I remember when I was about 18 years old, one of the first jobs that I got was at an events company.

My personal experience with a 9 to 5 job

I helped to build those tents that you see at a carnival and I tear it down when the event is over.

That was pretty much what I did at 18 as a part-time job. That was me back then.

I was a little bit buffer than I am now because back then I was hitting the gym regularly, plus I had a job which allowed me to move physically.

That helped to keep me in shape. I did that for a few years and it was fun doing with my friends, laughing and going crazy.

I did that for a few years and then slowly like most things that you do, you start to feel sick and tired after a while, and it’s the same for this job that I had.

Long hours

I started to feel tired because the hours were long. I work anywhere from 10- 16 hours a day if it’s a big event.

Income ceiling

And I realized that there’s an income ceiling to what I’m doing. I get paid like $8 an hour back then.

If I work 10 hours a day, that’s $80 if I work about 20 hours a day, that’s $160 and I know that there’s a limit to my time.

In other words, there’s a limit to how much I can potentially earn, so that was the first lesson that I had from that job, that there is an income ceiling when you work in a 9-5 job.

Replaced by younger, cheaper and faster workers

And also, I realized at that job, when I first got in, I was replacing people who were older than me, who were not so mobile or they were tired, they have some injuries. They couldn’t do this job anymore, so I was replacing them.

When I did this for a few years, I kind of realized that the young people are coming in and starting to eventually replace me. They are cheaper, better and faster than me.

I knew that this is something that I cannot do for long because the people who are coming in just keeps getting younger. After all, I’m getting older.

Let me share with you a story…

I was having a long day at the event, tearing down as usual, and there’s this 6-year-old boy who saw me.

He didn’t say this to me in my face, but he said it in Chinese to one of my colleagues. In English, it means “this uncle is ugly”.

He said that I was ugly. So, imagine when you work so hard under the sun, you’re slogging your guts out then you have a comment from this little kid who said, “You’re ugly”.

I didn’t feel good, to be honest. To this day, I still remember it. You can see how much of an impact it had on me.

That was one of the key moments that I had that wasn’t too good. And it comes with part of the job.

The best thing that happened

Yeah, so I was at this job for a few years and slowly, I was at a crossroad.

I could either further my education at a SIM global education to get my degree, or I could continue working part-time and study the degree part-time as well. I had just two choices.

Finally, I decided to go all-in with my studies and see how far it brings me. So that’s where I stopped working the part-time events job.

And I go all in my studies, and I would say it’s one of the best decisions I’ve made, not because of the results that I had from my school.

But because when I go all in to study at the university, I had time to explore what other curricula that might interest me.

Exposed to the world of trading

On a good day, a broker came down to my university and organized a trading competition.

It’s on a demo account and I figured, “This seems interesting. Let me just get my tool suite and see what trading is all about.”

After two days, boom! I blew up my trading account.

I learned a few things.

Firstly, In trading, there’s no income ceiling. I realized because there’s no limit to how much you can potentially make. The larger your account size, the more money you could make.

That’s when I realize your limited time does not cap your earning potential.

Secondly, I realized that in trading, I don’t have to answer to anyone.

No boss, no colleague, no one calling me ugly. I’m in control. I’m in charge, and that’s the second thing that I realized.

Trading offers a lot of freedom and there’s no one to answer to.

I realized that this is so different from what I did previously, so I decided to go all in and learn about trading.

You know what, as a university kid, I didn’t have much money. So, I did what any other university student would do.

I hopped around the internet, YouTube, Facebook or a website’s blog to learn all about trading. I learned stuff like trading indicators, support and resistance, candlestick patterns, and chart patterns, etc.

That was my stepping stone into trading.

I learned everything that I could get my hands on. And after a few years even after I graduated from university, my trading results were still bad.

I was still a losing trader, to be honest, and I was puzzled. And I graduated with a degree with First-Class Honours and I couldn’t even make my trading account profitable in the green.

I was puzzled. Why is this a case?

It’s nothing to do with IQ. It’s something which I’m doing that’s wrong.

I decided to find out the answers. What am I doing wrong?

At that point, I could go for a regular 9-5 job, or I could seek answers, join a trading firm and see what the professional traders were doing that I’m not and learn from them.

I decided to get into prop trading. And fortunately, after about 6-months to a year of job hunting, I got into a firm that hired me as a proprietary futures trader.

And that’s where I get to see what these professional traders were doing.

That’s when I realized that the reason, I was losing money is because I didn’t have an edge in the markets.

You must have an edge in the markets

That’s what these professional traders had. They have an edge in the markets and that’s why they are making money consistently.

The reason why I didn’t have an edge in the market is that I was trying everything.

I couldn’t focus on one thing to find out whether it works or not and I dabbled here and there a little bit. After a few losing trades, I would try something else.

That’s why I couldn’t get an edge in a market.

What is an edge?

