This post is written by Jet Toyco, a trader and trading coach.

Maybe you’re here right now because someone hyped you to buy a cryptocurrency only to leave you hanging in a losing position…

Perhaps you’ve entered a stock that reached the moon but didn’t exit your trade when it got there.

But whatever the case is, you’re in for a treat.

Because in today’s article, you’ll learn:

- How pump and dumps occur in all markets and timeframes

- How to spot potential pump and dumps before they happen

- When to exactly enter and exit before the “dump” without relying on anybody else’s opinions

Are you ready?

Let’s get started…

What Are Pump And Dumps And Why You need to Know About Them

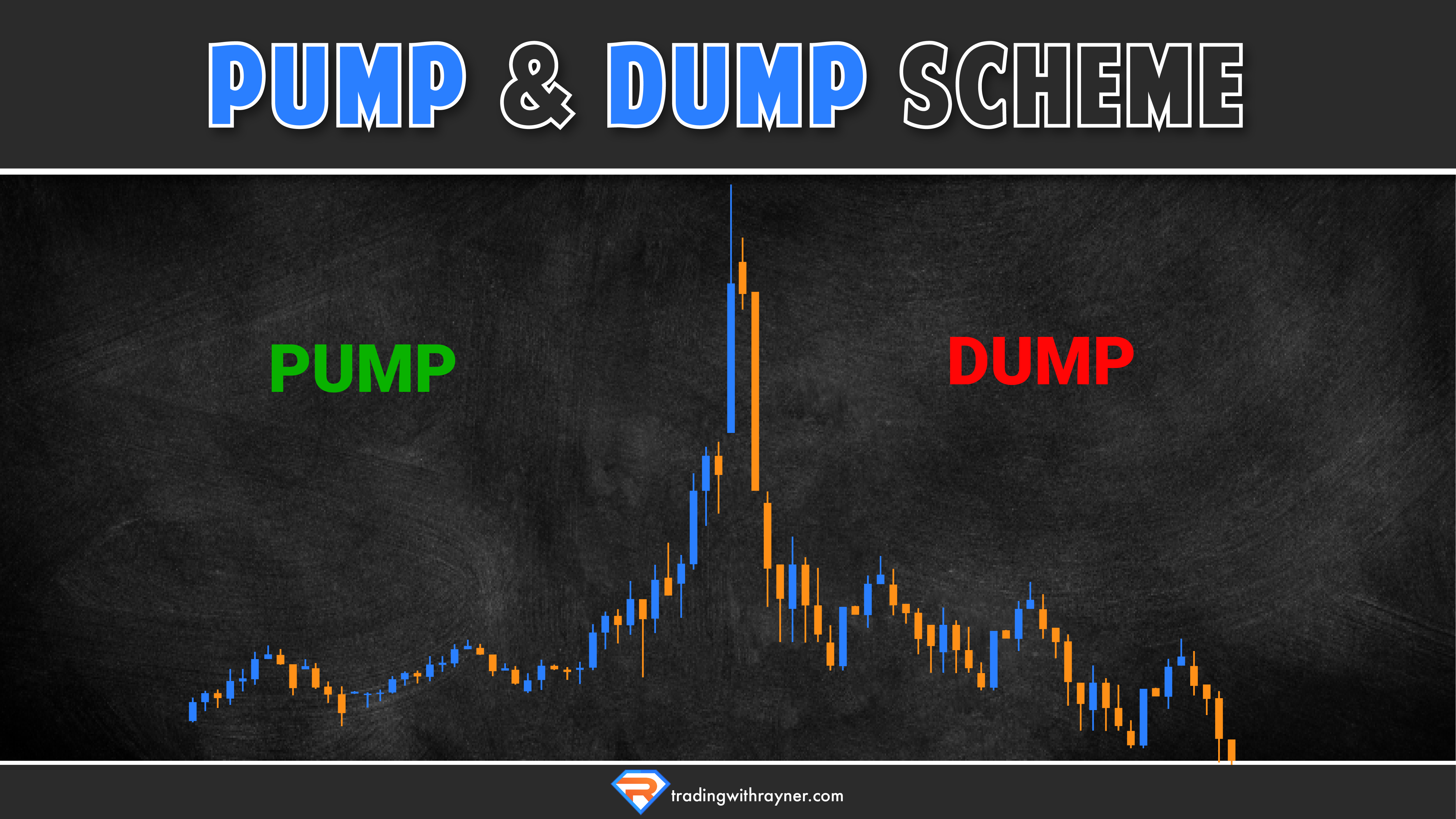

Firstly, what is pump and dump?

