A successful trader is not the trader who makes a lot of money over a short period of time because he could simply be lucky. Rather it is the consistently profitable trader who makes money year after year that is successful.

After reading Market Wizards 3 times and crossing path with other successful traders, I notice they all follow certain principles in their trading. It doesn’t matter if a trader is a scalper, swing trader or trend follower, these principles still hold.

Thus if you want to be a consistently profitable trader, then it would make sense to learn and follow these principles right?

Some Tips by the Successful Traders:

Always have a stop loss

Trading without a stop loss is like playing Russian Roulette. You may escape once or twice but eventually, you are going to blow up your trading account.

I remember vividly years ago when I got long a particular stock Yangzijiang. I did not have a stop loss in place but was simply going to see where the market takes me. And the worst thing is having that long position while I was in Krabi having a holiday. I obviously couldn’t enjoy it at all.

Price was going against me day after day and the pain was too much to bear that I eventually bailed out my position on the last day of the trip. It ruined my holiday and taught me a very important lesson in trading, always have a stop loss!

By having a stop loss in place, is insurance for you and gives you peace of mind about what’s the worst that could possibly happen. If you are trading without a stop loss, you will never know how much you could lose and your mind will always be in a state of worry and uncertainty. Trust me you wouldn’t want to go near there, especially when you are on a holiday.

If you can’t take a small loss, sooner or later you will take the mother of all losses – Ed Seykota

Risk a fraction of your equity

Successful traders know that trading is for the long haul. Your trading success isn’t determined by a few trades, rather it is determined by the next 10,000 trades you are going to take and how much risk you are putting on each trades.

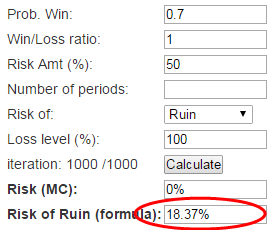

You can have a trading system that wins 70% of the time, but if you are risking 50% of your account on each trade, your risk of ruin is certain.

I am sure you notice all casinos have table limits and do you wonder why?

It’s the same as trading, they are risking a fraction of their equity on every round of gamble. Their edge over the players is no more than 2-3% and if they are risking 20% of their equity on each gamble, their risk of ruin is almost certain.

Successful traders are looking to trade the markets over the next few decades. If you can keep your risk to a fraction of your equity then you are ensuring your longevity of being a trader.

Have an edge

When you have an edge in the market it means that you have a positive expectancy.

Expectancy = (Probability of Win * Average Win) – (Probability of Loss * Average Loss)

I can tell you honestly I took years to find out what my edge in the market is. I was like most traders out there, lurking at trading forums and checking new trading strategies. After 1 strategy failed, I will hop on to the next strategy rinse and repeat all over again.

And this is the cold hard truth, 95% of all trading systems posted by the successful traders on the internet do not have an edge. This brings you to understand why 95% of traders fail to be consistently profitable.

You can have the best trading psychology in the world but if you trade without an edge, you will still lose over the long run due to spreads and commissions. You must find out what is your edge in the markets before anything else.

Here are some different areas in trading you can look to find your edge, mine lies in trend following.

Have a trading plan

Plan your trades and trade your plan – Linda Raschke

All successful traders that I’ve read about or come across have a trading plan that suits their personality. A trading plan helps you stay objective during the heat of trading and prepares you for all possible scenarios that could happen. Your trading plan must answer the following questions

- How much are you risking on each trade?

- What markets are you trading?

- How will you enter your trades?

- How will you exit your trades if you right?

- How will you exit your trades if you are wrong?

If you need more help, check out this post where I teach you How To Build A Trend Following Trading System.

Trade with the trend

This may not apply to all traders as there are some out there who are successful despite not trading with the trend. But the majority of successful traders out there align their trading with the trend.

Imagine you are out in the open sea swimming against the current. I’m sure you know how difficult it takes to move from one point to the next if you are against the current. And how easy it is to move from one point to the next if you have the current behind your back.

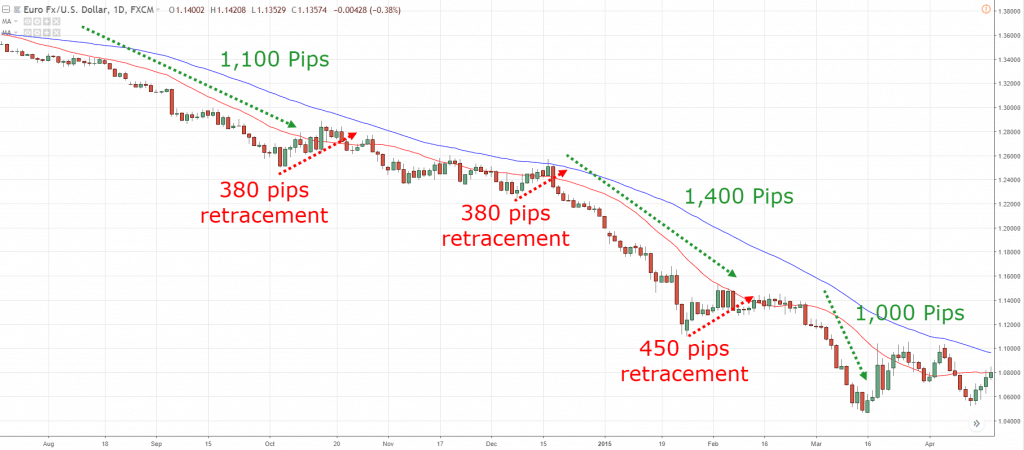

Trading with the trend is like swimming out in the open sea, you want the trend behind your back so that it is easier to capture pips from one point to another.

