This post is written by Jet Toyco, a trader and trading coach.

There are thousands of stock trading books out there that you can easily get overwhelmed with and be confused on which ones to read first.

However, what I’m about to share with you today are stock trading books that:

- Stood the test of time.

- Deserves to be read first

- Have produced thousands of exceptional traders throughout the years

Sounds good?

Then let’s get started…

Stock Trading Book #1: Reminiscence of a Stock Operator by Edwin Lefèvre

This book was written by Edwin Lefèvre back in 1923.

It is a fictionalized biography of Jesse Livermore, one of the greatest traders ever lived.

Yes, I know.

You’ll never pass an article without recommending this book.

But what makes this book so unique?

Well, it gives you an insight into what you can expect in your trading journey.

Insider news?

Market manipulation?

Gambling in the markets?

This book has those great stories that will give you practical advice on navigating through them.

So here are three things I’ve learned from this book.

1. The fewer the people know about a “stock tip,” the more reliable it is

Let me ask you…

Is your source reliable when you get “secret” information about a particular stock?

Are you getting those tips from someone who gossiped it from someone else?

Is the news publicly disclosed where millions can see it?

If you answered yes, you’re already at the tail-end of that information.

Now it’s not to say that you should try and pursue reliable insider trading (as it’s illegal) but it’s to not let a stock tip dictate your actions in trading — whether you should buy or sell.

So what’s the solution?

Have a rule or a process that lets you consistently select good stocks without others’ opinions.

This can be in the form of stock screeners or fundamental metrics found in tools such as Finviz or Tradingview.

2. Trade what you see and not what you think

I’m sure you’ve heard this saying a couple of times somewhere.

But what does it mean?

Well, in simple terms…

Don’t put your expectations on a chart, and be realistic!

Just because you’re holding a colossal loss, shouting at your chart for the price to go up doesn’t mean it will.

Has the price hit your stop loss level?

Well, then exit the trade.

The chart isn’t showing any trading setups?

Then look at another stock.

Is a stock in a clear downtrend?

Then don’t buy the dip.

See what I mean?

We act based on what we see, then do our best not to make a fool out of ourselves.

So what’s the fix?

Have a trading plan in place where you know how you’re going to enter, manage, and exit your trade and your trading account as a whole.

If you want to learn how to make one, you can read this article here: How to be a Profitable Trader Within the Next 180 Days (Even if You Are New to Trading)

3. Always trade with peace of mind

Imagine this:

You’ve experienced eight losing trades in a row.

You’re starting to get frustrated and anxious.

Now, what do you think happens next?

You guessed it.

You start revenge trading by breaking your rules and risking a lot more than you used to, thinking that your problems will go away and your losses will be recovered if this trade “works out.”

What do you think usually happens?

You can’t think straight, and your emotions had amplified before you even took the trade.

Do you want to trade like this?

If you do, unfortunately, then your money is better suited in a casino.

But if you don’t want to trade like this, then here’s a possible solution:

Withdraw half of your portfolio.

Now, why the heck would you do this?

Once you decide to reduce your portfolio, the less you’ll become attached to the markets.

When you become less attached to the markets, you become more objective with your wins and losses and help you trade with peace of mind.

That sounds better right?

But of course, as you get consistent in trading, who’s not to say you can’t add those funds back?

Sounds pretty fair, right?

Nonetheless, if you want to learn how to pull yourself out of being a fearful trader to become a confident and consistent trader…

You can check this article out: I Lost 50% Of My Capital Before Turning Profitable. Here’s How…

This book is a fictionalized biography of Jesse Livermore, so reading it can be similar to reading a novel.

While there are practical trading tips here and there, this book isn’t the type to show you charts and teach you indicators.

So, if you’re looking for more charts and fundamentals, then the next book is for you…

Stock Trading Book #2: How to Make Money in Stocks by William O’ Neil

Right out of the bat, this book introduces you to a hundred pages worth of charts!

Enough for you to familiarize William O’ Neil’s setups.

However, what makes this book stand out is how it introduces you to two fields of trading:

- Technical analysis

- Fundamental analysis

The best part?

William O’ Neil shows you how both fields can co-exist with each other!

Finally, this book will shower you with timeless trading wisdom and trading principles that will stick with you for the rest of your trading journey.

Nonetheless, here are the three things I’ve learned from this book…

1. Paper losses are actual losses

There’s a common saying:

“It’s not a real loss until you sell it!”

Of course, I believed in that statement back when I was a newbie.

So, I held onto a losing stock from 2014 to 2016.

Here’s the question, did I make money?

The truth is that I had waited two years for my stock to break even.

Sure, I technically did not lose any money.

But what if I had taken my losses early?

What if I learned from that mistake earlier and used that learning to pick even better stocks?

You see, even though the statement that “it’s not a real loss until you sell it” is technically true…

The cost of you holding into that statement is time—an opportunity cost.