A pump and dump happen when a market’s price exponentially increases and gains public attention on a massive scale—only to be “dumped” later on as the price crashes down…

Look at this pump and dump chart as an example:

But here’s the thing…

Many sources will tell you that pump and dump schemes are illegal when traders or news outlets promote a specific market.

However, the truth is that it doesn’t matter.

Because pump and dumps happen in all markets and timeframes, with or without media coverage, illegal or not!

So, why is it essential for you to know that as a trader?

Unfortunately…

A lot of new traders always fall for it by getting hyped by the news and price.

It might even be why many people got into trading because those markets are getting a lot of attention.

But more often than not…

New traders tend to buy the tops and get trapped when it starts to crash.

Remember when Bitcoin gained so much popularity that many people suddenly became “traders” to join the hype train?

Bitcoin Weekly Timeframe:

How about when GME started increasing in price, and many people wouldn’t want to miss the move?

GME Daily Timeframe:

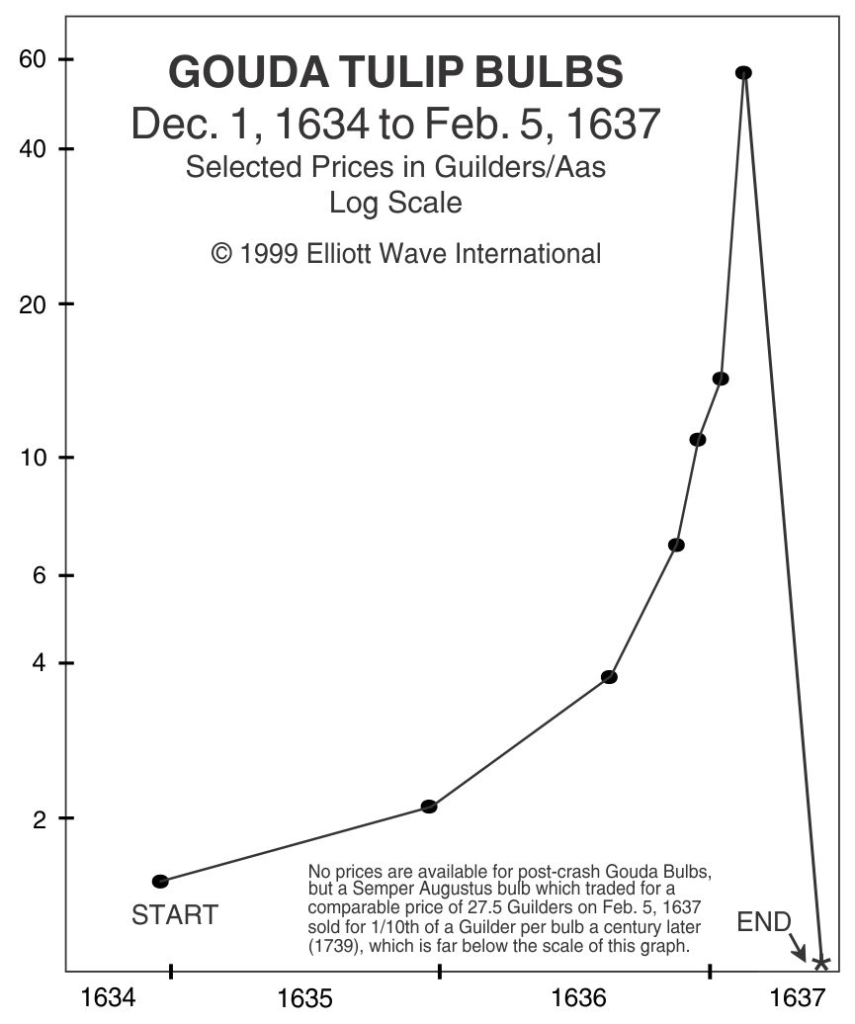

Or what about a couple of centuries back during the Tulip mania bubble?

