This post is written by Jet Toyco, a trader and trading coach.

Four years ago, I was an undergraduate student looking for a stable job.

I didn’t have any luck in finding a job.

So I (and my parents) made the decision that I should become a full-time trader.

I worked my ass off.

I watched every trading video, read every trading article I found and spent a lot of time demo trading.

I was passionate about becoming a successful trader.

After three months…

I was finally ready to trade live for the first time.

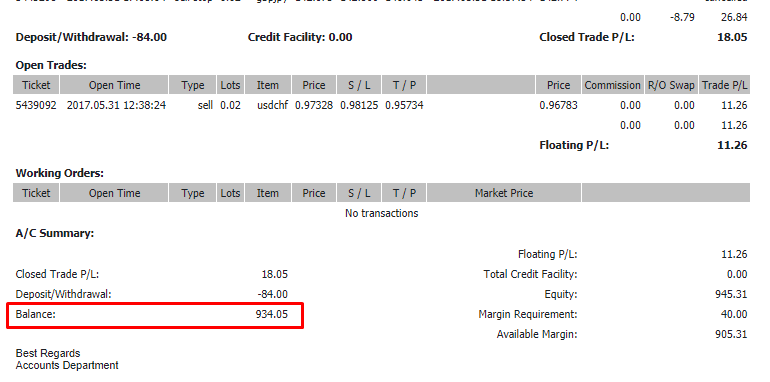

My first forex account ($1,000 USD):

For some, $1,000 may not be a lot, but it was most of our family’s savings at the time.

So, how did it go?

Well, you might’ve guessed it already.

Things did not go well.

I was making mistakes from one trade to another.

I was inconsistent and hopped from one trading strategy to another until I decided to stop trading live after three months – after experiencing a 50% drawdown.

My forex account (50% drawdown):

I kept asking myself:

“Why did this happen?

“I worked so hard for months only to lose half of the money entrusted to me; why?”

“Is the market rigged and just a scam?”

After taking an extended break…

I eventually found all the answers to my questions which ultimately helped me improve as a trader, and I’ll share them with you in this article.

Ready?

Let’s get started…

Put Yourself In The Right Environment To Trade

Putting yourself in the right environment to trade is single-handedly the most important thing to consider if you want to improve your trading psychology.

Why?

Because if you’re in an environment where you’re pressured to trade or in a desperate need to make a specific amount of money…

You’ll always find yourself in a spiral of inconsistency due to these “external” forces that unconsciously affect your trading.

Four years ago, I was a losing trader because I was in an environment where I was pressured to trade.

I wanted to be a “full-time” trader, and that I am trading most of my family’s savings.

A lot of people depend on me, and I was in a bad environment.

So, what’s the solution?

Well, you might not like it but…

Maintain a stable source of income

I get it.

You want to leave the full-time job that you hate and be your boss.

But here’s the thing:

It would help if you accepted that trading is a business and not a job.

It means that it can take you months or even years to build your skill, discipline, and portfolio before seeing favorable results.

There will be losses along the way, but it’s about how small you make them and how fast you learn from them.

But if you have a stable source of income, you will:

- Be less emotionally affected by your losses

- Crave for improvement rather than crave for instant results

- Tend to be more critical on which tools/strategies to use

Makes sense?

With that said…

Put less than 50% of your net worth into your trading account

I want you to imagine this…

You’re a new trader, and you’re about to trade 80% of your family’s savings.

How would you feel?

Of course, you’re confident that this will work.

You’re going all-in on resources.

You expect certainty.

However…

Whenever there’s a slight uncertainty (losing streak), the impact of you doubting yourself is very high; it messes up your trading psychology!

It’s usually how bad trading habits start being produced.

Why?

Because you’re trading with confidence that you do not have yet.

The worst part?

You’re going all-in immediately!

So instead…

Start with a small portion of your net worth in trading.

Then continue adding funds every 2-3 months as you prove yourself consistent.