An edge in the markets is something that you do repeatedly which makes you money.

Let’s use a coin toss example. Let’s say you have a coin, and every time the coin comes up head you get $2, every time the coin comes up tail you lose $1.

And you know when you flip a coin heads or tail, it’s 50-50 chance.

In the long run, you know that the more times you flip this coin, the more money you’re going to make.

Why is that?

Because you have an edge in this coin toss and the one who is gambling against you, doesn’t have an edge. It’s a negative expectancy. This is the same for trading.

Your trading system, your trading strategy must have an edge in the market. Without it, you’ll never be a consistently profitable trader.

When I realize it was that I was like, “Okay, an edge, so important. How do I find it?”

I studied academic research papers. I talked to successful traders. I see what they are doing, why it’s working, and I go all in to find my edge in the markets.

Eventually, I found my edge in the market.

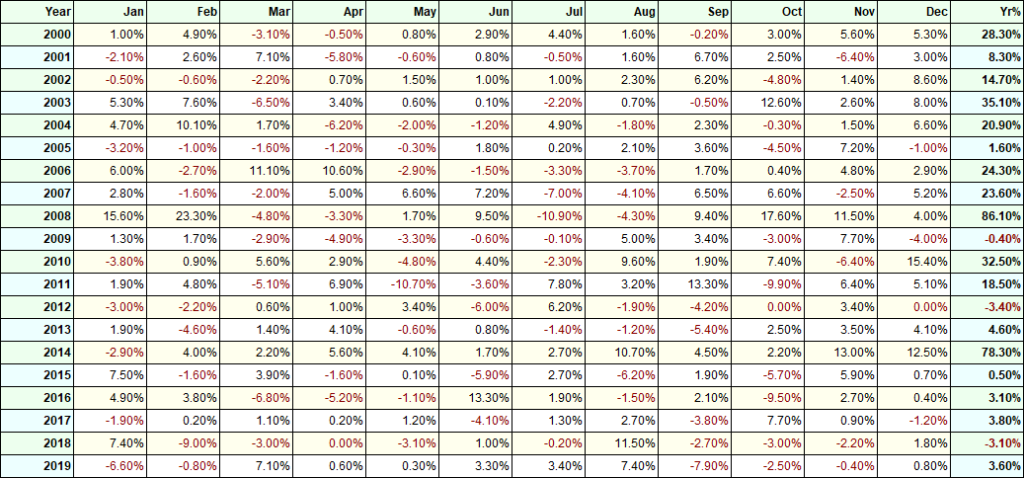

And this is one of the trading systems I’ve developed. You can see that this trading system over the last 19 years made money in most years.

But generally, you can see that in the long run, this system makes money once you have an edge in markets. Once I have an edge in markets, I became confident.

I started to trade larger and larger sums of money because once you know that you have something that works you will have the confidence, the courage, to trade larger accounts, five figures, six figures, and possibly even seven figures account.

This is one of the live trading accounts that I trade.

You can see that right now it’s about $320,000. This is a trading account that I’m trading, and that’s possible because I have in edge in the markets.

Once I have an edge market, do you know how I felt? I felt vindicated because all my efforts were not wasted.

I’ve got an edge in the markets, I’ve got a skill no one can take away. I don’t have to answer to anyone or anything. I got something which could feed me and my family for the rest of our lives.

Can you imagine trying so many things but having no results to show for?

I especially fear the question when someone asks me:

“Hey Rayner, you’ve been trading for the last three years. How are your results?

I was like, “Well, I’m still not making money. I’m still breakeven.”

You know I had difficulties showing them the proof because the truth is that I wasn’t making money, even though I’ve spent so much time on this thing.

So, when I have an edge in markets where I could profit from the market consistently, I felt vindicated. I realized that I’ve got a skill that no one can take away from me.

This skill is mine, and you know, my ownership to it. I don’t have to answer to anyone. There is no boss, no colleagues, no company to answer to.

Trading is all on me and I realized that trading is something that you know you can use to feed yourself or your family for the rest of your life.

As long as you have an edge in the market, you have the capital to trade with, you have something that could earn you a return for the rest of your life. This was how I felt, when I had an edge in the market, and probably you will feel the same way too with an edge.

But now this is not me trying to brag. This entire video is not about me. It’s about you.

And the question is…

Why can’t most traders get an edge in the market?

That is the question.

Let me share with you a few reasons why most traders don’t find an edge.

You focus on the wrong things, like:

- Psychology

- Risk management

- Relying on fundamental analysis

- You follow what most traders do

I don’t blame you because if you study books, websites, they talk about trading psychology, how psychology is 80% of trading.

1. Psychology

Think about this, if psychology is 80% of trading, meaning psychology is the most important component, right?

Then if you can go down to any casino nearby your house, you can bring your hypnotist and psychologist with you to be able to prep you for the gamble that is about to occur in a casino.