There are probably a lot more examples out there, but you get my point.

With that said…

Should you stay out of the hype?

Definitely not!

Because here’s the good news:

Assuming you don’t sell your house and go all-in…

You can take advantage of it and make a profit from it.

You can be ahead of the herd by entering and exiting at the right time.

That’s why in the following sections…

I’m going to teach you:

- How to identify them

- How to trade them

- How it’s possible to make money from them

All these so that you don’t lose money from them, unlike the other new traders out there.

Ready?

Keep reading…

Pump and Dumps: Spotting It At Its Early Stages

Remember what I said that pump and dumps happen on all markets and timeframes?

Good.

Because before you start asking me:

“What is the best timeframe?”

“What is the best market?”

“Are there pump and dump indicators to spot them easily?”

My answer right now would be to find a timeframe that wouldn’t affect your daily responsibilities and choose a market you have more screen time on.

So pick a timeframe and market you think you can be consistent in the long run.

With that out of the way…

Here are two objective methods on how to spot potential pump and dumps.

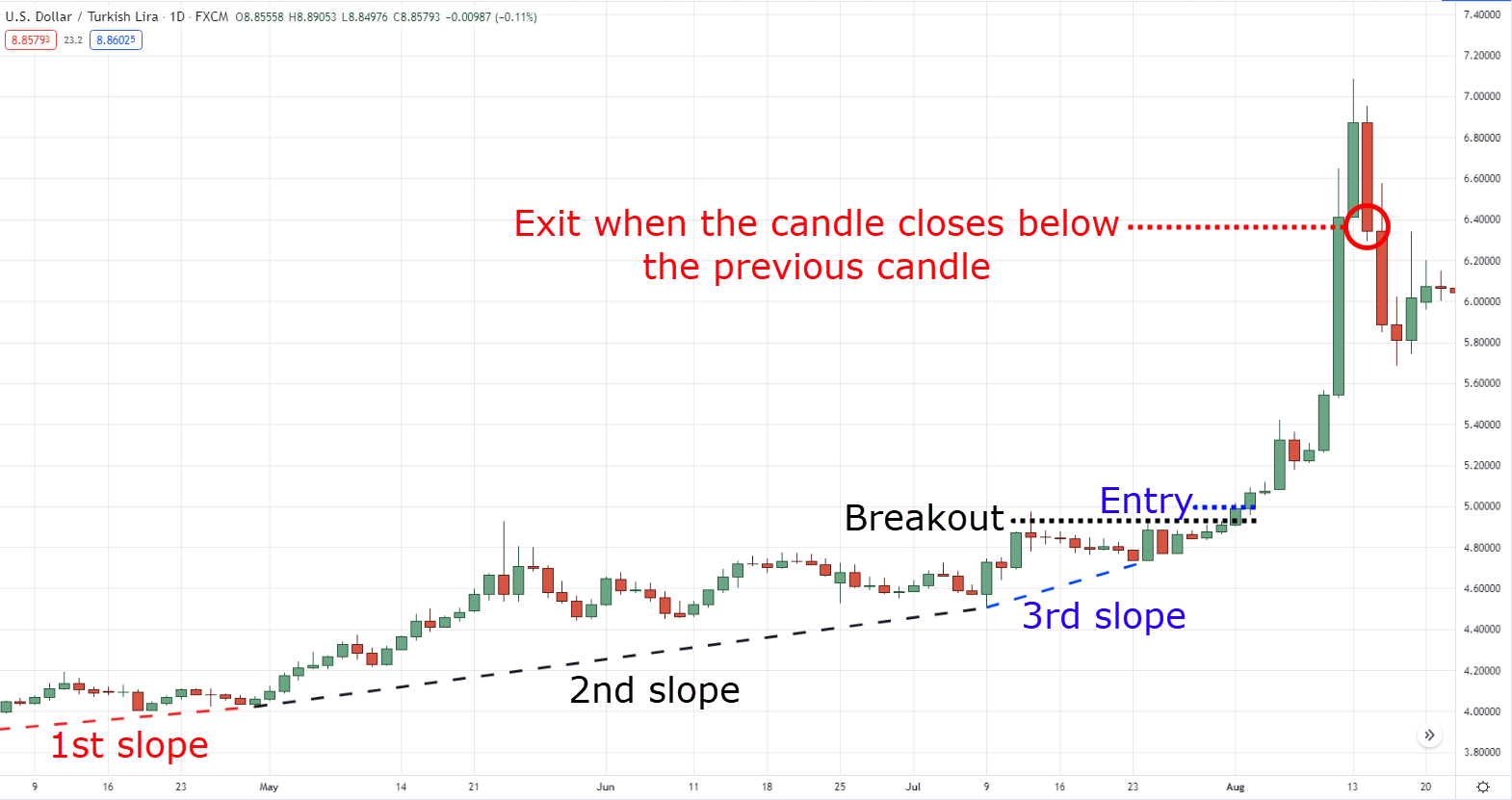

Method #1: Third slope

With charting tools such as the trend line, it will be easier to spot potential pump and dumps.

That’s why to confirm a potential pump and dump…

Connect the lows using a trend line tool and wait for a third “slope” from its lows.