So in case, if things go south, the damage is minimal, and you still have enough resources to try again.

Learning something new, am I right?

(By the way, that “new trader” I mentioned earlier was me, and you already know how that went, right?)

Have healthy financial habits

Here’s the reality…

Your behavior on how you manage your money will reflect on how you will manage your trading portfolio.

It means if you’re already having a hard time managing your own money, what more if you were to manage a trading portfolio?

That’s why if you still find yourself mismanaging your finances, I suggest you dedicate your time to nailing that one first before opening up a trading account.

Now:

This article isn’t about better managing your finances, so I highly suggest you check out Dave Ramsey’s work here.

The bottom line is that money makes you more of who you are.

Next…

Have A Well-Defined Trading Plan That Puts Subjectivity Out Of The Window

Keep in mind…

A trading strategy is different from a trading plan.

It means it’s not enough for you to know when to buy and when to sell.

You must know which markets to trade, why you should trade them, and how to apply risk management.

To break it down for you quickly, here are the criteria for building a trading plan…

To put it simply…

A trading plan is a business plan.

It is a system you must have to make your actions subjective and consistent as much as possible.

It means the more focused you are on which method to use…

The fewer trading errors you would make, which produces consistency.

Because the only way to have consistent results is when you have consistent actions.

Makes sense?

So if you want to take the first step off of growing your trading business seriously…

Then I highly recommend this article as well: How to be a Profitable Trader Within the Next 180 Days (Even if You Are New to Trading)

Now, if you’re still struggling to become a consistent trader even though you already have a trading plan, then the next section will help you out.

Keep reading…

Have a Repeatable Trading Process That Makes Trading Effortless

Every single one of us has a daily routine something like:

- Wake up

- Have breakfast

- Take a bath

- Start working

- Have lunch

- Finish work

- Have dinner

- Take a bath

- Sleep

- Repeat

I know it can be different for each one of us.

But have you realized that sometimes you do those routines over and over again that you start to lose track of what day it is?

You thought it’s still Thursday, but it’s Saturday already!

And it should be the same with trading.

You must also have a trading routine in a way that you wouldn’t realize that you’ve already made 10-20 trades!

Because if you want to trade whenever you only “feel” like trading, I can almost guarantee you that you’d have inconsistent results.

So let me show you how a trading process should look like:

- Build a watchlist

- Analyze the market

- Execute your trading plan

- Repeat

Let me explain…

Build a watchlist

Building a watchlist can depend from trader to trader.

But the key idea here is that you need to have a repeatable process on choosing which markets to trade.

That’s right.

It will help if you build a watchlist to not depend on other people’s opinions or rumors.

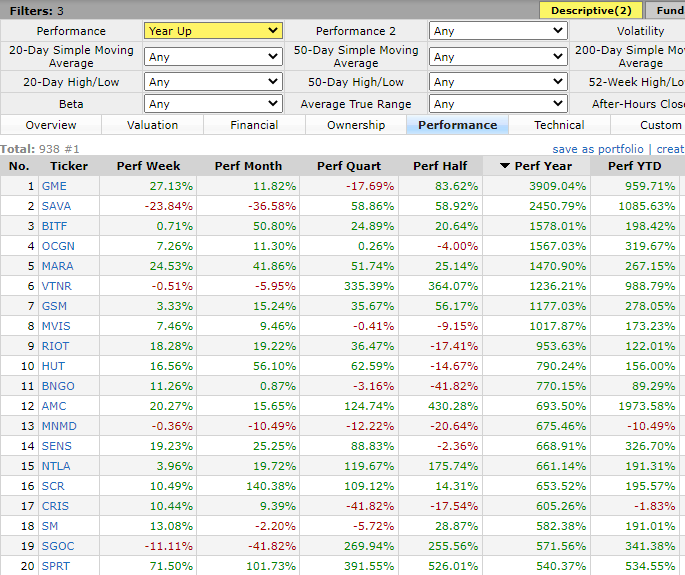

So if you are a trend follower who wants to take advantage of high-performing stocks…

