Have you ever wondered whether it is possible to build your own trend following trading system? You know, the same system that the billion-dollar hedge funds employ.

Initially, I thought I needed to join a hedge fund to learn their trend following secrets. But after doing my own research and reading books on trend following, I eventually manage to develop my own trend following trading system.

And today, I will share with you the 5 key elements to building a trend following trading system, after which you can start building one yourself too.

Trading a large number of markets

As a trend follower, you should know that you only make money when there’s a trend. So to expose your trading system to more trending opportunities, you have to trade more markets.

You should be in every sector of the markets like indices, bonds, currencies, energy, metals, agriculture, interest rates, and meats.

One thing to take note of is to balance yourself throughout the different sectors. You wouldn’t want to be overweight in a particular sector and underweight another as this creates a bias in your trading performance. So what you should do is to try to keep a similar number of products in each sector. E.g. 7 currencies, 7 bonds, and 7 metals

A rule of thumb would be trading at least 30 markets with exposure to all the different sectors.

This is the key on how to build a trend following system.

However…

How exactly would you find all of those markets to trade?

Which broker would you choose?

Well, one broker that we would recommend is:

- CMC Markets

- Saxo Trade

You see…

Most brokers you commonly see mainly offer forex and almost forex alone!

But the brokers that I’ve recommended to you have more than 5000 markets for you to choose from.

This gives you enough flexibility and diversification if you are to make a trend following system.

But of course…

Just because we recommend you some brokers doesn’t mean that you would immediately try them out.

Make sure to:

- Do your due diligence

- Try out the platform with a demo account

- See if you can register with the broker (as some countries may be blocked)

Makes sense?

Good.

Risking a small % on each trade

Trading is all about probabilities when it comes to trend following strategies. We should be indifferent from one trade to the next because we do not know which trades will be the home runs and which will be the losers.

One thing we do know is that we want to stay in the game long enough to hit those home runs. The only way to do so is the risk a small % on each trade.

I would suggest risking no more than 1% of your account on each trade. Reason being you will be trading many markets and it’s a good chance that you will have multiple positions across it.

Also there would be instances whereby correlation of markets will increase thereby increasing your risk exposure.

E.g. During a financial crisis, indices would tend to be positively correlated with one another.

One thing to note, however…

Is that it is possible to have a profitable trend following a system risking more than 2% per trade.

There will be higher rewards!

But you must expect that your potential losses or losing streaks would be deeper.

So, what’s the solution if you have a small account?

I suggest that you risk 2% per trade.

But eventually, reduce your risk to 1% as you reach a certain milestone on your trading account as you deposit more funds.

Remember.

Always aim for stability when it comes to developing a trend following system.

Knowing when to enter a trade

There are different ways to enter a trade and there isn’t a best way to do so. Rather, it should be a method you are comfortable executing.

Some methods you can consider are moving average crossover, breakouts or pullbacks.

Remember, entry alone will not give you an edge, so do not focus too much on it that you neglect the other important aspects of trading like risk management, position sizing etc.

All of these are a part of a complete trading plan when it comes to trend following strategies

Knowing when to exit when you are wrong

Before putting on each trade you must know when to get out when price goes against you. You do not want to be in a trade watching price moving further against you till the point whereby you blow your account.

The only way we are going to make money is by having large profits to cover the series of small losses. And to have small losses we need to cut our bad trades as soon possible.

A thing to note is the larger your Stoploss, the higher your winning rate but at the expense of a low reward to risk ratio.

Some methods you can consider with a trend following system are moving average crossover, ATR or X bars high/lows.

Knowing when to exit when you are right

For trend followers, it is a fact that we will never be able to enter at the start of the trend or exit at the end of the trend. We are only focused on the ‘meat’ of the move. This means that we could possibly exit a profitable trade only to watch price goes further in our favor. This is something we must accept and live with.

A thing to note is the larger your trailing Stoploss, the less chance you will be stopped out by a ‘fake move’ but at the expense of giving back a larger portion of your profits.

Some methods you can consider are moving average crossover, ATR or trailing with X bars high/lows.

Now what I told you is that there’s one specific indicator that you can use to both enter and exit your trades.

And that its an indicator commonly used by trend following systems.

Want to know what that is?

