes years to get really good at it, to be consistently profitable. Hard truth.

Thanks for stopping by!

Rayner

Most of the trading schools are after the money they cannot trade even for themselves They don’t tell U any thing about trading strategy

Hi Ralph,

Trading strategy is just one part of the equation.

You also need to focus on risk management.

A failure in either one, will not lead to consistent profitability.

Rayner

Thanks Rayner.

You’re welcome Juan 🙂

Hi Rayner.

It’s truly a great post, it was pleasant to read it 🙂

The reason why most traders fail, is because they don’t read your post 🙂

Thank u so much!

Shlomi

Thank you for your kind words, Shlomi.

Glad to see you’re reading everything I’ve post 🙂

Rayner

Hi Rayner,

I’ve been trading for past 14 months. Like most of the traders, I had a mixed bag (mostly losing) of trades for first 4 months. After carefully studying my trades and the reasons behind executing them, I learned that I was poor on risk management, lacked trading plan and couldn’t control my emotions.

All that you’ve said in your article applies, but the one thing that stands out in my case is , as you’ve quoted “Nearly all successful traders I have known are one-trick ponies. They do one thing, and they do it very well. – Steve Clark”.

I’ve found that one thing that I am good and have been applying that strategy in options trading and have been profitable for past 10 months.

So yes would like to reiterate that dedication, careful analysis and risk management helps in consistent profitability.

Hey Azhar,

Thank you for sharing your results.

I’m glad that sentence resonates with you. Sometimes this is all we need to be a game changer for us.

Rayner

Hi Rayner,

I read your e-book ‘The Ultimate Guide to Trend Following” and must admit that it is one of the finest books on Stock Trading that I have read in a long time. A book that calls a spade a spade… and even as you have kept it all so simple and straight…. it is at the same time full of all the knowledge that one may ever need to be really successful.

Personally however I liked what I read at the end of the book … it was like you kept the best for the last….a paragraph that sure would boost the sagging morale of many a trader who has been on the verge of giving it all up after hitting the wall time and time again. A paragraph so good that I would like to repeat it here ” I’ve more than 500 trades that hit my Stop Loss. I’ve lost 50% of my capital….More than 30 times I thought I will hit a home run only to be Stopped Out. I have failed Over and Over again in trading… AND THAT IS WHY I SUCCEED”

If you have succeeded… there is hope that so will I…….hopefull that I would not repeat my mistakes…. but learn from them and inculcate the required discipline, the risk and money management and the hard work that is required to succeed.

Thanks for freely sharing your knowledge and wisdom so magnanimously with the world….you sure would be rewarded manifold. Heavenly blessing be upon you and your family.

Best Regards

Allen

Hi Allen,

Thanks for reaching out. Keep on going my friend, I’ll be here if you need me.

Rock on!

Thanks,Rayner you wrote very helpful articles for us

Where do i read more of your articles?

Hi Ujjwal,

You can read more from the links below.

https://www.tradingwithrayner.com/category/blog/

https://www.tradingwithrayner.com/podcast/

https://www.youtube.com/user/tradingwithrayner/playlists

Cheers.