This post is written by Jet Toyco, a trader and trading coach.

The book Market Wizards has become one of the most influential trading books of all time.

So at this stage, there’s a chance that you’ve already heard of it or read it once.

That’s why in today’s Market Wizards guide…

I won’t be giving you a quick summary of each interview mentioned in the Market Wizards book.

Instead, I will share with you four trading tips that I’ve learned so you can use them to improve your trading results.

Sounds good?

Then let’s get started.

“For most great traders, early failure is more than a rule than an exception.” — Michael Marcus

This has to be said…

You will inevitably go through a painful stage of huge and consistent losses.

A stage where you make all the trading errors possible and make huge consistent losses.

If you haven’t experienced it yet, it’s only a matter of time before you do.

What’s the reason?

Why does it happen to every trader?

Is it impossible to profit from the markets?

Here’s the thing:

We are our enemy the moment we start being a trader, and it’s how we tackle it head-on that matters.

That’s what this trading journey is all about!

Now, the good news is that it’s possible to profit and succeed from the markets.

So, as a new trader, what can you do to make this early failure as painless as much as possible?

Simple.

Start trading live with a small portfolio

I know.

Sounds pretty obvious.

But what a lot of traders miss is that just because you have $10,000 on your trading account, for example, it doesn’t mean you have a $10,000 mindset.

Instead, reduce your portfolio to $1,000 and treat it as if you are managing a $100,000 trading account.

Then add $1,000 from time to time as you prove your consistency on a smaller account.

Makes sense?

You’re probably wondering:

“What the hell man, I don’t have that huge money to start trading!”

“I only have $100 on my trading account; what should I do?

Same thing.

No matter how huge or small, your account is, you must treat it as a business.

But the main concept still applies:

Start small and deposit funds consistently so that you instantly reduce the risk of your early failures!

Sounds good?

“I know where I am getting out before I get in.” — Brunce Kovner

Let me ask you…

- Do you know when to enter a trade when it meets your rules?

- Do you know where to exit when you’re right on the trade?

- Do you know where to exit when you’re wrong on the trade?

If you already have an answer to these questions, then great!

If not, the worst thing that you can do is try to come up with the answer when you’re already in the trade.

The worst part?

Some traders only concern themselves with how to enter trades but don’t know how to exit them!

That’s why a lot of traders become “investors” instead.

Nonetheless, all of those questions must be answered before you even hit the buy button.

I know what you’re thinking…

“Easy for you to say, show us some practical tips on what you mean!”

Yes, I hear you!

But it’s something I cannot wholly show you in one article.

That’s why if you want to learn practical and comprehensive guides that teaches you a complete trading strategy, then I highly suggest investing your time in these articles:

The Bull Trap Trading Strategy Guide

Pump and Dump Strategy (The Essential Guide)

20-Day & 30-Day Moving Average: Definition, Calculation & Strategies

Now, each of those guides will tell you the “why” behind the concepts taught to you so that you don’t blindly use the strategies you’ll learn.

However, each of them will also teach you different styles of trading.

That’s why you must immerse yourself in different strategies and decide on one that you know you can consistently commit to.

“The key to long term survivability and prosperity has a lot to do with the money management techniques incorporated into the technical system.” — Ed Seykota

Managing your trades is one thing.

But managing your trading account is another.

Let me explain…

Money management is the most significant factor in how your results will be steered in the long run.

So it’s how you adapt your money management rules depending on the obstacle you face.

There are many ways to go about this, but it usually boils down to these three.

Maximum risk per trade

Early in the year, I took a significant drawdown on my forex trading portfolio.

At this point, I was in a -13% drawdown, risking 1% per trade.

But I came to a realization…

If I had risked 2% per trade instead, I would’ve possibly faced a 26% loss!

Can you see how a simple increase of 1% risk per trade could’ve made the difference?

Of course, some traders could stomach it, but nonetheless…

Keeping my risk small at a maximum of 1% risk per trade helped me recover most of the losses.

Of course, your risk per trade depends on the frequency of your trades and the size of your portfolio.

But as a rule of thumb…

Risk 1% per trade when you start trading, decrease it to 0.5% when you’re doing poorly, and consider increasing it up to 3% if you’re doing well.

Maximum open trades

You’re not going to believe how many times I get asked this.

But that’s a good thing!

Because you can’t just have a maximum open trades of 20 while you are scalping the markets.

You’d probably need six eyes and ten monitors for it!

Nonetheless, the main concept here is that:

- The lower the frequency (higher timeframe) of your trades are, the more diversified you should be

- The higher the frequency (lower timeframe) of your trades are, the more concentrated you should be on a specific market

What do I mean?