I can guarantee you that you’ll still lose money in the long run to the casino.

If that is the case or if psychology is the most important, the richest people in the world are psychologists or hypnosis because they can psych themselves up to prepare right for the mental challenge.

But it’s not true. Psychology is important in trading, but it’s not the most important thing.

2. Risk management

You can have the best risk management in the world. You can risk 1% on your trade and you get a minimum of a 1:2 risk-reward ratio on every trade.

But I can guarantee you that without an edge, you’ll still lose money.

You can bet with me maybe 0.5% of your capital on each gamble of the coin toss.

Let’s say, for example, every head you win $2 and every tail, I lose $1.

No matter what risk management I use, I’m still going to lose money to you in the long run. The risk management only dictates how fast or slow I lose my money. But in the grand scheme of things, I’m still going to lose my money.

Remember, when you want to find an edge in the market. Don’t just focus on trading psychology and your risk management. They are important.

But without an edge, these two components are useless. I’ll be honest with you.

3. Relying on fundamental analysis

You rely on fundamental analysis to make your trading decisions, and this is not smart.

I’m sure you’ve noticed, that the price can go up on bad news or even go down on good news.

Why is that?

It’s because the market isn’t reacting to whether the news is positive or negative.

The market is reacting to the people’s expectations of the news.

So, if you’re going to make money with fundamental analysis, you need to predict what are people’s expectations towards the news.

For example, let’s say the market comes up, a good piece of bullish news, but the price drops.

Why is that? Maybe it’s because the good news is not as good as they expected.

Let’s keep things simple. Let’s say in the earnings report, a company made a profit of $20 million a year. But the stock dropped. Why is that?

Maybe the expectations were that the earnings would be $50 million.

We can see that is good news, but not good enough to warrant a price increase.

So that’s what I mean by there is the possibility of price going up on bad news and going down on good news.

Another thing about fundamentals is that it is like technical analysis. There are hundreds of factors out there. You can look at revenue, net income, liabilities, assets, PE ratio, PB ratio, cash flow.

There are just so many things to look at. So many factors. How do you know which factor to pay attention to?

And maybe if you know which factors to pay attention to, how much of weight should you give to the factors? 70% or maybe 50% weightage? How do you know which factors are more important than the other factors?

You can see that when you use fundamentals to trade, it’s not a good idea.

So, if you are thinking of you’re going down this route, please step back. Don’t dig the hole further because this isn’t the way.

Here’s one example you can see:

AMD stock rose when they had negative earnings in 2014-2016. But the share price still gained 700% in 12 months.

How do you explain that? To be honest, the only way I can explain is I would just say price broke out.

The path of least resistance is up, time to buy.

And for those of you who are using fundamentals to trade and invest. And you say,

“Oh man, earnings are bad, let me short the markets.”

I mean, you’ll get toasted. You get killed in this scenario.

So, fundamentals aren’t the solution right to finding your edge in trading.

4. You follow what 99% of traders do

The reason why you don’t have an edge is that you follow what 99% of traders do.

What do 99% of traders do?

Well, they blindly use chart patterns, wave counting (Elliot wave), trading indicators, chart patterns,

“Oh look, Rayner, head, and shoulder, let me short this pattern.”

“Hey Rayner, let me count the number of waves. Oh look, this is wave three the strongest wave, let me buy.”

Or

“Hey, Rayner the MACD is oversold, let me buy.”

Here’s the thing. If you’re going to use the same tools as other traders, that’s not wrong.

You can use the same tools, but if you use the same tools and you interpret these tools the same way as the other traders then that is wrong.

Because if you follow what 99% of traders are doing and most traders lose money in the long run, you’re asking for trouble as well.

Now the question is, what do 1% of the traders do differently?

What do winning traders do differently?

That’s what I’ll talk about in my next video, but for not for now.

Here’s what I want to know…

What are the things you have tried in trading?

Leave a comment below, share your thoughts with me.

excellent

Hey Amitava,

Thank you!

Thank u Rayner for sharing your story. I’ve been asking myself the same question the whole week. I guess what I would like to ask you is what do you think are the basic principles one needs to understand to develop a personal trading strategy that gives an edge?

Hey Gabriel,

Check this post out…

https://www.tradingwithrayner.com/profitable-trader/

Hey Rayner, thanks so much for this post! Can’t wait to read the next.

Hey Adewunmi,

It’s my pleasure!

I’ve tried buying low selling high (dip buying) also oversold and overbought. I’m having a tough time with consistency.

Hey Chris,

Check out this post…

https://www.tradingwithrayner.com/stochastic-indicator/

All of the above things are so true. Eagerly waiting for the next part. You got so much experience and I consider myself lucky that I got to read your experiences and learn from them so early in my carrier. I am now in a place where I want to take the least risk possible and earn consistently for a month. I tried different setups, and lost money as I was trading in large quantities too soon without thinking about risk reward. Now the first thing I think about is to minimize loss in my trades and check out the adjustment trades I can possibly do before even I enter the trade.