You can consider using a filter that ranks stocks based on their performance and focus on trading the top 20 on the list:

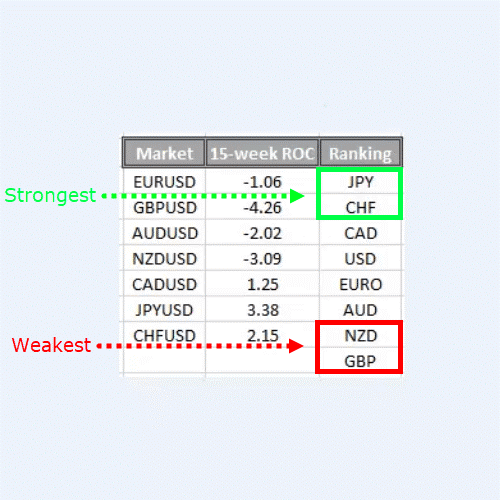

On the other hand, if you trade the forex market…

You can consider using a currency strength meter and trade the strongest and weakest pairs:

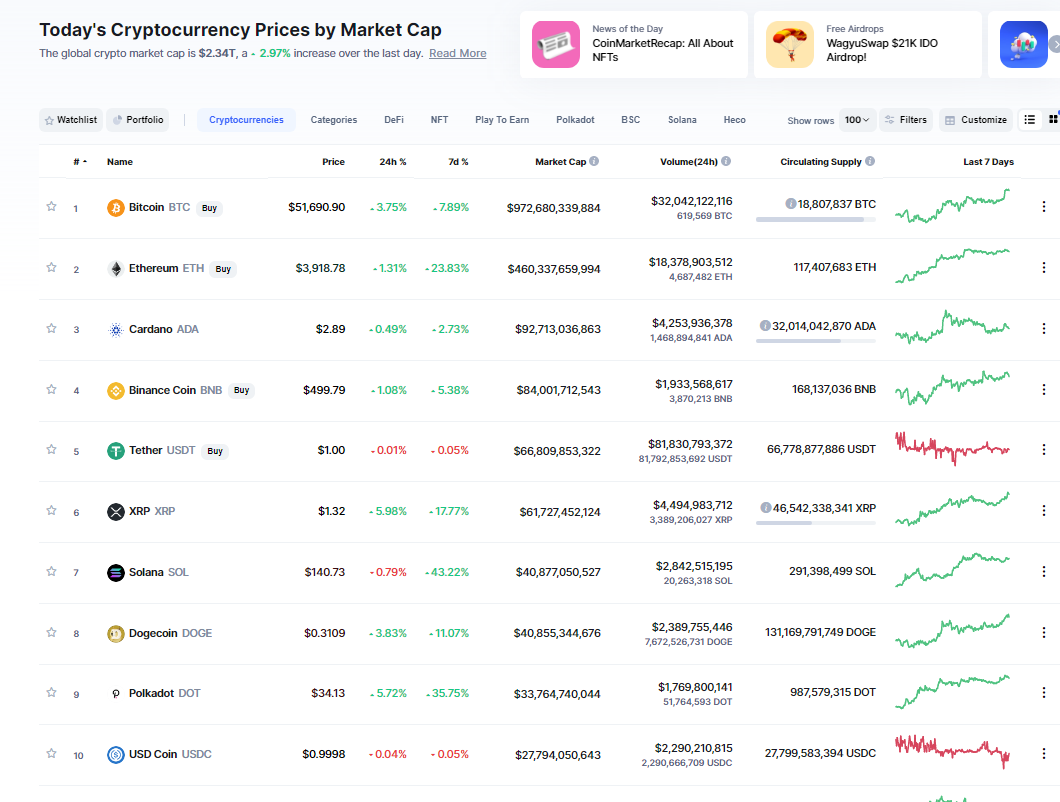

How about crypto you may ask?