It’s a simple indicator we call…

The Donchian Channel: Using the indicator to both enter and exit your trades

Just to walk you through briefly…

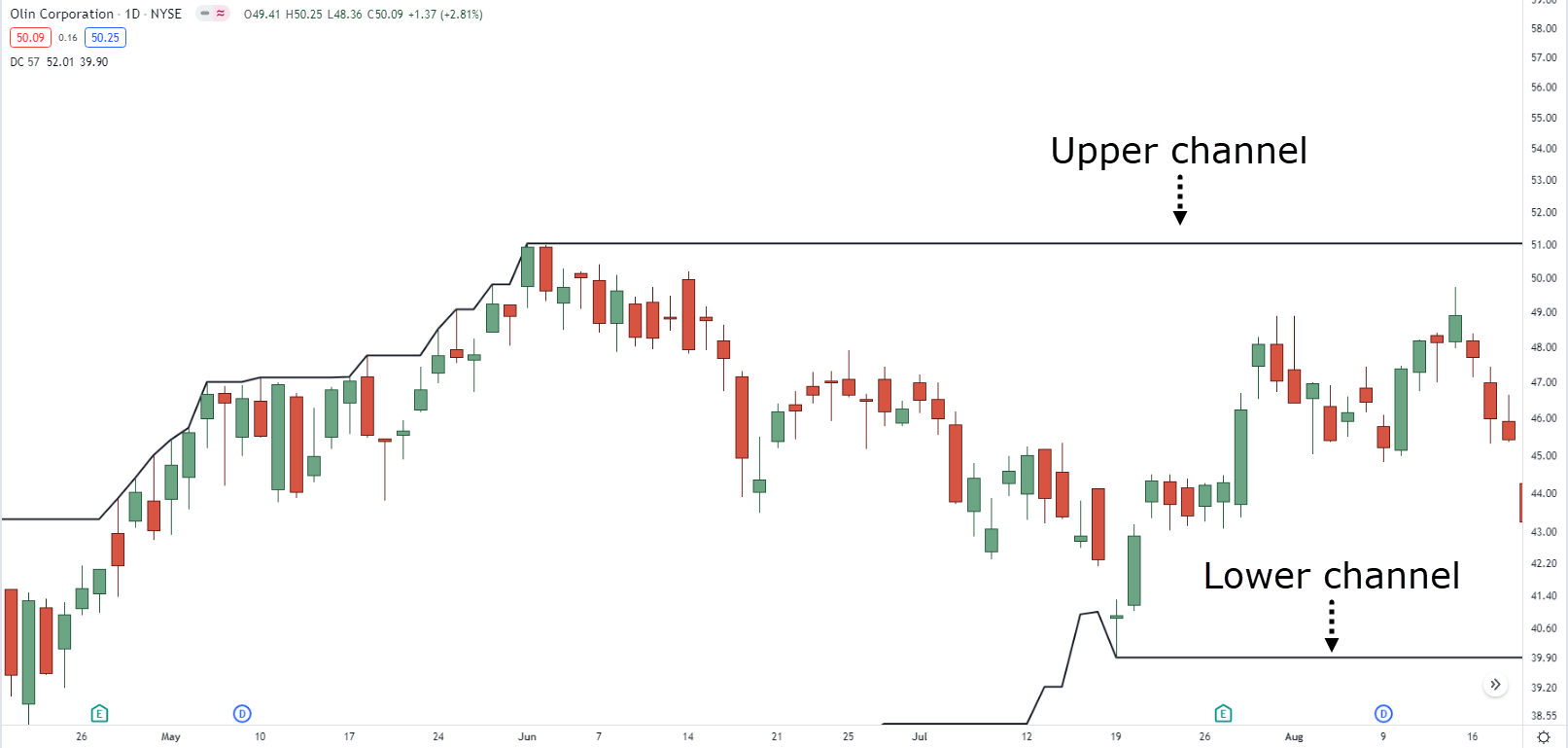

A Donchian Channel simply represents the highs and the lows.

It has its upper, and lower channels:

So for example…

If you have a 20-period Donchian Channel, then it will simply visualize the highs or lows over the past 20 bars.

Here’s what I mean:

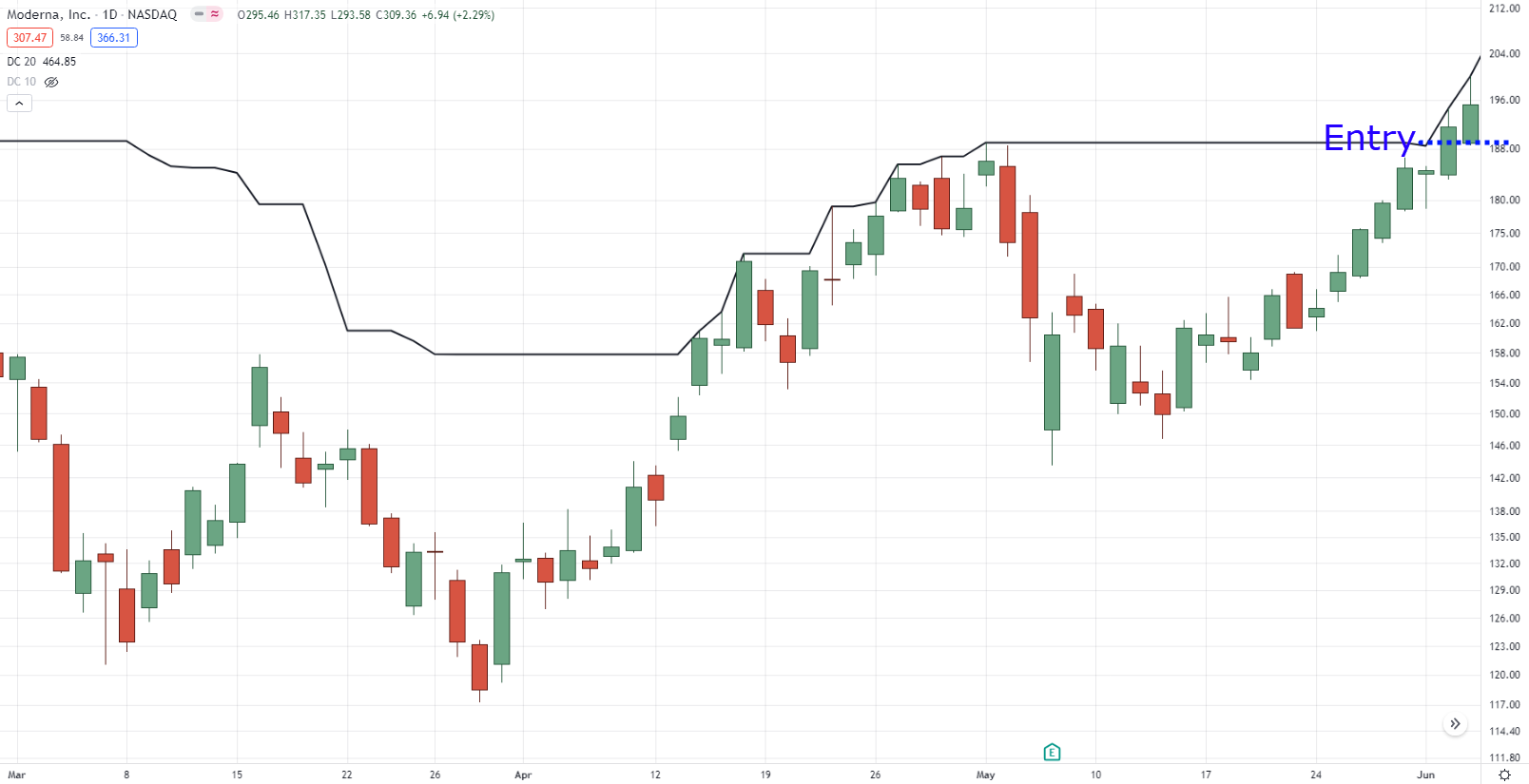

Now can you exactly enter this trade?

Entries

You can simply wait for the price to break out and close above the highs and enter on the next candle open!

Can you see how simple this is?

It’s objective and systematic.

And how about exits?

Exits

Similar to the entries.

The exits can be done the same way…

By using the lower channel as a trailing stop loss:

Boom.

Again, pretty simple, right?

But as you know…

There can be a lot of settings to choose from.

There’s the 100-period Donchian Channel, 50-period, 20-period, 10-period, and so on.

So, which is the best?

Now that’s the tricky part …

But to walk you through this dilemma here’s what you need to consider.

The goal of your trend following strategy

In simple terms…

If you want to capture short-term trends, then you can use the 20 to 50-period Donchian Channel to both enter and exit your trades.

For medium-term trends, you can use the 50 to 100-period Donchian Channel.

Finally, if your goal is to capture long-term moves, then you can use the 100 to 200-period Donchian Channel.

I know what you’re thinking…

“Oh hell yeah, I’d choose short-term trends anytime because fast money is made there, skrrt!”

Not so fast buddy…

Trying to capture short-term moves means that not only your wins are frequent, but also your losses.

So, what if you experience 5 losses in a row in less than a few days?

Are you comfortable with that?

Now, if you don’t want to do the hard work and want to get inspiration from working trading systems.

Then you might want to check out the next section…

Complete trend following trading systems

Okay so you’ve understood the 5 elements I’ve discussed earlier and would like to start somewhere on how to create trend following systems, but how?

Below are some trend following trading systems you may want to check out

And their performance results for 2014.

Conclusion

Trend following requires more than just knowing when to buy or sell or knowing trend trading system rules. You also need to take into consideration your risk management, markets exposure, cutting of losses and riding of profits.

All these combined as a whole, will give you an edge in the markets.

So, are you ready to build your own trend following trading system?