While money can be earned back, time can’t.

Remember that.

So always follow proper risk management and know your identity as a trader, which you can learn more about in this blog post here: Forex Risk Management and Position Sizing (The Complete Guide)

2. Understanding market conditions is crucial to making good trading decisions

Whether you are a stock trader or not, you’ve heard the saying “buy low and sell high” a couple of times, even as a kid!

But the truth here is that statement turns a lot of traders into losing investors who buy the low and never see the high.

Even if they do see the high, they’ll never be satisfied until the market pushes the price back to its starting point.

Sounds familiar, right?

But there are two important words that a lot of traders miss out on when they say that you should buy low and sell high:

Market condition.

If you want to buy low and sell high when the market is in an uptrend, you might never be able to catch the low and ride the trend.

If you want to buy high and sell higher on a ranging market, you’ll always find yourself getting stopped out of the trades.

It makes sense, right?

So before you hit that buy button, ask yourself:

“What is the current market condition, and am I using a strategy appropriate for this market condition?”

Now, if you want to learn different techniques to trade other market conditions…

I suggest you spend time reading this comprehensive guide here: 5 Types of Trading Strategies That Work

3. There’s no such thing as a “risk-free” investment

I know at some point that we’re trying to look for that high win-rate get-rich-quick scheme trading robot that never loses money.

But as you progress through your trading journey, it becomes clear…

Losing streaks or losses are a part of this business, and trying to look for that “holy grail” gets you scammed or ripped off.

At this point, you might be thinking:

“Wait, why should I still be a trader if you know that you’re going to lose at some point?”

Let me tell you the answer…

Being a trader means that we are in a constant loop of trying to learn and improve from our losses to continue to increase our gains in the markets!

In hindsight, minor losses along the way help us profit in the markets.

Now, if you’re looking for an “all-in-one” book that introduces you to a lot of areas in trading, then check out this next book…

Stock Trading Book #3: Trade Like a Stock Market Wizard by Mark Minervini

As a trader for almost five years, here’s an important principle that I’ve learned that would’ve shortened my learning curve…

“Model someone successful.”

It means that before you even think of creating your own rules and strategy, you must successfully follow a working one from a successful trader.

Who’s that trader?

Mark Minervini.

He’s been a wall street veteran for almost 40 years.

He’s a market wizard.

He’s a top trader on the U.S. Investing Championship who recently made a +334.8% gain with a million-dollar account last 2021.

In his book?

He shares with you his thought processes and his exact techniques not only in selecting stocks…

But also how he enters and manages his trade, understands the framework behind them, and deals with losses.

It’s an all-in-one book that teaches you how to enter trades and manage your trading business through good and bad times.

So here are the three things I’ve learned from this book.

1. Paper trading can be a waste of time

A few years ago, I had my first major setback as a trader, where I lost half of my money trading the markets.

Before I got back trading live in the markets, I told myself that I want to be prepared with a solid trading plan with an edge!

But here’s what I didn’t know…

The fear of trading live in the markets and possibly losing half of my money again was still there even though I didn’t realize it!

At that point, I wasn’t growing as a trader, and it felt like my trading journey was going nowhere; even though I’m only paper trading,

I was wasting my time!

Now, why am I telling you this?

You see, I was questioning my growth even though I’m not making an actual performance in the markets, and I hope that you won’t end up in the same situation.

So, instead of “waiting” for the right timing to trade live…

Start fast, but start small, because as himself Mark said:

You perform better when you’re putting real money in the line!

Nonetheless, if you need a concrete plan on how to transition from paper trading to live to trade, then this training guide has the answer: The Complete Guide to Demo Trading

2. Follow stock leaders and avoid laggards

Remember the two other books I’ve shared with you just now?

At some point in those books, you’ll always encounter a chapter about leading and lagging stocks, including this one.

Here’s the thing…

Mark Minervini, William O’ Neil, Jesse Livermore, and more veteran stock market traders can agree to this principle:

Always follow leaders, the best performing stock in the industry, and avoid laggards.

So how can you do just that?

How will you be able to determine leaders out of thousands of stocks out there?