Here’s what I mean…

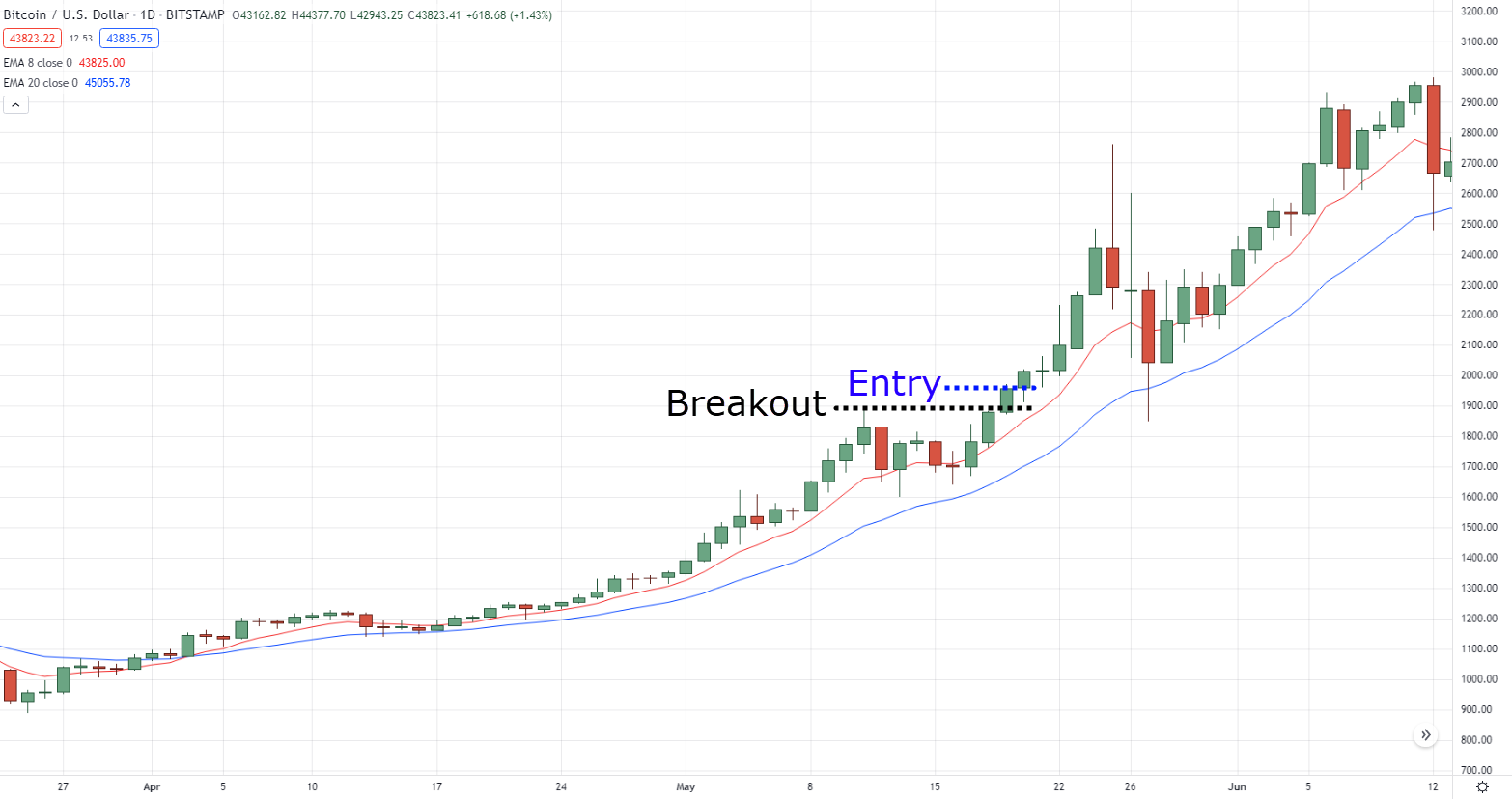

Bitcoin Daily Timeframe:

Once the market shows you a sloping behavior, then there’s a good chance that the “pump” has already started.

The only downside to using this method is that as the price develops, you may have to constantly re-plot your trend lines again…

Palladium Daily Timeframe:

Next…

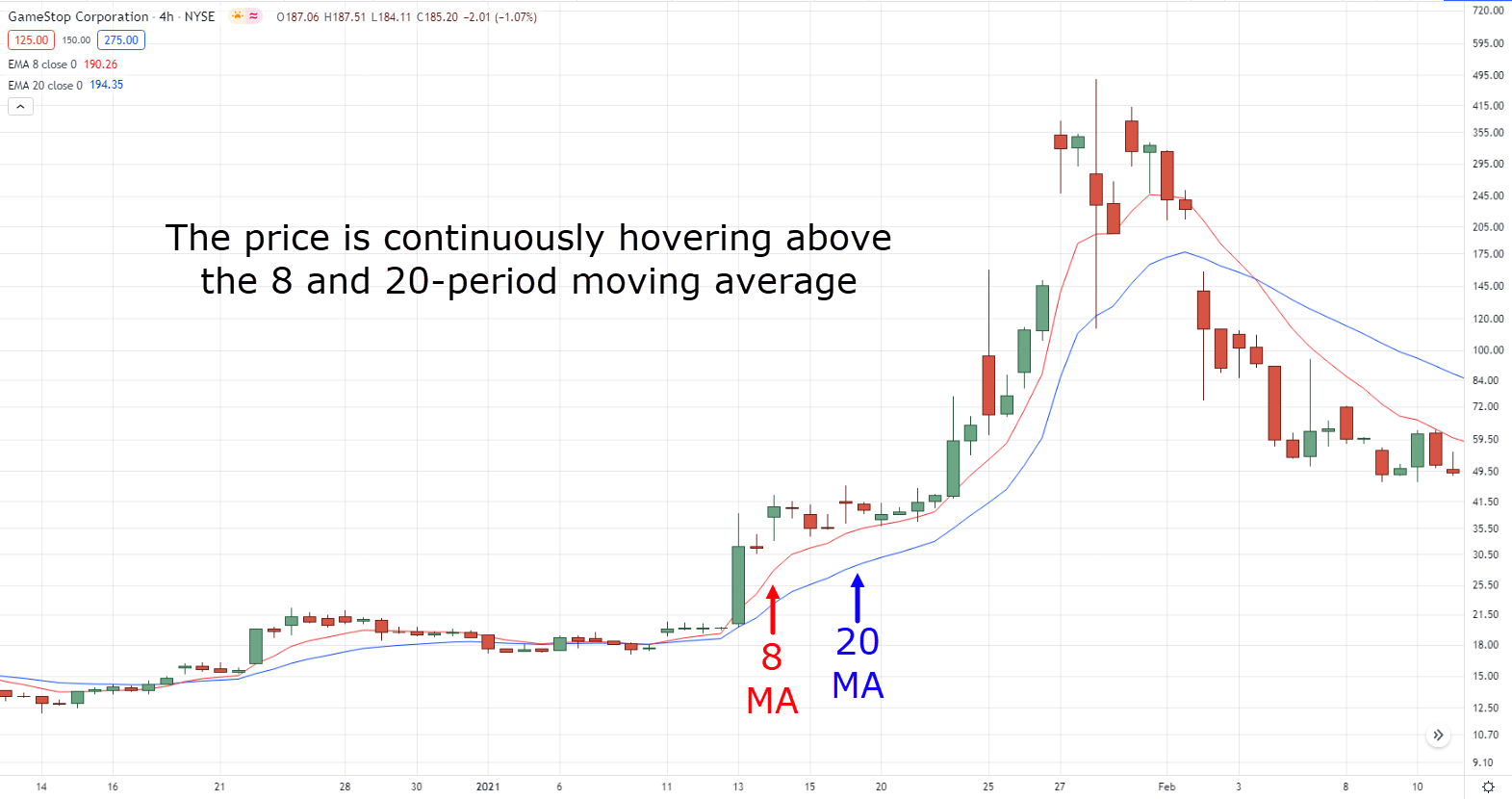

Method #2: Moving Average

If you’re the type of trader that wants to keep things objective as much as possible, then this method could be for you.

The moving average is one of the “pump and dump indicators” you can utilise.

For this, we would be using the 8-period and the 20-period moving average, and we’d want the price to be above both the 8 and 20-period moving average to spot a potential pump and dump.

Here’s an example…

GME 4-Hour Timeframe:

You might ask:

“Why not the 50-period moving average?”

“Should I use the 7-period moving average instead?”

“How about the 22-period moving average?”

I’m sorry to say this…

The answer is that it doesn’t matter.

Adding or subtracting 2-5 values from the period wouldn’t make much of a difference, so feel free to do so!

But remember…

The concept here is to use a “tight” moving average period to spot potential fast moving prices.

Though as you know, the moving average is an indicator good for trending markets.

However, the downside to using this method is that there could be a lot of false signals from “choppy” markets…

USDCHF Daily Timeframe:

Now here’s the thing:

There’s nothing such as the best pump and dump indicator.

All methods and concepts have their pros and cons, strengths and weaknesses.

So whether you choose method #1 or #2 is up to you.

Because it’s all about “why” you use the tools and not “what” tools you use.

In the end, it’s all about being objective as much as possible, no matter how much hype there is.

Now comes the best part…

How To Trade It And Make Money From Pump and Dumps

Here’s the deal:

I will share a complete pump and dump strategy with entries and exits to take advantage of pumps and dumps.

However…

It would be best if you promised me that you will:

- Make tweaks depending on what you’re comfortable with

- Do the work and do your backtesting

- Not fall into the hype

- Take responsibility

- Manage your risk

Because in the end, it’s your money, and you must be a good steward of your money.

Got it?

Entries

Recall:

We would only define a potential pump and dump when it’s either:

- Making its third slope on its trend line

- Above both the 8 and 20-period moving average

No matter what your chosen method is, you’d want always to be buying the breakouts…

BTCUSD Daily Timeframe:

Why not buy on pullbacks?

It’s because you are potentially dealing with volatile markets that can crash anytime!

That’s why you’d want extra confirmation by waiting for a breakout and candle close, then entering the trade at the next candle open.

Now…

What if your chart looks like this?

What would you do?

GME Daily Timeframe:

“Where’s the slope?”

“Where’s the breakout?”

“The price is all over the place!”

So, I know I said in the earlier sections to stick to one timeframe.