Hey Senthur,

I’m glad to hear that!

Thanks for this eye opener secret of most traders,I really appreciate

Hey Lucky,

You are most welcome!

Thanks for sharing your experience. I’m trying to make a trade where divergence or hidden divergence created.

Hey Mowdud,

You are most welcome!

Where to find this edge in the markets everyone talking about???

Hey Ali,

Check out these posts…

https://www.tradingwithrayner.com/profitable-trader/

https://www.tradingwithrayner.com/pte/

Edege is a strategy which suits you for making profit…you only should find yours. Even I am not found one yet.

Hi Vengadesh,

I’m glad to hear that!

I did a trading course with a well known company. I’m sure the course teaches good trading for certain people but it was misleading in saying that anyone can make two to three thousand dollars a month by trading. What they didn’t address at all was the account size needed to make that kind of money.

Hey Guy,

I’m glad to hear that!

Very enlightening. Looking forward to the next video.

Hey Irene,

You are most welcome!

Excellent

Cheers Naresh

Hey hey Rayner

Thanks for sharing this. But you stopped so abruptly. Want to know what happened next. In anticipation.

You sure bro, are a good story teller.

Love from

India

Coming right up!

Risk management for me… i thought its the golden but you have the said the truth that the books rarely say.

Hey Gillian,

You are most welcome!

Thanks for sharing the story. Please share the best practices for trading.

Wow. I think im going to learn a lot from you since im new in the trading industry

Awesome to hear that!

Very nice useful story and excellent trading experience mate!

I’m happy to hear that, Richee!

nice training

Hi Brian,

Thank you!

Rayna thanks for sharing your experience. The issue still remains finding an edge in the market. I’ve been using indicators: MA cross over, stochastic+MACD, Support and Resistance, Trend line price action and all that. How do I really find an edge in the market.

It’s better to just use one and be good at it rather than use multiple and be confused with it

Hi Jimmy,

You are most welcome!

Hi Edita,

Check this post out…

https://www.tradingwithrayner.com/profitable-trader/

it happen to me 99% trader.. could you show the way so i can be the 1% trader

Then how do u trade now can u explain me bcz I’m in the same stage of other 99% traders

Hi Onikajus,

Check this post out…

https://www.tradingwithrayner.com/profitable-trader/

Hey Rayner,

By reading the first part I feel less confident now.

I am a Forex trader. I have 90 (!) straight winning trades but I’m not sure now…

Hi Amir,

Never give up!

Cheers

I tried Pivot points, RSI, stochastics, moving averages, price action trading.

Present using price action+cpr+moving averages(8, 20)

Very useful article

Thanks bud!

A for Away

I am usually trading on support and resistance. Look out for breakouts and movements in that area and find the area of value to put my trades. have been trading on this for last one year have seen some results but definitely needs to improve

Thanks for sharing, Jagdish!

I have been trading from July 2018. I used many indicators, follower many people on YouTube and twitter still I lost everything thing I was struck in compound debt. At last I realised taking to much information is bad then I prepared a setup according to my mentally and working on that setup and now I’m slowly recovering the money but I’m feeling good that finally I’m able to sustain in the market. I use a combination of 5and 20 EMA on 5 minutes and 1 minute time frame. I’m doing scalping multiple trades with small targets. It is giving me decent profits.

Awesome, thank you for sharing!

Hello Rayner, i’m focusing of some stocks i like and i want to keep them in the long run what do you think aboput that ?

Been watching you for a while,love your trading style

Thank you, Ernie!

Hey Rayner! What’s up! You are doing great service to traders. Thanks a lot. Initially, I did positional trading in stocks. I did fundamental analysis for stock selection and applied technical analysis-chart patterns for entry. Now I do intra day trading only in Nifty options using price action with few indicaters. Your you tube videos are so useful to me.

Hi Subramanian,

I’m glad to hear that!

I generally buy high and sell low. I chase. I’m impatient. I have watched most of your videos but cannot gain any traction. Nothing seems to work consistently for me..

Hi Tom,

Check this post out…

https://www.tradingwithrayner.com/trading-psychology-6-practical-tips-to-master-your-mind-and-money/

Have tried chart pattern, MacD, and also candle sticks.. But sincerely still not making profit.. Get puzzled sometimes.

Hi Micheal,

Have you tried price action trading?

I still don’t know how to find an edge in this market ,Rayner.

Hi Micheal,

Check this post out…

https://www.tradingwithrayner.com/profitable-trader/

Sweet brother thanks, always posting good content

Hi Alex,

You are most welcome!

Thanks Rayner for your great writeup. I am new in forex and for some time i have been depending on indicators to trade but to no avail. There are just too many of them and i keep trying different ones but always loosing. but now your articles are being helpful. Thanks

Hi Rawlings,

I’m glad to hear that!