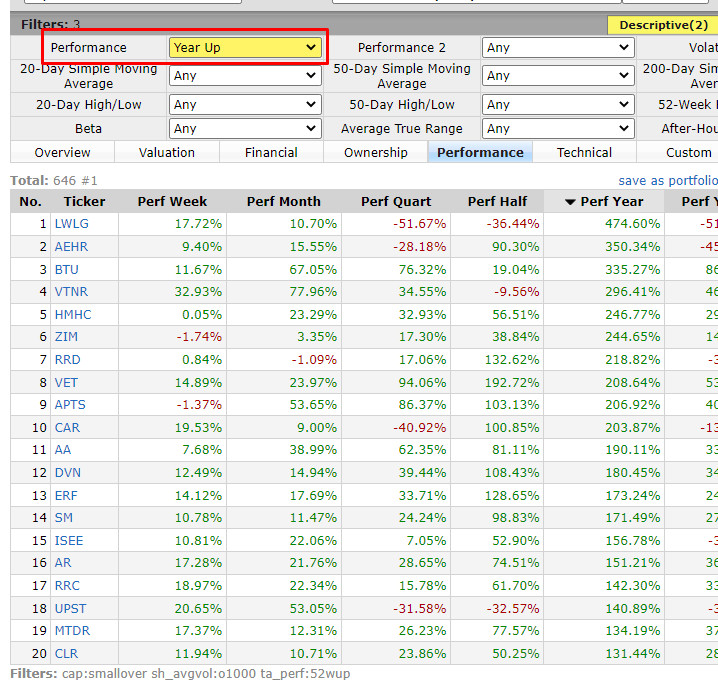

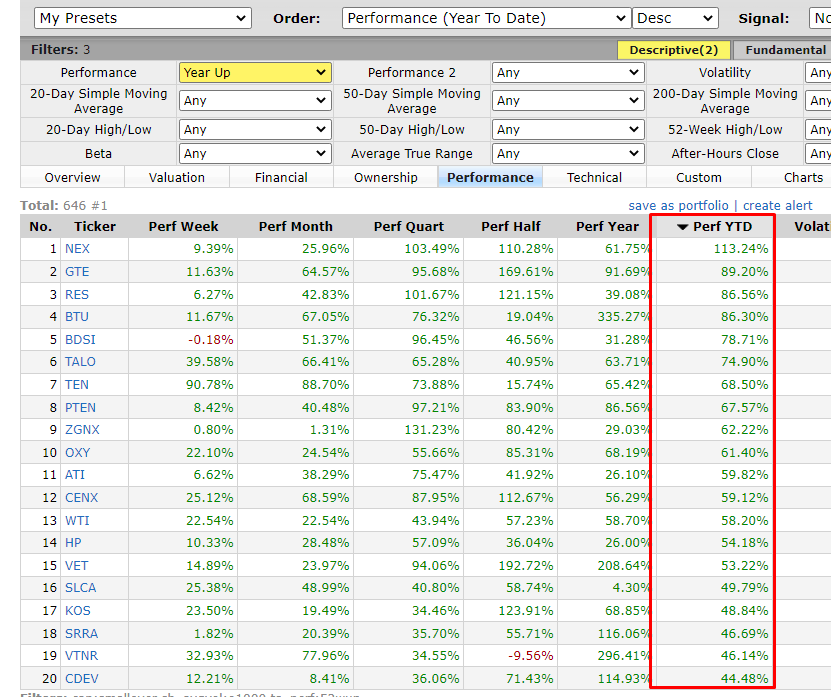

Simple, use a stock filter and make sure you’re looking for stocks that are up for the year:

Rank them based on their performance, and focus trading the top 10 stocks on the list:

Pretty cool, right?

Of course, there are other criteria that you can include when using stock screeners, but if you’re interested, you can use the same settings that I’ve shown you here.

Overall…

The stronger the stock is, the higher the chance is for the stock’s price to hit your take profit levels.

3. Make improvements with your trading habits first before you improve your trading strategy

At the end of the book, Mark Minervini mentioned that if you’re on a losing streak, it’s either one of these reasons:

- Your criteria to select stocks isn’t working

- The market condition isn’t compatible with your trading setups

Truly, those two reasons helped me as the market changed throughout the years.

But as time went on, I realized that it’s just one side of the coin.

So what’s the other side?

It’s yourself.

Let me explain…

When you are currently on a losing streak, the first thing that you should ask yourself is:

- Have I followed my entry rules more than 80% of the time?

- Have I managed and exited my trades based on my trading strategy more than 80% of the time?

If you’ve said no to any of those, then you must make changes to your trading routine.

That’s right.

If you find yourself breaking your rules most of the time, then the strategy isn’t the problem here.

So, when reviewing trades, constantly improve your trading habits first before you improve your trading strategy.

Got it?

But if you’re still not sure how to create your trading journal, then check this out: How to Create a Trading Journal and Find Your Edge in the Markets

Now with everything I’ve shared with you, let’s put things into perspective…

Conclusion

As you’ve noticed…

Each book has its type of trading wisdom and techniques to offer.

However, the effectiveness of a stock trading book depends on what stage you are in on your trading journey.

So even though all of these books are must-reads, choose the one you think is best for you and apply concepts as fast as you can.

Sounds good?

Now here’s what I want to know…

Is there a stock trading book I’ve missed on the list?

What else can you recommend?

Let me know in the comments section below!

Nice.Beautiful write up

Thank you very much!

Can the books also be applied on Cryptocurrencies?

Hey there Kim, definitely!

Some books were made for the stock market, but I was able to translate it trading Forex, so you’d have to do the same when trading the Crypto market.

Excellent work, Thanks.

Thank you, Antony!