However, when the market structure is not clear, then you’d want to go down the lower timeframe…

GME 1-Hour Timeframe:

With that said, if you want to learn more about trading breakouts, then check out this article here: The Complete Guide to Breakout Trading

Next comes the essential part…

Exits

Let me tell you right now that if you depend on someone’s opinion on Reddit or on Discord for when to exit your trade…

You’re doomed.

Because there’s a high chance that those traders are emotionally attached to the trades that they are hyping.

The thing is—they would tell you to keep HODLing onto your losses.

But no.

You’re better than them after reading this pump and dump strategy guide, and you’ll want to be objective.

So, in this case, you want to use a trailing stop loss.

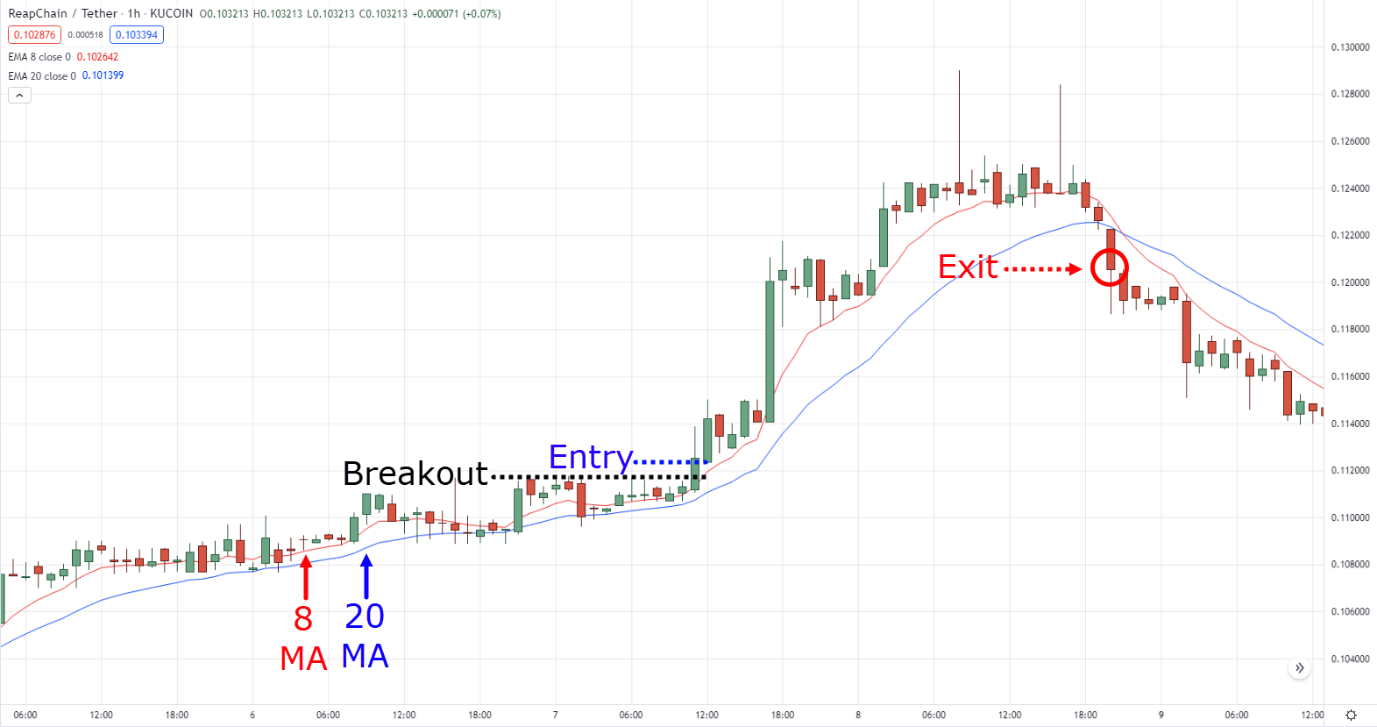

One trailing stop loss method is to wait for the price to close below the 20-period moving average…REAPUSDT 1-Hour Timeframe:

However, if you trade the higher timeframes, you’d want to consider using a “previous candle close” trailing stop loss…

USDTRY Daily Timeframe:

Again, what matters here isn’t the type of trailing stop loss we are using.