Thank you. You always keep it simple, the newbies can understand. This is a great lesson!

Hi Kenny,

You are most welcome!

Hi Rayner, Thank you for sharing your story with us. I look forward to seeing the next instalment.

Hi Karl,

You are most welcome!

hi, two questions.. why is trading not a form of gambling and a source of reliable income and what Exaclty is your edge in the market? What do you do that sets you apart from the 99% of all other traders? thank you. god speed

Hi Rayner, first of all I love your intro: Hey hey, what’s up my friends! and i love listening to you. You are a genius. Well I am a total beginner and I am just taking every thing in at the moment. As you said to have an edge as a bigginer is something I have to discipline myself as a begginer you want to try things because you don’t know which is which. But having listened to some few traders online apart from the coach that I signed up with for training I must say you are the best. I love your candle stick teaching, I am studying charts and recognising the engulfing, the Harmer and twiser buttoms etc these I didn’t learn from my coach. At the moment I am loosing trades still trying to know what works and stick to it. I will like to have wining trades when you place them to study more of your strategy if that is okay.

In conclusion, I will appreciate it if you can help me to master how to trade, I am a single mother of three boys. I am doing this for them so that they can learn a different idea to earn money apart from work.

Bless you.

Hi Rosie,

Thank you!

I have tried a lot

Hey Rayner. . I’ve just started trading . It seems it’s always going in the wrong direction , either I buy or sell . I’ve been watching your videos I guess I’m a slow learner . It’s just not working out. Please Advice

Hi Loice,

Always trade what you see. Follow the trend.

Found one stock that I could predict and trade that stock only successfully.

Hi Anthony,

I’m glad to hear that!

Very very valuable advice.

Hi Nand,

You are welcome!

How well I understand. “Been there. Done that. Still doing that.”

Mostly eliot wave with a combination of FIB! Your mindset is my personality, but i don’t really have a clue how to handle my self with all this signs. I am really greatfull for this information that will help me to stay stable in this thougth’s.

Excellent, thank you, I look forward to the next lesson. Brian

Hi Brian,

Thank you!

Thank u Rayner for sharing your story. I’ve been asking myself the same question the whole week. I guess what I would like to ask you is what do you think are the basic principles one needs to understand to develop a personal trading strategy that gives an edge?

Hi Arun,

Check this post out…

https://www.tradingwithrayner.com/profitable-trader/

Hi Rayner, I’ve tried the RSI, technicals, fundamentals and not profiting at all!

Hi Aanand,

Check out this post…

https://www.tradingwithrayner.com/profitable-trader/

Using Indicators and applying Psychology strategy on my demo trading but I ended losing.

Hi Zhen,

Every Indicator has its purpose. You need to define that first.

I don’t want to hold a position for more than a week.

Hi, studying forex trading, can you share your trading method?

Hi Rayner, I made the bloomer of combining fundamental analysis

and chart reading…ended up as you rightly said…loosing money……

now am learning ….trying to correct myself,,,made up most of my losses…………..discipline i think most important..cant deviate

Hi Shailesh,

I’m glad to hear that!

Hey Rayner,

Your experience reflects the emotions of many… in the long run..

but what really is the edge — you refer to — the discipline or the knowledge – skill … cant wait ..

Hi Ramesh,

Check this post out…

https://www.tradingwithrayner.com/profitable-trader/

Followed different traders and different stategies. Then I tried different Indicators and still not consistently winning. Then I listen to your videos … Studied the MAEE principle… Since then it’s like I got a whole new view of the market.

Hi Renald,

I’m glad to hear that!

Macd, Trend Channels, Awesome Indikator, Fractals

Rayner

like all iam it that stage of your journey where you are looking for what works.

iam in suspense to hear how to get the edge

It’s like my story …lots of hit and trails but still in uncertainty in confidance.

I haven’t tried much because I’m a beginner but I must say I was being taught indicators before I started watching your videos, but now I know indicators lag and price action is the best, which makes me watch a lot of your videos on price action and I must say they are well explanatory. I look forward to having a good trading journey.

Hi Jimmy,

I’m glad to hear that!

This is so inspiring and educative, wonderful!

I have been demo trading for three months now and it has been very hard. But with this your explanation and life experience, I have gotten a professional expo. Thanks so much sir

Hi John,

Thank you!

Cheers.

This is helper looking for to know how to get out of that level of losing money,because I am in such level now for over 3 years learning I have not got that edge.

Hi Sam,

Check out this post…

https://www.tradingwithrayner.com/profitable-trader/

Whats the edge again?