Well, you’d want to avoid trading s*!t coins of course.

So I suggest you trade coins that are on the top 20 highest market capitalization.

Next…

Analyze the market and execute your trading plan

Let me ask you…

When you look at a chart, what’s the first thing you would do?

NZDUSD Daily Timeframe:

Zoom out?

Plot your indicators?

Pull out your Fibonacci?

You see, there’s a lot of ways on how to approach a chart.

However, you’ll need only a handful of tools set in that you can execute repeatedly.

That’s why to make things more straightforward; you can consider adopting the M.A.E.E. formula, which stands for:

- Market structure

- Area of value

- Entry trigger

- Exit

So let’s look at our chart again and apply this formula.

First, what is the market structure?

NZDUSD Daily Timeframe: Market Structure

Looking at the chart, it is in a downtrend as the market continues to make lower highs and lower lows.

It means that if you want to take advantage of this market, you’d like to trade in the direction of the trend by looking for selling opportunities.

Next, looking at the same chart, where is the area of value?

NZDUSD Daily Timeframe: Area of Value

As you can see, the market made a retest, which has formed a new resistance area.

So, now that you know what the market condition is and where to enter the trade…

The question is, how will you enter the trade?

Well, you have two options (and this applies to any trading setup)…

NZDUSD Daily Timeframe: Pullback

Your first option is to wait for the price to close below the area of resistance before you enter the trade.

However, your second option is that you can wait for the price to break below the nearest swing low.

NZDUSD Daily Timeframe: Breakout

Next comes the most crucial part.

When do you exit when you’re wrong, and when do you exit when you’re right?

If you say you’d only exit when “you’re satisfied with the profits,” then you’re doomed.

Why?

It’s because you’ll never exit your trade, no matter how significant your losses are.

You’d be stuck on your trade for months or even years just to break even.

On the other hand, you’ll never exit your trade no matter how significant your gains are because you’d always be wanting more.

So, what’s the solution?

Have a rule in place to exit when you’re right and when you’re wrong.

NZDUSD Daily Timeframe: Stop loss

You’d want to put your stop loss where it would invalidate your trading idea.

So looking at our chart, a suitable place to put your stop loss is slightly above the nearest swing high.

Remember, you have a stop loss because you can never predict where the market will go and you want limit to your losses.

Finally, the next one is to know when to exit when you’re right.

Because everyone wants to know they’re right.

Right?

NZDUSD Daily Timeframe: Take profit

Assuming you choose to trade the pullback, an excellent place to take profits is before the nearest swing low.

You are trying to take profits before potential buying pressure comes in.

What about if you choose to trade the breakout?

Well, you can consider using a 50-period moving average to trail your stop loss.

NZDUSD Daily Timeframe: Take profit

It means that you will not exit the trade unless the price closes above the 50 MA.

Makes sense?

Now, I know I shared with you a top-down analysis of approaching a blank chart objectively.

But keep in mind that this is just one example.

However, as long as you have the M.A.E.E. formula in mind, you’ll never see your chart the same way ever again.

Cool?

With that said…

Do These Techniques Work?

I know you wouldn’t want to waste your time on something that doesn’t work.

But it’s essential to know that your journey from mine will be different.

The way you would adjust your lifestyle and trading to these techniques will be different as well.

So your results from mine could be better (or worse).