But why we are using it.

I mean, why not have a fixed target profit instead?

You see, we’ll never really know how high “pumps” can go.

So instead of trying to predict that prices will fly up to the moon…

Why not just stay on the ride and see if the price hits mars?

Nonetheless, if you want to learn more trailing stop loss techniques, then you may want to check this out: How to Use Trailing Stop Loss (5 Powerful Techniques That Work)

Disclaimer

I know that I’ve shared with you cherry-picked charts of winning trades.

But the reality is that there will be losses along the way and that trading pump and dumps are a high-risk, high-reward scenario due to the volatility.

Nonetheless, as long as you manage your risk and don’t use 30x leverage on your Binance account (please don’t)…

You’ll be able to reap the rewards in the future through your patience and consistency.

Sounds good?

With that said, let’s do a quick recap and put all things in perspective…

Conclusion

- Pump and dumps have been around for centuries and can be spotted through different markets and in different timeframes.

- Spotting potential pump and dumps could either be waiting for a 3rd slope confirmation on the trend line or if the price is above both the 8 and 20-period moving average

- Always consider trading the breakouts and trailing your stop loss

Now here’s what I want to know…

What are some of your experiences with pumps and dumps?

Have you been involved with these types of “schemes” before?

Let me know in the comments section below!

Thanks so much Rayner, I appreciate every effort you made to send this across, God bless you, I will be forever grateful. Thanks.

You’re welcome Onyedika, make sure to apply the concept well!

Thank you, Jet! This phenomenon seems to be common practice as of late. Elucidating how to spot/screen and then trade them effectively is an invaluable lesson.

Definitely Randall, though they’ve been happening for a hundred and more already!

It’s already a recurring pattern in the markets that lure and trap new traders hah

great article. thanks a lot for sharing such valuable and practical info. I am so glad to find this site in the beginning days of my trading.

Awesome to hear that Ally, a lot more to come!

Recent pump and dump done in Indian markets

Happens all the time!

Hi Jet, great intro !

Question, in your strategy, do you offer a stock ( markets ) scanner strategy included ?

Best regards,

Thomas L.

Hey there Thomas, since this article is aimed around different types of markets, I don’t offer a scanner strategy as of now!

Hi Jet !… Look forward to implementing your strategy to see how it works for me. Question: When I find a stock that looks like it has periodic pump and dumps, is it advisable to share that with as many other traders as possible in hopes that it will amplify the next pump and dump ? I know this group activity happens on social media with the meme stocks. Your thoughts ?

Hey there Tom, such method can work on penny stocks or crap coins with little to no liquidity, though I think that pursuing that kind of method would make you end up being the sucker at the end of the lin

But in the case of GME and meme coins such as DOGE with huge liquidity, the huge moves were produced by the overall sentiment of thousands of traders, and I’d rather follow the sentiment and manage my trade & risk than try to “force” a pump and dump (and since they might also be illegal)

I hope that helps!

Thanks Rayner… Got it. I stay so busy anyway with many other sound strategies… much from your PATS book(it’s great !). After reading the pump and dump strategy, I became curious if some such group impetus could all-of-a-sudden be in play with a stock I now keep an eye on because it’s made three(3) wild, transient, up-and-down moves beginning in May of this year. Moves which I have yet to find any fundamental reason for. Has a $984 M market cap, I might add. Not to mention that, prior to May, it had been trading relatively flat for eleven(11) years… leaves me scratching my head.

I have been trading AMD for years. I have heard traders complain that AMD has an am Pump & Dump daily around 9:40 am ET.

Is that what is actually happening daily?

Hey there Jim,

It’s best you do a quantitative analysis of this certain stock, you’d want to ask yourself:

“What are the chances does the pump occur in a single trading week? how about within a month?”

You’d also need to classify how many % does a stock need to go up to be considered a “pump”

If your results come up more than 50% of the time that it pumps from 9:40am to 12pm then you can use that as a strategy with an edge to trade the stock

Nonetheless, test and verify everything!!

Great advice and an education – much appreciated

Thank you, Pam!