Hi Fernando,

Check this post out…

https://www.tradingwithrayner.com/profitable-trader/

Hey Rayner,

This is excellent! I believe this applies to 99.99% of the traders all over the world. Personally I have had my fair share of loss (aka contribution to learning the markets) before I learned the lesson on Risk Management. I feel that neither the fundamentals alone nor the technicals alone can help – its the holy combination of both that matters. Not to forget the fact that the key is the your interpretation (aka the edge) 🙂

Hi Kishan,

I’m glad to hear that!

Oh I have tried a few. Can’t wait for the next video tho.. Thanks Rayner

Hi Libby,

You are most welcome!

I have tried all of the one stated below…

.Hedging

.Price Action

.Scalping

.News trading

Mauragon!

I did many of the thing what you have said like looking at charts, use indicators, risk management etc. but could not make money till date. Also have gone through all your previous email you have forwarded to me like price action, MACD but don’t understand what I am doing wrong. Will wait for your next video to understand.

Thank you Rayner. I have been following your youtube programme and I could the see the passion you have for it. What is the way froward for newbie that are interested and do not want to blow up his hard earned money before he can master the act of trading. I really need your response. Which area is most important to concentrate more effort and which is less.

Hope to here from you soon. Thanks.

Hi Awe,

Check out the trading academy…

https://www.tradingwithrayner.com/academy/

Hello Rayner

Thanks for sharing your experience..

I am doing paper trade with chat patterns & OBV along with other technical indicators .. in paper trade I get good results, I know that paper trade miss fear and greed .. Hope to see next post on edge

Wow Rayner…Thank you for sharing this valuable information.Let’s just say…I’ve tried just about everything on your list…Lol

Hi Eumeka,

Thank you!

Sir I tried new methods ..but failed, but after your valuable teachings I have not lost a single penny till now

Hi Gajender,

I’m happy for you!

i still try my edge and as you explanation i also doning same as 99% trader do..that i also in RED candel.

Since the market has been so volitile and I am new to trading I have tried a few things. The one that seems to work for me is finding the support line then finding the resistance line and buying just befor the support and selling just below the resistance. With a stop loss in case the stock drops to far below the resistance line.

Although I miss out when it puches theough the resistance line. Also I have only do long positions. I have been trading since april. I am still learning what works. I do not know all the patterns or alot about technical indicators. What i do see is that when looking at the candle sticks I can see a pattern devloping and it is fairly obvious where support and resistance have been. So I trade within what I can Identifi. If I am right which I have done 60% of the time i make some money. If I am wrong I loose a smaller amount than I would have made. Recently I also discovered that buying higher price stock in lesser amounts I can do better than buying lower price stocks in higher amounts. All sudden my realization is higher price stocks make bigger moves between the support and resistance. This allows me to make more on each stock and also helps with stop loss percentage.

I have tried to develop my own algorithm. I didn’t finish. I stopped the project because I didn’t believe it will work.

Good. You will Try it. and finally help me if possible

Great Lessons from you. If I am not wrong. The 1% is using the price value by using the indicators as confirmations.

Hi Armold,

I’m glad to hear that!

awesome job Rayner I wish u did trade alerts or signals id join u group

This is a great story and a reversal to what most traders are doing right now.

Hi C,

Thank you!

I have been trading for about 8 months now, but no profit , losses and more losses, one step forward, two or three steps backwards! Fear of losing money gets me out of good trades quickly, and not putting stop loss makes me lose massively, FOMO makes me lose good trading opportunities, etc

Hi Hassan,

Check out this post…

https://www.tradingwithrayner.com/how-to-overcome-your-fears-in-trading/

Good sharing Ray..thanks

GBU FROM INDONESIA

Hi Rasyid,

You are most welcome!

I am following 99% of traders do. so i still now loser.

An honest true story. I believe you.

Hi MR,

Thank you!

very good explanation Rayner, Hopefully this will change my trading style and lead towards the 1% winners.

Hi Harold,

Thank you!

Hi Harold,

You are welcome!

wow, thank you soo much, I will spec the next video

Hi Pascual,

You are most welcome!

Hi Rayner

I’m struggling to understand your principle around keep it simple when you have hundreds of videos with different indicators etc and then other videos to say don’t use this. So what do you suggest I could do to keep it simple? Less is more so would love to know your most simple strategy for trading.

Regs

Grant

Hi Grant,

In essence, understanding the use and function of every indicator makes it simple.

Cheers.

Thank you for your testimony. I’ve tried everything. I had a mentor but he used a 1 minute chart and I could’n stay at the computer all day, I have a job and a wife and she wanted me home not at his home learning to trade, so I never learned how to get an edge. I think that looking back my mentor was also looking for an edge using E.W., Gann, etc.

Hi Al,

I’m so glad to hear that!

Keep practicing.

Cheers!

Very interesting !

Hi Mervyn,

Thank you!

Hey Rayner, thanks for sharing your story. But I have one question, how can one become a better price action trader?