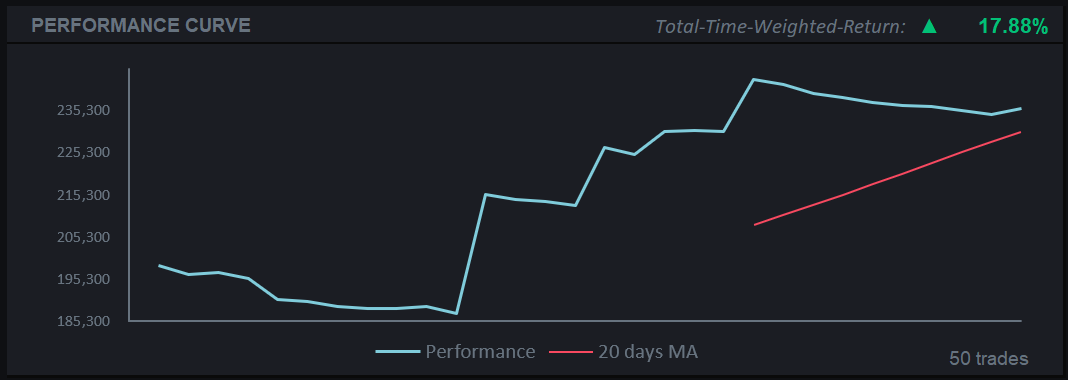

Nonetheless, after going through the process of putting myself in the right environment, consistently executing my trading plan, and having a consistent trading routine…

I can tell you that this process works.

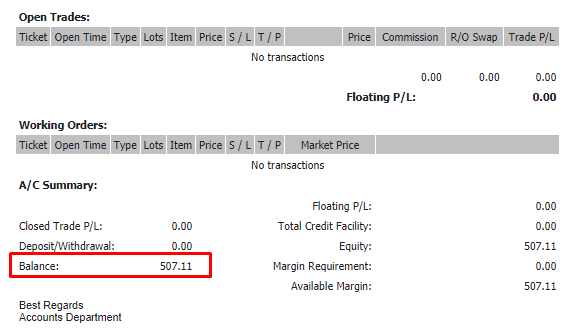

My stock trading portfolio (YTD Performance, 2021):

On the other hand, my forex portfolio isn’t doing very well at the moment.

But adopting this process continuously and remaining persistent helped me turn things around.

My forex trading portfolio (YTD Performance, 2021):

I know it’s not the kind of results you usually see on the internet showing +5,000% or double-your-money type of returns.

But this is what “real trading” is about—winning streaks, losing streaks, and continuously improving from your mistakes.

In the end, this trading journey isn’t about trying to copy me or other people’s returns.

It’s about you, and you continue trying to become the best version of yourself.

With that said, let’s do a quick recap on what you’ve just learned…

Conclusion

Improving your trading psychology is never just banging your head and telling yourself to stop being greedy and fearful.

But it’s about setting systems and processes in place that set you up for success.

So, if you are a trader who’s still having a hard time improving your trading psychology, then keep this checklist in mind:

- Do you have a stable source of income?

- Are you putting less than 50% of your net worth into your trading account?

- Do you have a well-written budget plan, and you’re following it consistently?

- Do you have a well-defined trading plan in place?

- Do you have a trading process that doesn’t interfere with your lifestyle and relationships?

Once you’ve nailed all five of those down…

You’ll unconsciously start to produce fewer trading errors and nurture good trading habits, which will produce consistent results.

Got it?

Now over to you…

Are there any techniques you are willing to add to improve trading psychology?

Can you relate to some of these techniques I’ve shared with you today?

Share your experience in the comments section below.

I’d love to hear it!

Great insights about the market Thank you Rayner

I hope that helped you out Lawrence!

The content is clear and very helpfull. Thanks Rayner!

Awesome to hear that!

Well said Jet, awesome

Thank you, Joe!

thanks Rayner .. however it’s about trend and divergence … but it took long time to train your eyes with it ..

Thanks for sharing Leith!

Too helpful for a trader who just have started

Definitely!

Every time I read your comments I learned a new thing. Thanks Rayner

Awesome to hear that Leci!

Beautiful insight, your are a blessing to us who are led by you.

Appreciate it Abel!

It’s a great in-depth yet comprehensive plan of where to start, where to navigate and where to end.

If we put into practice, we are all Warren Buffet.

You said it best Magesh!

thanks for this content, its really helpful.

Glad to hear that!