Grit

Trading is one of the toughest endeavors you will ever experience. The markets don’t care if you are a 1st class honors graduate or a school drop out. If you don’t follow the rules, it will take away your money before you know it.

And there are many rules of trading that you will only learn about after years of trading the markets, that’s if you haven’t given up yet. This is why grit is the hallmark of all successful traders.

- Martin Schwartz, a market wizard who became successful only after 9 years trading the financial markets

- Michael Marcus, a market wizard who blew his first trading account and, went on to multiply his company account by 2500 fold over a 10 year period

- Jesse Livermore, possibly the most famous speculator was declared bankrupt a number of times but, came back stronger and made $100 million during the great depression

- Tony Saliba, a market wizard who almost lost his trading capital in 6 weeks and, went on to string 70 consecutive months of profits exceeding $100,000

Success in any field requires you to have the fighting spirit to constantly overcome any obstacles in your way. Studies have shown that if you want to be successful, you must have Grit.

Discipline

I am sure you already know that discipline is paramount to being a successful trader. You cannot be disciplined in your trading but remain undisciplined in your everyday life, it simply doesn’t work that way.

Thus to be a disciplined trader, it has to come from within you yourself and it will spill over to your trading. You must have the discipline to follow your trading plan religiously, continuously improve yourself, continuously learn about the markets, consistently execute your trades and to control your emotions.

If you have no discipline in the markets, you will do things that are detrimental to your trading account. Like the failure to cut your losses, hopping from one trading system to the next or risking too big on a single trade. So how do you become disciplined?

It all starts from within yourself and here are some of the things I do to make sure my discipline stays intact.

- Always be punctual for any meetings whether it’s family, friends or colleagues

- Have an exercise regime and stick to it, try lifting weights, running or cycling

- Do housework on a weekly basis like washing toilets or mopping the floors

- Make your bed every morning without fail

- Wash your own dishes after every meal

Do things that don’t get you excited at first. But do it anyway because it will slowly change how you feel towards it and gradually learn to love it.

And just like trading, you have to do all the little things that don’t get you excited, like developing your trading plan or continuously improve yourself. But slowly you find yourself getting better at it and your equity curve starts pointing in the right direction.

Conclusion

Successful trading is the sum of small efforts, repeated day in and day out – R Collier

These are my own findings after reading hundreds of trading books, interacting with other traders and observing how they trade.

I don’t consider myself a successful trader, but I do know the fastest way is to learn from the best traders out there. I enjoy reading books like Market Wizards, interacting with other traders and following them on social media.

So, what do you think successful traders have in common?

Do you know the 5 Secrets of trend following that makes it profitable over the last 200 years? In my FREE trading course (valued at $48), I reveal to you what are the 5 secrets, and how it can improve your trading immediately.

You can download it here for FREE.

great post, u nailed it totally! Look forward to reading your next one. Cheers

Hey Peter,

Thank you for your comments, glad you enjoyed it! 😀

Cheers

Rayner

They follow the plan with great decipline.

They don’t react they are always prepared and they are always expect the unexpected.

They listen to everyone but they make their own judgement.

They all have driving desire to overcome.

They are all patience and know when to enter and when to exit.

They have all the elements what unsuccessful trader don’t have.

They have the mentallity to accept the loss and move on.

All of them come from very hard work and experience and have love for trading.

Rayner you explained it very nicely. Thanks for the post.

Hey Kam,

Totally agreed with what you said. Trading is serious business and it takes hard work and dedication to get through the steep learning curve.

Thanks for stopping by! 🙂

Rayner

Hello Rayner,

Quote “interacting with other traders and following them on social media.”

May I ask who are the best traders with the most valuable info that you follow on social media? Can you name a few of them for me for daily motivation and info purposes? What platform etc?

Thanks

Wade

Hi Wade,

You can look at the list of traders I follow on twitter, there’s only about 20. I think they are all good in their own way.

You can find my twitter account here https://twitter.com/Rayner_Teo

I don’t think there’s any best traders with most valuable information. They have their own style and personality and what suit me may not suit you.

Hope that helps you!

Rayner

Hi Rayner:

I think this post might be improved:

When you said:

“Here are some different areas in trading you can look to find your edge, mine lies in trend following. “ Then you listed these sophisticated algo strategies.

Please note most of us (guess yourself included) are not algo trader.

And honestly I don’t understand most of the strategies you mentioned.

The only things I (probably) know are:

Trend following.

Mean reversion.

News reading (means trading the news release?)

Scalping.

HFT (know what it is. But how can I find my edge in it?)

Other strategies (Titanic, well, I mean Iceberg, when I hear iceberg I think about Titanic :D, and Stealth, etcetera, etcetera, etcetera), I know nothing about them and don’t know how will find my edge.

This is only a comment (not question). You don’t need to answer.

Eugene