Hi Uche,

Check out this post…

https://www.tradingwithrayner.com/price-action-trading/

I have trouble in multiple timeframe trading. Sometime, a timeframe is bullish, another timeframe is bearish

Hi Peter,

Check this post out and combine it with your multiple timeframe analysis…

https://www.tradingwithrayner.com/200-day-moving-average/

Looking forward to part two

Hi Cleo,

Thank you!

A systerm that has an Edge in the markets. This is very essential Rayner.

Hi Neo,

Thank you!

Have tried all strategies for intraday. Some like on swing trading. Sometime revenge trading trying to always right. Some YouTube strategies but over the long period of time I have lost too much of equity. Now, looking to quit trading.

Still watching and reading too much of videos and trading articles.

I tried break and retest, divergence in the area of value, MA 20, reversal

Hi Rayner I have tried oversold and Overboard strategy and all field. Thanks so much

Hi Abdul

Most strategies and indicators have their uses and when to apply them.

Its not a guarantee that it must work most are being used as a confirmation while you follow price action.

Cheers…

What have I tried? Like a lot of people, so many things, and yet I find sometimes that if I had just entered in the opposite direction than I did, I would have had winning trades. So frustrating.

Im excited for the next video sir..God Bless you always..Continue to be a blessing to others..

Hi Gerwin,

Thank you…

You are most welcome.

Thank you RAYNER ,I now understand clearly the questions I have been asking myself about my trading approach. THIS WAS VERY HELPFUL TO ME.

Hi M,

I’m so glad to hear that!

Cheers.

Cheers

Hi Roland,

Thank you!

hey trading… well, i only recently realized that i have an edge because i keep doing the same thing (price action, with more focus on structure) over and over again. I see profits but my ratio isn’t in favor. Now, you surprised me when you say trading psychology isn’t a major factor in our losses (which is what i used as a scape-goat, learned how to control emotions but still consistency).

CONSISTENCY RAYNER!!!!!!!!!!!!!!!!!!!!!!!

Hi Sharlom,

I’m glad to hear that!

Cheers.

Hi Rayner, I have more indicators in technical analysis but I still not making money.

Hi Chiun,

Every indicator has its purpose. You need to know the function of each

Check this post out…

https://www.tradingwithrayner.com/best-trend-indicators/

Watch this: https://youtu.be/ARu5kSL-3Cs

It is so nice for Rayner to share his story. I am trading Phil Town style with some good profit, tried day trading with little success and found some success in crypto. Looking forward to the next two segments.

Hi John,

You are most welcome!

Thank you for sharing your experience

Hi G,

You are most welcome!

Excellent, thank for sharing your story, I have been battling with trading for 2years now, not making profit always losing money, I think I need and edge that will works in the market

Hi Opeyemi,

I’m glad to hear that!

I’ve tried trading with with indicators like stochastic but I don’t get frequent trade setups.. Tried price action trading but I seem not to get it right… I wait too long and eventually miss or loose in a good trade. I’m unable to get a trading group.. I’m also a student in the university I’m Nigerian and forex trading is a secret here and no way to learn

Hi Rae,

Check this post out…

https://www.tradingwithrayner.com/trading-multiple-timeframes/

Really

Am in Uganda but usually we get trades from Nigeria and they train us at cost though at one point you get confused with all the techniques you have learnt

You are a savior for the retailers Rayner ….keep growing..

Hi Alekh,

Thank you!

Thanks you so much, Rainer.

Hi Minn,

You are most welcome!

Thanks Rayner… Truly inspired…

Hi Radha,

You are welcome!

hi rayner which broker do you use so you can trade so many markets like corn, lean hogs, palladium etc?

Hi James,

Kindly contact support…

support@tradingwithrayner.com

Hey Rayner thnx for the info

Me I hv been trading since the beginning of the year but things weren’t working out well until 3months back when I specialized and started trading the pound pairs except the Gbpjpy and the going hasn’t been bad

and at one point I was confident to grow my blown account from $4.4 until infinity come Monday

but then I have lost my confidence after reading this message so I don’t know what to do.

I’ve tried so many patterns but it seems not to work all the time. Please Rayner, can you help me with the idea on how to be a successful trader just like you?

Hi Derick,

Check out this post!

https://www.tradingwithrayner.com/profitable-trader/

Hi Rayner,

Thanks for sharing your knowledge and experience. I am learning and lot from your blog.

I want to say that I dont agree with your casino example for Psychology. Its like saying gambling and trading are the same thing. They are not, in gambling the house always wins and the gambler cannot have an edge. A trader on the other hand can have an edge.

I think having an edge is as important as having the correct mindset for trading. One cannot be successful in the long run without either.

Do share your thoughts.