It means that if you are an intraday trader who frequently opens and closes trades…

Then having a maximum open trade of 3-5 would be better.

On the other hand, if you are a trend follower with trades that can last from months to years…

Then having a maximum open trade of 20 or more diversified in different markets would be great.

Again, there’s no fixed number on what your maximum open trades should be.

That’s why I’m sharing with you the principle behind the concept so that you can decide what you think is best for you!

Maximum portfolio drawdown

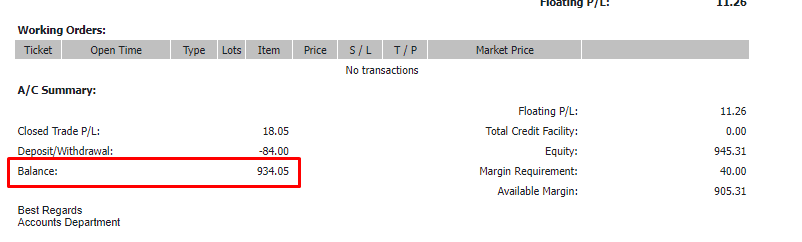

When I was still in my early stages as a trader, there came a time where my losses were uncontrollable.

Even though I knew how to apply risk management, I kept switching strategies and slowly bleeding money.

It wasn’t until I lost 50% of the whole portfolio that I decided to take a step back and see what was going on.

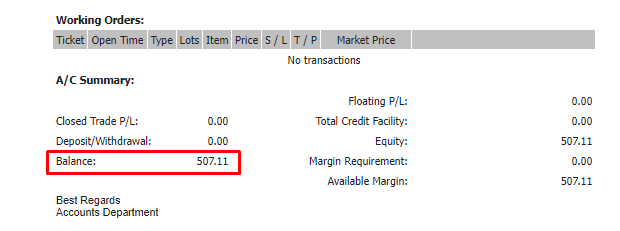

So, starting from a $1,000.

Down to $500 in just a few months.

That would’ve set me back even more!

Now, why am I sharing this with you?

It’s because that we’ll come to a point where our actions will be dictated by our emotions that will cause us to take in more risk and gamble.

When that happens…

It would help if you had a worst-case scenario plan to STOP trading when your portfolio declines 30% to 40%.

It means that if you have a $5,000 account and it went down to $3,000 (40% drawdown) through consistent losses…

Then you must stop trading and take a bird’s eye view on things that you must improve.

Got it?

“The rule of thumb is if you have lasted a year, you will make it, but it is hard.” — Tom Baldwin

If you’ve been live trading consistently for one year, whether you’ve earned or lost money…

I consider you a successful trader—I mean it!

You see, a lot of people start to trade by chasing the rewards.

However, few stay to learn the process and never give up.

But what if you haven’t started live trading yet?

You’re still a new and aspiring trader ready to get beaten up by the markets?

Well, your focus should be to survive in your first year of trading.

Why?

Because trading is a skill that cannot be learned in just a few months, similar to a profession.

Okay so…

What do you do to increase your survival in trading in your first year?

Have a stable source of income

It’s a weird answer to hear, I know.

But having a stable source of income puts you in an environment wherein you’re focused on improving yourself as a trader instead of spending too much time fantasizing about how much you’d earn.

Can you see how this makes sense?

I know that you want to leave the job that you hate as soon as possible.

But why not use your stable source of income to pump in some resources towards your trading business?

Wouldn’t that accelerate you faster towards your goal?

That’s why if you’ve gotten into trading so that you can pay your medical bills and debts…

Then I’m afraid that trading may not be for you at the moment.

With that said, let’s put things into perspective.

Shall we?

Conclusion

Jack Schwager’s Market Wizards is an outstanding book that even new traders can relate to and pick up tons of practical trading tips and strategies.

That’s right!

Despite everything that I’ve taught you today, that’s not even 1% the book has to offer to you.

Nonetheless, if you’re looking for something to apply real fast, then these four things that you’ve learned today will help:

- Failing at some point as a trader is inevitable, so prepare for it by learning how to convert failures into learning opportunities and by starting with a small capital

- Always add objectivity to your trading business by knowing how exactly you’ll enter and exit your trade before even entering it.

- Knowing your maximum risks will help you reduce potential losses small enough for you to bounce back and become a better trader easily

- Most traders don’t last a year, so focus on survival and focus on improving your skills as a trader, then profits will naturally follow

That’s it!

Now over to you…

Have you read any of Jack Schwager’s Market Wizards books?

What are the things you’ve tried to apply?

Let me know in the comments below!

hello

Hi, Ak!