I have tried to read the chat using indicstors, I know a specific time I should place a trade and I make money from it but the problem I have is the indicators fail me and that makes me place a trade when I see I can make money but I end up loosing all av made for the day. I don’t know y it happens each day I have tired different strategies but still get same result each day I can make up to $20 but before the day runs out I will loose everything it as if am wasting my time

Hey Rayner. Thanks a lot for sharing this post. I have personally tried a few strategies on trading and I’m still struggling to be consistently profitable. I make profits here & there but I still don’t have an edge. My trading is improving but there’s still a couple of things I’m struggling on.

Hi Gift,

You are most welcome!

I am fairly new to trading, a friend of mine introduced me to fx trading during lockdown of covid 19 virus in March this year, and so far I have been watching YouTube videos, downloading books and articles, to be honest I am that guy that’s been trying every trading strategy that I came across on the internet, until I came across Rayner and he started teaching about having an edge in the markets so right now I have stopped trading blindly and started working on finding my edge…

I have been trading 3 years and I really don’t have an edge in my trading ….

Hi Heri,

Check this post out.

https://www.tradingwithrayner.com/profitable-trader/

I love your insights. They ring true to me. You explain things very simply, in a way that is easy to understand.

Hi Robert,

Thank you for appreciating.

Cheers.

Hey Reynar, i tried using technical analysis like support, resistance drawing trend lines and also i tried using systems and i still fail

Hi Kago,

Check this post out!

https://www.tradingwithrayner.com/trend-line-trading/

Wow can’t wait to discover my edge

Hi Rayner,

I have back tested a ‘First hour strategy’ using a 15 minute chart. Enter on break of the first hours range (actually 75 minutes) and exit once it completes the same amount of pips as the first hour. I have only tested this on one index but it shows a 66% success rate: 150 x trades with 100 winners. Only thing is my risk on loosing trades is the same as the profit on winning trades. This is not a bad result on futures but there is no guarantee it will keep working, and once I increase the $’s invested it might change the success rate!

Cheers,

John

I have tried trading in different way’s looking the best for me to get a good understanding of what i was doing, but then just to get fooled and lost in strategy again, or the market change and i ‘m not able to keep up with it. I still work full time, and have ahard time getting in front of screen.

Hey Mike,

That’s good to know.

Check out these post.

https://www.tradingwithrayner.com/the-maee-formula/

https://www.tradingwithrayner.com/trading-multiple-timeframes/

Thanks Rayner,that’s why i chosed you as my mentor cause I’m learning each day from your experience teachings,can’t wait for the next story.

Hi Warilyn,

I’m glad to hear that!

Cheers.

i used macd but shifted to trendline trading (TAE) with nill indicator

Thanks Rayner for this teaching and enlightenment. I am a baby trader of one month with less than $1000 trading fund. I have been doing well in the market until recently my trade got negatives and brought my capital down to 3 figures because my trades hit stop loss lines frequently. I love trading I don’t want to quit soon. What do I do.

Hey rayner..i trade the nasdaq open. I scalpe the news release..ive got a strategy that works. Your price action has showed me alot. I found my edge i would like to share with u

Hi Gemeale,

I’m glad to hear that!

I am a young trader and I enjoyed your training I have blown my account several times and I’m on the verge of giving up when I met you on telegram thanks for the encouragement

Hi Victoria,

I’m glad to hear that!

Thank you rayner,

recently i am on implementing your moving average strategy which is take price when pullback happen under the ema200 and price comeback to ema20 and/or ema50

i strongly believe this strategy have a great outcome

Hi Ady,

I’m so glad to hear that!

Cheers.

Yes I have done ALL the things you have said and more but I THINK I have found that edge only time will tell .

Hi Philip,

I’m glad to hear that!

Studying the structure of the market.

Hi Adoji,

Thank you!

Do you use an API to trade with your backtesting program?

I am still struggling getting it right. I have tried following successful traders trade, use several indicators from macd, stoch, rsi, ma, envelope. I have studied chart patterns, trends. And still it hasn’t worked for me in long run

Hi Ubochi,

Check out this post.

https://www.tradingwithrayner.com/forex-indicators/

Already 5years trading Forex.. seems that I still don’t have an edge of the market..

Hi Iskandar,

Check out this post.

https://www.tradingwithrayner.com/profitable-trader/

Its great…

Let us know your edge! Your process

Hi Rayner thanks fo sharing your trading ideas and experience. I’m very appreciative of your supports toward beginners like us.

However, I share your experience when your first began trading. I loss money a lot. I feel that I know ABC of trading, sometime I simply don’t know why I loss. Please I need your assistance on the basics.

Hi Okon,

Check out the trading academy.

https://www.tradingwithrayner.com/academy/

Brand new trader.2 months.Made money with CHY but loss everything. Did not know what a stop loss was. Same thing with BABA.

However my question is: when we talk about resistance and support what time period are we talking about for short term or day traders?

Since money and time are limited ,I am sticking with stocks short term.

Thanks

Hi Reyner

I have basically tried executing trades by following the trends and sometimes don’t get to make profit out of it